Solana Price Prediction is a hot topic right now, and for good reason. I believe Solana has real momentum behind it: staking ETFs have launched, major payment players are experimenting with Solana-native stablecoins, and developer activity continues to accelerate. In this Solana Price Prediction I will walk you through the recent news, the technology, the on-chain dynamics that matter, realistic price targets, and how traders and long-term holders can think about positioning for the months ahead.

Table of Contents

- Quick TLDR: My Solana Price Prediction

- Outline

- Why Solana Matters Now

- Key Recent Catalysts Driving This Solana Price Prediction

- Technical Fundamentals That Support My Solana Price Prediction

- The Meme Economy and Ecosystem Growth

- Price Targets: The Case for $500 (and the Outside Case for $1,000)

- How ETF Flows Change the Game

- Trading and Entry Considerations

- Where to Buy SOL and Practical Notes

- Risks That Temper a Bullish Solana Price Prediction

- How I Think About Timeframes

- Actionable Takeaways

- What is the basis for the $500 Solana Price Prediction?

- Is $1,000 for SOL realistic?

- How do ETFs affect Solana’s price?

- Should I use cryptocurrency trading signals for Solana trades?

- Where should I buy SOL?

- Final Thoughts on My Solana Price Prediction

Quick TLDR: My Solana Price Prediction

Solana Price Prediction summary: Solana has the infrastructure, active development, and now institutional access via staking ETFs. I believe SOL has a very good shot at reaching $500 in this bull cycle, with an outside possibility of hitting $1,000 if institutional flows accelerate dramatically and high-profile investors begin to champion the chain. The recent $223 million first-day inflow into a Solana staking ETF is a key catalyst and one of the principal reasons behind this bullish Solana Price Prediction.

