Table of Contents

- Outline

- What is MLN (Enzyme Finance)?

- Why fundamentals matter: check before you buy

- The painful price history: why MLN is dangerous until it proves strength

- Technical approach: timeframes, key levels, and the trade trigger

- Risk management: capital preservation is everything

- Real example: MNT trade and why signals matter

- Price scenarios: conservative, base, and aggressive outcomes

- How to buy MLN safely: exchanges and practical steps

- Psychology and the survival mindset

- Integrating a “crypto signal” approach responsibly

- Final thoughts and practical checklist before taking the MLN trade

- Conclusion

- FAQ

Outline

- What is MLN (Enzyme Finance)?

- Why fundamentals matter: the token’s ecosystem and listings

- The painful price history: 95% drop from the all-time high

- Technical approach: timeframes, key levels, and the trade trigger

- Risk management: stop loss, position sizing, and capital preservation

- Real example: the MNT trade and how consistent signals help

- Price scenarios and my wild target — and why you should treat it cautiously

- Conclusion and next steps

- FAQ

What is MLN (Enzyme Finance)?

Enzyme Finance (MLN) is a DeFi protocol focused on asset management — think of it as a decentralized platform that lets users create, manage, and invest in on-chain funds. It provides smart contract-based fund management tools so portfolio managers and investors can operate with transparency and composability inside the Web3 ecosystem.

Key points:

- MLN is a governance and utility token within the Enzyme ecosystem.

- It operates within the DeFi space and leverages broader networks like Polygon for scaling (as noted during the breakdown).

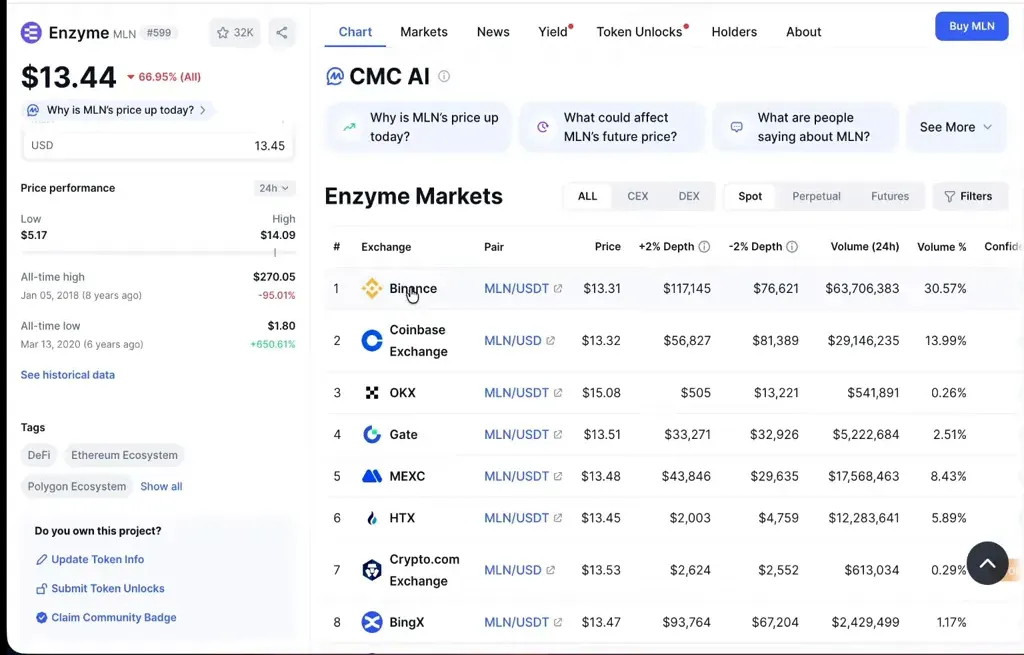

- It has exchange listings on major centralized platforms, which improves accessibility for retail traders.

Why fundamentals matter: check before you buy

One theme I hammered is simple and non-negotiable: never buy a token when you have doubts about its fundamentals or distribution. In my words, “If there is a doubt… don’t buy.” Crypto is extremely volatile — that’s both the attraction and the danger.

Before placing any trade on MLN or similar DeFi tokens, run through a checklist:

- Is the protocol live and actively used? Check TVL (total value locked) and on-chain activity.

