Table of Contents

- Quick summary: What is Aster and why does it matter?

- How Aster arrived here: rebrand, APX conversions, and early momentum

- Usage and revenue: real activity or speculative flows?

- What sets Aster apart: leverage, stocks, and Binance backing

- Competition: Where Aster sits relative to Hyperliquid and the market

- Tokenomics and staking: a closer look at supply dynamics

- Risk factors: leverage, oracle accuracy, and airdrop sell pressure

- How I read the on-chain signals: what to watch next

- Trading considerations: where Aster fits in a portfolio

- Relative valuation: the safer way to express conviction

- Scenario analysis: how Aster could 3x–15x

- Practical checklist if you’re tracking Aster now

- My bottom line: a measured Aster Price Prediction

- Final words on risk management and strategy

- FAQ

- Where to go from here

Quick summary: What is Aster and why does it matter?

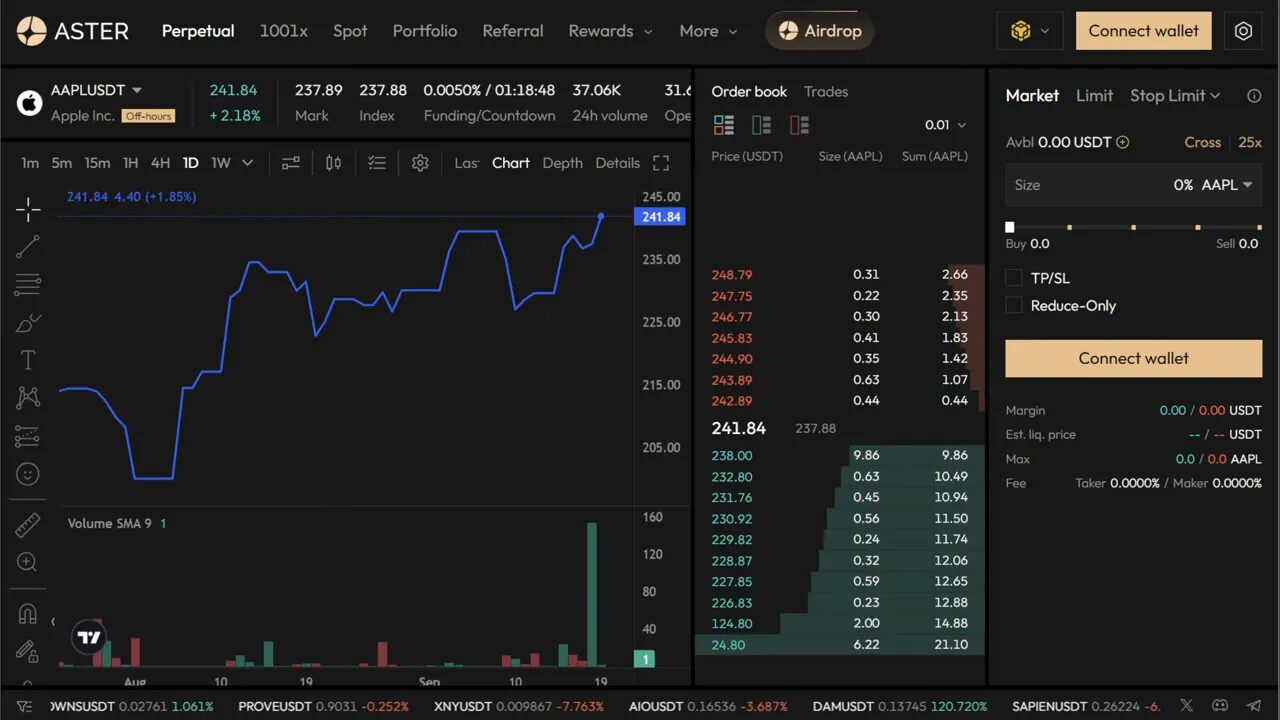

Aster is a newly rebranded perpetual futures exchange deployed on the Binance Smart Chain (BSC). It offers extremely high leverage (marketing points claim up to 1000x) and — importantly — the ability to trade tokenized stocks (Apple, Tesla, Nvidia, Amazon, Meta, NASDAQ-100 exposure). The combination of high leverage, on-chain perpetuals, and stock derivatives positions Aster as a direct competitor to the dominant player in DeFi perpetuals: Hyperliquid.

