In this guide I’ll walk you through exactly how to make a meme coin on Pump.Fun in 2025, from finding the idea to launching, promoting, and protecting your project. I created this step-by-step breakdown to teach creators how to build meme tokens responsibly and effectively. If you’ve ever wondered how to make a meme coin that gains traction without a rug, this tutorial covers the full workflow I use: wallet setup, trend scouting, token details, contract checks, charts, token locks, paid promotion strategies, and community building.

Throughout this article I’ll reference practical screenshots captured during the live walkthrough to make each step clear. I’ll also share the tactics I’ve used when launching coins that moved from a few thousand dollars in market cap to meaningful growth. Whether you’re building for fun, for a community, or as an experiment, this walkthrough explains how to make a meme coin the right way on Solana’s Pump.Fun platform.

Table of Contents

- Introduction: Why Create a Meme Coin in 2025?

- Preparation: Wallet Setup and Funding

- Finding Trends and Choosing an Original Narrative

- Designing Token Metadata: Name, Ticker, Description, Image

- Creating the Token on Pump.Fun — Step-by-Step

- Immediately After Launch: Contract Checks, Holders, and Snipers

- Using DexScreener to Enhance Discovery and Paid Listings

- Locking Supply with Streamflow — Building Trust

- Marketing: Boosts, Ads, and Building a Twitter Community

- Advanced Tips & Real Examples

- Risk Management, Ethics, and Legal Considerations

- FAQ

- Conclusion

Introduction: Why Create a Meme Coin in 2025?

When people ask me how to make a meme coin today, the deeper question is why. Memecoins are cultural artifacts — they succeed on narrative, timing, and distribution. In 2025 the Solana ecosystem and platforms like Pump.Fun make it fast and inexpensive to launch tokens. That speed is both an opportunity and a risk. If you spot an original trend early, creating a token can capture attention and liquidity fast; if you rush without planning, it can fall flat or attract predatory snipers.

My goal with this guide is educational: to show the practical, honest steps for how to make a meme coin and position it to perform well while keeping ethical guardrails. I focus on ideas that are unique, timely, and tied to real events or cultural moments — the kind of thing people will naturally talk about and share.

Throughout, I’ll emphasize the three pillars you need when you learn how to make a meme coin: 1) an original narrative, 2) a clear token presentation (metadata, image, link), and 3) trust-building actions (paid discovery channels, token locks). Put those together and you have the best chance to create momentum without faking fundamentals.

Preparation: Wallet Setup and Funding

Before you start creating tokens, you need a secure wallet that’s funded with enough SOL to pay fees. When I show people how to make a meme coin on Pump.Fun, I always start with the wallet setup because mistakes here are costly. Use a clean wallet address dedicated to deployment if you want privacy from later scrutiny. People will often track wallets that create successful tokens — if you want to separate your identity, create a new Phantom account for deploys.

Recommended minimum funding: $10–$20 worth of SOL when launching a basic memecoin on Pump.Fun. Fees vary with network conditions, and if you plan to use additional services (DexScreener enhanced listing, Streamflow token lock, boosts) you’ll need more. I usually ensure the deployer wallet has around $50 worth of SOL before doing anything stretched beyond the basic creation step.

Key wallet tips when learning how to make a meme coin:

- Use Phantom or another reputable Solana wallet and confirm you control the seed phrase securely.

- Create a fresh account for deploys if you want to minimize traceability from your main holdings.

- Always double-check the address before signing transactions — especially when connecting to third-party dApps.

- Keep a small, separate “operational” wallet for day-to-day interactions so you don’t expose major holdings.

Finding Trends and Choosing an Original Narrative

When people ask me how to make a meme coin, the most common mistake they make is launching a generic token with no meaningful story. A token without a narrative is noise. You’ll get better traction if you create something tied to a real, new, or underdiscovered trend — something that people can understand and share in one line.

Where to look for ideas:

- Real-time news: animals, viral events, pop culture moments (e.g., a viral dog or a strange monkey sighting).

- Local or niche stories that haven’t yet been capitalized into tokens.

- Major calendar events (sporting “puppy bowl” moments, award shows, viral tech releases) — front-running these can work if done ethically.

- Community-driven memetics — Reddit threads, Twitter viral posts where an image or phrase resonates.

