Q4 is shaping up to be one of the most consequential quarters for Bitcoin and the broader crypto market. I want to walk you through exactly how I would allocate $10,000 heading into Q4. This isn’t a random list of tickers — it’s a sector-driven playbook that lines up macro catalysts, product-level revenue mechanics, and community/utility strengths. If you want to think like a trader who expects markets to move fast, read on.

Table of Contents

- Why Q4 Could Be Explosive: Macro Setups to Watch

- How I Think About Position Sizing

- Layer Ones: The Big Winners in Alt Season

- The Revenue Meta: Projects That Actually Make Money

- Stablecoins: The Quiet Powerhouse

- DAOs and Communities: Utility Over Hype

- Memes: High-Risk, High-Reward When Culture Returns

- Real-World Assets (RWA): Institutional Flows Start to Matter

- Base Ecosystem: Coinbase-Backed Momentum

- Putting It All Together: A Hypothetical $10,000 Allocation

- Execution Tips: How to Buy Before the Pump

- Risk Considerations and Final Notes

- FAQ

- Conclusion

Why Q4 Could Be Explosive: Macro Setups to Watch

Before we dive into sectors and specific picks, let’s cover the macro backdrop because it changes everything. Several high-quality analysts and market participants are signaling that Q4 could bring a major bullish impulse. The core of that argument rests on two big items:

- Softening jobs data that could force the Fed to pivot to more aggressive cuts (some scenarios even suggest a 50 basis point move in October).

- The end of quantitative tightening (QT) — central banks reversing a long period of balance sheet reduction would remove a major headwind for risk assets.

Combine a disinflationary labor market, potential Fed cuts, and the end of QT and you’ve got liquidity pouring back into markets. That’s historically when crypto — particularly altcoins and layer-one ecosystems — outperforms. Narrative flows flip quickly in Q4s, and if you’re not positioned early, you’re reacting to the move rather than front-running it.

How I Think About Position Sizing

Think in buckets, not single-ticker bets. If I had $10,000 to deploy, I’d spread exposure across sectors that historically outperform during alt seasons while also tilting toward projects with measurable revenue, institutional interest, or strong community utility. That reduces single-point failure risk and increases the odds of catching a big winner.

Throughout the sections below I’ll mark the type of thesis I’m using — macro-driven, revenue-driven, community-driven, or utility-driven — so you can replicate the exact risk profile if you want.

Layer Ones: The Big Winners in Alt Season

When alt season arrives, layer-ones usually capture the largest premiums. These are the rails that everything else is built on — apps need base-level settlement and liquidity — which means their tokens often benefit the most when risk appetite returns.

Ethereum (ETH) — My Core Layer One Hold

Thesis: Institutional adoption + dApp activity + macro tailwinds = ETH to new highs.

Ethereum dominated earlier in the cycle — you might remember “ETH season” in August when it outperformed much of the alt market. Even when that rotation paused in September, the underlying fundamentals didn’t vanish. Institutions continue to build on Ethereum; tokenized products (like money market funds on-chain) are being launched, and long-term participants are gobbling up ETH to support dApp activity and liquidity needs.

If macro liquidity returns and institutions keep building tokenized financial products on Ethereum, the supply-demand equation for ETH becomes very favorable. For anyone looking to anchor a Q4 portfolio, ETH is the anchor I’d start with.

Solana (SOL) — The High Beta Layer One

Thesis: ETF pipeline + treasury activity + user growth = Solana finishing strong.

Solana lagged during parts of ETH’s run, but it’s been gaining steam. This chain has been one of the cycle’s highest-beta performers, driven mostly by consumer UX, fast block times, and real product traction. Add the prospect of ETFs and growing activity from Solana treasury companies and you get a compelling setup.

Solana is riskier and more volatile than Ethereum, but that’s the upside: when risk-on returns, Solana has historically amplified gains. Allocate a meaningful portion of your layer-one bucket if you’re comfortable with higher short-term volatility for higher potential returns.

