Welcome to your comprehensive Axiom Beginner’s Guide, designed to walk you through everything you need to know to get started with Axiom, the revolutionary DeFi trading terminal that’s transforming how traders interact with decentralized exchanges on Solana and beyond. Created by two UC San Diego graduates, Henry Zhang and Preston Ellis, Axiom isn’t just another crypto exchange—it’s a powerful command center that connects you to multiple decentralized exchanges while keeping your crypto securely in your own wallet.

Whether you’re new to on-chain trading or looking to maximize your efficiency, this guide breaks down Axiom’s core features, from account setup and funding to advanced trading tools, portfolio management, and yield generation. Plus, you’ll discover insider tips to trade smarter and safer, along with how to leverage Axiom’s unique reward system.

Table of Contents

- What is Axiom and How Does It Work?

- Setting Up Your Axiom Account

- Funding Your Axiom Wallet

- Discovering Tokens to Trade on Axiom

- Tracking New Tokens with Pulse

- Mastering the Axiom Trading Terminal

- Exploring Axiom’s User Interface and Tools

- Using the Wallet and Twitter Tracker Features

- Perpetual Futures Trading on Axiom

- Managing Your Portfolio on Axiom

- Generating Passive Income with Axiom Yield

- Understanding Axiom’s Trading Fees and Rewards

- Conclusion: Why Choose Axiom for DeFi Trading?

- Frequently Asked Questions (FAQ)

What is Axiom and How Does It Work?

Axiom is not a traditional exchange—decentralized or otherwise. Instead, it acts as a sophisticated trading terminal that connects you directly to various decentralized exchanges (DEXs) across the Solana ecosystem and other blockchains. This means you can execute trades on platforms like PumpSwap, popular for meme coins, or HyperLiquid for perpetual futures trading, all from one interface.

Additionally, Axiom integrates yield-generating protocols native to Solana, allowing you to put idle crypto assets to work without leaving the platform. The key advantage? Axiom never takes custody of your crypto, so you maintain full control while accessing powerful trading tools across multiple platforms.

Setting Up Your Axiom Account

Getting started with Axiom is straightforward. Head to the official sign-up page via the provided link or QR code to secure an exclusive 10% cashback for life on all your trades, plus a 2x point multiplier that unlocks additional perks and potential airdrops.

You can register using:

- Email (with verification code and strong password requirements)

- Google Account

- Phantom Wallet (recommended for seamless Solana integration)

If you choose the Phantom Wallet option, you’ll be prompted to approve connection requests—always ensure you’re on the genuine Axiom website before confirming. Importantly, Axiom will provide a separate recovery key, your wallet’s master key. Write this down on paper and never store it digitally to safeguard your funds.

Funding Your Axiom Wallet

After signing up, you’ll need to fund your Axiom wallet. Note that the Phantom wallet balance does not automatically sync with Axiom since Axiom creates a unique wallet for you during registration.

