Table of Contents

- Introduction — Why this debate matters

- Quick primer: What people mean by the “four-year cycle”

- Why the four-year cycle has convinced so many

- The case against the four-year cycle — why I think it’s broken

- Alternate explanation: global liquidity and macro cycles

- Why the cycle might still “look” like it held

- Practical scenarios: sell now, hold, or something in between?

- How to translate this into actionable trading decisions

- Market tools and platforms — what’s changed and what to use

- Retail coordination: a new edge in a changed market

- What I’m watching next

- Final take — a practical summary

- Join the coordinated retail movement

- Is the Bitcoin four-year cycle definitely over?

- What changed structurally in the market to weaken the halving argument?

- If I want to protect profits, what are the best tools?

- Should I trust on-chain indicators anymore?

- How can retail investors get an edge in this market?

- Closing thoughts

Introduction — Why this debate matters

I’m going to walk you through both sides of the argument, explain the data and logic that matter, and give you a practical framework for what to do next. If you hold Bitcoin or trade crypto, this is one of those conversations you can’t ignore—because getting this wrong means either selling too early and missing a huge run, or holding through a top and watching gains evaporate.

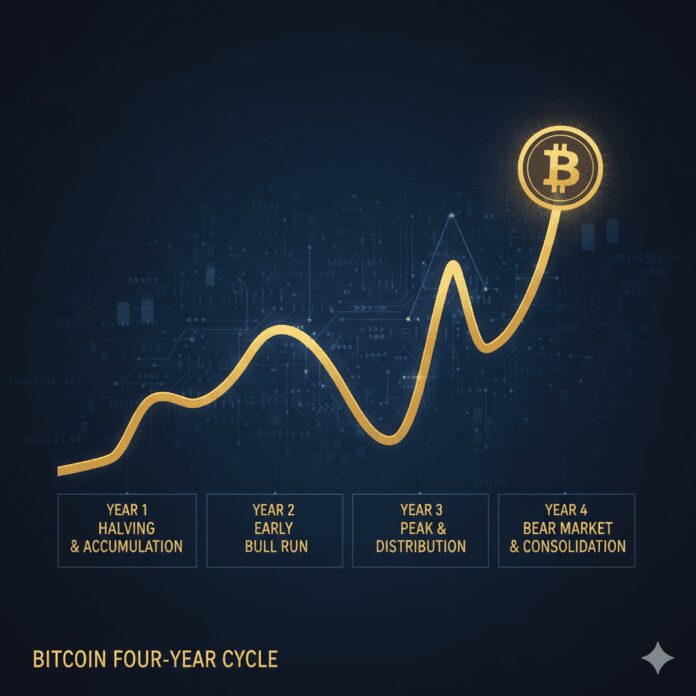

Quick primer: What people mean by the “four-year cycle”

When most traders talk about Bitcoin’s “four-year cycle” they’re shorthand for the rhythm created by halving. Every 210,000 blocks—roughly every four years—Bitcoin cuts miner rewards in half. That event is called a halving. Historically, each halving preceded a major bull run: reduced new supply, then rising price, then a frenzy of media headlines and retail participation, followed by a crash and eventual accumulation.

Here’s the simplified chain of cause and effect that sits behind the theory:

- Halving reduces miner rewards → new Bitcoin entering the market drops.

- Less new supply + steady or growing demand → price rises.

- Price rise sparks momentum, headlines, and FOMO → parabolic gains.

- Top forms, profit-taking ensues → correction and cycle reset.