In the live example I used in the walkthrough, I found a viral puppy from the Puppy Bowl. Animals and cute stories have consistently high shareability, which is why they make good meme coin narratives. Another example I spotted earlier was a lonely Japanese sunfish coverage — these events sometimes present the perfect opening for a token that can trend quickly.

Three quick rules when choosing your narrative:

- Be original or be faster — if someone else already made the token, either pivot to a different angle or pick another idea.

- Choose a story people can tweet about — short, emotional, shareable narratives work best.

- Document the source — save article links and tweets to use for your metadata and token listing so others can verify the context.

Designing Token Metadata: Name, Ticker, Description, Image

When you learn how to make a meme coin on Pump.Fun, the metadata you enter matters more than you might expect. A token looks like a project when it has a polished name, a readable ticker, a clear description, and a compelling image. These details are what will appear on DEX aggregators, on token charts, and in the wallets of early buyers.

Metadata checklist:

- Name: A longer, descriptive name that includes the narrative (e.g., “Smush — Puppy Bowl Dog”).

- Ticker: Short, memorable token symbol (e.g., SMUSH).

- Description: One or two short sentences describing why the token exists.

- Image: High-quality image or banner that represents the character (1500×1500 recommended for headers).

- One primary link: Either a website or a Twitter link — choose one and treat it as your “single source of truth.”

Important note on links: You do not need to create a full website to make an effective launch — a well-designed Twitter account or a single landing page is often enough. Pick one link and use it consistently in your metadata and charts. People will check the link to validate your narrative, so make it convincing and easy to consume.

Creating the Token on Pump.Fun — Step-by-Step

Now for the practical part: how to make a meme coin on Pump.Fun. Follow these steps carefully.

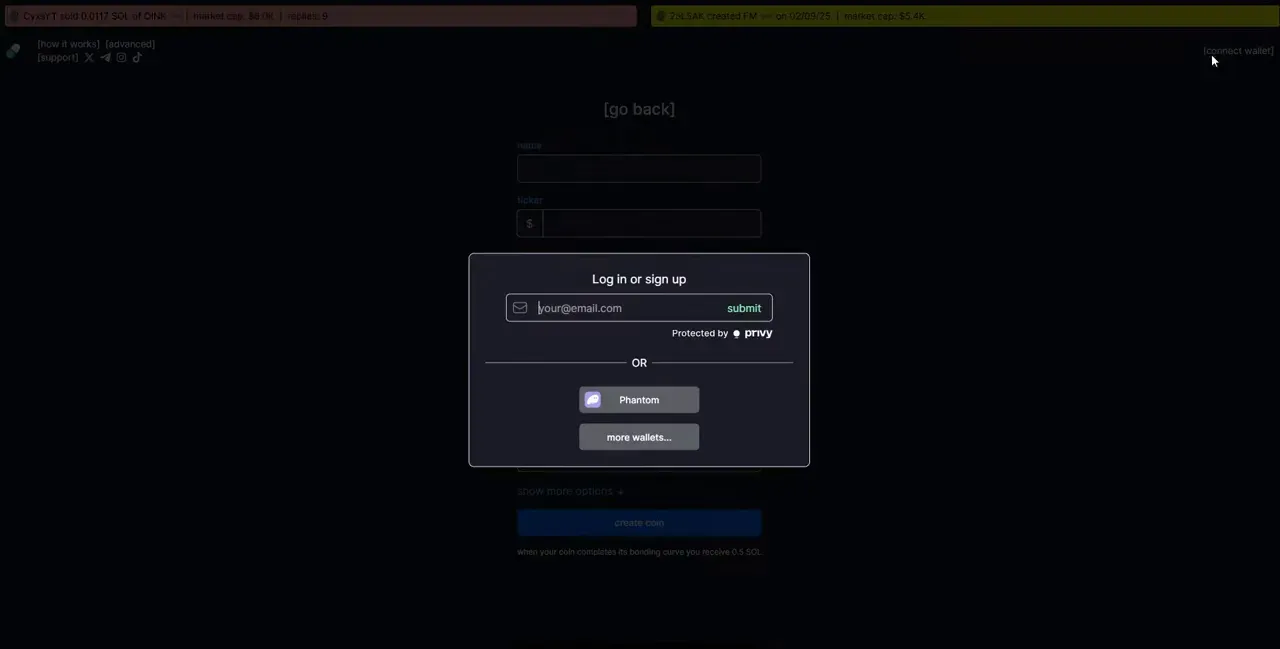

- Connect your Phantom wallet to Pump.Fun and confirm the deployer account. Use a deployer wallet with enough SOL for the fees. (See the screenshot of the connect flow above.)

