Table of Contents

- Quick summary in plain language

- Why this Aster crypto review matters

- Table of contents

- What is Aster? A clear explanation

- Real numbers: why usage matters more than hype

- The CZ catalyst: how a single buy changed market psychology

- Why CZ’s long term mention multiplies the effect

- What Aster is used for right now

- Possible path to $5 — a conservative scenario explained

- Where Aster is listed and where to trade

- Leverage, risk, and why caution is mandatory

- Technical points: support, resistance, and what to watch

- Tokenomics and holder distribution

- Use cases that increase organic demand

- Market timing and the macro context

- Integrating crypto signals into your trade plan

- Practical buy and sell strategies

- Potential downsides and headwinds

- Closing thoughts from this Aster crypto review

- What is Aster and what does it do?

- Why did Aster’s price spike recently?

- Can Aster realistically reach $5 this bull cycle?

- What are the main risks of trading Aster?

- Where should I trade Aster and how do I manage fees?

- How can crypto signals help with trading Aster?

- How many holders and trading pairs does Aster have?

- Is Aster a long term hold or a trading opportunity?

- What should I watch next if I am tracking Aster?

- Final action points

Quick summary in plain language

Aster crypto review summary: Aster is a perpetuals decentralized exchange built to serve both spot and perpetual traders across multiple chains. It is non custodial, supports high leverage, and has posted staggering trading volumes since launch. High profile buying by a major industry figure has already caused a sharp pump and changed market psychology. At current usage levels and with continuing attention, Aster has a real shot at multi-dollar targets this cycle. That is the thesis explained in this Aster crypto review.

Why this Aster crypto review matters

This Aster crypto review matters because Aster is not just another token with marketing noise. Usage metrics are extreme. When an asset shows real product-market fit through trading volume and open interest, that is when speculative markets start to follow fundamental traction. The Aster crypto review you are reading will walk through the metrics, the people involved, and the tactical steps you can consider if you are evaluating an entry or sizing a position.

