Table of Contents

- Introduction

- Outline

- What is EdgeX? The concise EdgeX Review summary

- EdgeX architecture explained

- EdgeX vs competitors: fees, liquidity, and mobile

- On-chain metrics and market quality in this EdgeX Review

- EdgeX incentives program: points, distribution, and anti-wash measures

- Security and risk checklist — what this EdgeX Review warns you about

- Getting started on EdgeX: wallet connect, email signup, and mobile

- Trading on EdgeX: the interface, order types and risk controls

- Withdrawals, network costs and tax considerations in this EdgeX Review

- Passive points and the ELP Vault

- Advanced trader tips and practical strategies in this EdgeX Review

- Practical risk management checklist

- Why EdgeX may matter long-term — summary from this EdgeX Review

- Using signals with EdgeX — a practical integration note

- Final takeaways from this EdgeX Review

- FAQ

- Closing thoughts from this EdgeX Review

Introduction

In this EdgeX Review I’ll walk you through everything I found important: origins, architecture, user flows, fees, liquidity, metrics, risks, and how to actually use the platform — desktop and mobile. If you’ve been watching the PERP DEX wars unfold, EdgeX deserves a hard look, and this EdgeX Review gives you the practical, no-spin breakdown so you can decide if it’s worth trying.

Outline

- What is EdgeX and why it matters

- How EdgeX works technically and architecturally

- EdgeX vs competitors (fees, liquidity, mobile)

- On-chain metrics and health indicators

- Security, custody and risk management

- Step-by-step onboarding: wallet, email, and mobile flows

- Trading on EdgeX: order types, margin, funding and stops

- Providing liquidity via the ELP Vault

- Withdrawals, fees and tax considerations

- Advanced tips, strategy ideas and practical takeaways

- FAQ

What is EdgeX? The concise EdgeX Review summary

This EdgeX Review opens with a simple proposition: deliver centralized exchange-grade perpetuals while keeping settlement on Ethereum and preserving self-custody. EdgeX launched its mainnet in September 2024 after incubating inside Amber Group — a familiar name in institutional crypto trading and market making. The pedigree matters: Amber’s market-making DNA helped EdgeX start with deep liquidity and professional-grade execution goals.

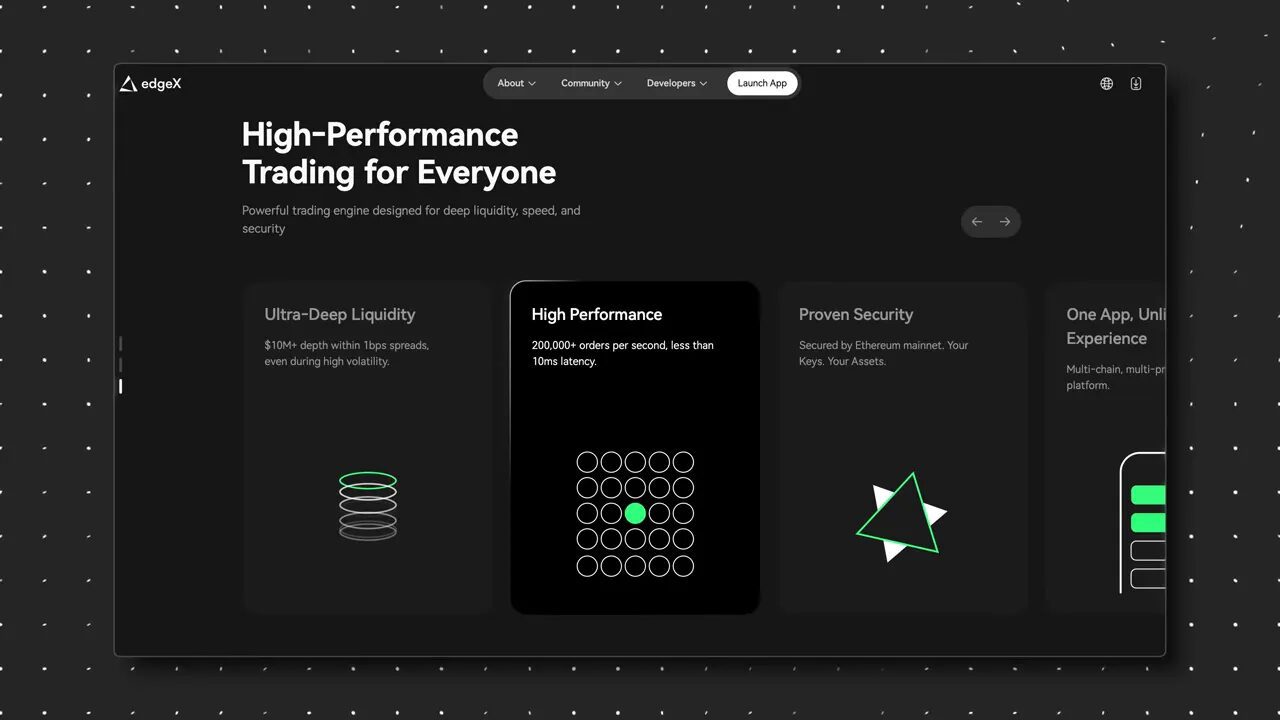

At its core, EdgeX is an order book perpetuals DEX that runs on a Stark-based Layer 2 stack (StarkX), designed to combine the speed of centralized exchanges with the trust-minimizing benefits of on-chain settlement. This EdgeX Review will unpack what that means for latency, order execution and your everyday trader UX.

