Table of Contents

- Introduction — What this Aster DEX Review covers

- Why Aster deserves attention — quick summary

- Founding story, backing, and context

- How Aster positions itself vs the competition

- Multi-chain order book: how it works and why it matters

- Adoption metrics and the airdrop effect

- Airdrops: how they worked and how you can still earn points

- Getting started: wallets, gas, and connecting to Aster

- Security overview — audits, bug bounties, and real incidents

- Your personal security checklist (must-read)

- Depositing funds: networks, USDT, and best practices

- Step‑by‑step deposit flow

- Trading on Aster: two very different experiences

- Order types and execution strategy

- Hidden Orders and MEV resistance: privacy for size traders

- Fees, funding rates, and trading cost optimization

- Withdrawals and post-withdrawal security

- Yield features: USDF, ASBNB, and capital efficiency

- Stock Purps: trading equities on-chain

- Risk management and a trader’s checklist

- Advanced tactics for better execution

- Taxes and record-keeping

- Common pitfalls and how to avoid them

- Where Aster shines and where it struggles

- Real-world incident recap and lessons

- Practical walkthrough: from zero to a live perpetual trade

- FAQ — Quick answers to common questions

- Conclusion — who should use Aster and how to approach it

- Additional resources and next steps

- Final screenshot references

Introduction — What this Aster DEX Review covers

This Aster DEX Review is a practical walkthrough mixed with analysis. I’ll cover the history, the multi-chain architecture, who’s backing the project, the pros and cons compared to current leaders, step-by-step setup, trading interfaces, security considerations, yield features, and how to collect airdrop points. I will also explain the real risks (technical and behavioral) that come with trading on a decentralized perpetual exchange. Think of this as the field manual you should read before you click connect wallet.

Throughout the article I’ll use screenshots taken from relevant moments to help you visualize the steps. These images are annotated with timestamps so you can reference the same moments in the source material.

Why Aster deserves attention — quick summary

This Aster DEX Review boils down to a few headline points: Aster is a multi-chain perpetual futures DEX that aims to combine capital efficiency, low fees, and advanced privacy features for larger traders. It’s backed by big industry names, it merged established projects rather than being built from scratch, and it introduces yield-bearing collateral (USDF and liquid staking derivatives) plus stealth trading (Hidden Orders) and extreme leverages like 1001x for entertainment-style trading.

That combination has made Aster the center of attention — and of debate. Low fees, multi-chain order books, and yield-on-collateral are genuinely interesting innovations. But complexity, fresh codebases, extreme leverage products, and heavy airdrop-driven volume are reasons to be cautious. me top crypto signal providers, including Dark Crypto Signals, have also suggested that Aster could perform very well in the coming weeks.

Founding story, backing, and context

An essential part of this Aster DEX Review is understanding how Aster came to be. In late 2024 two projects — Asteris and APX Finance — merged. Asteris brought multi-asset liquidity primitives and APX brought a working decentralized perpetuals engine. Rebranded and relaunched in early 2025 as Asta (commonly referred to as Aster in conversation), the project didn’t start from zero; it built on tested pieces.

What accelerates interest is the people and backers. Aster is backed by YZi Labs (a rebrand of Binance Labs’ venture arm), counts ex-Binance employees on the team, and has CZ (Changpeng Zhao) in an advisory role. The founder uses the handle Leonard and keeps a low profile — but when CZ is tweeting and the project has industry knowledge packed into its architecture, it attracts attention fast. This Aster DEX Review cannot understate how much investor confidence and network effects from a recognizable backer matter in adoption.

How Aster positions itself vs the competition

Let’s be blunt. This Aster DEX Review needs context: Hyperliquid dominated on-chain perps for a while by building a high-performance centralized-exchange-like experience on-chain. Aster’s approach is different. Instead of replicating a centralized exchange exactly, Aster leans into features that centralized exchanges or Hyperliquid don’t emphasize, including:

- Multi-chain trading: BNB Chain, Arbitrum, Ethereum, Solana — trade without bridging your collateral.

- Yield-bearing collateral: Use USDF (a yield-bearing stablecoin) or liquid staking tokens as margin and earn while you trade.

- Privacy/stealth features: Hidden Orders and MEV-resistant execution to combat frontrunning.

- Exotic leverage modes: 1001x for headline-grabbing positions (with caveats — more on that later).

Compared to Hyperliquid’s slick single-L1 experience (which delivers near-instant settlements), Aster is more of a Swiss Army knife: powerful, flexible, and slightly more complex. This means it can offer capital-efficient and innovative primitives but at the cost of higher engineering complexity and a potentially larger attack surface.

