Is Altseason Already Over? That is the question burning through every chat room, comment section, and late-night trading thread right now. Sentiment has swung hard from greed to fear, altcoins are painfully low, and a lot of people are asking whether the party ended already or whether this is the quiet before the storm. In this deep dive I lay out three distinct scenarios for altcoins in 2025, walk through the on-chain and macro evidence for each, and explain my own plan: cautious optimism, concentrated exposure to high conviction positions, and tactical buys using only money I can afford to lose. Is Altseason Already Over? Read on and you will have a framework to decide for yourself.

Table of Contents

- Why this question matters

- Quick primer: What I mean by altseason

- Where we stand today: sentiment, price, and what it feels like

- Scenario 1 — The party is over: cycle top already in

- Scenario 2 — The cycle is not broken: one more big leg to go

- Scenario 3 — The cycle timeline is stretched: the super cycle arrives in 2026

- Comparing the three scenarios side by side

- Technical and on-chain indicators to monitor

- Practical strategies for each scenario

- Trading opportunities by chain and sector

- How I am positioning: cautious optimism

- Common mistakes to avoid

- Checklist to answer Is Altseason Already Over?

- FAQ

- Final thoughts: how I answer Is Altseason Already Over?

Why this question matters

Is Altseason Already Over? It is not just a rhetorical headline. For many traders and investors the answer determines whether they should sell, hold, or double down. The wrong call can mean missing a generational move. The wrong call can also mean wiping out a portfolio. That is why we need a structured approach, not wishful thinking or FOMO. In this piece I will outline three plausible outcomes for altcoins in 2025, explain the evidence for and against each scenario using technicals, on-chain metrics, and macroeconomic tailwinds, and give a practical plan for navigating each path.

Quick primer: What I mean by altseason

Before we jump in, a quick reminder of what object we are debating. Altseason refers to a period where altcoins (the top altcoins beyond Bitcoin and Ethereum) significantly outperform Bitcoin, often with parabolic returns across the board. Historically altseasons happen during the most euphoric legs of crypto cycles when liquidity chases risk and retail participation surges. Is Altseason Already Over? We must keep that definition in mind because not every rally is an altseason. We are looking for broad-based strength across the top 30 or 50 altcoins relative to Bitcoin, not just a handful of meme pumps or single-asset rallies.

Where we stand today: sentiment, price, and what it feels like

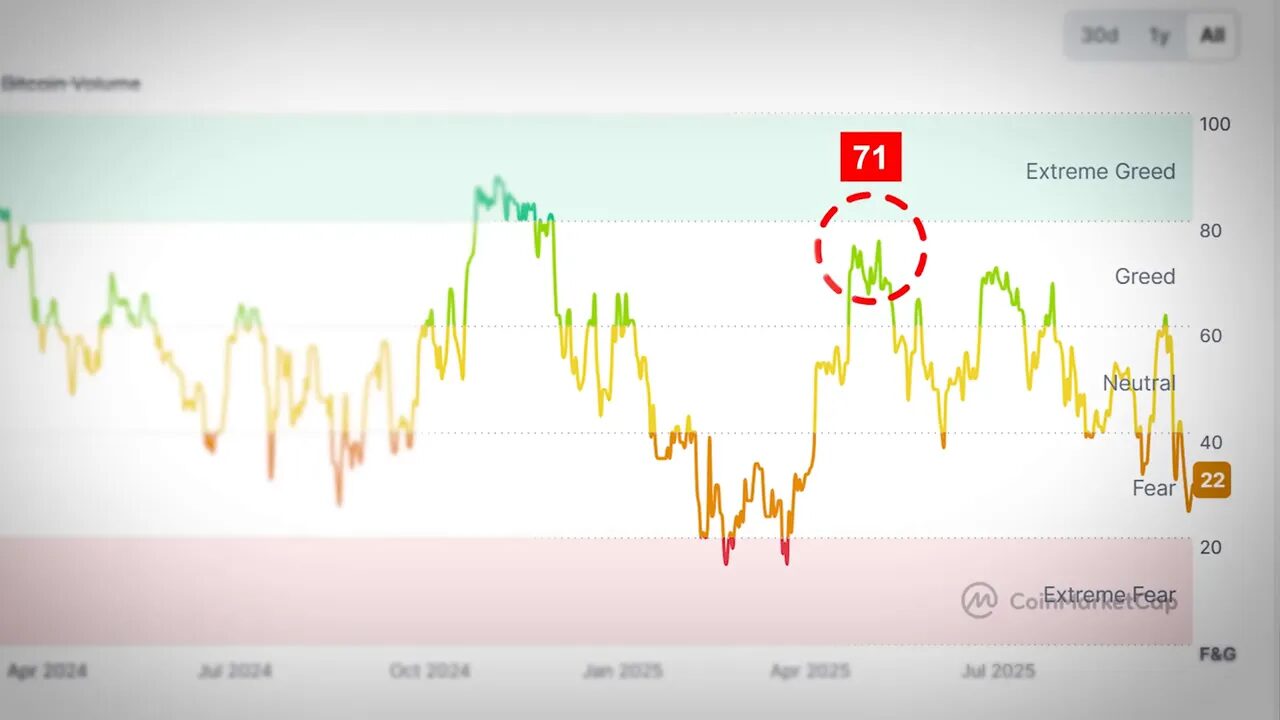

Right now the market feels defeated. A few weeks ago the Fear and Greed Index scored 71 — greed. Today it sits in the low 20s — extreme fear. That psychological swing is huge. Many wallets are underwater. Many traders are tired. When retail feels burned out, they tend to sell at a loss and wait for certainty that never quite comes.

