Table of Contents

- Why the question “can pepe coin reach $1” even matters

- Tokenomics: the bedrock of the “can pepe coin reach $1” question

- Run the math: what would PEPE’s market cap be at different prices?

- Comparisons to global companies and assets

- Supply change scenarios: is burning the only hope for $1?

- What I realistically expect this cycle

- Practical advice: how to think about trades and take profits

- How to run your own “can pepe coin reach $1” calculation

- Common misunderstandings about price per token

- What would change my view?

- Summary: the plain answer to “can pepe coin reach $1”

- Frequently Asked Questions (FAQ)

- Final thoughts

Why the question “can pepe coin reach $1” even matters

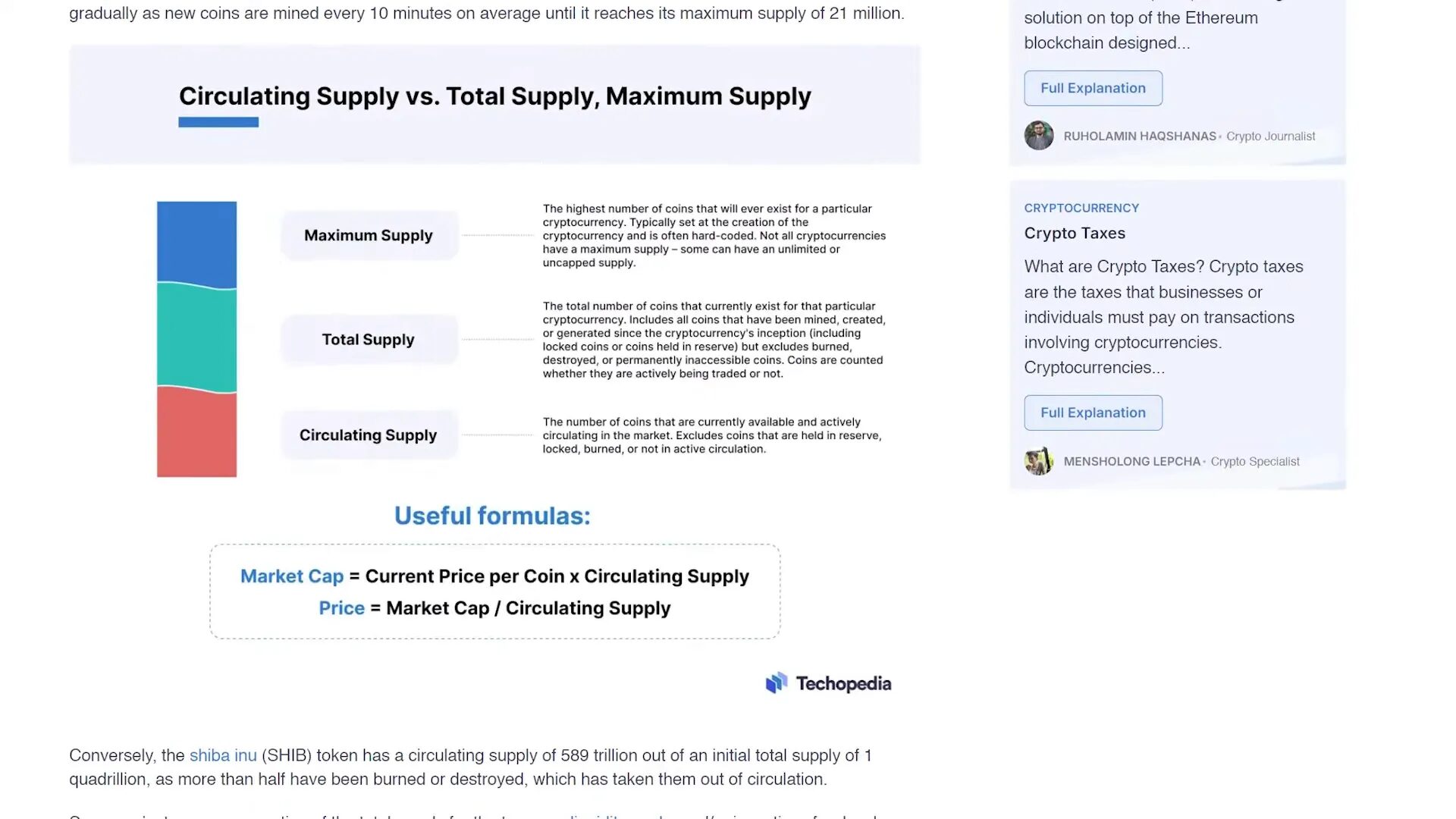

At first glance asking can pepe coin reach $1 seems like a simple unit price question: PEPE is trading for a fraction of a cent, so why couldn’t it eventually be worth a dollar? But that question ignores the most important part of modern cryptocurrency valuation: token supply. Tokenomics — the total supply, circulating supply, whether tokens can be burned or minted, and distribution — changes everything.

When people fixate on the price per token without considering how many tokens exist, they’re missing the whole picture. So before you set unrealistic expectations or hold bags forever waiting for a $1 dream, learn what drives that unit price. And to answer can pepe coin reach $1 you have to do the math.

