Over the years, I’ve been asked this question countless times. Four years ago, I decided to put this curiosity to the test by investing $100 across five different types of investments and tracking their progress. Now, I’m sharing the results and insights to help you understand which options might be best suited for beginners like you.

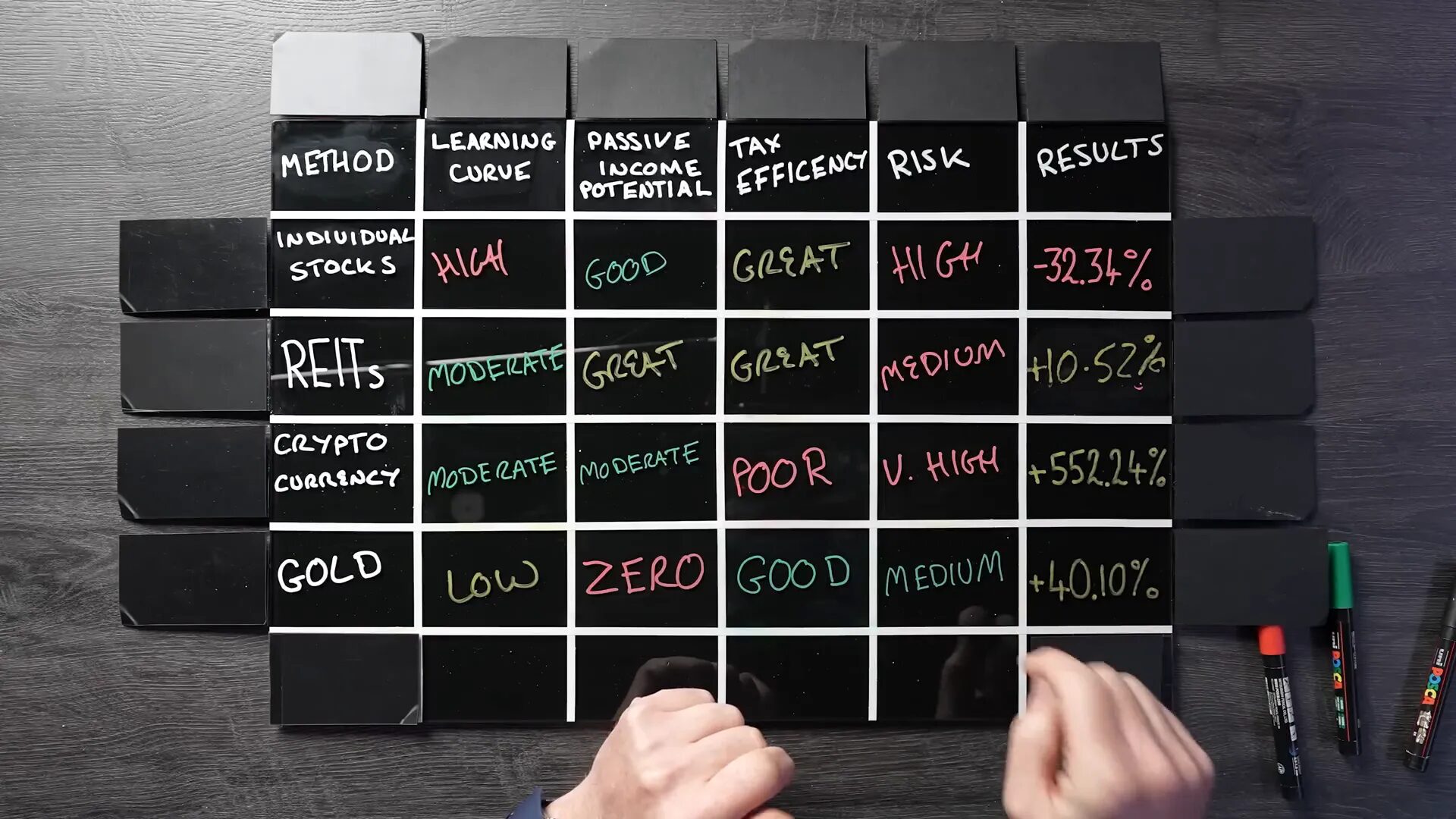

In this comprehensive beginner investment guide for 2025, I’ll break down each investment type by looking at the learning curve, passive income potential, tax efficiency, risk level, and actual returns on my $100 investment over the past four years. Whether you want to dive into individual stocks, real estate investment trusts (REITs), cryptocurrency, gold, or index funds, this post will give you a clear picture of what to expect and how to approach investing with confidence.

