Table of Contents

- Aster vs Hyperliquid: Origins and Money

- Technical Philosophies: Vertical vs Horizontal

- Product Features & Trader Experience

- Tokenomics & Airdrops

- Adoption, Metrics & Who’s Winning Users

- Risks: What Could Kill Them

- Verdict: Aster vs Hyperliquid — who takes the crown?

- FAQ

Aster vs Hyperliquid: Origins and Money

Hyperliquid began life as Camellian Trading in 2020, built by Jeff Yan — a Harvard math grad who learned latency warfare at Hudson River Trading. The founding myth is staunchly bootstrap-first: Yan publicly derided venture capital as an “illusion of progress.” That said, a later pitch deck raised eyebrows by listing several investment firms, so the messaging vs reality question lingers.

By contrast, Aster (sometimes styled Asta) launched with prominent backing. YZi Labs — the family office linked to Binance co‑founders including CZ — has been openly supportive. CZ’s tweets around Aster’s token generation and feature set have driven huge waves of attention. In short: Hyperliquid sells purity (allegedly), Aster sells scale and connections.

“VCs become a scar on the network when they own too much of a crypto project.” — quoted from Hyperliquid’s founder

Technical Philosophies: Vertical vs Horizontal

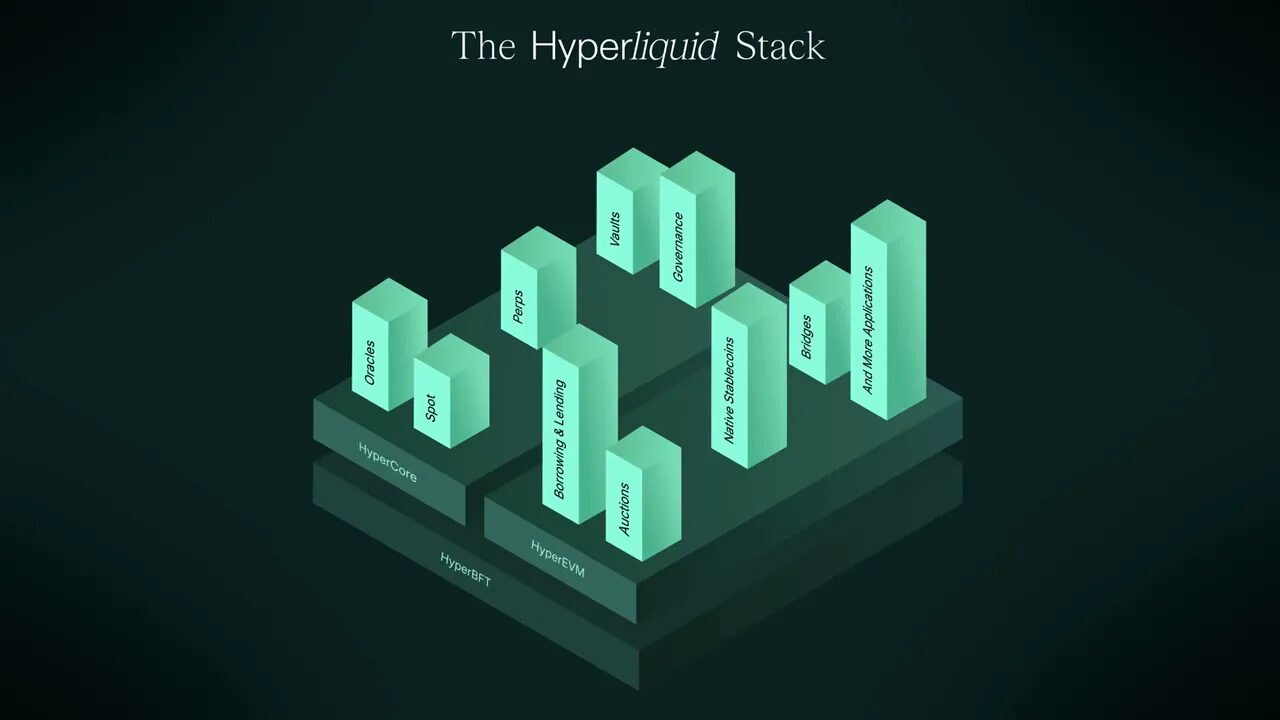

When comparing Aster vs Hyperliquid technically, you can’t overstate how different they are. Hyperliquid built vertically: a custom Layer 1, its own consensus (hyper-BFT), order-matching engine and execution environment (Hyper Core), plus an EVM layer (Hyper-EVM) for smart contracts.