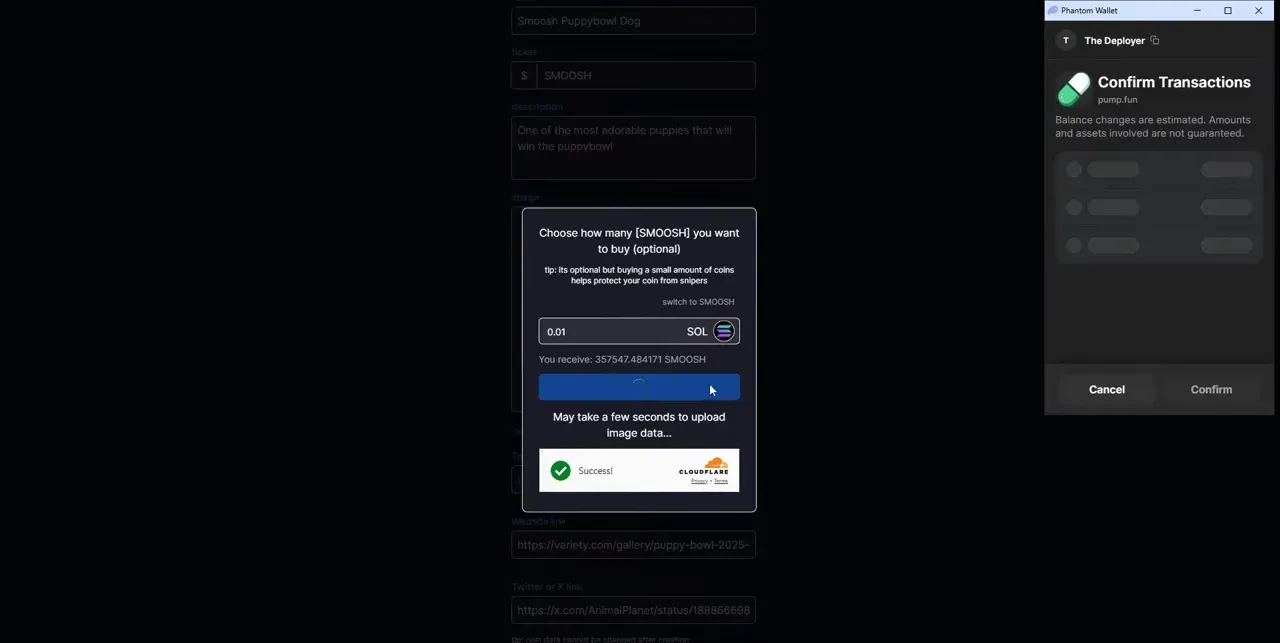

- Choose “Start New Coin” on Pump.Fun and fill in the ticker and name fields. For my example I used “SMUSH” and the extended name “Smush Puppy Bowl Dog.”

- Upload your image — ideally a 1500×1500 header-friendly image — and write a short description that tells the narrative in one sentence.

- Paste your primary link (Twitter or a news article) into the metadata so buyers can verify the story. I usually include the original news article and a social post that corroborates the event.

- Set a small initial buy amount from your deployer account (e.g., 0.01 SOL or the minimum). Purchasing some supply immediately as the deployer shows initial liquidity and ownership of the token.

- Confirm the transaction in Phantom and wait a few seconds for Pump.Fun to create and list the token. You should then be able to view the profile for your newly created memecoin.

Once the token is created, take the contract address and immediately perform basic checks (outlined next). Small initial buys are fine — you’re signaling interest while keeping the token open to the public. Don’t buy and lock huge amounts unless you plan the token economics and communication carefully; transparency is key if you want to avoid “rug” accusations.

Immediately After Launch: Contract Checks, Holders, and Snipers

After you create the memecoin, you need to monitor early activity. The first few minutes and hours will determine how the token is perceived. Snipers — automated bots and traders that buy and sell newly minted tokens — will often enter immediately. That’s normal; learning how snipers behave helps you plan.

Do this right away:

- Grab the token contract address from Pump.Fun.

