In a recent deep-dive presentation, laid out an argument that goes beyond charts, on-chain metrics, and macro narratives: the most important variable for crypto prices is the structure of the market itself — how money flows, who can access crypto and where that access is expanding. This article expands on those insights, explains the forces reshaping the landscape, and outlines what the Crypto Bull Run 2025 could look like for investors and traders.

Table of Contents

- Outline: What I’ll Cover

- Introduction: Market Structure Beats Signals

- From Peer-to-Peer to ETFs: How Market Structure Evolved

- Three Objections to the “Better Market Structure” Thesis

- Attention: The Achilles’ Heel of the Current Cycle

- How Market Structure Could Shift by the Next Cycle (2029)

- Practical Takeaways: Positioning for the Crypto Bull Run 2025

- What to Watch Over the Next 24–48 Months

- FAQ

- Conclusion: A Different Kind of Bull Run

Outline: What I’ll Cover

- Why market structure matters more than most indicators

- How crypto market structure has evolved since Bitcoin’s early days

- What changed between the 2017 and 2021 cycles — and why 2025 could be different

- Three structural debates: altcoin proliferation, spot ETFs, and stimulus myths

- Why attention — not capital — may cap rallies this cycle

- How TradFi’s march into crypto could transform the market by 2027–2029

- Practical takeaways for investors, traders, and anyone planning for the Crypto Bull Run 2025

- FAQ

Introduction: Market Structure Beats Signals

People love to debate technical setups, macro catalysts, and on-chain ratios. Those tools help, but they are downstream of a more fundamental force: market structure. Market structure determines how quickly capital can enter and exit, which assets get attention, who benefits from price moves, and how liquidity distributes across the ecosystem. Understanding structure helps explain why certain assets pump and why some rallies are longer or shorter.

When we talk about the Crypto Bull Run 2025, we aren’t just forecasting higher prices — we’re examining a different plumbing for the financial system. That plumbing affects everything from retail flows and ETF mechanics to DeFi borrowing and the potential role of megabanks. In short, the Crypto Bull Run 2025 won’t just be another price cycle; it may be the moment crypto is reorganized into a new asset class — with benefits and risks that every investor should understand.

From Peer-to-Peer to ETFs: How Market Structure Evolved

In 2009 buying Bitcoin meant awkward, risky peer-to-peer trades on forums. Exchanges like Mt. Gox appeared later, and banking pathways were sparse or hostile. Fiat on-ramps were often manual or unavailable. Then came a few structural breakthroughs that changed everything:

- 2014: USDT (Tether) provided a de facto USD-like token for exchanges, reducing reliance on traditional banks and enabling USD trading pairs.

- 2015–2017: The first exchange-traded products (ETPs) and the CME listing of Bitcoin futures legitimized crypto in the eyes of institutions.

- 2017–2021: Improved compliance from exchanges and the emergence of regulated products made fiat access easier.

- 2021–2024: Spot Bitcoin and Ethereum ETFs, user-friendly wallets, and in-house offerings from legacy asset managers further lowered barriers.

These changes didn’t just make it easier to buy crypto — they redefined who can buy crypto and how quickly capital moves. The Crypto Bull Run 2025 will happen inside this new framework, meaning inflows could be larger and more persistent — but they may also behave differently.