- Is there clear tokenomics and transparent team/backers?

- Which chains and bridges is it using (e.g., Polygon, Ethereum)?

- Which exchanges list the token (Binance, Coinbase, etc.) and how liquid are those markets?

- Has it suffered centralized points of failure, hacks, or massive token unlocks that could cause dumps?

These fundamentals set the groundwork for any technical trade to make sense. If you cannot answer these questions clearly — if you feel uncertain — you are not trading, you are speculating at best, and gambling at worst.

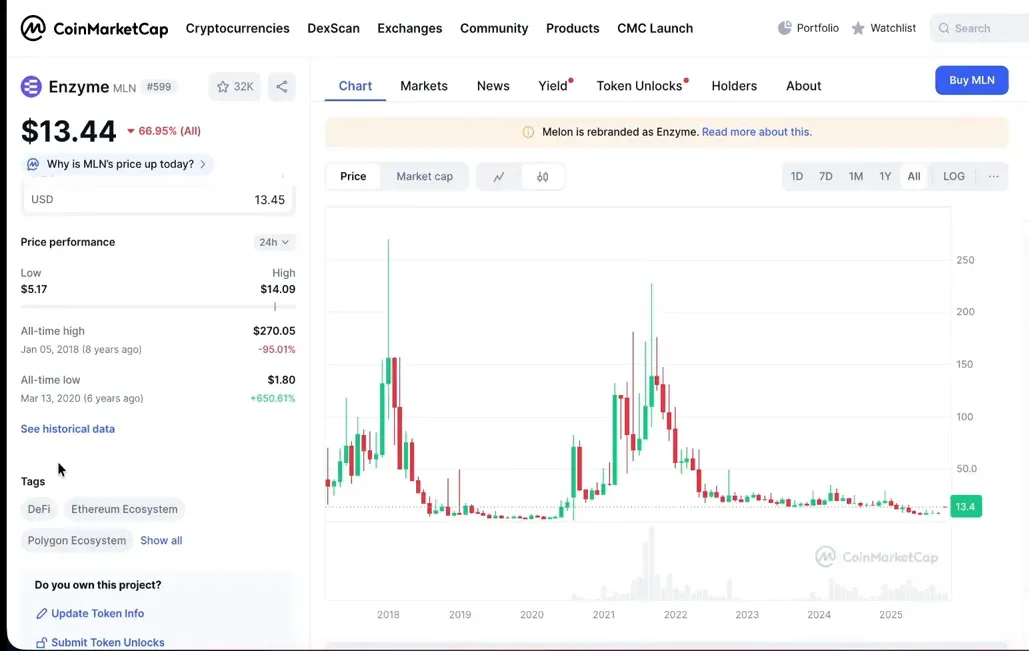

The painful price history: why MLN is dangerous until it proves strength

This is an important part of my analysis. You must respect price action. MLN’s historical drop is brutal and instructive: from an all-time high of around $270 to roughly $13 at one point — a decline of around 95%. That magnitude of destruction is rare but not unheard of in DeFi.

Why this matters:

- A 95% decline means the token lost almost all speculative demand and trust from many holders.

- Buyers near the left side of the chart (near the top) suffered catastrophic losses; that creates a long tail of potential sell pressure as desperate holders realize losses or attempt to exit on rallies.

- It increases the probability of volatility spikes and fake breakouts. So when MLN moves, it can move violently in either direction.

Because of that history, my recommendation is conservative: only consider buying if price shows convincing strength and structural change in the higher timeframe. In plain language — if you want to buy, wait for confirmation.

Technical approach: timeframes, key levels, and the trade trigger

Trading without a technical plan is like driving blind. Here’s my step-by-step technical framework that I used when analyzing MLN:

1) Timeframe matters — use the 4-hour and daily chart

Short timeframes show noise. I analyze MLN on the 4-hour timeframe for structure and the daily for context. The 4-hour gives a clear view of accumulation, breakout levels, and momentum changes without the intraday chatter.

2) Identify a reliable level — this is your filter

After zooming out, I found a critical level around $21–$23. My rule: no buys below that area unless you have a contrarian strategy or you’re prepared for a high chance of further downside. I said it bluntly: “less than $21, no way man — I will not even touch this token.”