Table of Contents

- How to Evaluate Your Investment Options

- 1. Investing in Individual Stocks

- 2. Real Estate Investment Trusts (REITs)

- 3. Cryptocurrency

- 4. Gold

- 5. Index Funds

- Balancing Your Portfolio and Getting Started

- FAQ: Beginner Investment Guide 2025

- Final Thoughts

How to Evaluate Your Investment Options

Before we jump into each investment, let’s set the framework I use to evaluate them. When I analyze an investment, I focus on five key categories:

- Learning Curve: How long does it take to understand the ins and outs of the investment? Ideally, you want this to be as short as possible to get started quickly.

- Passive Income Potential: How much money can the investment earn for you passively while you hold it, without needing to sell?

- Tax Efficiency: What tax advantages or benefits does this investment offer to help reduce your tax burden?

- Risk Level: How likely are you to lose money, and how volatile is the investment’s value?

- Results: What was the actual return on my $100 investment after four years?

With these categories in mind, let’s dive into each investment type.

1. Investing in Individual Stocks

Buying individual stocks means owning a piece of a company you believe in. This can be exciting because you’re directly investing in businesses you think will succeed or grow over time.

Learning Curve: High

Investing in individual stocks is not a simple guessing game. To be successful, you need to dig into the fundamentals of the company. This involves understanding its financial health by reviewing income statements, balance sheets, and cash flow statements. You also want to consider who is leading the company and how strong the brand is.

When I invest in stocks, I commit for the long haul, typically holding for two to ten years. To learn how to pick stocks, you can start with investing apps that offer demo accounts, allowing you to practice with fake money until you’re confident in your strategy.

Passive Income Potential: Good

There are two main ways to make money from stocks:

- Capital Gains: Selling the stock for more than you paid if its price increases.

- Dividends: Many companies pay regular dividends, which means you receive income without selling your shares. This is true passive income.

Keep in mind not all stocks pay dividends, but if they do, that can provide a steady income stream.

Tax Efficiency: Great

Using the right accounts can help reduce your tax burden. For example, in the UK, stocks and shares ISAs protect your profits from taxes. In the US, Roth IRAs serve a similar purpose. These accounts act like shields, letting you keep more of your earnings. However, tax rules vary widely, so be sure to research your specific situation.

Risk Level: High

Individual stocks can be quite risky. I remember back in 1995 during the dot-com boom, I got lucky with a few great picks but also lost money on others when the bubble burst. If you put all your money into just a few companies and one fails, you could lose everything. Diversification is key to managing this risk.