Is Altseason Already Over? The immediate feeling suggests maybe. But feelings are not data. We need to look at evidence: cycle timing, Bitcoin dominance, altcoin market structure, on-chain flows, and macro indicators like the global business cycle and financial conditions. Below are the three scenarios I believe deserve serious consideration.

Scenario 1 — The party is over: cycle top already in

Is Altseason Already Over if the cycle top has already happened? Scenario one is blunt: the bull market is over. If you are a strict four-year cycle purist who insists the cycle is exact on dates, then the peak should have been around October 2025. For those purists, the brief move to a new all-time high already marked the top. The reasoning behind this scenario is straightforward and popular among cycle purists.

Key arguments for this scenario

- Timing alignment: Some people measure cycles exactly by days from the last cycle low to the current high. Historical patterns of 1,064 days get referenced as precise rules.

- Technical divergence: Bitcoin’s RSI showing bearish divergence from March 2024 to the cycle high is used to argue momentum peaked earlier.

- Meme coin euphoria: The proliferation of high-profile meme coins and celebrity tokens is read as an end-of-cycle sign, similar to late-stage speculative mania in previous cycles.

- Retail absence: Search interest for Bitcoin and Ethereum is still below 2021 highs. The Coinbase app rankings and app-store visibility show retail hasn’t resurfaced in numbers typical of bull mania.

All of these points deserve respect. If the macro or a single catalyst forces a broad unwinding, we could see a cascade that ends the cycle. That is why this scenario is the most bearish of the three.

What would confirm this scenario

- Weekly close below the 365-day simple moving average on Bitcoin. That would be an invalidation and a clear technical warning that the trend may have reversed.

- On-chain indicators that historically signal tops hitting their thresholds — for example a very large spike in exchange inflows combined with rising sell-side liquidity from whales.

- Retail capitulation evidenced by app downloads, search trends, and option market positioning collapsing.

If these confirmations occur, the prudent action would be risk reduction: tighten stops, rebalance to cash or stable assets, and redefine exposure only to high-quality projects with long-term utility. Is Altseason Already Over? In this scenario, yes it would be over for the foreseeable cycle.

Scenario 2 — The cycle is not broken: one more big leg to go

Is Altseason Already Over? Scenario two says not yet. The four-year cycle remains undefeated in its core structure, and the most explosive part of this cycle might still be ahead. This is the traditional “we are in the mid-cycle reset” perspective — we have had corrections and consolidation, but the core bull market continues.

Evidence supporting a continued cycle

- Pattern continuity: The four-year rhythm has been historically consistent. Despite ETFs and institutional shifts, that rhythm has not been violated in terms of major stages.

- Bitcoin dominance has not convincingly stayed above 60 percent. That means altcoins retain relative strength even in fear, which is atypical unless altcoins are preparing for their season.

- New cycle lows for top 50 altcoins could be a prelude. When many alts bottom together it can indicate capitulation followed by accumulation, which precedes altseason.

- Technical and on-chain structures in alt markets show bullish formations: multi-year ascending triangles, cup-and-handle patterns on total crypto market cap minus USDT and other aggregated charts. These are bullish setups that can result in parabolic moves if they break.

- Cycle top indicators are mostly untriggered. A broad set of 30 historical cycle top indicators are not yet firing. That is persuasive evidence that we may not be at the end.