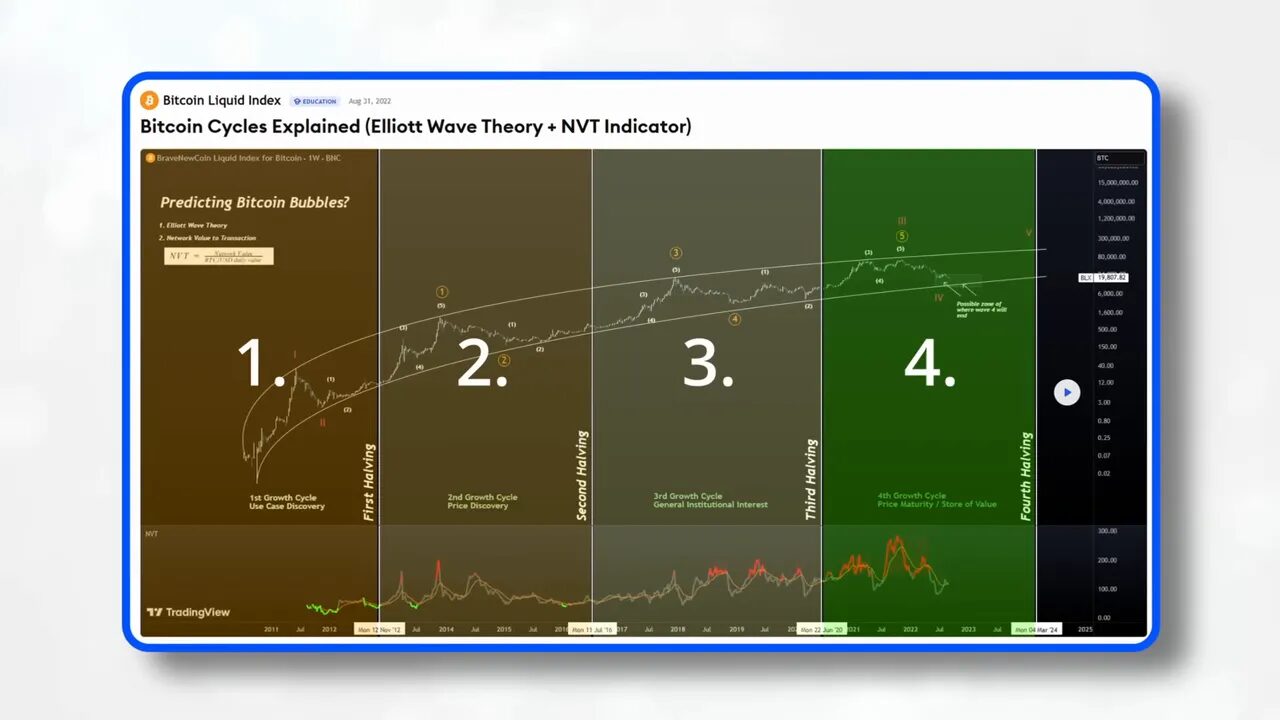

Why the four-year cycle has convinced so many

There’s a seductive simplicity to this model. Put vertical lines at each halving on a long-term Bitcoin chart and you’ll notice a repeating pattern: halving → bull market → top → cleanup → accumulation → repeat. It’s intuitive and it’s worked three times in Bitcoin’s history. That track record is enough for a lot of people to trade exclusively around halvings: buy before the halving, ride the post-halving mania, then sell into the top.

That pattern is also a self-reinforcing narrative. If enough traders expect the cycle to repeat, they act in ways that make it more likely to repeat. That is the textbook definition of a self-fulfilling prophecy—and it’s one reason the four-year theory stuck so stubbornly in the community.

The case against the four-year cycle — why I think it’s broken

But here’s where I want to pull the curtain back: the market has changed fundamentally. When you dig into the numbers and the structural shifts in the ecosystem, the idea that Bitcoin will keep following the neat four-year script begins to look shakier. Below are the main reasons I’m skeptical that the cycle will continue in the clean way many assume.