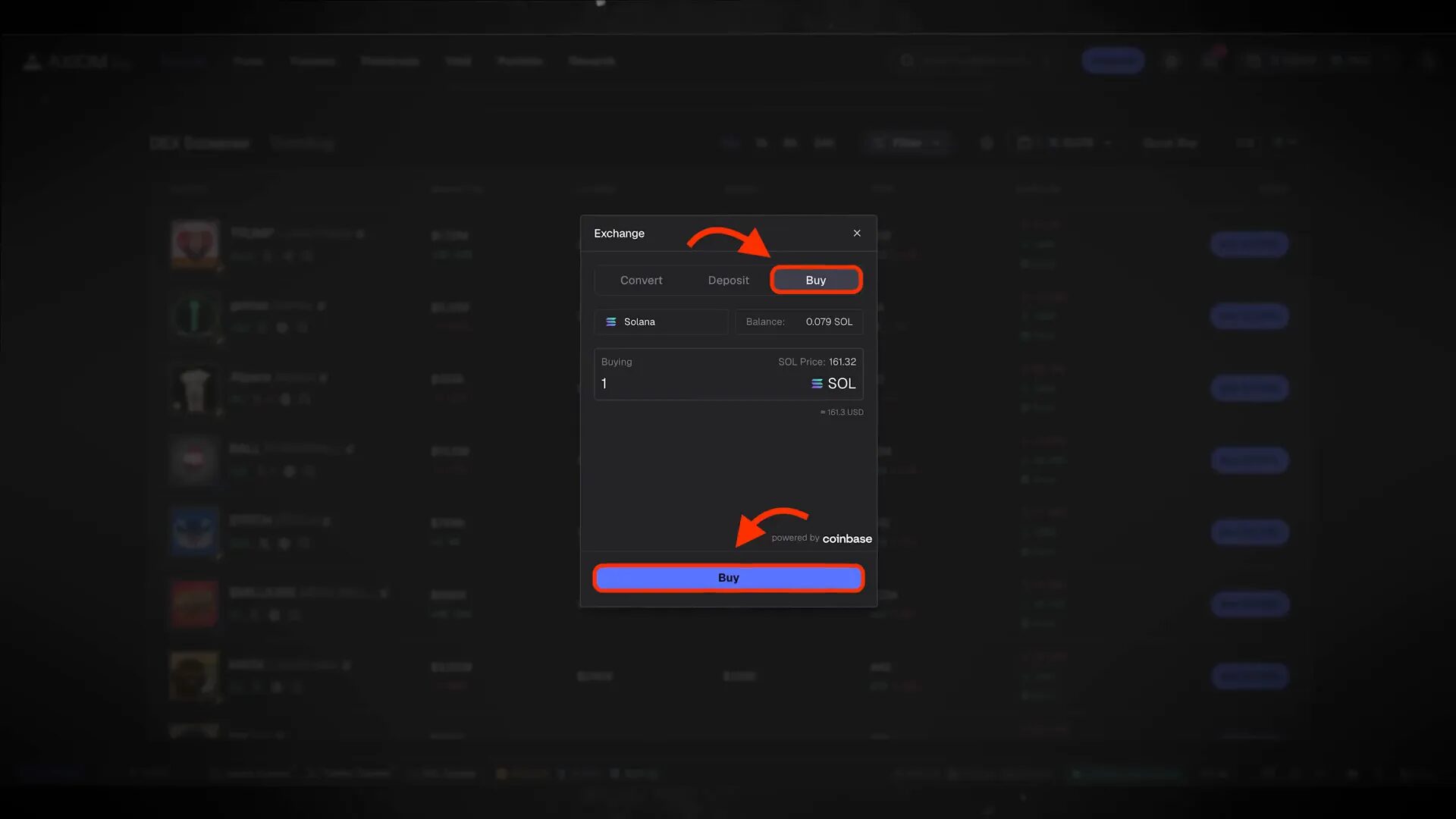

To deposit SOL:

- Click the deposit button at the top right of your screen.

- Choose between two options:

- Buy SOL via Coinbase integration (requires a Coinbase account but may incur higher fees)

- Deposit SOL directly from your Phantom wallet by copying your Axiom deposit address and sending SOL from Phantom.

- Perform a small test transaction first to ensure accuracy.

Axiom also offers a convert feature that swaps your SOL on Solana directly into USDC on Arbitrum, essential for perpetual futures trading on HyperLiquid. This is useful for preserving stable value or moving funds between networks efficiently.