The Revenue Meta: Projects That Actually Make Money

This is my favorite narrative heading into Q4. For too long crypto narratives rewarded hype over sustainable business models. The revenue meta flips that script: allocate to projects that have predictable revenue streams, clearly defined tokenomics that return value to holders, and scalable product adoption.

Hyperliquid (HYPE) — Leading the Revenue Wave

Thesis: High-fee capture + buybacks + infrastructure expansion = compounding upside.

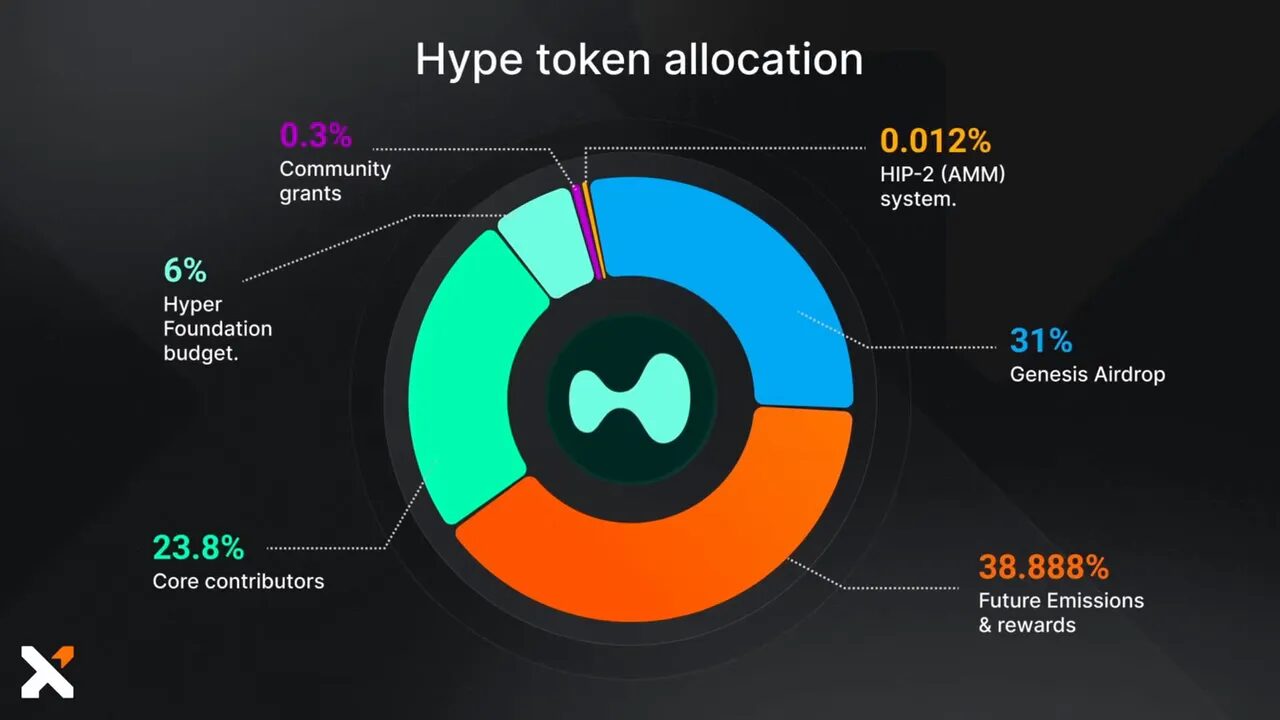

Hyperliquid has earned a spot on my radar because their tokenomics are engineered for value capture. A large portion of trading fees flows into token buybacks, which creates a direct mechanism to reduce circulating supply and concentrate value for long-term holders. Their product road map — including HIP3, which allows anyone to stake HYPE to launch perps markets — turns them from a DEX into an infrastructure provider.

