Table of Contents

- Why Horizen is back on many radars

- Market context: why privacy is trending again

- What Horizen is building: confidentiality meets compliance

- Layer 3 on Base: why that matters

- Practical use cases for private execution

- Price action and market opportunity

- Risks to the thesis

- How traders and investors can approach Horizen

- Comparatives: Horizen versus other privacy technologies

- Realistic timeline for adoption and price movement

- Takeaways

- Is Horizen a pure privacy coin?

- What makes the Horizon 2.0 model different from other privacy projects?

- Why would a business choose Horizen over a public chain?

- What are realistic price targets for ZEN?

- How should traders manage risk with privacy tokens?

- What are the biggest risks to Horizen’s adoption?

Why Horizen is back on many radars

Privacy coins have quietly edged back into relevance, and Horizen is one of the projects that stands out. What makes it interesting is not just a price chart that can swing dramatically, but a strategic pivot: from being a pure privacy-focused token to becoming a privacy-first infrastructure layer where businesses can build private, compliant applications.

Horizen launched in 2017 as a fair launch, non-ICO project. Over time the team refined the technology and strategy, and the result is Horizon 2.0 — a next-generation Layer 3 app chain deployed on Base, Coinbase’s Ethereum Layer 2. That sounds technical, but the core idea is simple: deliver privacy that businesses can actually use without exposing sensitive operations to competitors or regulators.

Market context: why privacy is trending again

For years many investors were cautious on privacy coins. Regulatory pressure in the EU and elsewhere created genuine uncertainty. Exchanges were asked to delist certain privacy tokens, and governments published arguments about risks like misuse in illicit financing. That regulatory friction dented adoption and sentiment for a long time.

Now there are signals that public sentiment is shifting. A combination of increasing awareness of government data collection, the emergence of centralized digital identity proposals in multiple countries, and a wider backlash against perceived overreach is driving renewed interest in on-chain privacy. Investors, developers, and businesses are asking a new question: how can we use distributed ledgers while keeping commercially sensitive information private?

What Horizen is building: confidentiality meets compliance

Horizen’s selling point is a practical one: a private execution layer where businesses get the benefits of blockchain — immutability, programmability, composability — without the downside of public visibility. The platform leverages privacy technologies such as zero knowledge proofs to enable confidential transactions and private smart contracts, while also designing for compliance requirements.

Confidentiality meets compliance. It empowers businesses, it protects data, and it enables compliance.

That balance is crucial. No company wants its full transaction history publicly visible on a ledger; competition can undercut deals, suppliers can infer margins, and sensitive strategic moves become visible. Horizen aims to give businesses a way to put logic on-chain and still keep the operational details private — and to do so in a manner that can satisfy regulators and auditors.

Layer 3 on Base: why that matters

Horizen’s Horizon 2.0 is built as a Layer 3 app chain on Base, which is notable for a few reasons:

- Throughput and lower cost — Base provides higher throughput and lower fees than Ethereum mainnet, which is attractive for businesses that need predictable costs.

- Developer ecosystem — Base benefits from tooling and integrations in the broader Ethereum/L2 ecosystem, making it easier for teams to port or build applications.

- Security model — As a Layer 3 solution, Horizen can focus on privacy and app-specific performance without reinventing the base layer security assumptions.

For businesses, this translates into faster, cheaper private apps with access to the Ethereum-compatible ecosystem. That makes Horizen’s infrastructure pitch more realistic: not an abstract privacy toy, but a usable stack for enterprise and web3-native teams.

Practical use cases for private execution

Here are some examples where a privacy-first app chain makes sense:

- Private business-to-business contracts — finance deals, supply chain terms, or licensing agreements where on-chain settlement is valuable but terms must remain confidential.

- Confidential financial products — on-chain derivatives, private vaults, or internal treasury functions where disclosure could harm competitive advantage.

- Protected user data — applications that process sensitive information (health, identity attributes) and need both encryption and verifiable compliance.

- Confidential auctions and bids — marketplaces where bids or reserve prices must stay hidden until settlement.

When you combine these practical scenarios with the performance and developer tooling of Base, you get a compelling niche: private, compliant, performant on-chain apps — exactly the kind companies have been reluctant to adopt until now.

Price action and market opportunity

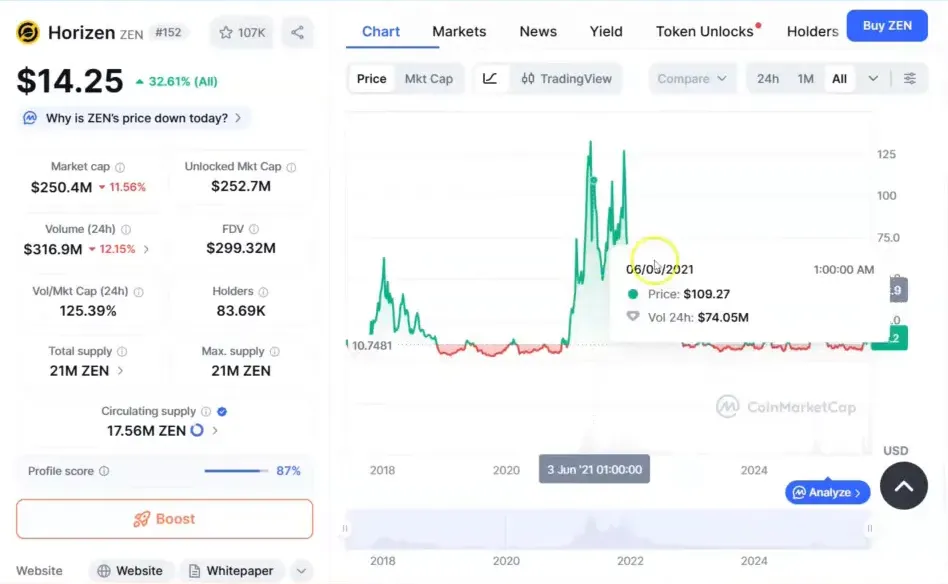

Horizen has a history of wide price swings. It reached highs near $165 in the previous bull cycle and is trading substantially lower now. That dynamic is what makes the argument for upside straightforward: the market cap sits well below prior peaks, so even moderate renewed interest could push the token significantly higher.

