Table of Contents

- What you need: the minimal toolset

- A simple idea that works: moving average crossover

- Refining the display: labels and readability

- Focus on the right time of day: time filters

- Define a pragmatic exit: take 100 points and walk away

- From prototype to proven: backtesting and examples

- Step-by-step prompt blueprint

- Practical considerations and risk management

- Why this approach beats black box promise

- How to adapt this system for crypto

- Example live-trade math

- Troubleshooting common issues

- Frequently asked questions

- Putting it into practice

- Final thoughts

What you need: the minimal toolset

Keep the setup lean. Two components are all you need to prototype and test a live trading strategy immediately.

- ChatGPT (GPT-4) — to generate Pine Script code, refine logic, and add features like time filters and exits. A paid subscription is helpful for reliability, but the free tier can still produce usable code.

- TradingView — where you paste the Pine Script, visualize crossovers, and backtest. The Pine Editor makes iterative development fast.

A simple idea that works: moving average crossover

There is beauty in simplicity. A moving average crossover — a short period average crossing a long period average — is the kind of signal that is easy to explain, quick to test, and simple to automate. The version I prefer as a starting point uses a 10-period moving average crossing a 100-period moving average. It is clean, responsive, and gives obvious entry points.

Trading strategies do not have to be complicated.

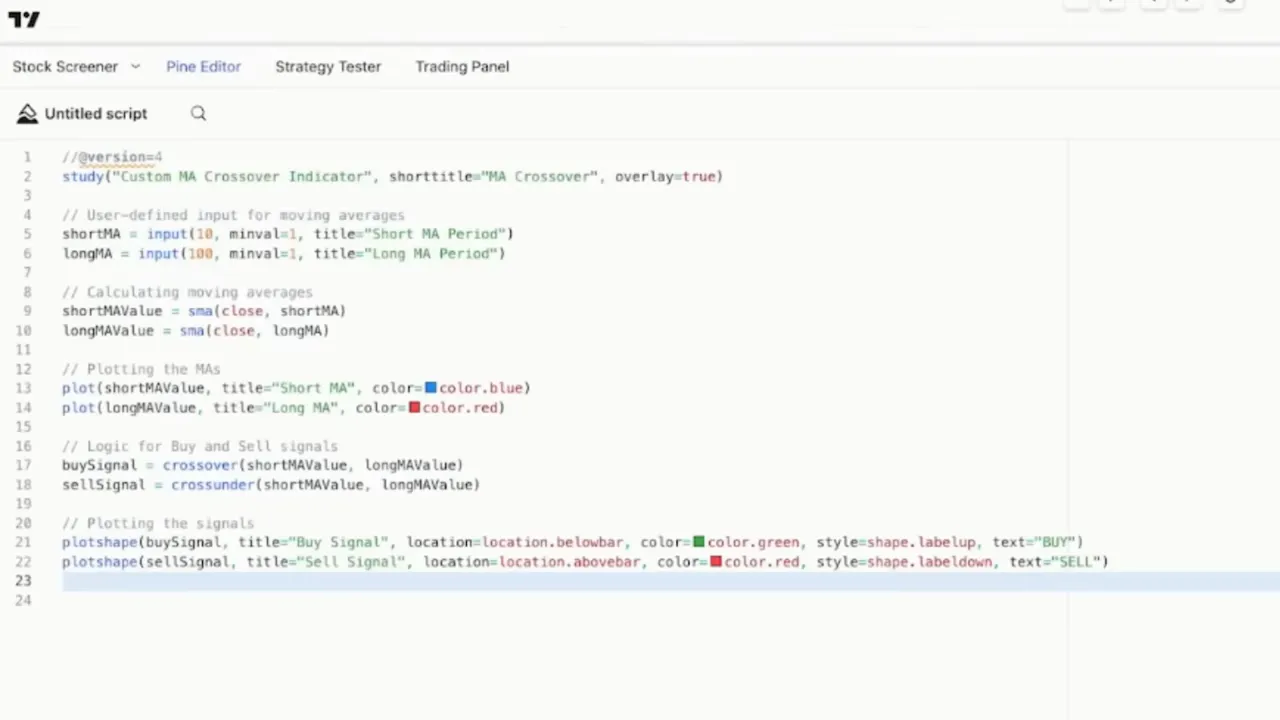

What ChatGPT gives you here is speed. Instead of wrestling with syntax, you describe the indicator and it returns Pine Script. Ask for user-defined inputs so you can change 10 and 100 to whatever you like, and instruct it to plot buy and sell labels at each crossover.