Integration with major wallets that have millions of retail users further reduces friction to adoption. When retail and derivatives markets converge on a low-friction interface, trading volumes can spike. That’s why I view Hyperliquid as a premium revenue-meta play heading into Q4.

Note: If you trade actively or want to follow short-term signals across revenue-generating protocols, our crypto signal service offers curated entries and risk management tips tailored to precisely these kinds of revenue-backed setups. We highlight liquidity events, buyback triggers, and exchange flow that matter to traders looking to capitalize on Q4 momentum.

Pump — The Meme-Innovator With Revenue Mechanics

Thesis: Meme adoption + innovation + buybacks = asymmetric upside during meme season.

“Pump” is controversial, yes — many of the tokens launched in this space have been fast-moving pump-and-dump cycles. But the team has demonstrated sustained innovation (remember the streamer coin meta they helped pioneer). Importantly, they route a portion of fees into buybacks, which again ties user activity to token scarcity.

If meme season returns, projects that actually command cultural attention and have built-in fee capture are likely to outperform the scattershot copycats. Pump fits that niche.

Stablecoins: The Quiet Powerhouse

Stablecoins might not sound sexy, but in terms of real-world adoption, liquidity provision, and institutional on-chain demand, they’re one of the hottest sectors right now. Stablecoin rails are like money printers when infrastructure and cross-border efficiency improvements roll out.

Plasma (XPL) — Zero-Fee Transfers Backed by Major Players

Thesis: Product-market fit + Tether/Bitfinex backing = rapid initial liquidity inflows.

XPL launched with massive liquidity inflows, helped by incentives but also by clear product value: zero-fee USDT transfers. Being backed by industry heavyweights like Tether and Bitfinex reduces execution risk and makes adoption from high-volume traders and platforms more likely.

When stablecoin rails offer genuine cost savings and trust, they win. If you’re positioning for Q4, having exposure to next-generation stablecoins that improve on fees and settlement speed deserves consideration.