Why that level matters:

- It represents the previous accumulation and a structural pivot point where momentum was lost.

- Price behavior around this level determines whether buyers are willing to step in aggressively.

- A decisive close above ~$23 signals strength and reduces the probability of a collapse back to prior lows.

3) The trade trigger — wait for a closing breakout

A breakout that matters is not just an intraday wick above resistance — it must close and hold above the level on your chosen timeframe. For MLN, the trigger I recommended is a clean 4-hour (or daily) close above $23. After that, the trade becomes valid in my systematic approach.

4) Stop loss and target

Always define risk. My plan for MLN was:

- Entry: On a confirmed close above $23

- Stop loss: $19 — below the trigger level and recent structure, limiting downside if the breakout fails

- Potential upside: in a bullish scenario I discussed a stretch target — very optimistic — of $1,000. This is not a forecast to blindly rely on; it’s a way to illustrate asymmetric upside vs. defined risk. Treat it as a hypothetical maximum, not a promise.

Risk management: capital preservation is everything

Here’s the core difference between successful traders and gamblers: protecting your capital. “If I’m going with one million dollars… I should not lose my money.” That mindset drives everything I do with position sizes and trade selection.

Concrete risk rules I follow and recommend you consider:

- Never risk more than a small percentage of your total capital on a single trade (commonly 1–3%). If your stop loss size implies a loss you can’t tolerate, reduce position size.

- Use hard stop losses — once the price hits your stop, exit the trade. Emotions will try to keep you in losing positions; the market doesn’t care about your feelings.

- Think probabilistically: the outcome is binary (it goes up or down). Your job is to construct edges where the reward justifies the risk.

- Prefer trades where you can define risk clearly. The MLN plan (entry $23, SL $19) is an example of a trade where risk is quantifiable before you buy.

Example: if you have $10,000 and you’re willing to risk 2% per trade ($200 maximum loss), and your stop loss distance is $4 (from $23 to $19), that constrains your position size to 50 MLN tokens (200 / 4 = 50). That’s how position sizing works — mathematically and unemotionally.

When integrating signals into your trading, use them as one input among many — not as an autopilot. For example, a good “crypto signal” offering will send you the trade setup and the reasoning so you can decide whether it fits your risk profile. If you use signals, ensure they emphasize risk management and alignment with your plan.

Price scenarios: conservative, base, and aggressive outcomes

When I look at a trade like MLN, I mentally prepare three scenarios: conservative, base case, and aggressive. Each scenario has different probabilities and implications for position sizing.

Conservative scenario

MLN fails above $23 and falls back into accumulation or lower structure. In this case, the trade stops out at $19 (as planned) and you move on to the next opportunity. You preserve capital, pay for education with small loss, and remain ready for asymmetric winners.

Base case (my preferred path)

MLN closes above $23, accumulates momentum, and begins a series of higher highs and higher lows. Volume confirms the breakout and multiple exchanges continue to provide liquidity. In this case, partial profits along the way and trailing stops let you capture most of the upside while protecting gains.

Aggressive case

MLN rallies hard, breaking major resistance levels and entering a parabolic phase. I floated a very optimistic target of $1,000 — that’s a hypothetical extreme-case scenario that implies a massive market revaluation. While mathematically possible, it’s improbable and should never be the sole reason to take a trade.

Remember: the higher the reward target, the lower the probability. Position sizing and scaling out (taking partial profits) are how you manage that trade-off.

How to buy MLN safely: exchanges and practical steps

MLN is listed on major exchanges (Binance, Coinbase were mentioned). That simplifies the buying process for many users. Practical checklist for buying MLN:

- Choose a reputable exchange with good liquidity to avoid slippage (Binance, Coinbase, or centralized alternatives in your region).

- Make sure you have an exchange account verified and funded in advance — you don’t want to scramble during a breakout.

- Set your limit order around your desired entry, or use a market order with awareness of slippage if liquidity is thin.

- Have your stop-loss order ready. If the exchange supports conditional orders, set them at the time of entry.

- Consider using small incremental entries (scaling in) rather than an all-in approach if volatility is expected.