Refining the display: labels and readability

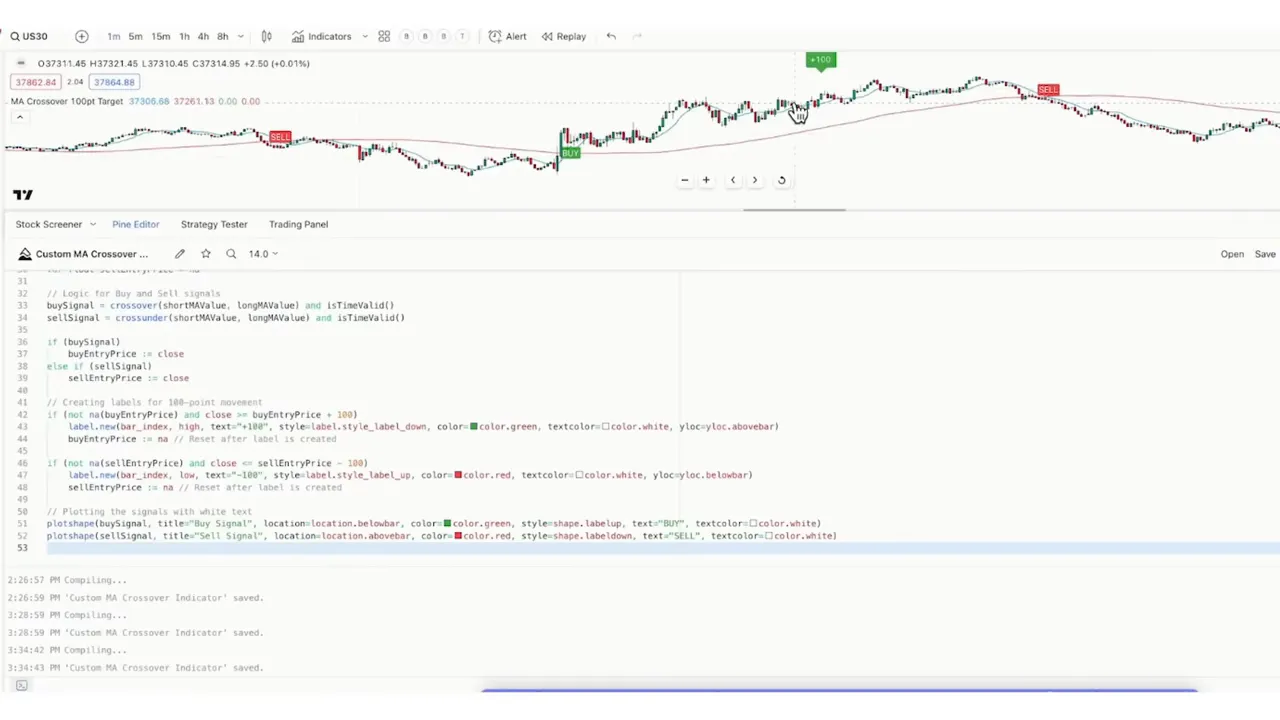

Small tweaks make the script useful. For example, asking the script to make the buy/sell label text white or larger makes signals readable on any background. ChatGPT will adjust the same script iteratively — you do not need to start from scratch each time. This rapid loop between prompt, paste, test, and tweak is where you convert an idea into a usable tool.

Focus on the right time of day: time filters

Not all signals are equal. Markets have rhythms: overnight ranges, opening spikes, lunchtime quiet, and closing volatility. When you visually scan intraday charts you begin to notice patterns. For many US indices, high-quality moves cluster around the New York open. That is where we concentrate the signals.