- Paste it into a block explorer or a charting site (I use NeobullX/NeoBullX and DexScreener) to view holders and trade history.

- Watch for rapid buy-sell cycles (sniping) in the trade feed — short-term buyers will flip quickly and that will show in the on-chain history.

- Record any large buyers and whether they hold or immediately sell — this gives you an early sentiment snapshot.

In my live example, I created SMUSH and saw the usual pattern: I purchased a small amount as the dev, then automated snipers entered and some quick sells occurred. That’s the typical behavior for new memecoins. The presence of snipers does not mean the project will fail — it just means there’s immediate trading interest. The question is how you respond: do you communicate, lock tokens, or invest in discovery features?

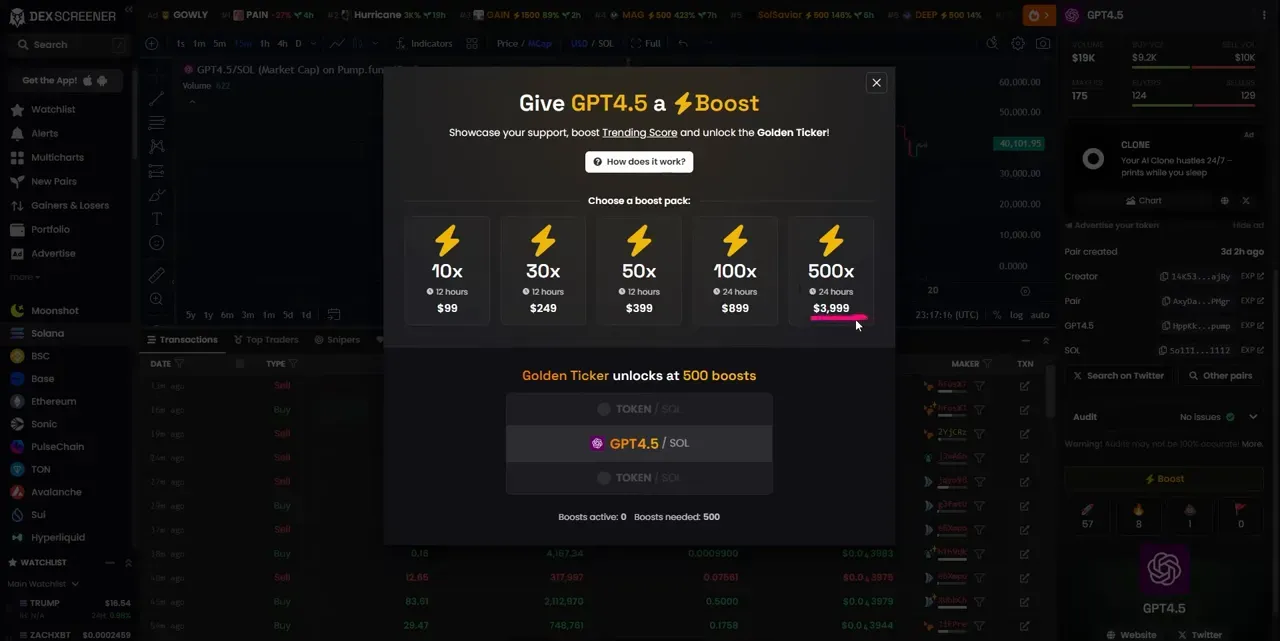

Using DexScreener to Enhance Discovery and Paid Listings

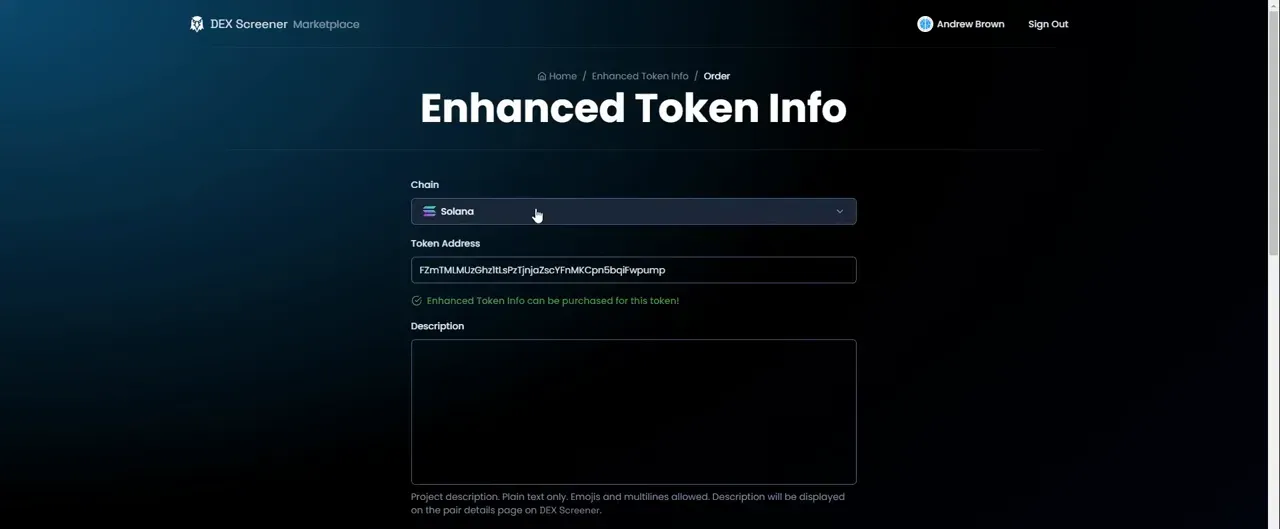

DexScreener is a central tool in the process when you want to make a meme coin visible. After the token is launched, paste the contract address into DexScreener and claim the token page. DexScreener offers paid enhanced listings that can dramatically increase impressions and credibility — this is an investment decision many creators make when they believe the token has real potential.

Why pay for DexScreener enhanced info?

- Visibility: Paid tokens appear with nicer cards and images, and they’re more clickable in searches.

- Credibility: A $299 enhanced listing signals to buyers that the project invested resources into presentation.

- Analytics: You can update token info (description, image, links) to present a polished listing that matches your Pump.Fun metadata.

How to do it:

- Open DexScreener and search with your contract address.

- Click “Update Additional Token Info” and follow the flow to purchase enhanced token info.

- Upload your header image (1500 x 1500 recommended), set the description and primary links (Twitter or website), and confirm checkout. DexScreener accepts cards and SOL.

Price: Enhanced info typically costs around $299. There are smaller boosts (e.g., $99 for modest trending boosts) and larger boosts that go up to thousands (500x boost is often $4,000). Deciding to pay depends on your budget and ambitions; paid exposure can accelerate traction quickly but is not a substitute for a good narrative and community effort.

Important note: Don’t use DexScreener payments to hide poor fundamentals. Use paid listings to amplify a genuine token story and to help buyers verify your narrative via clear links and an image. I’ve paid for DexScreener when I believed in a token’s potential and seen great results; paid listings are one of several levers to increase visibility.

