Table of Contents

- Why hunt altcoins and how I think about sector plays

- My four-step framework to find high-upside altcoins

- Step 1 — Bitcoin Rainbow: high time frame context

- Step 2 — Altcoin Season Index: are alts ready to run?

- Step 3 — DeFi Llama and TVL: find on-chain strength

- Step 4 — Arkham: follow the smart money

- Putting the four tools together: a repeatable process

- Practical tips for execution and risk management

- Where to research and execute

- Final thoughts

- FAQ

Why hunt altcoins and how I think about sector plays

I discovered Render when it was $0.57 and put a big position in. Today it sits around $7.31—about a 12.8x move (~1180%). That kind of return is why I look for promising altcoins early, especially when a sector is just beginning to take off.

Right now the macro theme I was focused on was artificial intelligence. AI momentum from big-cap names creates a tailwind for projects that sit at the intersection of crypto and AI. When a thematic trend accelerates, selecting the right protocol inside that theme can produce outsized returns.

My four-step framework to find high-upside altcoins

I use four simple, complementary tools that together filter for timing, market regime, on-chain fundamentals, and smart money activity. The process:

- Check overall market timing with the Bitcoin Rainbow.

- Confirm whether it is altcoin season or Bitcoin season via the Altcoin Season Index.

- Compare protocols by on-chain health using DeFi Llama (TVL).

- Track influential addresses and smart money with Arkham.

Step 1 — Bitcoin Rainbow: high time frame context

The Bitcoin Rainbow looks playful but acts as a surprisingly reliable long-range support and resistance map. It colors zones from “fire sale” up to “maximum bubble” so you can quickly see whether BTC is in a buy or sell band.

Right now, Bitcoin sits in a still cheap area on that tool, which historically has been a reasonable accumulation zone. It also highlights a red flag level—around the hypothetical $140k mark—where I would start tightening exits if price ever reached that extreme.

Important seasonal note: halvings have historically preceded significant rallies. If halving dynamics line up with a favorable rainbow band, it strengthens the case to accumulate selectively.

Step 2 — Altcoin Season Index: are alts ready to run?

Even if Bitcoin is healthy, altcoins do better in a specific regime. The Altcoin Season Index is a simple, visual meter that signals whether gains are concentrating in BTC or across altcoins.

When that bar is low, Bitcoin season is dominant and altcoins typically lag. When it races to the alt side, smaller caps often explode. I only shift heavy alt exposure when the index favors altcoins—this preserves capital and avoids chasing tops.

