Watching Bitcoin surge to fresh all time highs is exhilarating, and it is natural to wonder when altcoins will join the party. Some altcoins do pop off spectacularly, but many others keep sliding lower, leaving investors asking the same painful question: is this project merely hibernating or is it a corpse?

Below is a practical, no-nonsense checklist you can use to assess whether your altcoin still has a pulse — or whether it is time to move on. This guide covers on-chain signals, DApp metrics, exchange accessibility, runway and funding, developer and community activity, roadmaps and milestones, and the deadly phenomenon of zombie pumps. Use it to make more informed decisions, protect your mental health, and improve as an investor.

Table of Contents

- Why charts do not tell the whole story

- 1) On-chain activity: the first and most objective check

- 2) Can people actually buy it? Exchange listings and accessibility matter

- 3) Runway: how long can the team keep building?

- 4) Developer activity and open source signals

- 5) Community engagement: attention is a currency

- 6) Roadmap and measurable milestones

- 7) Beware the zombie pump: price can lie

- 8) Tokenomics and distribution: who controls the supply?

- 9) Governance transparency and community decision making

- 10) If it is dead: practical and emotional steps

- Practical checklist you can copy and use

- Using signals and resources to augment your analysis

- Case examples and what to watch for

- Final rules of thumb

- Frequently Asked Questions

- Parting thoughts

Why charts do not tell the whole story

First thing to accept: price alone is an incomplete judge. Charts showing lower lows for months or years understandably scare people, but many cryptos grind down for long stretches before undergoing massive re-rates. Some of the most explosive 20x plus rallies came from projects that looked dead on the surface for a very long time.

Price is the market’s summary, but it lags fundamentals. If you want to know whether a token is truly dead, go underneath the hood and examine usage, funding, development, and distribution. Those are the things that ultimately create durable value and real price appreciation.

1) On-chain activity: the first and most objective check

On-chain metrics are the purest, real-time signals you can use. For layer 1 or layer 2 projects, look up the blockchain explorer for that chain — think Etherscan for Ethereum, Solscan for Solana, or the equivalent explorer for the protocol — and check:

- Active wallets (daily and weekly unique addresses interacting with the chain)

- Daily transactions (total transactions per day)

- Median gas or fees and fee revenue (shows economic demand)

- Smart contract interactions (how many different contracts or dApps are being used)

- Token transfers (are people sending the token for payments, staking or liquidity?)

If these metrics are rising, it signals actual usage that might precede price appreciation. Fee revenue in particular makes for a compelling narrative; when users pay fees and fee revenue climbs, media and investors notice, which can trigger a positive feedback loop.