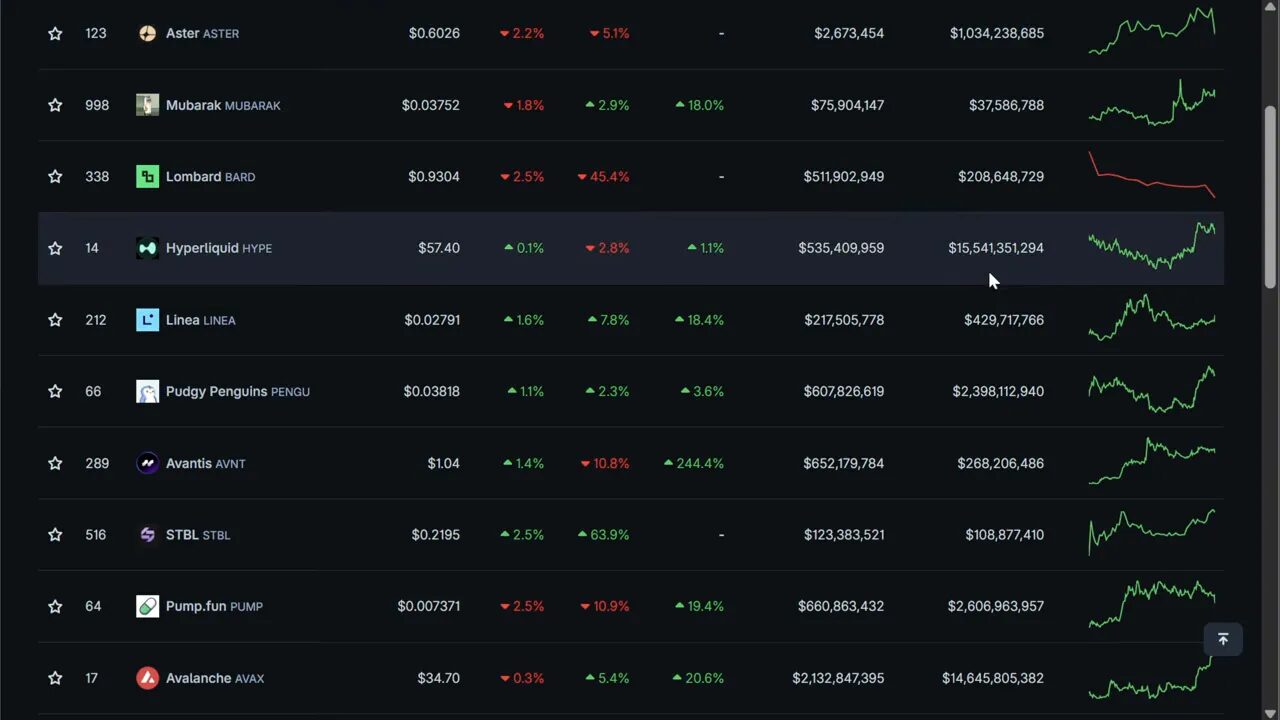

Two facts to anchor the story:

- Aster’s market cap (at the time of analysis) sits around $1 billion.

- Hyperliquid’s market cap sits near $15 billion — a useful benchmark for upside potential if Aster captures market share.

