In this article I’ll walk you through exactly what happened, why it unfolded the way it did, who made money and who got absolutely wrecked, and most importantly — my real-world plan for surviving and navigating the fallout.

This piece mirrors the tone and directness I use on the channel: candid, slightly blunt, and pragmatic. I’ll explain the mechanics (order books, perp engines, auto-deleveraging), the timeline (the trigger and how traditional markets fed into the carnage), and the structural takeaways you should internalize as a trader or long-term holder. Expect charts, screenshots, and clear rules you can apply if volatility spikes again.

Table of Contents

- Quick summary: What we just lived through

- Why this felt and looked different from previous crashes

- Flash crashes and order book mechanics — the anatomy of the wipeout

- Exchanges, uptime, and A/L events: who held and who didn’t

- Timeline: the trigger, the bleed, and the final cascade

- Who profited and how — an inside look at positioning

- Real examples: ATOM, Memes, and the scale of wicks

- Technical context: cycles, three-drives, and privacy coins

- Macro and cycle theory: is the four-year halving cycle broken?

- My current trading stance — how I’m personally managing this

- Opportunities in chaos: how to think about buying the fear

- Psychology and well-being — what matters more than account balances

- Practical checklist: Immediate actions after a cascade

- Integrating trading signals responsibly

- What this means for alts vs. BTC

- Long-term view: is crypto “broken” or just re-calibrating?

- How I’ll adapt my strategy if this becomes a multi-week correction

- Lessons learned — the key takeaways you should write down

- FAQ

- Final thoughts — what I’ll be watching next

Quick summary: What we just lived through

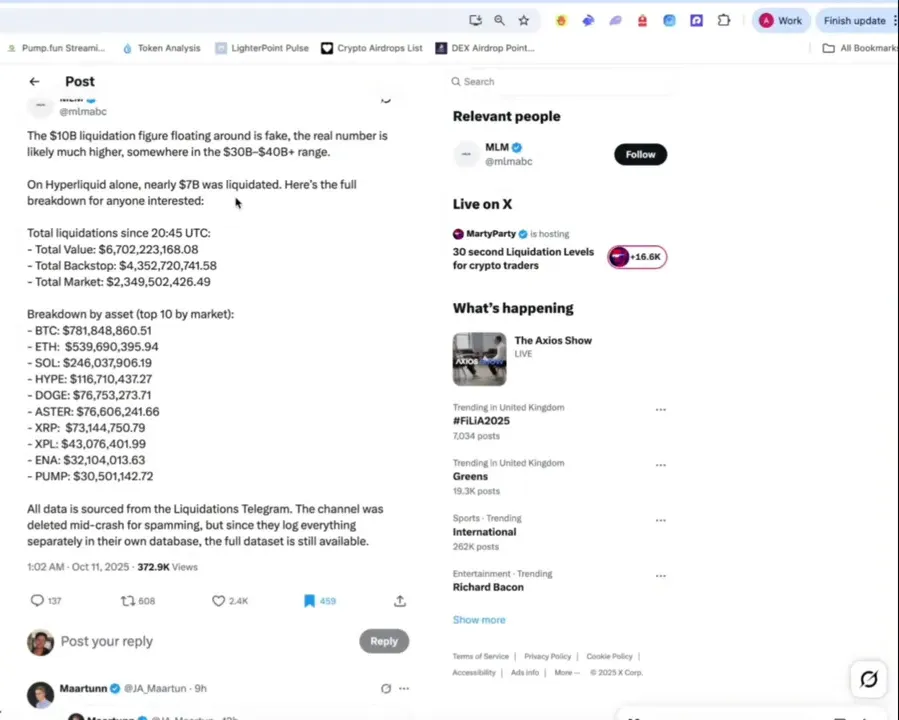

Here’s the short version before we dig in deep: over $20 billion in positions were liquidated across crypto derivatives in roughly a 24-hour window. Some data providers put the number even higher — estimates ranged into the $30–40 billion territory when looking at less visible DEX and CLOB activity. Perpetuals and cross-margin positions were the primary casualties. Several major exchanges reported outages or auto-deleveraging events. Meanwhile, on-chain and centralized market maker liquidity evaporated in sections, producing flash crashes with wicks down to levels previously unimaginable.