Discovering Tokens to Trade on Axiom

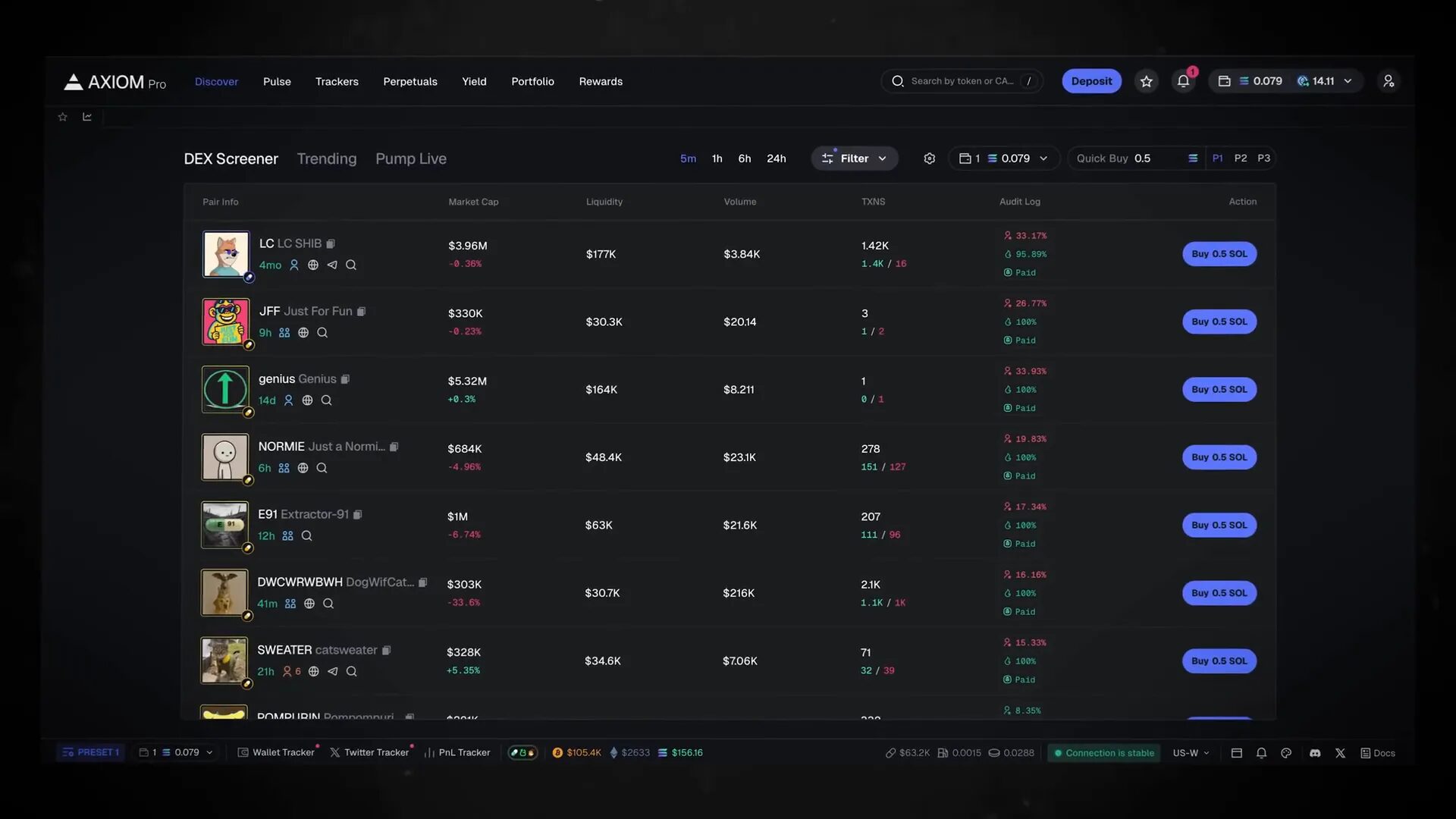

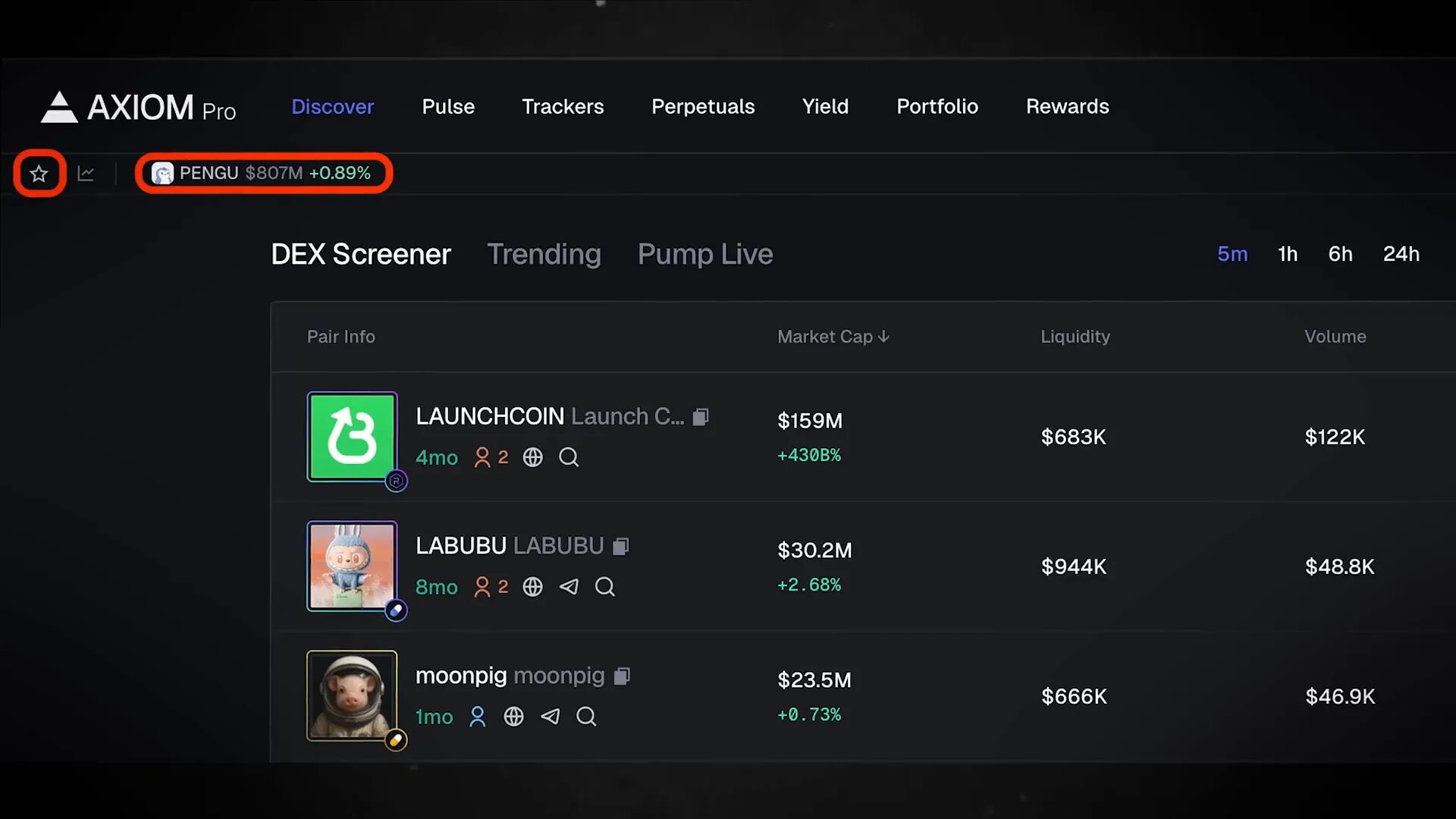

The Discovery page is your gateway to finding promising tokens across the Solana ecosystem. It features three main sections:

- DEX Screener: Sort tokens by time frames (5 minutes, 1 hour, 24 hours) and use multi-wallet toggles for managing active wallets. Quick buy buttons let you purchase preset amounts instantly. Key metrics like market cap, liquidity, and trading volume are displayed.

- Trending: Highlights tokens with significant real-time trading activity, filterable by very short intervals, helping you catch sudden volume spikes.

- Pump Live: Shows tokens listed on Pump.fun with active live streams, featuring a cleaner interface than the original platform.

Use the filter button to evaluate tokens by market cap, liquidity pool size, trading volume, and token holder distribution. If you already have a token contract address, simply paste it into the search bar for direct access.

Tracking New Tokens with Pulse

Pulse is designed to help you monitor newly created tokens and those nearing migration to decentralized exchanges like PumpSwap. The interface divides tokens into three columns:

- New Pairs: Tokens just created, updating continuously. Use filters to narrow by protocol, age, and key metrics such as developer allocations or early sniper wallet holdings. Trading these is highly risky.

- Final Stretch: Tokens approaching the end of their bonding curves, preparing to migrate from launch platforms to DEXs.

- Migrated Tokens: Tokens that have completed bonding curves and migrated to exchanges like PumpSwap or Raydium.

You can customize the display to highlight metrics most relevant to your trading strategy.

Mastering the Axiom Trading Terminal

The trading terminal is the core of your experience on Axiom. Access it by selecting tokens from Discovery or Pulse pages or searching by ticker or contract address.

Key features include:

- Token Details: Name, ticker, market cap, price, liquidity, and original liquidity pool indicator.

- Quick Links: Access the token’s website, Twitter, and Telegram instantly.