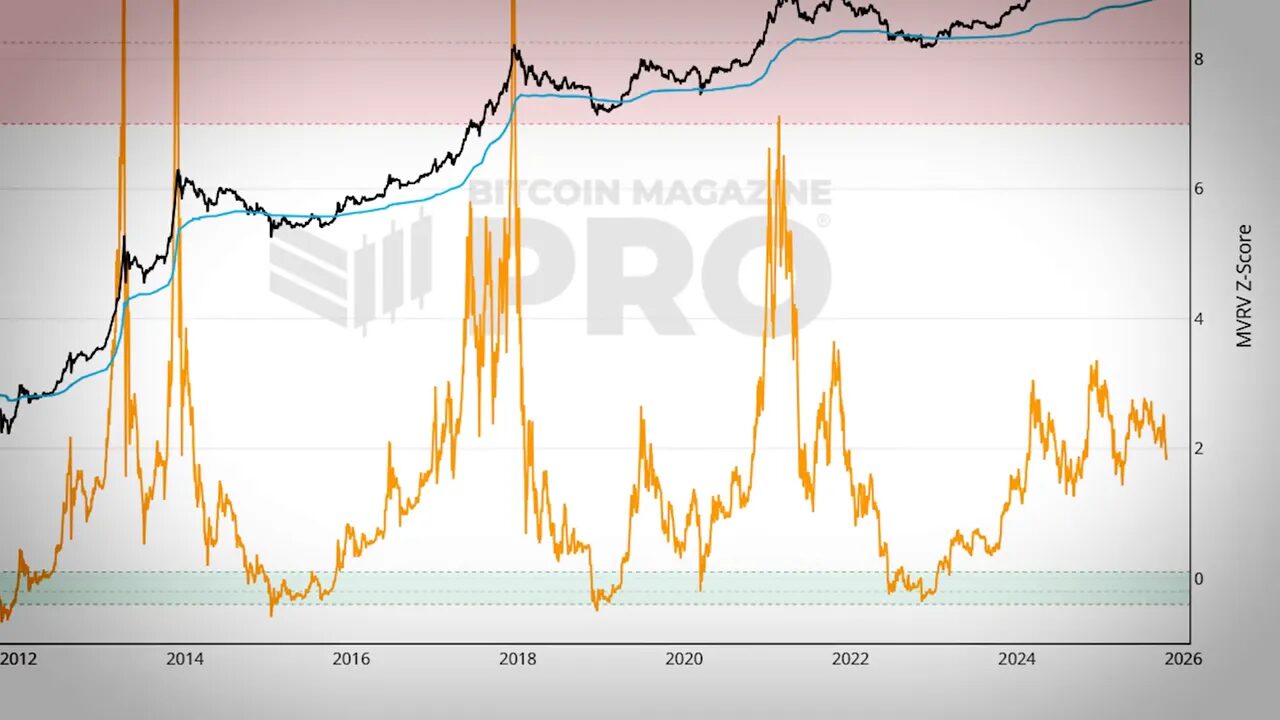

One key on-chain metric to watch is the MVRV ratio. MVRV compares current market price to the average price at which coins last moved. Historically, when Bitcoin’s MVRV exceeds about 5 it indicates extreme overheat and local tops. Today the MVRV sits around 1.8. That implies, if one relies solely on this metric, a Bitcoin price on the order of hundreds of thousands is required before MVRV signals a top. Is Altseason Already Over? MVRV suggests not at the moment.