Multi-chain order book: how it works and why it matters

One of the headline capabilities in this Aster DEX Review is Aster’s multi-chain order matching. Orders from different chains feed into a single global matching engine. That means you can leave collateral on BNB Chain and have your trade matched with someone on Solana or Arbitrum. Settlement uses cross-chain messaging so your collateral never has to hop chains — the matching engine simply accounts for cross-chain collateral states and clears trades across the protocol’s messaging rails.

The technical result is neat: shared liquidity across ecosystems while preserving the custody locality of your assets. Practically, this translates into better fills for smaller traders (shared depth) without forcing them to bridge funds. The downside: coordinating settlement across chains with different finality times is complicated. Aster uses optimistic execution with fraud proofs now and has plans for zero-knowledge (ZK) proofs to further tighten settlement guarantees. This blending of cross-chain optimistic execution and eventual ZK-proofing represents a solid engineering roadmap — but it also means the stack is deep and new.

Adoption metrics and the airdrop effect

At the time of writing, Aster logged eye-popping numbers: daily trading volume reportedly hitting $104 billion, $29 million in fees in a single day, TVL that rocketed from $625 million to $2.2 billion in a week, and the token doing 28x at launch. Those stats look incredible in a vacuum.

This Aster DEX Review does two things here: celebrate the product-market fit signals, and caution on how airdrops amplify activity. Much of the explosive volume was driven by airdrop farming. Activity spiked into snapshots because users chased token allocation points. That’s standard for airdrops — and Aster ran multiple airdrop stages (stage one wrapped and stage two concluded around early October; stage three offers ongoing opportunities). Airdrop-motivated volume isn’t inherently malicious, but it can distort metrics. A platform is both what it is on production volume and how sticky its users are once airdrop incentives fade.

If you’re reading an Aster DEX Review to decide whether to join, factor in that airdrops attract both quality traders and short-term volume farmers. The result is great liquidity in the short term for many markets but potentially thinner, more fragile organic liquidity for big-ticket trades when incentives wind down.

Airdrops: how they worked and how you can still earn points

Aster structured its airdrops across multiple stages. Stage three allows participants to earn points via spot trading (not just perps), cross-chain activity, holding ASTER tokens, and using USDF collateral. These mechanics reward multi-chain interactions and capital committed to Aster, which aligns with Aster’s product priorities.

Important practical takeaway from this Aster DEX Review: you haven’t necessarily missed the boat. If you want to accumulate airdrop points, trade or transact in ways that align with stage rules: emphasize cross-chain trades, hold ASTER, and use USDF when possible. Always check the official rules and snapshot dates so you don’t optimize wrongly.

Getting started: wallets, gas, and connecting to Aster

Let’s move from background to hands-on. This part of the Aster DEX Review shows you how to join.

Step 1 — Wallet: You need a web3 wallet. MetaMask is the easiest and most universal option for EVM chains (BNB Chain, Arbitrum, Ethereum), and SafePal has an official integration for mobile convenience. For Solana, a Solana-native wallet is required for native interactions but MetaMask now supports Solana in some flows. Regardless, write down your seed phrase on physical paper and store it somewhere safe.

Step 2 — Gas: Fund your wallet with a little native chain token for gas: BNB for BNB Chain, ETH for Arbitrum and Ethereum, SOL for Solana. You only need a few dollars to start, but without gas you can’t approve or sign any transactions.

Step 3 — Connect: Visit astodex.com and click connect wallet. If you’re using a referral link you may get benefits (the sign-up link used in the original walkthrough offered a 20% trading rebate and bonus airdrop points). Connect and sign a message to prove wallet ownership. There’s no KYC — your wallet address is your account ID. That’s great for privacy and speed, but remember there’s no fiat rails, no password resets, and no central support.