Ask ChatGPT to add a time-window filter with UTC inputs. Pine Script can convert input hours and minutes to Unix-based times and return a boolean for whether the current bar falls within your trading window. Tie that boolean into your buy and sell conditions and suddenly many of the noisy, low-probability crossovers disappear.

Benefits of this step

- Fewer false positives and choppy signals

- Signals concentrated around predictable liquidity and volatility

- Cleaner PnL curves when you backtest

Define a pragmatic exit: take 100 points and walk away

Entries are important, but exits determine profit. Price tends to run a chunk and then mean revert. Instead of chasing the perfect top or bottom, take the clip and protect gains. I prefer a simple rule: once a position is open, if price moves 100 points in our favor (or 100 points against for a stop), mark an exit. This gives you triple-digit outcomes regularly without overcomplicating position management.

Ask ChatGPT to add exit labels: detect when price is +100 ticks from your entry (label as exit long) or -100 ticks (exit short). The script can create those labels and also prevent re-entry until the exit is processed, depending on how you want to handle overlapping signals.

Why fixed clips work

- They lock in a consistent edge instead of gambling on big, rare runs

- They remove emotion from exits and reduce the risk of giving back gains

- They make performance predictable and easier to scale within risk limits

From prototype to proven: backtesting and examples

When the moving average crossover is combined with a New York opening filter and +100 exit targets, the results become striking. Daily intraday sessions often produce a 50 point run followed by another 50 or a full 100 point move. Catching one or two of these in a single morning on instruments like Nasdaq futures can translate to substantial dollar returns.

To make this concrete: a 100-point move on Nasdaq eminis is about $20 per point. Two such moves in a day = $4,000 on a single contract. The same set of rules applied to YM (Dow) yields different dollar values per point, but the math is the same: consistent triple-digit moves become meaningful profits once you size positions sensibly.

These patterns are not limited to equities. Crypto markets have comparable intraday behaviors, particularly around major news releases, protocol updates, and liquidity windows across time zones. The exact timeframe and tick size differ, but the idea of focused time-based filters and fixed exits translates. If you trade crypto, a useful compliment to this workflow is a reliable crypto trading signals service that alerts you to asymmetric setups across blockchains and helps prioritize which instruments to apply your moving average system to that day.

Step-by-step prompt blueprint

Here is a distilled set of prompts you can use to get started with ChatGPT and TradingView. Copy these, paste them into ChatGPT, and iterate.

- Initial request: Please create Pine Script code for an indicator that plots a short moving average and a long moving average with default periods 10 and 100. Include user inputs to change those values and plot labels at crossover points.

- Refinement: Make the label text white and increase font size. Color the short MA blue and the long MA red.

- Time filter: Add user inputs for start hour, start minute, end hour, end minute in UTC and only allow signals during that window.

- Exit rule: Add a condition to mark an exit label when price moves +100 points from entry or -100 points from entry.

- Backtest hooks: Add plot shapes and optional strategy.entry/strategy.exit calls so you can run a quick backtest in TradingView.

Use precise language. ChatGPT is powerful, but it responds best when treated like an engineer: be explicit about variable names, units (points vs ticks), and time zones.

Practical considerations and risk management

Some important trading discipline elements to pair with any AI-assisted strategy:

- Position sizing: Never risk more on a single trade than you can afford to lose. Fixed-point exits make risk math easy: you know your maximum adverse move.

- Slippage and commissions: Simulated backtests ignore real-world execution friction. Subtract a realistic slippage and commission model from your performance expectations.

- Out-of-sample testing: Validate the script on multiple months and different market regimes. A strategy that worked for a volatile week might fail in a low-volatility stretch.

- Stop-loss discipline: Even with +100 targets, define hard stops. That prevents a catastrophic single-bar reversal from wiping multiple winners.