Psychology and the survival mindset

One line I used and repeat often: “Before making money my top priority is I should not lose my capital.” This is not pessimism — it’s survival. Without capital you cannot be in the game. Emotions wreck trades: greed gets you buying early, fear gets you selling winners. The survival mindset is unemotional, mathematical, and patient.

Practical tips to cultivate it:

- Write your trade plan before you act and follow it.

- Keep a simple trading journal with entries, stops, and outcomes.

- Avoid FOMO buys on social noise; wait for your edge and confirmation.

Integrating a “crypto signal” approach responsibly

Signals can be a helpful tool if used correctly. I run a VIP where I deliver trade ideas — two trades every day — but my emphasis is on quality and risk management. If you use signal services:

- Verify past performance and ask for transparent records.

- Make sure each signal contains an entry, stop loss, and target.

- Use signals as educational guidance rather than turnkey instructions. Understand the thesis behind each trade.

For example, when I post a signal like the MNT buy at $0.70, I also include why it fits the strategy so members can learn how to replicate the reasoning. Good signal services will help you identify setups more efficiently, but your responsibility remains: protect capital, size positions, and manage trades.

Final thoughts and practical checklist before taking the MLN trade

Here’s a compact checklist to run through before pressing buy on MLN:

- Confirm the 4-hour or daily close above $23.

- Check volume on the breakout to ensure participation.

- Set stop loss at $19 or adjust based on your risk tolerance and account size.

- Decide on position size using a max-risk approach (1–3% per trade is a good default).

- Plan partial profit-taking points and a trailing stop structure.

- Document the trade in your journal, including why you entered and what would make you exit early.

Conclusion

MLN is an interesting DeFi project with legitimate fundamentals and exchange listings — but its history includes a spectacular 95% drawdown that demands respect. My stance is conservative and process-driven: wait for a confirmed close above $23, use $19 as a stop, and size your position so you never feel the pain of a catastrophic loss. That is how you stay in the game long enough to take advantage of big winners.

Signals and VIP services can accelerate your learning and surface trade ideas, but they should be used as a tool, not a crutch. If you want trades with clear entries, stops, and documented reasoning, look for services that emphasize risk control and education. That’s how you separate noise from opportunity.

Trade with discipline, preserve capital first, and let winners run while cutting losers short. Good luck — and as always, do your own research.

FAQ

What is MLN (Enzyme Finance) and what does it do?

Enzyme Finance (MLN) is a DeFi protocol focused on on-chain asset management. It enables users to create and manage decentralized funds using smart contracts, offering transparency and composability for portfolio managers and investors.

Why was MLN’s price so volatile and why did it fall 95%?

Several factors can cause extreme drawdowns in DeFi tokens: speculative mania at the top, poor token distribution, large sell pressure from early holders, liquidity issues, and sometimes protocol-specific concerns. The 95% drop from the all-time high indicates a loss of speculative demand and creates long-term volatility due to sellers attempting to exit during later rallies.

What is the technical trade plan for MLN?

The conservative technical plan is to wait for a confirmed close above $23 on a 4-hour or daily timeframe, enter after confirmation, place a stop loss at $19, and manage position size so you risk a small percentage of your capital. Partial profit-taking and trailing stops are recommended as price advances.

Why not buy MLN below $21?

Buying below $21, according to the technical structure discussed, would be gambling because the token has lost momentum at those levels historically. Without a confirmed breakout, the probability of further downside is higher, making it an unattractive risk/reward for disciplined traders.

How should I size my position for MLN?

Determine your maximum acceptable risk per trade (commonly 1–3% of your total capital). Calculate the dollar distance between entry and stop loss, then divide your risk amount by that distance to get position size. This keeps losses manageable and consistent across trades.

Can signals or VIP services help with these trades?

Yes, good signal services can help by providing trade ideas with clear entries, stops, and targets as well as reasoning behind setups. Use signals as an input while maintaining your own risk management and understanding of the trade. Prioritize services that document past performance and emphasize education.

Is the $1,000 price prediction realistic?

A $1,000 target is an aggressive, low-probability scenario meant to illustrate potential upside rather than a high-probability forecast. While not impossible mathematically, such targets require massive market revaluation and multiple structural validations. Treat such predictions skeptically and plan trades around more probable scenarios.