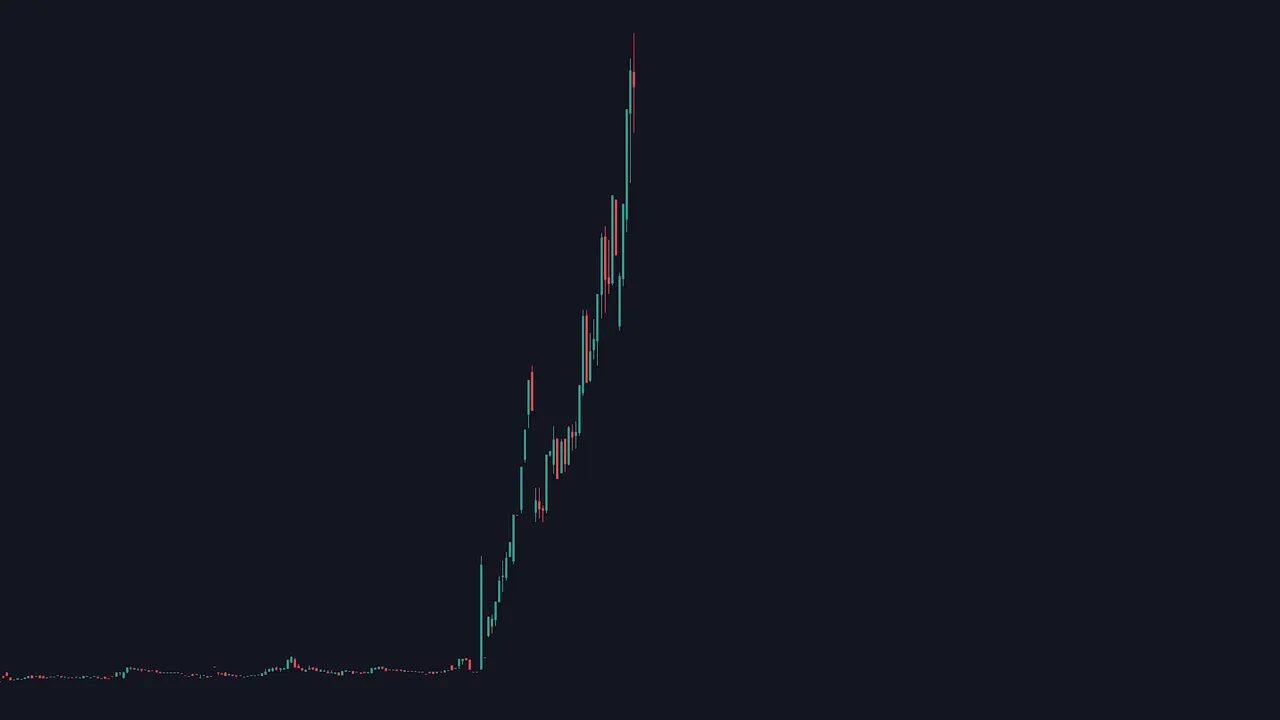

Some stocks explode 200 to 300 percent inside a few hours while blue chips creep up over years. The trick is not to chase the move after it already happened. The better move is to find the candidates before they blast off — the stocks with the right ingredients that make huge intraday moves possible.

Table of Contents

- What makes a great day trade candidate?

- How to combine volume and float into filters

- News: the catalyst that turns potential into motion

- Three practical ways to find those news-driven opportunities

- How to quickly judge whether an article is tradeable

- Quick trading checklist before entering

- Other useful notes

- Frequently asked questions

- Parting thought

What makes a great day trade candidate?

There are three core elements I watch for every morning: high volume, low float, and a strong news catalyst. When these align you get volatility and liquidity — two things day traders live for.

Volume: the eyes on the stock

Volume is simply the number of shares traded over a period. The more buyers and sellers, the higher the volume. High volume means the stock will move, and it also makes it much easier to enter and exit positions without getting stuck.

Trade low-volume stocks and you’ll usually see muted price movement and poor liquidity. Trade high-volume names and you’ll see frequent price swings, large candles, and multiple trade opportunities throughout the session.