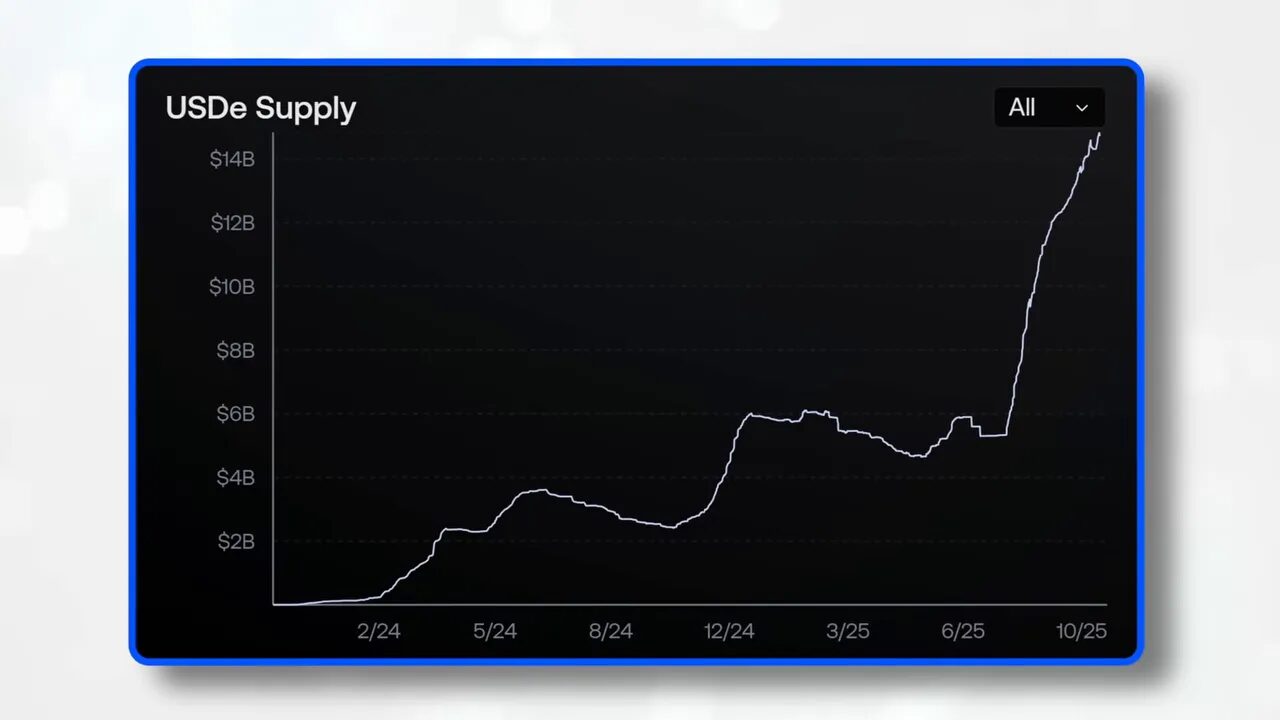

Athena (ENA) — Institutional Bid + Fee Switch Potential

Thesis: Rapid on-chain dollar growth + institutional treasury demand + fee switch = upside to token holders.

Athena’s stablecoin, USDE, is one of the fastest-growing on-chain dollars, with supply nearing $15 billion. Institutional demand is material — digital asset treasuries are stepping in and buying billions of ENA, which functions like a steady bid under the ecosystem. The planned fee switch is a major tokenomics lever: when revenues can flow back to stakers, token holders benefit directly from adoption.

Stablecoins are no longer just “parking spots” for traders — they are revenue-generating products with an increasingly institutional user base. ENA is a standout in that category.

DAOs and Communities: Utility Over Hype

DAOs haven’t been the hottest sector recently, but they bring something more valuable than short-term charts: community edge and access. Owning the right DAO token can be the difference between being an outsider and having front-row access to alpha, deal flow, and coordinated trades.

Retail DAO — A Practical, Utility-First Community

Thesis: Token-gated research + coordinated alpha = survivable edge in fast-moving markets.

Retail DAO is different because it’s focused on actionable edge — real-time debates, analysis, and a token-gated Discord where members break down moves before they hit your public feeds. Full disclosure: I’m a core contributor. That said, the value proposition is simple: in a Q4 where narratives flip overnight, being plugged into a focused community is less of a luxury and more of an edge.

Buying into the DAO is not a bet that the token will “moon” by itself. It’s a bet that access to better information and coordinated execution helps you make fewer mistakes and seize opportunities faster than the average retail trader.

If you’re trading aggressively in Q4, pairing community-driven research with execution-level signals matters. Our crypto signal service complements communities like Retail DAO by providing trade-level entries, stop guidance, and liquidity warnings — a nice one-two punch for those who want both macro research and tactical execution tools.

Memes: High-Risk, High-Reward When Culture Returns

Meme coins were the breakout sector of this cycle. While they cooled off for a bit, cultural tailwinds can re-ignite them quickly. If alt/meme season returns, the asymmetric upside on certain well-positioned meme tokens can be ridiculous — but risk management is crucial.