Why the Numbers Matter

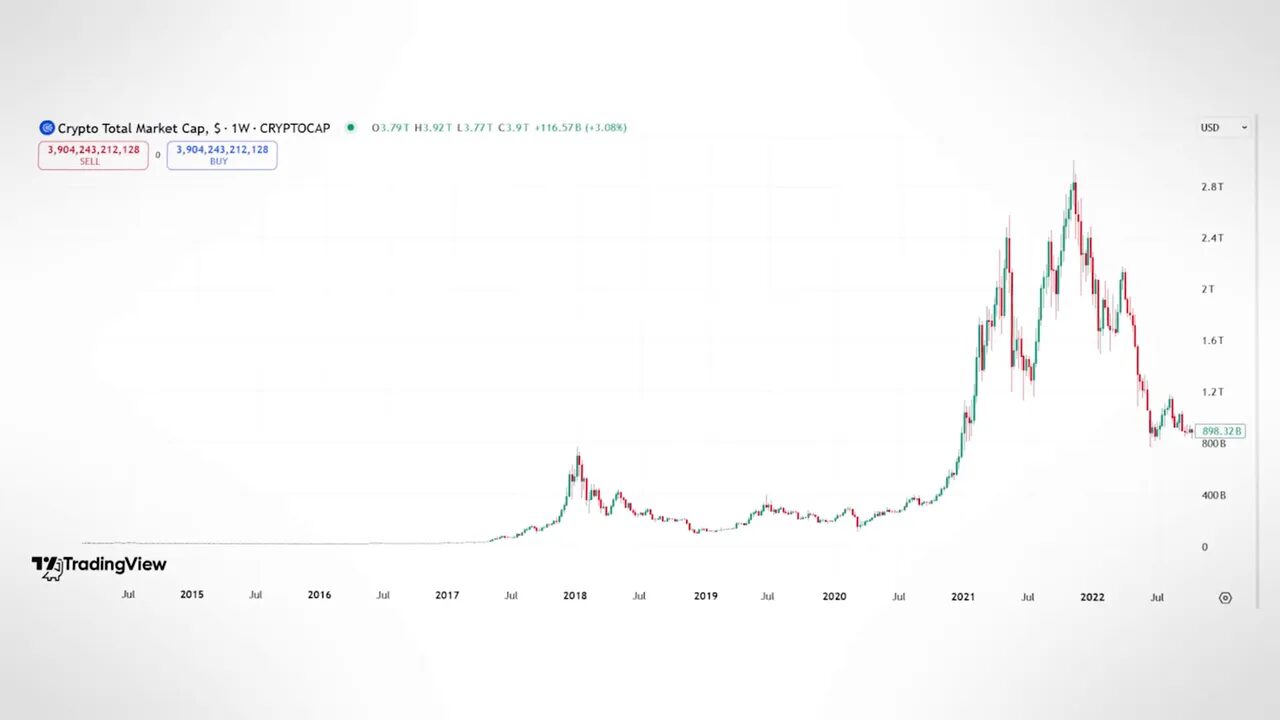

Compare peaks: the total crypto market cap was roughly $750 billion in 2017 and near $3 trillion in 2021. That’s a near 4x expansion. With institutional access improving and retail familiarity rising, the total addressable investor pool for crypto could increase dramatically. Consider that about 20% of investors in many developed countries currently hold crypto versus 60% who hold stocks. If crypto adoption grows closer to stock ownership levels, inflows could be substantial during a major bull run.

Some conservative modeling suggests the Crypto Bull Run 2025 could take total market capitalization into the multi-trillion range — targets like $6 trillion to $9 trillion have been proposed under certain assumptions. Those scenarios assume that the number of investors and average inflows per investor rise meaningfully because market structure now enables participation at scale.

Three Objections to the “Better Market Structure” Thesis

Even as the plumbing improves, critics claim the new structure has weaknesses that could mute upside. Let’s take each objection in turn and assess the real impact.

1) Too Many Altcoins — Liquidity Dilution?

Critics argue the explosion of tokens drains liquidity across the board. But the story is nuanced. CoinMarketCap lists virtually every token ever launched, including ephemeral meme tokens created and traded by bots. CoinGecko is more selective and arguably reflects the coins real traders care about. CoinGecko’s tracked token count moved from around 10,000 in 2021 to about 19,000 today — less than a 2x increase over four years. That’s not trivial, but it’s not an order-of-magnitude dilution either.

More importantly, token supply growth may be offset by a larger investor base and more capital entering the space via regulated rails. So while dilution exists, structural demand — driven by ETFs, better custodial solutions, in-wallet swaps, and fiat on-ramps — could absorb it during the Crypto Bull Run 2025.

2) Spot ETFs Kill Rotation Into Altcoins?

It’s tempting to assume that once retail and institutions park capital into spot Bitcoin or Ethereum ETFs, they’ll never rotate into altcoins again. But capital rotation inside crypto rarely behaves as simplistic theory suggests.

Large holders typically prefer to keep exposure to large caps while accessing altcoin upside by borrowing. Rather than selling BTC or ETH and buying altcoins directly, whales and sophisticated allocators often borrow USD-stable assets against their BTC/ETH collateral. That lets them maintain upside on the blue-chips while speculating in smaller projects.

DeFi lending has surged, and most borrowing uses BTC or ETH as collateral to mint USDC or other stablecoins. Interoperability improvements — bridges, centralized on-ramps, cross-chain stablecoin flows — make it easier to move liquidity between chains. ETF inflows that push BTC and ETH prices higher therefore create more collateral value and increase borrowing capacity. The end result is often more on-chain liquidity that can find its way into altcoins during the Crypto Bull Run 2025.

3) No Stimulus = No Rally?

