This post unpacks the surge in precious metals and the market dynamics behind the phrase everyone’s talking about: Gold And Silver ALL TIME HIGHS. I’ll walk through why gold is melting up, why silver is racing to catch up, where mining stocks fit into this rally, what could derail the move, and what these trends say about the broader economy and investor behavior.

Table of Contents

- Introduction — The Meltup That Got Everyone Talking

- Why Gold Is Melting Up

- ETF Flows and Central Bank Buying — The Structural Demand

- Gold Technicals and Price Targets

- Silver: Catch-Up, Industrial Demand and an Independent Thesis

- ETF Flows Into Silver and What They Mean

- The Gold-Silver Ratio (GSR) — Interpreting the Catch-Up Move

- $50 Silver — Realistic or Hype?

- Mining Stocks: The Leveraged Bet on Metals

- What Could End the Rally?

- Macro Implications — A Precious Metals Rally Isn’t Cheerful News

- Crypto, Bitcoin ETFs and How Traders Are Reacting

- Ways to Gain Exposure — Practical Options

- Trading and Tactical Considerations

- FAQ

- Conclusion — Takeaways and Cautions

Introduction — The Meltup That Got Everyone Talking

When headlines read Gold And Silver ALL TIME HIGHS, it feels like the market is sending a loud message. Gold’s move has been unusually steep and persistent, and silver has started to join the party with aggressive upside momentum. Mining shares, which historically act as leveraged plays on bullion prices, have been racing higher, reflecting both fundamentals and speculative flows.

So: why now? Part of it is simple monetary market mechanics. But the full story is a mix of macro, political and technical forces intertwined with investor psychology and supply-side realities. I’ll unpack each element, highlight the risks, and suggest how different participants — long-term holders, traders, and curious investors — might think about exposure.

Why Gold Is Melting Up

The label Gold And Silver ALL TIME HIGHS is driven by three clear pillars: monetary policy expectations, currency dynamics, and risk/hedge demand. Each is powerful on its own; together they’ve acted like rocket fuel.

1) Monetary Policy and Rate Cut Odds

In short: rising chances of rate cuts have been a major driver. When the market prices easier policy, bond yields drop and the dollar tends to weaken. That combination benefits gold because: a) bullion doesn’t pay interest (so it looks relatively more attractive when yields fall) and b) a weaker dollar raises the USD price of gold for foreign buyers.

Recent weak labour market prints pushed rate cut expectations higher and that helped gold accelerate. Every macro print that suggests easing nudges yields, the DXY and gold in predictable directions — lower yields, weaker dollar, higher gold. That mechanical relationship has been central to the Gold And Silver ALL TIME HIGHS narrative this year.

2) Dollar Weakness and the DXY

The DXY has materially weakened year-to-date. Think of the dollar as the base currency for global trade and asset pricing. When the dollar retreats, dollar-priced, non-yielding assets (like gold and silver) get an immediate boost. That’s a big part of why the Gold And Silver ALL TIME HIGHS conversation gained momentum: the macro backdrop favors precious metals on a currency-adjusted basis.

3) Political Pressures, Fed Credibility and the Hedge Bid

When central bank independence feels threatened or political rhetoric challenges institutional credibility, investors reach for assets viewed as “outside” the system. Pressure on the Fed and heated political debate create a hedge-the-institution impulse. That impulse favors gold and silver and helps explain part of the premium behind the Gold And Silver ALL TIME HIGHS phenomenon.

4) Geopolitics and Trade Frictions

Heightened geopolitical risk and trade uncertainty also support a safe-haven bid. As trade frictions rise and global growth expectations wobble, assets that don’t rely on cross-border payment rails or corporate earnings become more desirable. Gold and physical bars often win these contests, which contributes to the structural bid underpinning the rally.

ETF Flows and Central Bank Buying — The Structural Demand

When you see the Gold And Silver ALL TIME HIGHS story play out, it’s not just retail traders piling in — it’s institutions and central banks too. Physically backed gold ETFs posted their strongest first-half inflow since 2020, adding roughly 397 tonnes. Total ETF holdings hit their highest levels since August 2022.

Equally important: central banks have been steady buyers. Official buying has topped 1,000 tonnes per year for three consecutive years, pushing reserves closer to 36,000 tonnes. Central banks buying at scale is a structural demand factor — it’s not short-term speculative froth. That sustained appetite helps support higher prices and legitimizes the Gold And Silver ALL TIME HIGHS narrative.