Outline

- Why Solana matters now

- Key recent catalysts: Western Union stablecoin and staking ETFs

- The tech fundamentals: proof of history plus proof of stake

- Meme economy, developer growth, and ecosystem health

- Price targets and the logic behind a $500 Solana Price Prediction

- How ETF flows and institutional capital change the market

- Where to buy and practical trading considerations

- Risk factors and timelines

- Actionable ideas, including how cryptocurrency trading signals can help

- FAQ

Why Solana Matters Now

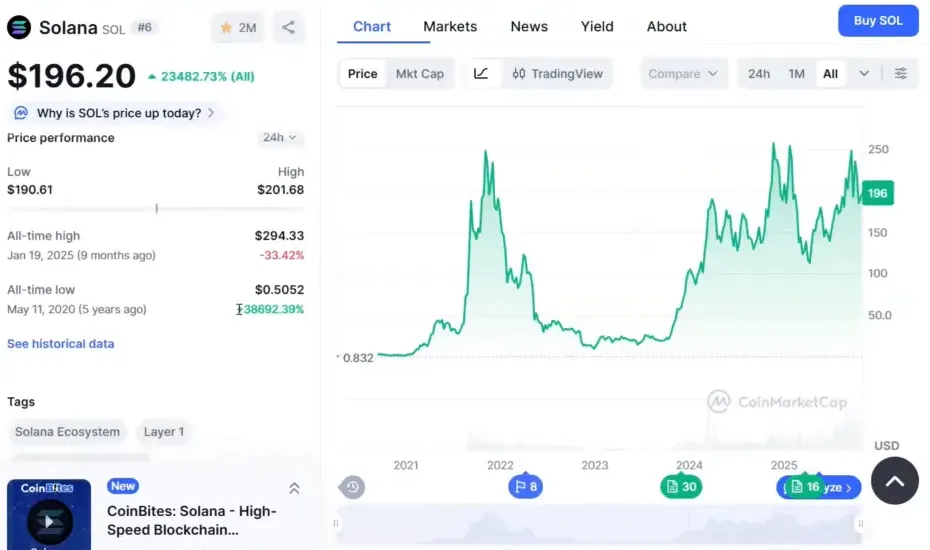

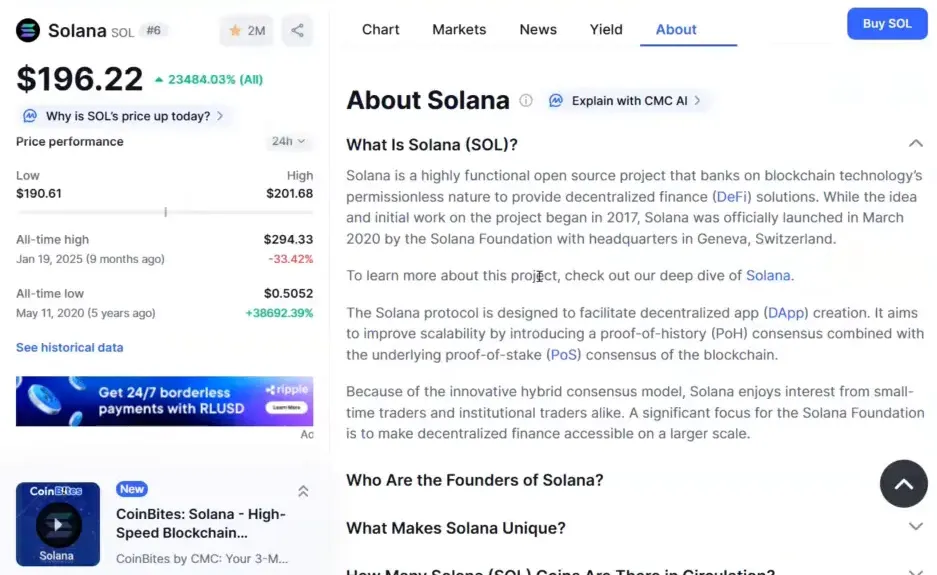

Solana Price Prediction begins with adoption and utility. Solana is an open source blockchain built to enable decentralized applications by prioritizing speed and low fees. The protocol uses a combination of proof of history and proof of stake to achieve high throughput, and that technical design has made it attractive to developers and communities that care about fast, inexpensive transactions.

What matters now is not just the tech alone but the momentum behind it. Over the last several months we have seen Solana re-ignite its narrative through meme coin activity, DEX growth, and now major institutional access via staking ETFs. When a large blockchain gets multiple angles of adoption at the same time—retail enthusiasm, developer tooling, and institutional access—the price tends to follow the utility and the capital inflows. This forms the backbone of any serious Solana Price Prediction.

The founder and community

Anatoly Yakovenko, Solana’s founder, remains an influential voice. He is active publicly and engages with developers, ecosystem projects, and the broader crypto community. That leadership and public presence matter for sentiment and for directing technical priorities. A Solana Price Prediction that ignores the influence of core contributors and the community that rallies behind them would miss a major piece of the puzzle.

Key Recent Catalysts Driving This Solana Price Prediction

There are two major news items I want to highlight because they materially impact my Solana Price Prediction.

1) Western Union and a Solana-based stablecoin

Western Union launching a Solana stablecoin for global payments is not fluff. Western Union is still widely used for remittances and cross-border transactions. If a legacy payments provider integrates a Solana stablecoin into its global flow, that can bring real transactional volume and real user testing to the chain. More on-chain transactions mean higher usage metrics, which institutional allocators and retail traders watch closely when making a Solana Price Prediction.

2) Solana Staking ETF momentum

The Solana staking ETF pulled in roughly $223 million on its first trading day. This is the clearest sign yet that institutional and ETF-based retail flows are prepared to move beyond Bitcoin and Ethereum into meaningful altcoin exposure. A Solana Price Prediction that discounts a new channel of capital would be incomplete. ETFs make it easier for large pools of capital—pension funds, endowments, family offices—to allocate to Solana without the custody and compliance hurdles of direct coin ownership.

Technical Fundamentals That Support My Solana Price Prediction

To make any credible Solana Price Prediction we must examine the technical backbone.

- Proof of History + Proof of Stake: Solana’s consensus leverages proof of history to timestamp events and proof of stake to secure the chain. This combination is engineered to provide high throughput and low latency.

- Speed and low fees: Solana’s architecture is designed for fast block times and very low transaction costs compared to many other smart contract platforms. This makes it attractive for apps that require frequent on-chain actions, such as gaming, NFTs, micropayments, and DEX operations.

- Developer tooling: Solana has improved its developer experience with SDKs, tooling, and better documentation. Faster iteration times for devs correlate with more dapps launching, which contributes to my bullish Solana Price Prediction.

When you combine technical scalability with tangible transaction growth—especially payments rails like the Western Union initiative—you get a structural story that supports higher valuations. That is the foundation for predicting higher price targets like $500.

The Meme Economy and Ecosystem Growth

Part of Solana’s recent resurgence comes from community-driven meme coin activity. In the last cycle meme coins on Solana grew rapidly, attracting hype and massive short-term trading volume. That retail energy tends to pull in liquidity and attention, which then encourages more developers to build on the chain. A healthy balance between speculative activity and real product development has historically propelled chains forward.

When assessing any Solana Price Prediction it is important to factor in this cyclical pattern: meme-driven inflows can create short-term spikes while solid dapp and infrastructure growth sustain longer-term appreciation.

