Today we’re dissecting the chaotic 15 minutes that flushed roughly $200 million in liquidations across the crypto market. This one-day bloodbath felt dramatic, but when you peel back the headlines and zoom out on the charts, the picture is a lot more nuanced. In this deep dive I’ll explain what triggered the move, why the market structure isn’t broken, where the smart money is positioned, and why I believe this is a buying opportunity for quality crypto assets like Bitcoin, Ethereum, and Solana. I’ll also cover macro catalysts, on-chain signals, institutional progress, and policy developments that matter for crypto’s next leg up.

Table of Contents

- Quick summary: the headlines and the panic

- Why this dump happened: the immediate triggers

- Zoom out: market structure is not broken — why I’m still bullish

- Personal positioning: what I’m doing and why

- Fed minutes and the macro backdrop: why easing is likely

- On-chain signals: who’s buying and who’s selling?

- Ethereum: a healthy retest and future breakout potential

- Institutional adoption: the floodgates are opening

- Bitcoin as economic lifeline: real-world adoption stories

- Regulation and clarity: Market Structure Clarity Act

- Short-term catalysts and the timeline I’m watching

- How to approach this dip: a practical playbook

- Why quality alts still matter — and how to pick them

- Reality check: risk, patience, and the human element

- Conclusion: this is a dip — and an opportunity

- Frequently Asked Questions (FAQ)

- Final thoughts

Quick summary: the headlines and the panic

On the surface the market looked like it was imploding: $200 million in liquidations in about 15 minutes. Social feeds filled with charts going red, margin calls, and traders crying foul. A specific political shock hit headlines: a proposal to dramatically raise tariffs on certain Chinese imports, with a focus on rare earth exports. That news re-ignited fears of a global trade war and sent risk assets lower across the board — not just cryptocurrencies but equities and commodities too.

To be clear: headline macro shocks like trade-war rhetoric can absolutely trigger forced selling and cascades. But those forced moves often create liquidity and price dislocations that sophisticated buyers — and long-term holders — use to accumulate. Don’t confuse short-term volatility with structural market breakdown.

Why this dump happened: the immediate triggers

There were a few simultaneous triggers that together amplified selling pressure:

