Table of Contents

- Quick take

- What Folks Finance does and why it matters

- Why TVL vs market cap matters for early-stage DeFi

- How the product actually works: deposits, loans, swaps, XPortal

- Tech stack and integrations

- On-chain distribution and holder analysis

- What’s driving recent price action

- Price outlook: reasonable scenarios

- How to approach Folks Finance from a trading and investment perspective

- Practical safety checklist before interacting

- Risks to keep in mind

- Actionable next steps if you want exposure

- Final thoughts

- Is Folks Finance audited and safe to use?

- Which chains does Folks Finance support?

- What are typical APYs on Folks Finance?

- How does the XPortal work for cross-chain transfers?

- Can Folks Finance reach $40?

- Should I use leverage on ultra-swap?

- How do I stay informed about key events and airdrops?

Quick take

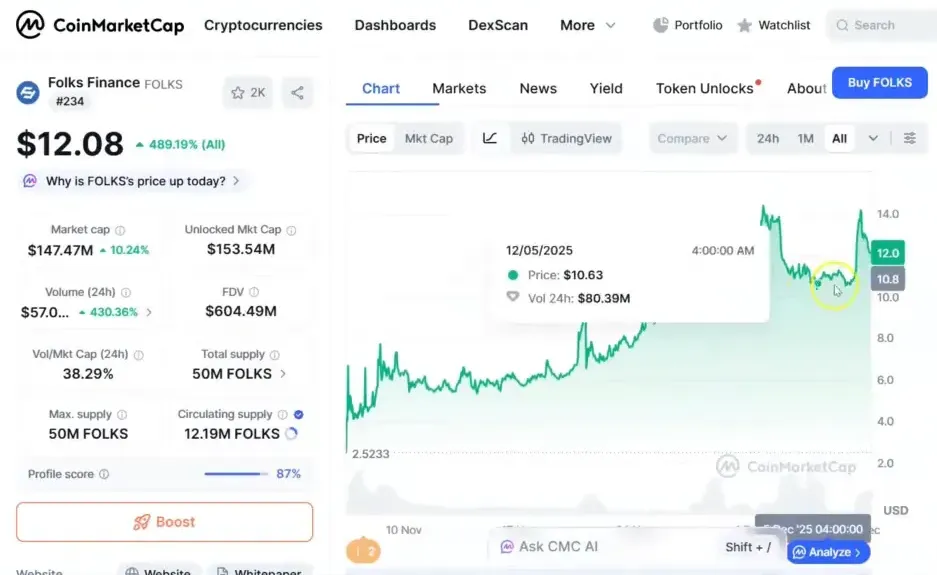

Folks Finance has emerged as one of the more interesting cross-chain DeFi protocols this cycle. It offers lending, borrowing, staking, swaps, and seamless cross-chain transfers while already showing strong on-chain traction: total value locked around $132 million shortly after launch and a market cap in the same neighborhood. Those two metrics lining up is a bullish structural signal, but the token still carries typical early-stage risks: uneven distribution, limited holder counts on some chains, and heavy momentum driven by an ongoing airdrop.

What Folks Finance does and why it matters

At its core, Folks is a cross-chain DeFi ecosystem built to remove the friction of moving assets between blockchains. It combines native lending and borrowing markets, staking, and a unified liquidity layer that aims to eliminate the need for wrapping or awkward bridge mechanics. That means users can collateralize an asset on one chain and access liquidity or lending markets on another — without the usual liquidity splits that kill capital efficiency.

Key features include:

- Cross-chain lending and borrowing that lets assets act as native collateral across multiple ecosystems.

- XPortal and ultra-swap for fast cross-chain transfers with a focus on simplicity and speed.

- High APYs for depositors on a range of assets, which attracts idle liquidity and yield-seeking capital.

- An airdrop and promotional activity that has helped the token gain visibility and short-term momentum.