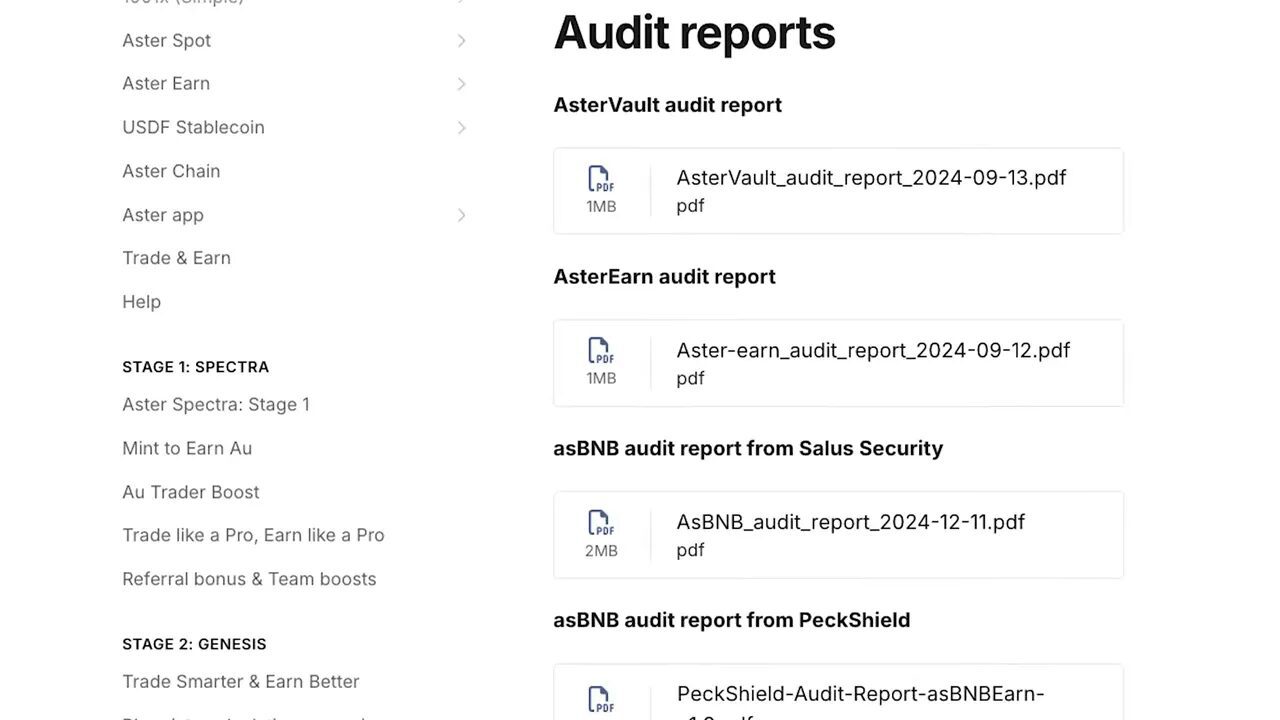

Security overview — audits, bug bounties, and real incidents

This Aster DEX Review spends more time on security than many reviews because it matters. Aster’s smart contracts were audited by Cyberscope, Salis Security, Peckshield, and Halborn. Multiple audits are a baseline requirement, and Aster also ran a bug bounty on Immunify with rewards up to $200,000 for critical issues — a good sign that the team incentivizes external white-hat testing.

However, audits reduce risk, they do not eliminate it. Aster had a notable configuration error early on: a token listing (XPL) had a price index hard-coded at $1, which temporarily made XPL behave like a stablecoin. When the price cap was lifted before a correct fix, XPL spiked on Aster to nearly $4 while its market price elsewhere sat near $1.30. That misconfiguration caused mass liquidations for short positions. To their credit, Aster publicly acknowledged the issue, refunded affected traders (including fees), and acted quickly to repair the problem — the kind of responsivity that matters in earning trust.

Nevertheless, you should assume new platforms will have teething problems. The bigger, broader risk is social engineering: phishing sites, cloned Twitter or Discord accounts, and malicious links. Bookmark the legitimate astodex.com URL, never click unsolicited links, and only trust official channels when in doubt.

Your personal security checklist (must-read)

- Use a hardware wallet for significant funds; hot wallets for active trading only.

- Regularly audit token approvals and revoke unused permissions.

- Never follow wallet connection links from direct messages or unknown Discord posts.

- Keep a small test deposit before moving larger amounts.

- Consider a dedicated trading wallet for all DEX activity to simplify tax reporting and minimize risk to long-term holdings.

Depositing funds: networks, USDT, and best practices

Deposits on Aster are straightforward but require attention to the network you choose. The platform primarily uses Tether USDT as collateral. That means trades, P&L, and margin are denominated in USDT. Always choose the correct token standard when sending from an exchange: ERC20 for Ethereum, BEP20 for BNB chain, etc. Sending tokens on the wrong network can cause permanent loss.

This Aster DEX Review recommends starting with a test deposit (small amount) the first time you use a new chain. Solana is extremely fast and cheap, but it behaves differently than EVM chains and occasionally has UI sync quirks. For most traders, BNB Chain or Arbitrum currently offer the best balance of low fees and smooth MetaMask integration.

Step‑by‑step deposit flow

- Fund your wallet on the chain you intend to use (BNB, Arbitrum, Ethereum, or Solana).

- On astodex.com select your wallet address in the top right and click Deposit.

- Choose USDT and select the matching network.

- Enter an amount and approve the token allowance in your wallet (one-time per token/contract).