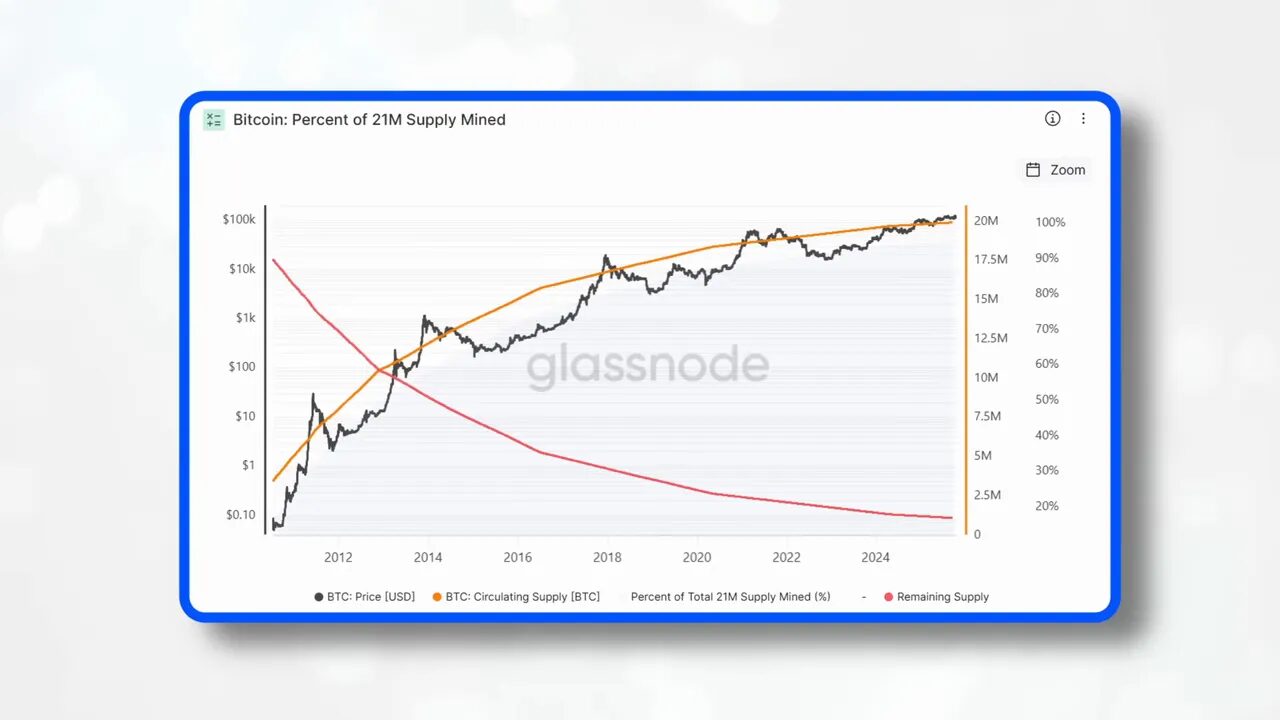

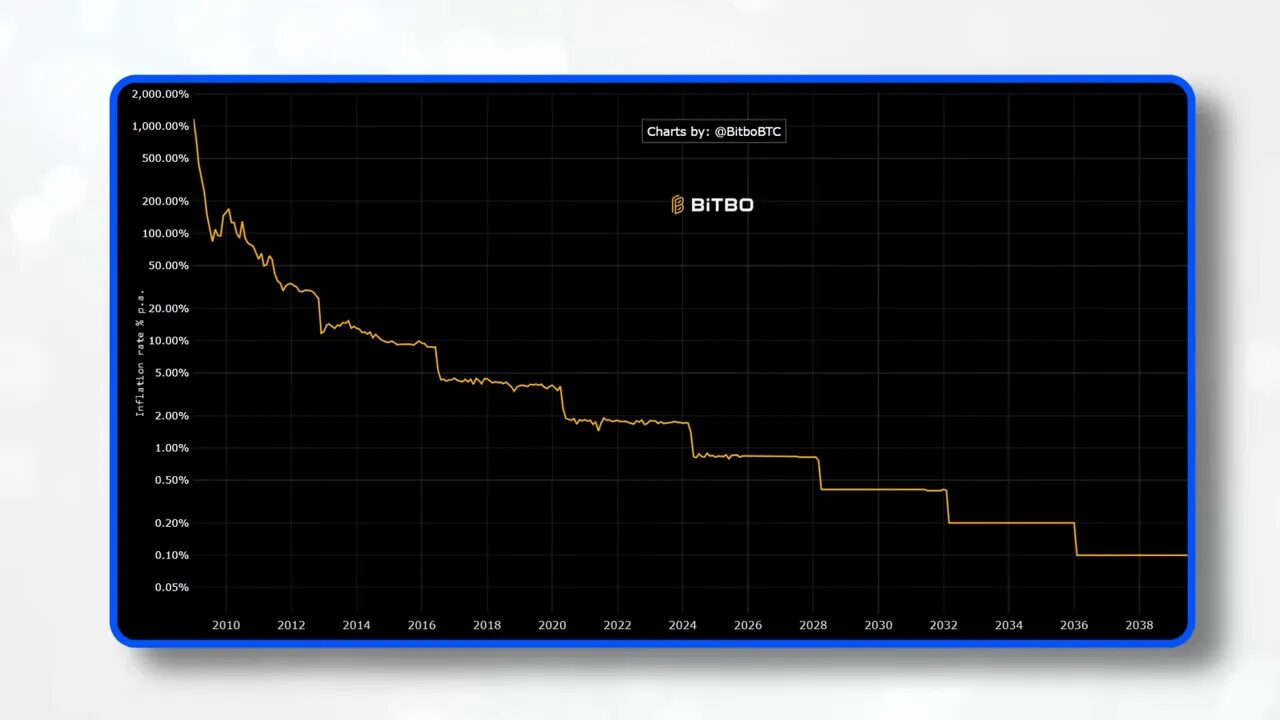

1) The halving’s direct impact is much smaller than it used to be

Early in Bitcoin’s life the inflation rate was massive—around 30%—then it dropped to 15% after the early halving. That mattered. But after the 2024 halving the inflation rate moved from about 1.7% to 0.8%. That’s a tiny change in the context of global markets.

Put another way: the marginal reduction in daily new Bitcoin entering the market is now relatively inconsequential compared to total daily trading volume, which sits in the tens of billions of dollars. When miner selling represents only a sliver of market flow, calling a halving a “supply shock” starts to feel like an overstatement.

2) Miners aren’t the dominant sellers anymore

Miners used to be among the largest natural sellers—they had to convert rewards to fiat to pay electricity, hardware, salaries. That dynamic amplified the supply shock. Today, with higher prices, more diversified revenue streams, and complex hedging, miners‘ sell-side pressure is comparatively smaller. They don’t move the market the way they once did.

3) The player base has changed—institutions, not just retail

2013 and 2017 were very different markets: mostly retail traders and a few whales. Now institutions, corporations, hedge funds, and even nation-states allocate to Bitcoin. These are long-term allocators. They buy based on macro conditions, balance-sheet needs, and portfolio construction metrics—not based on crypto Twitter memes or rainbow charts.

That shift matters because institutions behave differently: they smooth flows, use derivatives and ETFs to gain exposure without touching the on-chain supply, and make decisions driven by liquidity and rates rather than internal Bitcoin rhythms.