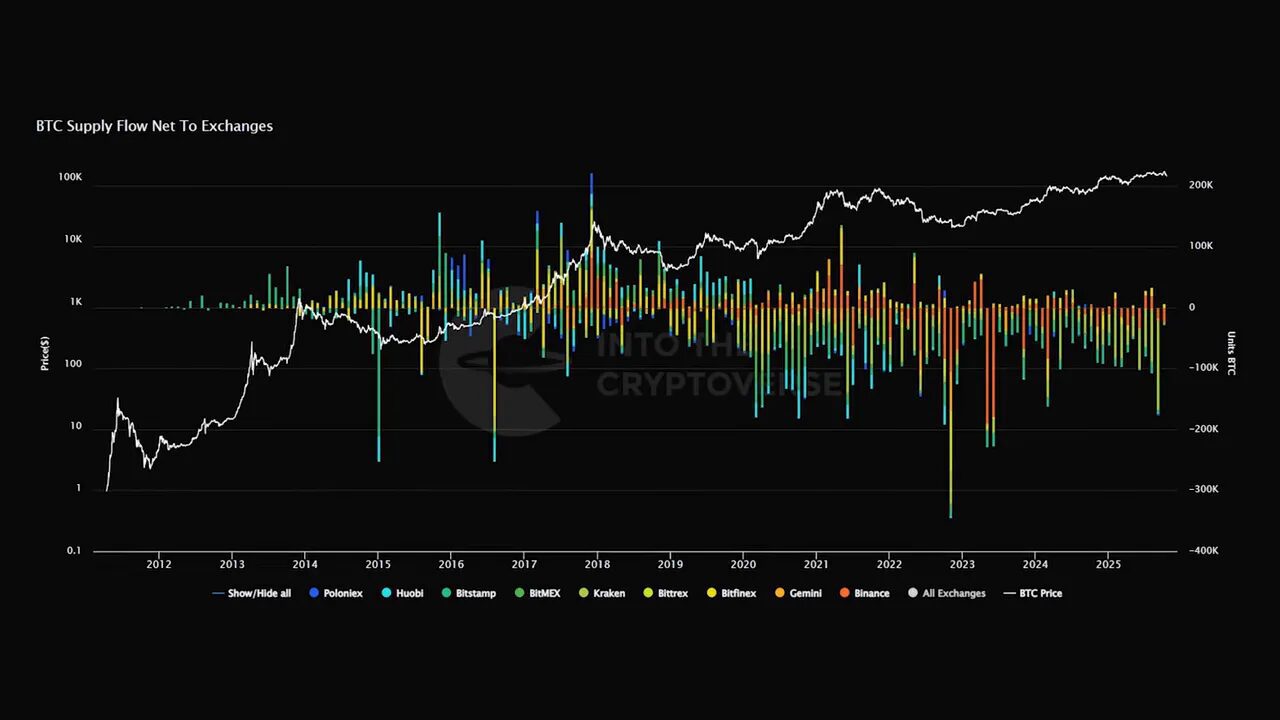

On-chain flows and exchange balances

Another important data point is net exchange flows. Charts that track whether Bitcoin is being sent to exchanges or withdrawn show that we have not seen the massive net inflows typical of cycle peaks. Negative net inflows or withdrawals indicate holders are absorbing supply. Sell side liquidity is a metric that aggregates OTC desks, exchange listings, ETF inventories, and large accumulators. Right now that sell side liquidity is trending down, not up, which suggests big players are not distributing like they did in 2017 or 2021.

All together, scenario two points to a plausible finishing leg where Bitcoin can still run higher and altcoins follow with substantial outperformance if rotation into alts occurs. Is Altseason Already Over? Not necessarily. This scenario leaves room for a classic finish to the post-halving year rally and a potential altseason in Q4 or early 2026.

Scenario 3 — The cycle timeline is stretched: the super cycle arrives in 2026

This is the most controversial scenario, but also the one I find most compelling based on macro dynamics. Is Altseason Already Over? In this framework the answer is no, but for a different reason: the entire cycle has been elongated due to macroeconomic aftershocks from COVID-era interventions, and the real mania will arrive in 2026.