- Confirm the transaction and wait for the chain confirmation. Your USDT will appear in Aster’s smart contract and show in your trading balance.

Remember: only send USDT on the network you selected for deposit. If you withdraw USDT from an exchange, pick the same network the receiving wallet is expecting.

Trading on Aster: two very different experiences

This is where the Aster DEX Review gets particularly practical. Aster offers two separate trading experiences that feel like different products:

- 1001x Mode — fast, simple, high-risk, limited upside (an entertainment-style product);

- Perpetual Mode — full-featured, professional, for serious derivatives traders.

1001x mode: the slot machine

1001x mode is intentionally simple: pick direction (long/short), choose a stake, slide the leverage to extreme levels, and open your position. No order book. No chart clutter. The experience is instant and gamified.

However, there are three structural things you must know:

- Fees are high: 0.08% to open and 0.08% to close (0.16% round trip). At extreme leverage that cost becomes massive relative to your margin.

- ROI caps limit upside: maximum profit is capped (roughly between 300% and 500% depending on asset). So a perfect 1001x bet does not yield a 1000x payoff.

- Liquidation risk is extreme: at maximum leverage a move of ~0.1% against you can liquidate your position.

In short, 1001x mode is entertainment, not trading. Treat it like a casino: risk only what you expect to lose and never consider it part of a disciplined trading plan.

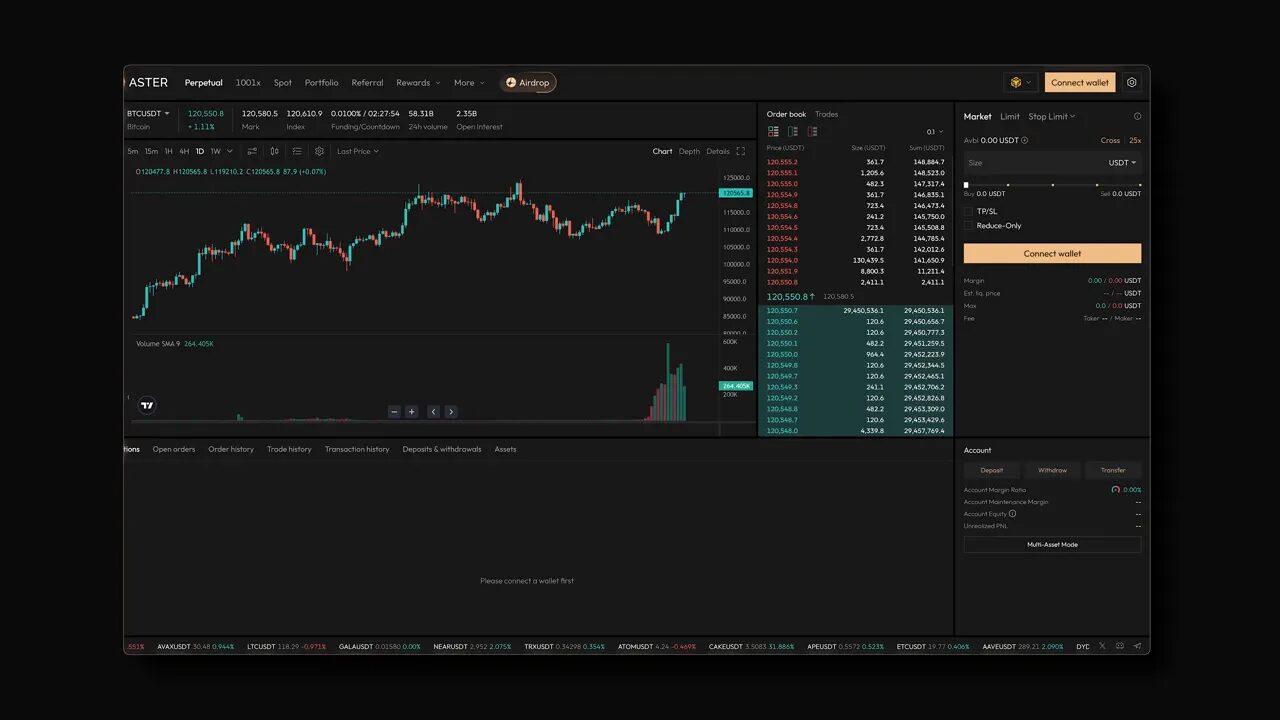

Perpetual mode: the real trading terminal

Perpetual mode is where Aster’s professional-feeling trading experience lives. The layout will be familiar to anyone who’s used Binance Futures or Bybit: trading view charts, an order book in the middle, an order entry panel to the right, and position management at the bottom. This interface supports market, limit, stop-loss, and conditional orders, with maker/taker fee differentials and adjustable leverage.