How Aster arrived here: rebrand, APX conversions, and early momentum

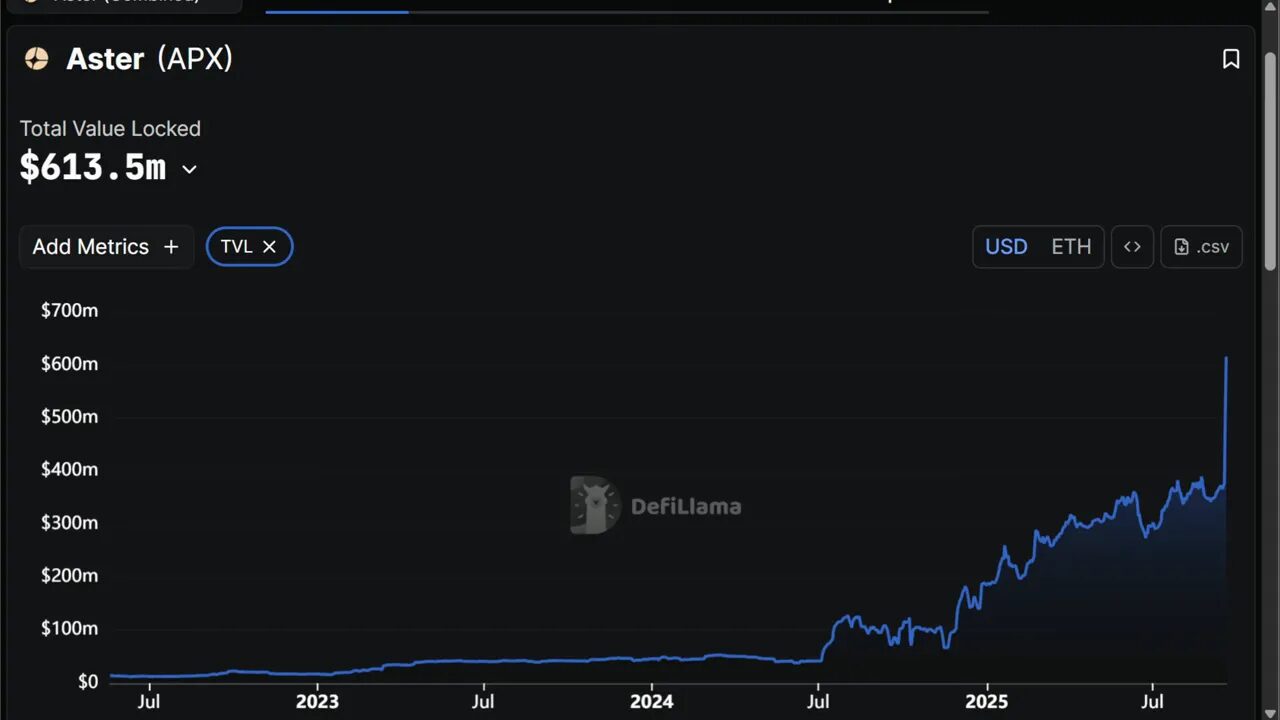

Aster is not an entirely new token out of thin air. It arose as a rebrand and consolidation of the APX ecosystem. APX holders were able to convert their tokens into Aster, which produced a sharp price re-rating during the transition. That conversion process explains a meaningful portion of the early surge in on-chain metrics such as total value locked (TVL) and token price — but it’s only part of the story.

TVL has shot up with the rebrand, but it’s critical to distinguish whether TVL growth is simply price-driven (i.e., token price inflation increasing dollar-denominated balances) or usage-driven (real positions and fees). To answer that, we need to look at activity metrics and fee generation.

Usage and revenue: real activity or speculative flows?

One of the more interesting data points is fee generation. Aster’s protocol-level fees are approaching roughly half a million dollars per day. That’s a non-trivial figure and implies active trading and liquidity provision on the platform — not just wallets holding tokens.