Tokenomics: the bedrock of the “can pepe coin reach $1” question

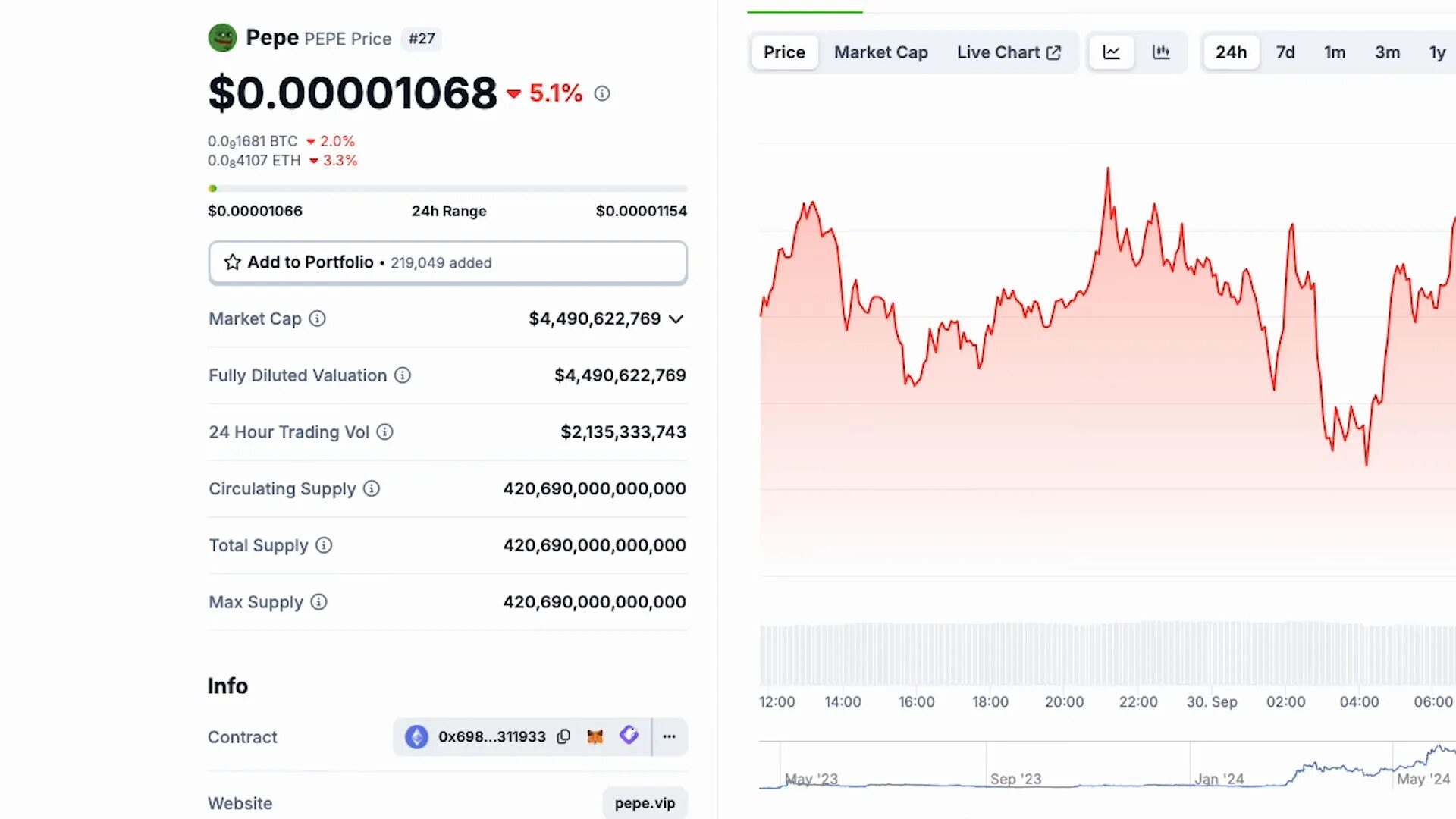

Let’s start with the raw numbers. PEPE currently sits at roughly a $4.5 billion market cap, with an FDV (fully diluted valuation) matching that figure. Why are those values the same? Because for PEPE the circulating supply and the max supply are identical — a setup commonly seen with meme coins.