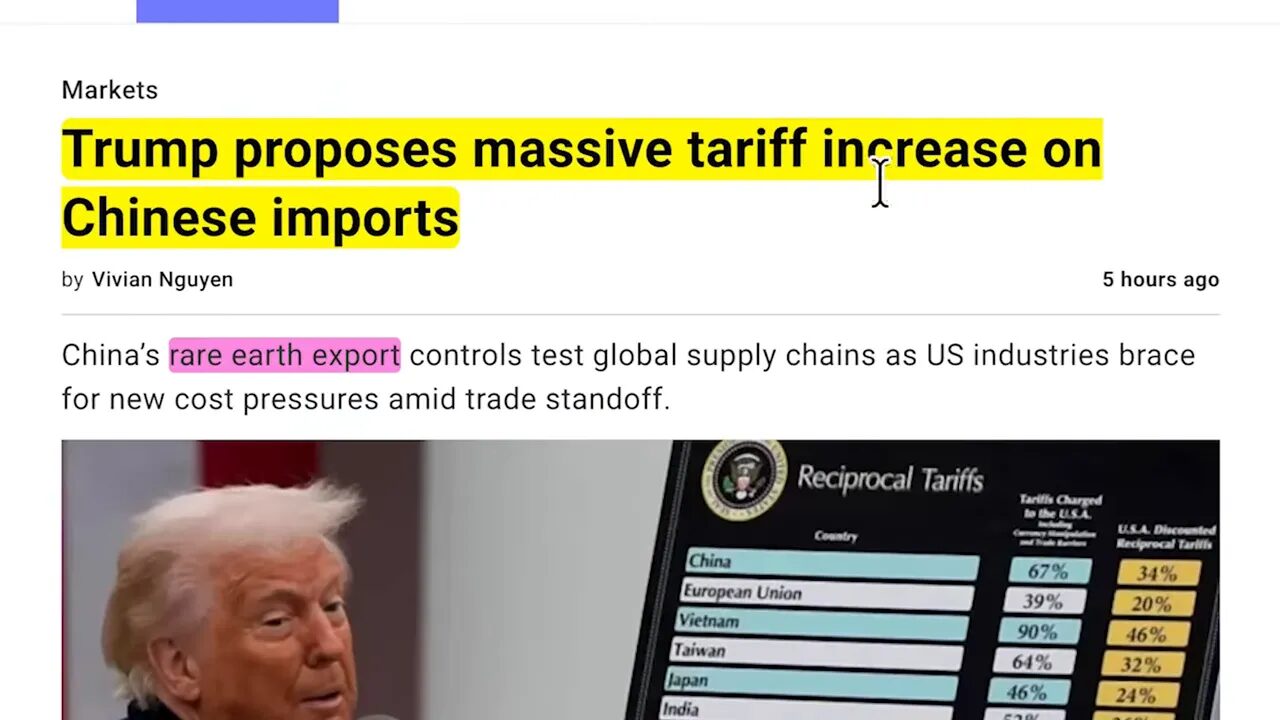

- Trade-tension headlines: The proposal to impose heavy tariffs on Chinese imports — especially strategic materials like rare earths — rattled markets. Risk assets sold off as investors price in higher costs, supply-chain disruption, and slower global growth.

- Leverage and liquidations: Crypto is a high-leverage ecosystem. When price moves fast, the domino effect of margin calls can amplify a 1–2% move into a cascade. That’s how $200 million gets wiped in minutes.

- Macro uncertainty: Fed minutes and government shutdown chatter add to nervousness. Investors don’t like compound uncertainty: trade war + fiscal impasse + evolving Fed guidance = more risk-off behavior.

- Short-term technical selling: Many crypto traders manage positions based on trendlines and wedges. Breaks in narrow ranges attract algorithmic selling or stop-loss hits that can accelerate moves.

Zoom out: market structure is not broken — why I’m still bullish

When you zoom out, the market structure looks intact. The drop we’re seeing today is very similar to many previous corrections in Bitcoin and other major cryptocurrencies. If you compare the current pullback to prior cycles, you’ll notice recurring patterns: sharp corrections followed by healthy retests of long-term trendlines and wedges, then continuation. Here’s how I look at it:

- Price action: Bitcoin and Ethereum are retesting long-term support levels. These are normal, expected events during bull cycles.

- Volume profile: The selling happens in short bursts but often meets absorbing bids from long-term holders and institutions.

- Relative strength across cycles: Dips with similar characteristics in the past have set up very profitable entries for those willing to buy into strength.

I asked myself: how is “right here” any different from “here” or “down here” on older charts? The technical retest looks healthy. Ethereum is retesting a wedge — and that kind of retest, if managed well, is a buying opportunity for accumulation. I’m not worried. In fact, I’m adding.

Personal positioning: what I’m doing and why

I’ve never been more confident in Bitcoin, Ethereum, and Solana than I am right now in this cycle. That doesn’t mean there won’t be more volatility; it means the risk/reward at these retest levels is attractive for long-term accumulation.

Practically, I’m doing the following:

- Buying Bitcoin on dips and continuing to dollar-cost average into core positions.

- Accumulating Ethereum for long-term protocol and DeFi exposure; watching for range breakouts.

- Picking selective exposure to Solana and other quality alts that have demonstrable on-chain usage and developer activity.

If you actively trade or want more tactical entry signals as price action unfolds, our crypto signals can help you time entries and exits—especially in fast-moving conditions like these. We deliver trade ideas, stop-loss levels, and risk management suggestions that are designed to fit a variety of time horizons. Consider it a way to pair long-term conviction with short-term tactical guidance.