That vertical stack is optimized for trading performance: up to 200,000 orders per second and sub-0.2s finality. Everything — matching, margining, liquidations — happens on-chain so transparency is baked in (and visible to everyone).

Aster takes the horizontal approach: it aggregates liquidity across BNB Chain, Ethereum, Solana and Arbitrum. This gives Aster flexibility and reach, but it also multiplies complexity and the potential attack surface introduced by cross-chain bridges.

Product Features & Trader Experience

Feature design tells you who the product is for.

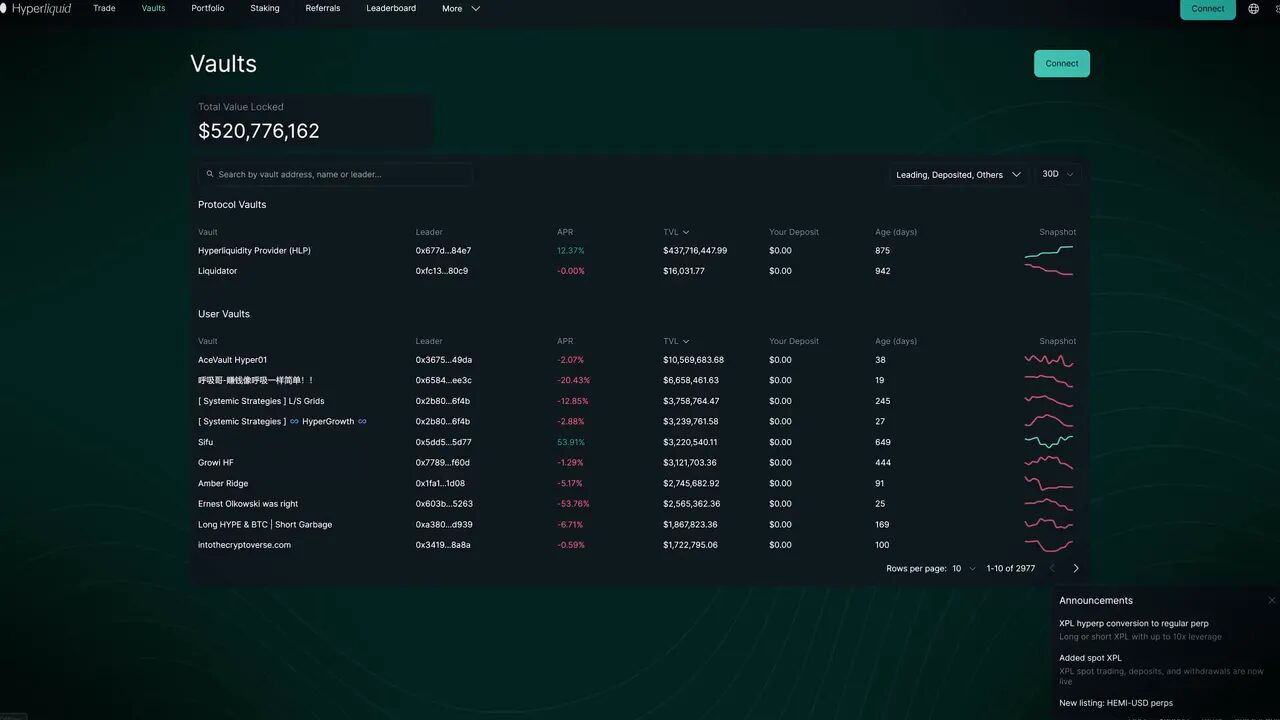

Hyperliquid is built like a precision trading engine: perpetual futures up to 50x, cross/isolated margin, social trading vaults, and an HLP vault that runs automated yield strategies. Liquidity on major pairs is deep — you can trade significant BTC perp size without blasting the book.

