In this deep-dive I’m laying out exactly why I’ve quietly accumulated $37,000 worth of Injective (INJ). This article synthesizes on-chain metrics, protocol design, real-world asset initiatives, AI integrations, tokenomics, recent announcements, and a data-driven INJ Price Prediction framework for the 2025 bull run. If you care about why INJ could be a multi-narrative winner this cycle, read on — I’ll walk through the reasons step-by-step and show the scenarios that back my view.

Table of Contents

- Introduction — The core thesis behind my INJ position

- What is Injective? A quick primer

- The five narratives Injective hits (and why that matters)

- On-chain metrics that validate the thesis

- The Injective burning mechanism and why it matters for tokenomics

- Recent and notable Injective updates (what’s being built right now)

- Putting the pieces together — the Injective flywheel

- INJ Price Prediction methodology — transparent and data-driven

- INJ Price Prediction scenarios — realistic, optimistic, and stretch

- Putting the numbers into perspective

- Risks, downsides, and what could go wrong

- What I’m watching next (indicators that would change my INJ Price Prediction)

- My personal stance and risk management

- FAQ — Short answers to common INJ Price Prediction questions

- Final thoughts — the risk/reward and the edge

- Where to go from here

- Closing

Introduction — The core thesis behind my INJ position

I’ve been accumulating INJ because it isn’t just another layer-one blockchain making marketing claims. Injective solves practical problems for developers and institutions and is executing across multiple narratives simultaneously. That combination — multi-narrative exposure plus real, composable infrastructure — is what convinced me to invest $37,000 into a single project that I believe has asymmetric upside.

Right up front, the term that ties this piece together is INJ Price Prediction. I’ll use data-driven assumptions to project plausible price ranges for INJ in the 2025 bull run. This is not empty hype — the math behind market dominance, token supply, burning dynamics, and global crypto market cap scenarios underpins each projection.

What is Injective? A quick primer

Injective is a layer-one blockchain focused on decentralized finance, derivatives, tokenized real-world assets, and cross-chain composability. Its main claim to fame is developer ergonomics: Injective offers modular building blocks (modules) that let teams spin up complex applications very quickly without rebuilding everything from scratch. Think of it as “plug-and-play” infrastructure for exchanges, DeFi apps, tokenized assets, and more.

That modular approach matters because it accelerates product development, lowers technical risk for teams, and encourages a broader ecosystem of third-party applications. In turn, that activity creates transactions, fees, liquidity, and community — the classic virtuous cycle that strong layer-one ecosystems need.

Why modules and developer experience are better than raw specs

- Lower friction: Developers don’t need to re-invent standard features (NFT support, staking, order books, tokenization primitives).

- Faster go-to-market: Teams can launch a product by composing modules rather than building from the ground up.

- Network effects: More apps → more users → more revenue → more builders. That’s the flywheel.

Compare that to building on a chain where you must assemble a team that knows a different virtual machine or rewrite core pieces from scratch — it’s expensive and slow. Injective’s modularity is effectively a developer growth engine, and developer adoption is one of the most underrated variables for long-term success in blockchain.

The five narratives Injective hits (and why that matters)

In crypto, narratives are the tides that lift projects. Injective isn’t a one-trick pony — it’s currently positioned across at least five high-conviction narratives:

- Layer-one infrastructure

- Real-world assets (RWA) and tokenized equities

- DeFi and derivatives

- AI integrations and AI-native tooling

- U.S.-focused institutional accessibility (regulatory-friendly products)

By aligning with multiple narratives, Injective gets exposure to several potential capital inflows at once. When a narrative (say AI or RWA) attracts attention, Injective is more likely to benefit — because it has protocol primitives and product features directly relevant to that narrative.

Why narratives matter for an INJ Price Prediction

Market cycles aren’t random; they are shaped by narratives that attract investor and institutional attention. A project that sits at the intersection of several powerful narratives is more likely to see outsized capital flow during the next bull market. That multiplies the protocol’s chance to gain market dominance relative to peers — which is the core input in our INJ Price Prediction methodology later in this article.

On-chain metrics that validate the thesis

Data matters. Injective’s on-chain metrics show a project that has traction, revenue, and inflows — even before the bull fully kicks in. Here are the key metrics and why they matter.