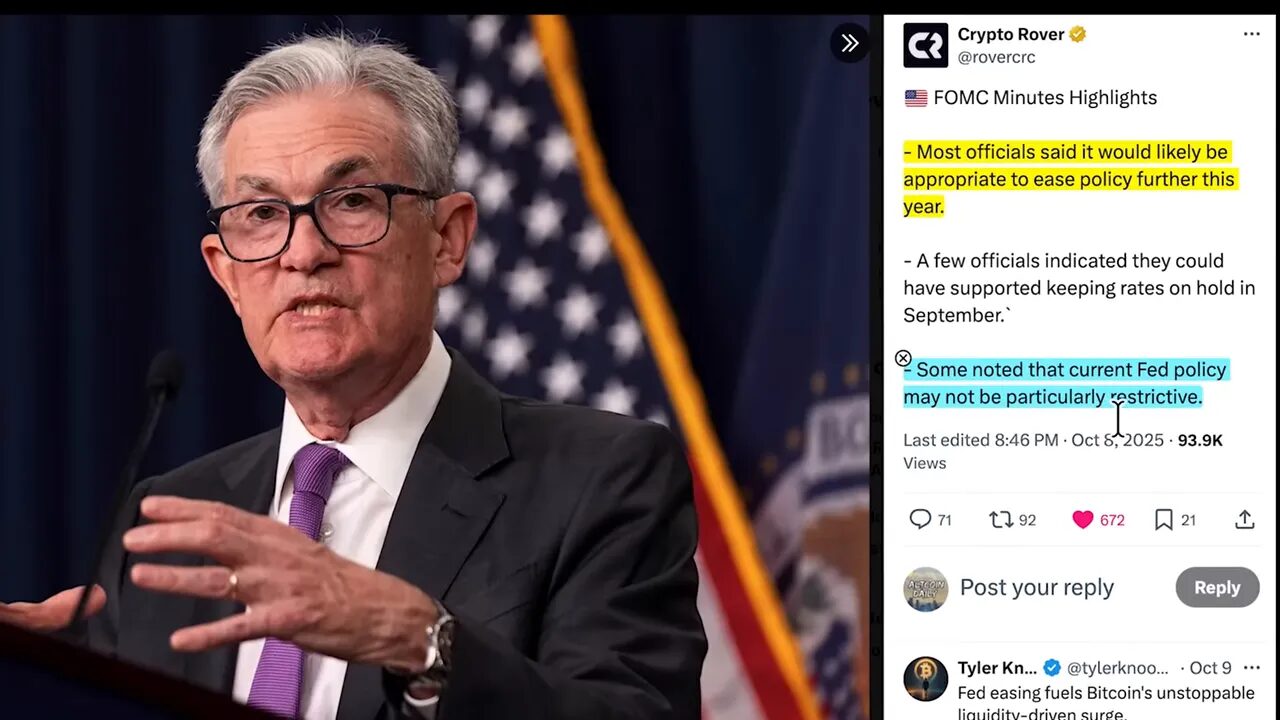

Fed minutes and the macro backdrop: why easing is likely

Beyond trade rhetoric, one of the most important macro pieces recently was the Fed minutes. The gist: most Fed officials indicated it would likely be appropriate to ease policy further this year. Some even noted that policy may be particularly restrictive. Combine that with political dysfunction — a government shutdown and early reports of federal layoffs — and you have a backdrop pushing markets toward expecting rate cuts.

Why does that matter for crypto?

- Lower rates generally increase appetite for risk assets. Over time, easier monetary policy tends to be bullish for speculation and asset prices.

- If corporate earnings growth disappoints due to trade friction, central banks often offset with easier policy, which can re-inflate asset valuations.

- Crypto’s narrative as a macro hedge and alternative store of value strengthens when fiat returns are weak and monetary policy becomes more accommodative.

In my analysis, a Fed rate cut seems likely within 1–2 weeks given the current dynamics. There also may be additional cuts later in the year and into 2026. That’s bullish tailwind for crypto — especially if those cuts coincide with legislative clarity and institutional onboarding.

On-chain signals: who’s buying and who’s selling?

On-chain data paints a fascinating picture. We’re seeing so-called “OG” wallets — the early Satoshi-era or long-term holders — selling chunks of Bitcoin. That can look scary if you assume they’re panic-selling. But context matters: much of this selling is being absorbed by the market in a way that suggests careful distribution rather than outright capitulation.

Key observations:

- Large wallet transfers to exchanges spike during volatility, but inflows alone don’t equal sell pressure. Some of that supply gets bought up by deep-pocketed entities.

- Newer investors are cost-averaging in at lower prices — picking spots on pullbacks rather than chasing the top.

- Institutional entities and high-conviction buyers are accumulating, not panicking. Evidence: decreasing exchange reserves and increasing custody holdings with regulated custodians.

This interplay — large sellers versus absorptive demand from long-term holders and institutions — is a hallmark of healthy market maturation. The market burned leveraged longs, cleaned house, and allowed stronger hands to position themselves. That’s constructive.

