This deep dive explains the mechanics, the data, and the tradeoffs behind the Bitcoin vs Ethereum argument. I’ll lay out the strongest case on both sides, show the signals that matter, and give a practical verdict you can use to trade or allocate capital responsibly.

Table of Contents

- Introduction — What the flippening actually is

- The Bull Case — Why Ethereum Could Flip Bitcoin

- The Bear Case — Why the Flippening Might Never Happen

- Verdict — My Take on Bitcoin vs Ethereum

- Practical implications — How to act on Bitcoin vs Ethereum

- Signals that would materially change the Bitcoin vs Ethereum odds

- FAQ — Bitcoin vs Ethereum

- Conclusion — Where things stand in Bitcoin vs Ethereum

Introduction — What the flippening actually is

When people talk about the flippening they mean one simple scoreboard: the ETH/BTC ratio rising until ETH’s market capitalization surpasses Bitcoin’s. In plain terms, the flippening is a target ratio — roughly 0.16 ETH per BTC — that would represent Ethereum overtaking Bitcoin in total market cap. Right now, that’s roughly a 4x move from recent ratio levels, so it’s not trivial.

One important point you should remember when thinking about Bitcoin vs Ethereum is that it’s not about dollar price alone. What matters is the ratio: ETH relative to BTC. That ratio is the scoreboard. Short-term candles can be noisy, but flows, staking mechanics, institutional allocations, and settlement use-cases are what change that scoreboard over time.

The Bull Case — Why Ethereum Could Flip Bitcoin

If you’re bullish on Ethereum in the Bitcoin vs Ethereum debate, you’re usually leaning on a few core arguments: institutional flows are massive, staking creates yield and supply dynamics Bitcoin lacks, tokenized assets and settlement use-cases favor Ethereum, and on-chain activity metrics already show Ethereum competing with Bitcoin in important ways. Let’s unpack each.

Institutional flows and treasury companies: the rising bid

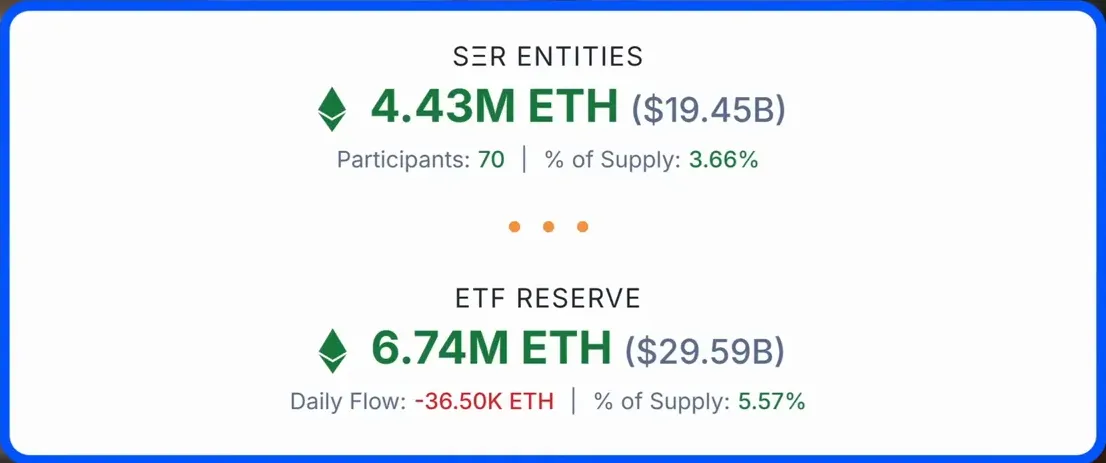

One of the biggest shifts since prior flippening conversations is that institutions are now major players. Combine what ETFs and corporate treasuries have bought and you’re looking at a meaningful chunk of ETH supply — numbers have been cited around over 9% of the entire ETH supply being held by these institutional channels. Treasury companies themselves are reportedly holding about 3–4% already and have capital earmarked to buy more.