The macro lead: ISM PMI and the business cycle

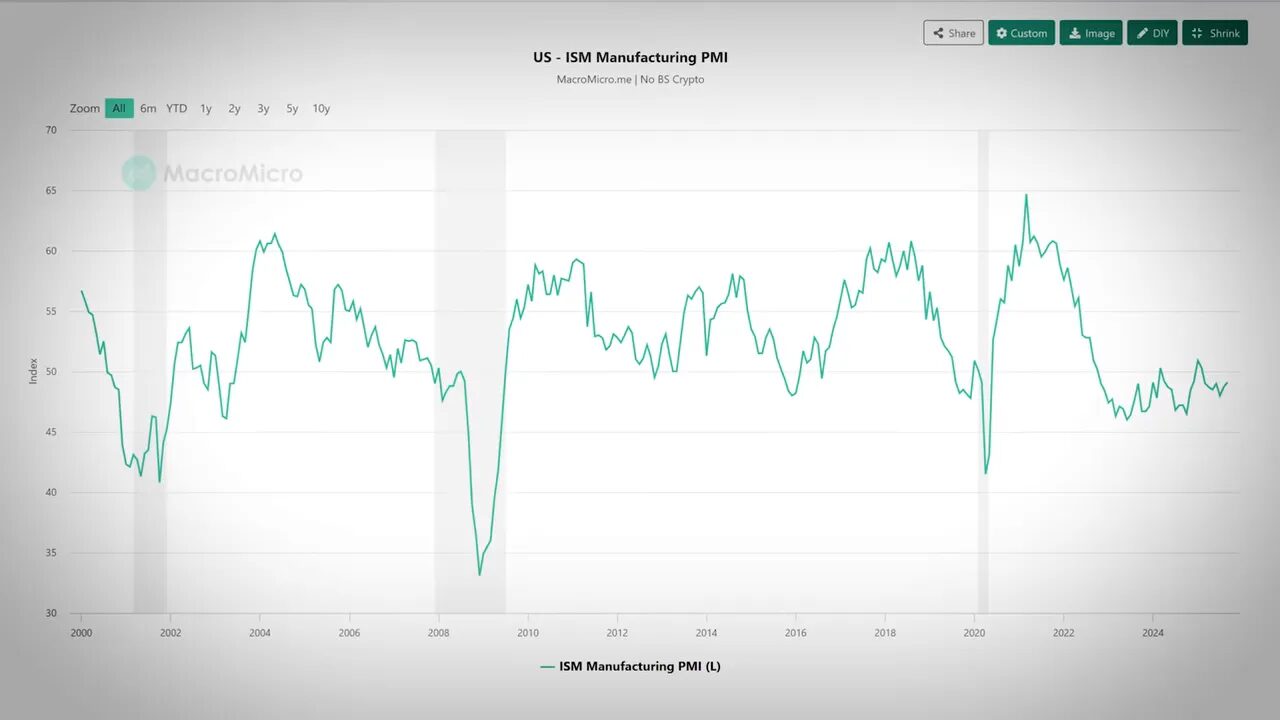

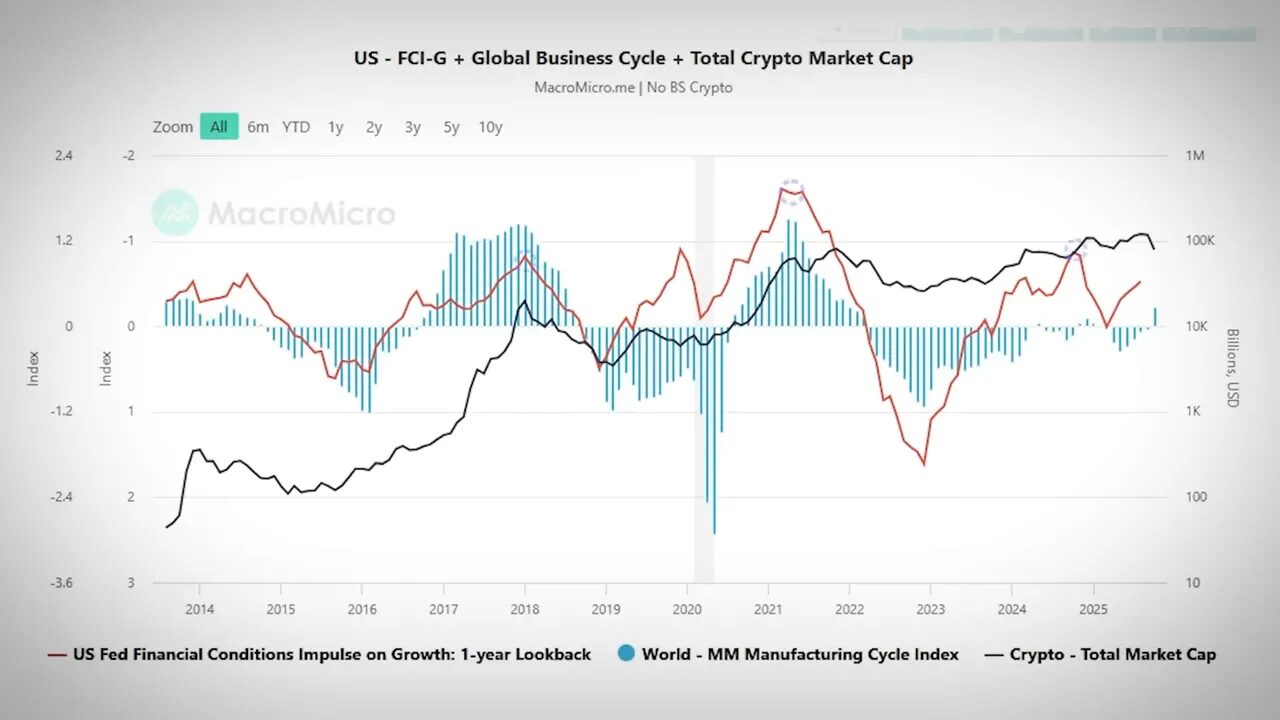

Altcoins and crypto markets do not exist in a vacuum. The broader business cycle and liquidity conditions matter. One indicator that helps explain speculative appetite is the ISM Manufacturing PMI index. When the PMI is below 50 it signals contraction; above 50 implies expansion. Historically, when the PMI climbs above 50 it often coincides with liquidity expanding and speculative markets warming up. Two mini alt seasons in 2024 aligned with the PMI poking above 50. That is telling.

Beyond the PMI, a leading indicator called the Financial Conditions Impulse on Growth, or FCIG, measures tailwinds or headwinds for economic growth over the next year using seven variables. Look at the behavior: the FCIG tends to lead the business cycle. When the FCIG turns strongly positive, the business cycle follows, and then risk assets like crypto rally. Right now the FCIG is rising and the global business cycle is beginning to expand. Historically this pattern leads crypto by months, sometimes years.