Float: the supply side

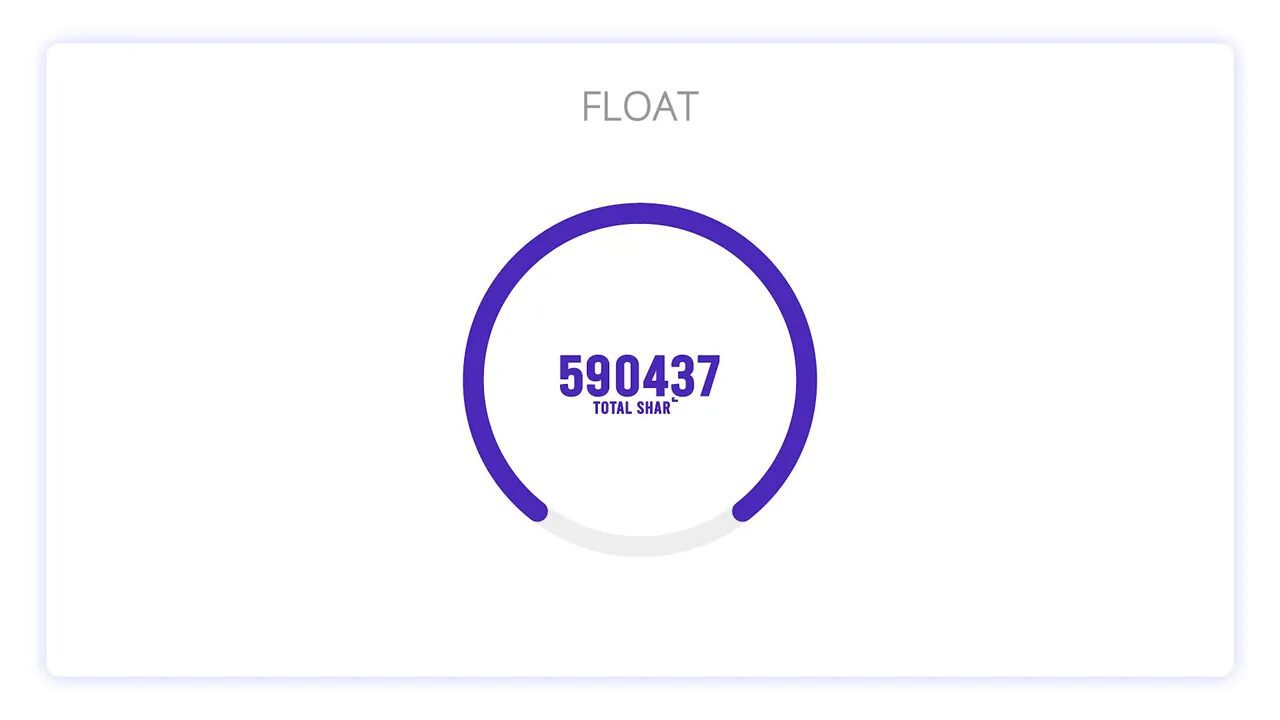

Float is the number of shares available for public trading. Think supply and demand: if demand (volume) is rising but supply (float) is tiny, price moves will be amplified. That’s why penny stocks with a few million shares in float can jump dramatically on modest volume.

My personal rule for day trading: prefer stocks with a float of 20 million shares or less. The lower the float, the better the chance for big intraday moves. If float exceeds that threshold, I usually pass unless the market is unusually slow and opportunities are scarce.

How to combine volume and float into filters

Make filters your first line of defense. A simple pair of filters you can start with:

- Minimum volume: 100K+ intraday (adjust by dollar price)

- Maximum float: 20 million shares

When you see a stock that meets these two filters and it’s also a top gainer, you’re looking at a day trader’s dream. Single candles moving 5 to 10 percent happen frequently in that setup.

News: the catalyst that turns potential into motion

Volume and float provide the mechanics, but news provides the push. Positive catalysts such as partnerships, earnings beats, regulatory wins, or meaningful product breakthroughs are the most reliable triggers for big spikes.

Most corporate news drops in the premarket between about 4 a.m. and 9 a.m. Eastern, with heavy concentration from 7 a.m. to 9 a.m. and often appearing in batches at round times like 7:00, 7:30, and 8:00. The goal is to catch a strong article as soon as it posts and before everyone else piles in.

Not all news is created equal

Some press releases are fluff and produce no price action. The job is to quickly decide whether the headline actually merits a major move. A meaningful headline combined with a low float and rising volume is what you want.