How to check DApp projects

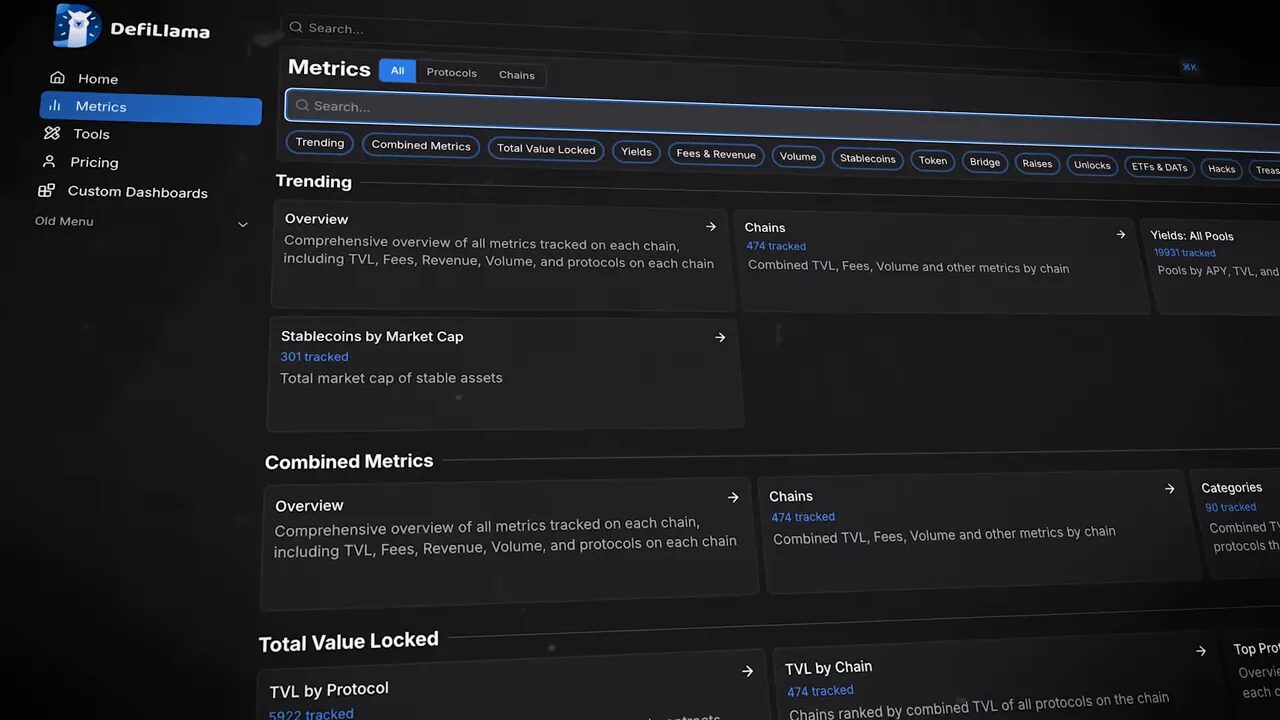

If your token is tied to a decentralized application, use aggregators like DAppRadar and DeFiLlama to see total value locked (TVL), active users, and daily volumes across chains. A DApp that is getting steadily more users and TVL might be quietly building product-market fit even if the token’s price lags behind.

2) Can people actually buy it? Exchange listings and accessibility matter

Even the best fundamental story needs liquidity and access. If the coin or token is absent from major centralized exchanges, or only tradable on obscure markets with weak rails, retail and institutional adoption will be limited. Accessibility includes:

- Listings on several centralized exchanges or major decentralized exchanges

- Availability on chains that are cheap, fast, and user friendly such as Solana or BASE

- Listing in fiat or stablecoin pairs to allow easy on ramps

Without these, any on-chain growth may never translate into meaningful price action. If you trade actively or plan to react to news, consider using reliable signals and analysis to identify entry and exit points. Best crypto trading signals can help spot momentum and liquidity shifts across exchanges, aligning your trades with improving fundamentals and exchange listings without the emotional noise.

3) Runway: how long can the team keep building?

Runway refers to how long a project can fund its operations and development. In crypto this usually comes from treasury funds raised during token sales, private rounds, or ICOs. You can track funding history on sites like ICO Drops or ICO Analytics, and in many cases the project’s filings or governance posts will disclose treasury holdings.

Key runway questions:

- When was the last raise? If it was many years ago for only a few million, runway may be limited.

- Did they secure tens or hundreds of millions recently? That greatly improves odds they can execute long term.

- Has the project raised additional funds after launch? Post-ICO funding rounds indicate investor conviction.

- What is the burn rate? How quickly is the treasury being spent?

Important caveat: runway is often generated by selling tokens on market. That can pressure short term price but fund long term product builds. The Ethereum Foundation, for example, routinely sells ETH yet reinvests into protocol development. If token sales lack a clear, documented purpose — for example, no roadmap tied to the spending — consider that a red flag and dig into governance forums for explanations.