- Customizable Trading Chart: Toggle between price and market cap views with time frames as short as one second. Use technical indicators like Fibonacci retracements to analyze trends.

- Trades Display: See trades by wallets you track, marked with green or red bubbles.

- Trading Panel: Choose market, limit, or advanced orders, including automated trades based on developer wallet activity.

- Profit and Loss Tracking: Monitor your positions in real time, including holdings and current profits or losses.

- Transaction Settings: Adjust slippage tolerance, priority fees for faster confirmations, and bribe fees to incentivize validators (though not always guaranteed).

- MEV Protection: Configure Maximal Extractable Value protection to guard against front-running attacks.

Additional panels provide insights into token distribution, recent trades, holder lists with bubble maps for wallet clustering, top traders’ profiles, and developer token holdings to assess risks.

The instant trade feature allows rapid buying or selling with hotkeys for set amounts or percentages, making execution swift and efficient.

Exploring Axiom’s User Interface and Tools

Axiom’s interface is thoughtfully designed for streamlined trading:

- Watch List: Bookmark tokens for quick access.

- Active Positions: Overview of your open trades with profit/loss info.

- Wallet Controls: Toggle multiple wallets on or off and manage transaction presets.

- Wallet Tracker: Follow specific wallets’ trading activity with detailed histories and timestamps.

- Twitter Tracker: Monitor real-time activity from Twitter/X accounts, customizable by handles and activity types (tweets, follows, etc.). Note this requires a minimum 5 SOL trading volume to activate.

- Comprehensive Documentation: Direct access to support resources and platform guides.

Using the Wallet and Twitter Tracker Features

The wallet tracker enables you to monitor wallets of interest by adding addresses manually or importing lists. You can export and back up wallet lists, assign custom labels for easy identification, and view detailed trading behavior and positions.

The Twitter tracker complements this by aggregating social sentiment and real-time updates from selected accounts, helping you stay informed on market-moving news and community chatter.