Ethereum: a healthy retest and future breakout potential

Ethereum dipped hard today but remains in a multi-month range. That retest is healthy. Historically, post-retest breakouts have led to sustained rallies when fundamentals and on-chain activity align.

What I’m watching for Ethereum:

- Break of the established range on volume — that would signal conviction and potentially a major leg up.

- Continued growth in activity: DeFi TVL, L2 transactions, NFT flows, and staking behavior all imply sustained demand for ETH.

- Institutional and developer momentum: continued migration of assets and activity to EVM-compatible chains or L2s that settle back to Ethereum reinforces ETH’s value proposition.

On dips like this, I’m adding to ETH positions. Again, tactical help is useful: our crypto signals team issues entry ranges, risk levels, and targets tailored to both swing traders and longer-term holders.

Institutional adoption: the floodgates are opening

Institutional adoption is showing up in real ways:

- Morgan Stanley: Removing restrictions on Bitcoin and crypto investments for all clients — that’s huge. When major wealth managers relax rules, client demand becomes much easier to service.

- BNY Mellon: Moving toward tokenized deposits and blockchain-based payments. They’re not just buying tokens; they’re integrating crypto rails into core banking infrastructure.

- Custody and custody-as-a-service: The large custodians are building rails — institutional flows will be easier, safer, and larger in scale.

This trend is structural and compounding. More access + clearer product offerings + institutional-grade custody = exponentially higher potential demand. That’s long-term bullish for both Bitcoin and smart-contract platforms like Ethereum and Solana.

Bitcoin as economic lifeline: real-world adoption stories

One of the more profound catalysts for Bitcoin’s adoption isn’t just price speculation — it’s survival and sovereignty. We heard powerful testimony from a Nobel Peace Prize winner who called Bitcoin a lifeline for people under authoritarian rule. Their statements were clear: Bitcoin bypasses government-imposed exchange rates and offers a means to restore and preserve national reserves when traditional assets are plundered or frozen.

These are not hypothetical use cases. Around the world, people living under unstable regimes and cratering currencies are turning to Bitcoin as a store of value and a payment rail. That real-world demand is slow to show up in price charts compared to speculative flows, but it is arguably the strongest possible narrative for long-term adoption: money that dictators can’t easily stop.