Table of contents

- What is Aster and how it works

- Real numbers: volume, open interest, holders, trading pairs

- The CZ catalyst and the 30 percent spike

- Why Aster could reach $5 this bull cycle

- How to trade Aster: leverage, exchanges, risk management

- Practical portfolio and timing notes

- How crypto signals can help with timing and trade ideas

- FAQ

What is Aster? A clear explanation

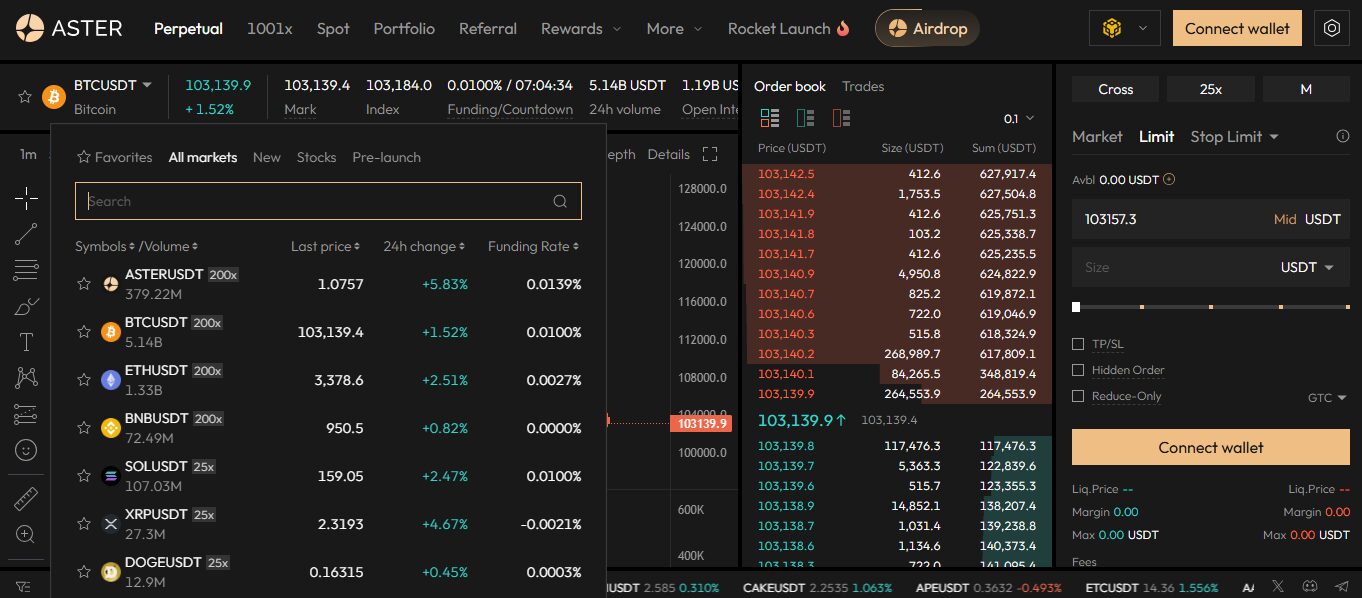

Aster crypto review begins with the product. Aster is a perpetuals decentralized exchange that aims to be a one stop shop for global crypto traders. It supports spot trading and perpetual contracts, and even adds a pro mode with stock perpetuals, hidden orders, and grid trading. It operates across major chains such as BNB Chain, Ethereum, Solana, and Arbitrum and it includes liquid staking tokens and yield generating stablecoins. The architecture emphasizes high performance and privacy, and is backed by YZNI Labs.

Aster crypto review perspective: what makes it different is the combination of being non custodial, offering deep perpetuals liquidity, and cross-chain accessibility. That trifecta is attractive to both retail traders and more sophisticated liquidity providers who want to run strategies without the custody risk traditional centralized venues have.