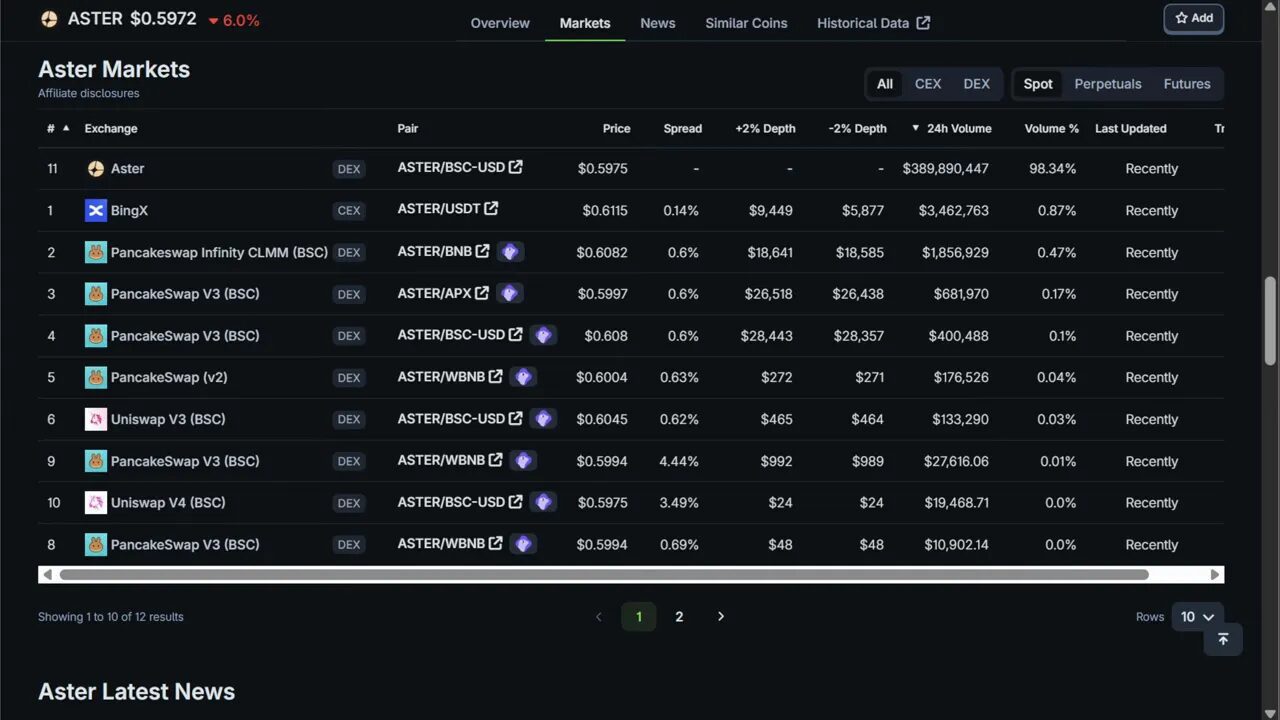

Volume data corroborates this: Aster reported roughly $390 million in trading volume over the last 24 hours on the platform’s spot/perp surfaces, while APX — the previous token — continues to see spot activity on PancakeSwap. Put simply, Aster is seeing real on-chain usage.

What sets Aster apart: leverage, stocks, and Binance backing

There are three differentiators worth highlighting:

- Ultra-high leverage. Aster advertises massive leverage (they highlight up to 1000x). A typical example shown is 101x on Bitcoin: stake $100 and control $100,000. This is attention-grabbing marketing; it brings traders in.

- Tokenized stocks. The inclusion of US stocks like Apple, Tesla, Nvidia, Amazon, and Meta — and the ability to lever NASDAQ-100 exposure up to 50x — is a product differentiator that broadens Aster’s addressable market beyond pure crypto traders.

- Backing by Binance-related entities. Aster’s Twitter and public materials highlight support from YZI Labs (formerly Binance Labs). Any connection to Binance’s broader ecosystem is strategically important: promotional distribution and integration opportunities could accelerate user acquisition on BSC.

Why Binance backing matters

Binance’s ecosystem has distribution power. If Binance or affiliated labs push developer integrations or liquidity incentives, Aster could capture users migrating from centralized KYC’ed venues or from Layer-1 competitors. Hyperliquid succeeded by offering permissionless perpetuals with competitive pricing; Aster could carve a parallel path on BSC if Binance ecosystem support materializes.