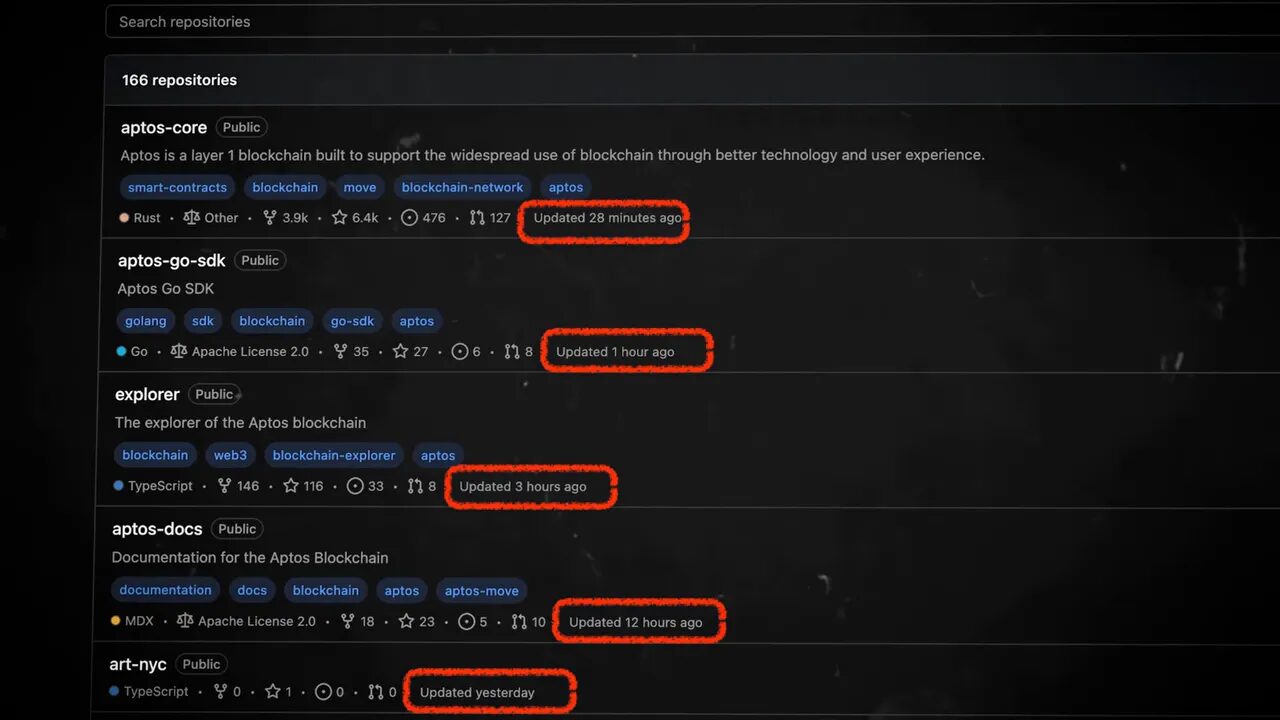

4) Developer activity and open source signals

Most serious crypto projects are open source. GitHub is your friend. A project with active commits, multiple contributors, recent merges and releases is a living project. Metrics to check on GitHub include:

- Number of commits in the last 30, 90, and 365 days

- Number of active contributors

- Frequency of releases and tagged versions

- Closed pull requests and issue activity

A long silence on GitHub while marketing noise ramps up is a warning sign. Conversely, steady technical progress — even behind the scenes — suggests genuine development. If a project posts “we are building” but you cannot find corresponding commits, ask why. Sometimes teams post developer updates rather than public commits, but transparency should still be present in developer channels or release notes.

5) Community engagement: attention is a currency

Projects live and die by community. A token can have brilliant tech but without community adoption and attention, price recovery is unlikely. Look at the team’s social channels — X, Telegram, Discord — and judge engagement quality, not just follower numbers. Questions to ask:

- Are posts getting meaningful likes, replies and shares relative to follower count?

- Is the team responsive to community questions?

- Are other reputable projects or companies sharing or endorsing the project?

- Is the narrative simple enough for average investors to understand and repeat?

A healthy community amplifies news, drives liquidity, and attracts integrations. If nobody is paying attention, even a great product will struggle to escape obscurity. Conversely, if larger projects are promoting your project, that can accelerate adoption and press coverage.

6) Roadmap and measurable milestones

Milestones are the heartbeat of a project. They are the catalysts that can move price if they are meaningful and measurable. Find roadmap milestones by:

- Reading documentation and the whitepaper

- Listening to interviews with the team

- Searching the project’s X account for terms like roadmap or milestone

- Checking blog posts and governance updates

Milestones that matter include:

- New partnerships or integrations

- Mobile or browser extension wallets

- Cross-chain bridges to major blockchains

- Upgrades that improve speed, security or decentralization

- Transition from token to native chain, or mainnet launches

The roadmap should be concrete and trackable. If the team keeps announcing ambitious builds but GitHub, release notes, or developer updates show no evidence of work, treat this as a red flag. Also assess media traction. If crypto media outlets are covering past and upcoming milestones, more capital and attention are likely to flow in as milestones approach.