My $100 Investment Results in Stocks

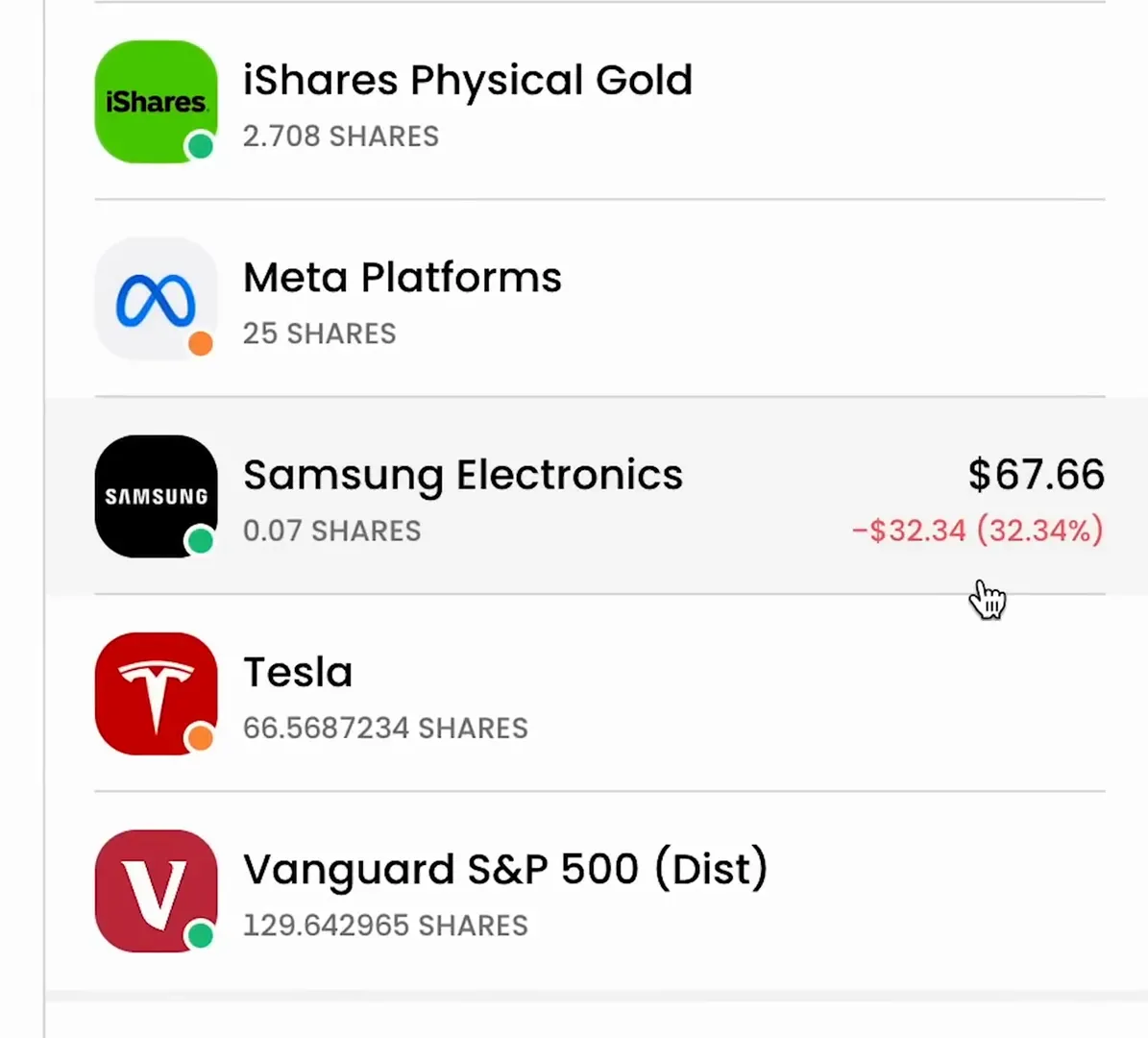

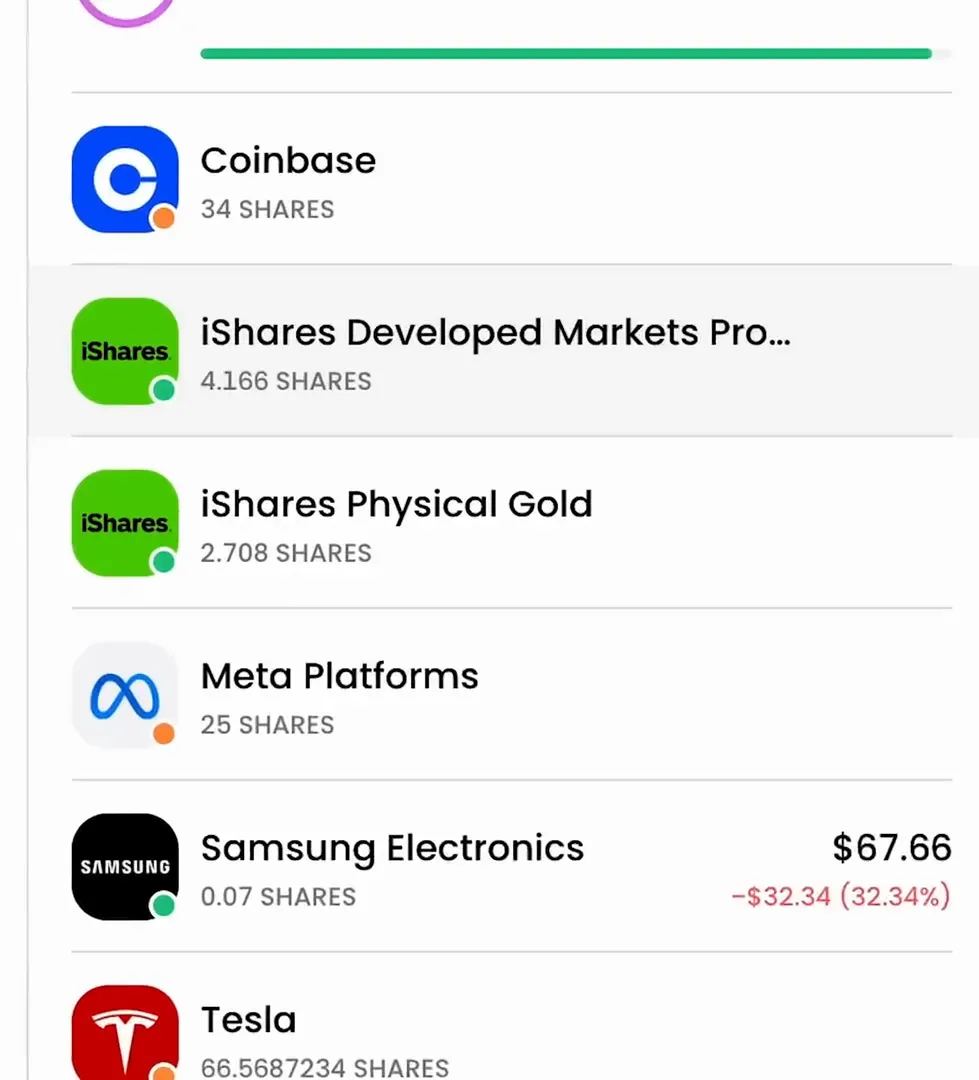

To test luck versus strategy, I randomly selected a stock by throwing a dart at a board of 20 stocks, investing $100 into whichever it landed on while blindfolded. The dart landed on Samsung.