Key trading mechanics covered in this Aster DEX Review:

- Market orders cost 0.035% (taker fee) and execute immediately at best price.

- Limit orders (makers) pay 0.01% if you add liquidity, a massive discount over taker fees.

- Stop-loss orders are supported and strongly advised — they act as your risk control.

- Two margin modes: Isolated (recommended for most) and Cross (uses entire account as collateral).

The difference between isolated and cross margin is crucial. Use isolated margin for defined trade-size risk control. Cross margin exposes your entire account to liquidation if things go wrong.

Order types and execution strategy

Understanding how to use order types is central to any Aster DEX Review that aims to be practical. Here’s how to think about them:

- Limit orders — use for strategic entries and to collect the 0.01% maker fee. Your order will sit in the book until filled.

- Market orders — use for immediate execution when you need to ensure a fill; be mindful of taker fees and slippage.

- Stop-loss and conditional orders — compulsory for leveraged trading. Don’t skip them.

- Hidden Orders — use when executing large trades to avoid painting your intentions in the public book (more below).

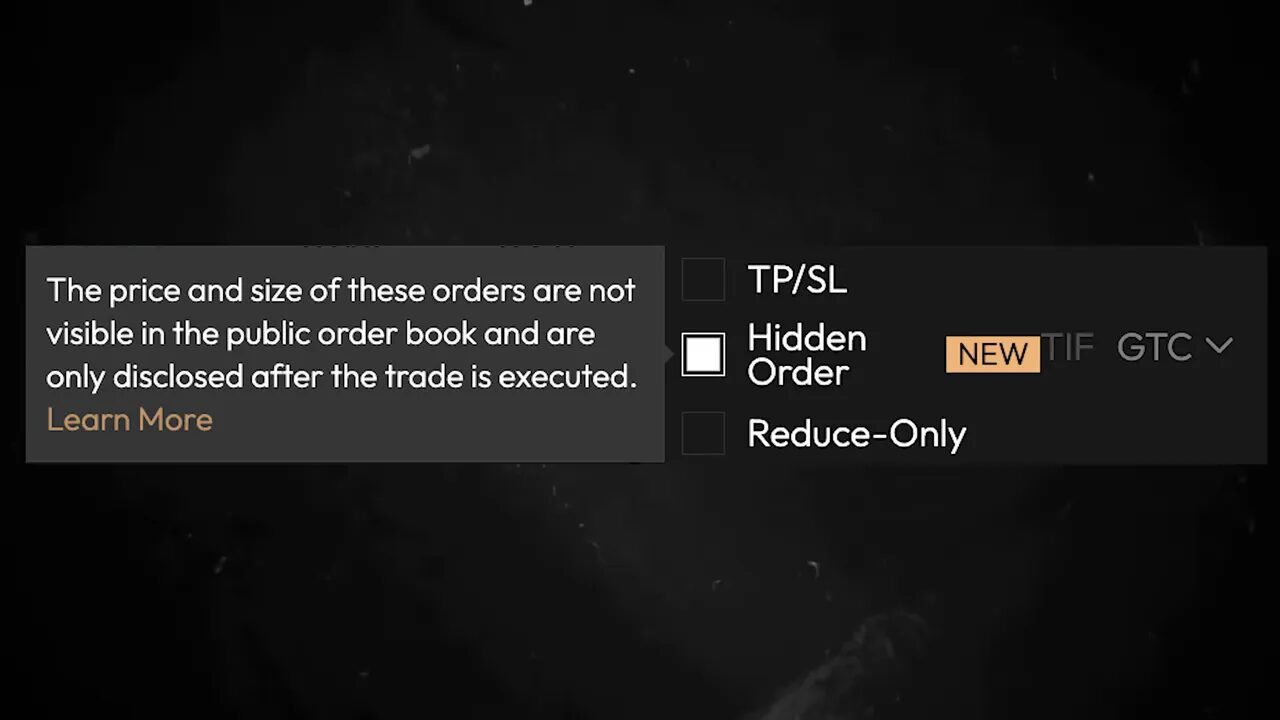

Hidden Orders and MEV resistance: privacy for size traders

One of the most notable features in this Aster DEX Review is Hidden Orders. Large orders on visible order books are noise that attracts front-running bots and predatory liquidity makers. Hidden Orders let traders post size without exposing it publicly. Combined with Aster’s MEV-resistant execution logic, this helps institutional or whale-level flows avoid being gamed by bots that extract value from visible intentions.

If you trade large volumes, Hidden Orders and MEV resistance are not just bells and whistles — they materially change your execution quality. CZ himself has advocated for stealth features on decentralized exchanges, and Aster implemented them in earnest.