Where Solana stands in the ecosystem

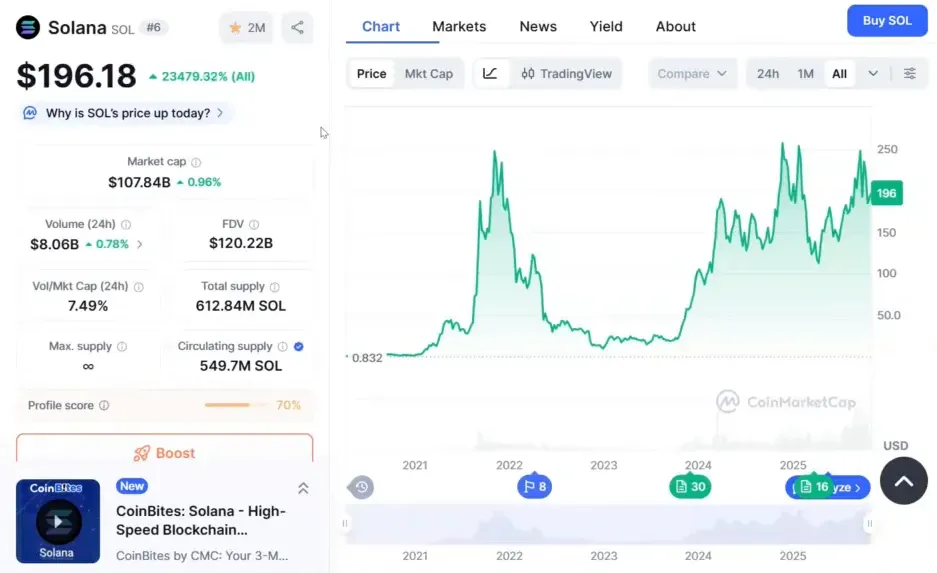

Today Solana’s ecosystem is one of the largest in crypto, often placed just behind Ethereum and Binance Smart Chain in terms of activity. Solana is known for speed and for the ability to build quickly. We’ve seen periods where Solana outpaced Ethereum in monthly volume. If that trend returns, it would reinforce a bullish Solana Price Prediction, as volume growth is a major driver of price appreciation.

Price Targets: The Case for $500 (and the Outside Case for $1,000)

My baseline Solana Price Prediction for this bull cycle is $500. Here’s why that level is reasonable and how it could happen.

- Institutional inflows via ETFs: The $223 million first-day ETF inflow is an early but strong signal. Over months, if ETF inflows continue and more products launch, a steady stream of institutional capital can lift market caps across the board. This is the primary engine for pushing SOL toward $500.

- On-chain activity and payments use cases: Western Union-style integrations and payments use cases increase transaction volume and real utility. More utility equals more valuation premium for SOL.

- Developer-driven growth: The bigger the dapp ecosystem, the more fees and usage the chain generates, and the more token demand appears for staking and governance activities.

- Meme cycles and retail flows: A renewed wave of meme coin enthusiasm can produce parabolic short-term rallies that amplify ETF-driven gains.

Now, the stretch case to $1,000 is possible but less likely. For SOL to reach $1,000 we would need: a multi-month sustained institutional influx far larger than the initial ETF day; major public endorsement by significant investment names beyond Bitcoin and Ethereum; and continued explosive developer growth. Those things together could push SOL into the higher valuation bands. My Solana Price Prediction notes this as an outside possibility.

How ETF Flows Change the Game

Before staking ETFs, institutional exposure to alt layer tokens often required over-the-counter trades or complex custody arrangements. ETFs lower the friction and broaden the buyer base. For this Solana Price Prediction it is crucial to understand that ETFs not only bring money; they change the investor profile. Money that once stayed on the sidelines can now enter through familiar channels.

We are likely to see a two-step process:

- Initial adoption by retail and smaller institutions via ETFs, which lifts price and attention.

- As performance and reliability are observed, larger institutions allocate and funds re-balance portfolios to include exposure to Solana, creating deeper and more sustained inflows.

That second step is what can transform a temporary rally into a long-term re-rating of the asset. That re-rating is the core thesis behind my higher Solana Price Prediction.

Trading and Entry Considerations

If you are considering trading Solana or using a portion of a risk portfolio to gain exposure, consider these practical points that influence any Solana Price Prediction in the short term:

- Use dollar-cost averaging if you expect volatility. SOL can move sharply on news, and averaging reduces timing risk.

- Watch ETF inflow reports and on-chain metrics like active addresses and transaction volume. These are leading indicators for price action.

- Consider using regulated exchanges that offer staking and integrated services if you plan to hold long term. Platforms like Bitget offer incentives for new users, which can be a practical way to offset entry costs.

To help active traders capture shorter-term opportunities, my members and I use cryptocurrency trading signals that highlight high-probability setups and timing cues. These signals combine on-chain metrics, ETF flow data, and technical analysis to surface trades that align with larger macro narratives—like those shaping this Solana Price Prediction. If you are actively trading and want disciplined, timely entries and exits, signals can complement your strategy without taking over your decision-making.