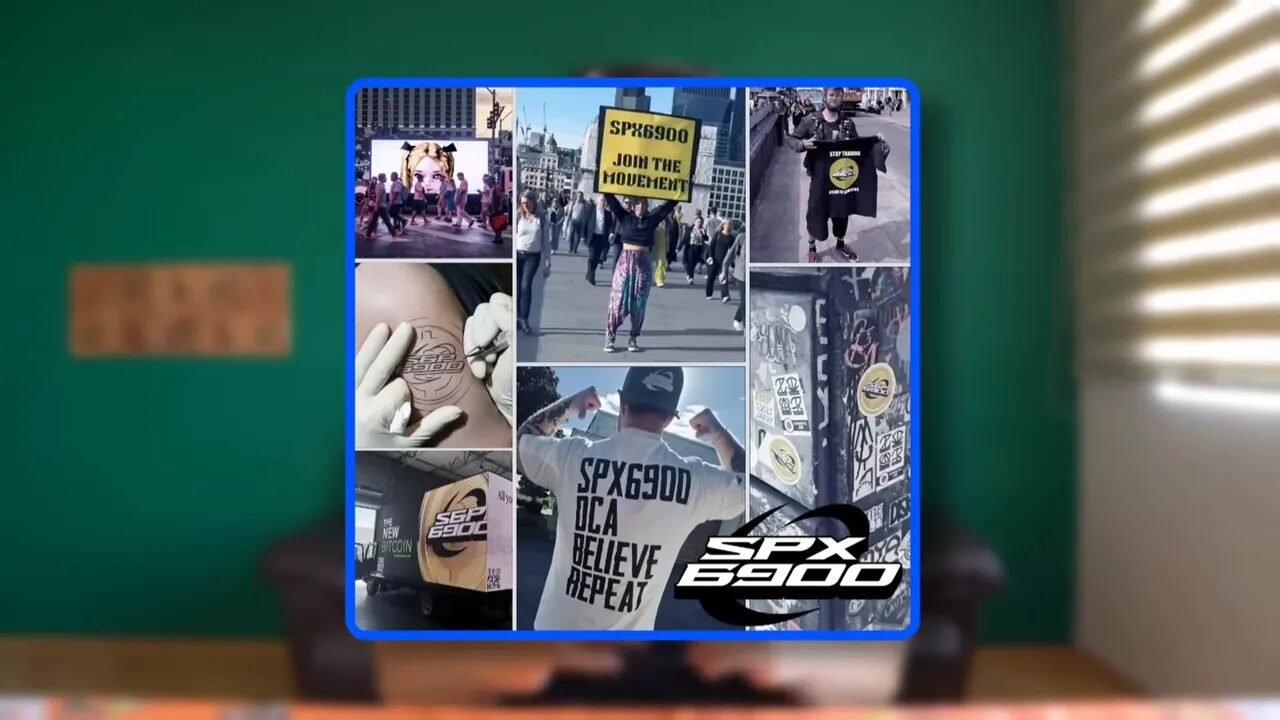

SPX 6900 (Maraud) — Strong Holder Base

Thesis: Loyal community + cult-like holders = durability in rallies.

SPX 6900’s holders are famously diamond-handed. That kind of holder psychology can turn a meme token into a stickier asset class during speculative rallies.

Fartcoin — The Bellwether Meme Token

Thesis: Viral potential + market signal properties = early indicator of meme momentum.

Fartcoin has become the unofficial bellwether for meme-market sentiment. When it starts moving, expect a cascade across smaller meme projects. Part of my strategy would be to watch Fartcoin as a leading indicator and scale into other meme exposure accordingly.

Pengu (Pudgy Penguins) — Meme With Product and Team

Thesis: S-tier team + product expansion + burning mechanics = meme with staying power.

Pudgy Penguins isn’t just cute artwork. The team has executed product expansion (Abstract Chain, token burns, growing merchandise and product lines) and the founder is actively hustling. That operational rigor differentiates Pengu from purely speculative meme plays.

Real-World Assets (RWA): Institutional Flows Start to Matter

RWA is still early, but its potential is enormous. Tokenizing real assets — loans, invoices, property — brings TradFi flows on-chain. That means real, recurring revenue and institutional counterparties. I’m bullish on projects that have already shown product-market fit and scaled assets under management.

Syrup (Maple Finance) — Fast Scaling RWA Play

Thesis: AUM growth + revenue allocation to buybacks = direct token holder benefits.

Maple Finance’s token Syrup is one of the RWA names I’d hold heading into Q4. They’ve crossed $4 billion in assets under management, a material milestone that proves institutional demand for on-chain lending and credit primitives. Maple allocates 25% of revenue to buybacks — that’s a direct mechanism for returning value to token holders as the business scales.