After four years, that $100 investment is worth $67.76, including dividends—a negative return of 32.34%. This shows how hit-or-miss individual stock investing can be.

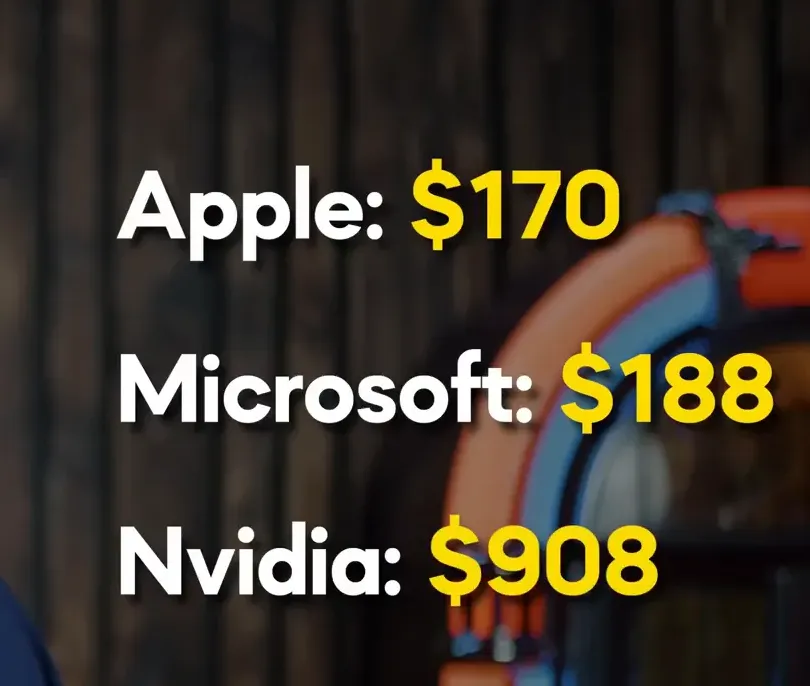

But what if I had picked differently?