4) Paper Bitcoin has eclipsed on-chain flows

Another big structural change: paper Bitcoin—ETFs, futures, perpetuals, options—has exploded. A huge portion of BTC trading volume never touches the blockchain. That undermines a lot of the on-chain signals traders used to rely on to time cycle tops and bottoms.

When on-chain supply metrics were dominant, analysts could track real flows with more confidence. Today, massive off-chain exposure means market moves can occur without a corresponding on-chain footprint, making some historic indicators less reliable.

5) The four-year pattern might be coincidental

Statistically speaking, a pattern that happens three times can be a correlation, not causation. Bitcoin has only completed three full market cycles under the halving regime so far. Three examples are not a long-run probability sample. It’s possible that the observed timing matched broader macro liquidity cycles—interest rate easing and global liquidity provision—rather than being driven purely by halvings.

Alternate explanation: global liquidity and macro cycles

Another plausible frame is that Bitcoin’s bull runs are more about macro liquidity than halvings. When central banks loosen policy and liquidity floods markets, risk assets rally. Bitcoin, as perhaps the purest risk asset, tends to front-run these rallies and often peaks before broader markets.

Overlaying Bitcoin price history with global liquidity indicators or rate cycle timelines shows a strong correlation. Each major Bitcoin bull run has coincided with increased liquidity or rate cuts globally. If that’s the true engine of the rallies, then the four-year pattern was a happy alignment with macro cycles—until it wasn’t.