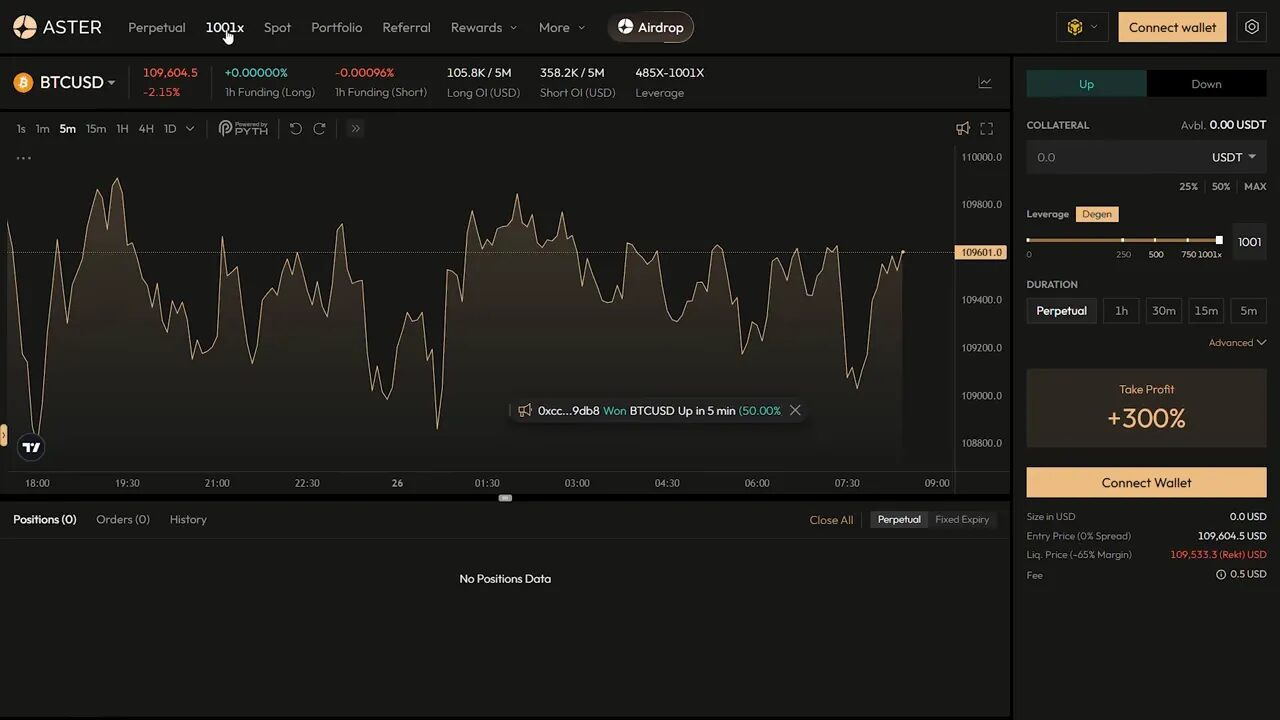

Aster’s UX splits into Perpetual (traditional orderbook, stops, limit orders) and the infamous 1001X mode — effectively one‑click gambling with up to 1,001x leverage. It’s designed to be accessible (or addictive) for retail traders: minimal fuss, MEV resistance, hidden orders, and the killer product differentiator — stock perpetuals (Apple, Tesla, etc.) tradable 24/7 settled in USDT with leverage.

Another notable Aster feature: you can collateralize with yield-bearing assets (like liquid staking derivatives) and keep earning while they back your trades — capital efficiency dialed to max.

Spot trading opportunities and Crypto Spot Signals

Both platforms create trading opportunities beyond perpetuals. For traders focused on spot trends across multiple chains — especially when Aster is aggregating liquidity from Solana, BNB and Ethereum — a curated spot signals service can be useful. Our Crypto Spot Signals deliver concise, cross‑chain spot trade ideas and timing cues that complement derivatives strategies and help traders act on emerging on-chain flows without getting lost in noise.