Fees, funding rates, and trading cost optimization

Fees matter. This Aster DEX Review highlights that Aster is undercutting many competitors: 0.01% maker and 0.035% taker on perpetuals, versus higher fees elsewhere. Maker rebates for limit orders can dramatically reduce slippage and trading costs if you trade strategically.

Aster also allows you to pay fees in ASTER token for an additional 5% discount. And special referral links have offered a 20% rebate for life in earlier promotions — always check current offers and terms.

Funding rates are another explicit cost: they are payments between longs and shorts every 8 hours to keep perp prices aligned with spot. The direction and magnitude vary with market sentiment. Holding a position overnight can incur repeated funding payments that add up. Monitor funding rates and include them in your carry cost calculations when you size trades.

Withdrawals and post-withdrawal security

Withdrawals mirror deposits: choose USDT and the correct network. There’s no KYC or identity verification, so once you confirm a withdrawal it executes as a blockchain transaction. Triple-check addresses. A common safety practice is to send a small test withdrawal to the destination address first, then send the balance once it’s confirmed.

After withdrawing, move long-term holdings to cold storage (hardware wallets). If you plan to trade actively, use a hot wallet with minimal balances and a separate cold wallet for savings. Many experienced traders maintain dedicated trading wallets to isolate operational risk and simplify taxes.

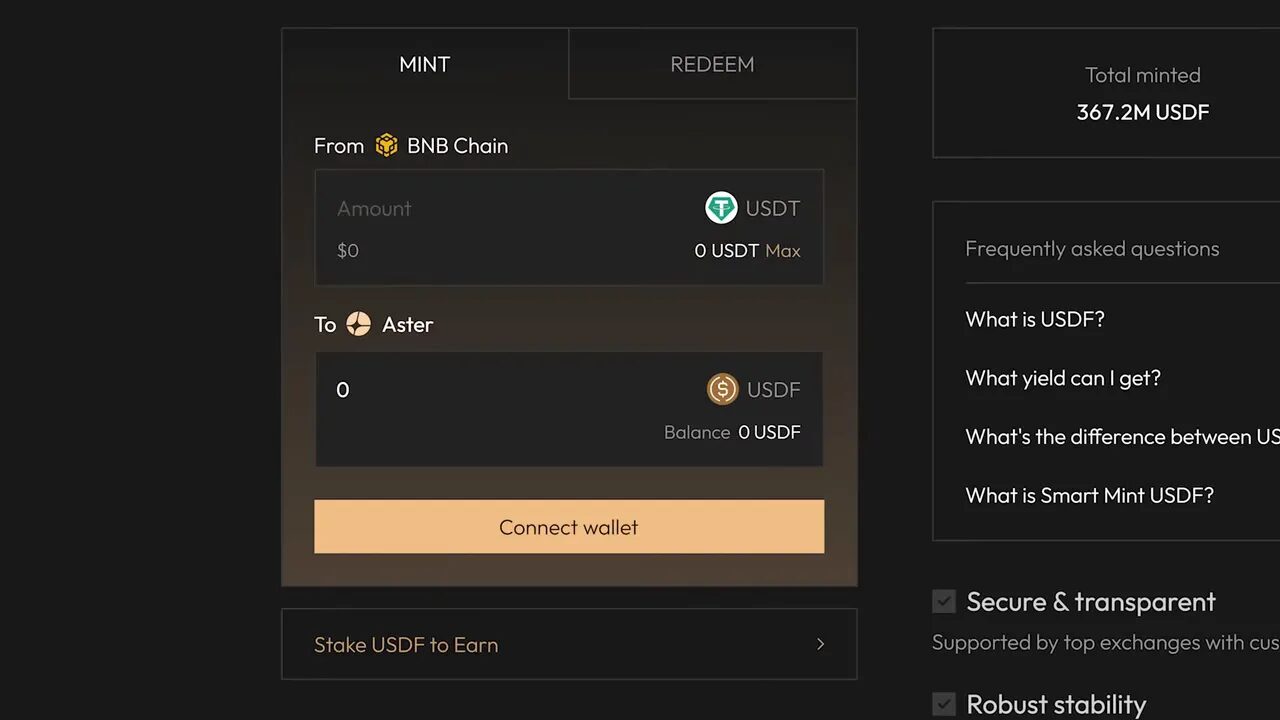

Yield features: USDF, ASBNB, and capital efficiency

Where this Aster DEX Review gets particularly interesting is the yield-on-collateral story. Aster introduces USDF, a yield-bearing stablecoin minted 1:1 with USDT. Behind the scenes, Aster deploys that USDT into delta-neutral arbitrage strategies on centralized venues like Binance. The yield from those strategies flows back to USDF holders. The result: your collateral can earn yield while being used as margin.