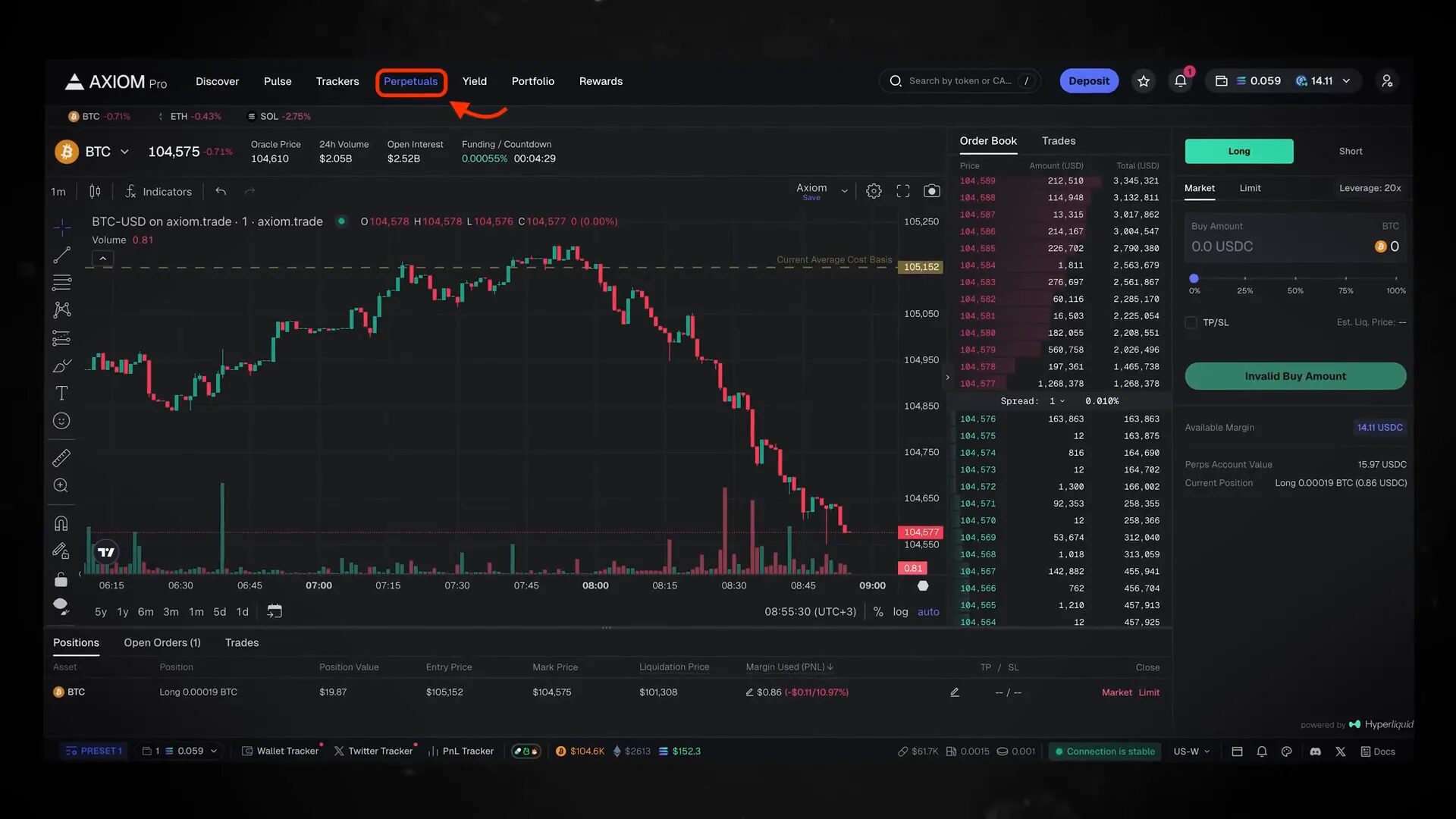

Perpetual Futures Trading on Axiom

Axiom integrates perpetual futures trading through HyperLiquid, allowing you to trade contracts for major cryptocurrencies like BTC, ETH, and SOL directly on the platform.

Key points to remember:

- Perpetual contracts are traded using USDC on Arbitrum, so you need to have USDC in your wallet before trading.

- Convert SOL to USDC easily within Axiom using the convert feature.

- Choose between long (betting price will rise) or short (betting price will fall) positions.

- Select trade size in USDC and leverage up to 40x, but be cautious: leverage amplifies both profits and losses. Beginners should start with low or no leverage.

- Place limit or market orders and manage your positions in dedicated tabs showing entry price, liquidation price, margin, and take profit/stop loss settings.