That isn’t just a retail problem. Big players, market makers, and hedge accounts were hurt too. At the same time, certain entities and market structures — most notably Hyperliquid’s vaults and some short-position wallets — made jaw-dropping profits. That polar contrast is exactly why crypto remains a brutal, zero-sum arena in extreme stress.

Why this felt and looked different from previous crashes

People who lived through 2017, 2020–21 and even 2022 have been saying: this looked different. And they’re right. There are a few structural reasons:

- Concentrated perp liquidity: Perpetual markets dominate leverage activity. When the bids or asks thin on those books, the cascade effect accelerates faster than in spot markets.

- Cross-exchange order book mismatch: Price discovery fragmented across CLOBs (centralized limit order books) and DEXs, so a single shock could push price through thin order books on one venue while other venues lagged.

- Auto-deleveraging & forced liquidations: Auto-deleverage systems on several exchanges closed profitable positions to balance exposure. That mechanism alone can exacerbate crashes.

- Timing vs TradFi hours: The worst of the cascade happened after US equity markets closed — meaning institutional liquidity that might have softened the blow was offline while crypto, open 24/7, took the hit.

Those factors combined to make order books look like they’d been run over by a combine harvester: massive sell walls on one side; microscopic buy-side interest left to catch the falling knives.

Flash crashes and order book mechanics — the anatomy of the wipeout

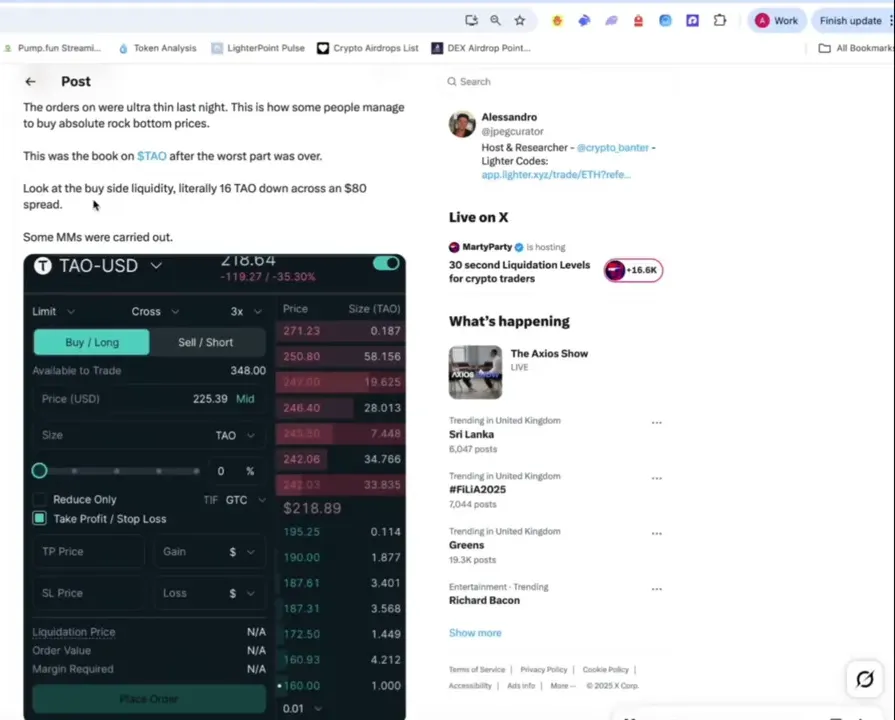

Let’s step through the mechanics in practical terms using a concrete example I showed during the video. Imagine an order book on TAL where the best ask cluster is huge — 33 TAL at $242 — while the best bids are microscopic — 0.1 TAL at $195. Between $195 and $160 there are only small bids, maybe a total of 15 TAL. That is not an order book; that is a cliff.

When a large sell hits that kind of market, the price simply “travels” down the thin bids and prints a wick to levels that no sane market participant thought possible. If enough leveraged longs were hanging on below that prior level, their margin call or automatic liquidation will hit as price slices down. Those liquidations become new market sell orders. That pushes the price down further. More liquidations. More forced selling. The cascade becomes self-feeding.

Perp engines are designed to allow huge leverage and instant liquidation. That’s why leverage is a two-edged sword: in calm markets it provides alpha; in collapses it’s the fastest way to burn accounts. Because many of those liquidations are executed by the exchange itself or a liquidation engine that posts market orders, the price impact is immediate and enormous when liquidity is thin.