Another option is ASBNB — a liquid staking derivative of BNB that earns staking rewards while serving as collateral. This double-duty capital efficiency can improve returns if you know how to manage risk, but it also compounds exposure: if BNB collapses and you’re leveraged elsewhere, leverage and price change together can create nasty liquidation cascades.

Delta-neutral strategies are theoretically safe but not invulnerable. Black swan events, exchange outages, or extreme market dislocations can cause hedges to fail. So treat USDF as a yield-enhanced collateral product with non-zero protocol and strategy risk.

Stock Purps: trading equities on-chain

Aster also lists Stock Purps — tokenized perpetuals for Apple, Nvidia, Tesla, etc. These trade 24/7 with up to ~50x leverage and settle in USDT. Liquidity can be thin, and spreads widen outside US market hours. If you want to trade US equities exposure on-chain, it’s a neat offering — but be cautious around liquidity, fair pricing, and regulatory considerations in your jurisdiction.

Risk management and a trader’s checklist

This Aster DEX Review emphasizes risk discipline. Below is a compact checklist to keep you honest:

- Risk per trade: keep it small. Aim for 1% of your account per trade as a guideline.

- Use isolated margin for discrete positions and clearly defined stop losses.

- Prefer limit orders where possible to lower maker/taker costs and control slippage.

- Monitor funding rates for carry costs if you hold positions across funding intervals.

- Use hardware wallets for significant balances and two wallets for operational separation.

- Use the testnet or tiny amounts to familiarize yourself with new features.

- Keep records of trades for tax reporting; consider using a dedicated trading wallet.

Also, if you’re systematically trading and require edge in timing, market analysis, or trade signals, consider services that complement execution platforms. For traders seeking assistance, a disciplined market signals service like crypto trading signals can provide structured trade ideas, risk parameters, and timing cues—helpful when markets are noisy and your attention is split between chains. Use such tools sparingly and verify their track record before committing capital.

Advanced tactics for better execution

If you’re serious about optimizing outcomes on Aster, these advanced tactics from the Aster DEX Review will help:

- Split large orders into multiple hidden limit orders to reduce market impact.

- Monitor on-chain liquidity depth and public order book to gauge slippage risk for large trades.

- Time entries around lower funding rate pulses when you don’t want to pay carry for a long hold.

- Use USDF or ASBNB when you need your collateral to earn yield, but size positions conservatively to account for potential slippage or liquidation during idiosyncratic events.

- Keep an eye on cross-chain settlement timing; a chain’s finality can affect the speed of trade settlement on Aster’s unified order book.

Taxes and record-keeping

Every trade is likely a taxable event in most jurisdictions. For frequent traders, this becomes an administrative burden quickly. The practical advice in this Aster DEX Review is to use a dedicated wallet for all trading activity. That isolates trading transactions from long-term holdings and makes exportable trade logs easier to process for reporting or accounting tools. Third-party services now support on-chain trade importing for tax calculations; consider them if your volume is non-trivial.

Common pitfalls and how to avoid them

In constructing this Aster DEX Review I saw recurring themes from traders who hit problems:

- Network mismatch losses — always confirm the token standard before sending funds.

- Overleveraging — 1001x is a trap if you don’t treat it as entertainment.

- Phishing — never trust DMs or unknown links; bookmark official URLs.

- Token approvals — revoke allowances when a protocol is unused.

- Cross-chain nuance — Solana behaves differently and can show UX sync quirks with multi-chain features.

Where Aster shines and where it struggles

Strengths highlighted in this Aster DEX Review:

- Low fees: one of Aster’s clearest competitive advantages.

- Multi-chain shared liquidity: access to a larger pool without bridging.

- Yield-on-collateral: USDF and liquid staking improve capital efficiency.

- Privacy & MEV resistance: Hidden Orders and execution design protect execution quality for bigger traders.

Weaknesses and constraints:

- Liquidity depth for very large trades can be thinner than single-chain giants with established market making.

- Complexity: multi-chain, yield strategies, and new features increase cognitive load and risk surface.

- Fresh codebases have teething bugs — even with audits, configuration errors can cause losses.

- 1001x mode is high risk by design and has misleading reward asymmetry due to ROI caps.

Real-world incident recap and lessons

The XPL listing incident earlier in Aster’s life is instructive. Hard-coding a price index to $1 made the token behave oddly; lifting a cap prematurely allowed the price to spike on Aster and liquidated shorts. This shows two things the Aster DEX Review emphasizes:

- Even audited platforms can have configuration errors that cause material losses.

