The SUI Coin Review below examines why Sui has become one of the most talked-about layer one blockchains and why its recent rally looks sustainable. Sui has tech pedigree, growing on-chain activity, and a pivotal regulatory milestone that unlocked fresh demand. This article breaks down the fundamentals, the catalyst behind the price move, technical levels to watch, ecosystem growth, and the real risks to consider before allocating capital.

Table of Contents

- Why Sui matters: architecture, pedigree, and raw speed

- Regulatory catalyst: Coinbase New York approval and why it matters

- Token unlocks, sentiment flips, and why supply shock didn’t turn bearish

- Technical picture: consolidation, key levels, and next targets

- Market tools and the advantage of informed signals

- Ecosystem growth: projects, accelerator support, and developer momentum

- Network activity and usage: why transactions per day matter

- Is $10 a realistic target and what would it take?

- Risks to balance against the upside

- How to think about allocation and time horizon

- What is Sui and what sets it apart from other layer one blockchains?

- Final thoughts

Why Sui matters: architecture, pedigree, and raw speed

Sui stands out because of its design choices aimed at extreme throughput and low-latency transactions. The core team includes former lead architects from Meta’s blockchain research group, and the project is built around parallel execution of transactions. That parallelism is not just marketing copy: in controlled tests the network has demonstrated theoretical throughput metrics that get attention.

Parallel transaction execution means Sui processes non-conflicting transactions concurrently instead of queuing them serially. In practice this architecture promises dramatic improvements in transactions per second, which matters for games, microtransactions, and high-frequency on-chain applications.

The theoretical throughput figures are eye-catching and deservedly so. While lab numbers do not equate to roadmap milestones, the architecture itself is purpose-built for high-volume consumer and enterprise workloads—think Visa or MasterCard scale if the ecosystem ever fully realizes that capacity.

Regulatory catalyst: Coinbase New York approval and why it matters

A major inflection point for Sui was approval enabling New York residents to trade SUI on Coinbase. That approval represents a practical expansion of retail access in the single largest regulated U.S. market. More access equals more natural buyers and deeper order books, which can substantially change short-term dynamics.

When a token gains New York listing approval, it is not just a cosmetic win. It reduces a friction point for roughly 20 million potential traders and investors who previously had limited routes to buy the asset on regulated platforms. That demand shock combined with improving macro conditions—markets pricing in lower interest rates—helped Sui outperform the broader market during the most recent rally.