Why TVL vs market cap matters for early-stage DeFi

Total value locked (TVL) is a direct expression of capital actually using a protocol. Market cap reflects market sentiment and token supply mechanics. When TVL and market cap trade in the same ballpark, it signals that real economic activity backs the token price rather than pure hype.

Folks Finance shows roughly $132 million TVL and a market cap around $147 million. For a protocol that has been live for only a few weeks this is a very constructive ratio. It suggests the app is capturing genuine liquidity and that users are engaging with the core product: depositing, borrowing, and swapping.

How the product actually works: deposits, loans, swaps, XPortal

The user experience is deliberately simple and mirrors established DeFi patterns while adding cross-chain glue. Here’s how each piece functions in practice.

Deposits and yield

Deposit flows are straightforward: connect your wallet, pick a chain, choose an asset, and deposit into a pool. APYs vary by asset and chain, but some numbers stand out. Bitcoin deposits show around 7.5% APY, while certain native or stable assets report double-digit yields (one token listed at roughly 34.33% APY in the UI example). Those rates are attractive for passive holders and can pull capital out of idle wallets into productive use.

Borrowing and collateral

Borrowing works like other lending protocols: choose a collateral asset, decide how much to lock, and draw a loan against it. The cross-chain element means collateral can be native to one chain while loans or other positions operate on another, increasing leverage and liquidity options without extra wrapping steps.

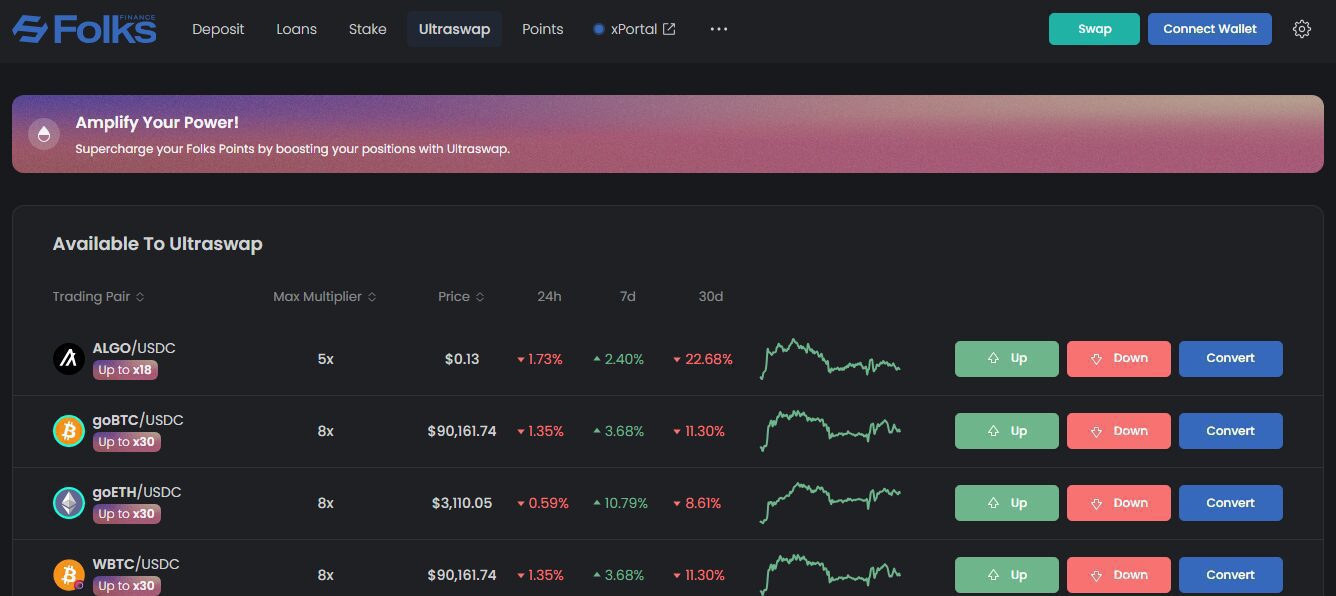

Swaps and ultra-swap

Swapping is built into the protocol with the usual route selection and expected slippage/quote screens. The ultra-swap feature layers on cross-chain functionality and adds leverage multipliers for traders who want exposure with tighter capital. The UI shows estimated receive amounts, timeframes (often under a minute), and liquidation margins for leveraged trades.