Why does that matter? These treasury companies operate a self-reinforcing model: if their stock trades at a premium, they can issue equity to raise capital and buy more ETH, which can then enhance perceived performance and keep the premium alive. That creates a flywheel — a compounding demand mechanism that doesn’t exist at the same scale for Bitcoin.

That flywheel is exactly the kind of flow-driven event that moves ratios. If you’re a trader watching Bitcoin vs Ethereum, flows like these create short-to-midterm opportunities to ride ETH relative strength. For traders who prefer spot signals, services that track large flows and liquidity events — such as our Crypto Trading Signals — can help identify when to enter ETH vs BTC pairs because we flag the on-chain and ETF moves in real time.

ETFs, Wall Street, and who’s buying

Ethereum ETFs have shown up with real size and, at times, outpaced Bitcoin ETFs in inflows. There were weeks where ETH funds saw billions more than BTC funds — one notable stretch showed roughly $2.8 billion into ETH ETFs versus about $0.5 billion into BTC ETFs during the same period. Equally important isn’t just the totals but the buyers: institutional market makers and prop desks such as Goldman Sachs, Jane Street, and Citadel have been visible among top holders.

That’s not small-time retail FOMO. That’s deep-pocketed balance sheet capital allocating into tokenized ETH exposure. When professional flow desks and market makers position, it changes liquidity dynamics and depth in a way retail cycles didn’t in prior years. If you’re trading the Bitcoin vs Ethereum relationship, watching ETF flow sheets and block trades becomes crucial. Again, this is where tactical Crypto Trading Signals can be helpful: they monitor flow-driven events and can alert traders when institutional windows open or when ETF inflows diverge between ETH and BTC.

Staking, yield and supply mechanics

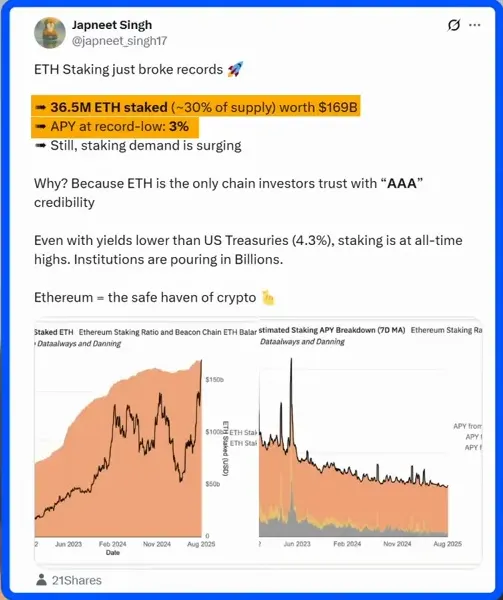

Ethereum’s native ability to be staked and to generate a yield — even at modest rates — is a structural differentiator in the Bitcoin vs Ethereum story. Today, staking APYs for ETH might be around ~3%, but staking demand is historically high: roughly ~30% of supply has been locked in staking protocols. Why does that matter? Locked supply reduces float and can tighten the market in the face of demand, particularly if staking becomes accessible through ETFs and custodial products.

Several existing ETF providers have filed to add staking to their offerings. If that becomes mainstream, ETFs won’t be just directional bets on ETH price — they’ll be yield plays with income plus capital appreciation. Institutional investors, who value cash flows and predictable yield, may prefer such instruments to pure BTC exposure, and that could reallocate demand over time in the Bitcoin vs Ethereum debate.