Transactions per second (TPS) and active usage

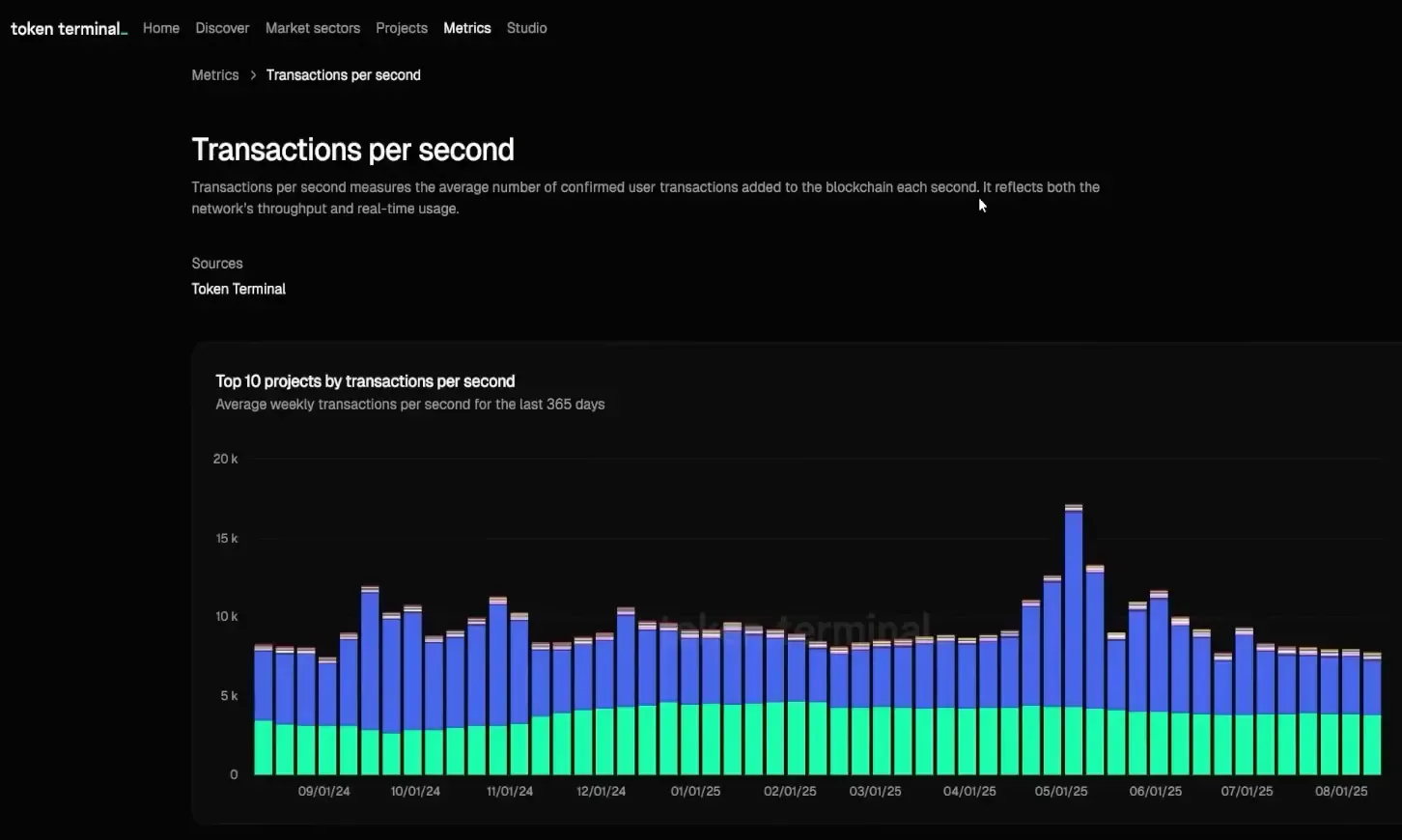

Injective is ranked roughly in the top 10 for active TPS, with around ~42 active transactions per second at the time of analysis. I don’t care about being “the fastest” chain for the sake of a headline. What matters is sustainable throughput and the presence of real users and applications. Being in the top ten is a meaningful validation that the network is being used.

Revenue generation

Injective ranks well among revenue-producing chains. When you isolate layer-one projects, Injective sits ahead of some large names (it beat Near and Avalanche in the particular metric referenced). Revenue is a key metric because it reflects real economic activity on the chain; protocols that generate revenue tend to attract developers and institutional interest because they create sustainable incentives for continued development.

Net flows and bridges

Net flows across bridges give a picture of capital moving into a chain. Injective ranked in the top four for net flows over a three-month period at roughly $120 million net inflows — more than double Solana in that snapshot. That demonstrates the network is attracting liquidity investors are moving capital into Injective — a signal many traders use to anticipate meaningful price action.

Daily active addresses and transactions

Injective’s daily active addresses were in the tens of thousands (e.g., ~81,000 at snapshot). That level of DAAs and the cumulative transaction count (over 2.4 billion transactions historically) aren’t small numbers — they show consistent usage and an active ecosystem.

Assets, locked state, and tokenization count

Injective already supports over 2,000 assets and has a large portion of the network state locked. The asset diversity and state locked indicate multiple applications and use cases are already live or in maturation, which helps the flywheel.