Real numbers: why usage matters more than hype

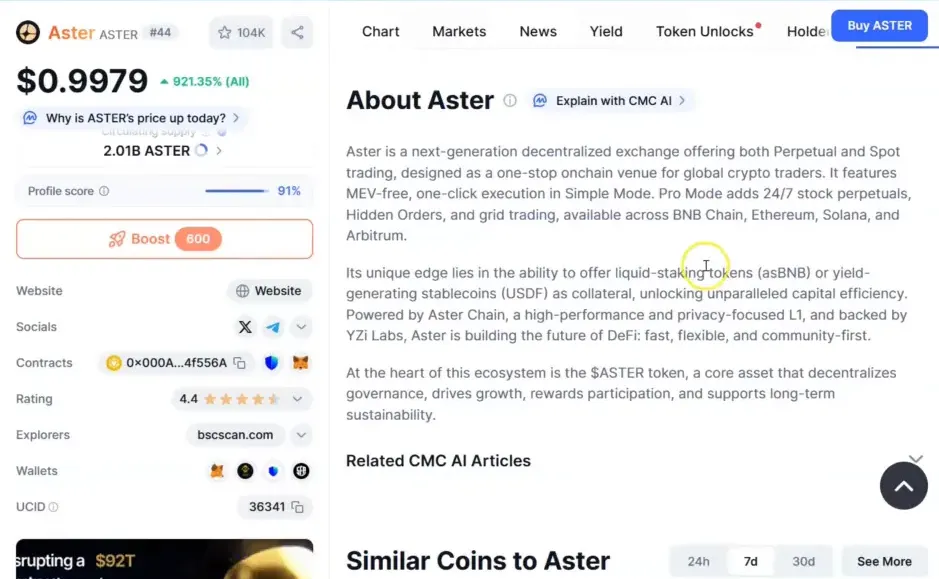

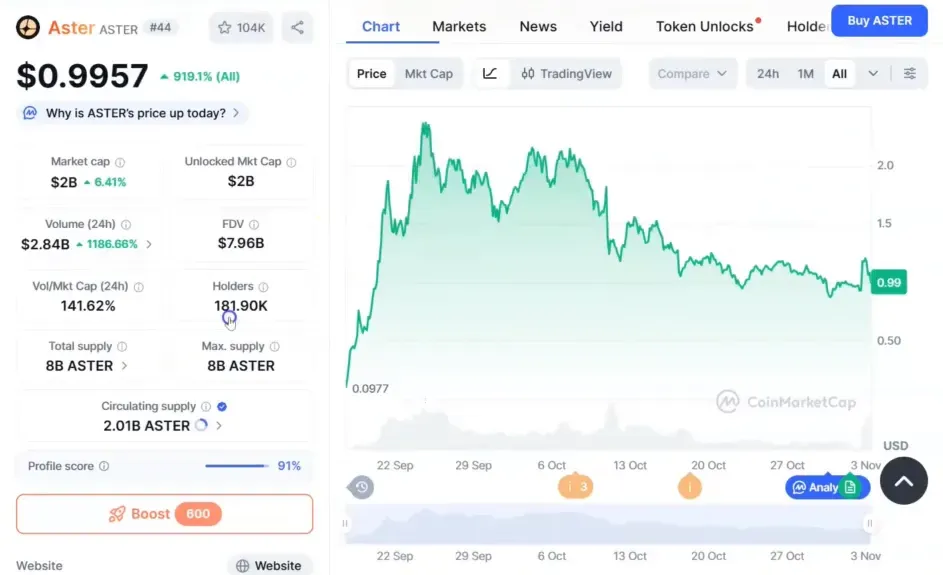

Aster crypto review needs to focus on metrics because in crypto volume and open interest often precede valuations. Aster has produced mind blowing numbers: total trading volume since launch has been reported at $2.93 trillion. Yes, that is trillion not billion. Open interest sits just shy of $3 billion and the token currently trades across roughly 181 pairs. Holders are already in the hundred thousands and climbing.

These metrics are not fluff. High sustained volume translates into fee revenue potential, deeper order books, and better pricing for traders. From a market structure point of view, when an exchange or protocol demonstrates consistent, high throughput, it becomes more likely that liquidity will continue to compound as market participants prefer venues where they can execute large positions efficiently.

The CZ catalyst: how a single buy changed market psychology

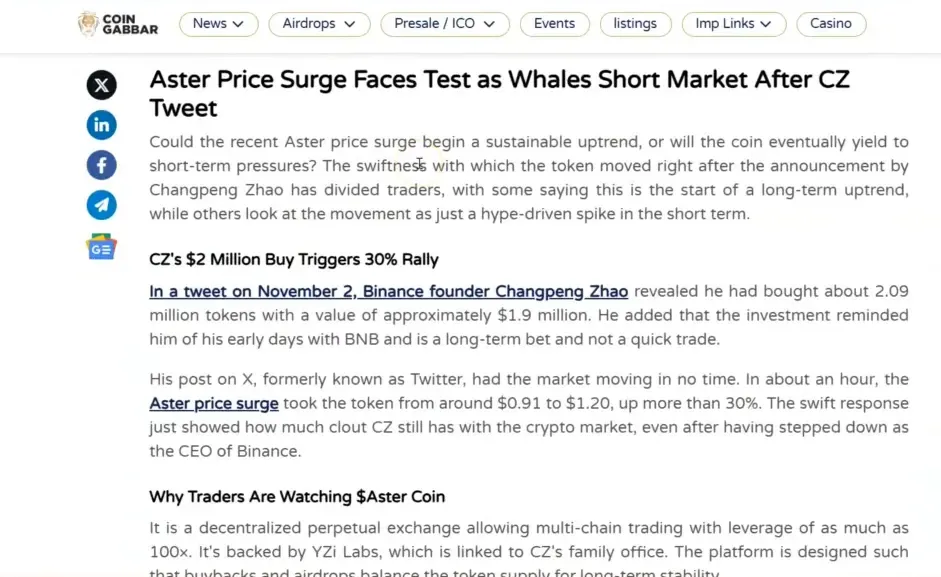

Aster crypto review must include recent on chain events. The single most immediate catalyst was a public disclosure from Changpeng Zhao, known widely as CZ. CZ announced he purchased 2.09 million Aster tokens at an approximate value of $1.9 million and described it as a long term bet that reminded him of early days with BNB. Within roughly an hour of his post, the Aster price jumped from about $0.91 to $1.20 — more than a 30 percent move.

In this Aster crypto review I emphasize why that matters. CZ is one of the most influential voices in crypto. When he describes an investment as long term, that signals not only capital committed but also ongoing attention. Every positive mention from someone with CZ’s reach can re-trigger price reflexivity in lead traders and retail audiences. The result is repeated surges whenever sentiment swings positive.

Why CZ’s long term mention multiplies the effect

Aster crypto review notes that endorsements have different impacts depending on the messenger and the framing. CZ did not frame this as a short term trade. He framed it as a long term bet. That combination of credibility plus a long term thesis pushes the narrative from meme pump to a serious product endorsement. It encourages infrastructure players, market makers, and institutions to evaluate the project from a different lens. Over time, repeated mentions and engagement could create waves of on chain activity and higher sustained market caps.