Three practical ways to find those news-driven opportunities

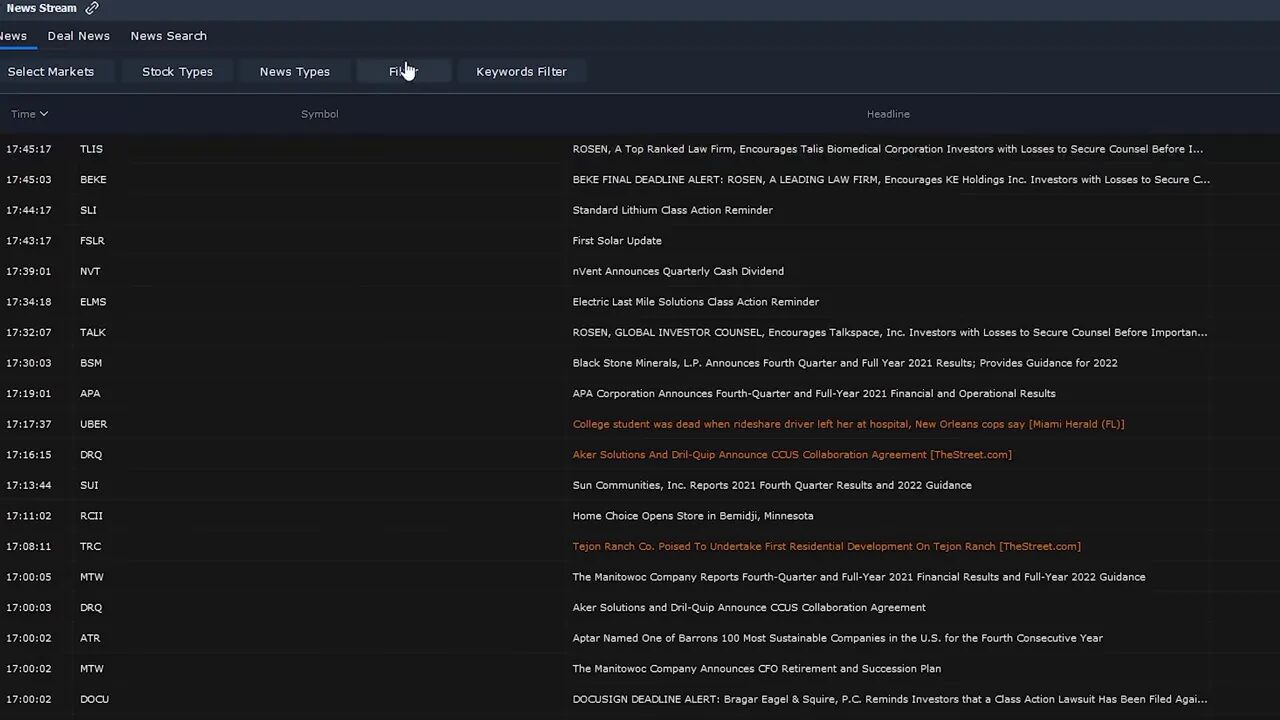

- Broker news feed — convenient, but 95 percent fluff. Good for basics but not great for speed or signal-to-noise.

- Stock screener watching top gainers — refresh the top gainers around key times (for example, 9:00 a.m.). If a new ticker pops up and is already +10 percent, dig for the premarket article. This can work, but frequently you’ll be late.