- Apple: $170

- Microsoft: $188

- Nvidia: $908

These stocks have boomed recently, showing the importance of strategic stock selection rather than luck.

2. Real Estate Investment Trusts (REITs)

REITs are a way to invest in real estate without buying property yourself. Imagine pooling money with thousands of other investors to buy commercial or residential properties, then sharing rental income.

Learning Curve: Moderate

REITs are easier to get started with than physical real estate because you don’t need a large down payment or to deal with agents and solicitors. However, it’s important to understand what types of properties the REIT owns—offices, shopping centers, apartments, hotels, etc.—and how they generate income.

Passive Income Potential: Great

REITs are known for paying high dividends because they are legally required to distribute at least 90% of their profits to investors. This means you can earn a steady stream of passive income as long as the properties are rented out.

Tax Efficiency: Great

In many countries, including the UK, you can hold REITs in tax-advantaged accounts like stocks and shares ISAs, protecting your dividends and profits from tax.

Risk Level: Medium

REITs spread risk by investing in multiple properties, making them less risky than buying a single property. Still, they’re not risk-free. Market downturns or vacancies can reduce dividends and investment value.

My $100 Investment Results in REITs

Using a UK-based platform similar to Trading 212, I invested $100 in a REIT four years ago. Today, it’s worth $98.59—a slight loss of 1.41%. However, I earned $11.93 in dividends, making my net gain $10.52 or 10.52% overall.

This demonstrates that REITs can provide reliable income but might not always appreciate in value, especially if the real estate market struggles, like during the pandemic.

3. Cryptocurrency

Cryptocurrency is digital money that operates independently of governments and banks. Bitcoin and Ethereum are the most well-known examples, based on blockchain technology that ensures security and transparency.

Learning Curve: Moderate

Crypto might sound complicated, but it boils down to a few essentials:

- Wallets: Digital piggy banks where you store crypto. Online wallets are easy to use but require strong passwords. Offline hardware wallets are more secure.

- Exchanges: Platforms like Coinbase and Binance where you buy and sell crypto.

- Tokenomics: Understanding supply and demand. For example, Bitcoin has a limited supply, earning it the nickname “digital gold.”

Passive Income Potential: Moderate

Crypto doesn’t pay dividends, but you can earn passive income through:

- Staking: Locking up your crypto to help validate transactions and earning rewards in return.

- Yield Farming: Lending your crypto to others and earning interest.

These methods can generate returns but come with higher risks, including platform hacks and price volatility.

Tax Efficiency: Poor

Crypto taxes can be complicated. In many countries, swapping one cryptocurrency for another is taxable, and staking rewards count as income. You also cannot hold crypto in tax-advantaged accounts like ISAs or Roth IRAs, making it less tax efficient than stocks or REITs.

Risk Level: Very High

Crypto is extremely volatile. Prices can soar or crash dramatically within short periods. I personally stick to Bitcoin and Ethereum, which are considered blue-chip cryptocurrencies. Smaller altcoins carry even greater risk, and scams are common. Keeping your crypto safe is crucial.

My $100 Investment Results in Bitcoin

I invested $100 in Bitcoin four years ago via Coinbase and left it untouched. Today, that investment is worth $652.24—a staggering 552.24% return.

While this growth is impressive, it’s important to realize that Bitcoin’s performance is not typical for most cryptocurrencies, many of which lose value entirely. Crypto is exciting and potentially transformative but requires a strong stomach for volatility.

4. Gold

Gold has been a trusted store of value for thousands of years. Often called a “safe haven,” it protects wealth during times of inflation or economic uncertainty.

Learning Curve: Low

Investing in gold is straightforward. You have two main options:

- Physical Gold: Bars and coins. Avoid gold jewelry for investment since it often includes a markup for craftsmanship. You’ll also need a safe place to store physical gold.

- Gold ETFs: Funds that track the price of gold without owning it physically. You can buy shares through platforms like Trading 212 with ease.

Passive Income Potential: Zero

Gold doesn’t generate income through dividends or interest. Its value comes purely from price appreciation and its ability to hold value over time.