Step 3 — DeFi Llama and TVL: find on-chain strength

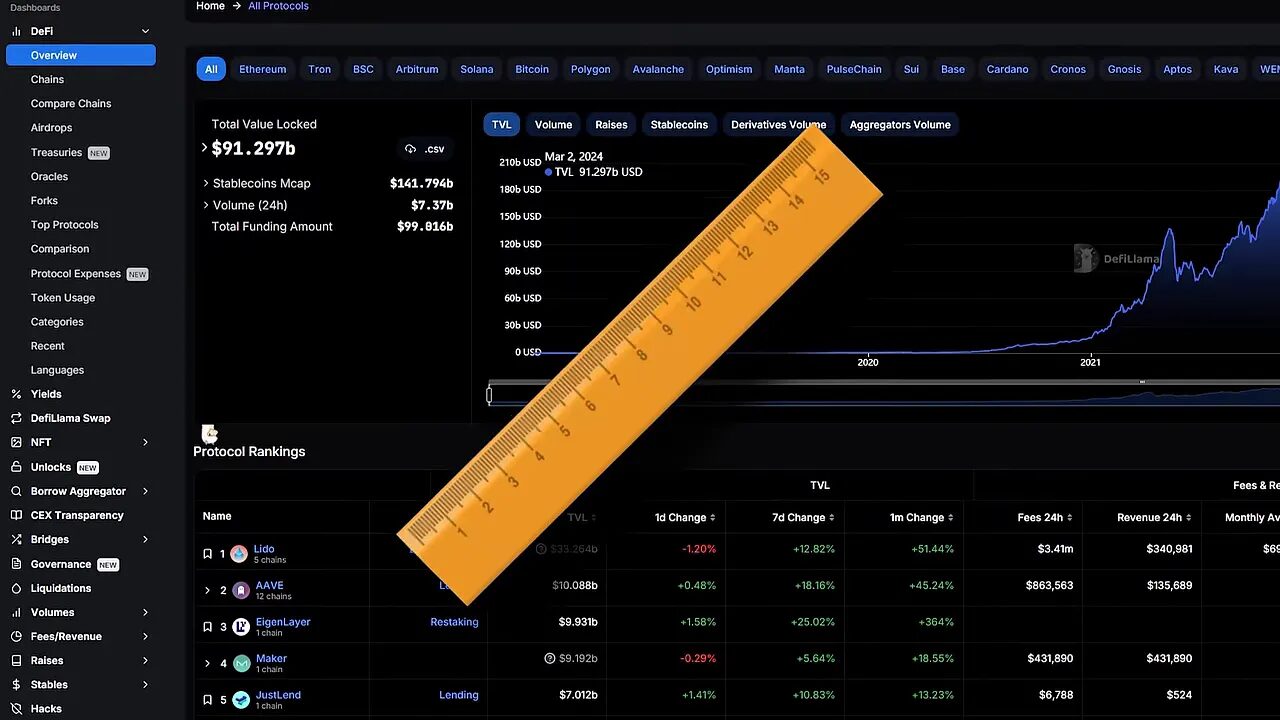

Total value locked (TVL) is how much capital is actively used or staked on a protocol. DeFi Llama lets you compare TVLs across projects. The insight I use is simple: compare TVL to market cap.

Example: two protocols with similar TVL but very different market caps. If one has a lower market cap while supporting the same TVL, it can offer more upside because the on-chain activity already exists. That mismatch is often where I find gems.

Think of TVL as the amount of real economic activity behind a token. When users must deposit, swap, or stake funds to use a protocol, that creates a practical demand floor for the token economy.