EdgeX architecture explained

In plain terms, EdgeX is built as a three-layer system:

- Settlement layer — on-chain finality and custody verification, handled on Ethereum L1 and supported chains.

- Matching engine layer — order matching and execution at CEX speeds.

- Hybrid liquidity layer — routing flows between order books and shared liquidity pools.

That design lets EdgeX claim up to 200,000 orders per second and sub-10 millisecond latency when the system is fully optimized. Those throughput metrics are the kind of numbers required to make a DEX feel as responsive as a centralized exchange, and are the backbone to the claims in this EdgeX Review about institutional-caliber performance.

StarkX provides the zero-knowledge execution layer, helping keep on-chain settlement compact while allowing off-chain matching performance. For traders, the result is lower friction and faster fills without surrendering custody — a core selling point of this EdgeX Review.

EdgeX vs competitors: fees, liquidity, and mobile

A big part of any EdgeX Review is direct comparison. Two obvious competitors in the PERP DEX space are Hyperliquid and the newer incentive-heavy venues (e.g., Aster). Here’s how EdgeX stacks up in the areas that matter most for active traders.

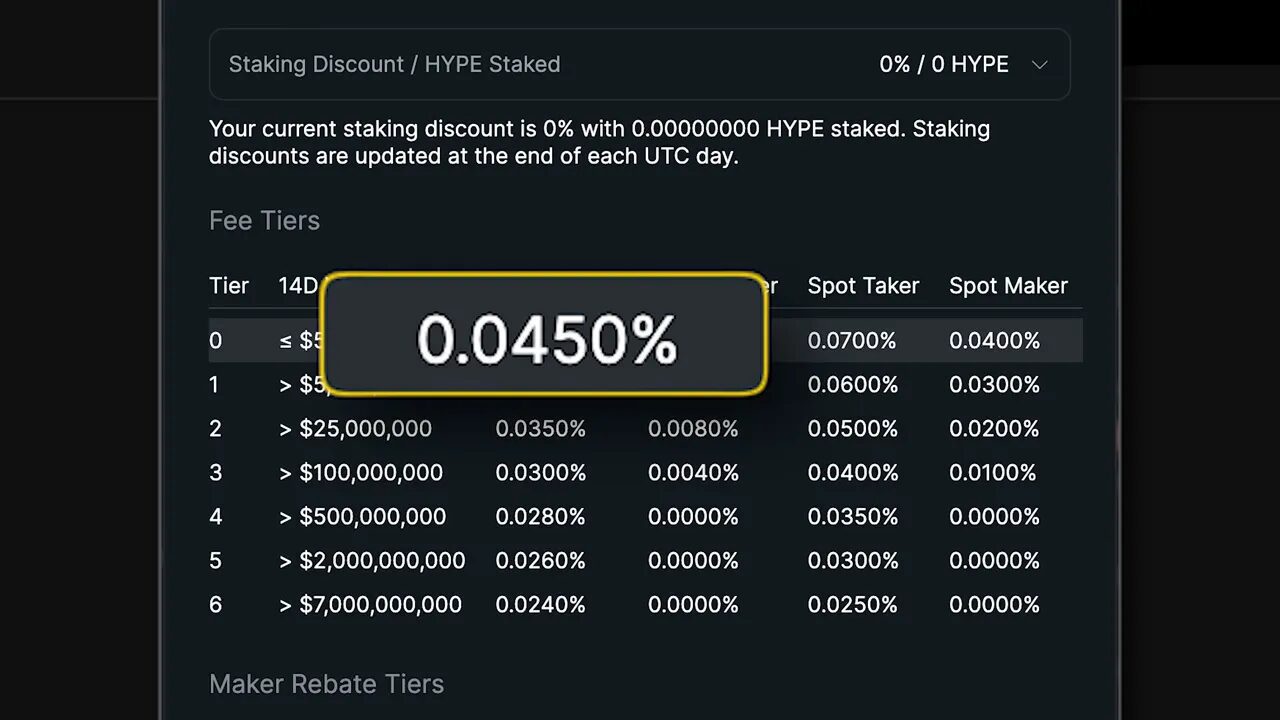

Fees

EdgeX’s baseline taker fee is 0.038% and maker fee 0.012%. That’s lower than Hyperliquid’s early base of 0.045% taker and 0.015% maker. For frequent taker flow (market orders) or for traders stacking many micro trades, the fee difference compounds quickly. This EdgeX Review emphasises the practical effect: if you trade dozens of entries, trims, and exits per week, shaving basis points on each leg adds up.