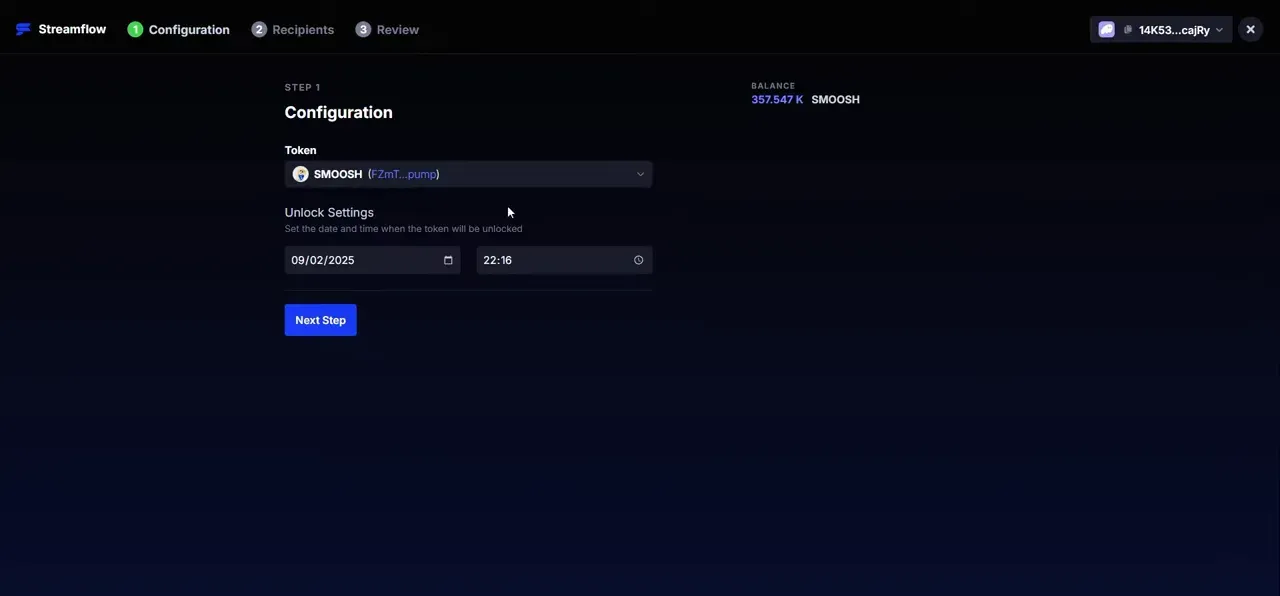

Locking Supply with Streamflow — Building Trust

One of the single most effective trust-building mechanisms you can use when you learn how to make a meme coin is to lock tokens that would otherwise sit centralized in developer wallets. Use a service like Streamflow for token locks on Solana. Locking supply communicates a commitment to the community and reduces rug concerns.

How token locking works:

- Connect your wallet to Streamflow.

- Select “Token lock” and choose the token contract you deployed.

- Specify the amount of tokens to lock and the release date (e.g., June 2026 in my example).

- Set the recipient address (usually your operational wallet) and confirm the contract. You’ll sign a transaction to lock tokens on-chain.

What does a lock show publicly?

- Proof that tokens intended for developers or marketing aren’t immediately sellable.

- Dates and amounts that can be verified on-chain; buyers can see when tokens unlock.

- Enhanced confidence for buyers and indexers (like DexScreener) that the team isn’t quickly extracting liquidity.

Tip: If you personally buy a large supply during creation, locking a meaningful portion of it and announcing it publicly will help the token’s credibility. The Streamflow interface will prompt you for the details, and the on-chain lock is visible to everyone.

Cost considerations: locking requires SOL for gas and possibly platform fees; ensure your deployer or operational wallet has enough SOL for the lock transaction. A locked supply is the strongest single demonstration that you’re not planning a quick exit.

Marketing: Boosts, Ads, and Building a Twitter Community

Marketing separates tokens that fizzle from tokens that gain traction. When you learn how to make a meme coin, you must plan how to reach buyers. I recommend two focused strategies: paid discovery (DexScreener boosts and ads) and organic community work (Twitter, retweets, and engagement).

DexScreener boosts

DexScreener offers boost options that increase a token’s trending score. Boosts range from small ($99 for a 10x boost) to large ($4,000 for a 500x boost). Higher boosts place a token more prominently on the site, increasing impressions and clicks. Some creators spend thousands to secure front-page visibility. For many token launches, a mid-tier boost (if affordable) can materially increase early liquidity.

Ads and sponsored spots

DexScreener also sells ad placements separate from boosts. Ads can appear in sidebars or as promoted listings. Cost varies based on placement and duration. Ads are useful when you want to sustain visibility beyond the first few hours.