Ethereum as a settlement layer & tokenized assets

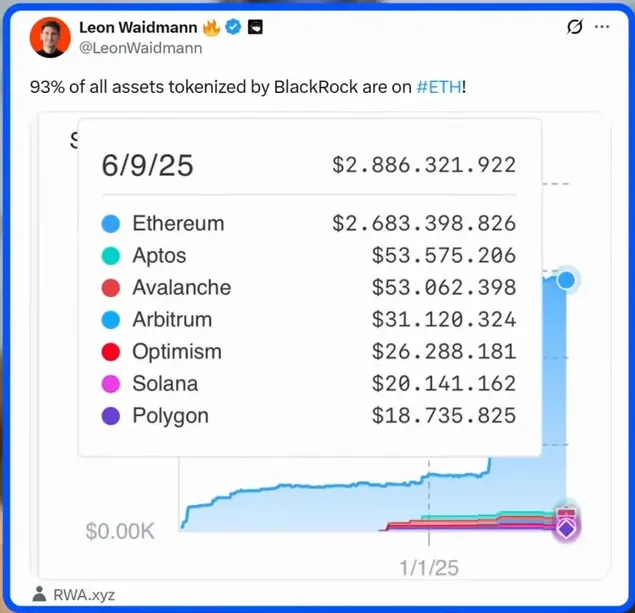

One of the most compelling bull arguments for ETH in the Bitcoin vs Ethereum analysis is the settlement-layer thesis. Major asset managers and product launches are building on Ethereum: BlackRock’s tokenized asset products, Franklin Templeton’s offerings, and Fidelity’s work on an on-chain money market — these signal that large portions of tokenized finance are choosing Ethereum as their home.

To put it bluntly: roughly 93% of BlackRock’s tokenized assets have been deployed on Ethereum. If the asset management industry migrates more of their instruments on-chain, what does that imply for addressable market size? The total global stock market plus tokenized bonds and funds dwarfs the market for gold. Bitcoin’s narrative is digital gold; Ethereum’s can be the settlement and tokenization layer for global finance. In a world where tokenized stocks and bonds are on-chain, ETH’s market cap upside becomes orders of magnitude larger than if it were simply an application platform.