Competition: Where Aster sits relative to Hyperliquid and the market

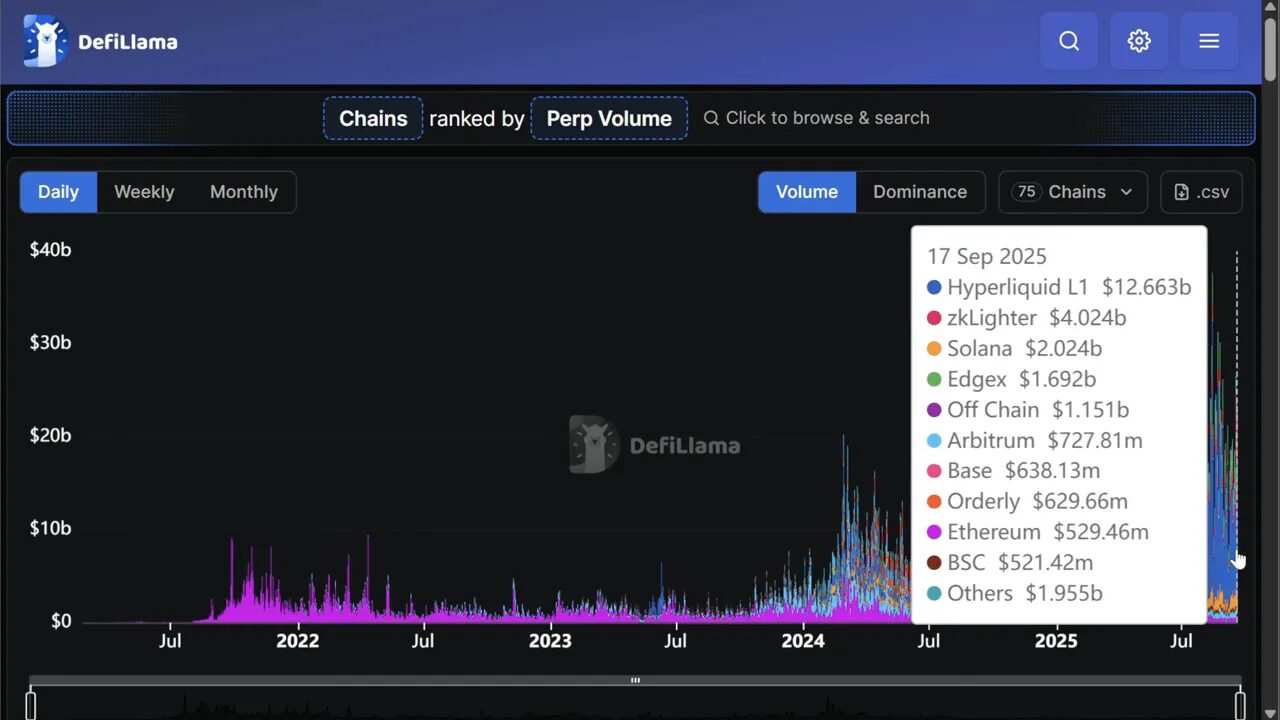

Perpetual futures trading in DeFi has matured rapidly. Hyperliquid is the current leader for on-chain perpetuals by trading volume and liquidity, boasting significant market share. The data snapshot shows Hyperliquid’s Layer 1 at about $12.6 billion in perpetual volume, while Binance Smart Chain’s perpetual volume (before Aster’s rise) was comparatively small — around half a million. That delta is where the growth narrative for Aster comes in: BSC perps are underpenetrated.

If Aster can scale fees, volume, and liquidity, it could begin to narrow that gap. The theoretical upside ranges from a conservative 3–5x to more optimistic scenarios matching Hyperliquid multiples — but realize this is conditional on adoption, liquidity incentives, and sustained product stability.