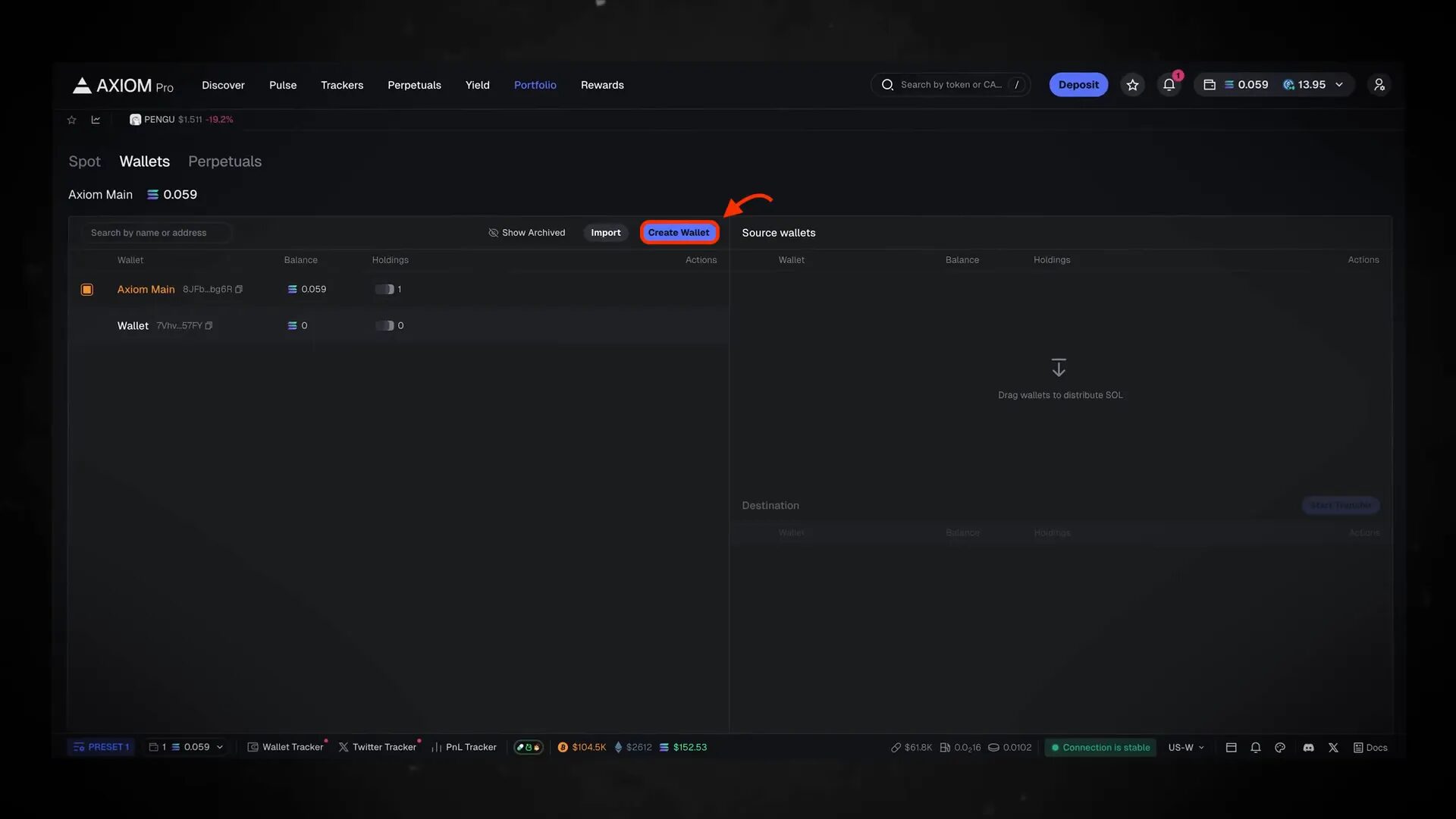

Managing Your Portfolio on Axiom

The portfolio section offers a unified interface to manage multiple wallets:

- Create new wallets or import existing ones using public keys.

- Toggle wallets on/off for multi-wallet trading.

- Archive wallets temporarily to declutter your view, with easy restoration.

- Use wallet consolidation to combine small leftover balances from multiple wallets into one destination wallet automatically.

- View wallet balances, recent transactions, and performance metrics at both spot and perpetual levels.