There’s a persistent myth that retail stimulus money — like pandemic-era checks — was the fuel behind the 2021 bull market. Research by the Federal Reserve and other institutions shows most of those checks went to retail goods or debt repayment, not crypto. Meanwhile, retail trading activity in equities (options and penny stocks) has remained elevated. This implies that speculation appetite exists, but attention is the limiting factor rather than money itself.

So, the absence of fresh fiscal stimulus is not a valid reason to believe the Crypto Bull Run 2025 cannot happen. In fact, capital is available — what matters is where attention and accessibility converge.

Attention: The Achilles’ Heel of the Current Cycle

This is perhaps the most important nuance: everything about crypto’s structure has improved — more regulated access, better custodial services, robust protocols and user-friendly wallets — yet one critical input has declined: attention.

During the pandemic, people had time to research and learn about crypto. That increase in attention helped drive prolonged rallies where niches received deep rotation. Stimulus checks played a minor role compared to the time people had to educate themselves and deploy capital strategically. Today, with busy lives and shorter attention spans, rallies can be short, sharp, and driven by transient narratives.

Evidence: rallies in 2024 lasted only a few months each despite ample capital availability. These episodes resembled 2017 rallies more than 2021’s prolonged bull market. The implication is simple: even in a structurally superior market, the Crypto Bull Run 2025 could be shorter and more frenzied unless attention returns in a sustained way.

The Attention Loop and Accessibility

Price action drives attention, and attention drives price action — the classic feedback loop. An altcoin pumps, narratives form, retail checks social feeds, allocations increase, and price rallies further. But one limiter remains: accessibility. If an altcoin is hard to buy, those pumps will tend to fizzle quickly because many potential buyers cannot access the token easily.

The most accessible cryptos historically have been long-established coins (e.g., Litecoin, XRP) and tokens on fast, low-fee blockchains with friendly wallets and front-ends (e.g., Solana with Phantom, Base with Coinbase). These assets will naturally attract more attention in a short-cycle Crypto Bull Run 2025 because far more participants can buy quickly and with low friction.

How Market Structure Could Shift by the Next Cycle (2029)

The next multi-year cycle after the Crypto Bull Run 2025 will likely arrive around 2029. By then, regulatory changes and TradFi integration may reshape crypto more radically than past cycles. Two regulatory pillars to watch are:

- The stablecoin-focused legislation (nicknamed here as the “Genius Act”) that clarifies how stablecoins are regulated in the U.S.

- The broader crypto regulatory framework (referred to as the “Clarity Act”) that could bring tokenized assets, securities law clarity, and infrastructure rules into force.

Both sets of regulations are expected to take effect around 2027, according to current timelines. Until they are active, their passage acts primarily as a bullish sentiment catalyst. Once enforced, however, they will alter market structure in material ways.

TradFi Moves Into Crypto: Opportunity or Extinction?

The major change these laws usher in is TradFi participation at scale. That means banks, exchanges, and asset managers can bring their balance sheets, client bases, and processes onto crypto rails. On the one hand, this increases liquidity and legitimacy. On the other hand, it creates formidable competition for crypto-native projects.

Consider practical examples:

- Megabanks collaborating on a shared stablecoin could enable direct mint-and-redeem from bank accounts, vastly improving convenience compared to Tether or Circle, which restrict minting/redemption to select institutions.

- TradFi exchanges like NASDAQ exploring tokenized real-world assets (RWAs) could create institutional-grade venues for buying tokenized bonds, stocks, or other assets.

- Regulated TradFi platforms may acquire crypto startups during bear markets, folding infrastructure into legacy systems and shifting where retail and institutional flows go.

If these trends unfold, the next cycle might be called a “digital asset cycle” rather than strictly a “crypto cycle.” Trading venues could be dominated by traditional players using familiar custodial rails and possibly shared bank-issued stablecoins.

Winners and Losers in a TradFi-Enabled Future

Worst-case scenarios for many smaller tokens are plausible. If major exchanges delist or TradFi platforms focus on a curated set of assets, a large number of smaller crypto projects could lose access to liquidity and disappear. That’s not an indictment of decentralization so much as a likely market consolidation when institutional channels dominate.

On the bright side, dozens or hundreds of projects will persist, and new tokenized asset classes — tokenized RWAs, debt, or other financial instruments — will create fresh speculation arenas. Practically, this means traders should expect new opportunities, but also an environment where listing/accessibility dictates winners more than pure technical merit.