Tokenomics and staking: a closer look at supply dynamics

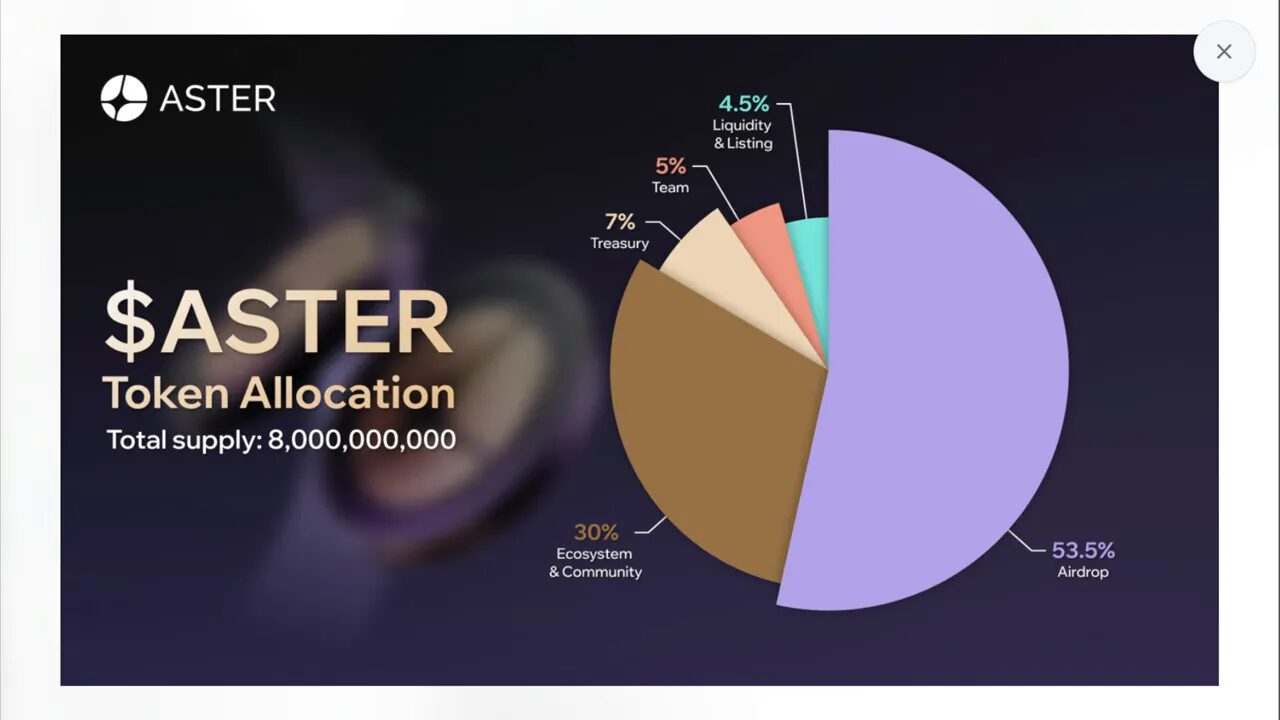

Tokenomics matter. Aster’s token distribution includes a large allocation for airdrops — about 53.5% of supply. That allocation is scheduled to vest/release over a long timeframe (seven years), but it still represents ongoing potential sell pressure if recipients monetize allocations as they arrive.

Staking data shows a mixed picture: staking participation (historically with APX) has not been overwhelming. There are now two token tickers circulating: APX (legacy) and the new Aster token (new liquidity and holders). Aster currently has about 1,600 holders while APX has many more wallets. Whales were swift to convert to Aster; smaller wallets have followed more slowly.

For long-term price stability, the protocol needs utility hooks to encourage staking and reduce sell pressure. Hyperliquid’s HYPE token shows a useful blueprint: staking rewards plus fee discounts for holders create a meaningful incentive to hold rather than immediately sell. If Aster introduces trading-fee discounts or other utility for Aster token holders, it could materially improve token-holder behavior.

Risk factors: leverage, oracle accuracy, and airdrop sell pressure

Aster’s product carries several inherent risks that investors must weigh carefully:

- Ultra-high leverage is effectively gambling: 1000x leverage reduces margin for error to nearly zero and makes traders vulnerable to micro-manipulation. Even when trading on-chain, oracle latency or manipulation risks can cascade into liquidations.

- Oracle and price feed accuracy: The reliability of price oracles on BSC is crucial. If oracles lag or are manipulated, risk to perp holders and liquidity providers grows quickly.

- Airdrop supply and unlock schedule: Over half the token supply is earmarked for airdrops. Even though releases are stretched over seven years, continuous vesting can create a steady stream of sellers unless the protocol successfully creates strong token utility.

- Centralized promotion risk: Relationship with Binance/YZI can be a double-edged sword. While it can bring users, perceived centralization or regulatory scrutiny linked to stock derivatives can add volatility and regulatory risk.

How I read the on-chain signals: what to watch next

If you want to track Aster’s prospects, focus on these indicators:

- Daily fees and fee trajectory (sustained high fees indicate sticky usage).

- 24-hour and 7-day trading volume across perps and spot on Aster’s platform.

- Net inflows versus outflows (wallet activity: new users vs whales selling or converting APX to Aster).

- Staking participation rates and whether new utility (fee discounts or governance) is introduced.