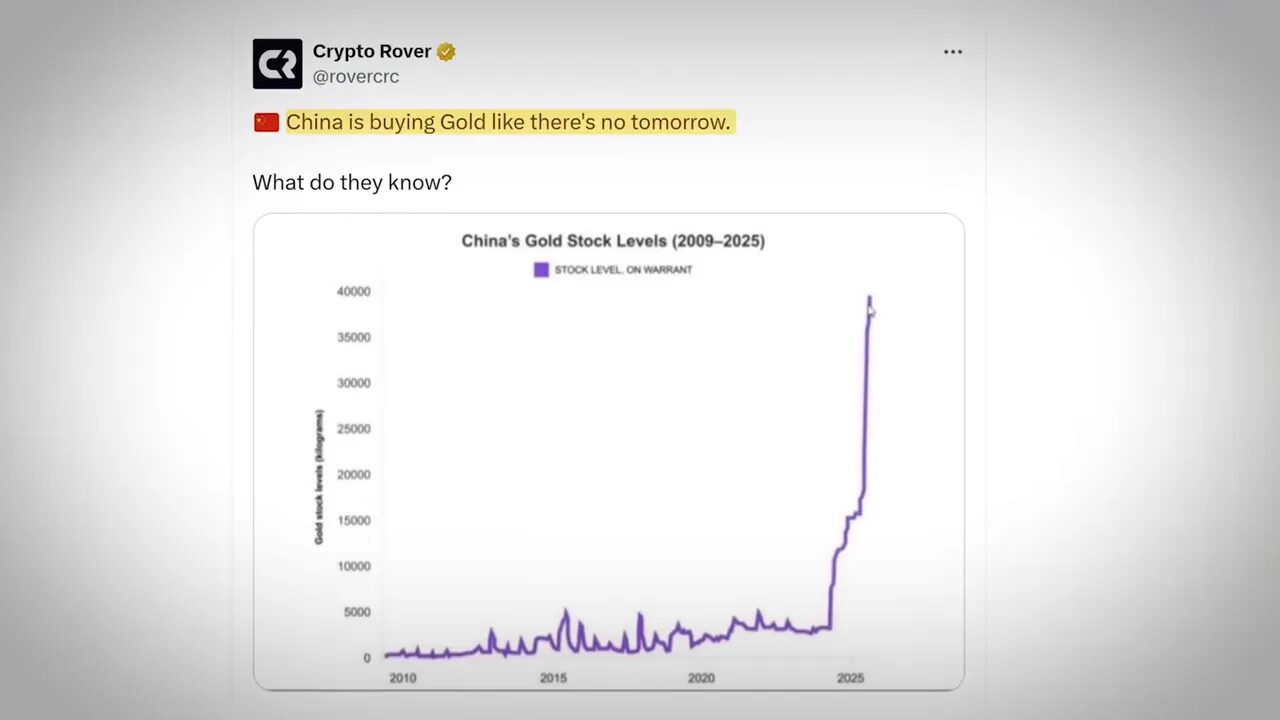

Industrial vs precious metals: a risk-on shift

Another macro lens is the relative performance of industrial metals versus precious metals. When industrial metals like copper and steel start to outperform gold and silver, capital is rotating from a safety posture into economic activity and risk. Historically the bottoming of industrial versus precious metals has preceded large upticks in the global business cycle and, subsequently, Bitcoin’s parabolic moves. The same pattern repeated in prior cycles and has marked the start of altseason three out of three times in the modern era.

Gold is already parabolic right now and is viewed by many institutions and nations as a hedge and safe haven. For capital to rotate from gold into Bitcoin, the drivers for gold demand need to subside — typically lower real rates, active QE or central bank liquidity. If the Fed pivots to cutting rates and ends quantitative tightening, that can reduce the urgency to hold gold as a safety asset. That can release capital into riskier assets. Is Altseason Already Over? Not if capital rotation hasn’t peaked yet. If monetary policy loosening happens and the FCIG continues to expand, the timing could point to 2026 for the big speculative peak.

Institutional plumbing: ETFs and regulatory changes

Institutional participation is another critical element. This cycle has been characterized more by institutional demand than big retail flows. Spot Bitcoin ETFs changed the landscape. More importantly for altcoins, the SEC has introduced generic listing standards that make it easier for altcoins to launch spot ETFs. Legislative efforts like the Genius Act and the Clarity Act — if passed — would create clearer pathways for institutional capital to deploy into digital assets that are currently in regulatory grey areas.

Those developments could dramatically increase the pool of institutional capital able to access altcoins, stretching market depth and pushing prices higher once a macro liquidity wave arrives. In short, institutional plumbing plus macro stimulus creates a compounding effect of demand the market may not have fully priced in yet. Is Altseason Already Over? If institutions are still in accumulation mode, the door is wide open for further upside.

Comparing the three scenarios side by side

Let’s compare the three scenarios cleanly so you can see the different risk profiles and what to watch for.

- Scenario 1: Peak already occurred — Bearish. Signals: weekly close below 365-day SMA, retail capitulation metrics, MVRV spikes collapsing, big sell side liquidity increases. Action: reduce risk, preserve capital, rotate to long-term blue chips or cash.

- Scenario 2: Cycle continues and finishes this post-halving year — Neutral to bullish. Signals: classic four-year rhythm holds, altcoins display technical breakouts, MVRV remains moderate, no destructive weekly close. Action: hold high conviction positions, rebalance prudently, accumulate risk on pullbacks.

- Scenario 3: Cycle extended into 2026 super cycle — Bullish, macro-driven. Signals: FCIG and business cycle continue to expand, Fed eases, institutional flows increase via ETFs and regulatory clarity, gold-to-risk rotation. Action: maintain allocation, buy the dips, prepare for concentrated bets in promising alts when liquidity turns.

Technical and on-chain indicators to monitor

Regardless of which scenario you lean toward, monitoring the same set of indicators keeps you in tune with market reality. Here are the priority indicators I watch and why they matter.

- 365-day SMA weekly close on Bitcoin. A weekly close below this is an explicit invalidation for the bullish cycle narrative. It is one of the cleanest technical signposts for moving from risk-on to risk-off.

- MVRV ratio. Tracks unrealized profits and helps identify overheating. At a current reading near 1.8 there is room for higher prices before historical overheat thresholds.

- Sell-side liquidity. Tracks supply available to sell across OTC desks, exchanges, ETFs, and large wallets. Downward trending liquidity suggests accumulation; spikes suggest distribution.

- Bitcoin exchange flows. Net inflows to exchanges often precede dumps; net outflows indicate HODLer intent.

