Table of Contents

- Round 1 — Founders and funding

- Round 2 — How they work: products, UX and revenue

- Round 3 — Stock price performance and valuation

- Round 4 — Adoption and growth

- Round 5 — Key challenges

- Scorecard & Verdict

- Final thoughts

- FAQ — Robinhood vs Coinbase

Round 1 — Founders and funding

Robinhood and Coinbase both started with a simple mission: democratize access to markets. Robinhood was founded in 2013 by Vladimir Tenev and Baiju Bhatt after they built trading systems for institutional players and realised retail traders were paying as much as $10 per trade while hedge funds paid almost nothing. Their pitch attracted over 70 rejections before a $3 million seed round from Index Ventures, Andreessen Horowitz and Tim Draper. By the time Robinhood IPO’d it had raised more than $5.6 billion.

Coinbase began a year earlier in 2012 when Brian Armstrong (after witnessing inflation in Argentina) and Fred Ehrsam set out to make buying Bitcoin easy and safe. Coinbase started with $150k from Y Combinator and later raised significantly, including a $75 million round in 2015 backed by the NYSE and USAA. Before its 2021 public listing, Coinbase had raised roughly $525 million.

Round 2 — How they work: products, UX and revenue

At first glance, the two platforms target different strengths. Robinhood built a clean, mobile-first experience focused on commission-free equities, options, ETFs, crypto, retirement accounts and even a branded debit/credit product. Its signature appeal is simplicity and accessibility.

Robinhood’s primary revenue source historically has been payment for order flow — market makers pay Robinhood to route retail orders. The company also monetizes through Robinhood Gold (premium features), interest on uninvested cash and card rewards that can be directed into portfolios. Robinhood has expanded into tokenized US stocks in Europe, perpetual futures, ETH and SOL staking, and is building the Robinhood chain (an Arbitrum-based custom blockchain).

Coinbase, by contrast, is the incumbent crypto on-ramp and infrastructure provider. It lists over 300 cryptocurrencies, offers staking, custody for institutional clients, and powers on-chain payments and ETF custody. Transaction fees remain a core revenue component (often higher than competitors), but Coinbase emphasizes security, compliance and ease of use. Their product stack includes Coinbase 1 (subscription tiers), Coinbase Advanced (pro tools) and Base — Coinbase’s Ethereum Layer 2 that hosts mini-apps, social features and payments.

Fees and crypto selection

- Robinhood: commission-free trading with a limited crypto selection (around 50 coins as of 2025).

- Coinbase: over 300 listed tokens, broader global availability (100+ countries) but higher retail fees unless you subscribe to Coinbase 1.

Round 3 — Stock price performance and valuation

Both companies have experienced wide price swings tied to investor sentiment and broader market cycles. Robinhood listed at $38 in July 2021, briefly surged to ~$85, then crashed to under $7 by June 2022. By 2025 it staged a dramatic comeback, trading above $100 with a market cap near $100 billion. Its valuation metrics (around 57x P/E and ~28x P/S) are high compared to the S&P 500 average.

Coinbase debuted via direct listing in April 2021 and closed its first day around $328. It too plunged during the 2022 crypto bear market but later recovered strongly — shares climbed back into the low $300s with a market cap just under $80 billion. Coinbase was added to the S&P 500 in May 2025. Its valuation sits lower than Robinhood’s (roughly 29x trailing P/E and ~12x P/S), indicating comparatively less premium pricing by the market.