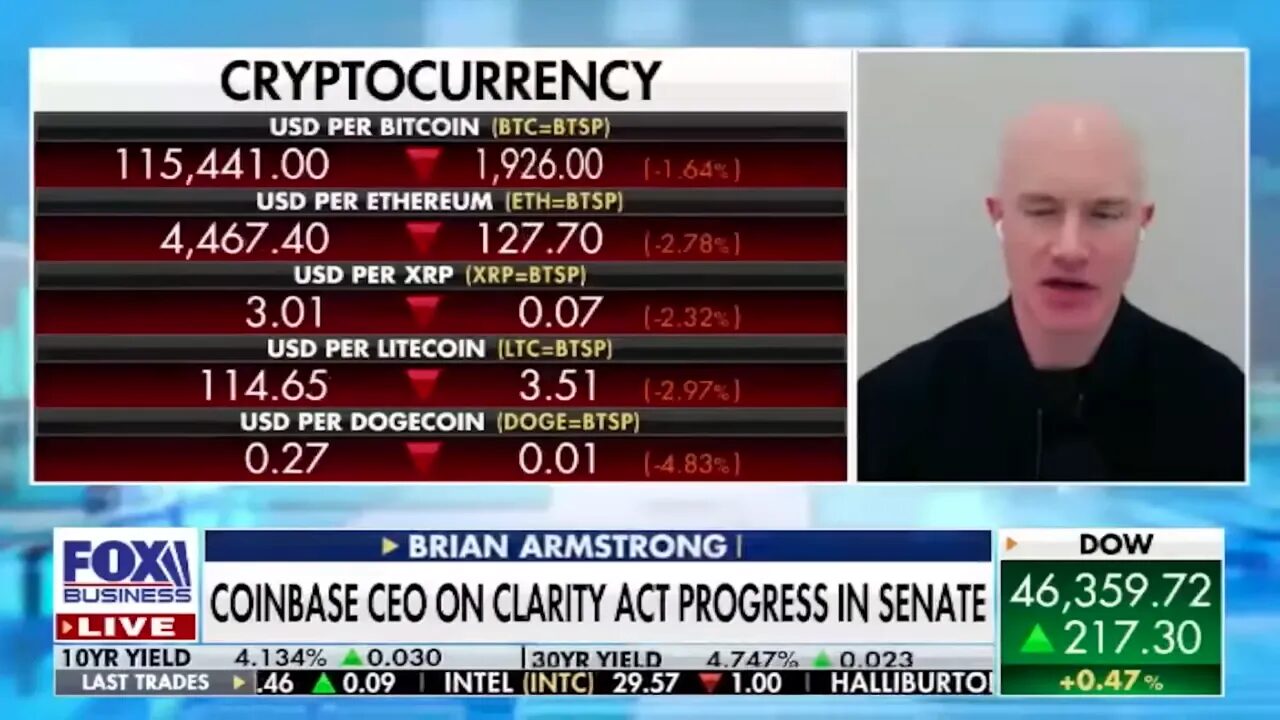

Regulation and clarity: Market Structure Clarity Act

Another major bullish development is the push for legislative clarity. The Market Structure Clarity Act — a bill aimed at clearly defining how non-stablecoin crypto assets (like BTC and ETH) are regulated — has bipartisan support and is being debated in the Senate after passing the House. Coinbase’s CEO called it a freight train: a bipartisan push to resolve whether crypto assets are commodities or securities.

Why this matters:

- Regulatory clarity reduces business risk for exchanges, custodians, and institutional allocators.

- Clarity unlocks products: ETFs, custody solutions, and financial engineering become easier when legal wrinkles are resolved.

- It sidelines previous actions that “weaponized” unclear rules to disadvantage certain market participants.

There are some lobbyists trying to reopen settled issues (like banning rewards on stablecoins), but most senators we’ve talked to aren’t inclined to regress. If this legislation passes, it will be a major catalyst for inflows, infrastructure build-out, and mainstream adoption.

Short-term catalysts and the timeline I’m watching

In the short term, several catalysts could accelerate the market’s recovery and set up a new leg higher:

- Fed signaling and rate cuts: easing policy is supportive for risk assets.

- Legislative clarity: passage of market-structure bills can unlock billions in institutional flows.

- Institutional onboarding: banks and wealth managers removing internal restrictions.

- Real-world adoption narratives: sovereign interest and humanitarian use cases.

Combine these, and Q4 into next year looks constructive for crypto. That said, timing is never certain. Volatility will remain, and there will be headline-driven shocks. The key is to plan position sizing and risk management ahead of time.

How to approach this dip: a practical playbook

If you’re wondering how to act in this environment, here’s a pragmatic approach I recommend:

- Assess time horizon: Are you a trader, swing trader, or long-term investor? That defines your targets and stop-loss discipline.

- Size appropriately: Don’t commit your entire position on a single flash dip. Dollar-cost averaging reduces the risk of catching a falling knife.

- Identify core allocation: Keep a base allocation to core assets (BTC, ETH) and use a smaller, discretionary allocation for high-conviction alts.

- Use tactical signals: For active traders, having reliable trade signals for entries, stops, and profit targets can improve outcomes. Our crypto signals offer actionable setups, tailored risk points, and step-by-step trade plans to help manage trades during volatile windows.

- Keep a margin for volatility: If you use leverage, make sure it’s low enough to survive multi-week corrections. Leverage turns small corrections into forced liquidation events.

Why quality alts still matter — and how to pick them

While my strategic message is „accumulate Bitcoin,“ I also use quality altcoins to increase exposure to crypto-native innovation. Alts are more speculative but can offer outsized gains if you pick projects with real adoption, developer activity, and tokenomics that reward long-term holders.

What I look for in an alt:

- Real on-chain usage: transactions, active addresses, and real economic activity.

- Developer and community activity: real development velocity signals commitment to the protocol.

- Clear value accrual: whether through staking, fees, or token utility.

- Institutional or enterprise adoption potential: integrations with banks, exchanges, or large custodians.

Examples I’m actively watching and accumulating include Solana for its throughput and app ecosystem, and projects across Layer 2s and infrastructure that help scale Ethereum. If you want more tactical ideas on specific alts and when to enter, our crypto signals provide curated setups with time-tested risk management rules.