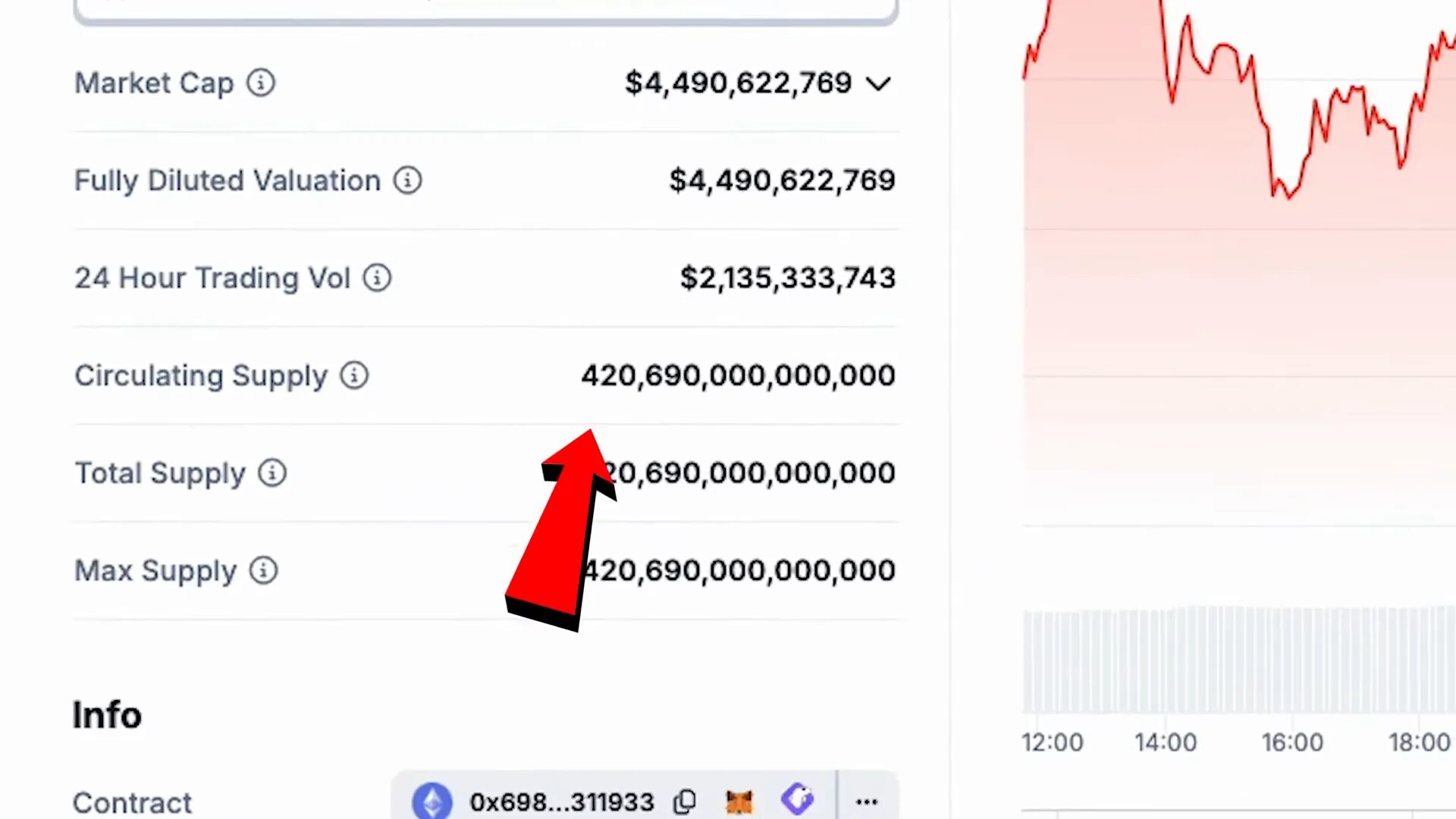

The circulating supply is what really kills the $1 dream: PEPE’s supply is enormous — about 420,600,090,000,000 tokens (420.6 trillion). That’s not a typo. When you multiply that kind of supply by a unit price like $0.01, $0.10, or $1, the resulting market capitalizations explode into figures that dwarf real-world assets.

Why supply is more important than unit price

When assessing a coin’s potential, think in terms of market cap, not per-token price. Market cap = price per token × circulating supply. If the supply is fixed and enormous, even a small dollar price becomes astronomical in market-cap terms. So the real question is not merely can pepe coin reach $1, it’s can the market absorb a market cap large enough to place PEPE at that unit price.

If you’re wondering how to make realistic predictions, start by noting the supply. A low-priced token with huge supply needs an enormous influx of capital to raise price materially. That’s why understanding tokenomics should be the first step in any crypto investment thesis.

Run the math: what would PEPE’s market cap be at different prices?

Let’s do the math step-by-step so the implications are crystal clear. Using PEPE’s supply of roughly 420.6 trillion tokens, here’s what different unit prices imply:

- At $0.01 (one penny) per PEPE: market cap ≈ $4.2 trillion

- At $0.10 (ten cents) per PEPE: market cap ≈ $42 trillion

- At $1 per PEPE: market cap ≈ $420 trillion

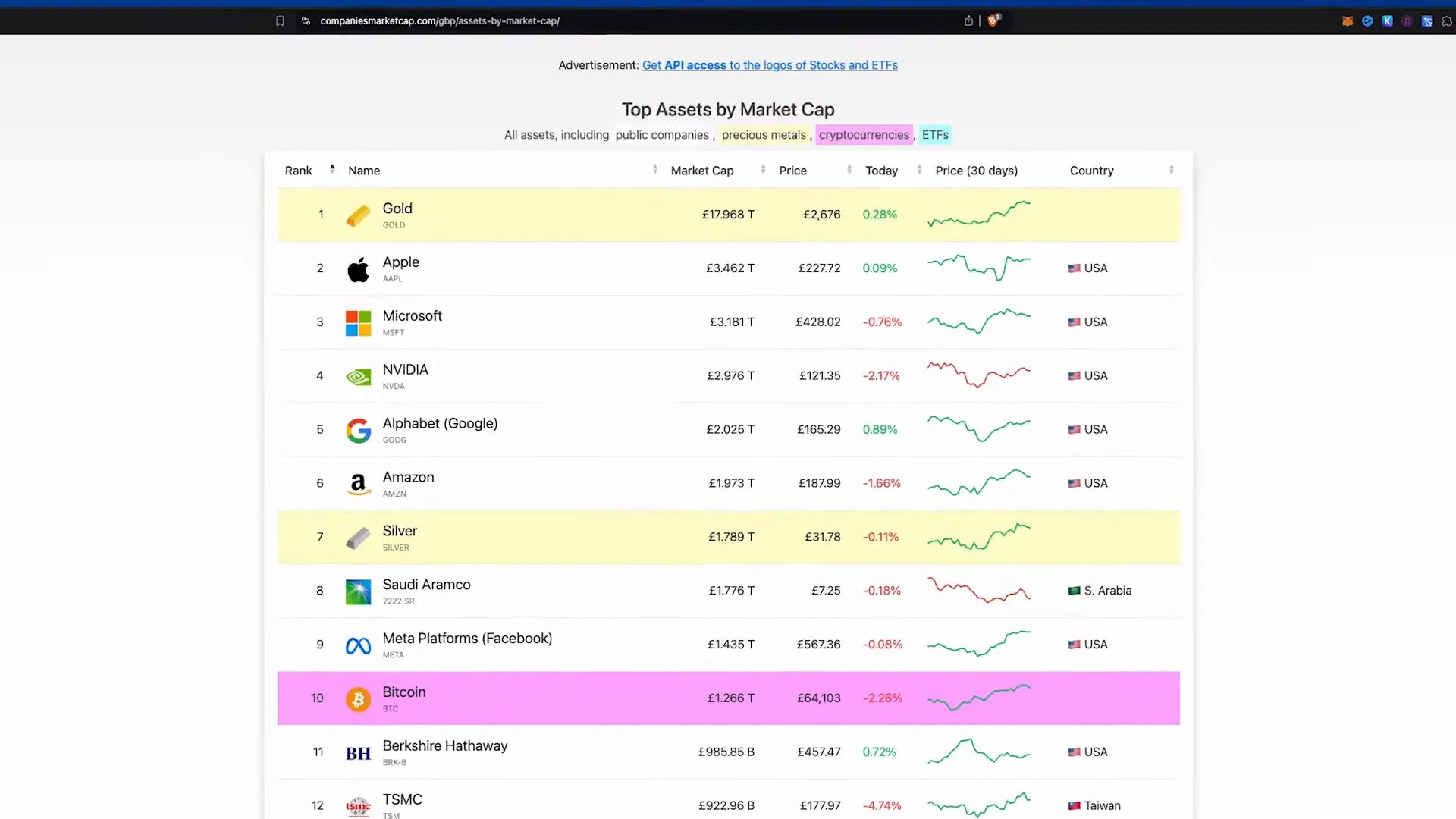

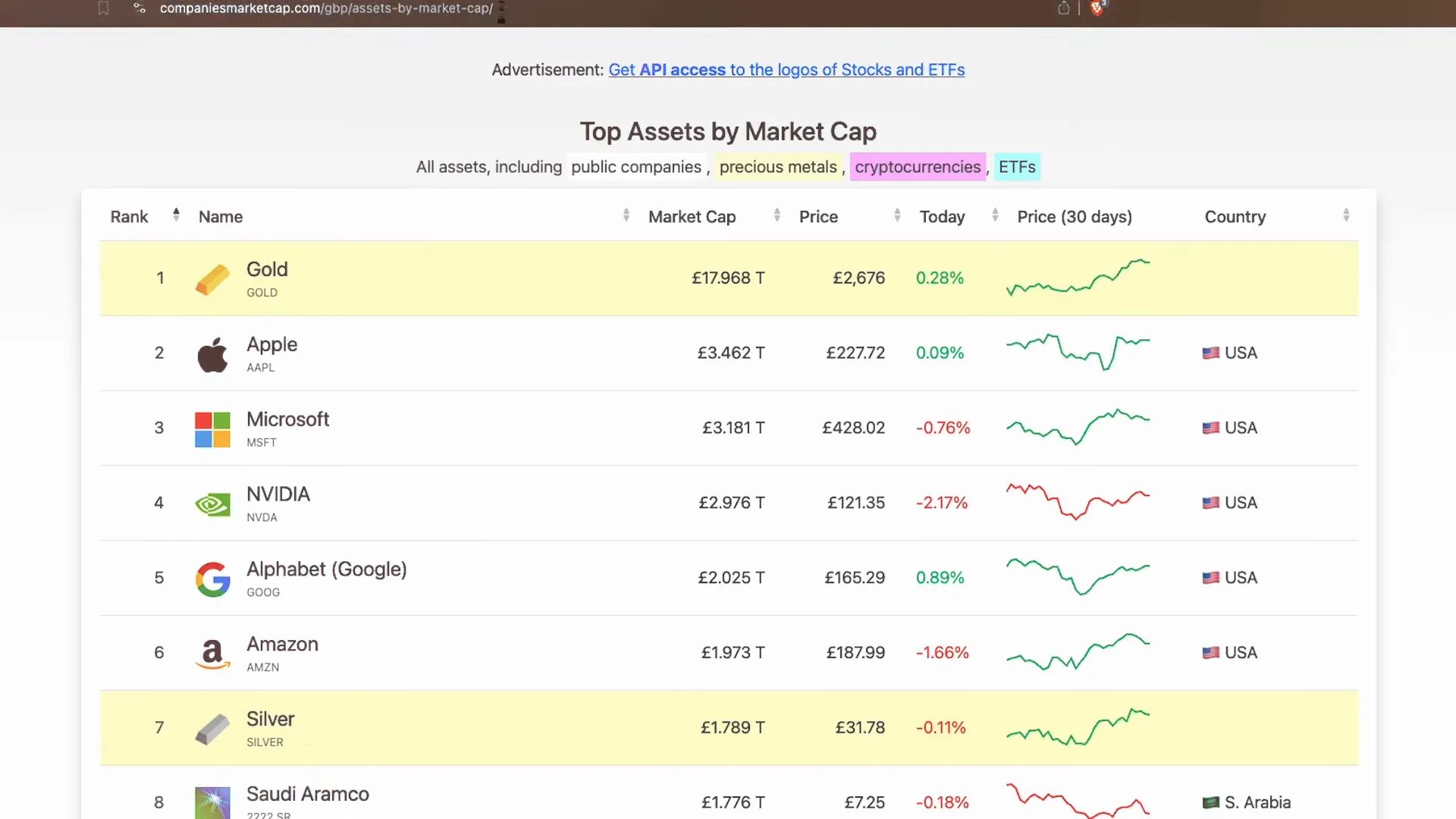

Those aren’t small numbers. To put them in perspective:

- A $4.2 trillion market cap (for $0.01 PEPE) would make PEPE larger than any public company today, including Apple, which sits around $3.4 trillion.

- A $42 trillion market cap (for $0.10 PEPE) would exceed the combined value of many top companies and assets — think Apple, Microsoft, NVIDIA, gold, silver and Bitcoin — all added together in some comparisons.

- A $420 trillion market cap (for $1 PEPE) would surpass the total global value of real estate, estimated at roughly $380 trillion as of September 2023.

These are not hyperbolic thought exercises — they are the unavoidable arithmetic you must accept when answering can pepe coin reach $1.

Comparisons to global companies and assets

When evaluating whether PEPE can reach certain prices, it helps to compare potential market caps to known benchmarks. This highlights how unlikely certain outcomes are without major structural changes to the token’s supply or a massive reallocation of global capital to one meme coin.

One penny (0.01 USD)

For PEPE to reach one penny, the required market cap would be just over $4 trillion. That would place PEPE above the biggest companies in the world. For a meme coin to eclipse the value of the largest tech firms requires either radical tokenomics changes (burns, supply reduction) or a massive and unlikely shift in investor behavior.

Ten cents (0.10 USD)

At ten cents, PEPE’s market cap would be around $42 trillion. That’s a number larger than most national economies’ GDP and larger than many asset classes combined. The scale of capital required to push PEPE to $0.10 means the market would need to treat PEPE as a store of value comparable to the largest global institutions — not a probable scenario for an entertainment-driven meme token.