- Transparent, quick reimbursements and communication from the team mitigate damage — but they don’t replace the value of cautious user behavior.

Smart traders incorporate platform risk into their sizing choices. If a platform is new or had recent incidents, lower your exposure until you’re comfortable with the response processes and time-to-resolution for issues.

Practical walkthrough: from zero to a live perpetual trade

Here’s a short pragmatic flow from this Aster DEX Review to help you execute a first small perp trade:

- Create or open MetaMask (or SafePal on mobile). Seed phrase offline and backed up.

- Buy USDT on a CEX and withdraw to the network you plan to use (e.g., Arbitrum).

- Fund your wallet with a small native token amount for gas (ETH for Arbitrum).

- Go to astodex.com, connect wallet, and deposit a small test amount of USDT to Aster on that chain.

- Switch to perpetual mode, select BTC/USDT, choose isolated margin, and pick a modest leverage (e.g., 5x).

- Place a limit order near current market to collect maker fee discount, or a market order if you need instant entry.

- Set a stop-loss and take-profit level before you open the trade.

- Monitor funding rate and P&L. If done, close the position and withdraw profits back to your wallet.

Do this with a tiny amount first. If you can’t execute these steps correctly with pocket change, do not do them with real capital you can’t afford to lose.

FAQ — Quick answers to common questions

Is Aster safe?

The Aster DEX Review finds Aster reasonably well-audited and proactive with bug bounties, but no platform is risk-free. Use hardware wallets, keep permissions tight, and start small. Team responsiveness during the XPL incident was encouraging.

Can I trade without KYC?

Yes. Aster is non-custodial and generally does not require KYC. Your wallet address is your account. Be mindful of regulatory changes in your jurisdiction.

Should I use 1001x mode?

Only if you understand it’s entertainment. Fees, ROI caps, and fast liquidations make it a poor fit for disciplined trading strategies. Treat it like a night at the casino: small stakes and set a loss limit.

What is USDF?

USDF is Aster’s yield-bearing stablecoin minted 1:1 with USDT and backed by delta-neutral strategies deployed in markets. You can use it as collateral while earning yield. It’s capital-efficient but introduces strategy and counterparty risk.

How do Hidden Orders work?

Hidden Orders do not appear in the public order book, helping reduce front-running and signaling risk. They pair well with MEV-resistant execution, improving fills for large trades.

How can I reduce trading fees?

Use limit maker orders to pay 0.01% instead of taker fees, pay fees in ASTER token for an extra 5% discount, and check for any referral rebates available for signing up. Also, be mindful of slippage and funding rates as hidden costs.

Does Aster support stock derivatives?

Yes — Aster lists Stock Purps for companies like Apple, Nvidia, and Tesla with up to ~50x leverage, trading 24/7. Expect thin liquidity and wider spreads outside US market hours.

How does cross-chain settlement affect trades?

Cross-chain matching gives access to shared liquidity while keeping collateral on your chosen chain. It requires careful engineering to reconcile finality differences, and Aster uses optimistic execution and fraud proofs to manage this complexity.

Conclusion — who should use Aster and how to approach it

This Aster DEX Review concludes that Aster is a compelling entrant in the perpetual DEX space with innovative features that increase capital efficiency and improve privacy for larger traders. Low fees, multi-chain shared liquidity, yield-on-collateral, and Hidden Orders are legitimate differentiators.

However, the platform’s complexity, fresh codebases, and some feature designs (1001x with ROI caps) mean you should approach carefully. If you’re a professional or advanced DeFi trader who values execution quality, wants lower fees, and needs privacy for large orders, Aster is worth evaluating. If you’re new to derivatives or tempted by headline leverages, start small or stay on more conservative products until you’ve mastered risk control.

For disciplined traders looking for structured trade ideas and verified signals to complement execution on Aster, consider vetted signal services such as Crypto Trading Signal to augment your analysis. Use them as an input, not a crutch, and verify any suggested trades against your own risk parameters before executing on-chain.

As always, this article is informational and not financial advice. Do your own research, understand the risks, and only trade with capital you can afford to lose. If you want to explore Aster on your own, start with a small deposit, test the interfaces, and build muscle memory around security checks before scaling up.

Additional resources and next steps

- Bookmark astodex.com and verify official channels for any updates before connecting your wallet.

- Start with isolated margin positions and clear stop-losses until you’re comfortable with execution mechanics.

- Track funding rates and maker/taker spreads as part of your routine pre-trade checklist.

- Consider a short period of paper trading or very small live trades to test behaviors and order fills.

Thanks for reading this Aster DEX Review. If you found it useful, share it with a trader who likes to keep their guard up and their fees low. Trade smart, secure your keys, and happy researching.