EdgeX also offers a VIP tier system. Using the sign-up mechanism often linked by partners will typically get you to VIP1, which reduces fees modestly (for example, taking maker down to 0.01% and taker to ~0.036% in many promos). In short: EdgeX competes aggressively on fee structure, and that matters a lot for retail and professional traders alike.

Liquidity (the real-world, retail size case)

Liquidity can be a misleading metric if looked at without context. This EdgeX Review focuses on the liquidity most traders actually use: sub-$6M market orders. Independent comparisons indicated EdgeX often provides more executable size on BTC order books in that range than Hyperliquid and several other venues. The practical implication: tighter spreads, less slippage on market orders and better chances of your limit orders getting filled.

Remember that liquidity is dynamic — market conditions shift and order book depth fluctuates. But with Amber Group’s market-making muscle behind EdgeX, the expectation is that they will maintain healthy liquidity for retail-sized flow. That’s a noteworthy reason this EdgeX Review flags the platform as competitive.

Mobile experience

EdgeX ships official mobile apps for iOS and Android. The apps aren’t just wrappers — they’re first-party, polished interfaces for futures trading with wallet connectivity and order management. Hyperliquid is mobile-friendly on web and has third-party clients, but it lacks a first-party native app. If you trade on the go, that first-party mobile experience is a distinct advantage highlighted throughout this EdgeX Review.

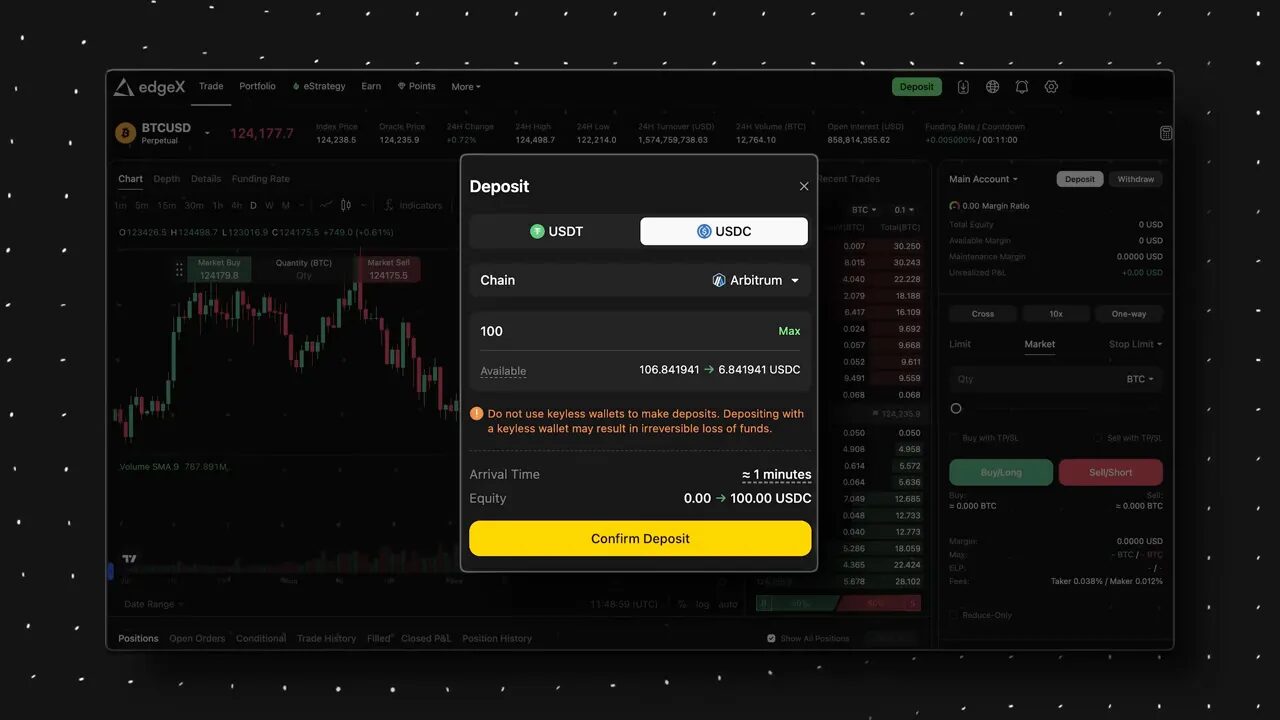

Collateral friction and multi-chain support

EdgeX supports deposits on Ethereum L1, Arbitrum, and BNB Chain, and accepts both USDT and USDC as collateral. This multi-chain approach reduces the need for bridging in many cases and makes depositing/withdrawing stables more flexible. Your collateral remains on your chosen chain while trades tap a shared liquidity pool. It’s a smart UX design that reduces friction — another practical reason to include EdgeX in this EdgeX Review discussion.

Withdrawals can be routed to the same three networks, which helps if your workflow spans multiple ecosystems or if a chain faces congestion. Hyperliquid’s single-path USDC -> Arbitrum model is simpler, but less flexible. That difference is worth considering if speed and the ability to choose withdrawal rails matter to you.

On-chain metrics and market quality in this EdgeX Review

Numbers tell a story. For this EdgeX Review I pulled public metrics (e.g., DeFiLlama data) and cross-compared them to industry context:

- ~$100 billion PERP trading volume in the last 30 days (at time of data snapshot).