Where to Buy SOL and Practical Notes

Solana is widely available across centralized and decentralized exchanges. If you want to buy SOL, pick an exchange you trust and that provides clear staking and custody options. Platforms that reward new users and provide a smooth staking process make it easier to participate in the upside of any Solana Price Prediction.

Note: when using any exchange promotion be mindful of the terms. Welcome packs and sign-up bonuses often require certain trading or engagement thresholds to claim. Use those promotions to improve your cost basis while staying disciplined about your overall position sizing.

Risks That Temper a Bullish Solana Price Prediction

No prediction is complete without discussing risk. Consider the following when evaluating any Solana Price Prediction:

- Network stability concerns: Solana has experienced outages in the past. Persistent downtime undermines confidence and can inhibit institutional adoption.

- Competition: Ethereum remains dominant for smart contracts, and Binance Smart Chain maintains a strong retail base. Solana must keep innovating to maintain its edge.

- Regulatory risk: Broader crypto regulation can affect ETF flows, staking mechanics, and custodial arrangements. Regulation can be a tailwind or a headwind depending on jurisdiction.

- Macro and liquidity cycles: Crypto markets are sensitive to macro liquidity conditions. If broader liquidity tightens, altcoin performance often suffers even if fundamentals remain intact.

These risks do not invalidate a bullish Solana Price Prediction; they simply shape the probability distribution and potential timeframe. Expect higher volatility and maintain position sizing discipline.

How I Think About Timeframes

For a Solana Price Prediction of $500 I am thinking within this bull cycle, the next several months to a year, assuming consistent ETF inflows and steady on-chain adoption. The $1,000 scenario is a multi-month to multi-year stretch that depends heavily on outsized institutional allocations and market enthusiasm.

Timeframes matter because speculative catalysts like meme coins can cause rapid moves, but real, sustained appreciation usually follows broader adoption and capital reallocation. That is why my Solana Price Prediction places high weight on structural drivers like ETFs and payments integrations.

Actionable Takeaways

- Track ETF inflows and Western Union payment integrations as primary on-ramps for real demand. These are the most important near-term indicators for any Solana Price Prediction.

- Use dollar-cost averaging and risk management to navigate volatility.

- If you are an active trader, consider combining technical analysis with curated cryptocurrency trading signals to capture momentum moves and manage exits.

- Monitor network performance metrics. Frequent outages or instability would reduce the probability of the higher end of this Solana Price Prediction.

What is the basis for the $500 Solana Price Prediction?

The $500 Solana Price Prediction is based on a combination of factors: substantial ETF inflows that lower the barrier to institutional capital, increased on-chain utility including payments integrations like a Solana stablecoin, developer growth that drives transaction volume, and the potential for renewed retail/meme cycles to amplify gains. These forces together make $500 a reasonable target within this bull cycle.

Is $1,000 for SOL realistic?

A $1,000 Solana Price Prediction is an outside possibility. It requires sustained and significant institutional inflows far beyond initial ETF days, broader market liquidity, and endorsement from major investment names. It is possible but lower probability compared to a $500 target.

How do ETFs affect Solana’s price?

ETFs make it easier for large pools of capital to access Solana without needing direct custody. That can unlock institutional allocations and steady inflows. Initial ETF inflows like the reported $223 million on day one are early indicators that this is happening. More ETFs and more product adoption typically mean more consistent buying pressure, which supports higher valuations.

Should I use cryptocurrency trading signals for Solana trades?

Cryptocurrency trading signals can be a useful complement if you are an active trader. Signals that combine on-chain metrics, ETF flow data, and technical analysis help identify high-probability setups aligned with macro drivers. They should not replace your own risk management or research, but they can add discipline and timing to your approach when executing any Solana Price Prediction strategy.

Where should I buy SOL?

SOL is widely available across major centralized exchanges and DEXs. Choose platforms with strong security, clear staking options, and transparent fees. Some exchanges offer welcome bonuses or trading credits which can modestly improve your entry cost, but read the terms and maintain sound portfolio allocation rules.

Final Thoughts on My Solana Price Prediction

Solana Price Prediction is bullish for this cycle. The combination of staking ETFs, major payments integration experiments, growing developer activity, and the potential for renewed retail enthusiasm lays the foundation for a significant run. I am setting a realistic target of $500 for SOL during this bull cycle while acknowledging an outside chance for $1,000 if institutional interest becomes dramatically larger.

If you are looking to trade or time the market, consider disciplined approaches like dollar-cost averaging, clearly defined stop-losses, and using trustworthy tools. For active traders, combining technical plans with cryptocurrency trading signals can enhance timing and risk control while keeping you aligned with the structural narrative described in this Solana Price Prediction.

Remember, markets are uncertain. Use this Solana Price Prediction as a framework for thinking, not a guarantee. Keep position sizes manageable, monitor the ETF flows and on-chain usage metrics, and adapt as the story unfolds.