Why the cycle might still “look” like it held

Here’s a twist: even if the cycle is no longer fundamentally driven by halvings, market timing could still align with the old calendar. Right now macro liquidity is historically high, asset classes are at or near highs, and sentiment is bullish. Many macro strategists warn a meaningful correction is overdue.

Bitcoin tends to peak before broader market corrections because it’s so sensitive to risk-on flows. If stocks and broader markets correct in the months ahead, Bitcoin could get knocked down in roughly the same window the four-year cycle has historically topped. To an observer, it could appear the classic cycle “held,” even though the underlying driver was macro liquidity.

Practical scenarios: sell now, hold, or something in between?

There are two practical mistakes you can make right now: selling too early, or selling too late. If you sell early because you believe the old playbook will hold, and the market keeps going, you’ll likely FOMO back in at or near the top—painful. Conversely, if you assume the cycle is dead and hold through a classic top, you could lose significant gains.

Here are three workable strategies depending on your risk tolerance and views:

- Defensive scaling: Gradually trim exposure as prices rise and reallocate to cash or stablecoins. This preserves participation in upside while locking some gains. Use trailing reductions—sell a percentage at set increments (e.g., every 10–20% move higher).

- Active hedging: Keep core long positions but hedge with options or short futures to protect against tail risk. This is where professional tools and quality market intel matter—crypto trading signals that highlight high-probability setups can guide hedging decisions without full divestment.

- Purist HODL: If you view Bitcoin as an allocation to a long-term store of value, accept volatility and hold through cycles. This works if you’re capital-neutral to short-term pain and believe BTC’s role in portfolios will steadily increase.

Personally, my plan is to remain flexible: I don’t intend to time an exact top, but I will become increasingly defensive if we get one more strong leg up that looks like a blow-off top. For many readers, a blended approach—scaling out some profit while hedging the remainder—is the practical middle ground.

How to translate this into actionable trading decisions

If you trade or manage risk in this environment, two things matter more than ever: a clear plan and timely signals. Markets are faster, more liquid, and driven by a wider set of players than ever before. That means you can’t rely on a single narrative—like the halving—to make all your decisions.

Here are specific trade-management rules that help in either scenario:

- Set predetermined sell levels and stick to them. Emotional decision-making at tops is the most common way traders lose gains.

- Use position sizing to limit downside. Even if you’re bullish, small positions in speculative altcoins and larger, core allocations to BTC reduce overall risk.

- Employ hedges selectively. Options and inverse ETFs can protect gains without fully exiting a position.

- Monitor macro indicators—rates, liquidity, and equities sentiment—because Bitcoin is increasingly correlated with these variables.

To make these decisions well, timely and reliable market information is critical. That’s why many traders use professional crypto trading signals to identify momentum shifts, hedging opportunities, and potential distribution phases. The right signals service can warn you earlier when a market is losing structure or highlight tactical entry points when dips are likely exhausted. Use them as part of a rules-based trading plan, not as a black box that does all the thinking for you.

Market tools and platforms — what’s changed and what to use

Another structural change: exchanges and trading platforms offer more products and better liquidity than ever. Spot, derivatives, tokenized stocks, and leverage are all available in slick interfaces. The growth of these tools makes it easier to implement hedges, scale positions, and trade tactically.

If you’re actively trading, prioritize the following features in a platform:

- Solid liquidity across spot and derivatives.

- Reliable security and proof of reserves.

- Support for USDC and major stablecoins for quick deployment.

- Access to tokenized ETFs or stocks if you manage cross-asset hedges.

Having access to a platform that checks those boxes and pairing it with actionable crypto trading signals helps you trade with structure and avoid emotional mistakes—especially as market dynamics evolve.

Retail coordination: a new edge in a changed market

One underappreciated change is the power of coordination. When retail traders coordinate—share research, pool insights, and move as a group—they can create outsized influence. That’s the idea behind retail DAOs and coordinated research groups. Collective intelligence helps uncover better setups and spot distribution patterns earlier.