What Aster is used for right now

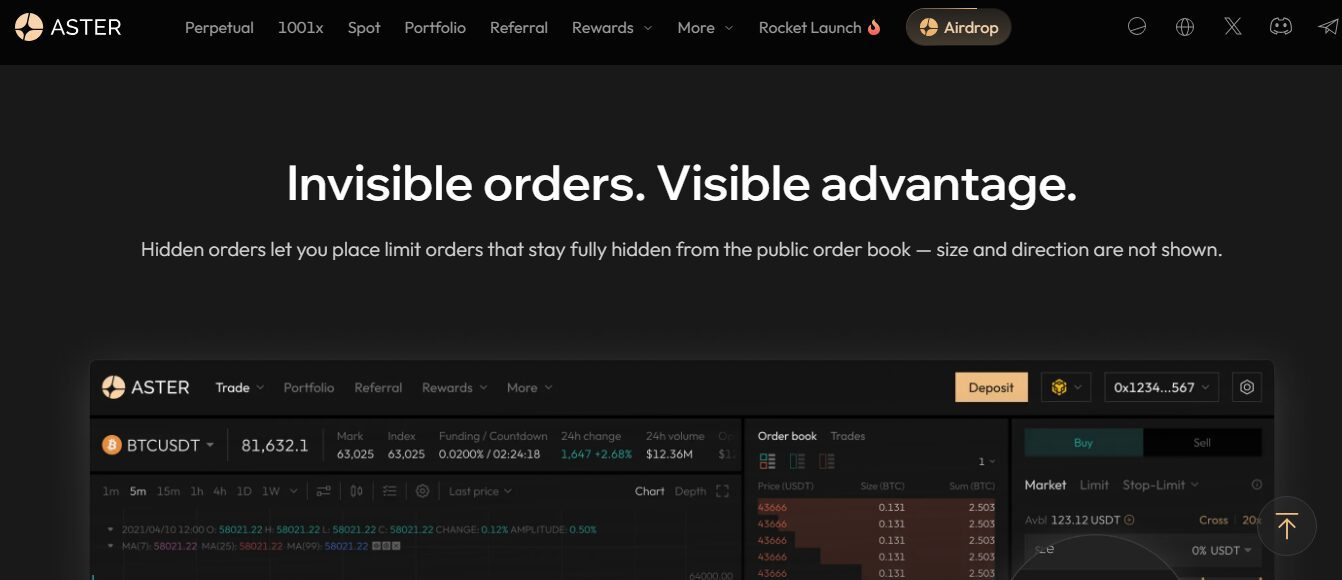

Aster crypto review should catalog current use cases. Today the protocol supports:

- Perpetual contracts for major assets like Bitcoin, Ethereum, and BNB

- Spot trading across multiple chains

- Grid trading and hidden orders for algorithmic traders

- Liquid staking token integrations

- Yield generating stablecoins and treasury products

These features make Aster attractive to both retail and professional traders. The ability to trade cross-chain perpetuals non custodially is a feature set many market participants have been asking for.

Possible path to $5 — a conservative scenario explained

Aster crypto review projects a plausible path to $5 this bull cycle. At a $5 price, Aster would imply roughly a $10 billion market cap assuming consistent circulating supply figures. Given current usage with trillions in trading volume and billions in open interest already flowing through the protocol, reaching a $10 billion valuation is not outlandish.

Here is the conservative logic:

- Product market fit yields sustainable daily volume growth and fee revenue.

- Influential industry figures advocate and hold long term positions, drawing attention and liquidity.

- New exchange listings and integrations broaden access and reduce friction for institutional flows.

- Macro tailwinds and bull market cycles increase leverage-driven flows and speculative interest.

If all four of these work in tandem, Aster crypto review suggests a path to $5 is realistic rather than dreamlike. I personally see a very real shot at $5 this cycle based on current metrics and the credibility from major buyers.

Where Aster is listed and where to trade

Aster crypto review considers practical access. Aster trading is already live across several major exchanges and DEX interfaces. If you prefer centralized onboarding, many traders are watching for a potential Binance listing. Until any listing is confirmed, large liquidity pools exist on exchanges like Bitget and other major venues that support perpetuals trading. If you plan to trade on a centralized venue, I recommend checking available welcome packages and fee discounts as they can materially impact small to medium sized accounts.

Side note on trading infrastructure: if you want to improve the timing and execution of trades, consider using professional crypto signals that provide trade ideas, stop loss levels, and position sizing recommendations. Signals can be particularly useful when markets spike and liquidity shifts quickly. Integrating high quality crypto signals with a disciplined plan helps avoid emotional mistakes while taking advantage of volatility.