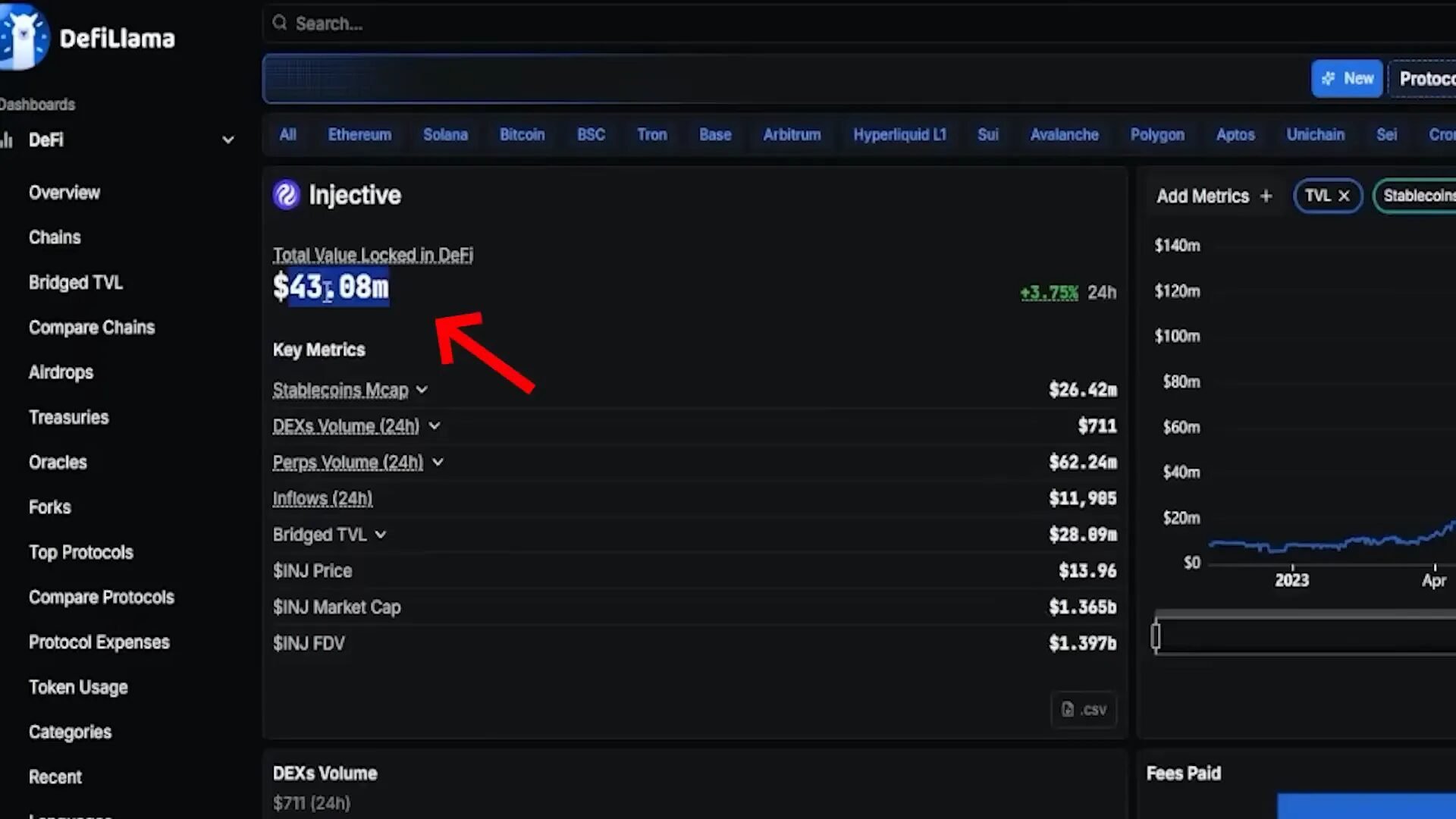

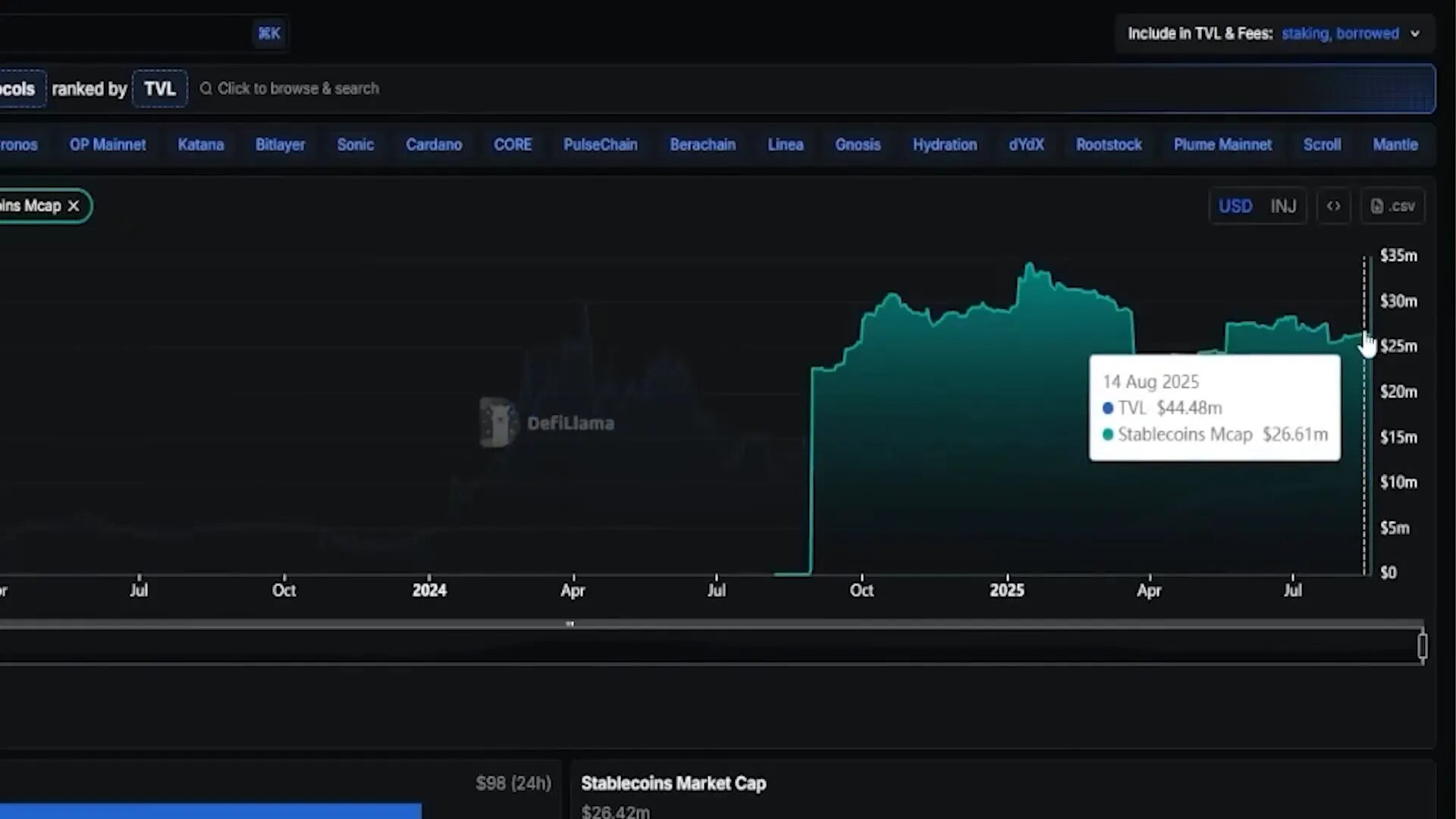

TVL and stablecoin market cap — the weak spot

This is the honest part: Injective has a comparatively low TVL and a tiny stablecoin market cap (around $26 million in the data snapshot). That’s a notable drawback because DeFi TVL often underpins liquidity and usable on-chain capital for loans, synthetic assets, and yield products.

I consider this a solvable short-term issue. EVM compatibility (Athonian EVM mainnet) and the iAssets suite are specifically designed to boost TVL by making tokenized real-world assets and EVM-native liquidity easy to build on Injective. But it is a real risk that deserves attention before making any investment decisions.