If you’re a retail investor or trader, consider participating in coordinated groups that emphasize research and discipline over hype. Combining shared insights with a signals service and a disciplined execution plan is a practical way to adapt to the new market structure.

What I’m watching next

There are a handful of indicators that will change my view decisively:

- Liquidity shifts from global central banks. If liquidity loosens further, odds of continued risk-on moves rise; if liquidity tightens, market tops are more likely.

- Price action around major macro events. Bitcoin tends to lead risk assets—if equities roll over hard, BTC will often top first.

- Derivatives flows and funding rates. Rapid changes in perp funding or open interest can reveal when leverage gets crowded.

- On-chain metrics versus off-chain flows. Divergences between ETFs/derivatives flows and on-chain movement can signal a regime change.

For traders, combining these signals with high-quality crypto trading signals makes executing a pre-planned strategy that much easier. Signals can surface changes in leverage, liquidity, or momentum that may not be obvious from price alone.

Final take — a practical summary

Here’s the bottom line in plain language:

- The classic four-year cycle is under stress. Halvings no longer create the same supply shock they used to because inflation is much lower and institutions dominate flows.

- Bitcoin’s behavior increasingly tracks macro liquidity, rates, and TradFi correlations. The apparent four-year rhythm may have been coincidental alignment with global liquidity cycles.

- That said, macro timing can still make current price action look like the old cycle. Expect one more leg of upside to be possible—perhaps right up until a macro-driven correction hits.

- Act with a plan: scale out, hedge, or hold depending on your time horizon. Use rules-based approaches to avoid the emotional mistakes that kill traders.

- Leverage available market tools—exchanges with solid liquidity, derivatives for hedging, and reliable data sources or crypto trading signals—to execute your strategy cleanly.

Join the coordinated retail movement

If you believe retail should compete on research and coordination rather than noise, consider joining groups that emphasize collaboration and disciplined execution. When retail works together thoughtfully, we can surface higher-quality ideas and trade them with conviction. That’s exactly the premise behind organized retail DAOs and research collectives: better intel, better discipline, better outcomes.

Is the Bitcoin four-year cycle definitely over?

Not definitively. The cycle is under stress and its causal power is weaker than before, but price action—driven by macro liquidity—could still align with the historical timing and make it appear intact. Treat the pattern skeptically and prioritize real-time indicators over calendar-based rules.

What changed structurally in the market to weaken the halving argument?

Several structural changes: the inflation impact of halvings is much smaller now; miners sell less relative to total volume; institutions and ETFs add huge off-chain demand; and the proliferation of derivatives means much trading never touches the blockchain. These shifts make the halving-driven supply shock less decisive.

If I want to protect profits, what are the best tools?

Use a combination of scaling out (trading partial profits into strength), hedging with options or inverse instruments, and employing stop-losses or trailing sells. Complement these tactics with high-quality crypto trading signals to identify momentum shifts and potential distribution phases early.

Should I trust on-chain indicators anymore?

On-chain indicators remain useful but are less comprehensive. Because a large portion of exposure now sits in ETFs and derivatives, off-chain flows can dominate market moves. Use on-chain metrics in conjunction with derivatives flows, ETF flows, and macro signals for a fuller picture.

How can retail investors get an edge in this market?

Form or join disciplined research groups, follow macro liquidity indicators, use reliable platforms with good liquidity, and lean on objective crypto trading signals for tactical execution. Coordination and shared research can amplify retail influence and uncover higher-quality opportunities.

Closing thoughts

Markets evolve, and narratives that once explained price action can become outdated. The four-year cycle was a powerful narrative during Bitcoin’s early growth, but today the market is bigger, more complex, and more intertwined with global macro conditions. That doesn’t make Bitcoin any less valuable—just more complicated to trade and time.

If you take one practical thing from this piece: decide on a plan now, before the market makes it for you. Whether that plan is scaling out, hedging, or simply HODLing, pair it with disciplined execution and timely information—whether that comes from careful analysis, coordinated retail research, or trusted crypto trading signals. That’s how you avoid selling too early, and how you avoid getting wrecked by selling too late.

Stay sharp, stay disciplined, and trade like you have a plan.