Recall spendING the whole time poking numbers into a spreadsheet, only to discover you’ve missed a decimal and “lost” an imaginary $300?

Meet Mia, the hero of our story—and maybe a lot like you. Mia trades small amounts of bitcoin after homework.

She’s great at algebra, but even she’s tired of chasing price snapshots, fee tables, and tax rules. One night, she whispers, “There has to be an easier way.”

There is. It’s called a crypto profit calculator.

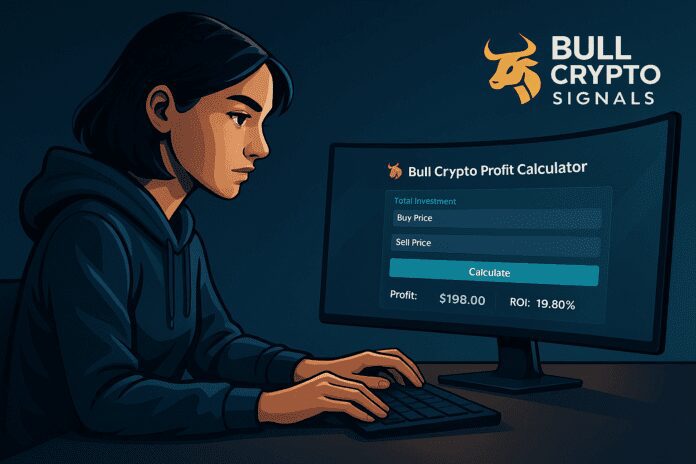

Walk-Through: Mia Runs the Numbers

| Step | What Mia Does | Why It Matters |

|---|---|---|

| 1 | Enters $1 000 in the Total Investment field | Sets the capital she’s allocating to this trade |

| 2 | Types $50.00 in the Buy Price field | Establishes her cost basis per coin |

| 3 | Puts $60.00 in the Sell Price field | Defines her target exit price |

| 4 | Selects Binance in the Or Select Your Exchange dropdown | Auto-fills Buyer Fee (0.10 %) and Sell Fee (0.10 %) |

| 5 | Clicks Calculate | Instantly computes profit, and fee totals |

Result Card (what she sees):

-

Profit/Loss: $198.00 (19.80 %)

-

Total Investment Amount: $ 1,000

-

Total Exit Amount: $ 1,198

-

Total Fees Paid: $2.00

Reading the Output Without Guessing

-

Profit/Loss: The net cash you walk away with after fees

-

Total Exit Amount: What you’d receive at the target sell price before fees

-

Total Fees Paid: Sum of entry and exit fees, so there’s no mystery about hidden costs

Why Crypto Math Feels Hard

Cryptocurrency prices never sleep. Add maker‑taker fees, network fees, cost basis, and the dreaded capital‑gains tax, and simple subtraction turns into a spaghetti bowl of variables. Maker fees reward you for adding liquidity; taker fees charge you for removing it, and every exchange sets its own tiered rates.

Then there’s cost basis—the official starting line for tax math. Get it wrong and you may over‑ or under‑pay Uncle Sam.

A calculator removes those moving targets so you can focus on decisions, not decimals.

What the Crypto Profit Calculator Actually Does

-

The Calculator prompts you to enter Total Investment, Buy Price, and Sell Price into dedicated input fields—no extra hidden variables.

-

You can either type in your Buyer Fee % and Seller Fee % manually or choose your exchange from a dropdown to auto-fill those fee fields with typical rates.

-

Under the hood, it computes the number of coins as

Total Investment ÷ Buy Price, then applies the core formula: -

Hitting Calculate instantly displays:

-

Profit/Loss in USD

-

Total Investment Amount and Total Exit Amount

-

Total Fees Paid

-

-

No signup or data storage—everything runs client-side so you get fast, private estimates on desktop or mobile

Common Mistakes the Calculator Protects You From

| Mistake | How the Calculator Helps |

|---|---|

| Ignoring fees entirely | Auto-populates buyer/taker rates when you select an exchange |

| Manually converting dollars → coins | It calculates coin count for you via Investment ÷ Buy Price |

| Mis-estimating exit proceeds | Displays your Total Exit Amount so you see exactly what you’ll walk away with |

If you’ve bought the same coin at different prices, use the Average Buying Price Calculator right below the profit tool. It guides you in adding multiple buys and outputs your weighted cost basis—handy before running your profit/loss (P/L) numbers.

Weaving the Calculator Into Mia’s Routine

Mia’s five-minute pre-market ritual combines planning, automation, and disciplined execution to keep her trading focused and efficient.

| Step | What Mia Does | Why It Matters |

|---|---|---|

| 1 | Jots down her planned entry and exit prices in a notebook before trading | Lays out clear stop-loss and profit targets to remove guesswork and emotional bias |

| 2 | Opens the Free Crypto Profit Calculator and inputs those price targets into the Buy Price and Sell Price fields | Automates coin count and fee math so she focuses on strategy, not arithmetic |

| 3 | Checks that her computed ROI meets her personal threshold (e.g., ≥ 10 %) | Ensures each trade offers sufficient reward-to-risk before committing capital |

| 4 | Uses the Average Buying Price Calculator when she’s layered multiple buys | Calculates weighted cost basis to refine profit/loss projections and breakeven points |

| 5 | Screenshots the result and adds it to her trading journal | Builds a historical record for later review, spotting patterns and mistakes over time |

| 6 | Places her limit order on the exchange only after the math checks out | Uses predefined exit prices to lock in profits and manage risk without second-guessing |

Routine Card (What Mia Gains)

-

Disciplined decision-making: Sticking to a pre-trade checklist curbs impulsive actions and nurtures consistency.

-

Time savings: Automating math frees up minutes for market research and strategy refinement.

-

Emotional control: Having clear entry/exit plans reduces fear and greed during volatile moves.

-

Accurate trade logs: A journal of screenshots and notes builds a rich dataset to analyze performance trends.

-

Better risk management: Predefined stop-loss and profit targets help preserve capital and optimize reward-to-risk ratios.

Lessons Learned

Mia’s first spreadsheet had 14 tabs, each screaming in neon red when one formula broke. She was proud—but also overwhelmed. Once she switched to the calculator:

-

Confidence jumped – No more “Did I count network fees?” nightmares.

-

Focus returned – She now spends more time reading project news than wrestling Excel.

-

Patience improved – Seeing breakeven levels visually reminds her not to panic‑sell on normal pullbacks.

Her journey shows that the calculator isn’t a magic profit button—it’s a clarity tool. It frees brain space for better decisions.

Quick‑Grab Checklist Before Your Next Trade

Record your cost basis (screenshot or note).

Know your exchange’s maker/taker fee tier.

Decide on a target price before buying.

Enter the data into a calculator and calculate the ROI percentage.

Add a 0.2–0.5 % slippage buffer for volatile pairs.

Export or jot down the results in your journal.

Place the trade only if the math aligns with your plan.

Print it, tape it to your monitor, thank yourself later.

Final Thoughts

Crypto’s thrill comes from possibility, not from punching numbers at 2 a.m. A simple profit calculator brings order to the chaos, handles fees and taxes in the background, and lets you trade (or sleep) with a calmer mind.

Ready to try the math sidekick Mia uses? Explore the Crypto Profit Calculator tool and see how your last trade stacks up—no spreadsheets required.

(Information in this article is educational, not financial advice. Do your own research and consult a tax professional for personalized guidance.)