XPortal and cross-chain transfers

XPortal is the bridge-style component for quick transfers between supported chains. It leverages interoperability messaging and messaging protocols rather than classic wrapping, aiming to avoid liquidity fragmentation. That makes cross-chain UX faster and simpler for retail users and traders who want to move funds without complex bridge steps.

Tech stack and integrations

Folks Finance ties together several interoperability solutions and messaging standards. The protocol mentions using technologies like Chainlink cross-chain messaging, CCIP, wormhole messaging, and other bridges. These connections let the protocol provide unified pools where liquidity is accessible natively across chains rather than split into siloed vaults.

On-chain distribution and holder analysis

One of the early red flags is distribution concentration and inconsistent holder counts on different chains. Holder numbers vary widely by chain: Etherscan shows modest numbers, BSC displays over a thousand holders, and other chains have far fewer. That uneven distribution is common for multi-chain launches, but it matters because price moves are heavily impacted by how many hands hold the token and where liquidity sits.

On-chain snapshots also show large balance increases on certain dates, which aligns with sudden price jumps and suggests concentrated buying or coordinated accumulation. That can drive dramatic short-term price action yet increases risk if selling pressure comes from a small set of wallets.

What’s driving recent price action

Several catalysts explain the rapid price appreciation:

- Airdrop and promotional momentum that continually surfaces the token to new audiences.

- Strong APYs and an intuitive product that attract yield-seeking capital.

- Cross-chain product novelty where a simpler UX for multi-chain collateralization is genuinely valuable.

- Speculative momentum as traders chase quick gains in a bull market.

These elements together create a positive feedback loop: users deposit to earn yield, TVL rises, headlines form, and traders pile in looking for short-term gains. That can carry the token toward price targets like $40 under continuing momentum, but it also intensifies volatility.

Price outlook: reasonable scenarios

Short-term price moves are primarily momentum-driven. Here are three reasonable scenarios to keep in mind:

- Extension of momentum – Continued airdrop hype, rising TVL, and broader market strength push the price higher. With enough buying, a move to $40 within weeks is plausible.

- Consolidation – After aggressive spikes the token consolidates while the team adds features or audits, and TVL growth continues more gradually. Price stabilizes and becomes less volatile.

- Sharp pullback – Concentrated holders take profits or broader market sentiment shifts, leading to a rapid retracement. This is common in early-stage tokens with uneven holder distribution.

Which scenario plays out will depend on liquidity flows, how the airdrop unfolds, and whether user retention on the protocol grows beyond the initial hype cycle.

How to approach Folks Finance from a trading and investment perspective

Folks offers several ways to participate: long-term token holding, yield farming by depositing assets into pools, borrowing and leveraging positions, or short-term trading around news events and airdrop drops. Each approach has a different risk profile:

- Long-term holder – Evaluate team credentials, roadmap, and audits. Keep position sizing conservative until distribution becomes broader.

- Yield farmer – Use deposit APYs to generate passive income, but track impermanent risks and the health of the underlying assets used as collateral.

- Trader – Trade volatility around announcements and airdrop-related events. Be disciplined on entries and exits.

For traders focused on timing and risk management, cryptocurrency trading signals can be a helpful complement. Signals provide structured entry and exit ideas for volatile names and can help manage the rapid swings created by airdrops and concentrated buying. If your plan includes active trading around Folks or similar tokens, consider adding a reliable signals layer to your process to avoid emotional trading during sharp moves.

Practical safety checklist before interacting

Before depositing funds or trading a new DeFi token, run through this checklist:

- Confirm the contract address across multiple sources and use verified links to avoid phishing.