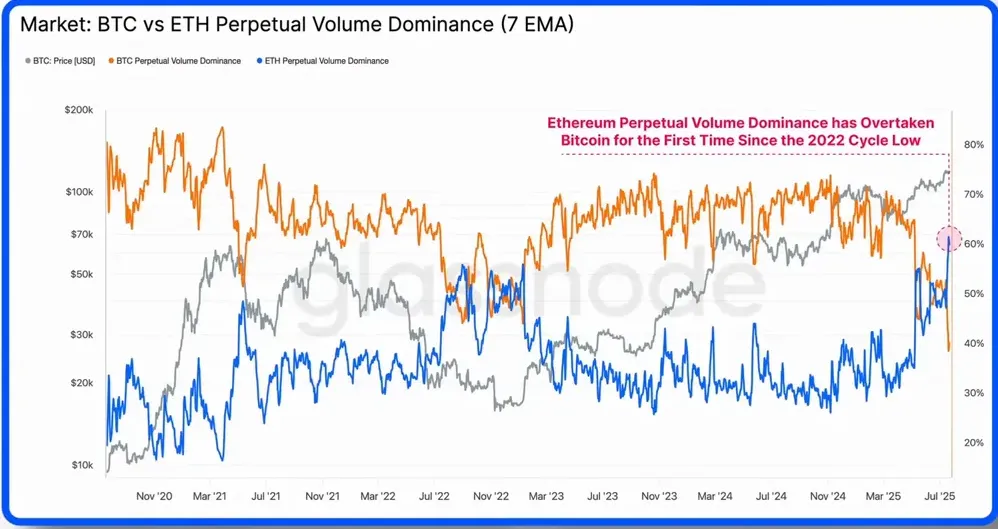

On-chain activity and market metrics where ETH is already winning

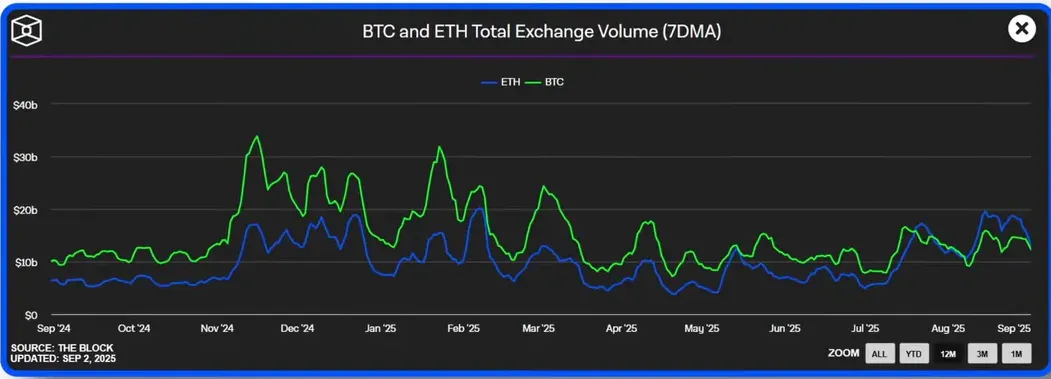

It’s worth underscoring: Ethereum has already flipped Bitcoin in several activity-driven metrics. There have been days when ETH spot volume exceeded BTC spot volume, and the same has occurred in futures markets. Mindshare has shifted too — there have been 24-hour windows where Ethereum surpassed Bitcoin in attention and volume. Those are leading indicators: flows and usage often precede valuation changes.

So when you measure Bitcoin vs Ethereum, look beyond market cap to the real economic activity happening on-chain and in professional structures. If the on-chain settlement thesis continues to accelerate, the flippening thesis gains legitimacy.

The Bear Case — Why the Flippening Might Never Happen

Before you get swept up in narratives, there are strong, structural reasons why Ethereum overtaking Bitcoin is far from guaranteed. Many of the same dynamics that power ETH’s upside are fragile or temporary. Let’s walk through the major headwinds.

The treasury flywheel is fragile and potentially reversible

The treasury company model that helped kickstart ETH demand can also reverse rapidly. The flywheel depends on a premium: if a company’s stock trades above intrinsic value and it can issue shares, it can buy ETH and perpetuate momentum. But if that premium evaporates, the same mechanism becomes a liability. Companies may be forced to sell assets to manage dilution or cash needs. Many of these treasuries are short-term minded and could be described as ‘zombie companies’ riding a treasury wave — if market conditions change, they might need to liquidate positions.

This is a critical risk for the Bitcoin vs Ethereum thesis because a handful of large sellers can overwhelm demand during a run. Flows create rallies, but they can also create systemic dependencies that reverse.

More crypto products dilute ETH’s unique bid

Ethereum is no longer the only chain Wall Street is willing to tokenize or provide exposure to. Solana ETFs are on the horizon and other altcoins will likely follow. Once capital allocators have the choice of multiple tokenized exposures, money will spread. That dilutes the concentrated demand that would be necessary for an ETH-to-BTC flip based purely on institutional flows.

In a diversified ETF world, the Treasury and ETF-driven bid for ETH could be crowded out or rebalanced across ecosystems, reducing the single-chain momentum Ethereum needs to overtake Bitcoin in market cap.