Token unlocks, sentiment flips, and why supply shock didn’t turn bearish

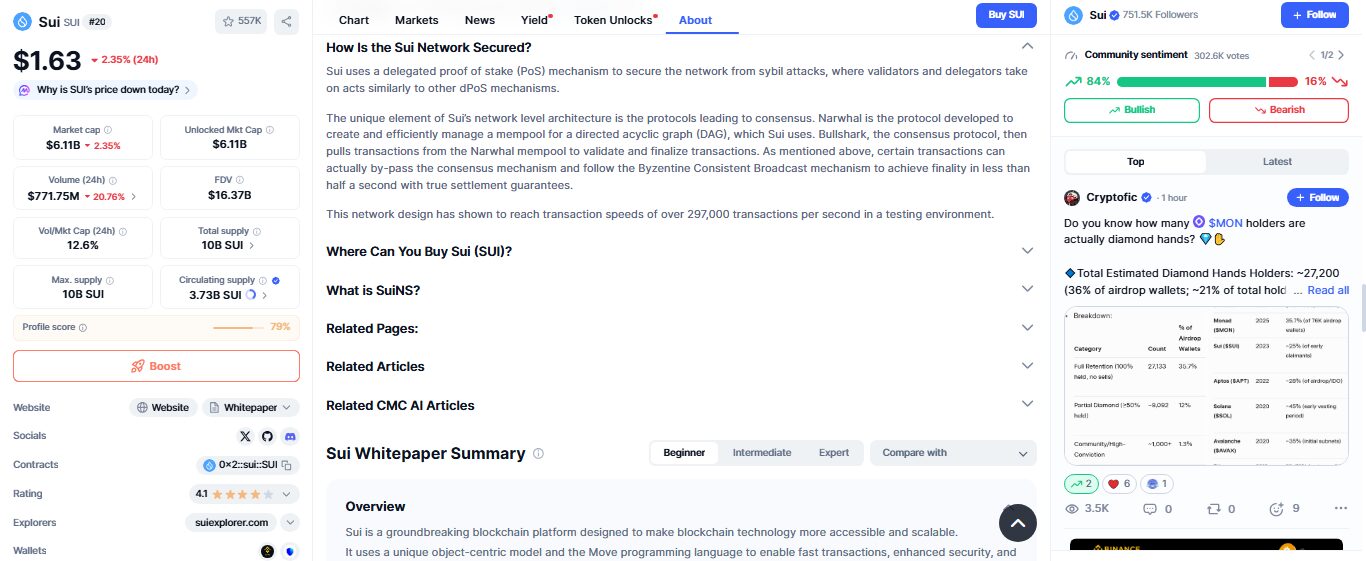

Token unlocks usually create selling pressure. On December 1, Sui scheduled an 86.86 million token unlock—the largest for the month—an event that often leads to price pullbacks. Instead the market absorbed the supply. Net exchange flows turned positive, and the unlock acted like a contrarian filter that flushed out weak short positions.

Analysts and traders described the move as a sentiment flip. Over $350 million worth of shorts were squeezed, and liquidity that might have turned into sell pressure was instead soaked up by buyers betting on the Coinbase listing and the bullish macro narrative. That kind of absorption is a structural bullish signal when it happens: supply arrived, but demand arrived faster.

Technical picture: consolidation, key levels, and next targets

From a technical standpoint, Sui has been consolidating above a critical zone near $1.60. Maintaining that level matters because it shows buyers are defending the market after the unlock and regulatory news. The 200-day exponential moving average is close by, around $1.78, and that level acts both as resistance and a momentum checkpoint.

If Sui closes above roughly $1.92 it would invalidate the November downtrend and open the path toward the October peak near $2.72. That path is meaningful because it would confirm resumed trend direction and likely attract additional momentum traders and institutional flow. Short-term traders will watch for volume confluence around those prices; a strong breakout with rising volume tends to be more durable.

For position traders the scenario becomes clearer: sustained closes above the 200-day EMA and above the $1.92 mark create a clean technical runway toward the October highs. From there, momentum and narrative could carry Sui toward higher price bands if ecosystem growth and usage continue to match the rhetoric.

Market tools and the advantage of informed signals

Trading a fast-moving asset like SUI benefits from having accurate, timely market intelligence. Cryptocurrency trading signals that track exchange flows, open interest, and short-squeeze risk can be especially valuable during token unlocks and listing events. These signals help identify when demand is absorbing supply and when momentum trades are becoming crowded.

Using signals as part of a disciplined plan allows traders to place entries and set risk levels with more conviction. For anyone looking to trade or hold Sui, consider incorporating professional-grade cryptocurrency trading signals into your toolkit to reduce guesswork and exploit event-driven moves more confidently.

Ecosystem growth: projects, accelerator support, and developer momentum

Sui’s ecosystem is beginning to show the signs of a healthy early-stage platform. A steady pipeline of new projects is launching, ranging from DeFi primitives to gaming and NFT experiences. Unlike some chains that focus purely on memetic speculation, Sui is seeing meaningful traction in DeFi applications where total value locked is rising and several protocols are reporting double-digit weekly or monthly growth.

The platform supports developers through dedicated accelerator programs and dev tooling. One example is the accelerator that offers mentorship, hands-on support, and capital introductions without taking equity—an attractive proposition that lowers the barriers to prototype and launch. Real-world support like pitch competitions, in-person conferences, and developer grants fosters a community that builds more quickly and iteratively.

Compare this to early Solana stages a few years ago: the cadence of developer activity, hackathons, and grassroots tooling looks familiar. When developers can prototype quickly and tokens or apps demonstrate product-market fit, that is a structural tailwind for token valuation—assuming user growth follows.