Round 4 — Adoption and growth

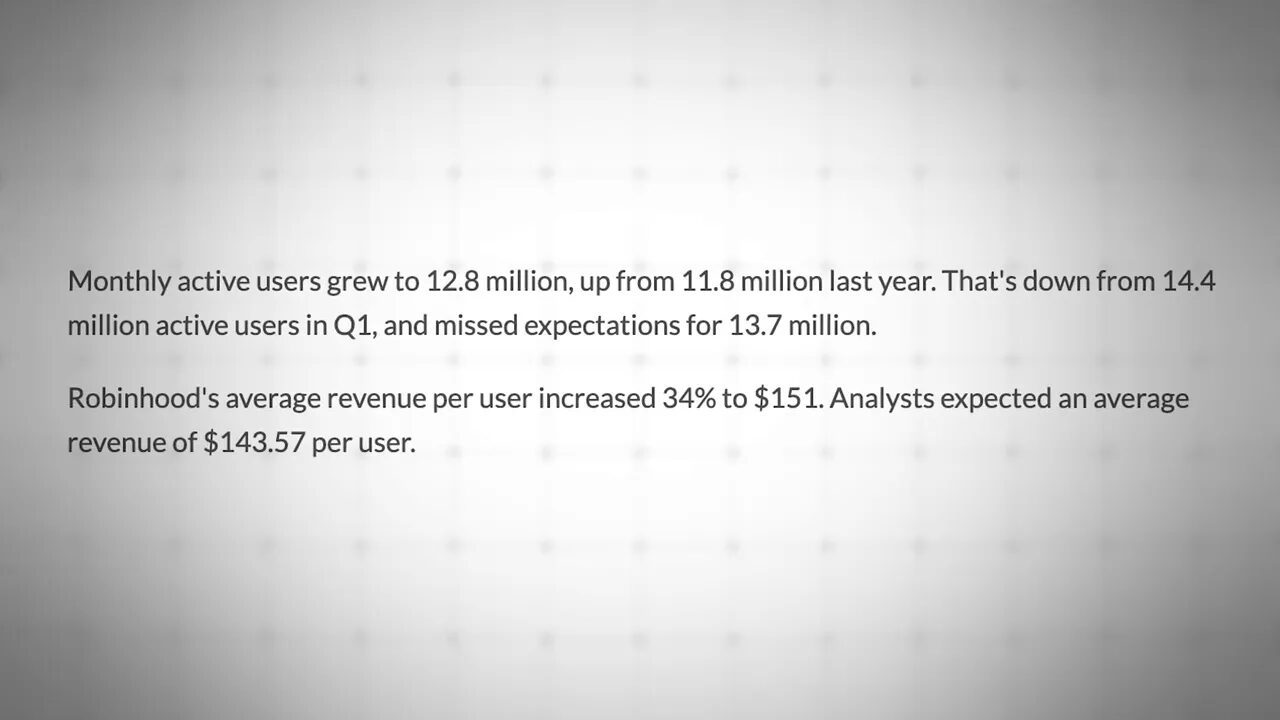

Numbers tell complementary stories. Robinhood has built scale in raw users and engagement: from 2 million funded accounts in 2017 to nearly 13 million monthly active users by 2025. The user base skews young (about 75% under 44). Assets under management (AUM) rose to about $279 billion in Q2 2025. Notably, retirement assets jumped from $800 million in Q2 2023 to $19 billion, while Robinhood Gold subscribers grew to 3.5 million.

Coinbase has fewer transacting monthly users (around 8.7 million in Q2 2025) but manages roughly $245 billion in assets and dominates institutional ETF custody — over 80% of US Bitcoin and Ethereum ETF assets. Base (Coinbase’s L2) showed strong traction with close to $5 billion TVL and over a million monthly active addresses, positioning Coinbase as both consumer-facing and infrastructure-driven.

Round 5 — Key challenges

Both companies face heavy regulatory, security and competitive hurdles.

Regulation

Robinhood’s reliance on payment for order flow has drawn scrutiny; the EU has banned the practice effective end of 2026, and any similar US move would pressure Robinhood’s business model. Tokenized stock initiatives have also created controversy around private-company token distribution.

Security

Security lapses have hit both firms. Coinbase disclosed a major cybersecurity incident in May 2025 costing over $300 million in reimbursements and legal fees. Robinhood settled a 2025 data breach for $45 million and faced a $70 million FINRA settlement in 2021 for outages and customer harm. Trust is fragile in financial services — breaches cost money and reputation.

Competition

Robinhood competes with legacy brokerages (Fidelity, Charles Schwab) and fintech challengers (SoFi, Chime). Coinbase faces global crypto exchanges (Binance, OKX), banks entering crypto services, and the possibility of big tech moving into payments and crypto. Both must keep innovating on price, UX and reliability.

Scorecard & Verdict

I broke this comparison into five rounds. Here’s the short version:

- Founders & Funding: Robinhood — their disruption around commission-free trading reshaped an industry.

- User Experience & Features: Robinhood for simplicity (stocks, cards, mobile). Coinbase for crypto infrastructure breadth.

- Stock Market Performance: Coinbase — more attractive valuation multiples and S&P 500 inclusion give it an edge.

- Adoption & Growth: Coinbase — deep crypto assets under custody, ETF custody leadership and Base traction outweigh Robinhood’s larger user count.

- Challenges: Tie — both face intense regulatory, security and competitive pressures.

That leaves us with a tie overall: each company dominates its lane. Robinhood is the simpler, consumer-first super app for everyday finance. Coinbase is the heavyweight in crypto infrastructure and institutional custody. Which wins depends entirely on what you value — convenience and breadth of retail finance, or depth, institutional trust and crypto-native infrastructure.

Final thoughts

Robinhood vs Coinbase is less about declaring an absolute winner and more about watching two giants expand into each other’s territory. Robinhood is building blockchain and tokenized products while Coinbase moves into tradfi partnerships and tokenized equities. Both are pushing the future of money forward; the ultimate winner will be decided by regulation, security track record, execution and user trust over the coming years.

FAQ — Robinhood vs Coinbase

Which platform has more cryptocurrencies?

Coinbase: about 300+ tokens listed as of 2025. Robinhood lists roughly 50 crypto assets.

Which platform is cheaper for small trades?

Robinhood offers commission-free stock trades and zero-commission retail trades, but Coinbase’s fees can be higher for small non-subscribed trades. Coinbase 1 subscription tiers can reduce costs for frequent traders.

Which is better for institutional services and ETFs?

Coinbase leads in institutional custody and ETF custody, holding a dominant share of Bitcoin and Ethereum ETF assets for US institutions.

Are either of these companies expanding internationally?

Yes. Coinbase operates in over 100 countries. Robinhood expanded via the Bitstamp acquisition and holds more than 50 international licenses while focusing on US and European expansion.

Should I pick one over the other?

It depends on your priorities: choose Robinhood for a simple, all-in-one retail finance experience; choose Coinbase for broader crypto access, institutional-grade custody, and DeFi/Layer-2 integration.

If you want a deeper video-style walkthrough of this comparison, check out the original Coin Bureau coverage for visuals and timestamps that map to each section above.