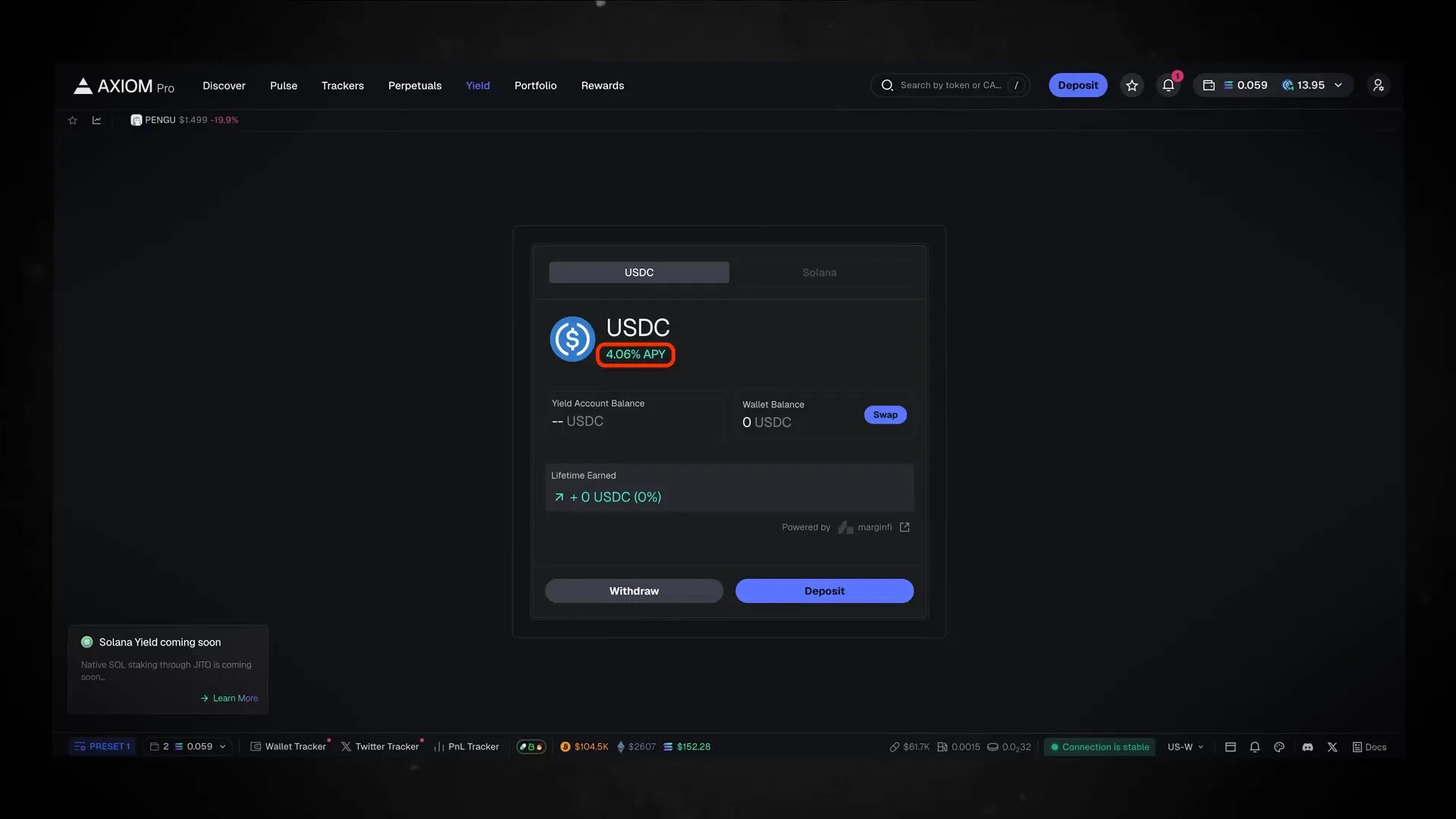

Generating Passive Income with Axiom Yield

Axiom offers a built-in yield feature to earn passive income on USDC holdings. Powered by the MarginFi protocol, it currently provides an approximate 4% annual percentage yield (APY).

To start earning yield:

- Convert SOL to Solana-based USDC using the swap button (note: this is different from the convert feature, which swaps SOL to USDC on Arbitrum).

- Select the amount of USDC to deposit into the yield program.

- Watch your yield accrue in real time within the platform.

- Withdraw your USDC and rewards anytime.

Axiom plans to expand yield options soon, including native SOL staking via Jito.