Step 4 — Arkham: follow the smart money

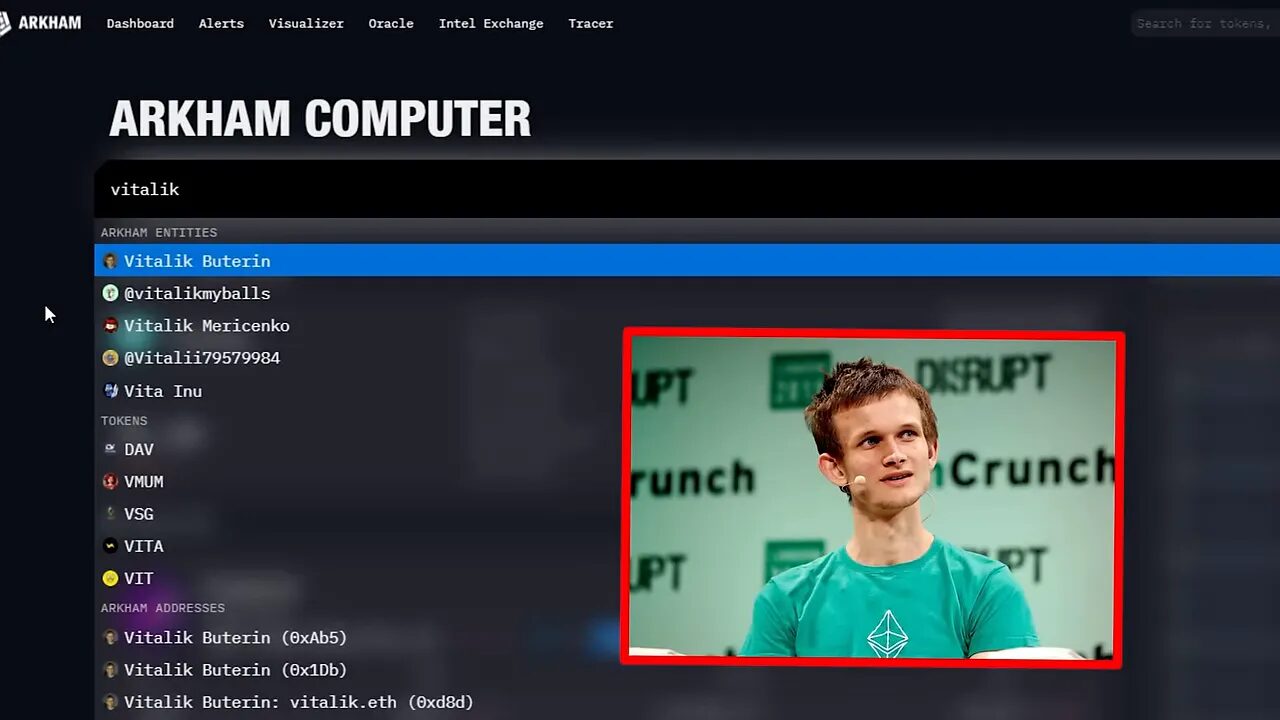

On-chain transparency lets you track big names and whale activity. Arkham aggregates addresses and transactions so you can see what influential accounts are buying and holding.

Scanning the portfolios of known developers, funds, or skilled traders can reveal early interest in an emerging project. If a high-profile address starts accumulating a token, it is a signal to research that project more deeply—not a guarantee, but a worthy data point.

Putting the four tools together: a repeatable process

I don’t use any single tool in isolation. Here’s the playbook I follow:

- Confirm Bitcoin is in a supportive long-term zone with the Bitcoin Rainbow.

- Check the Altcoin Season Index to see if alts have favorable momentum.

- Use DeFi Llama to screen protocols by TVL-to-market-cap ratio.

- Cross-reference names with Arkham to check who is accumulating.

For Render, that checklist lined up: the AI theme had momentum, Bitcoin’s macro timing looked constructive, Render’s on-chain metrics were compelling relative to peers, and smart-money patterns supported the thesis. The result: a sizable gain and still holding because the thesis remains intact.

Practical tips for execution and risk management

Altcoins can deliver enormous returns but also pose outsized downside. Keep these habits:

- Position sizing: limit any single altcoin to a percentage of your portfolio you can afford to lose.

- Staging entries: scale into positions as conviction rises rather than buying all at once.

- Exit plan: set target zones and trailing rules based on both Bitcoin Rainbow and token-specific liquidity.

- Rebalance: take profits periodically, especially as altcoin season peaks.

If you prefer trade-ready, actionable ideas instead of building every filter yourself, integrating a professional signal stream can speed decision making. Our cryptocurrency trading signals focus on combining macro timing, on-chain metrics, and smart-money cues so you can apply this framework faster.

Where to research and execute

Useful platforms for this workflow:

- Bitcoin Rainbow charts for macro timing.

- Altcoin Season Index for regime evaluation.

- DeFi Llama for TVL and protocol comparisons.

- Arkham for address-level intelligence.

Combine these with a reliable exchange and proper account hygiene. If you want curated signals that follow the exact combination of timing, TVL analysis, and smart-money tracking, consider exploring cryptocurrency trading signals to augment your own research.

Final thoughts

Finding altcoins before they explode is about disciplined filters and a repeatable process. Themes matter. Timing matters. On-chain fundamentals matter. And so does following where the real capital and attention are going.

If the AI trend continues, there will be more opportunities similar to Render. Using simple, complementary tools increases the odds that the next pick is a high-quality one.

FAQ

What is the Bitcoin Rainbow and why should I use it?

The Bitcoin Rainbow is a visual, color-coded long-term chart that highlights historical buy and sell zones. It helps identify high-level support and resistance bands and aids in deciding when to accumulate or consider exiting large positions.

How does TVL help me find promising altcoins?

TVL measures the capital actively used on a protocol. Comparing TVL to market cap reveals projects where real activity exists but the market cap has not yet priced that activity in. Those mismatches can indicate undervalued opportunities.

When should I favor Bitcoin over altcoins?

Use the Altcoin Season Index. When it indicates Bitcoin season, altcoins typically underperform and it is safer to favor BTC. When it points to altcoin season, smaller caps tend to rally and deserve higher allocation.

Are on-chain tracking tools like Arkham reliable indicators?

Arkham and similar tools reveal real transaction activity from public addresses, which is valuable context. They are not predictive on their own but are powerful when combined with macro timing and on-chain fundamentals to form a conviction.

Can I use this framework without paid services?

Yes. All four tools mentioned have public access points. Paid services like curated cryptocurrency trading signals simply speed up research and package the same signals into trade-ready entries and exits for those who prefer a shorter decision-making loop.

Risk reminder

This is not financial advice. Altcoins carry risk and can be highly volatile. Use proper risk management and only invest what you can afford to lose.