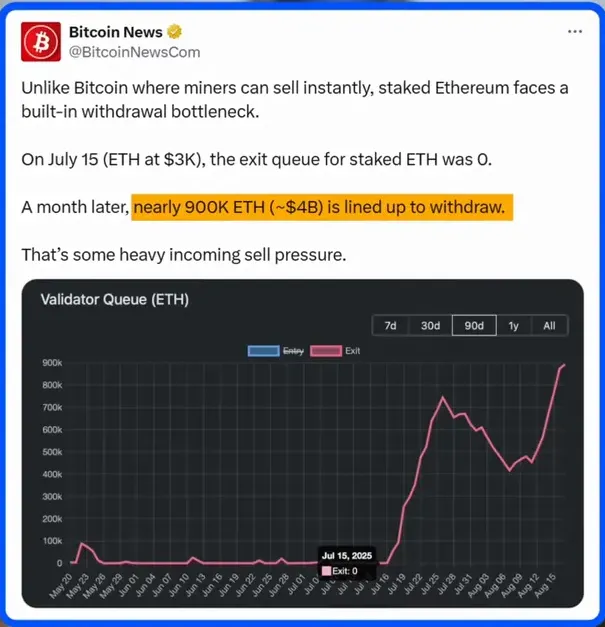

Unstaking and sell pressure when prices run

Staking locks supply, but it doesn’t eliminate sell pressure forever. When prices run, validators and stakers may choose to exit and realize gains. The exit queue for unstaking has spiked into the hundreds of thousands of ETH at times — figures above ~800,000 ETH have been reported lining up for withdrawal. That represents billions of dollars of potential pressure waiting to be released.

Even if staking delays immediate sell pressure, it acts as a deferred supply overhang. During frothy rallies, this can become a tailwind turned headwind when profit-taking hits. Importantly, Ethereum historically hasn’t had as deep a “hodl culture” as Bitcoin among long-term holders. That means, historically, when ETH gets frothy, profit-taking has been relatively heavier.

Narrative cycles and tops have coincided with flip-like talk

History is a cautionary teacher. Every time the flippening narrative has gone mainstream, it has often marked a local top for ETH relative to Bitcoin. In 2017 during ICO mania, ETH almost closed the gap and then corrected hard. In 2021, the combination of DeFi mania and NFTs again pushed ETH toward Bitcoin, then the ratio peaked and retraced. Even more recently, when Solana chatter suggested it could overtake ETH, that narrative peak coincided with a top for SOL vs ETH.

Narratives are often price-lagging: they reflect what’s already happened rather than what will happen. If you anchor your portfolio to a meme, you risk getting caught at the top. This is one reason traders and allocators emphasize flows, on-chain metrics and institutional behavior over social media narratives.