One dollar (1.00 USD)

At $1 per token, the implied market cap would be roughly $420 trillion. That’s larger than the estimated total value of global real estate. To get there, nearly every major investor, institution, and retail participant would have to dedicate a significant portion of capital to PEPE — an unprecedented reallocation.

Supply change scenarios: is burning the only hope for $1?

The only realistic way to materially change these outcomes is if the supply is dramatically reduced. If the circulating supply were burned or locked away at scale, then the per-token price required to achieve a reasonable market cap would drop. For example, cutting supply by 99% would reduce the market caps above by a factor of 100, making the unit prices much more achievable.

But here’s the problem: PEPE’s tokenomics show a fixed supply with no planned mechanisms for large-scale burns. Without token burns or supply sinks, you can’t change the math. That means can pepe coin reach $1 is effectively impossible under current supply parameters.

Hypothetical burn example

Imagine PEPE burned 99% of the supply. The max circulating supply would become 4.206 trillion instead of 420.6 trillion. Then:

- At $1 per PEPE, market cap ≈ $4.2 trillion — still huge, but more within the realm of high-value assets.

- At $0.10, market cap ≈ $420 billion — now comparable to large but achievable crypto market caps in strong bull environments.

Burns can change the feasibility of higher unit prices, but burns of that magnitude are rare and typically require either community consensus, governance mechanisms, or developer intent. With no indication that PEPE’s supply will change, the arithmetic stands as a hard limit.

What I realistically expect this cycle

Being realistic is not pessimism; it’s necessary risk management. With that in mind, here’s my view: I do not believe PEPE will reach $1 this cycle. I also think it’s unlikely PEPE will reach $0.10 this cycle, and I’m skeptical it will even hit $0.01 in the next 12 months.

To be clear: I’m not saying PEPE can’t have huge rallies. Meme coins have delivered exponential short-term gains before. What I’m saying is that a feat as large as $1 per PEPE requires macro conditions and capital flows that seem improbable within a single market cycle given the current supply.

Bitcoin comparison: why even BTC has limits

If you think PEPE can reach $1 without considering Bitcoin’s only realistic ceiling, you’re missing context. If Bitcoin were to scale to a $4 trillion market cap (which would put it roughly at $200,000 per BTC), that would imply massive capital inflows into crypto across the board. I don’t think a $4 trillion Bitcoin market cap is a given this cycle, and without Bitcoin or the overall crypto market expanding to those levels, the capital simply isn’t there to push PEPE to the extremes described.

Practical advice: how to think about trades and take profits

If your thesis is based on the question can pepe coin reach $1, reassess the likelihood and adjust your position sizing. Here are practical rules I recommend:

- Understand tokenomics before allocating capital. Check circulating supply, max supply, and any burn/mint mechanisms.

- Set realistic targets using market-cap math, not psychology. Calculate the implied market cap for each price level and ask whether that market cap is reasonable.

- Take profits in stages. If PEPE rallies, don’t hold everything for a $1 fantasy. Lock in gains at sensible milestones relative to your entry.

- Diversify. Meme coins can pump, but exposure should be sized proportionally to risk tolerance.

- Use stop losses or rebalancing strategies. Protect capital when volatility spikes.

How to run your own “can pepe coin reach $1” calculation

Follow this simple process to test any coin’s feasibility for a target price:

- Find the circulating supply. Always use circulating supply for market-cap calculations.

- Multiply the target price by the circulating supply to get the implied market cap.

- Compare that implied market cap to realistic benchmarks — largest companies, top global assets, national GDPs, or total crypto market cap.

- Ask whether it’s credible that the market would allocate that much capital to the asset within your time horizon.

Example: for PEPE, use 420.6 trillion as the supply figure. Multiply by your target price and then measure whether a $4.2T, $42T or $420T market cap is believable.

Common misunderstandings about price per token

Here are common traps I see investors fall into when thinking about the question can pepe coin reach $1:

- Price illusion: people see a low unit price and assume it’s “cheap” without considering supply.