Practical Takeaways: Positioning for the Crypto Bull Run 2025

Here are pragmatic strategies to consider as we move toward the Crypto Bull Run 2025:

- Prioritize accessibility. Assets that are easy to buy on major exchanges or in popular wallets are likelier to see rapid inflows and attention-driven rallies.

- Monitor DeFi borrowing trends. ETF inflows can indirectly create on-chain liquidity via borrowing against BTC/ETH. Watch collateralization ratios and lending platforms for early signs of allocation shifts.

- Watch regulatory calendars. Rules going into force in 2027 will change the game. Position accordingly and be ready for increased TradFi competition.

- Be mindful of attention cycles. Short rallies mean timing and nimbleness can be more valuable than long-term narrative conviction in the early stages.

- Diversify across accessibility profiles. Holding a mix of long-standing coins (high accessibility) and high-upside small-cap tokens (if accessible) can balance participation in short, attention-driven cycles.

- Use tools that help you act quickly. If you trade spot, consider services that provide timely trade ideas and risk management. For example, cryptocurrency trading signals for spot trading can help you stay on top of fast-moving opportunities during the Crypto Bull Run 2025 without distracting you from broader portfolio strategy.

Integrating high-quality trading signals can be particularly effective when rallies are short and attention-driven. Signals can help identify momentum, stop levels, and entry points so you can act decisively — especially important when the market structure favors fast-moving, accessible tokens.

What to Watch Over the Next 24–48 Months

If you want to be prepared for the Crypto Bull Run 2025 and beyond, keep an eye on these measurable indicators:

- ETF inflows and the distribution of ETF holders (retail vs institutional).

- DeFi borrowing volumes and the collateral mix (BTC, ETH, stables).

- Number of accessible listings on top exchanges and native wallet swap volume (e.g., Phantom, Coinbase Wallet).

- Regulatory milestones and announcements from major banks or exchanges about stablecoins and tokenized assets.

- Social and search attention metrics for specific altcoins and niche narratives.

These signals will reveal whether next-cycle growth is broad-based or concentrated in more accessible and TradFi-aligned instruments.

FAQ

Q: Will the Crypto Bull Run 2025 be bigger than 2021?

A: It depends on how you define “bigger.” In absolute dollar terms, it’s plausible the market cap could reach new highs given increased institutional access and ETFs. In percentage terms, rallies may be shorter and more concentrated due to waning attention. If adoption triples toward stock ownership levels, total inflows could be enormous — but their distribution will be shaped by accessibility and TradFi participation.

Q: Do spot ETFs mean altcoins won’t rally?

A: Not necessarily. Spot ETFs change the mechanics of how some capital enters the market, but rotation often happens via borrowing rather than outright sales. DeFi borrowing against BTC/ETH can create stablecoin liquidity that flows into altcoins. So expect different pathways for rotation rather than the end of altcoin rallies.

Q: Are stimulus checks needed for the next bull run?

A: No. Evidence suggests stimulus played a minimal role in earlier rallies. There’s capital for speculation; what’s missing is time and attention. If attention returns, rallies can happen with or without broad fiscal stimulus.

Q: Will TradFi kill crypto if banks issue their own stablecoins?

A: TradFi stablecoins would change the landscape by offering easier minting and redemption for retail banking customers, which could shift liquidity away from crypto-native stablecoins. But “kill” is too strong — many crypto-native projects and tokens will survive, and new tokenized assets will emerge. The market may simply evolve into a hybrid of TradFi and crypto-native systems.

Q: How should traders prepare for the Crypto Bull Run 2025?

A: Focus on liquidity and speed of execution. Use tools to monitor borrowing and ETF flows, track which assets are being listed on major exchanges and wallets, and consider incorporating quality trading signals to help capture short, attention-driven moves while managing risk.

Conclusion: A Different Kind of Bull Run

The Crypto Bull Run 2025 won’t be a mere replay of past cycles. Market structure — the plumbing that moves capital — has changed in profound ways. Improved access, ETFs, user-friendly wallets, and DeFi leverage create the potential for larger absolute inflows. At the same time, attention constraints and the looming integration of TradFi present new dynamics: rallies may be shorter, winners will often be the most accessible assets, and the long-term ecosystem may consolidate under institutional rails.

Whether you are a long-term investor or an active trader, the key is to adapt to this structural environment. Prioritize accessibility, understand borrowing and liquidity dynamics, and watch regulatory changes closely. For traders, having signal-driven tools like Cryptocurrency Trading Signals can make the difference between catching an opportunity and watching it pass by. The Crypto Bull Run 2025 promises opportunity — but also a new set of rules. Preparing for both is essential.