- Monthly revenue record: >$31M in September (a substantial jump over previous months).

- 24h snapshot: ~$3.6B in volume and ~$1.3B in open interest — volume/open interest ratio ~2.7.

How do you interpret that ratio? A very high volume/open interest (V/OI) ratio can indicate incentive-driven churn — platforms that pay heavy rewards for volume often show extreme ratios (one example: Aster showing a ratio of 58 during heavy farming windows). Conversely, ultra-low ratios can suggest relatively stable flows and less active churn (Hyperliquid sat around 0.6 at one snapshot). EdgeX’s ~2.7 sits in a middle lane: not clearly a pure farm, but not zero churn either. In this EdgeX Review, that middle-ground ratio suggests a healthy mix of real trading activity supported by a points program designed to reward meaningful flows rather than wash activity.

EdgeX incentives program: points, distribution, and anti-wash measures

EdgeX runs a points campaign structured to reward actual usage. The design matters and is summarized here in this EdgeX Review because poorly designed incentives can destroy order book quality:

- 60% of points go to trading volume

- 20% to referrals

- 10% to TVL and vault points

- 5% to liquidations

- 5% to open interest

The team emphasizes that wash trades won’t be rewarded. The distribution favors genuine trading over raw farming and is transparent about its rules. In this EdgeX Review, that transparency plus the maintained balance in V/OI metrics signals a points program that isn’t yet saturated — a potential asymmetry in your favor if you intend to participate legitimately.

Security and risk checklist — what this EdgeX Review warns you about

EdgeX is non-custodial. That means you retain responsibility for your keys and wallet security. This EdgeX Review can’t stress enough: non-custodial = you are the help desk and the fraud department. Here are the practical safeguards everyone should follow:

- Always bookmark the official EdgeX link provided by trusted sources and use that bookmark. Avoid random Google results and ephemeral social posts — these are common phishing vectors.

- Keep long-term holdings on hardware wallets and trade only with a small hot wallet. This limits exposure if you make a mistake or your browser is compromised.

- Never share your seed phrase. Anyone who asks for it is a scammer.

- Review audits and security reports. EdgeX publishes audits from RigSec and SlowMist, and StarkX has Peckshield reviews for the Layer 2 infra.

- Be conservative with approvals. Only enable token approvals you understand and consider using limited approvals or allowance managers.

Getting started on EdgeX: wallet connect, email signup, and mobile

EdgeX offers two main onboarding flows discussed in this EdgeX Review: connect with a crypto wallet or sign up with an email. Both are convenient, but you still need an on-chain source of collateral (a wallet or centralized exchange) to deposit funds.

Wallet-based onboarding (crypto-native)

Steps (desktop):

- Install a battle-tested wallet (e.g., MetaMask).

- Decide which chain to use (Arbitrum or BNB Chain are cheaper gas options; Ethereum L1 is available too).

- Visit EdgeX and click Connect Wallet, approve connection in MetaMask.

- EdgeX will request a few signatures to verify wallet control — sign them in MetaMask.