Leverage, risk, and why caution is mandatory

Aster crypto review must highlight leverage risk. Aster offers very strong leverage on major assets, with up to 200x available on Aster, Bitcoin, Ethereum, and BNB in certain venues. High leverage magnifies both gains and losses. If you do not understand liquidation mechanics and margin requirements, you will be wiped out. Never risk capital you cannot afford to lose and size positions based on your risk tolerance.

Practical rules to reduce blow up risk:

- Limit leverage to a size you can manage and understand. For most traders this is well below the maximum advertised leverage.

- Use defined stop loss levels and keep position sizes small relative to account equity.

- Monitor open interest and funding rates. Sudden spikes in open interest or negative funding can precede violent moves.

- Avoid margin farming during macro news events unless you have an iron discipline plan.

Including targeted signals from a reputable crypto signals provider can assist traders with tactical entries, stop levels, and profit targets, especially during periods of heightened market activity where timing matters.

Technical points: support, resistance, and what to watch

Aster crypto review technical takeaways: the token must hold key support levels to sustain rallies. In the run up after the CZ buy, Aster needed to stay above roughly $0.90 to maintain momentum. If that level holds, it becomes a base for continued accumulation and higher highs. If it loses that support, expect consolidation or deeper retracements until a new base forms.

Key technical metrics to watch:

- Support around $0.90 to $1.00 as short term base

- All time high near $2.42 as initial resistance to break for multi dollar moves

- Volume spikes that accompany breakouts — sustainable breakouts will be backed by higher on chain and exchange volume

- Open interest directional bias — rising open interest with price increase suggests fresh directional money

Every breakout that is backed by increasing volume and narrative support from major players improves the odds of a sustained run. This is central to the Aster crypto review thesis.

Tokenomics and holder distribution

Aster crypto review must consider tokenomics because holder distribution and supply mechanics determine tail risk. Aster already has a substantial holder base, with well over 181,000 reported holders. A growing number of smaller holders can provide a more stable base if they choose to HODL, but concentration among large holders can create volatility if those holders decide to realize gains quickly.

Important tokenomic questions to track:

- What percentage of circulating supply is in exchange wallets versus cold storage?

- Are large allocations subject to vesting that could create sell pressure at certain dates?

- How does protocol revenue flow to token holders or treasury, and does that create buybacks or burns?

The Aster crypto review thesis improves if tokenomics align with long term value capture like fee revenue sharing or protocol treasury mechanisms that reduce supply over time.

Use cases that increase organic demand

Aster crypto review also needs to highlight real demand drivers beyond speculation. These include:

- Perpetual trading that captures market-maker and professional flows

- Cross-chain traders who need efficient, non custodial access to leverage and spot markets

- Yield seekers using liquid staking tokens and yield generating stablecoins inside the ecosystem

- Developers building margin and derivatives tools that leverage Aster liquidity

When protocol features solve real trader pain points, price appreciation is more sustainable because it is backed by revenue and utility rather than pure meme energy.

Market timing and the macro context

Aster crypto review must be seen in the context of a bull cycle. We are in a broader uptrend where liquidity, macro sentiment, and retail interest are aligned. When macro events generate volatility, a venue like Aster that supports perpetuals can see explosive days of volume. For example, a major macro development like a government shutdown resolution or a big macro policy announcement can trigger intense trading and huge volume days on Aster.

That is why, in this Aster crypto review, I am paying attention not only to the token mechanics but also to macro calendar items, liquidity windows, and news catalysts. Those are the days when a well placed allocation and a clear exit plan can produce disproportionate returns.

Integrating crypto signals into your trade plan

Aster crypto review suggests that disciplined trading matters. If you are actively trading Aster or other high volatility assets, consider a hybrid approach: combine your own research with timely crypto signals that include precise entries, stop loss points, and profit targets. A good crypto signals service filters noise and helps you identify trades where risk reward aligns with your plan. The goal is to be opportunistic when volume and momentum are favorable and to stay defensive when the market is range bound.

In practice, this means using signals for entries and scaling while maintaining personal discretion over position size and risk management. Aster crypto review therefore recommends signals as a tactical tool, not a substitute for responsible capital management.

Practical buy and sell strategies

Aster crypto review practical tips:

- Dollar cost average into positions to reduce timing risk around volatile news cycles.

- Scale into leverage carefully and always define a maximum portfolio percentage for leveraged exposure.

- Set mental or hard stops. Decide ahead of time if you will take profits at specific percentage targets, and stick to the plan.