Base Ecosystem: Coinbase-Backed Momentum

Base has become one of the cycle’s hottest chains, mainly due to Coinbase’s push and the expectation of token-related incentives. If base unveils token mechanics and Coinbase routes product features through the chain, early ecosystem tokens could benefit materially.

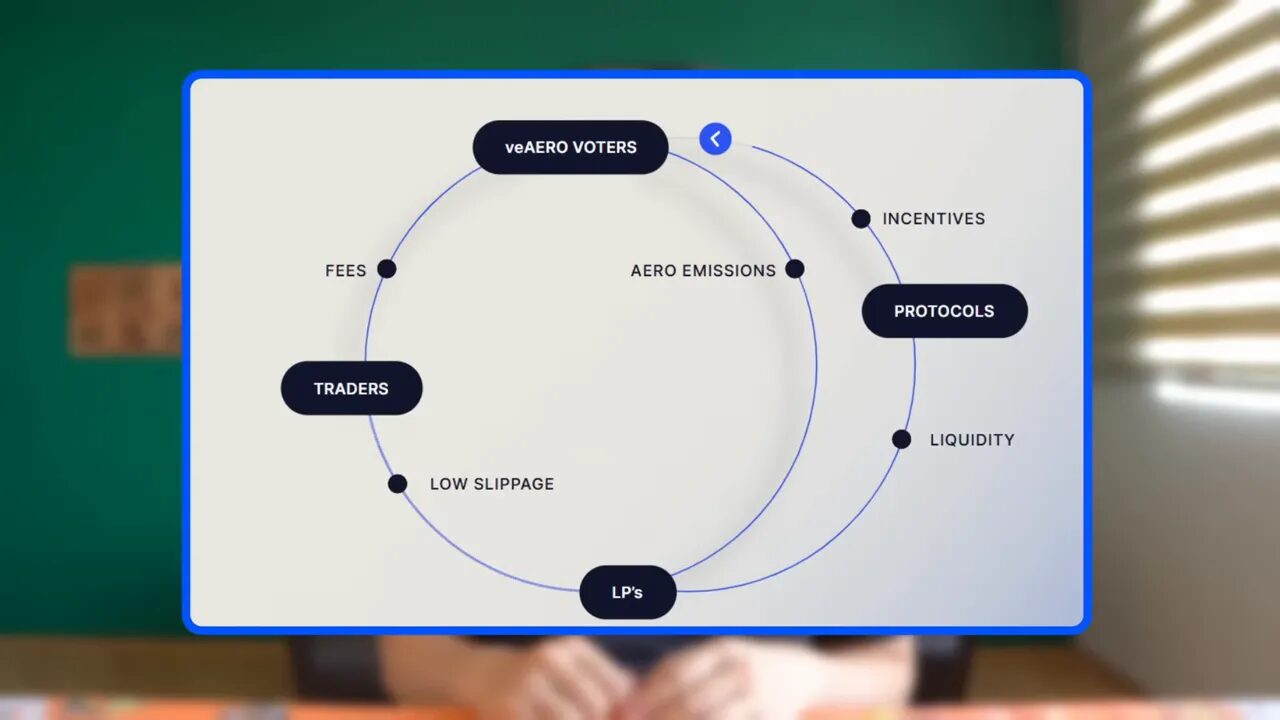

Arrow (Aerodrome Finance) — VE Tokenomics Flywheel

Thesis: VE model + emissions + Coinbase routing = strong on-chain metrics.

Aerodrome’s Arrow has all the ingredients: ve-style tokenomics, emission schedules built to reward liquidity, and an expectation of higher DEX activity as Coinbase routes trading features through the chain. That flywheel tends to deliver strong on-chain growth when the base chain sees product adoption.

