The Lumia Crypto Review below breaks down what Lumia (recently rebranded to Orion), its on-chain activity, products, partnerships, and the core risks that will determine whether it lives up to its promise. If you are scanning opportunities during a bull run, this Lumia Crypto Review gives a practical, balanced view: clear upside potential, solid technology partners, and real questions around tokenization and regulation.

Table of Contents

- Quick snapshot: what Lumia is and why it matters

- Where the price is and recent market action

- Technology stack and strategic partners

- Products that form the Lumia ecosystem

- On-chain metrics and adoption signals

- Why the market is skeptical (and why that’s reasonable)

- Realistic price expectations in this Lumia Crypto Review

- Trade setups and risk management

- Where Lumia fits in a longer-term portfolio

- Opportunities across chains and liquidity paths

- What to watch next: catalysts and red flags

- Summary and where Lumia sits in the market

- Frequently asked questions

- Closing thoughts

Quick snapshot: what Lumia is and why it matters

Lumia Crypto Review starts with the business case. Lumia is positioning itself as a next-generation blockchain for real-world assets. It aims to handle the full lifecycle of tokenized assets: from initial tokenization to liquidity aggregation and connectivity with DeFi and Web3 traders. Think tokenized real estate, commodities, and other illiquid assets brought into a liquid, decentralized environment.

That sounds compelling because tokenization promises new capital flows into previously illiquid markets. Lumia intends to deliver that through two primary pillars: Lumia Chain for creating compliant, tokenized representations of assets, and Lumia Stream for packaging those assets into liquid financial instruments.

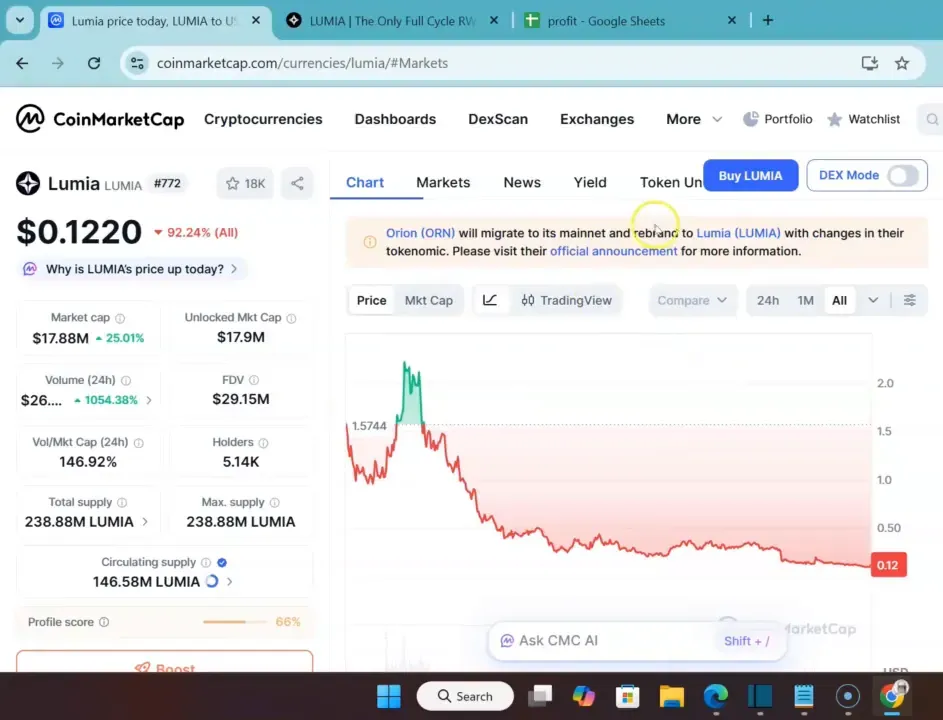

Where the price is and recent market action

Price action in this Lumia Crypto Review matters because the token spent much of the last year in a downtrend. Lately it posted a sharp uptick with a meaningful volume spike. That type of move often draws renewed attention from traders looking for fast gains during a bull cycle.

Supply metrics are important here. Roughly 146 million of a 238 million total token supply are in circulation now. Monthly unlocks are modest at around 6 million tokens and are linked to node emissions and ecosystem growth rather than a classic investor unlock schedule. That reduces the immediate risk of a large dump, though supply unlocks always deserve monitoring.