But it’s worth remembering that flows can shift. ETF inflows can flatten or reverse, and central bank demand can slow. Both would remove key pillars behind the rally.

Gold Technicals and Price Targets

Technicals matter when momentum accelerates. Gold consolidated in a roughly $3,300 range between April and August, then broke out in September. One simple measured move projects about $3,830 (the breakout range applied from the prior all-time high of roughly $3,500). That would push gold toward the psychologically important $4,000 level, possibly within Q1 next year.

Big financial houses have also weighed in. Goldman Sachs’ base case projects gold above $4,000 in the first half of next year if the drivers persist. They also carved out a scenario where, if Fed credibility suffered a larger hit and private portfolios rotated aggressively into gold, targets could edge toward $4,500–$5,000. That’s not the base case, but it shows how quickly the math can change if flows become magnitude larger.

Silver: Catch-Up, Industrial Demand and an Independent Thesis

Silver joined the move later, which is classic market behavior: gold runs first, then silver accelerates as traders recognize the trend. The Gold And Silver ALL TIME HIGHS storyline now includes silver because silver has momentum of its own — both as a monetary hedge and as an industrial metal.

Silver’s Dual Role: Monetary and Industrial

Unlike gold, roughly half of silver consumption is industrial: solar panels, EVs, electronics and other manufacturing. That creates a two-headed demand model: speculative/hedge demand on one side and real industrial use on the other. When the dollar weakens or rate cut expectations rise, silver jumps with gold — but the industrial component can sustain or amplify moves when global manufacturing or green-tech demand expands.

Supply Dynamics and Deficits

Most silver is produced as a byproduct of other metal mining, so a silver price spike doesn’t immediately translate into large increases in primary silver production. The Silver Institute projected another sizable shortfall in 2025 — the fifth consecutive year of deficits after above-ground stock declines since 2021. That structural shortage supports higher long-term prices and helps explain why the Gold And Silver ALL TIME HIGHS label now stretches to include silver.