Organic community work

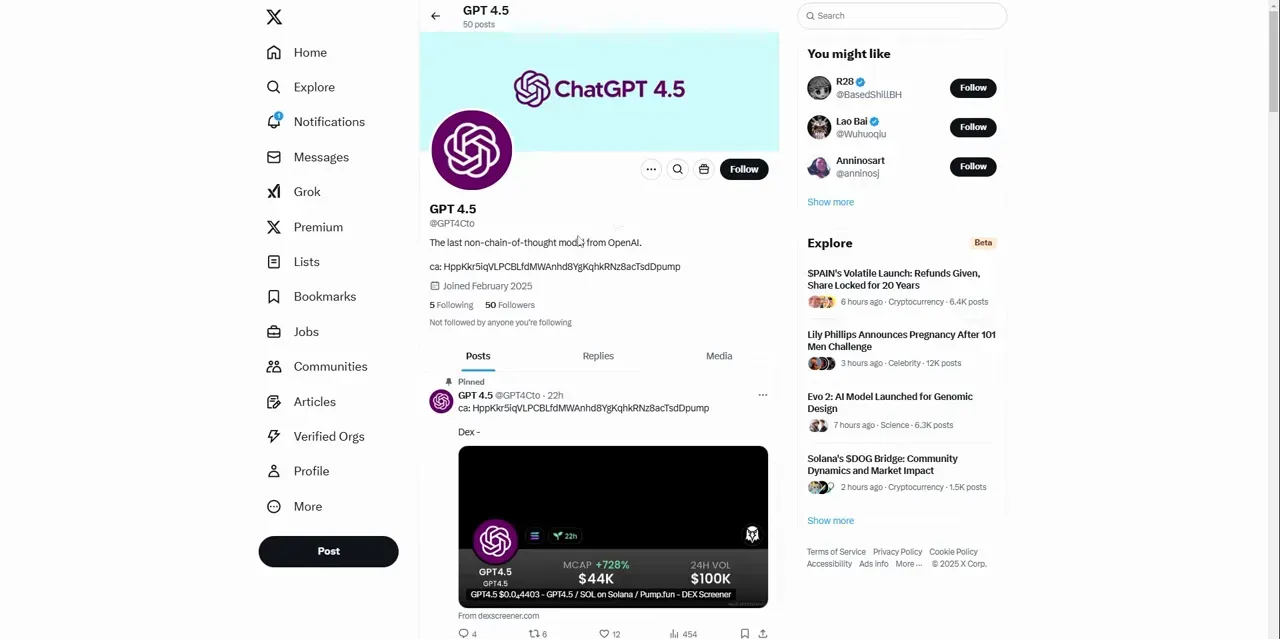

- Create a dedicated Twitter account for the token and tweet regularly about the narrative and roadmap.

- Use a new Gmail account to register the Twitter profile and use a consistent brand image and pinned tweet with the contract address.

- Engage with similar token communities and retweet supportive posts; a few well-placed retweets can seed interest quickly.

I typically create a Twitter account for each launch, pin the contract link, and tweet simple, clear updates: what the narrative is, where to buy, and any upcoming events. This direct communication builds the organic base and supports paid discovery campaigns. Remember: people buy tokens they can understand quickly — Twitter is optimized for short narratives.

If you offer a service like Meme Coin Signals that tracks Solana memecoin trends and provides buy/sell signals or market intelligence, mention it naturally in market-analysis sections or when discussing trading opportunities. For example, when you analyze trending Puppy Bowl tokens or AI-hype coins, a nod to a curated signal service can be useful for readers seeking structured entry points into memecoin plays.

Advanced Tips & Real Examples

Here are several advanced tips I use when I want to make a meme coin and maximize the chance of a healthy launch.

1. Front-run timelined events ethically

If a major event is coming (AI release, sports final, celebrity news), you can create a token that references the event before the mainstream memecoins appear. I did this with a token tied to GPT 4.5 hype: I launched early, shared with a small community at 8K market cap, and allowed organic tweets to push it higher. The key is transparency — don’t misrepresent the project as affiliated with the event or claim endorsements that don’t exist.

2. Holders distribution and top holders

Make sure the top-10 holders look reasonable. If the initial distribution shows one wallet holding 90% of supply, that invites scrutiny. Consider distributing a portion to community wallets or providing public plans for liquidity and marketing allocations. Use Streamflow locks or similar to lock tokens earmarked for operations.

3. Timing boosts and updates

Boost on DexScreener shortly after you have your Twitter or marketing assets ready. Paid visibility is most effective when the narrative is polished and the token page looks complete. A rushed boost with no links or image will deliver much lower ROI.

4. Monitor sniper activity and liquidity

Snipers are automatic and common. They don’t necessarily ruin a project, but they can create whipsaw price action. Monitor trades in real time and be ready to tweet clarifying updates if confusion spreads. If you’re running a fair launch, be transparent about what was pre-mined and what wasn’t.

5. Examples from recent launches

I shared a recent token idea with my private community at small market caps and it delivered 7x–8x gains for early participants. I used DexScreener payments and ensured the top holders were legitimate. In another example, a front-run of an AI release captured a lot of organic social attention and converted to sustained value because we locked tokens and actively engaged on Twitter.

If you want to follow signal-driven entry points for Solana meme coins, services like best Meme coin signals provide curated alerts and context for memecoin opportunities — they can complement on-chain checks (like DexScreener listings and Streamflow locks) and give you a structured way to monitor projects and time entries. I integrate signal checks with my launch workflow when advising community members on potential plays.