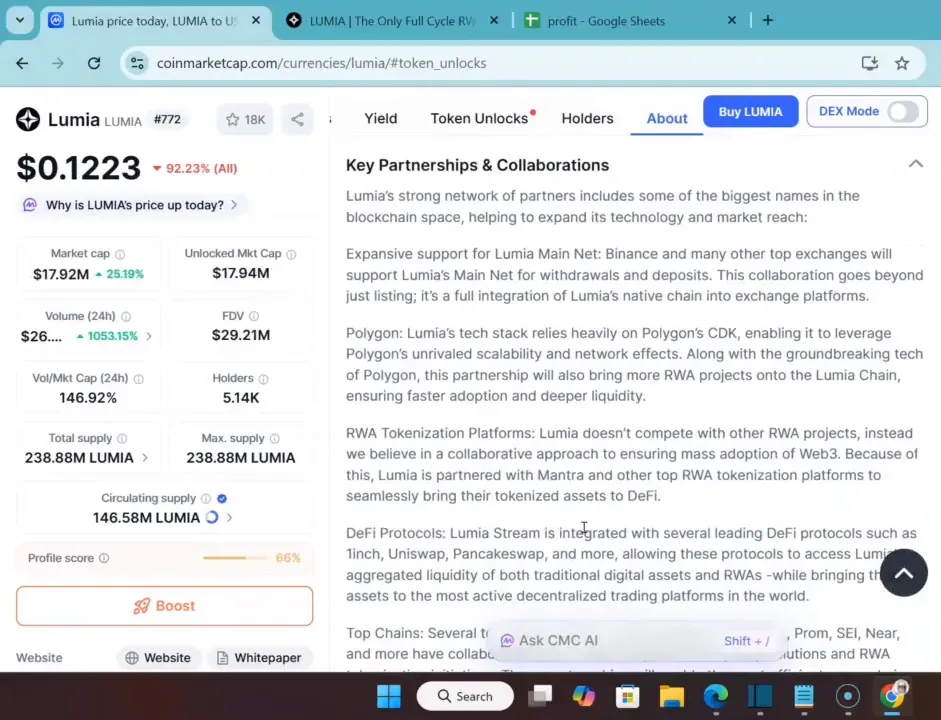

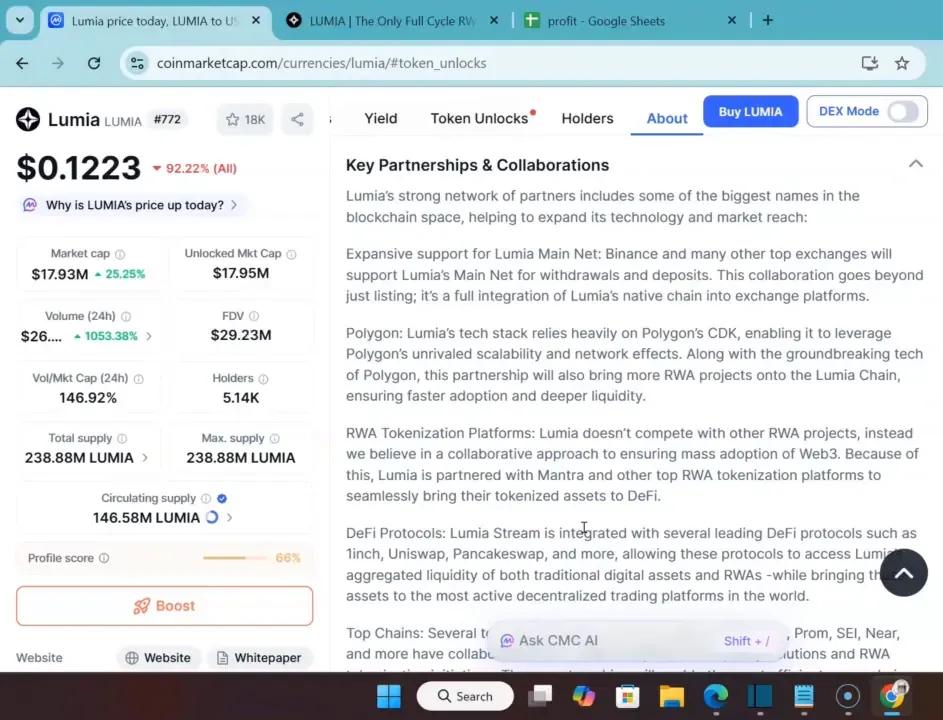

Technology stack and strategic partners

No Lumia Crypto Review would be complete without covering partners. Lumia is built heavily on Polygon’s CDK, which lets it inherit Polygon’s scalability and network effects while integrating innovative Polygon tech. That helps Lumia scale tokenized asset use cases without rebuilding basic infrastructure from scratch.