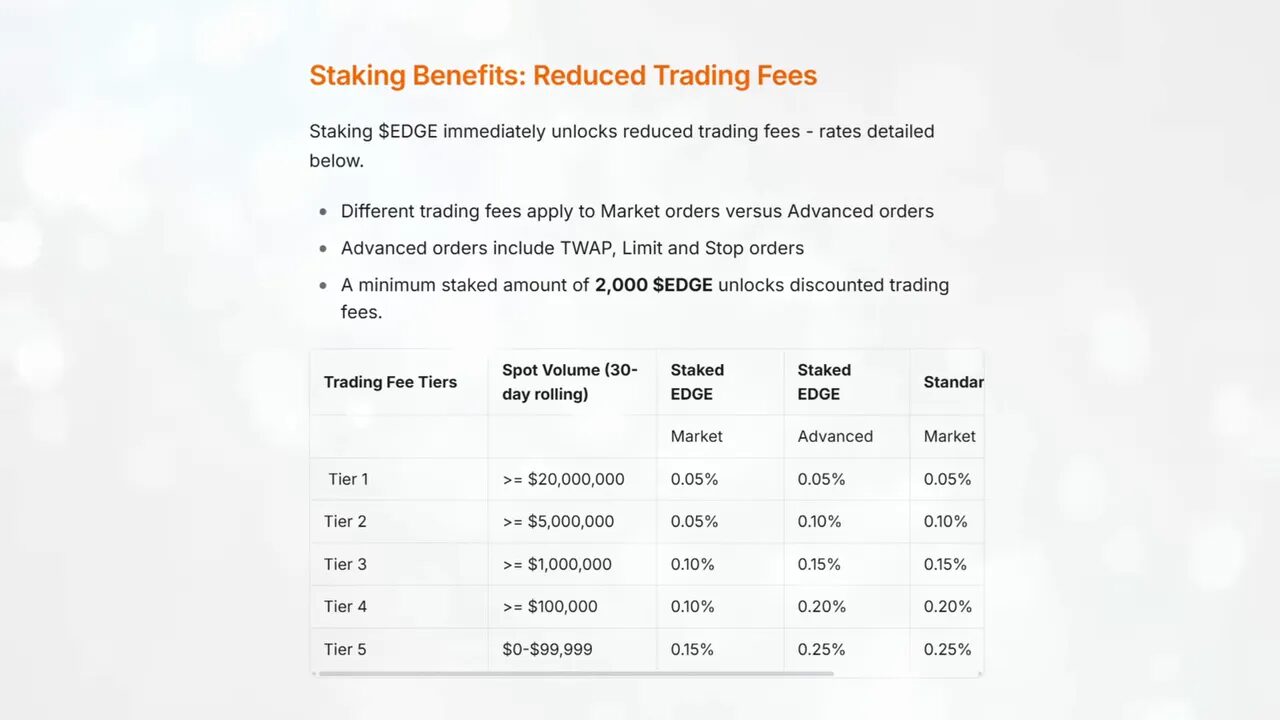

Edge — Utility for Pro Traders on Base

Thesis: Real utility + institutional staking for fee reduction = organic demand.

Edge powers Definitive, a pro-grade trading terminal with advanced order types. The chief value prop? Staking reduces trading fees — that’s a real utility that institutional clients already value, so they’re buying tokens to optimize execution costs. While smaller and riskier than some of the other names, Edge could significantly outperform if Base continues to rip.

Putting It All Together: A Hypothetical $10,000 Allocation

Here’s a sample allocation aligned with the theses above. This is an illustrative allocation aimed at balancing core exposure with higher-beta opportunities:

- ETH — 30% (core, lower volatility relative to alts)

- SOL — 10% (higher beta layer-one)

- HYPE (Hyperliquid) — 10% (revenue/meta play)

- Pump — 5% (meme innovation + buybacks)

- XPL & ENA (stablecoin exposure) — 10% combined (split across both)

- Retail DAO — 5% (community access / trading edge)

- Meme bucket (SPX 6900, Fartcoin, Pengu) — 10% combined (diversified across the three)

- Syrup (RWA) — 5% (institutional flow play)

- Base ecosystem (Arrow, Edge) — 10% combined (early ecosystem exposure)

This split is intentionally diversified: big core positions in ETH and SOL backed by smaller, tactical allocations to revenue projects and culture-driven tokens. Adjust proportions based on personal risk tolerance — if you’re conservative, increase ETH and reduce memes; if you’re aggressive, up the meme and base allocations.