- Check whether the protocol has undergone a third-party security audit and read the audit findings.

- Assess token distribution and holder concentration via on-chain explorers.

- Start with small allocations and scale up as you gain confidence in the protocol.

- Use hardware wallets for large deposits and avoid giving unlimited approvals when possible.

Risks to keep in mind

Even with compelling metrics, the token is not without downside. Key risks include:

- Concentrated holders who can produce heavy sell pressure.

- Airdrop-driven momentum that can reverse once distribution finishes.

- Cross-chain complexity which magnifies attack surfaces and operational risk.

- Smart contract risk inherent in any DeFi protocol, especially new projects.

Actionable next steps if you want exposure

If you decide to allocate, the following approach balances upside and risk:

- Allocate a conservative portion of your portfolio that you can afford to lose.

- Prefer depositing stable assets or blue-chip tokens into yield pools rather than holding large token positions if you are risk-averse.

- Monitor on-chain indicators daily: TVL changes, active addresses, and big wallet movements.

- Use limit orders and stick to risk rules for leveraged positions. Know your liquidation thresholds before opening trades.

- Consider complementing your strategy with cryptocurrency trading signals to time entries and exits around volatility events.

Final thoughts

Folks Finance is a strong example of the new wave of cross-chain DeFi: pragmatic product design, high initial TVL, and an easy UX for deposits, loans, and swaps. Those factors give it a plausible path to much higher prices in a sustained bull market. However, early-stage distribution concentration and airdrop-led momentum mean the upside comes with elevated volatility.

If you plan to participate, prioritize security, position sizing, and a clear exit plan. Use the protocol features—deposits, cross-chain swaps, and XPortal—to put capital to work, but keep an eye on holder concentration and TVL dynamics. For active traders, integrating structured tools like cryptocurrency trading signals can help you navigate fast moves and capitalize on short-term opportunities without getting whipsawed by emotion.

Is Folks Finance audited and safe to use?

Check the protocol documentation and the project website for audit reports. Even if an audit exists, smart contract risk remains. Use conservative position sizes, verify contract addresses, and avoid unlimited token approvals. Prefer small test transactions before committing larger sums.

Which chains does Folks Finance support?

Folks Finance supports multiple chains including Algorand, Avalanche, Ethereum, Base, BNB Smart Chain, and Arbitrum. Cross-chain features are a central part of the product, allowing native collateralization and unified pools across these ecosystems.

What are typical APYs on Folks Finance?

APYs vary by asset and chain. Examples shown in the interface include Bitcoin at roughly 7.5% and certain native tokens reporting double-digit yields up to the mid-30s for specific pools. Rates change based on supply, demand, and protocol incentives.

How does the XPortal work for cross-chain transfers?

XPortal uses interoperability messaging to move assets between chains quickly, aiming to avoid wrapping or splitting liquidity. Transfers are typically fast and the UI shows estimated execution time and receive amounts. Always confirm fees and bridge mechanics before initiating large transfers.

Can Folks Finance reach $40?

A move to $40 is plausible under continued bull market conditions, growing TVL, and ongoing demand from yield-seeking capital and traders. However, that outcome depends on sustained liquidity inflows, broader market strength, and improved distribution. Expect high volatility along the way.

Should I use leverage on ultra-swap?

Leverage increases both upside and downside. If you use leverage, understand liquidation margins and set stop-loss rules. For most users new to cross-chain leverage, conservative or no leverage is the safer choice until you fully understand the mechanics.

How do I stay informed about key events and airdrops?

Follow official channels and on-chain explorers for snapshots and distribution updates. Monitor TVL charts, active addresses, and large wallet movements. If you trade frequently around events, pairing your process with cryptocurrency trading signals can give timely alerts on volatility and trade setups.

Folks Finance is a compelling cross-chain DeFi experiment with real product traction and attractive yields. It could deliver strong returns in a strong market, but treat it like any early-stage crypto: size positions conservatively, verify everything, and manage risk actively.