- How much of Hyperliquid’s active user base experiments with Aster — track cross-platform addresses and migration patterns.

These metrics tell a much more complete story than price alone. In short: watch usage, not just market cap or token price. Aster’s early fee generation (nearly $500k/day) is promising, but the key is whether it can sustain and grow that revenue stream while keeping token sell pressure under control.

Trading considerations: where Aster fits in a portfolio

Aster is a high-risk, high-attention play. It’s not the kind of asset you allocate to for passive, long-term “set-and-forget” investing. If you trade or allocate to Aster, consider the following tactical thoughts:

- Size positions appropriately; remember that the protocol itself enables extreme leverage — that doesn’t mean you have to use it.

- Monitor token unlocks and airdrop vesting schedules closely; plan exits or hedges ahead of meaningful unlock milestones.

- Consider relative-value trades rather than outright directional bets. The strategy I emphasize in my work often involves going long stronger assets (e.g., ETH or BTC) while shorting structurally weak altcoins that have continuous insider selling pressure.

For spot-based traders interested in shorter-term opportunities around Aster’s growth, consider monitoring liquidity pools on PancakeSwap and the Aster spot orderbooks. Spot trends often lead perp adoption; if spot liquidity becomes deep and stable, that gives perps the backbone to scale.

If you’re active in spot trading and want concise, timely opportunities tied to market structure and on-chain flows, our Crypto Signal service can help. Crypto Signal delivers curated spot signals and market commentary that align with structural narratives like Aster’s rise on BSC. The service is designed to complement on-chain analysis — it highlights practical entries and risk levels for traders who prefer spot exposure over leverage.

Relative valuation: the safer way to express conviction

One of the most powerful takeaways of my approach is the concept of relative valuation bets. Instead of trying to hunt the single next 10x altcoin (a game where most participants lose), I pair trades: short underperforming altcoins and go long a strong market leader (like Ethereum). This reduces the noise of macro rallies and captures structural underperformance driven by unlocks and insider selling.

Example: a two-year pair trade shorting ApeCoin (APE) and longing Ethereum would have produced a smoother, strongly positive return profile compared to being long APE alone. That trade benefits from the asymmetric supply dynamics: additional capital into a small altcoin inflates market cap more than its proportional market share, and the reverse happens on outflows.

Applying this mindset to Aster exposure: if you want to be bearish on a basket of low-utility alts while staying bullish on blue-chip assets, use pair trades. For traders who prefer spot signals on ETH or BTC to pair against altcoin shorts, Crypto Signal issues spot-focused alerts that can be used to construct these relative-value positions. The service is tailored to match risk sizing and market moments — think of it as an operational complement to the strategic framework I outline.

Scenario analysis: how Aster could 3x–15x

Let’s take a look at plausible scenarios and what they would mean for an Aster Price Prediction:

Bear case (high probability if usage stalls or token sells dominate)

- TVL growth collapses or fee generation drops back to nominal levels.

- Airdropped tokens get sold en masse because there is little staking or fee discount utility.

- Oracle or manipulation events damage trader confidence, causing outflows.

- Result: token price drifts lower — potentially severe drawdown from current levels.

Base case (adoption but no major catalyst)

- Fees and volume remain steady but growth is incremental.

- Some conversion of APX holders continues, but airdrop selling offsets much of buying demand.

- Result: modest multiple expansion (1.5x–3x) as the market assigns a higher multiple to continued usage.

Bull case (Binance distribution + product-market fit)

- Binance-affiliated promotion, developer integrations, and liquidity incentives accelerate new user acquisition.

- Staking utility and fee discounts are introduced, reducing sell pressure.

- Aster captures a significant share of BSC perp activity — organic revenue scales and token utility grows.

- Result: multiple expansion in the range of 3x–5x is realistic; an aggressive case where it captures large share of Hyperliquid’s user base could see it go further toward Hyperliquid’s market cap multiples (theoretical 10x–15x), but that is a high-assumption scenario.

Important to remember: the top-end scenarios depend on execution and distribution. Aster’s current market cap around $1 billion vs Hyperliquid’s $15 billion creates an attractive narrative headline, but it’s not a straight mathematical 15x guarantee. Execution, product reliability, and token utility matter.