Execution Tips: How to Buy Before the Pump

“Buy before the pump” isn’t just a catchphrase — it’s the strategy. But execution requires discipline:

- Scale in over a few trades to avoid bad entries on short-term volatility.

- Define target exit points and stop losses for each position to manage drawdowns.

- Watch on-chain signals: inflows to exchanges, large whale buys, and wallet accumulation patterns often precede momentum moves.

- Monitor narrative rotation: when smart money shifts from layer-one to revenue plays to memes, you want to be redeploying capital along the rotation.

For traders who prefer a more hands-on approach, the right combination of research and timely trade signals is invaluable. Our crypto signal service provides curated entries, stop levels, and liquidity warnings tailored to the sectors covered above — a practical complement to the sector-based portfolio I outlined.

Risk Considerations and Final Notes

Crypto is volatile and Q4 could move fast in either direction. A few risks to keep in mind:

- Macro surprises: if inflation prints hotter or the Fed delays cuts, risk assets could pull back hard.

- Regulatory shocks: unexpected regulatory actions can disproportionately affect altcoins and stablecoins.

- Narrative fatigue: not every rotation will perform — some projects will underdeliver even if their sector rips.

Mitigate these risks by diversifying across sectors, sizing positions for your tolerance, and using stop discipline. Communities and signal services reduce research friction and can help you react faster, but they are complements — not replacements — for your own risk management.

FAQ

Q: Why focus on sectors instead of individual coins?

A: Sectors capture thematic drivers — macro liquidity, revenue mechanics, product adoption — that tend to move clusters of assets together. Positioning by sector reduces single-token idiosyncratic risk and improves the odds that at least one exposure benefits from a broader narrative tailwind.

Q: How much should a retail trader allocate to meme coins?

A: Meme allocations should be small relative to your core positions because of their high volatility and speculative nature. For most traders, 5–15% of crypto capital is a reasonable range, adjusted for risk appetite.

Q: What signals should I look for to know Q4 is really starting?

A: Look for macro signs (Fed commentary and rate moves), on-chain accumulation in key wallets, increases in DEX volumes and market depth on leading layer-ones, and narrative rotation on social platforms. Spike in stablecoin minting tied to a specific protocol can also signal institutional on-chain flows.

Q: Do I need a community or signals to succeed?

A: Not strictly, but both materially increase your edge. Communities surface ideas faster, and signals give tactical entries and risk frameworks that help you trade quickly and with discipline. Together they reduce the cognitive load of managing a multi-asset crypto portfolio in a fast-moving quarter.

Q: Is this financial advice?

A: This is educational and illustrative — not personalized financial advice. Always do your own research and consult a financial professional if needed.

Conclusion

Q4 looks like a fertile setup for crypto: potential Fed cuts, the end of QT, and rotation into higher-beta sectors. If I had $10,000 to deploy, I’d anchor in ETH, add targeted layer-one bets like SOL, and distribute the remainder across revenue-meta projects, selected stablecoins, DAO access, a measured meme allocation, RWA exposure, and early base ecosystem plays.

Execution matters more than hypothetical allocations. Scale in, define your risk, and stay plugged into both research communities and tactical execution signals. If you want a practical combination of both — curated trade entries plus community-grade research — consider pairing community access with disciplined signal-based entries to execute quickly when narratives flip.

Above all, plan your entries and exits, stay flexible, and prepare to act fast — Q4 doesn’t wait for indecisive traders.