Exchanges, uptime, and A/L events: who held and who didn’t

Different exchanges reacted differently — and that mattered. Hyperliquid stayed online and processed orders, which meant its vault and market maker mechanisms captured much of the flow. Other venues had partial outages (Binance had a 10-minute blip; Lighter went down briefly) meaning users were either stuck or auto-deleveraged in messy ways. When some venues go down, users’ collateral and positions can be auto-handled in ways they didn’t intend.

Hyperspecific example from yesterday: Hyperliquid’s HLP (Hyperliquid Provider) vault — the “house” vault that takes liquidity provision duties — made tens of millions (reported: $40M on one day, $122M across the event window) because it absorbed the other side of many forced positions. In short: the house won big when the clients were forced to exit.

Auto-deleveraging (ADL) — the hidden killer

Auto-deleveraging is the mechanism where an exchange automatically reduces or flips profitable positions to cover losses when there is no counterparty. Sounds arcane? It is — and it’s often invisible until it hits you. ADL can close your winning trade so the exchange doesn’t take a loss when liquidity pirates (or liquidators) are hunting. It’s brutal psychologically: you can be profitable, then find your position forcibly reduced or reversed because the exchange needed to rebalance.

In these events ADL can magnify volatility because winners get trimmed and losses are crystallized into more selling — another reason why the cascade snowballed.

Timeline: the trigger, the bleed, and the final cascade

Now let’s walk the timeline so you can see the causal chain. A trigger in macro news interacted with structural market mechanics to create the perfect storm.

- Initial macro shock: At ~03:00 UTC, a news cycle around tariffs on Chinese imports began to unfold. Initially it was a nudge about increased tariffs; then the rhetoric hardened — reports of potential 100% tariffs and export controls.

- Traditional markets react: Equities (SPX) began to sell off through the day as traders digested the potential economic impact of tariffs and export controls.

- Late-session pressure: As the news continued to land, selling pressure escalated into the US close. Traditional markets closed at ~22:00 UTC, taking a large bucket of institutional liquidity offline.

- Crypto—alone and exposed: Crypto markets remained open. With tradfi liquidity gone, and headlines still driving risk-off positioning, crypto’s order books and perp engines were left to handle amplified flow without the usual cushion of institutional counterparties.

- Final liquidation cascade: That’s when the worst hit. Price fell rapidly; perp liquidations triggered; ADL and exchange liquidation engines closed positions; order books ran dry; extreme wicks printed across spot and alt pairs.

Who profited and how — an inside look at positioning

For every account that collapsed, there was an entity that profited. A handful of wallets were positioned short before the announcement and rode the wave to massive gains. A wallet tracked on CoinMarketMan went from underwater to tens of millions up almost instantly because it was short and pre-positioned.

That’s the ugly truth of asymmetric information: those who can preposition against an imminent macro catalyst make life-changing gains. We’re not suggesting criminality by default, but the reality is that the market rewards preparation, and sometimes preparation looks a lot like having advance intel.

How vaults and market makers captured profits

Hyperliquid’s HLP is a perfect case study. HLP functions as the “house” vault: users deposit funds into it, and it acts as the counterparty when another user wants to trade but no natural counterparty exists. In normal times that earns small fees. During a cascade, when liquidity is thin, the HLP can capture giant spreads and absorb forced orders. Yesterday it made roughly half of all profits it had accumulated all year in a single day.

That’s a system risk observation: when you build a house that takes the other side of forced liquidations, it will make huge money in these scenarios. That’s not a criticism — it’s how market making works — but it’s a structural reality for participants to know.

Real examples: ATOM, Memes, and the scale of wicks

Some alt tokens flashed catastrophic intraday moves. ATOM — a well-known chain token from the last cycle — traded as high as $4 in the past cycle and in this cascade printed sub-$0.01 prices on at least one major exchange because the order book was completely depleted. Yes — that’s not hyperbole. Orders at that exchange were matched across microscopic bids, producing a print that is effectively meaningless in a fragmented market but describes how deep the liquidity drain was.

Memecoins and tiny market-cap tokens were the fastest to go. Pengu dropped 80% in 11 minutes; an ephemeral “fartcoin” fell 82% in 10 minutes. These are textbook cases of: low market cap + leverage + thin order books + panic selling = nearly instantaneous vaporization of market value.