Reality check: risk, patience, and the human element

Investing in crypto is emotionally demanding. Volatility triggers fear, and that fear can cause the worst decisions — selling at the bottom or blowing up a leveraged position. Remind yourself of the process:

- Have a plan before the move. Know your entry, target, and stop.

- Ignore the 24-hour noise when your horizon is multi-year.

- Trust proven metrics: on-chain flows, exchange reserves, custody inflows, and legislative progress.

I’m buying more into these dips, not because I’m reckless, but because I believe in the structural thesis for crypto and the improving backdrop of adoption and regulation. If you’re looking for a way to structure trades and limit emotional errors, tactical signals can be a useful tool: they help you follow a disciplined plan, rather than react impulsively.

Conclusion: this is a dip — and an opportunity

Short-term panic moves like today’s $200 million liquidation spike feel dramatic, but they are part of the maturing cycle of crypto markets. The market structure isn’t broken. Fundamental catalysts — potential Fed easing, institutional onboarding, legislative clarity, and meaningful real-world adoption — remain intact and arguably stronger than in prior cycles.

My take: this is a buying opportunity for high-conviction, quality crypto assets. I’m not just holding — I’m adding to positions in Bitcoin, Ethereum, and selective high-quality alts. If you trade, consider using structured guidance to manage risk and time your entries. If you invest for the long term, think about cost-averaging and preserving emotional capital to take advantage of dips.

We’ll keep tracking on-chain metrics, macro developments, and legislative progress. Stay disciplined, manage risk, and — if you want tactical entry and exit signals during this volatility — check out our crypto signals to complement your investing strategy.

Frequently Asked Questions (FAQ)

Q: Was today’s crash a signal that the bull market is over?

A: No. Flash crashes and liquidation cascades are common in leveraged markets. What matters is the macro context, on-chain behavior, and whether long-term trendlines hold. Right now, the larger structural indicators — institutional onboarding, declining exchange reserves, Fed easing expectations, and legislative progress — still point toward a constructive outlook.

Q: Should I sell my holdings to avoid further losses?

A: Only if selling aligns with your pre-defined risk plan or investment horizon. Panic selling during a forced liquidation event often locks in losses. If you have a long-term portfolio and believe in the fundamentals, consider dollar-cost averaging or adding to core positions rather than exiting impulsively.

Q: Is this the moment to buy altcoins like Solana?

A: This is a reasonable time to add selective alts if you’ve done the research and understand their risk profiles. Prioritize projects with active development, real usage, and clear value capture. Keep position sizes smaller than core holdings and use disciplined risk management.

Q: How can I protect myself from future liquidation cascades?

A: Reduce leverage, set sane stop-losses, hold adequate capital to survive drawdowns, and avoid using cross-margin positions that can wipe you out. Plan your entries and exits before major news events and stick to your rules.

Q: What role will the Market Structure Clarity Act play?

A: If passed, it will provide clarity about how crypto assets are categorized and regulated. That removes a major layer of legal risk for exchanges, custodians, and institutional allocators, which would unlock product innovation and larger capital inflows into crypto markets.

Q: How do on-chain metrics change my view?

A: On-chain metrics tell you who is moving coins, where supply is concentrated, and whether exchanges are accumulating or distributing. Right now, large wallets are distributing some BTC, but buyers are absorbing supply — consistent with selective accumulation rather than panicked capitulation. Keep watching exchange reserves, active addresses, and custody flows.

Q: What’s the simplest strategy for a new investor right now?

A: For beginners: pick a core allocation to Bitcoin and Ethereum, dollar-cost average regularly (weekly or monthly), and avoid leverage. Use a small allocation for high-conviction alts. Education and risk controls beat trying to time the bottom.

Final thoughts

Market volatility creates opportunity. Today’s crash was painful for leveraged participants, but it also carved out accumulation spots for those looking to build long-term positions in quality crypto assets. Remember: the game is to accumulate as much Bitcoin (and quality crypto exposure) as you can, while managing risk. If you want consistent, tactical trade ideas during times like this, our crypto signals are designed to help you act with a plan — not emotion.

Stay disciplined, stay curious, and I’ll keep bringing you the clarity and on-the-ground analysis you need to navigate these markets. Smash the like button if you appreciate straight talk — and keep stacking.