Network activity and usage: why transactions per day matter

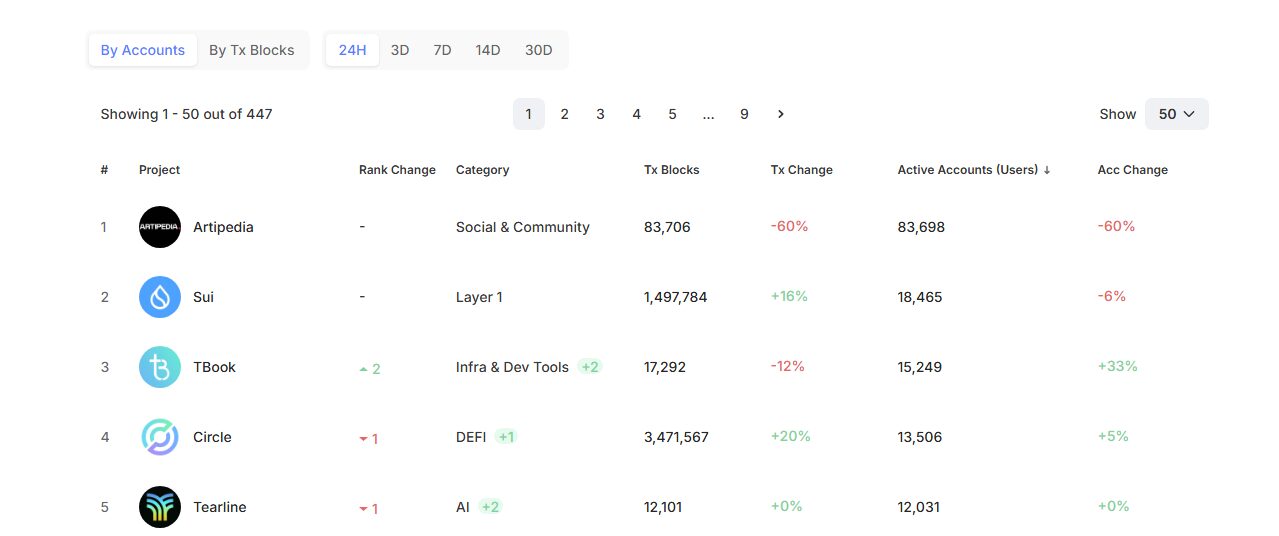

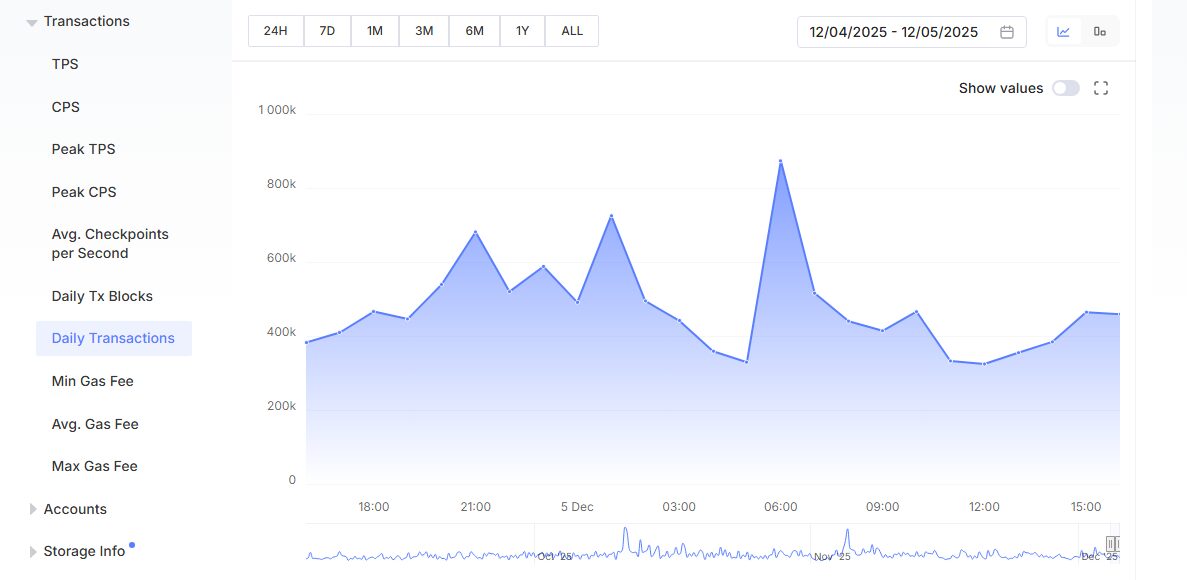

On-chain usage is a sanity check for any blockchain narrative. Sui is delivering solid daily transaction counts. A million or so transactions a day on a new layer one is not trivial. It demonstrates that developers are shipping and users are interacting with apps.

Real usage reduces the chance that Sui becomes merely a speculative token. As apps gain traction, total value locked and on-chain activity create organic demand for native tokens, which helps align incentives for builders, users, and long-term investors.