7) Beware the zombie pump: price can lie

Not all rallies mean life. Sometimes dead projects get short-lived pumps driven by whales or speculators. These are zombie pumps and they have predictable signatures:

- Very low baseline trading volume, then a sudden spike that coincides with an outsized price move

- Price rockets up and collapses just as fast

- Listing in top gainers sections without fundamental changes

- Large wallets moving tokens into exchanges shortly before or after spikes

Low liquidity means it takes little capital to move price. That makes dead tokens ideal targets for manipulation. Some zombie pumps are also chain correlated: if Ethereum or Solana rallies hard, unrelated tokens that live on those chains can get pulled up briefly. Similarly, if a particular niche (for example tokenized real world assets) becomes hot, zombie tokens in that niche can see short spikes.

The giveaway is that these rallies are not accompanied by corresponding on-chain growth, GitHub activity, community excitement, or meaningful news. They are noise traps that draw in late buyers who end up holding the bag.

8) Tokenomics and distribution: who controls the supply?

Understanding token distribution and vesting schedules is critical. Key things to check:

- What portion of tokens are held by the team, foundations, or private investors?

- When do large unlocks happen? Are upcoming unlocks likely to flood the market?

- Are there clear vesting schedules and are they being honored?

- Has the project sold tokens from its treasury without transparent justification?

Large concentrated holdings and opaque token sales are a common cause of price decay. If tokens are regularly dumped with no public spending plan, that is a big red flag. Conversely, transparent, scheduled unlocks tied to product milestones are easier to model and less likely to surprise holders.

9) Governance transparency and community decision making

Active governance forums are a healthy sign. If a project has a functioning governance mechanism where proposals, treasury spending, and token sales are debated publicly, this indicates maturity. Look for:

- Detailed governance proposals and voting records

- Clear explanations for treasury expenditures

- Community participation and diverse voices

Projects that hide governance or make unilateral decisions without community input are riskier. You should be able to trace why tokens were sold and how funds were allocated. If that information is hidden, your ability to judge the project’s health is compromised.

10) If it is dead: practical and emotional steps

Sometimes the honest answer is that a token is dead. There is no revival possible. If you reach that conclusion, consider:

- Cut your losses. Selling now may be emotionally painful, but it frees capital for better opportunities.

- Sell entirely if holding is causing anxiety or hinders decision making.

- Reflect and document lessons learned: why did you buy, what warning signs were missed, and how will your process improve?

- Move on. Use the experience to refine your screening process for future investments.

There is also an important mental health component. Watching a position decay for months or years can be emotionally draining. Ask yourself: how much time am I willing to spend hoping for a recovery? Will holding this token affect my ability to act on better opportunities?

Practical checklist you can copy and use

Use this simple checklist when evaluating any altcoin you suspect might be dead. If most of these are green, the project likely still has a pulse. If most are red, it may be time to move on.

- On-chain activity: Are active wallets and transactions rising?

- DApp metrics: Is TVL or unique user count increasing?

- Exchange accessibility: Is the token listed on multiple reputable exchanges and on accessible chains?

- Runway: When was the last raise and how much runway is left?

- Token sales transparency: Are token sales documented and justified?

- Developer activity: Recent commits, contributors, and releases on GitHub?

- Community engagement: Active, responsive channels with meaningful interactions?

- Roadmap: Clear, measurable milestones and evidence of progress?

- Media traction: Coverage by credible crypto media around milestones?

- Tokenomics: Concentration of supply, vesting schedule, upcoming unlocks?

- Zombie pump signs: Sudden volume spikes without fundamentals?

- Governance transparency: Public proposals and accountable spending?

Using signals and resources to augment your analysis

You do not have to do every data check manually. There are tools and professional services that can help you detect liquidity changes, on-chain shifts, developer activity and social sentiment without spending hours digging. For example, subscribing to best crypto trading signals can help you time exposure around catalysts, highlight liquidity shifts that precede zombie pumps, and identify chains where access is improving. When used responsibly, signals can be a useful complement to your fundamental due diligence, especially for traders who need timely alerts across multiple exchanges and chains.

Other recommended resources include blockchain explorers (Etherscan, Solscan), aggregator dashboards (DAppRadar, DeFiLlama), GitHub, ICO data sites, and governance forums. Combine these with media monitoring so you can spot real traction versus hype.