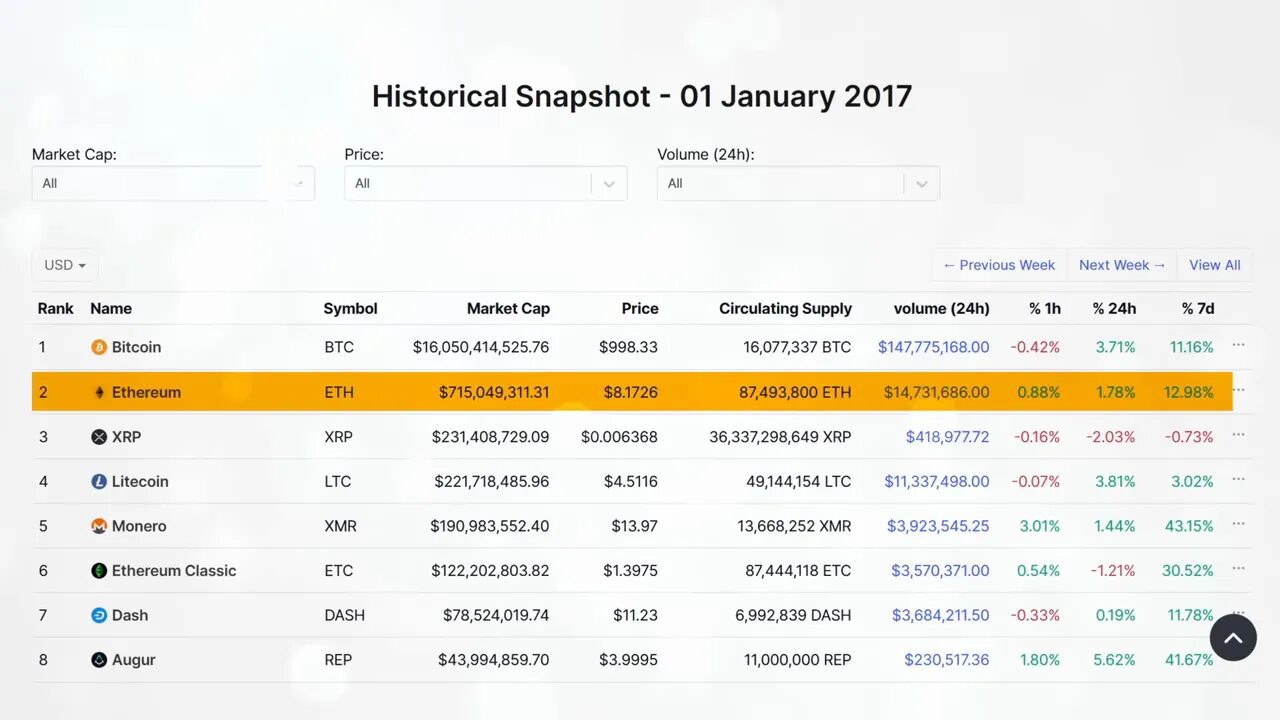

Market structure is different than earlier cycles

The market context in 2024+ is markedly different from 2017. Ethereum’s market cap is more than ten times larger than it was in 2017. More importantly, institutions now dominate large parts of market flow. Retail mania that once pushed ETH toward Bitcoin isn’t enough anymore to close the gap. The days where a few billion of retail-driven hype could push ETH to 85% of Bitcoin’s market cap are largely gone. So while retail cycles still matter, they’re no longer the decisive factor in the Bitcoin vs Ethereum contest.

Verdict — My Take on Bitcoin vs Ethereum

After digging through the data and weighing the arguments, my short answer is: I don’t expect the flippening to happen anytime soon. Ethereum’s best historical shot was during ICO mania, but today the ETH/BTC ratio sits significantly below the flip level — roughly around 22% of Bitcoin’s market cap in the most recent cycle, far from the 100% needed.

However, that doesn’t mean Ethereum won’t outperform Bitcoin in the short to mid-term. The balance of probabilities suggests ETH can have periods of strong relative performance, especially if tokenized finance continues to move onto Ethereum, staking ETFs tighten effective supply, and Bitcoin’s price consolidates. But outperforming is very different from flipping. Over a cycle or two, if all the bull signals align and BTC stagnates, ETH could make a sustained run toward parity — but that’s a conditional scenario, not a base case.

For traders, this distinction matters. Betting on ETH outperformance is a tactical call; betting on a flippening is a strategic, multi-cycle wager that requires different sizing and risk management.

Practical implications — How to act on Bitcoin vs Ethereum

If you’re trying to translate this analysis into positions, here are practical ideas and risk controls that reflect the Bitcoin vs Ethereum dynamics discussed above.

- Don’t anchor to the flippening meme: narratives are poor risk managers. Focus on flows and on-chain data.

- Use pairs trading: rather than going all-in on ETH, consider ETH/BTC pair trades to express relative strength while hedging broader crypto beta.

- Monitor ETF flows and treasury filings: sudden spikes in institutional purchases often precede strong relative moves for ETH.

- Watch staking and exit queue metrics: an exploding unstaking queue can presage future sell pressure.

- Size carefully: a flip is a low-probability, high-impact event — allocate no more than a small percentage of total risk capital to a multi-cycle flip bet.

If real-time flow monitoring and signal-driven entries are part of your strategy, consider using professional-grade alerts. Our Crypto Trading Signals service tracks ETF flows, large on-chain moves, and liquidity shifts across major exchanges — the exact signals that can help you trade the Bitcoin vs Ethereum relationship without getting blindsided by narrative pump-and-dump cycles.

Trade setups to consider

- Short-duration ETH longs when ETF inflows spike and the unstaking queue is low.