Technical context: cycles, three-drives, and privacy coins

I spent time discussing cycle patterns and technical structures because it matters to medium-term positioning. Two patterns stood out in recent price action:

- Three-drive pattern: Bitcoin has historically shown three distinct impulse drives higher before a meaningful sell-off into the subsequent leg lower. We printed another three-drive pattern just prior to this crash, which adds to a number of thesis that this could be a cycle top.

- Privacy coin behavior (Zcash): History suggests privacy coins often run late in cycles. The theory is straightforward: traders taking large profits late in a cycle may prefer privacy layers to obscure the movement of funds. ZEC’s run peaked around the same time as Bitcoin’s local top in this event — a pattern we saw in prior cycles as well.

Two caveats here. First, predictive patterns are never guarantees; they are probability tools. There are thousands of “accurate” retrospective predictions on the internet simply because some of them will match price action. Second, cycles can stretch or shift as debt markets and macro dynamics change — more on that below.

Macro and cycle theory: is the four-year halving cycle broken?

Some professional voices are arguing that the cycle is lengthening. The argument: debt issued and rolled over in 2021 was structured in a way that extends the liquidity cycle beyond the classic four-year halving rhythm. Ralph Powell and others have suggested the effective “liquidity” period might push tops into Q1 or Q2 of the year after a typical halving-based peak.

I’m open to this thesis — it’s plausible. It’s also worth recognizing that when smart people present theses, they aren’t always right. Their work should inform your thinking, not determine it. You cannot borrow conviction from anyone. You must have your own playbook and adapt as price and liquidity evolve.

My current trading stance — how I’m personally managing this

I’ll be blunt: after the cascade put Bitcoin below ~118k, I closed my leveraged positions. That was a tactical choice aligned with my thesis: under this critical line, the risk-reward flips and the probability of extended downside increases. I didn’t panic-sell my spot bags — I still hold most of them — because my conviction in certain projects is long-term and strong.

Here’s my explicit playbook right now:

- No new leveraged entries: I’m not taking on fresh leverage until the market re-establishes a clear bias. Volatility at this level can blow up marginal positions faster than you can blink.

- Sitting on hands: If Bitcoin remains below ~118k and we close higher timeframes under ~107–110k, I’ll consider reducing spot exposure more dramatically.

- Conviction buys at structured levels: For tokens I truly believe in — the ones I’ve done deep research on — I’ll scale into spot at opportunistic dips. This is not market-timing; this is conviction-weight risk management.

- Prepare for a longer consolidation: If the market closes higher timeframes beneath the critical level I mentioned, I am mentally prepared for a much longer correction into the 70–85k region. That is not necessarily the end of the bull market — it could simply be a phase adjustment.

And the emotional rule: do not trade when you’re compelled by fear or anger. Decisions made in those states are how accounts get wiped.

How I size trades and manage risk

Risk sizing is the practical guardrail that prevents emotional ruin. My rules are simple:

- Leverage only for short-duration, high-conviction trades; I keep leverage low relative to account size unless the trade thesis is bulletproof.

- Spot is my core allocation — especially in projects with strong on-chain fundamentals and team trust. I avoid majority allocations to highly speculative alts without robust thesis.

- Stop-losses and position limits: I predetermine exit points for leveraged trades, and I rarely increase position size after a stop — that behavior is how people average into wiping accounts.

If you’re looking to follow signals or curated trade ideas, consider services that transparently show risk parameters and historical performance. A good crypto signal service won’t promise moonshots; it will show how it sizes, how it manages risk, and when it suggests being out of positions. (I’ll touch on how I incorporate signals later in the article.)

Opportunities in chaos: how to think about buying the fear

Historically, fear and greed indicators collapse at these extremes. When fear spikes, buyers can get better entry points. But that doesn’t mean buying blindly — you need a framework:

- Differentiate liquidity dips from terminal failures: There’s a big difference between an illiquid wick on a CLOB and a protocol that no longer has sound fundamentals. ATOM’s flash print on one exchange due to order book thinness looks catastrophic on paper but doesn’t automatically invalidate Cosmos as a network.

- Use DCA when volatility is high: Dollar-cost averaging into conviction spots reduces timing risk and the chance of catching only the initial part of a continued decline.