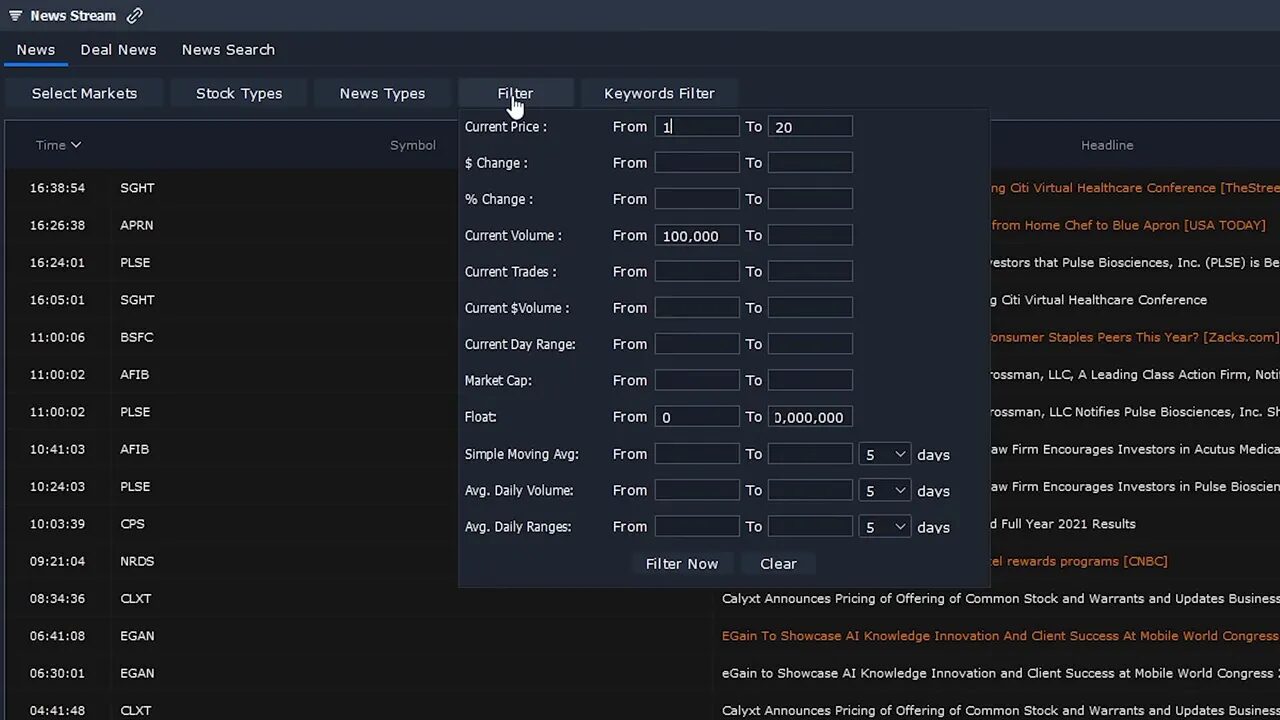

- News scanner — my preferred approach. Think of this as flipping the sequence: find the news first, then the price movement. A good news scanner delivers a live feed of articles and allows filters for price range, minimum volume, and float so you only see relevant headlines.

A news scanner reduces the guesswork. Instead of scanning tickers and then searching for news, you receive the headline and can react before the crowd. If the scanner supports filters, you can limit results to stocks priced between certain ranges, with minimum volume, and with float under your threshold.

How to quickly judge whether an article is tradeable

Experience helps, but when you are starting, focus on headline keywords and the type of announcement. Generally, these are ranked from most to least impactful:

- FDA approval, regulatory approval, cleared

- Acquisition, bought by, acquired

- Partnership, collaboration, agreement with

- Earnings beat, record revenue, raised guidance

- Clinical trial success, positive data

- Less impactful: press releases about minor operational changes, routine updates, or cosmetic announcements

If a headline contains terms from the top of that list and the stock matches your float and volume filters, that’s a strong candidate for intraday action.

Quick trading checklist before entering

- Confirm float is under your threshold (for me, 20 million shares).

- Confirm relative volume is elevated. A relative volume of multiples above 1 indicates heavier-than-normal trading; extremely high values usually signal a news catalyst.

- Read the article fully and confirm the headline matches the body of the release.

- Check order book depth and tape for early momentum — are buyers aggressive or is the move on thin buying?

- Plan your stop and profit targets before entry. Volatility can cut both ways.

Other useful notes

Not every top gainer will be news-driven. Breakouts above technical resistance or even spontaneous, unexplained spikes occur. Trading top gainers off technicals works too, but pairing technical setups with low float and news generally provides more consistent performance and confidence.

Finally, speed matters. Finding the news before the price fully reacts is a huge edge. News scanners are not free in most cases, but the time saved and the ability to filter out noise often pays for itself.

Frequently asked questions

What exactly is float and where do I find it?

Float is the number of shares available for public trading. You can view a stock’s float on financial sites such as Yahoo Finance under the statistics or share information section.

What is relative volume and why does it matter?

Relative volume compares current trading volume to the stock’s typical volume for the same time period. High relative volume shows increased interest and often accompanies news-driven moves, making the stock more tradeable.

When do most market-moving news articles come out?

Important corporate news commonly lands during the premarket window, roughly between 4 a.m. and 9 a.m. Eastern, with a concentration from 7 a.m. to 9 a.m. Many releases appear in batches at round times like 7:00, 7:30, and 8:00.

What basic filters should I use to build a morning watchlist?

Start with price range filters suitable to your account, a minimum volume threshold (for example 100K+), and a maximum float (for many day traders under 20 million). Combine those with a news scanner during the premarket for best results.

Parting thought

High volume plus low float plus meaningful news is a repeatable recipe for explosive day trades. Use filters and a news-first workflow to find the setups early, and always manage risk. With practice you will recognize the credible headlines and the patterns that produce the biggest, most tradable moves.