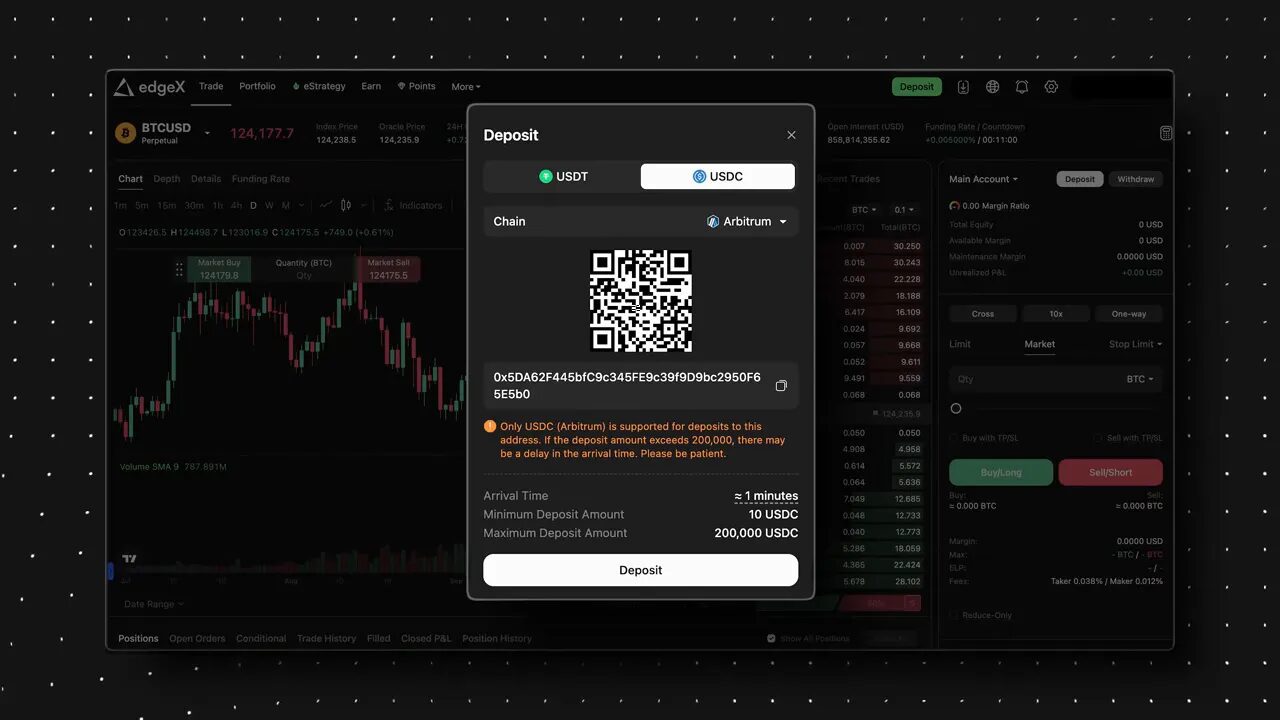

- Deposit USDC or USDT on the chosen chain (first deposit requires a token approval transaction for ERC-20 tokens).

In the EdgeX Review walkthrough, USDC on Arbitrum was used as an example. Deposit confirmations appear quickly on L2 networks and your funds show in the Portfolio tab.

Email-based onboarding (non-crypto-native friendly)

Email signup is smooth: add your email, input the confirmation code and you’re in. However, to trade you still need to deposit funds to the EdgeX deposit address provided — so you will either use a wallet or send stables from a centralized exchange (e.g., BitGet). If depositing from a CEX, be careful to choose the correct network: only Ethereum L1, Arbitrum or BNB Chain deposits will be credited to your EdgeX account — using other networks like Optimism will likely result in lost funds.

Mobile onboarding

EdgeX’s official mobile app is polished. If you want to connect your own wallet on mobile, most users will use the MetaMask mobile app alongside EdgeX. MetaMask mobile supports quick wallet creation with Apple ID/Gmail on iOS/Android, but hardcore users typically prefer writing down a seed phrase and securing it offline. The mobile Futures tab mirrors the desktop experience and is optimized for on-the-go order placement and position management — a recurring highlight in this EdgeX Review.

Trading on EdgeX: the interface, order types and risk controls

The trade cockpit on EdgeX is familiar to anyone who has used centralized futures platforms: a TradingView chart, an order book that stacks live bids and asks, a right-hand order ticket, and a position management panel showing P&L. This EdgeX Review focuses on the features that matter for risk-managed perpetuals trading.

Order types and stops

Core order types:

- Market orders — instant execution at the best available price (you pay taker fees and encounter slippage).

- Limit orders — placed at a set price, often earning maker fees and better fills for patient traders.

- Stops and OCO-style combos — you can attach stop loss and take profit to orders before submission which helps automate risk management.

Stop loss is your lifeline. In this EdgeX Review I stress attaching stops before you submit leveraged trades. EdgeX makes this straightforward: attach a stop and optional take profit to limit or market orders so you execute trades with a well-defined risk-reward profile.

Leverage, margin and an example calculation

Leverage can increase returns but also magnifies risk. A conservative rule of thumb I like — and recommend in this EdgeX Review — is to risk no more than 1% of your trading portfolio on any given margin trade.

Example:

- Trading portfolio: $10,000

- Risk per trade: 1% = $100

- Desired position size (BTC long): $1,000

- Using 10x leverage, margin required = $100

- If you set a stop 10% away, a 10% adverse move triggers the stop, costing you $100 — your predefined risk.

That example shows how leverage can be used as a capital efficiency tool to limit counterparty exposure while keeping position sizing intact. This EdgeX Review emphasizes that leverage reduces capital tied up, but only when used with disciplined stops and position sizing.

Margin modes: cross vs isolated

EdgeX defaults to cross margin (your account balance backs all positions). That’s powerful, but it exposes your whole account if you don’t enforce stops. Isolated margin spins up siloed accounts for positions — a liquidation in one won’t take down others. The practical takeaway in this EdgeX Review: use isolated margin if you want clean mental accounting and defined max loss per position; use cross only if you actively manage stops and understand shared account exposure.

Funding fees

EdgeX settles funding every four hours. Funding payments flip between longs and shorts depending on perpetuals’ premium or discount to spot. The UI shows a countdown and a sign: green/positive means longs pay shorts; red/negative means shorts pay longs. Funding can be a persistent cost for multi-day holds and sometimes dwarfs per-trade fees. Always glance at the funding indicator before sleeping on a position — a tip repeated across this EdgeX Review for practical safety.

Fees refresher

EdgeX’s fee schedule is tiered: the more volume you trade, the better your rates. Baseline maker/taker sits at 0.012%/0.038% at many data points. If you start at VIP1 via a promo sign-up (commonly used in partner referrals), you often start with slightly better rates (e.g., 0.01% maker and ~0.036% taker). For active traders, that difference compounds over weeks and months.