Back-of-the-envelope math suggests reaching a billion dollar market cap again would require roughly a 4x move from recent levels — a jump to the $50 range. A return to $100 is plausible under heavy momentum, but the conservative, realistic target to watch in the near term is $50, particularly if privacy coins broadly regain traction and Horizen capitalizes on enterprise adoption.

Risks to the thesis

The same factors that create upside also create risk:

- Regulatory uncertainty — renewed pressure from the EU, the US, or other major jurisdictions can quickly dampen pricing and listing access for tokens with privacy features.

- Execution risk — moving from a roadmap to production-grade enterprise adoption is hard. The team needs both developer interest and enterprise customers.

- Competition — other projects are pursuing privacy, confidential computing, or permissioned approaches. Horizen must differentiate on ease of use, compliance tooling, and performance.

It is important to weigh these risks when sizing any position. The privacy element is a double-edged sword: it can drive demand, but it also attracts regulatory scrutiny.

How traders and investors can approach Horizen

There are multiple ways to engage depending on appetite and time horizon:

- Speculative trade — short to medium-term play on privacy sector momentum. Monitor on-chain signals, exchange flows, and regulatory headlines closely.

- Medium-term swing — position for a retest of prior market cap levels (target $50) while using risk management tools like staggered entries and stops.

- Long-term fundamental — if you believe in private enterprise adoption, position as part of a diversified basket of infrastructure and privacy plays.

To navigate fast-moving market swings, many traders find value in professional tools. Cryptocurrency trading signals can help identify momentum shifts, actionable entry points, and risk-managed exits across privacy coins and infrastructure tokens. Signals that combine technical analysis, on-chain metrics, and regulatory news can be especially useful when trading a sector driven by headlines and sentiment.

Comparatives: Horizen versus other privacy technologies

It helps to put Horizen in the context of other privacy projects:

- Zcash — focused on private transfers using zk-SNARKs, primarily a privacy coin rather than an app-focused platform.

- Mina and ZK rollups — use succinct proofs to reduce data and preserve privacy in different ways, often focused on scaling and proof efficiency.

- Confidential computing — approaches like Intel SGX or multiparty computation offer off-chain privacy guarantees, but integration with on-chain settlements differs from Horizen’s model.

Horizen’s differentiator is the combination of an app-chain model and privacy-first execution designed to interoperate with the Ethereum ecosystem through Base. That makes it more of an enterprise-grade infrastructure play than a simple privacy token.

Realistic timeline for adoption and price movement

Adoption is rarely linear. Even with a strong product, real-world contracts, compliance integrations, and developer ecosystem growth take time. A few scenarios to consider:

- Quick momentum — privacy sector surge and positive headlines can push prices toward the $50 target within weeks to months.

- Measured adoption — steady enterprise launches and developer activity could produce a more prolonged uptrend over a bull cycle.

- Regulatory setback — policy moves could erase momentum quickly; monitor legislative activity in the EU and the US closely.

Timing entries around fundamentals, on-chain adoption signals, and exchange liquidity is key. Again, well-crafted cryptocurrency trading signals can provide a structured way to scan for setups and manage risk as these scenarios unfold.

Takeaways

- Horizen is no longer just a privacy coin — it is positioning as a privacy-first Layer 3 app chain for businesses, deployed on Base.

- There is a clear market need — businesses want on-chain settlement and automation but do not want commercial secrets exposed on a public ledger.

- Price upside is plausible — prior highs near $165 create a precedent, and a move to ~$50 is achievable if privacy sentiment and enterprise adoption pick up.

- Regulation remains the wild card — privacy features attract scrutiny, so risk management is essential.

Is Horizen a pure privacy coin?

Horizen started as a privacy-focused project, but it has evolved into a privacy-first infrastructure platform. Horizon 2.0 is designed as a Layer 3 app chain that enables private execution for applications while emphasizing compliance and enterprise usability.

What makes the Horizon 2.0 model different from other privacy projects?

Horizen combines zero knowledge technology and a private execution layer with an app-chain architecture on Base. This enables confidential smart contracts and private transactions while leveraging Ethereum-compatible tooling and higher throughput provided by the L2 ecosystem.

Why would a business choose Horizen over a public chain?

Businesses need to protect commercially sensitive information. Horizen offers confidential execution so companies can use decentralized infrastructure without exposing transaction details, pricing, or other strategic data to competitors or the public.

What are realistic price targets for ZEN?

Realistic near-term targets include a move toward $50 if privacy sector momentum and adoption accelerate. A retest of $100 is possible under strong bullish conditions, but regulatory setbacks or weak execution can counteract that upside.

How should traders manage risk with privacy tokens?

Use position sizing, staggered entries, stop losses, and stay updated on regulatory developments. Combining technical signals with on-chain metrics and news can provide a better risk-adjusted approach. For those without the time to monitor markets constantly, professional cryptocurrency trading signals can help identify and act on high-probability setups.

What are the biggest risks to Horizen’s adoption?

The primary risks are regulatory pressure, slower-than-expected developer and enterprise adoption, and competition from other privacy or confidential computing solutions. Execution and partnerships will determine how quickly Horizen can capture market share.