- Bitcoin dominance vs alt market cap. If Bitcoin dominance stays above 60 percent, alts often struggle. Conversely, lack of sustained Bitcoin dominance is a sign alts can run.

- Search trends and retail app ranks. Retail involvement is typically a late-cycle confirmation. Watch app-store ranks and Google search interest for Bitcoin, Ethereum, and crypto as a whole.

- Macro indicators: FCIG and ISM PMI. These lead macro liquidity cycles. A rising FCIG followed by an expansionary business cycle is often a leading sign for risk asset rallies.

Is Altseason Already Over? Keep tracking these indicators and update your thesis as the signals evolve. Flexibility is the trader’s advantage.

Practical strategies for each scenario

Now the tough part: what should traders and investors actually do? Regardless of your timeframe, always allocate capital you can afford to lose in high-volatility assets. Below are tailored approaches for each scenario.

If you believe Scenario 1

- De-risk aggressively. Trim speculative positions and move to cash or stablecoins.

- Keep small exposure to long-term blue-chip projects and use limit orders for selective buys if capitulation occurs.

- Use trading signals sparingly. If you are an active trader, consider following reliable timing signals to capture smaller, shorter-term bounces rather than trying to catch new highs.

If you believe Scenario 2

- Hold core high-conviction positions but hedge a portion of gains if you are up.

- Accumulate quality alt positions on consolidation and use scaling buys during dips.

- Watch rotation signals: when Bitcoin dominance weakens and alt technicals break, consider increasing allocation to altcoins.

- When liquidity conditions worsen, tighten stops and lock in profits incrementally.

If you believe Scenario 3

- Maintain convictions and be patient. Institutional-led cycles can be slower to develop but more durable.

- Scale into alts methodically. Use dollar cost averaging and allocate a portion of capital to higher-risk, higher-reward projects that would benefit most from an institutional wave.

- Position for a 2026 timeframe where macro liquidity could supercharge markets.

- Consider macro hedges and stablecoin liquidity for opportunistic buying when macro catalysts appear.

Across all strategies, a service that provides disciplined, data-driven trade signals can materially improve timing and risk management. For traders who prefer evidence-based entry and exit signals, using best crypto trading signals helps with disciplined buying on dips and warnings when liquidity or technical indicators deteriorate. These signals are particularly useful when markets are volatile and emotions are high. Integrating signals into a broader plan keeps allocation and risk aligned with your thesis.

Trading opportunities by chain and sector

Not all altcoins behave the same. Some sectors and chains are better positioned for an altseason depending on the macro scenario.

Smart contract platforms

Platforms that offer clear developer growth, liquidity, and real user activity are the safest bet if you expect a broad altseason. When money rotates down the risk curve, these chains often receive early inflows as institutional allocators seek yield and protocol growth. If you plan to trade this sector, monitor active addresses, TVL trends, and developer activity.

Layer 2s and scaling solutions

Layer 2s can benefit disproportionately when Ethereum gas dynamics and transaction demand increase. They can also experience explosive rallies because they combine the credibility of Ethereum with higher throughput and lower fees. A rising macro tide will often lift the most scalable solutions.

DeFi and yield sectors

DeFi projects that can sustainably attract TVL and yield tend to piggyback on broader market rallies. Watch lending utilization rates, protocol incentives, and user retention metrics. Projects with real yield and composability can outperform meme or purely hype-driven tokens in the long run.

Meme and community tokens

Meme coins hurt more in extended bear phases but sprint in mania. If you believe scenario 3 or the final manic leg of scenario 2 is coming, meme tokens can produce astounding short-term returns. That said, they are incredibly risky and often lead to severe drawdowns. Use minimal capital and risk only what you can afford to lose.

Again, this is where disciplined trade signals shine. If you want to capture opportunistic bounces across chains while limiting downside, consider pairing your research with best crypto trading signals to identify structured entries, stop levels, and profit-taking zones.

How I am positioning: cautious optimism

Is Altseason Already Over? My personal stance leans toward scenario three, the stretched cycle with a big institutional and macro-fueled move potentially in 2026. That said, I am not reckless. I call my approach cautiously optimistic.

Here is what that looks like in practice:

- Hold high conviction positions in top alts and allocate a portion of capital for tactical buys on significant dips.

- Only use money I can afford to part with forever for the riskiest trades and meme plays.

- Watch macro indicators closely, especially the FCIG and ISM PMI, and adjust risk exposure as they evolve.

- Follow on-chain signals like MVRV, sell-side liquidity, and exchange flows for immediate confirmation of distribution or accumulation.

I also rely on macro research channels and experts to keep a live read on the macro environment. Combining macro insights with on-chain and technical signals is the most robust way to build conviction without falling prey to narratives alone. When macro conditions indicate expansion and institutional supply remains subdued, that is when I am comfortable being more aggressive.

Common mistakes to avoid

Market participants make predictable errors that get costly. Avoid these traps:

- Acting on fear or greed alone. Emotion-driven trades are rarely profitable in the long term.