Tokenomics & Airdrops

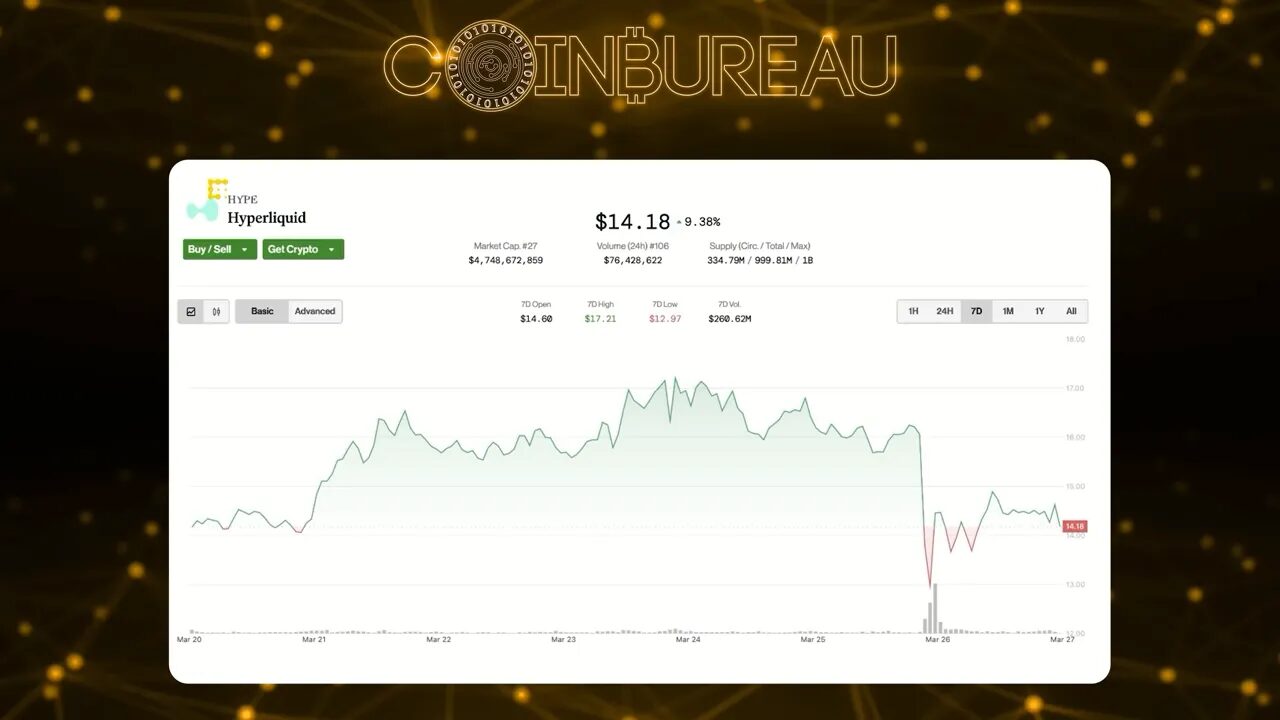

Token distribution is where the two strategies diverge again. Hyperliquid’s HYPE launched with 1 billion tokens and a headline FDV in the tens of billions, but distribution was focused: 310M went to ~94,000 users at launch. Crucially, Hyperliquid routes 93–97% of protocol fees to buybacks and burns, creating a deflationary, volume‑linked flywheel.

HYPE also functions as gas on Hyper-EVM, stakes validators, and provides fee discounts — utility stacked on utility.

Aster launched with a max supply of 8 billion and earmarked ~53% for rolling community rewards. Instead of a single “big bang” airdrop, Aster opted for phased distributions over months and years (80 months of gradual unlocks), with large allocations tied to on‑platform activity. That can incentivize long-term engagement but also creates predictable future supply — which may weigh on perceived scarcity.