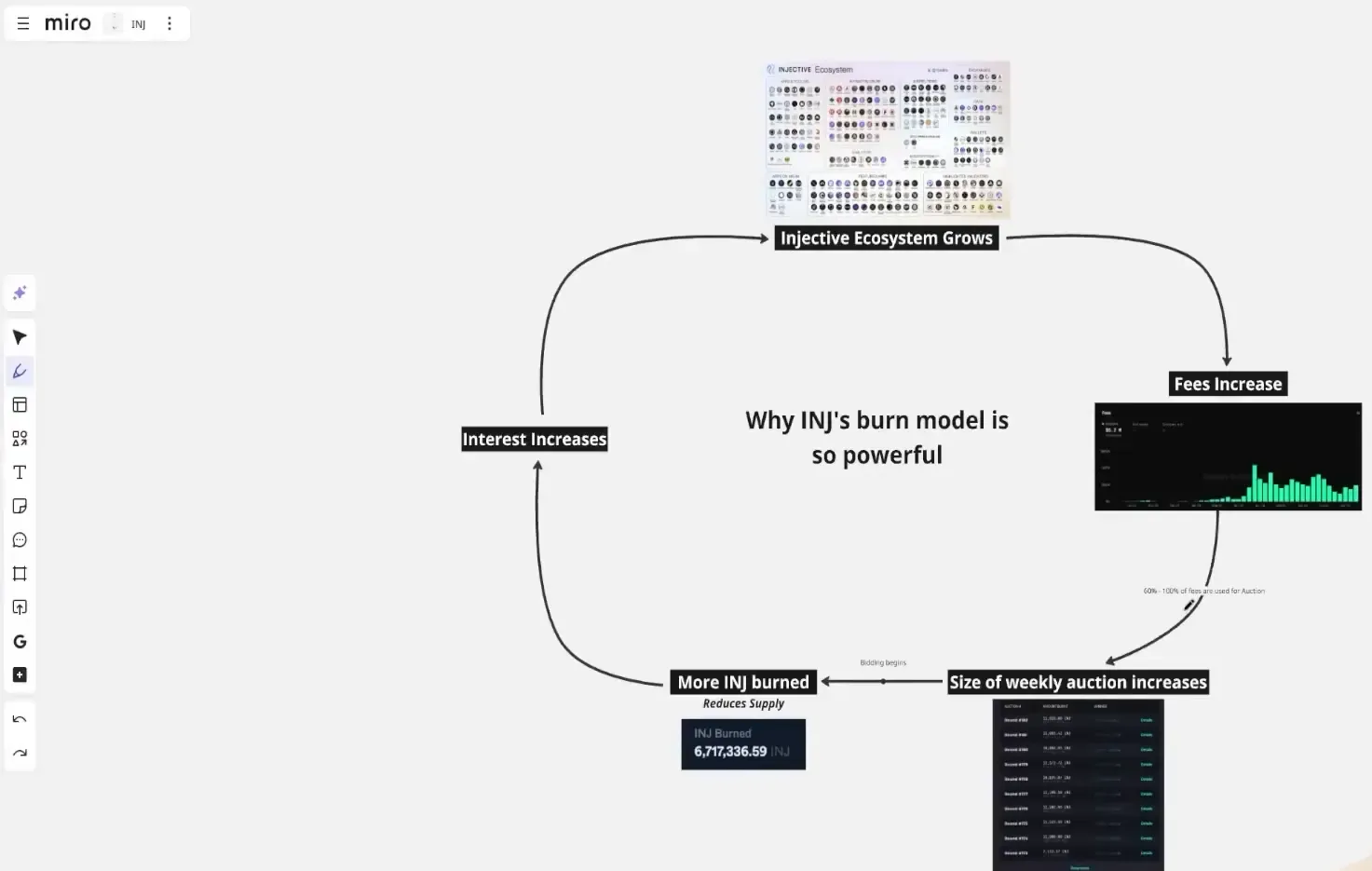

The Injective burning mechanism and why it matters for tokenomics

One of Injective’s most interesting features is a weekly auction-based burn mechanism that can create deflationary pressure as the ecosystem scales. Understanding this dynamic is crucial for any credible INJ Price Prediction.

How the weekly auction works

- All fees accrued during the week — protocol fees and ecosystem application fees denominated in INJ and other ecosystem tokens — are pooled into a weekly auction pot.

- Participants bid INJ to win the pot. If you win and your bid is lower than the pot value, you profit the difference — but the INJ bid you placed is burned.

- That bid (INJ) is removed from circulation permanently, reducing supply.

This mechanism creates a feedback loop: as the protocol generates more fees, the pot grows, bids increase, and more INJ is burned. More burns lower supply, which can support higher token price if demand stays the same or rises.

Burn metrics — real numbers

Injective has burned nearly 7 million INJ to date — equivalent to roughly $95–96 million in value at the time of those burns. I plotted auction data from the first auction to the present to analyze burn rates:

- Average historical burns: ~34–35k INJ per week (skewed by one large 5M INJ burn associated with a mainnet update)

- Recent stabilized burns: ~10k INJ per week

From the supply side, Injective mints new tokens through staking rewards and inflation. Based on protocol parameters and a reasonable assumption of 5% APY (an average between the recently tightened inflation bounds of 4% and 7%), we were adding roughly 98k INJ per week into circulation at the time of the analysis, while burning ~10k per week. Net issuance was around ~63k INJ per week.

Why the auction matters for INJ Price Prediction

The auction is not merely a tokenomic gimmick; it’s a structural source of deflation that scales with protocol revenue. In a bull market, as trading volumes, tokenized asset activity, and institutional usage increase, the fee pot should grow. Larger pots incentivize higher bids, which directly removes INJ from circulation. That dynamic amplifies price impact when demand rises.

Recent and notable Injective updates (what’s being built right now)

Injective has been executing on multiple fronts. Below I summarize the most important recent updates that influence ecosystem growth, revenue potential, and thus my INJ Price Prediction model.