- Ignoring market cap: not every coin can scale to the same valuation regardless of price per token.

- Failing to plan exits: hoping forever for $1 creates emotional holding and missed opportunities to secure gains.

- Not checking tokenomics updates: some projects may introduce burns or buybacks that alter supply dynamics — always watch for tokenomic changes.

What would change my view?

Two things could shift the calculation and make the question can pepe coin reach $1 more plausible:

- A planned, credible, and large-scale burn or supply reduction mechanism; and

- An unprecedented reallocation of global capital into meme tokens, alongside Bitcoin and crypto market caps expanding massively.

Absent either, the math is stubborn: with the supply fixed at hundreds of trillions, unit price milestones quickly translate into impossible market capitalizations.

Summary: the plain answer to “can pepe coin reach $1”

Short answer: Under current tokenomics, NO— PEPE cannot realistically reach $1. It’s not a doom-and-gloom call; it’s a math-based assessment. At current supply, $1 would require a $420 trillion market cap, larger than global real estate. Even modest-sounding targets like $0.01 or $0.10 imply market caps that would put PEPE above the largest companies or surpass many established asset classes combined.

If you want to hold PEPE for speculative reasons, do so with clear awareness of the odds and a plan for taking profits. If you want price targets, calculate implied market caps first and then ask whether that amount of capital shifting into the token is plausible. That’s the disciplined approach to the “can pepe coin reach $1” question.

Frequently Asked Questions (FAQ)

Q: Can PEPE reach $1 ever, ignoring timeline?

A: Theoretically anything is possible, but with current supply it’s effectively impossible without a massive supply reduction or unprecedented global capital flow toward one meme coin. So in practical terms, no, PEPE reaching $1 under present tokenomics is not realistic.

Q: What would need to happen for PEPE to reach $1?

A: Two main things: a dramatic reduction in circulating supply (via burns or token locks) and a staggering increase in capital allocated to PEPE. Without at least one of these, the math rules out $1.

Q: Is it better to look at market cap instead of token price?

A: Absolutely. Market cap is the single most useful normalized metric when comparing assets and evaluating realistic price targets. Always convert your target price into implied market cap using circulating supply.

Q: If PEPE burns tokens, could $1 become realistic?

A: It depends on the scale of the burn. A small burn changes nothing significant. Massive burns (e.g., 90%+) would materially reduce the required market cap for a $1 price, but such burns are rare and would likely require wide community support and governance mechanisms.

Q: Should I sell my PEPE now because it won’t reach $1?

A: Not necessarily. Selling should be based on your personal risk tolerance, entry price, and investment goals. The key is to set realistic targets and take profits in stages rather than waiting indefinitely for improbable milestones like $1 under current tokenomics.

Q: How can I learn to run these calculations myself?

A: Start by looking up circulating supply on reputable explorers or coin aggregators. Multiply by your target price to find implied market cap. Then compare that market cap to major assets, companies, or national GDPs. Repetition will make the process second nature.

Q: Can market sentiment alone make “can pepe coin reach $1” true?

A: Sentiment can drive rapid price moves, but it cannot conjure the required capital out of thin air. For the $1 level to be real, the market cap must be funded by actual investments. Sentiment may accelerate inflows, but structural supply and available capital are the limiting factors.

Q: Where can I find more realistic PEPE price targets?

A: Look for analyses that use market-cap math and consider tokenomics. Price targets that ignore supply are often misleading. Use resources that transparently show calculations and compare implied market caps to realistic benchmarks.

Final thoughts

Answering can pepe coin reach $1 isn’t about crushing hope — it’s about arming you with the facts so you make smarter decisions. Tokenomics and market-cap math are straightforward tools that cut through hype. Meme coins can still offer big returns in bull markets, but understanding the scale and probability of extreme outcomes like $1 per token is essential to avoid unrealistic expectations.

Do your own math, manage risk, take profits when appropriate, and always remember that price per token without context is a trap. Trade safe, invest smart, and keep tokenomics front and center when you ask whether can pepe coin reach $1.