Why this approach beats black box promise

Many traders drift toward complex models because they believe more inputs equal more edge. In practice, a simple rule executed consistently often outperforms a convoluted model that is poorly understood. The value ChatGPT adds is rapid iteration: you can implement clear rules, test them, and evolve them without spending weeks on syntax or debugging.

That said, ChatGPT is a tool — not a prophet. It helps you implement and automate hypotheses. The trading edge still comes from the idea, timing, and risk control you design into the system.

How to adapt this system for crypto

Crypto markets are open 24/7, which means you need to choose time windows that capture your preferred cross-chain liquidity periods. The same workflow applies: build the MA crossover, narrow signals by time windows tied to major timezone overlaps or events, and use fixed-point exits adjusted for crypto tick sizes.

Because there are so many tokens and exchanges, it helps to combine the strategy with a selective feed — a crypto trading signals service can provide curated setups and highlight which tokens show the volatility profile your moving average strategy thrives on that day. Use these signals to prioritize and allocate your capital efficiently across chains.

Example live-trade math

- Nasdaq: 100-point move = $20 per point = $2,000 per contract

- Two 100-point moves = $4,000 on a single contract

- Dow (YM): 100-point move = $5 per point = $500 per contract

These numbers show that consistent, repeatable clips can fund objectives quickly. For traders pursuing funded accounts, disciplined application of this strategy could hit funding targets faster than discretionary day trades that rely on guesswork.

Troubleshooting common issues

If your Pine Script does not behave as expected, check these items:

- Time zone mismatches between TradingView settings and your script inputs. Prefer UTC inputs to be explicit.

- Tick size vs point size confusion. Use instrument-specific multipliers when computing +100 points.

- Overlapping signals. Add logic to prevent re-entry immediately after exits if you want cleaner sessions.

- Label clutter. Use conditional plotting to only show labels during the most important sessions.

Frequently asked questions

Can ChatGPT give trading signals that are ready to trade?

ChatGPT can generate the code and logic for signals based on your rules, but it does not provide guaranteed ready-to-trade signals. Use ChatGPT to implement and automate rule-based strategies, then validate via backtesting and live paper trading before committing capital.

Will the moving average crossover work on all instruments?

The moving average crossover works as a framework across many instruments, but parameter tuning is necessary. Shorter averages and thresholds suit fast markets, while slower averages suit longer timeframes. Test across instruments, timeframes, and market regimes to find what fits.

How do I set the +100 point exit for smaller tick instruments like crypto?

Translate the fixed-point exit into the instrument’s tick or price units. For crypto, adjust the absolute target to reflect realistic volatility. Alternatively, use percentage-based exits if points do not align well with token price ranges.

Can I use ChatGPT to backtest directly?

ChatGPT cannot run backtests itself, but it can generate Pine Script strategy code with strategy.entry and strategy.exit statements that you can run inside TradingView to evaluate performance.

Is adding a time filter really that valuable?

Yes. Filtering signals to the most liquid and volatile windows reduces noise and improves the quality of entries. For many indices, the New York open concentrates high-probability moves.

Putting it into practice

Start small. Implement the baseline script, add the time filter, and set the +100 exit. Run the strategy on historical data for several months. If the edge is consistent, test it live on a small size or in paper trading. Use position sizing rules tied to maximum expected adverse movement so a single trade cannot derail your account.

For those trading crypto, consider integrating a curated feed or crypto trading signals service to highlight tokens showing ideal volatility or event-driven catalysts that align with your time windows. Combining selective signal feeds with a disciplined automated strategy can save time and reduce decision fatigue.

Final thoughts

Can ChatGPT give trading signals? It can produce and refine the algorithmic logic that creates signals, help you automate those signals in TradingView, and accelerate the cycle from idea to tested strategy. The human work remains: choosing the edge, validating it, sizing risk, and executing with discipline. Use ChatGPT as your development partner, not as a black box oracle, and you will be able to build simple, powerful systems that capture predictable, triple-digit gains without unnecessary complexity.

Simple rules executed well beat complex systems executed poorly. Build the rule, test it, and let automation handle the mechanics. Then focus on scale and risk management.

Good trading and clear prompts will get you a long way.