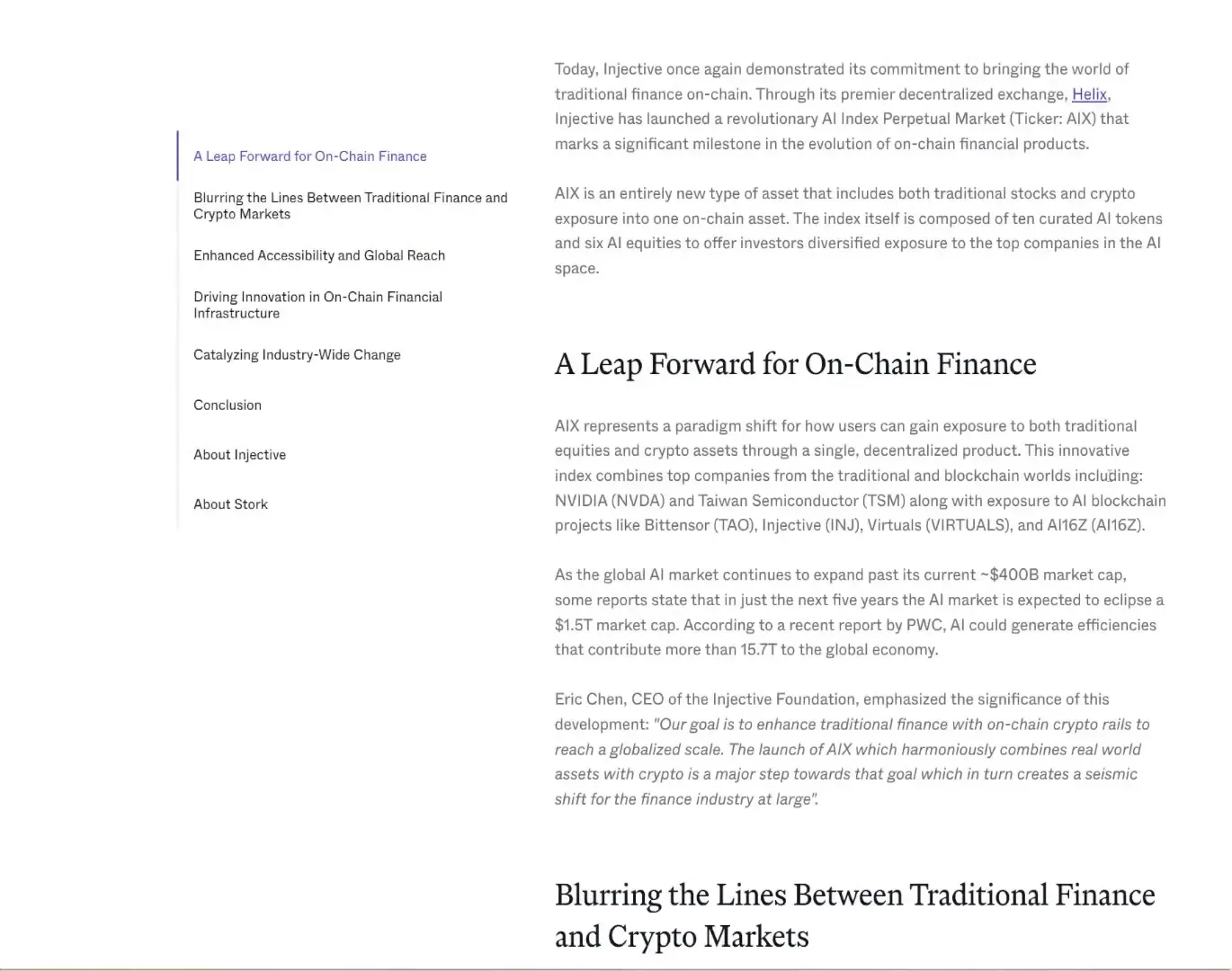

iAssets — tokenized real-world assets, done properly

Injective’s iAssets are a new class of tokenized derivatives that are designed to be fully on-chain, composable, and capital efficient. The key differentiator is that iAssets are built to be usable across protocols without excessive over-collateralization and without being awkward, low-liquidity wrapped tokens.

Use cases already launched or teased include:

- Tokenized compute exposures (e.g., tokenized exposure to NVIDIA H100 utilization)

- Tokenized index products (including an AI index that packages cryptocurrencies and equity exposure)

- Tokenized BlackRock fund index (first-of-its-kind tokenized index exposure)

- Tokenized ETFs and institutional treasuries (e.g., tokenized exposure to large Ethereum treasuries)

Why this matters: real-world asset tokenization is a massive market. Injective’s approach — composable, natively transferable iAssets — makes tokenized assets far more usable inside DeFi products. That multiplication of utility is precisely the sort of development that increases fees, TVL, and auction burn size over time.

ETFs and regulatory accessibility

Canary Capital filed for an “in-state” Injective ETF in the U.S. If this product goes through, it would make Injective available to traditional investment channels, including retirement accounts (401(k) plans) in the U.S., opening the door to a broader capital base.

Institutional demand from ETFs can be transformational for a token. The ability to earn yield (if the ETF supports staking) and the availability inside retirement vehicles would be a structural tailwind for INJ demand.

iBuild and iAgent — AI-driven developer tooling

Injective is building AI tooling to lower the development barrier further. iBuild promises to let developers create applications using natural language prompts. iAgent is an AI plug-and-play module that brings intelligent agents into the Injective ecosystem — potential partners include Fetch.ai for agent tech.

Imagine a non-technical financial team using natural language to generate a tokenized fund, wrap it into an iAsset, and deploy it across integrated DeFi rails — that’s the ambition here. Lowering the barrier to create productive apps should accelerate the flywheel mentioned earlier.

Sonic hub and cross-chain AI integration

Injective is working with Sonic to build a cross-chain hub between Solana and Injective, with AI as a central element. Cross-chain interoperability plus AI-driven automation opens interesting use cases like cross-chain indexes, AI-managed portfolios, and cross-network liquidity routing.