Tax Efficiency: Good

Tax rules for physical gold can be tricky. For instance, in the UK, some gold coins like Gold Britannias are legal tender and exempt from capital gains tax. ETFs are generally more straightforward and can be held in tax-advantaged accounts.

Physical gold also has the unique ability to discreetly transport wealth across borders, though this comes with risks such as theft and legal restrictions.

Risk Level: Medium

Gold is one of the safest investments, preserving value during economic turbulence. However, it lacks the growth potential of stocks or crypto and can have opportunity costs.

My $100 Investment Results in Gold

Using a UK platform, I invested $100 in a gold ETF four years ago. Today, it’s worth $140.10—a solid 40.1% return that reflects steady growth rather than explosive gains.

5. Index Funds

Index funds let you own tiny pieces of many large companies simultaneously. For example, an S&P 500 index fund includes hundreds of companies like Apple, Microsoft, and Amazon, mirroring the overall market’s performance.

Learning Curve: Low

Unlike picking individual stocks, index funds are passive investments. They’re bundled for you, so you don’t have to research each company. Buying index funds is simple with platforms like Trading 212—just a few clicks and you’re invested.

Passive Income Potential: Moderate

Index funds don’t pay high dividends like REITs, but many companies within the fund pay dividends that are either distributed to you or reinvested automatically. This provides some passive income alongside long-term growth.

Tax Efficiency: Great

Holding index funds in tax-advantaged accounts like ISAs or Roth IRAs means you don’t pay taxes on dividends or capital gains, allowing you to keep more of your profits over time.

Risk Level: Low

Index funds are less risky than individual stocks due to diversification across many companies and industries. Historically, the S&P 500 has delivered average annual returns of 8-10%. While short-term fluctuations occur, long-term holding (10, 20, or 30 years) makes this one of the safest ways to grow wealth.

My $100 Investment Results in an S&P 500 Index Fund

I invested $100 in an S&P 500 index fund four years ago. Today, it’s worth $179.57—a 79.57% gain. This steady, reliable growth is why index funds are my favorite investment and why I allocate most of my portfolio here.

Balancing Your Portfolio and Getting Started

Each type of investment has its pros and cons. Some are geared towards rapid growth but come with higher risk, like cryptocurrency and individual stocks. Others, like gold and REITs, offer stability and income, but slower growth.

Personally, I diversify by putting the majority of my money into index funds for steady growth, while allocating smaller amounts to other investments to balance risk and opportunity.

The most important lesson I’ve learned is to start early. Even small amounts like $100 can grow significantly over time thanks to the power of compounding. Time is your best friend in investing, so don’t wait to take that first step.

FAQ: Beginner Investment Guide 2025

What is the best investment for beginners in 2025?

For most beginners, index funds are the best starting point. They offer low risk, diversification, and steady returns without requiring deep research into individual companies.

Can I start investing with just $100?

Yes! Many platforms allow you to buy fractional shares or funds, meaning you don’t need to buy a whole stock or property share. You can start with as little as $100.

Are cryptocurrencies a good investment for beginners?

Cryptocurrencies are highly volatile and speculative. While they offer high reward potential, they come with significant risk and complexity. Beginners should approach crypto cautiously and do thorough research.

What is the learning curve for investing?

It depends on the investment. Index funds and gold have low learning curves, while individual stocks and crypto require more understanding of financials and technology.

How can I reduce taxes on my investments?

Use tax-advantaged accounts like ISAs in the UK or Roth IRAs in the US to shield your profits from taxes. Different investments have different tax rules, so research what applies to you.

Is investing risky?

All investments carry some risk. Diversification helps reduce risk, and holding investments long-term generally smooths out short-term market fluctuations.

Final Thoughts

Investing doesn’t have to be intimidating or require large sums of money. With just $100, you can begin building a portfolio that grows over time. Whether you’re drawn to the potential of individual stocks, the income stability of REITs, the excitement of crypto, the safety of gold, or the simplicity of index funds, the key is to educate yourself, start early, and stay consistent.

This beginner investment guide for 2025 is designed to give you a clear, honest look at your options and help you make informed decisions. Remember, investing is a journey, not a sprint. Take your time, do your research, and watch your money grow.

Credits: This article is based on research conducted by Mr. Mark Tilbury. You can watch his YouTube video