- Using excessive leverage. Leverage amplifies volatility and can blow accounts during unexpected macro moves.

- Ignoring macro context. Crypto does not live in a vacuum. Monetary policy and liquidity matter.

- Chasing breakouts without confirmation. Look for volume, on-chain accumulation, and macro tailwinds before committing large capital.

Also resist the temptation to assume every dip is a discount if the macro or technical invalidations (like the 365-day SMA weekly close) have occurred. Protection of capital matters as much as upside opportunity.

Checklist to answer Is Altseason Already Over?

If you want a simple checklist to regularly update your thesis, use the following. If more than two or three of these are triggered, adjust your allocation and strategy accordingly.

- Has Bitcoin closed weekly below the 365-day SMA? If yes, lean conservative.

- Is MVRV at extreme overheat levels (>5)? If yes, consider trimming exposure.

- Are exchange inflows spiking massively? If yes, watch for distribution.

- Is sell-side liquidity rising sharply? If yes, that suggests big players are selling.

- Are FCIG and ISM PMI moving into expansion and sustained growth? If yes, structural bull case strengthens.

- Is Bitcoin dominance collapsing while altcaps show structural breakout patterns? If yes, altseason could be impending.

- Are institutional access channels expanding (ETF listing standards, legislation)? If yes, prepare for deeper institutional flows.

Keep this checklist handy and revisit weekly or monthly depending on your time horizon. Is Altseason Already Over? This checklist will help you answer that question with data, not emotion.

FAQ

Is Altseason Already Over?

Not definitively. There are three plausible scenarios: the cycle top is already in and the bull market is ending; the four-year cycle is intact and a final leg higher could still occur this post-halving year; or the entire cycle has been stretched and the major speculative mania is delayed into 2026 due to macro dynamics. Track the key indicators outlined above to update your view.

What single metric should I watch most closely to know whether the cycle has ended?

If you can only watch one thing, monitor Bitcoin’s weekly close relative to the 365-day simple moving average. A sustained weekly close below that line has historically been a serious warning sign that the bull cycle may be invalidated.

How does MVRV help and what does its current reading mean?

MVRV compares current price to the average price coins were last moved at, giving a sense of unrealized profits. Historically, an MVRV above about 5 signals market overheat. Current readings around 1.8 suggest we are not in an overheated state by this metric, leaving room for more upside before a classic top signal fires.

Will institutional ETFs cause altseason?

Spot Bitcoin ETFs have changed the landscape and the SEC’s move toward generic listing standards for altcoins would make it easier for alt ETFs to be listed. This can bring institutional capital into altcoins over time, but ETFs alone are not a guaranteed trigger. They are a structural enabler that, combined with macro liquidity and retail participation, can amplify an altseason.

If I want tactical entry signals, what should I use?

Combine technical set-ups (breakouts, cup-and-handle, ascending triangles) with on-chain confirmers (sell-side liquidity, exchange flows, MVRV) and macro context (FCIG, ISM PMI). For disciplined execution, consider using a data-driven service for timing like best crypto trading signals to help manage entries, stops, and profit targets during volatile regimes.

How do macro indicators like FCIG influence crypto timelines?

FCIG measures tailwinds for growth and often leads the business cycle. When FCIG rises, the global business cycle tends to follow, which then helps fuel risk asset rallies. Crypto historically lags the FCIG and business cycle, so a rising FCIG suggests more fuel could be coming, sometimes with a lag of months to a year. That is why some analysts argue the main mania could be delayed until 2026.

Should I use leverage to play for an altseason?

No. Leverage amplifies both gains and losses, and in macro-driven cycles sudden policy changes or black swan events can wipe leveraged positions. If you are confident in a scenario, scale into positions with unleveraged capital and keep allocations sized to your risk tolerance.

How can I protect against downside while still participating?

Use diversified allocation across high-conviction projects, maintain a stablecoin buffer, hedge with options if you understand them, and use stop-losses or reduce position sizes when key invalidations occur. Combining macro monitoring with on-chain signals helps time these adjustments.

Final thoughts: how I answer Is Altseason Already Over?

Is Altseason Already Over? My answer right now is no, but with important caveats. The market is messy and uncertain, and multiple plausible outcomes exist. Scenario one is the harshest and could happen if market structure collapses quickly. Scenario two preserves the classic cycle and leaves room for a finish this post-halving year. Scenario three, which I lean toward, stretches the timeline and places the main speculative mania into 2026 driven by macro liquidity, institutional plumbing, and capital rotation from safe havens like gold back into risk assets.

Being cautious but prepared is the smartest posture. Hold your core convictions, add tactically on dips using money you can afford to lose, monitor the indicators in this article, and use disciplined tools to manage entries and exits. If you trade actively, pairing your research with reliable timing tools like best crypto trading signals can help you capture moves while protecting downside.

Markets write their own stories and they rarely obey simple calendars. Keep your thesis flexible, update with data, and treat every trade as an experiment with risk budgeting and exit rules. Is Altseason Already Over? For now the best answer is to stay informed, disciplined, and ready to act when signals line up.