Adoption, Metrics & Who’s Winning Users

Now for the numbers: Hyperliquid boasts real trader metrics — around $6.5B TVL, $2.7T cumulative volume, and hundreds of billions in monthly flow. Annualized revenue exceeds a billion dollars. These are not vanity stats; they reflect active derivatives traders.

Aster’s growth has been explosive but meme-like: 2 million users, 330k in the first 24 hours post‑TGE, TVL spiking to $2B then settling closer to $1B. On some analytics snapshots Aster reported 24‑hour volume and fees that outpaced Hyperliquid — largely thanks to multi-chain distribution and CZ’s social amplification.

Which metric matters most? For derivatives, engaged trader liquidity and sustainable revenue matter more than raw user sign-ups. But listability, marketing muscle and unique products (e.g., stock perps) can win short-term market share quickly.

Risks: What Could Kill Them

No platform is risk-free.

Hyperliquid’s transparency and performance are strengths — but centralization concerns bite. The core software remains closed-source in places and the validator set is small (capped at 21), meaning human intervention occurred during a past on-chain manipulation attempt. That intervention saved funds but revealed a centralized kill switch.

Aster’s risks are mostly operational: multi‑chain architecture increases attack surface via bridges, and much of the platform’s momentum ties to CZ’s amplification. Large, scheduled airdrops over years can also create persistent selling pressure. Critics argue that Aster rides borrowed legitimacy; supporters say distribution and features will win the day.

Verdict: Aster vs Hyperliquid — who takes the crown?

Based on five lenses — Origins, Tech, Tokenomics, Adoption and Risks — my view is clear: Hyperliquid is the better engineered perp DEX today. Its execution, throughput and revenue model are nearer to sustainable than many rivals.

That said, Aster might outgrow Hyperliquid in raw users. Multi‑chain reach, stock perps and CZ’s ecosystem push are powerful levers. In other words, Hyperliquid built a better car; Aster is building a fleet and has deep pockets to advertise it.

My practical takeaway: both will likely coexist. Traders who need institutional-grade perps with deep on‑chain transparency may prefer Hyperliquid. Traders chasing exotic products, ease-of-use or 24/7 stock exposure may lean towards Aster.

FAQ

Q: Which is better for serious derivatives traders — Aster or Hyperliquid?

A: For professional/performance-driven derivatives trading, Hyperliquid is generally preferable due to its order throughput, liquidity depth and fee-to-buyback model. Aster is catching up fast in user numbers and offers unique products but carries a different risk profile.

Q: Is Aster safe to use given its multi-chain design?

A: Multi-chain brings flexibility and liquidity but also more points of failure (bridges, cross-chain messaging). Use proper risk management and minimize exposure on freshly integrated rails.

Q: How do the tokenomics compare and why do they matter?

A: Hyperliquid focuses on a strong buyback-and-burn mechanism and concentrated airdrops; Aster uses rolling airdrops and a much larger total supply. Distribution cadence impacts scarcity and price pressure over time.

Q: Can I use spot trading strategies instead of jumping into high leverage?

A: Absolutely. Spot trading across chains is often lower risk and can benefit from momentum and cross‑market flows. If you want curated spot ideas that complement derivatives plays, services like Crypto Spot Signals provide cross‑chain, timely spot trade alerts to help you capture on‑chain trend opportunities without overleveraging.

Q: How should I approach high-leverage features like Aster’s 1001x?

A: Treat one‑click ultra‑leverage as pure gambling. Only risk money you can afford to lose, and prefer smaller, controlled sizing or avoid it entirely unless you truly understand liquidation math.

Q: Will both platforms survive long-term?

A: Likely yes — at least in some form. Both bring distinct value propositions: Hyperliquid brings a high‑performance, revenue-backed model, and Aster brings aggressive distribution and product innovation. Market dynamics generally allow room for multiple thriving DEXs if they continue to evolve.

Final note: whether you lean on on-chain perps or lean into spot, rotate risk appropriately and never ignore protocol-level threats. If you want concise, cross-chain spot trade ideas to act on emerging flows from platforms like Aster and Hyperliquid, consider giving Crypto Spot Signals a look as a complement to your derivatives playbook.