Risk Management, Ethics, and Legal Considerations

Building memecoins comes with real ethical and legal responsibilities. I want to be clear: I’m sharing how to make a meme coin for education and legal, ethical participation. Never mislead buyers or create a token to intentionally defraud. Here are the rules I follow and recommend.

- Transparency: Declare what portion of supply is controlled by developers and whether tokens are locked.

- No false endorsements: Don’t claim partnerships or affiliations unless you have proof and permission.

- Compliance: Be aware of laws in your jurisdiction. Marketing tokens as investments can trigger securities regulations in some places.

- Security: Don’t share private keys or sign transactions on unknown dApps that request unnecessary permissions.

- Community-first approach: Build a roadmap that benefits token holders and communicate openly when changes occur.

Remember: a sustainable token ecosystem relies on trust. Locking tokens, publishing sources, and engaging with buyers honestly will give your memecoin a better chance at long-term relevance.

FAQ

Q: How much does it cost to create a meme coin on Pump.Fun?

A: The base cost to create a token is small — you’ll need enough SOL to pay the mint and transaction fees, typically $10–$20 minimum. Additional costs come from optional services like DexScreener enhanced listings (~$299), DexScreener boosts ($99–$4,000), Streamflow token locks (transaction fees), and marketing or graphic design. Plan your budget around the level of professionalism and visibility you want.

Q: Do I need a website or Telegram to launch a memecoin?

A: No — you only need one strong link. Many successful launches use a polished Twitter account as the central hub. The most important thing is clarity and verifiability: a single high-quality link that explains your narrative and provides the contract address is enough to start.

Q: What is a token lock and why should I do it?

A: A token lock uses an on-chain contract to prevent certain tokens from being transferred until a specified date. It’s used to show commitment from developers or to time vesting for team tokens. Locks build trust by making it harder to immediately dump tokens after launch. Services like Streamflow help execute token locks on Solana.

Q: Are boosts on DexScreener worth it?

A: They can be. Boosts increase visibility on a popular discovery platform. If you have a polished narrative and a realistic plan, a boost can accelerate early liquidity and buyer interest. If you don’t have a narrative or community, boosts won’t make buyers hold the token long-term.

Q: What are snipers and how do I handle them?

A: Snipers are automated accounts or bots that buy and often quickly sell new tokens to capture short-term price moves. They’re pervasive for memecoins. The best defense is to be transparent, lock tokens when possible, and manage expectations publicly. Sniper activity alone doesn’t doom a project; it simply requires you to be prepared.

Q: Is launching a memecoin legal?

A: Legal considerations depend on jurisdiction and how the token is marketed. If you present a memecoin as a speculative asset without promising returns, you reduce regulatory risk. Always consult legal counsel if you plan to raise funds or promise utility or income. The information here is educational and not legal advice.

Q: How does “Meme Coin Signals” fit into this process?

A: Meme Coin Signals can be a helpful companion for traders and creators who want curated alerts and market context for Solana memecoins. It’s useful when you’re monitoring trends, considering paid boosts, or evaluating when to list a token on discovery platforms. Use signals as an additional data point, not as the sole decision basis.

Conclusion

Learning how to make a meme coin on Pump.Fun in 2025 is more than clicking “create” — it’s about constructing a repeatable process that balances creativity, credibility, and community. Start with a compelling, original narrative that people can share. Use a clean, funded deployer wallet and polish your token metadata. After launch, immediately check the contract and trade history, claim your DexScreener page, invest in enhanced listings if you can, and lock tokens to build trust. Combine paid discovery with organic promotion on Twitter, and always communicate transparently.

Memecoins are cultural experiments. Done well, they bring smiles, community moments, and sometimes meaningful returns to participants. Done poorly, they erode trust. If your goal is to create something fun and sustainable, follow the steps above, keep ethics central, and be deliberate with paid boosts and token locks.

One more practical nudge: if you’re actively trading or launching memecoins on Solana and want a curated feed of ideas and timing signals, consider supplementing your research with a service like Meme Coin Signals. It provides a disciplined way to spot trending meme opportunities and integrate them with the on-chain checks and promotion strategies discussed here.

Good luck. Build responsibly, document your choices, and enjoy the creativity of the memecoin space.