ETF Flows Into Silver and What They Mean

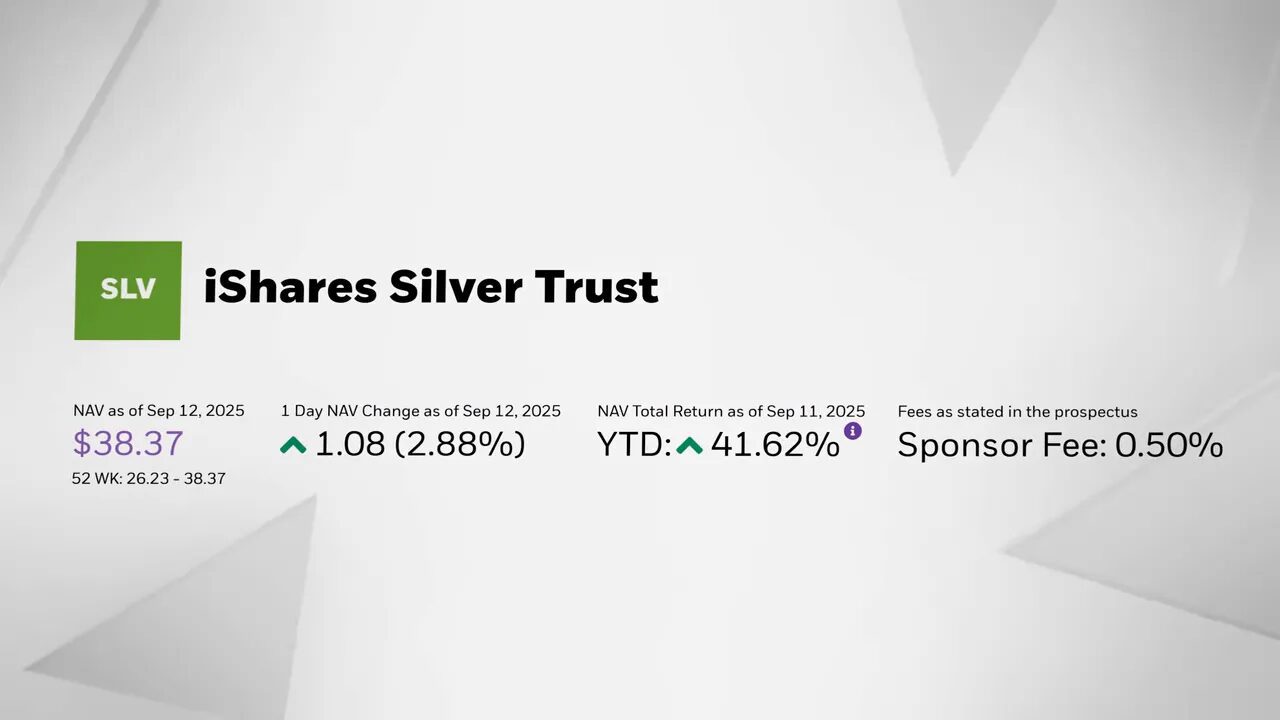

Investor flows have rotated into silver as some traders chase higher beta returns. The largest silver ETF (iShares Silver Trust) held over 15,000 tonnes at the time of the analysis — a clear sign that financial demand is meaningful. When traders move from gold into silver, they’re often targeting outperformance; that rotation has helped compress the Gold-Silver ratio and drive silver higher.

The Gold-Silver Ratio (GSR) — Interpreting the Catch-Up Move

The Gold-Silver Ratio (GSR) gives insight into relative value between the two metals. Historically, at cycle tops or times of panic, GSR spikes as gold outperforms and silver lags. But after the initial gap, silver can run hard on the catch-up.

Key historical moves:

- 1991: GSR peaked near 106, then slid to low-40s as silver outperformed.

- 2008–2011: GSR jumped to 88 then fell to about 30 as silver exploded in the commodities boom.

- 2020–2021: GSR spiked above 120 during the shock, then fell into the low 60s as markets rebounded.

Recently GSR moved to about 105 and has since retraced into the 80s — signaling silver’s catch-up phase. That’s technical confirmation that silver may continue to outperform gold in the near term if speculative momentum remains intact.

$50 Silver — Realistic or Hype?

With silver in the low $40s and momentum favoring the metal, the 2011 high just under $50 is a proximate target. Levels close to that historical peak become magnets once price gets near, especially during a momentum-driven rally. If macro and flow drivers persist into year end, $50 silver is feasible. Firms like Goldman also note scenarios where industrial and financial demand combine to make that outcome reachable by next year.