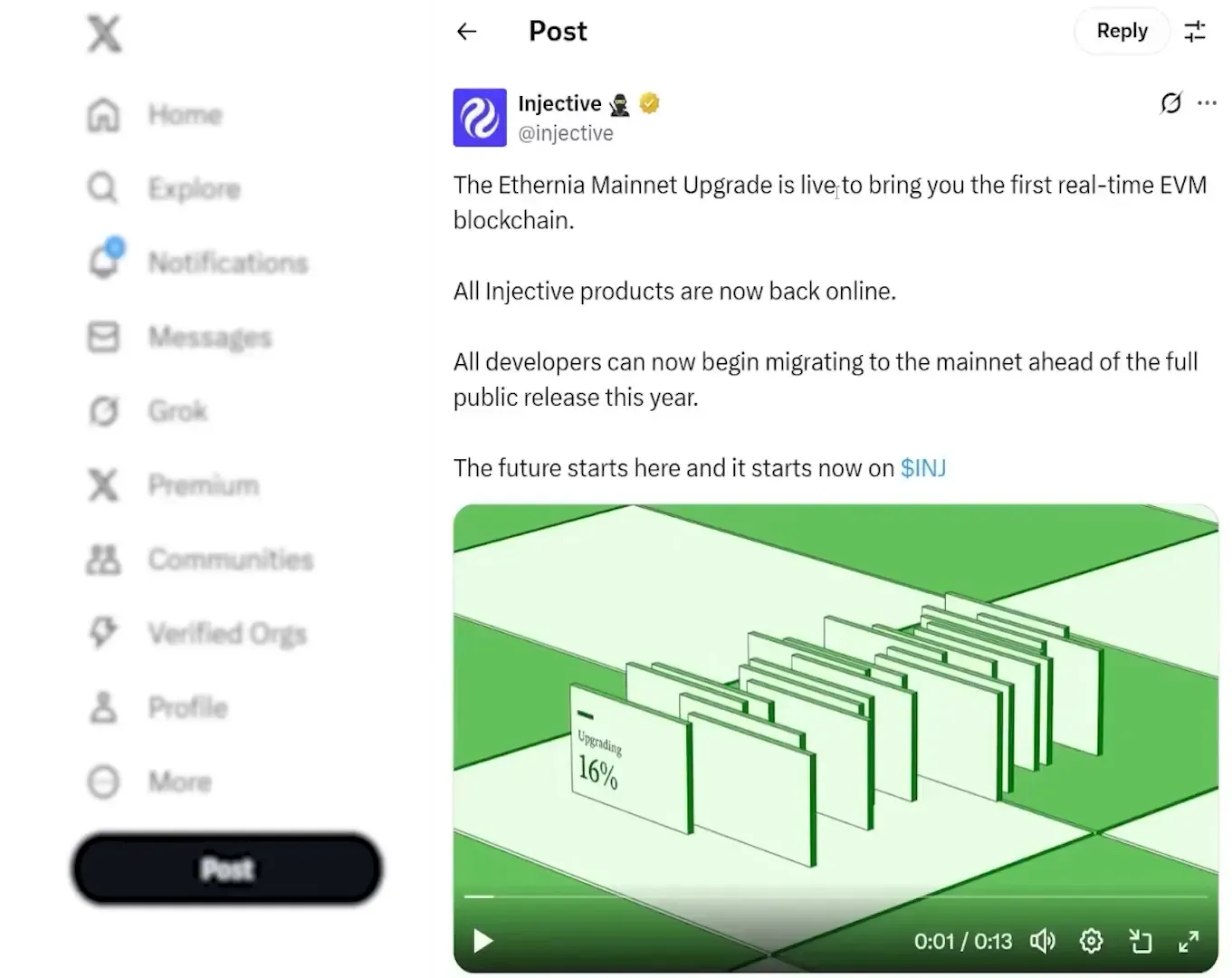

Athonian EVM mainnet — EVM compatibility to grow TVL

Athonian mainnet provides an EVM-compatible environment that is fast and compatible with both Ethereum tooling and the Injective base layer. EVM compatibility is crucial because it allows Ethereum-native projects and liquidity to port applications and TVL to Injective more easily.

I expect Athonian to be one of the main levers to help Injective close the TVL gap. If EVM-based liquidity can be ported or bridged into Athonian and then composed into iAssets and derivatives, TVL should grow meaningfully — which again feeds into revenue and burns.

Accelerator programs and media support

Injective is participating in joint accelerator programs (for example, with Cointelegraph) to fund and promote projects built on the protocol. This is a classic growth play: funding + PR = higher visibility for new apps, which increases the odds that builders succeed and bring users to the ecosystem.