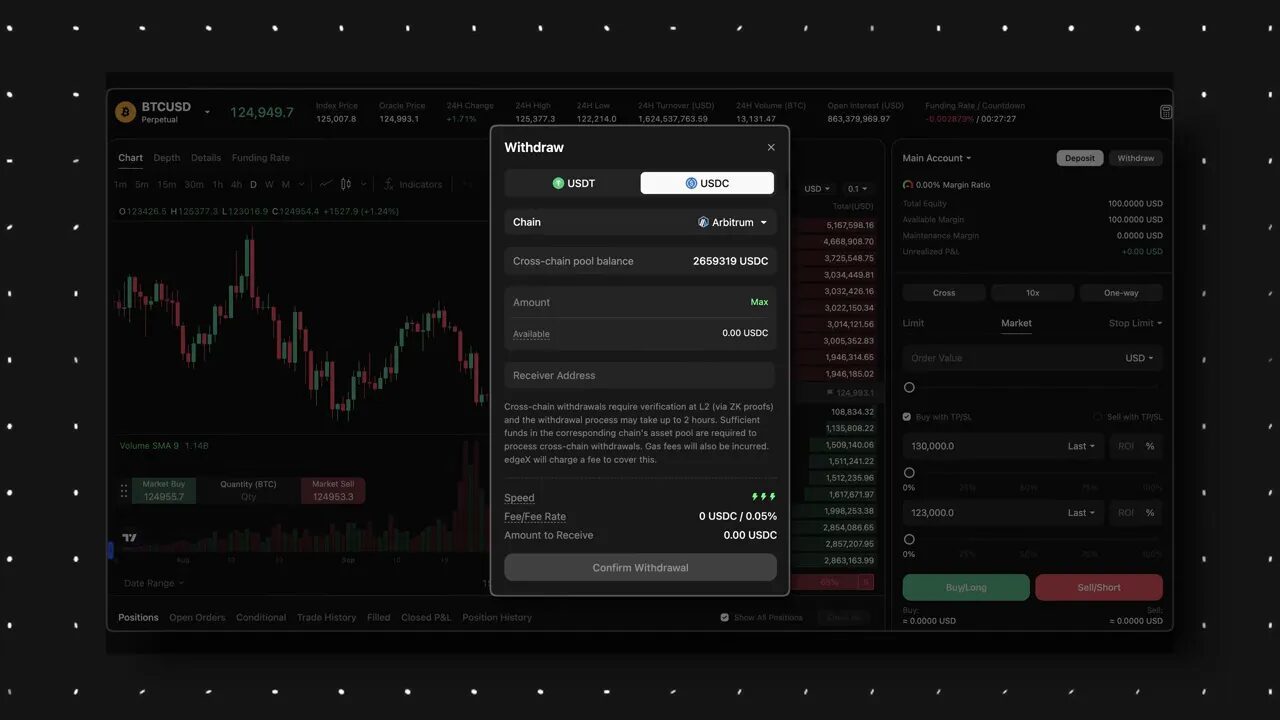

Withdrawals, network costs and tax considerations in this EdgeX Review

Withdrawal flow mirrors deposit flow: choose stablecoin, choose chain, enter receiver address and confirm. Arbitrum and BNB Chain withdrawals typically finalize in seconds; Ethereum L1 withdrawals often take longer but are usually minutes. EdgeX warns that under extreme conditions, withdrawals could take hours — rare, but worth noting.

Fee breakdown (typical):

- Ethereum L1: gas cost only

- Arbitrum: 0.05% withdrawal fee

- BNB Chain: 0.01% withdrawal fee

If you’re withdrawing often and gas is low, choosing Ethereum L1 for batch withdrawals can be economical. And a final practical reminder in this EdgeX Review: every trade is a taxable event in many jurisdictions. If you day trade, maintain clear records — consider dedicating a wallet to DEX trading for cleaner bookkeeping.