- ETH/BTC pair longs during sustained institutional allocation phases, hedging spot BTC risk.

- De-risk when narrative buzz reaches mainstream trending levels — use options or trailing stops.

- Consider yield-bearing ETH exposure via staking ETFs if approved, but factor in liquidity and lock-up risks.

Signals that would materially change the Bitcoin vs Ethereum odds

Here’s a checklist of events and metrics that, if they occur persistently, would make the flippening much more plausible:

- Consistent and growing institutional allocations into ETH (sustained ETF inflows outpacing BTC for months).

- Widespread approval and adoption of staking-enabled ETFs that materially increase locked supply.

- Large-scale migration of tokenized assets from custodial or other L1s to Ethereum, increasing settlement volume and fee capture.

- Significant stagnation in BTC price with muted institutional demand relative to ETH.

- Persistent reduction in the unstaking queue and long-term staking adoption by major institutions.

FAQ — Bitcoin vs Ethereum

What exactly is the flippening?

The flippening refers to Ethereum overtaking Bitcoin in market capitalization. Practically, it’s when the ETH/BTC market cap ratio reaches ~0.16 (ETH market cap ≈ BTC market cap). It’s a relative measure, so shifts in either BTC or ETH price can change it.

How likely is a flippening in the next cycle?

Not very likely as a base case. The structural headwinds and the current ratio gap make it improbable in the near term. It’s possible over multiple cycles if institutional flows, staking ETFs, and tokenized assets align strongly in Ethereum’s favor and Bitcoin stagnates.

Should I move all my Bitcoin to Ethereum to chase the flip?

No. That’s anchoring to a low-probability meme. A more prudent approach is size exposure based on risk tolerance, use pairs trading to express relative strength, and monitor the signals that matter—ETF flows, staking dynamics, and tokenization trends.

Does staking make ETH less likely to be sold?

Staking reduces circulating supply while funds are locked, which can tighten markets. But staking is reversible, and large unstaking queues can create deferred sell pressure. Staking ETFs could professionalize and lengthen lock-ups, but they can also produce distribution if allowed to unstake on a schedule.

Could another altcoin flip Ethereum instead?

Yes. The same arguments for ETH could apply to another chain if it captures tokenized finance, developer activity, and institutional flows. Solana and others are attracting product-level attention. Diversification and monitoring flows across chains is important.

How can real-time signals help when trading Bitcoin vs Ethereum?

Flow-based signals matter more than social media hype. Alerts on ETF inflows, large exchange flows, staking queue changes, and major custody filings let traders act on institutional behavior rather than narrative noise. Crypto Trading Signals offers a way to receive those tactical alerts so you can make data-driven entries and exits when Bitcoin vs Ethereum dynamics shift.

Conclusion — Where things stand in Bitcoin vs Ethereum

The Bitcoin vs Ethereum debate is not just academic — it defines where capital could flow and which protocols might capture long-term financial infrastructure. Ethereum has structural advantages: staking yield, the possibility of staking ETFs, first-mover advantage in tokenized assets, and on-chain settlement traction. Those factors create a credible bull case.

But those same advantages are fragile without sustainable demand. The treasury flywheel can reverse, unstaking pressures are real, competition from other chains could dilute institutional allocations, and narratives have a history of peaking near tops. For now, the most prudent view is that ETH can outperform BTC over the short to mid-term, but a full flippening is not likely in the immediate cycles.

If you’re trading or allocating around Bitcoin vs Ethereum, anchor decisions in flow data and risk management, not memes. Use pairs strategies, monitor ETF flows and staking metrics, and consider professional signal services to keep an edge. Crypto Trading Signals is built to highlight exactly these flow-driven events — ETF inflows, large on-chain transfers, and staking queue changes — so traders can act on what actually moves the scoreboard.

In the end, market structure and flows — not Twitter memes — decide the outcome. Watch the signals, size carefully, and let the data drive your trades.