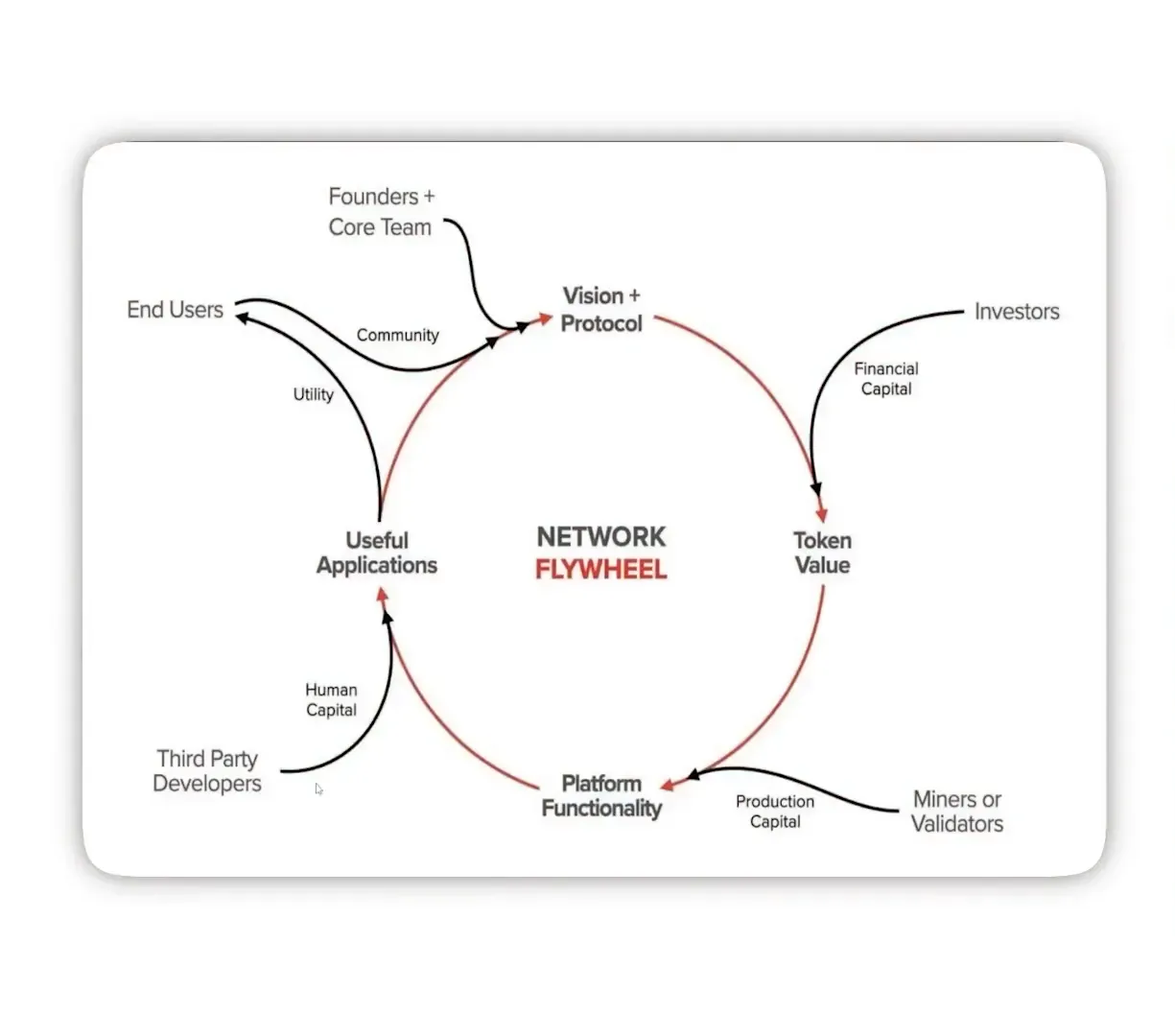

Putting the pieces together — the Injective flywheel

Summarizing the economic flywheel:

- Developer-friendly modules + AI tooling → more builders and apps

- More apps → more users, liquidity, and transaction volume

- Transaction fees → larger weekly auction pots

- Larger pots → higher bids and more INJ burned

- Burns + rising demand → upward price pressure on INJ

- Higher INJ value → more protocol visibility and institutional interest (ETFs, 401k access)

That’s the virtuous cycle that could move Injective from a small-market-cap project into a top-tier layer-one contender — if execution continues and external market tides cooperate.

INJ Price Prediction methodology — transparent and data-driven

When forecasting price, you must separate subjective hope from calculable scenarios. For my INJ Price Prediction I used a conservative methodology:

- Forecast a plausible global crypto market cap at the cycle peak (two scenarios: conservative and optimistic)

- Assume altcoin dominance expansion: historically, many altcoins gained 5x–10x dominance in a strong bull market

- Multiply the global market cap by Injective’s projected dominance to generate a market cap scenario for Injective

- Divide Injective market cap by projected circulating supply (accounting for burns and net issuance) to compute a per-token price

Key inputs and assumptions used in the INJ Price Prediction:

- Global crypto market cap at peak: Low scenario = $8 trillion; High scenario = $14 trillion

- Dominance multiplier (how much Injective’s market dominance grows): between 5x and 10x

- Supply assumptions: current supply adjusted for projected burns and inflation bounds (4%–7% per protocol update); I roughly used a 5% APY / average inflation assumption for baseline

INJ Price Prediction scenarios — realistic, optimistic, and stretch

After running the math, here are the summarized scenarios for INJ price at cycle peak based purely on the methodology above.

Realistic case (most probable)

Range: $200 — $400 per INJ

This corresponds to Injective reaching a market cap in the $21 billion — $40 billion range. That’s a reasonable and defensible outcome if Injective achieves substantial adoption, tokenized asset traction, and some institutional wallet flows (including potential ETF flows) during a bull market that pushes the global crypto market cap higher.

Comparison to Avalanche (previous cycle analogue)

Avalanche’s previous cycle price action is instructive. Avalanche peaked without being uniquely differentiated in the last cycle — it was mainly a fast, eco-friendly chain. If Injective matches Avalanche’s prior market cap performance, that implies an INJ price around ~$300. Given that Injective hits multiple narratives Avalanche didn’t fully capture at the time (tokenized RWA, AI tooling, institutional-friendly products), matching or beating Avalanche seems plausible.

Personal base / optimistic case

Range: $400 — $500 per INJ

This assumes Injective executes on iAssets, Athonian EVM starts pulling over meaningful TVL, ETFs or institutional flows materialize, and the bull market expands global crypto market cap toward the higher end of our scenarios. That would imply a 16x–29x move from current levels (depending on entry price).

Stretch / best case

Range: $500 — $800 per INJ

This is less probable but still within the theoretical bounds if the global market cap reaches the high-case scenario and Injective significantly outperforms its peers in dominance growth. This is what I’d call “bull-run everything goes right” territory. I don’t personally base my entire position on this case, but I won’t ignore it as a tail possibility.

Putting the numbers into perspective

A few observations to put the INJ Price Prediction scenarios in context:

- Even the realistic case assumes meaningful growth in TVL, fees, and use cases. The EVM bridge, iAssets adoption, and institutional products are critical enablers.

- Token burns need to accelerate to meaningfully shift the supply dynamics. Higher revenue → larger weekly auction pots is the pathway to achieve that acceleration.

- ETFs and retirement vehicle accessibility have outsized potential to drive demand from outside the “crypto native” investor base.

- Competition matters: protocols like Avalanche, Solana, and EVM challengers will continue to compete for developer mindshare. Injective’s modular and AI-first approach is a differentiator, but execution is everything.