Mining Stocks: The Leveraged Bet on Metals

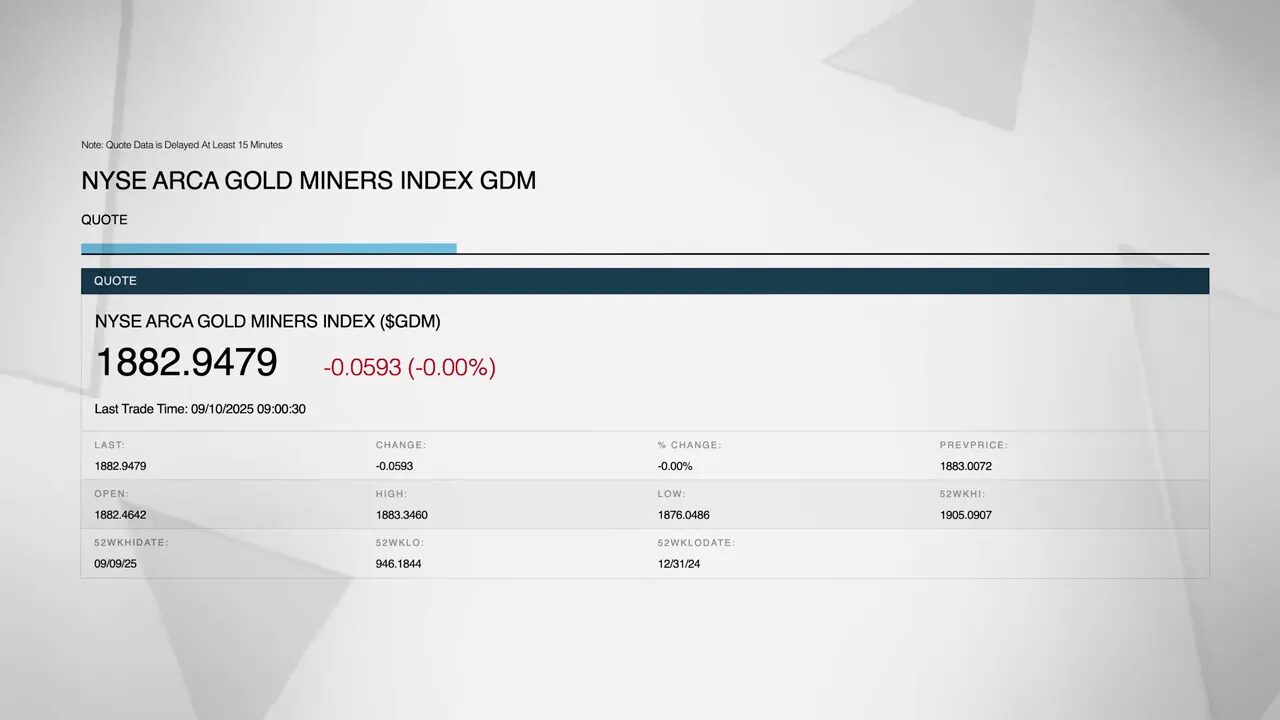

The miners historically offer leveraged exposure to bullion. When the gold price rises, the margin between price and a miner’s all-in sustaining cost widens, boosting profitability disproportionately. That’s why the NYSE Arca Gold Miners Index (the common benchmark) has soared — illustrating the concept of miners as a beta play on gold.

What’s Driving the Miner Rally?

- Rising gold prices pushing margins and free cash flow.

- Investor reallocations into miners ETFs — for example, a large August inflow into the VanEck Gold Miners ETF.

- Speculative positioning: traders treating miners as a way to amplify metal moves.

Practically: the miners’ index has printed new all-time highs (first since 2011) and is up roughly 100% year-to-date while gold itself is up around 40%. That spread reflects leverage, but it also magnifies company-level risks.

Unique Risks for Miners

Mining companies are individual businesses operating in specific jurisdictions. That introduces:

- Jurisdictional and political risk (country-level news can swing valuations).

- Cost pressures from labor and input inflation.

- Operational risk (accidents, permitting, reserves estimation).

- Balance-sheet and hedging choices that can blunt upside or worsen downside.

Miners can lag the metal for periods if costs surge or operations falter. They’re a powerful tool for investors who understand company-specific factors, but they’re not a simple one-to-one bet on the bullion price.

What Could End the Rally?

The Gold And Silver ALL TIME HIGHS narrative is powerful, but every rally has potential spoilers. The common endings are classic and worth reviewing carefully.

1) A Stronger Dollar and Higher Yields

Data that pushes the Fed toward tightening—or even less dovishness—would lift yields and the dollar. That typically hurts non-yielding assets like gold and silver. We saw this in August when an upside inflation surprise sent yields and the dollar up and gold down.

2) A Cooling of Geopolitical or Trade Risks

If global tensions cool and markets perceive lower conflict risk, the safe-haven bid would fade. That would remove a major psychological driver behind Gold And Silver ALL TIME HIGHS.

3) Flow Reversals

ETF demand and central bank buying have been pillars. If ETF inflows slow or reverse — or if central banks step back — price support weakens. The World Gold Council has already trimmed some central bank demand expectations; if that becomes a trend, the structural support could wobble.

4) Physical Demand Constraints

High prices can squeeze jewelry and retail demand. There’s evidence jewelry demand has fallen toward pandemic levels in response to soaring prices. If physical demand cracks while financial demand slows, that’s a double whammy for prices.

5) Silver-Specific Risks

Silver’s industrial demand is a strength — until growth slows sharply. A major manufacturing slowdown or weakness in solar/EV investment would hit silver harder than gold. And history shows silver can underperform in those scenarios even if gold holds up.

6) Miner-Specific Shocks

Cost inflation, strikes, jurisdictional changes, or hedging losses can decouple miners from the metal’s performance. Given the clear miner rally already priced in, any company-level disappointment can be painful for equity holders.

Macro Implications — A Precious Metals Rally Isn’t Cheerful News

While a metals rally can be rewarding for holders, persistent strength in safe-haven assets usually signals underlying economic stress. When gold and silver rally for months, markets are often telling us that confidence in currencies, institutions, or growth is weakening.

Some recent economic signals reinforce this cautionary tale:

- Revisions showing a weaker-than-reported US labour market.

- Import price rises amid a softer dollar, which squeezes consumers.

- Persistent retail and manufacturing softness in some regions.

- Tariff-driven price stickiness that keeps inflation elevated at the consumer level even as growth cools.

Put bluntly, a durable safe-haven rally is rarely a friend of Main Street. It can co-exist with high asset returns, but it often coincides with harder conditions for households and the real economy.

Crypto, Bitcoin ETFs and How Traders Are Reacting

Gold isn’t the only safe-haven alternative. Bitcoin and crypto have emerged as another place investors look to hedge systemic risk or seek an “outside the system” asset. Bitcoin ETF flows have been substantial — record two-day net inflows were recorded in July while gold was consolidating. Sometimes crypto and precious metals run together when trust is wobbling; other times they diverge as flows chase what’s moving fastest.