- Rebalance winners into stable positions or diversify into other high conviction projects to lock in gains.

These rules are not specific to Aster; they are general risk management best practices that become critical when trading high volume, high leverage ecosystems.

Potential downsides and headwinds

An honest Aster crypto review acknowledges the downsides. They include:

- Regulatory scrutiny around derivatives and perpetuals can shift market access and compliance requirements.

- High leverage can generate liquidation cascades that exaggerate drawdowns.

- Overreliance on endorsements could lead to sentiment driven spikes followed by heavy corrections.

- Token unlock schedules or large holder sell pressure can create periodic dumps.

Understanding these risks is part of building resilient positions and deciding whether Aster fits into your portfolio based on your time horizon and risk tolerance.

Closing thoughts from this Aster crypto review

Aster crypto review conclusion: Aster has shown remarkable, real usage and volume since launch. The combination of a non custodial perpetuals exchange, strong cross-chain functionality, and a high profile long term buyer has changed the narrative. There is a credible path to a $5 price this cycle if volume continues to compound, more listings and integrations occur, and macro conditions remain favorable.

At the same time, risk management is essential. Use defined entries, clear stops, and consider tools like crypto signals to get timely trade ideas without succumbing to emotion. If you are planning to participate, size positions to what you can tolerate and be prepared for volatility. This Aster crypto review aims to give you the framework to decide for yourself.

What is Aster and what does it do?

Aster is a perpetuals decentralized exchange that supports spot and perpetual trading across multiple chains such as BNB Chain, Ethereum, Solana, and Arbitrum. It focuses on non custodial trading, offers advanced trading features like grid trading and hidden orders, and integrates liquid staking tokens and yield generating stablecoins.

Why did Aster’s price spike recently?

A significant driver of the recent spike was a public disclosure by a major industry figure who bought 2.09 million tokens and framed the purchase as a long term bet. That endorsement, combined with already high trading volumes, created a rapid surge from around $0.91 to $1.20 within about an hour.

Can Aster realistically reach $5 this bull cycle?

Yes, Aster can realistically reach $5 under a conservative scenario where product usage continues to grow, industry endorsements bring further attention, exchange listings expand access, and macro liquidity supports speculative flows. A $5 price implies roughly a $10 billion market cap, which is possible given current and projected volume trends.

What are the main risks of trading Aster?

Key risks include high leverage liquidation dynamics, regulatory pressure on perpetuals trading, concentration of token holdings, and potential token unlocks or sell pressure. Traders should use strict risk management, limit leverage, and size positions appropriately.

Where should I trade Aster and how do I manage fees?

Aster is available on several exchanges and DEX interfaces. For centralized trading, exchanges like Bitget currently offer strong liquidity and welcome packs that can reduce effective trading costs. Managing fees includes choosing the right venue, using fee discount links, and considering fee structure for high frequency or leveraged strategies.

How can crypto signals help with trading Aster?

Crypto signals provide curated trade ideas, entry points, stop loss levels, and profit targets. For volatile assets like Aster, signals can help you time entries during volume spikes, scale positions based on risk, and avoid emotional decision making. They are a tactical tool to complement your research and risk plan.

How many holders and trading pairs does Aster have?

At the time of writing this Aster crypto review, Aster reported approximately 181,000 holders and around 181 trading pairs. These numbers are growing as awareness and listings expand.

Is Aster a long term hold or a trading opportunity?

Aster can be both. Long term investors may be attracted to the protocol’s product-market fit and fee revenue potential. Traders can exploit volatility and leverage opportunities. Your choice depends on your risk tolerance, time horizon, and portfolio objectives.

What should I watch next if I am tracking Aster?

Watch for continued mentions from influential industry figures, exchange listings, daily and weekly volume trends, changes in open interest, and any tokenomics related unlock schedules. These signals will indicate whether the narrative and liquidity environment remain supportive of higher prices.

Final action points

Aster crypto review final checklist:

- Confirm the current support and resistance levels before sizing any position.

- Decide your time horizon: short term trade versus long term hold.

- If trading leveraged products, keep leverage conservative and set explicit stops.

- Consider using a reputable crypto signals service to refine entries and exits when volatility picks up.

- Monitor on chain metrics like volume, open interest, and holder growth weekly.

Use the information in this Aster crypto review as a framework, not as financial advice. Always do your own research and consider speaking to a financial advisor before making material investments.

Good luck, and if you choose to engage with Aster, focus on disciplined execution. See you in the markets.