Risks, downsides, and what could go wrong

Any investment thesis must include clear risks. Here are the main downside cases for Injective that could derail my INJ Price Prediction:

Low TVL persists

If EVM compatibility and tokenization products do not translate into meaningful TVL growth, fees will remain modest and auction burn sizes will stay small. That undermines the deflation thesis and limits upside.

Competition wins on developer mindshare

Even with modules and AI tooling, other ecosystems could capture builders through larger grants, network effects, or superior UX. If Injective fails to grow its developer base, adoption stalls.

Regulatory headwinds

Tokenized RWA and ETF efforts raise regulatory scrutiny. If regulators stifle tokenization initiatives or ETFs for INJ are blocked, institutional flows could be limited.

Execution risk

Roadmap execution is non-trivial: iBuild, iAgent, Sonic bridges, and Athonian must be implemented and matured. Bugs, delays, and security incidents can sap developer and investor confidence.

Macro risk

All crypto tokens are correlated with macro liquidity and risk-on flows. A weak overall bull market could cap Injective’s upside regardless of its relative strengths.

What I’m watching next (indicators that would change my INJ Price Prediction)

- Weekly auction pot growth and burn rates. A sustained increase would materially improve the deflation thesis.

- TVL change on Athonian EVM: does EVM compatibility translate to real liquidity? Watch bridging flows and major protocols launching on Athonian.

- Adoption of iAssets: number of tokenized funds, market cap of tokenized assets, and whether those assets are used in other DeFi products.

- Institutional signals: ETF approvals, custody partners, and retirement-plan accessibility.

- Partnerships and accelerators that drive developer inflows and media exposure.

My personal stance and risk management

Transparency: I own INJ and have a meaningful position — I’ve disclosed $37,000 worth. That’s not financial advice and not a recommendation; it’s my personal allocation based on a thesis I believe has asymmetric upside. My position reflects a conviction in the multi-narrative exposure, the auction burn mechanism, and the team’s execution thus far.

For readers considering exposure, consider the following risk management ideas:

- Dollar-cost average (DCA) rather than buying a single large lump sum.

- Size positions relative to portfolio risk tolerance — injecting a significant portion of capital into a single altcoin is speculative.

- Monitor leading indicators and set stop-loss or re-evaluation triggers based on execution milestones (e.g., Athonian TVL milestones, major ETF filings progress, weekly auction burn trends).

FAQ — Short answers to common INJ Price Prediction questions

Q: What is the single biggest factor that will drive INJ price higher?

A: Scaled revenue leading to larger weekly auction pots and higher burns. In short: real economic activity that yields fee revenue on Injective.

Q: Can Injective match Avalanche’s previous cycle market cap?

A: Yes — that’s the middle-of-the-road scenario I used. Avalanche’s previous run provides a realistic benchmark because Avalanche was a high-TVL chain without the RWA and AI narratives Injective is now capturing.

Q: Will ETFs make a difference?

A: Potentially yes. ETF accessibility broadens demand to traditional institutional and retail channels that don’t currently hold crypto directly. If an Injective ETF is approved and is stakeable, it could be a meaningful source of demand.

Q: Is the auction burn mechanism guaranteed to make INJ deflationary?

A: Not guaranteed. It depends on fee growth relative to issuance. The mechanism enables deflationary outcomes if revenue scales quickly enough; without that revenue growth, inflation could persist.

Q: How should I interpret the INJ Price Prediction ranges?

A: They are scenario-based outcomes anchored in reasonable assumptions about global market cap and Injective’s dominance gains. The realistic scenario ($200–$400) assumes solid execution; the optimistic and stretch cases assume stronger macro tailwinds and protocol success.

Final thoughts — the risk/reward and the edge

Injective combines developer-focused modules, tokenized real-world asset tooling, AI-first developer primitives, EVM compatibility, and a unique auction burn mechanism. Those elements together give Injective optionality across multiple powerful narratives. That optionality is why I allocated $37,000 into INJ: the asymmetry between current market pricing and plausible outcomes in a bull market is attractive to me.

But a balanced take: Injective isn’t without weaknesses. TVL is low today; stablecoin market cap is small; and execution must continue to be flawless. If Injector fails to convert technology into usable liquidity and revenue, the burn mechanism won’t save price performance alone.

My INJ Price Prediction framework gives a rational set of outcomes based on market-cap math rather than pure hype. If you’re bullish on tokenized assets, institutional embrace, and AI-driven developer acceleration, Injective deserves a place on your research list. If you prefer simpler narratives or larger liquidity pools (e.g., already-established L1s), Injective may remain a higher-beta angle only appropriate for a portion of a speculative portfolio.

Where to go from here

If you like the approach used in this analysis, here are practical next steps you can take to form your own view:

- Track weekly auction pot sizes and burn totals — those numbers tell a real story.

- Monitor Athonian EVM TVL and which major protocols bridge to or launch on Athonian.

- Follow iAssets product launches and measure adoption over time (AUM and liquidity metrics).

- Watch for regulatory and ETF developments — filings, approvals, custody partnerships.

- Pay attention to developer activity: GitHub commits, grants, hackathon outputs, and accelerator participants.

Invest with a plan, manage position sizing, and treat INJ as a high-conviction but still speculative allocation within a broader portfolio. The INJ Price Prediction scenarios above are windows into what could happen under realistic assumptions — use them to set expectations and prepare for multiple outcomes.

Closing

Injective is one of the most interesting multi-narrative plays in the current crypto landscape. Between its modular developer experience, iAssets tokenization, AI tooling, EVM compatibility, auction burn mechanics, and early institutional interest, I believe the protocol has the components necessary to scale. My INJ Price Prediction scenarios reflect that optimism while staying rooted in market-cap math and supply/demand mechanics. I’ll be monitoring the leading indicators I listed and adjusting my view as evidence accumulates.

Thanks for reading — I laid out the logic, the numbers, and the scenarios. Now it’s your turn: where do you see Injective going in the next cycle? Use the INJ Price Prediction framework above to build your own scenario and backtest it with data.