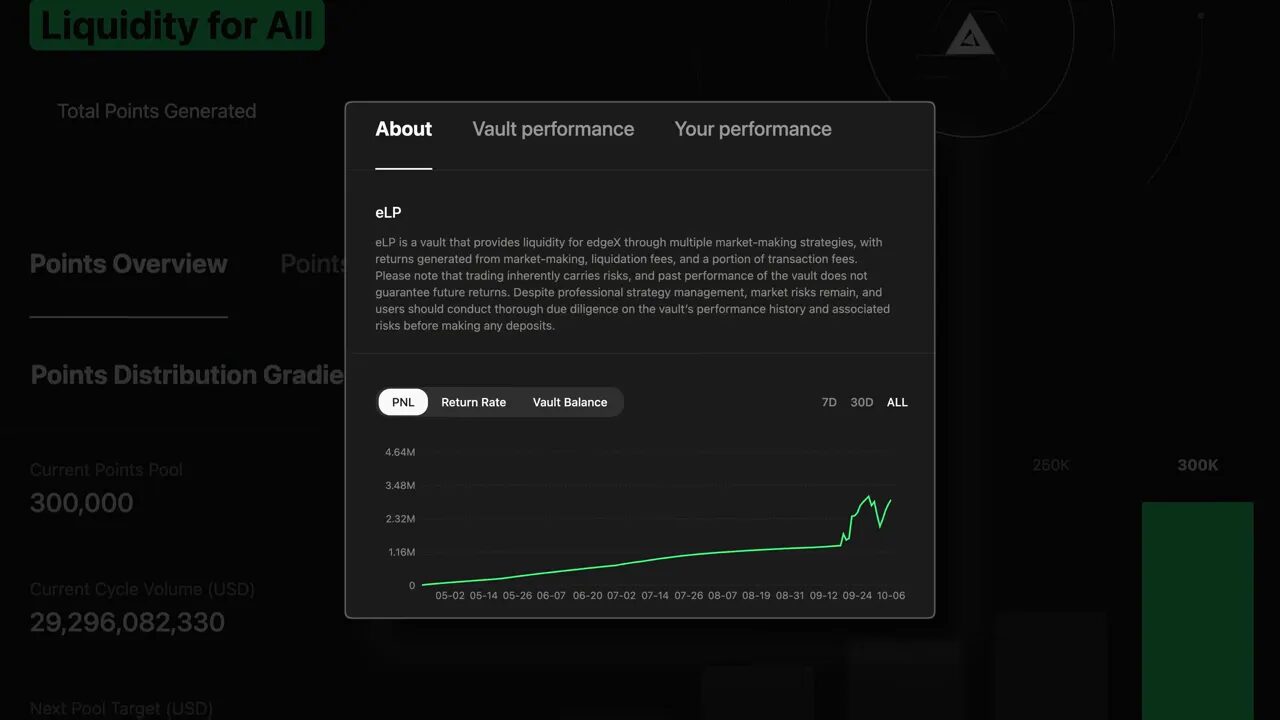

Passive points and the ELP Vault

Not everyone wants to trade perps. EdgeX provides a passive alternative: the ELP Vault. The ELP Vault supplies liquidity for the exchange through market-making strategies, earning returns from spread capture, liquidation fees and a portion of transaction fees. It’s a way to earn protocol yield and also accrue points because 10% of the points program is allocated to TVL and vault activity.

Steps to use ELP (summarized in this EdgeX Review):

- Go to E-Strategy → View Details → ELP Vault

- Create a Vault Account (sign the necessary ownership requests)

- Transfer funds from your main account into the Vault Account

- Track returns and withdraw when desired

At the time of my review, APR on the ELP Vault was advertised at ~34% (note: rates change). There’s smart contract risk and no guaranteed returns — treat ELP as a protocol yield product, not a guaranteed income stream. For those bullish on EdgeX but not interested in frequent PERP trading, ELP offers passive participation and point accrual — important context in this EdgeX Review.

Advanced trader tips and practical strategies in this EdgeX Review

Here are practical, action-oriented tips you can use if you plan on trading on EdgeX:

- Prefer limit orders for predictable fills and lower maker fees when you’re not rushing in. EdgeX’s order book depth in retail sizes makes limit execution attractive.

- Use small test trades to check fills and routing during volatile sessions. Even with fast matching engines, liquidity can momentarily thin.

- Slice large orders into multiple limit legs to reduce market impact if you need to move significant size relative to the order book depth you typically see.

- Set explicit stop losses and, if appropriate, use isolated margin per position to cap your maximum loss per trade.

- Check funding rate history before planning multi-day directional holds; if funding is persistently costly against your side, it can erode trade profitability.

- Use the ELP Vault if you want to earn protocol returns passively and collect points without the P&L swings of margin trading.

One operational suggestion that pairs naturally with the EdgeX Review’s trading strategies: if you rely on precise entry and exit timing, consider combining your trade plan with high-quality trade research. For traders who appreciate curated timing and trade ideas, a well-structured cryptocurrency signals service can provide disciplined entry points that fit your risk rules. Using signals in tandem with EdgeX’s fast execution can help you capitalize on intraday setups while sticking to strict risk management.

Practical risk management checklist

Before you trade using this EdgeX Review as a guide, confirm you’ve done the following:

- Wallet security: hardware wallet for long-term funds and a segregated hot wallet for trading.

- Know your chains: keep ETH for Arbitrum gas or BNB for BNB Chain transactions as needed.

- Test deposits/withdrawals with small amounts initially to validate network choices and addresses.

- Set stop loss and take profit levels for every margin trade before entering.

- Monitor funding countdowns if you plan to hold positions long-term.

- Record trades for tax purposes — treat every on-chain trade as a taxable event where applicable.

Why EdgeX may matter long-term — summary from this EdgeX Review

EdgeX is not just another DEX re-skin. Backing from Amber Group gives it meaningful access to market-making expertise and institutional-grade execution. Combined with a Stark-based L2 stack, flexible multi-chain deposits and a polished mobile app, EdgeX checks many boxes for traders who want CEX-like speed with non-custodial settlement.

Key reasons to consider EdgeX (summary points highlighted in this EdgeX Review):

- Competitive fee structure, particularly for makers and high-frequency retail traders.

- Healthy liquidity for retail-sized orders, reduced slippage and strong fill odds.