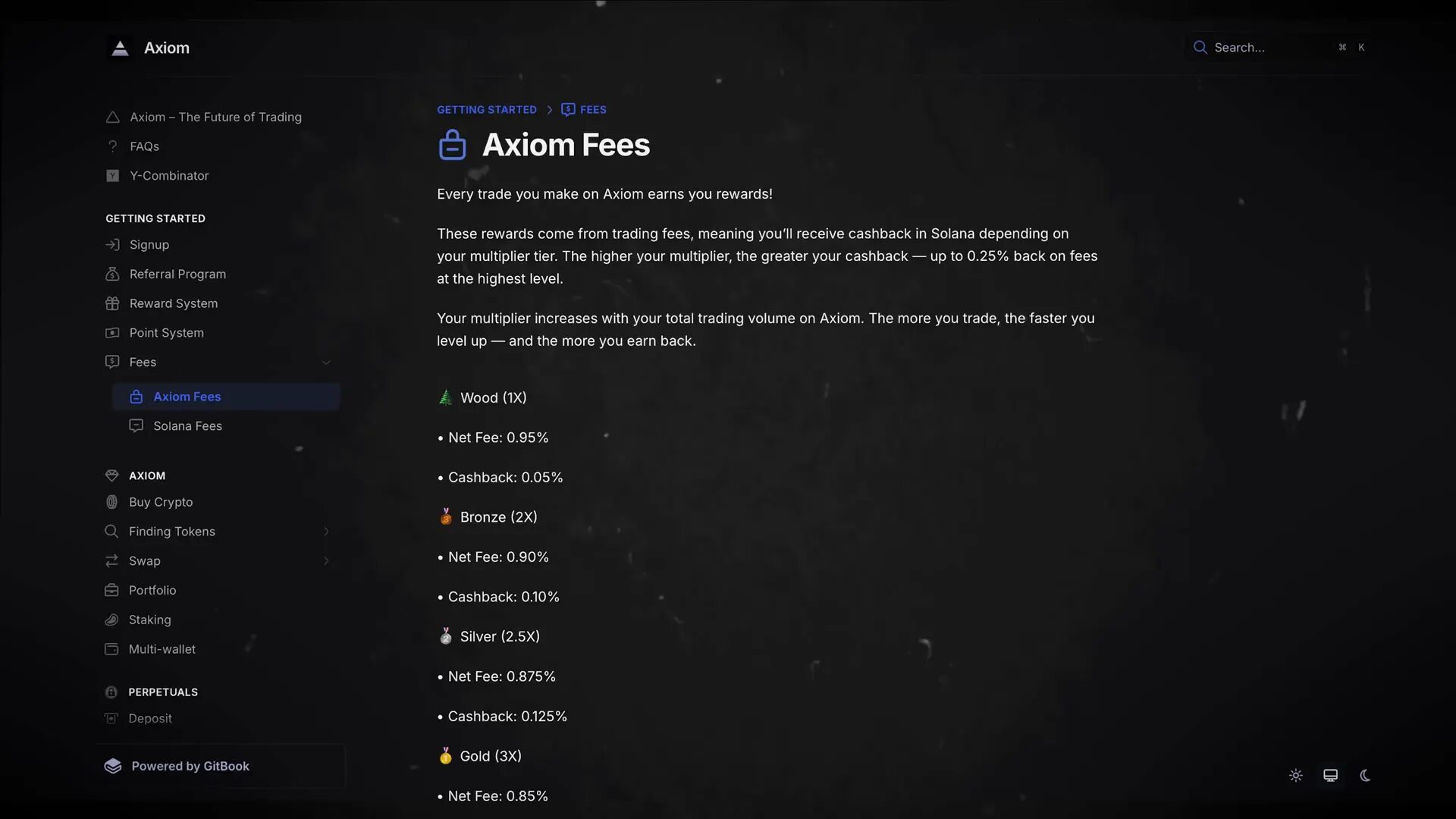

Understanding Axiom’s Trading Fees and Rewards

Axiom’s fee structure rewards active traders with tiered cashback based on total trading volume:

- Fees vary from approximately 0.75% at the highest tier to about 0.95% at the base tier.

- Cashback rewards range from 0.05% up to 0.25%, credited directly in SOL.

- Higher trading volumes unlock better multipliers and perks, including potential eligibility for lucrative airdrops.

You can claim your cashback rewards anytime from the rewards section on the dashboard.

Conclusion: Why Choose Axiom for DeFi Trading?

Axiom stands out as a comprehensive, user-friendly DeFi trading terminal that empowers you to trade across multiple decentralized exchanges without sacrificing control of your assets. Its robust feature set—ranging from powerful discovery tools and real-time tracking to perpetual futures trading and yield generation—makes it an invaluable platform for both beginners and seasoned traders.

Remember, while Axiom provides cutting-edge tools and a secure environment, successful trading always requires a solid strategy, disciplined risk management, and prioritizing security by storing crypto safely in hardware wallets when not actively trading.

Get started today to take advantage of exclusive cashback offers and point multipliers that can enhance your trading experience and open doors to future rewards.

Frequently Asked Questions (FAQ)

What is Axiom and how is it different from a traditional exchange?

Axiom is a DeFi trading terminal that connects you to multiple decentralized exchanges on Solana and other blockchains. Unlike a traditional exchange, it never takes custody of your crypto and acts as a command center for trading and yield protocols.

How do I sign up and secure my Axiom account?

You can sign up using email, Google, or Phantom wallet. Always write down and securely store your recovery key provided during sign-up, as it’s essential for account recovery.

Can I trade perpetual futures on Axiom?

Yes, Axiom integrates with HyperLiquid to offer perpetual futures trading for major cryptocurrencies using USDC on Arbitrum, with leverage options up to 40x.

How does Axiom’s cashback reward system work?

Your trading fees decrease and cashback rewards increase as your total trading volume grows. Cashback is paid in SOL and can be claimed anytime from your dashboard.

Is it safe to keep my crypto on Axiom?

Axiom does not custody your crypto; it connects to your wallets, so your funds remain in your control. For maximum security, store assets in hardware wallets when not trading.

How can I earn passive income with Axiom?

Axiom’s yield feature lets you earn approximately 4% APY on your USDC holdings via MarginFi, with plans to add native SOL staking soon.