- Prioritize projects with defensible value: Market cycles reward winners that compound. If you can’t explain why a project will survive a 2–3 year downcycle, it probably won’t.

One pragmatic tactic I use is to keep a portion of capital unallocated as “dry powder” specifically to pick up quality holdings after large liquidation events. That prevents the classic mistake: being 100% long right before a cascade and 0% when prices are attractive.

Psychology and well-being — what matters more than account balances

Market losses hurt. I’ve personally lost a lot before: I wiped my portfolio on Luna in 2022 because I misunderstood the protocol’s “cash” dynamics. I know the emotional pain and the guilt. Here’s what I’ll say plainly: nothing on this screen is more important than you. If you’re struggling after the crash, talk to someone. Step away from the screen. Reach out to friends or family. If you need professional help, get it.

Money losses can feel existential in the moment, but people care about you irrespective of account size. The market will move on; your life cannot be rebuilt if you make irreversible choices in a moment of emotional turmoil.

Practical checklist: Immediate actions after a cascade

If the crash just happened to you or you’re preparing for the next one, here’s a checklist you can follow right now:

- Stop and breathe. Don’t make impulsive trades.

- Assess margin usage. Close forced-leverage risk positions if you’re overexposed.

- Re-evaluate portfolio diversification: percentage in BTC vs ETH vs alts vs stablecoins.

- Flag core conviction holdings — those you’re willing to buy more of on weakness.

- Set defined re-entry levels (not emotional “I’ll buy the bottom” calls) and implement DCA plans.

- Review exchange counterparty risk — consider splitting positions across multiple reputable custodians/exchanges if you hold significant capital.

- Document lessons learned — write them down so you don’t repeat mistakes.

Integrating trading signals responsibly

Several times I get asked if I use trading signals. The short answer: yes, selectively. The long answer: signals are one tool among many. A well-run, transparent cryptocurrency trading signals service can provide disciplined entries, risk parameters, and ideas you might not find on your own. Use them as inputs, not as gospel. They’re best for people who need structure but still want to make final decisions themselves.

Good signals will have clear stop-losses, take-profit tiers, and position sizing recommendations. Avoid anyone who sends “bet the farm” moonshots without documented risk management. If you plan to use signals, integrate them into your personal rules (position size limits, overall exposure caps, and vetting the signal provider’s historical performance).

What this means for alts vs. BTC

Yesterday’s cascade hammered alts harder than BTC. That’s normal: alt liquidity is thinner, and leverage is often concentrated there. A few principles to keep in mind:

- Alt recovery is uneven: Winners from this cycle tend to consolidate value; losers rarely snap back to old highs without meaningful upgrades or adoption.

- Value accrues to the top: Networks with real usage and defensible economics continue to accumulate value. Speculative meme coins are fine for tiny, discretionary allocations — but they’re not the backbone of a portfolio.

- Decide use-case and thesis: You should be able to explain why you hold each alt for at least the next 12–24 months.

If you’re hunting opportunities, prioritize: on-chain usage metrics, tokenomics clarity, team transparency, and community strength. Those factors tend to hold through drawdowns.

Long-term view: is crypto “broken” or just re-calibrating?

Short answer: crypto is not dead. Ecosystems iterate and consolidate. The last 24 hours highlighted vulnerabilities in market infrastructure — dispersed books, ADL mechanics, and exchange operational risks — but it also confirmed strengths: market makers and vaults can handle flows and remain solvent, certain protocols are resilient, and blockchains continue to operate.

What’s changed is risk-perception. Institutions and retail traders now see clearer evidence that leverage, exchange selection, and liquidity management matter more than hype. That’s a healthy lesson for market maturation.

How I’ll adapt my strategy if this becomes a multi-week correction

Planning for a prolonged downswing includes both defensive and opportunistic moves:

- Increase stable allocation: Move some capital to stablecoins as optionality for buys after big dips.

- Reduce leverage exposure: Keep leverage for short-term tactical plays only and use minimal sizes.

- Harvest losses strategically: For taxable accounts, understand when taking realized losses makes sense.

- Monitor on-chain indicators: Look at exchange inflows/outflows, realized volatility, and long-term holder behavior to time larger buys.

I’ll also lean into higher-conviction research: if I’m going to increase exposure, I’ll want asymmetric risk-reward trades where upside potential meaningfully outweighs the downside probability.