- Official mobile apps for iOS and Android, enabling real on-the-go trading.

- Well-designed points program that aims to reward genuine flows and passive liquidity providers.

- Strong focus on safety and audits with StarkX reviews and public audits listed.

Using signals with EdgeX — a practical integration note

Within this EdgeX Review I’ve suggested the synergy between accurate trade signals and EdgeX’s fast order routing. If you subscribe to a disciplined cryptocurrency signals service, it can provide trade ideas, entries and exits that pair well with EdgeX’s low-latency filling and competitive fees. This approach helps you keep emotional trading in check and apply consistent sizing/risk rules to each setup. If you’re actively scalping or swing trading, combining quality signals with EdgeX’s execution characteristics can be a sensible workflow.

Final takeaways from this EdgeX Review

EdgeX is a strong contender in the PERP DEX wars. It blends Amber Group execution know-how with a StarkX L2 backbone, multi-chain collateral convenience and a polished mobile experience. Fees are competitive, liquidity is good for retail sizes, and the points program looks reasonably structured to reward real usage. The ELP Vault offers a lower-friction, passive route for those who want exposure without active margin trading.

That said, the platform is non-custodial and requires standard crypto discipline. Liquidation risk, funding costs and tax obligations remain real and require careful management. For traders who understand those risks and want centralized-speed execution with on-chain settlement, this EdgeX Review finds EdgeX deserving of a place among top PERP DEX options.

FAQ

What is EdgeX and who created it?

EdgeX is a non-custodial, order-book perpetuals exchange incubated by Amber Group, designed to provide centralized exchange-grade speed and matching while settling positions on a Stark-based Layer 2 and supporting multiple chains for collateral. Its mainnet launched in September 2024.

How does EdgeX differ from Hyperliquid?

EdgeX typically offers lower baseline fees, official mobile apps, multi-chain stable collateral (USDT and USDC on Ethereum L1, Arbitrum, and BNB Chain), and order-book liquidity tuned for retail-sized trades. Hyperliquid has its own strengths but EdgeX focuses on CEX-like execution alongside non-custodial settlement.

What are the fees on EdgeX?

Baseline maker fees are around 0.012% and taker fees 0.038% in many contexts. VIP tiers reduce these rates and partner sign-ups often start at VIP1. Withdrawal fees vary by chain (e.g., Arbitrum 0.05%, BNB Chain 0.01%) and L1 withdrawals carry gas costs.

Can I use EdgeX without a crypto wallet?

Yes — you can sign up with an email address and receive a deposit address to fund your account. However, deposits still require a wallet or a centralized exchange to send funds to the provided address, and withdrawals require specifying a destination address.

Is EdgeX safe?

EdgeX is non-custodial and has public audits listed. The platform emphasizes security, but as with all non-custodial platforms, user-side security (hardware wallets, seed phrase safety, careful approval management) is essential. There is still smart contract risk and the usual risks associated with on-chain trading.

What is the ELP Vault?

The ELP Vault is EdgeX’s liquidity provision product. It runs market-making strategies that provide exchange liquidity and generate returns via spread capture, liquidation fees and a share of transaction fees. The vault earns TVL/vault points in EdgeX’s points program and carries APRs that vary over time.

How is funding charged on EdgeX?

Funding is settled every four hours. Depending on perp premium/discount to spot, either longs pay shorts or shorts pay longs. The funding rate is displayed in the UI and impacts multi-day holding costs — always check it before leaving a leveraged trade open overnight.

Does EdgeX reward wash trading?

EdgeX’s points program explicitly states that it will not reward wash trading. The distribution focuses on trading volume, referrals, TVL/vault points, liquidations and open interest, with transparency in allocation to discourage gaming the system.

How can I minimize risks trading on EdgeX?

Use small hot wallets for trading, keep long-term funds on hardware wallets, set stop losses and consider isolated margin for defined risk per position. Monitor funding rates, use limit orders where possible, and maintain thorough records for tax reporting.

Can I integrate trade ideas or automation with EdgeX?

EdgeX’s fast matching and public API-friendly architecture make it suitable for systematic strategies, but any automation still requires careful risk controls. For discretionary traders, pairing EdgeX execution with an informed cryptocurrency signals service can supply timing and trade setups that fit disciplined entry/exit rules.

Closing thoughts from this EdgeX Review

EdgeX is an important entrant in the PERP DEX landscape — an exchange that balances professional execution, healthy liquidity for retail sizes, and a strong UX across desktop and mobile. With Amber Group’s market-making capability and a StarkX-based stack, EdgeX looks engineered to deliver the execution quality many traders have been waiting for de‑centralized.

As always, the EdgeX Review concludes with a reminder: self-custody equals responsibility. Follow security best practices, test flows with small amounts, and trade with strict risk rules. If you’re curious, try the platform with modest capital, or consider passive exposure through the ELP Vault if you prefer lower hands-on risk.

If you want to explore EdgeX after reading this EdgeX Review, make sure you use only official links and double-check networks when depositing from centralized exchanges. Good luck, trade safe, and remember — the best edge is discipline.