If you are active in crypto markets and want structured help navigating rapid moves and arbitrage windows between asset classes, consider using a disciplined signals approach. A reliable crypto signal service can help traders identify momentum shifts, risk-on/risk-off rotations and timing opportunities that matter when markets are volatile. Integrating timely signals can be particularly useful when macro-driven flows are shifting between gold, silver, miners and crypto. Think of it as a tactical complement to any strategic allocation you hold in bullion or miners.

Ways to Gain Exposure — Practical Options

If you’re convinced by the Gold And Silver ALL TIME HIGHS setup and want exposure, here are common avenues — each with pros and cons:

- Physical bullion (bars/coins) — Direct ownership, storage/custody issues, best for long-term holders who want a tangible hedge.

- Physically backed ETFs — Convenient, highly liquid, lower transaction friction. Major ETFs move with flows and are an easy way to express a macro view.

- Mining stocks and miners ETFs — Leveraged exposure. Higher volatility and company-specific risk but potentially greater upside.

- Futures and options — For traders seeking leverage and precise risk control, but require experience and active management.

- Tokenized gold on crypto exchanges — Newer route: tokenized, highly liquid, and sometimes cheaper to transact. Make sure the token is fully collateralized and audited.

Tokenized gold can be a convenient bridge between crypto and bullion markets. But due diligence matters: verify custodial arrangements, redemption terms, and regulatory oversight before relying on tokenized exposures as a core strategy.

Trading and Tactical Considerations

Trading the Gold And Silver ALL TIME HIGHS environment requires a plan. Momentum trades can be lucrative but are inherently risky when flows reverse quickly. Here are some tactical pointers:

- Define time horizon: Are you a swing trader or a multi-year allocator?

- Use position sizing and stop rules to manage drawdowns.

- Watch macro inflection points — Fed communications, labour prints, CPI/PCE releases and unexpected geopolitical headlines.

- Consider pairs or spreads (gold vs. miners, gold vs. silver) to express relative value views.

- For crypto traders: use signals to capture momentum when flows shift between asset classes. A disciplined crypto signal service can highlight entries and exits during volatile regime shifts.

FAQ

Will gold reach $4,000?

A move to $4,000 is well within reach if current macro drivers persist — weaker dollar, falling yields, continued ETF inflows and central bank buying. Technical measured moves and some prominent forecasts outline this path. However, markets can reverse, so this is a conditional outcome rather than a guarantee.

Is silver likely to hit $50?

Silver at $50 is a realistic target if momentum continues and industrial demand meets or exceeds expectations. Deficits in supply and ETF rotations from gold into silver make $50 plausible, especially given the current catch-up phase. But silver’s industrial sensitivity also means a growth slowdown could derail that path.

Are miner stocks a better buy than bullion?

Miners offer leveraged upside to bullion and can outperform during sharp rallies. But they carry company-specific and jurisdictional risks. For investors wanting amplification and willing to manage stock-level risk, miners can be attractive. For capital preservation and inflation hedging, bullion or physically backed ETFs are simpler.

What would cause the rally to end?

The rally could end if the dollar strengthens and yields rise, geopolitical risks cool, ETF or central bank flows reverse, physical demand weakens, or industrial demand for silver collapses. Company-level issues can also snap miner rallies quickly.

How should I time entry if I want exposure to Gold And Silver ALL TIME HIGHS?

Time entries based on your horizon. Dollar-cost averaging into ETFs or physical bullion reduces timing risk. Traders may use momentum breakouts, pullbacks to support, or signals from structured services for tactical entries. Always set risk limits and avoid overleveraging.

Conclusion — Takeaways and Cautions

The phrase Gold And Silver ALL TIME HIGHS captures a market moment driven by dovish policy expectations, dollar weakness, geopolitical and political tensions, central bank demand and speculative flows. Gold’s meltup is supported by measurable technical setups and macro underpinnings; silver’s catch-up is bolstered by structural deficits and industrial demand. Mining stocks are amplifying the move, but they also magnify company-level risks.

Remember that prolonged rallies in safe-haven assets can be warnings about the real economy. For traders, crypto and bitcoin have become parallel arenas where flows can shift quickly — a well-timed signal or disciplined crypto signal strategy can be a useful complement to precious metals exposure.

Finally, this analysis is educational and not investment advice. If you’re considering exposure, weigh your objectives, time horizon and risk tolerance carefully. Markets can turn fast — plan for the downside as rigorously as you plan for upside.