- Key collaborators include Polygon, Binance (listed on several exchanges), DWF Labs, Laser Digital, and TRGC.

- They also integrated with major DeFi plumbing: Uniswap, PancakeSwap, and bridges across chains like Arbitrum and others.

Those integrations accelerate adoption because tokenization thrives on liquidity and composability. Lumia’s partnerships place it in a practical spot to capture real-world asset projects that need on-chain plumbing, custody, and market access.

Products that form the Lumia ecosystem

This Lumia Crypto Review highlights the product suite because that is where the use cases live. Lumia ships multiple products that map to distinct pieces of the tokenization flow.

- Lumia Chain: A compliance-first chain for institutional and retail tokenization.

- Lumia Stream: A liquidity layer designed to bring tokenized assets into DeFi rails so they become tradable and interoperable.

- Lumia Hub: A no-code tokenization portal that helps asset owners mint compliant tokens.

- Lumia Wallet: Custody and user experience for holders of tokenized assets.

- Explorer and BlockBits: On-chain visibility and a Telegram mini-app to onboard users.

Having both a compliance-first chain and a liquidity-focused protocol is smart. One side handles regulatory requirements and identity; the other side makes the assets tradable. That combination underpins Lumia’s pitch to institutions and developers.

On-chain metrics and adoption signals

Adoption indicators are mixed in this Lumia Crypto Review. The blockchain explorer shows about 15,000 transactions per day and roughly 758,000 addresses created. Historical completed transactions are in the low millions. Those numbers indicate activity, but they are not yet at the level of a fully thriving ecosystem.

Active address counts, daily transactions, and the nature of those transactions matter more than raw numbers. Are these simple transfers, or are they tokenization flows, custody operations, and liquidity interactions? At present, the data suggests steady but not explosive usage. That means there is room for growth if the product-market fit sharpens and institutions start tokenizing larger asset pools.

Why the market is skeptical (and why that’s reasonable)

A major theme in this Lumia Crypto Review is skepticism about tokenizing real assets before regulatory clarity and robust risk frameworks exist. Tokenization sounds great in theory, but edge cases create real questions.

Consider this scenario: you tokenize a house, then use that token as collateral in a DeFi lending protocol, and borrow the equivalent of $200,000 in crypto. If the crypto market crashes, collateral liquidations can cascade. Who ultimately holds title to that real-world house? How do courts, custodians, and on-chain protocols reconcile the legal property transfer?

Until those answers are standard and enforceable across jurisdictions, tokenization projects will face conservative adoption. That does not mean tokenization will fail long term. It means phases of adoption, heavy regulation, and institutional frameworks are a prerequisite for scale.

Realistic price expectations in this Lumia Crypto Review

Forecasts are inherently uncertain, but a pragmatic view in this Lumia Crypto Review suggests modest near-term upside and stronger long-term potential. A reasonable expectation is that Lumia could return to roughly $0.25 this cycle—roughly a 2x from lower price points—assuming broader market tailwinds and incremental adoption.

Why not 10x or 100x? Real-world asset tokenization faces several frictions: regulatory uncertainty, custody and legal frameworks, and slower institutional onboarding. Those constraints cap how fast valuation multiples can expand in a single bullish cycle.

Trade setups and risk management

From a trading perspective, Lumia looks like a classic bull-cycle opportunistic trade. The recent retracement and volume spike suggest short-term momentum. For traders, consider these practical rules:

- Position size matters. Treat Lumia as a speculative allocation within a diversified crypto portfolio.

- Watch unlock schedules and on-chain flows. Monthly unlocks of ~6 million tokens are manageable but worth monitoring.

- Use technical levels for entries and exits; the market has shown swift re-rating in short windows.

And if you prefer signals to eliminate guesswork, integrating a reliable crypto trading signal can help you time entries and exits with data-backed trade alerts. A quality crypto trading signal service can add discipline in volatile moves and suggest stop loss and take profit levels tied to current on-chain momentum.