Practical checklist if you’re tracking Aster now

- Set alerts on daily fee generation and 7-day moving average. Sustained growth is bullish.

- Monitor token unlock calendar and airdrop release schedule. Mark major unlock dates.

- Watch staking participation changes and any announcements for fee discounts or staking utility.

- Track cross-platform migration: are Hyperliquid or other perp users testing Aster?

- Keep an eye on oracle updates and public audits; trust in price feeds is non-negotiable for perps.

For active spot traders seeking signal-driven entries tied to these metrics, Crypto Signal sends concise, actionable alerts that sync with my on-chain narratives. It’s a way to operationalize the observational work — spot alerts for ETH, BTC, and selected tokens make it easier to build the pair trades and hedges I describe.

My bottom line: a measured Aster Price Prediction

Here’s the practical conclusion I shared: Aster is a risky but interesting project with a real shot at materially higher valuation if several conditional factors align:

- Binance / YZI promotion and integrations accelerate adoption.

- Fee and volume growth remain robust beyond the initial rebrand spike.

- Token utility is expanded to reduce sell pressure (staking, fee discounts, governance value).

If those things happen, a 3x–5x from current levels is quite plausible. Achieving parity with Hyperliquid’s market cap (the 10x+ headlines) would require sustained market-share capture and structural shifts in perpetuals across chains. Don’t view a headline multiple as a forecast; view it as a conditional upside tied to execution.

Final words on risk management and strategy

Aster is a product-market experiment at scale: connecting high-leverage perps, tokenized stocks, and BSC’s liquidity. It’s exciting, but not for everyone. For most participants, the safest way to engage is either:

- Use small, risk-sized positions and never rely on extreme leverage.

- Express conviction via relative-value trades (short weak alts / long ETH) instead of outright long Aster with leverage.

My personal approach has leaned heavily into relative valuation trades for the last several years rather than hunting single altcoin winners. That strategy produces smoother returns and protects against systemic selling pressure from insider unlocks and airdrops.

FAQ

Q: What is the main differentiator of Aster compared to other perp exchanges?

A: Aster combines very high advertised leverage with tokenized stock offerings and the distribution power of BSC/Binance-affiliated labs. The stock derivatives and potential Binance ecosystem support are the key product differentiators.

Q: Is 1000x leverage a good idea for retail traders?

A: No. 1000x leverage magnifies execution risk, oracle risk, and market manipulation risk. It’s a marketing hook that attracts high-risk traders, but it’s not a prudent long-term trading approach for most people.

Q: How should I approach an Aster Price Prediction?

A: Treat price predictions as conditional scenarios. Monitor on-chain usage (fees, volume, TVL), tokenomics (airdrops and vesting), and utility changes (staking/fee discounts). A data-driven approach — watching adoption rather than blindly projecting multiples — is the safest path to form a realistic Aster Price Prediction.

Q: Could Aster reach Hyperliquid’s valuation?

A: It’s possible but requires strong distribution, sustained fee/volume growth, reduced sell pressure, and product reliability. That’s a high-execution scenario — plausible but far from guaranteed.

Q: Should I use leverage on Aster?

A: If you do, size very small positions and understand the risks. Consider alternatives like relative-value trades or spot exposure, which can provide favorable risk-adjusted returns without the fragility of near-total-leverage positions.

Where to go from here

I’ll continue tracking Aster and publishing objective, data-first updates on its metrics and market impact. If you want tactical signals to act on spot opportunities that relate to the narratives discussed here — for example, ETH/BNB moments you can pair with altcoin shorts — check out Crypto Signal for curated, timely spot alerts and market context. The service is designed to fit naturally into the workflow of traders who rely on data and want to act quickly when the market structure shifts.

Remember: the best Aster Price Prediction is an evolving one — constantly updated with new on-chain data, fee trajectories, and utility changes. Keep watching the usage stats, staking dynamics, and any Binance-affiliated announcements. Those are the variables that will determine whether Aster is a short-term hype token or a durable entrant in the on-chain perpetual futures market.

If you found this analysis useful, consider bookmarking the metrics checklist above and setting alerts on the key signals I highlighted. That will put you in the best position to assess any future Aster Price Prediction with clarity and discipline.