Case examples and what to watch for

Here are a few hypothetical scenarios and how to interpret them.

Scenario A: The sleeper chain

Price is down 90 percent for two years, but active addresses are steadily rising and fee revenue has grown 6 months in a row. GitHub shows steady commits and a mobile wallet launch is on the roadmap with testnet traffic increasing. Exchange listings are still modest but a large CEX has hinted at a listing. Interpretation: the project might be in a long accumulation phase and could re-rate when the wallet launches and the exchange listing is announced. This is a living project with runway and product traction.

Scenario B: The silent treasury dump

Token price keeps dropping with recurring sell pressure. On-chain, a foundation address is moving tokens to exchanges without clear governance proposals explaining use of proceeds. GitHub has been silent for months and community engagement is minimal. Interpretation: likely an unhealthy project where treasury sales are pressuring price. This is a high risk and potential candidate for cutting losses.

Scenario C: The zombie pump

A token with very low volume suddenly spikes 20x in one day and appears in top gainers lists. No GitHub activity, no milestone announced, no increased user activity on-chain. A handful of large trades appear to have driven the whole move. Interpretation: classic zombie pump. Avoid buying into such ephemeral rallies unless you are prepared to lose the capital.

Final rules of thumb

- Price is a lagging indicator. Look for leading indicators: on-chain growth, dev activity, and community traction.

- Liquidity matters. Low liquidity tokens are vulnerable to manipulation and may be effectively dead even if price spikes.

- Runway and treasury transparency are essential. Token sales should have logical, documented use cases.

- Milestones must be measurable and evidence-based. Promises without commits are red flags.

- Protect your mental health. Holding dead tokens out of hope is an emotional trap that can impair future decisions.

Frequently Asked Questions

What is the fastest way to tell if a token is still being actively developed?

Check the project on GitHub or other code repositories for recent commits, releases, and active contributors. Supplement that with developer updates in the project blog and review pull requests and issue threads. If development has been quiet for long periods with no releases, that is a warning sign.

Can on-chain metrics alone prove a project is alive?

On-chain metrics are powerful but not sufficient alone. Rising active addresses and transactions indicate usage, but you should cross-check with developer activity, treasury transparency, and community engagement. True health is multi-dimensional.

What should I do if my coin is being sold by the foundation on exchanges?

Investigate the reason publicly. Look for governance proposals explaining the sale and how proceeds are used. If no explanation exists or the sales are unexplained and continual, treat it as a red flag and consider reducing exposure.

How can I spot a zombie pump before it happens?

Look for extremely low liquidity and low baseline volumes. Monitor whale wallet movements and sudden exchange inflows. Services and signals that track liquidity and large transfers can warn you ahead of suspicious price movements. Avoid buying tokens that jump to top gainer lists without a corresponding fundamental catalyst.

Are there tools that combine these checks for me?

Yes. Aggregator dashboards, on-chain analytics services, and market signal providers combine metrics like active addresses, TVL, GitHub activity, token unlock schedules, and social sentiment. For traders, best crypto trading signals can provide concise, actionable alerts tied to liquidity shifts, milestone events, and exchange movements, helping you react quickly and avoid traps.

If I decide to sell a dead coin, when is the best time?

There is no universal best time. If holding causes stress or blocks better opportunities, sell sooner rather than later. If liquidity is extremely low, try to sell in smaller tranches or during times of higher market activity to reduce slippage. Remember, cutting losses is a strategic decision not an admission of defeat.

Parting thoughts

Not every altcoin is destined to survive, and many will disappoint. But the ones that eventually explode often hide beneath long periods of quiet work and accumulation. By using this checklist — on-chain activity, accessibility and listings, runway, dev and community signals, transparent tokenomics, and measurable milestones — you can separate truly dead projects from sleepers that are merely biding their time.

And remember to use the right tools to scale your due diligence. Combining manual analysis with curated alerts and best crypto trading signals can keep you informed across markets and chains without getting overwhelmed. Whether you are a trader hunting catalysts or a long term holder screening fundamentals, disciplined checks will help you avoid zombies and focus on projects with a real chance of revival.

Learn from every loss, refine your process, and get ready for the next wave. Smart, measured decisions compound over time. Now go run the checklist and decide whether your altcoin is sleeping, sick, or truly dead.