Where Lumia fits in a longer-term portfolio

This Lumia Crypto Review views the token as a thematic bet on tokenization. If you believe real-world asset tokenization will grow exponentially over the next five to ten years, Lumia is a plausible infrastructure play. It has partnerships, a working product suite, and a strategy that targets institutional compliance and retail accessibility.

Allocate accordingly: a small, conviction-sized core position for the long term, complemented by a tactical position for the next cycle’s upside. Rebalance as regulatory clarity emerges and as actual tokenization projects onboard real assets onto the chain.

Opportunities across chains and liquidity paths

Lumia’s integrations with Polygon and major DEXs mean tokenized assets could flow across chains and into familiar liquidity pools. That matters because liquidity begets price discovery. Lumia Stream is designed to create that liquidity, and integrations make it easier for asset-backed tokens to show up where traders already operate.

Using a crypto trading signal alongside cross-chain liquidity monitoring can spotlight when tokenized assets begin to attract serious volume. Signal services often highlight liquidity shifts and emerging pair volume—helpful when evaluating whether tokenization is moving from concept to capital.

What to watch next: catalysts and red flags

For anyone following this Lumia Crypto Review, monitor these items closely:

- Institutional tokenizations: announcements that real estate firms, commodity traders, or funds are minting assets on Lumia Chain.

- Regulatory clarity: legislation or rulings that define how tokenized assets are treated in major markets.

- Liquidity events: large pools appearing on DEXs or tokenized assets being used as collateral in mainstream DeFi products.

- Exchange listings: additional major exchange support improves access and price discovery. Current exchange coverage includes several major platforms, but watch for broader listings.

Red flags include: sudden large token sells tied to team or investor unlocks, regulatory crackdowns in key jurisdictions, or evidence that on-chain tokens are not legally enforceable representations of real-world titles.

Summary and where Lumia sits in the market

This Lumia Crypto Review concludes with a balanced take: Lumia is an interesting infrastructure play that is well positioned on the technology and partnership front. Short-term upside of roughly 2x is a reasonable base case during a supportive market environment. Long-term, Lumia could capture real value if tokenization scales, but that outcome depends on legal frameworks and robust custodial practices.

If you are looking for practical tools to manage trades and spot market momentum, consider a disciplined approach that includes both fundamental monitoring and actionable trading tools like a trusted crypto trading signal. Signals can streamline timing and help avoid emotion-driven mistakes during volatile rebounds.

Frequently asked questions

What is Lumia and why is it important?

Lumia is a blockchain focused on tokenizing real-world assets and creating liquidity for those assets through Lumia Chain and Lumia Stream. It aims to make otherwise illiquid assets tradable on DeFi rails while providing compliance tools for institutions and retail users.

Is Lumia the same as Orion?

Yes. Lumia has rebranded to Orion in some communications. The underlying product suite and strategy remain focused on real-world asset tokenization and liquidity solutions.

What are the main risks to Lumia’s success?

Key risks include regulatory uncertainty, legal enforceability of tokenized assets, custodial and title transfer complexities, and potential token unlocks that could increase circulating supply. The most critical single risk is the lack of standardized legal frameworks for tokenized ownership across jurisdictions.

What short-term price move is realistic?

A conservative short-term view is that Lumia could double from lower levels and return toward roughly $0.25 in a bull cycle if market conditions and adoption signals align. Larger multiples are possible but rely on faster regulatory clarity and big institutional tokenizations.

How should I trade Lumia?

Treat Lumia as a speculative, thematic trade. Use position sizing, monitor unlock schedules and on-chain flows, and set clear stop losses. Combining fundamental monitoring with a disciplined crypto trading signal can improve timing and risk management for both short-term and long-term positions.

Which on-chain metrics should I watch?

Track circulating supply changes, daily transaction counts, active addresses, and liquidity on major DEXs. Also watch for real-world asset tokenization announcements that tie actual asset pools to the chain.

Closing thoughts

This Lumia Crypto Review is a practical, no-nonsense look at an infrastructure project that sits at the intersection of traditional finance and decentralized liquidity. The core idea—making real-world assets tradable and composable—has genuine long-term merit. But adoption will be incremental, framed by legal and regulatory maturation.

If you choose to act, do so with a plan: allocate conservatively, follow on-chain data closely, and consider pairing your research with operational tools like a reliable crypto trading signal to help you execute with discipline during volatile phases.