Lessons learned — the key takeaways you should write down

There are clear lessons from yesterday’s carnage. These aren’t just platitudes; they’re survival rules.

- Leverage kills quickly: The fastest way to blow up an account in crypto is careless leverage. Respect the math.

- Liquidity is king: Order books matter — and thin books make fat wicks. Don’t confuse a flash print with fundamental value.

- Exchange selection matters: Outages and ADL policies vary. Understand your exchange’s risk frameworks.

- Have a plan: Predefine entry/exit rules. Don’t make decisions in panic mode.

- Conviction beats speculation: Holding a diversified set of high-conviction spot positions is a far better base strategy than chasing every mint or meme coin.

FAQ

What caused the $20B+ liquidation cascade?

A combination of macro news (tariff headlines that triggered risk-off across traditional markets), the timing of the move occurring after major exchanges and institutional liquidity had closed for the day, thin order books on many venues, and the mechanics of perpetual futures (forced liquidations and auto-deleveraging) caused a rapid, self-reinforcing sell-off. When bids are sparse, liquidations produce market orders that sink through prices quickly, creating cascading forced sales across exchanges.

Why did Hyperliquid and its HLP make so much money?

Hyperliquid’s HLP acts as the house vault and market maker — it supplies liquidity and takes the other side when no natural counterparty exists. During a cascade, when liquidity evaporates, the HLP absorbed numerous forced trades and captured the wide spreads and vol-driven flow, resulting in outsized profits. That’s the market-making business model amplified under extreme stress.

Is Bitcoin now in a bear market?

Not necessarily. The crash is significant, and if higher timeframe candles close below critical levels (e.g., my rough thresholds in the article), we could see a longer correction. However, Bitcoin has shown resilience over multiple cycles. A steep pullback does not automatically equal a structural bear market; context, macro dynamics, and on-chain behavior will inform the answer over the coming weeks.

Should I use leverage after this event?

Caution is strongly advised. Leverage magnifies both gains and losses. After a major liquidity event, the market can continue to whipsaw. If you do use leverage, reduce size, tighten risk controls, and ensure you understand exchange liquidation mechanics (ADL, cross-margin vs isolated margin, etc.). For most traders, staying in spot or waiting for clearer bias is the safer route.

How should I think about alts after the crash?

Alts are higher-risk and will likely remain volatile. Prioritize projects with clear fundamentals, on-chain usage, and strong teams. Keep speculative allocations small and consider DCA into assets you understand. Recognize that some alts might never return to prior highs if they lack product-market fit or sound tokenomics.

Can I trust exchange liquidation engines?

Liquidation engines do what they are designed to do: protect the exchange from counterparty defaults. However, different exchanges implement different policies (e.g., ADL, insurance funds, partial fills). You should read your exchange’s liquidation policy and be aware of the operational risks, especially during market stress or outages.

Should I follow trading signals or do my own analysis?

Use signals as an input, not a crutch. Good signal services provide trade ideas, risk parameters, and historical track records. They’re useful for structure and discipline. But you must integrate them into your own risk rules and position sizing. Don’t hand over decision-making entirely to external signals without understanding the logic behind trades.

What emotional steps should I take after losing money in a crash?

Prioritize your well-being: step away from the screen, talk to friends or family, and seek professional help if needed. Financial losses are painful, but they aren’t life-ending. Document what happened, identify lessons, and rebuild with a plan focused on risk management and diversification.

Final thoughts — what I’ll be watching next

I’m watching three categories of signals in the coming days and weeks:

- Higher-timeframe closes: Specifically daily and weekly closes relative to the 118k area and the lower ~107–110k zone. Those closes give the clearest structural guidance.

- Exchange flows and liquidity metrics: Inflows to exchanges often precede further selling; outflows can indicate accumulation by longer-term holders.

- On-chain demand for robust protocols: Sustained usage metrics, active addresses, and revenue-generating functions are leading indicators for which alts will survive the clean-up.

For now, I’m sitting on my hands, holding spots for projects I trust, out of leverage, and monitoring price action carefully. If you’re using signals, integrate them with the risk rules we covered. If you’re purely a spot hodler, use the volatility to average into conviction positions on a plan you can actually execute emotionally.

Finally, if yesterday’s event affected you materially — emotionally or financially — reach out. Take care of yourself first. Markets come and go. Lessons last, and you can rebuild smarter.