Is $10 a realistic target and what would it take?

Predicting exact price levels is always speculative, but a clear path to $10 exists under a few conditions. First, continued ecosystem growth and real usage that increases TVL and transaction throughput. Second, sustained listings and regulated access that keep bringing new buyers into the market. Third, macro tailwinds such as a lower-rate environment that typically supports risk-on flows into crypto.

Why $10? If Sui becomes a dominant platform for specific verticals like blockchain gaming and high-frequency microtransactions, the market could start to price in a utility premium similar to other high-usage chains. The comparison to Solana is instructive: a chain that demonstrates both developer and user traction can see multiple expansions in market cap across cycles.

A practical road map to double digits would require Sui to push sustained transactions per second well beyond the thousands, show continued protocol launches, and maintain favorable listings on major exchanges. None of that is guaranteed, but the ingredients are present and the regulatory and technical catalysts have already started to align.

Risks to balance against the upside

No thesis is complete without risks. Consider these when evaluating Sui:

- Token unlock schedules can create intermittent selling pressure. Even if a past unlock was absorbed, future unlocks could be distributed differently.

- Competition from other layer one chains with larger existing ecosystems can slow Sui’s market share gains.

- Execution risk around reaching real-world throughput and maintaining decentralization while scaling.

- Regulatory uncertainty beyond listings can change sentiment quickly, especially in major markets.

- Macro volatility can reverse risk appetite, impacting even technically strong projects.

Managing position size, having stop-loss discipline, and using market intelligence such as crypto trading signals to time entries and exits can mitigate some of these risks. Signals that combine on-chain activity, exchange flows, and short interest provide actionable context during high-event periods.

How to think about allocation and time horizon

For those who believe in the long-term blockchain thesis, Sui fits the profile of a developmental-stage, high-upside allocation. It is not a stablecoin or a yield instrument; it is a growth asset. Position sizing should reflect that reality.

Short-term traders might focus on technical levels and event-driven catalysts like listings and unlocks. Longer-term holders should monitor ecosystem growth metrics such as active developers, TVL expansion, daily transactions, and adoption from user-facing apps.

What is Sui and what sets it apart from other layer one blockchains?

Sui is a layer one blockchain built around parallel transaction execution and high theoretical throughput. It emphasizes low latency and high transactions per second, making it suitable for applications like gaming and large-scale microtransactions. Its architecture and team pedigree set it apart by design.

Why did Sui rally recently?

The rally was driven by a combination of factors: Coinbase New York listing approval, absorption of a major token unlock that flushed shorts, and broader market sentiment improving due to expected interest rate cuts. Together these catalysts created a demand surge that outpaced selling pressure.

Is the $10 price target realistic?

A $10 target is plausible if Sui achieves sustained ecosystem growth, high on-chain usage, and continued listings that broaden access. It requires positive macro conditions and strong adoption, so while possible, it is contingent on multiple favorable developments.

How can I buy SUI safely?

Buy SUI on reputable exchanges that list the token and offer regulatory compliance in your jurisdiction. Use secure wallets for long-term storage, enable two-factor authentication, and consider dollar-cost averaging to manage entry risk.

Should I use Coinbase or alternative exchanges?

Coinbase provides regulated access which has clear benefits for many investors, especially in the U.S. Alternative exchanges can offer different fee structures or derivative products. Choose an exchange based on regulatory coverage, fees, and whether you need advanced features.

How can cryptocurrency trading signals help me trade Sui?

Cryptocurrency trading signals provide timely alerts around exchange flows, short interest, and on-chain metrics. They are especially useful during unlocks, listings, and momentum phases, helping traders make informed entries, exits, and risk management decisions.

Final thoughts

Sui presents a compelling combination of technology and market catalysts. The Coinbase New York listing and the way the market absorbed a large token unlock show that investor sentiment can flip quickly when access and usage line up. On-chain metrics like daily transactions and increasing TVL reinforce the fundamental case.

That said, risks remain. Execution across the stack, ongoing unlocks, competition, and macro volatility can all change the trajectory. If the network’s developer momentum and user growth continue, Sui has a reasonable shot at significantly higher valuations this cycle. For traders and investors who want to navigate these event-driven moves with more precision, adding professional cryptocurrency trading signals to an existing strategy can provide clarity and help manage risk.

Use disciplined position sizing, track the technical levels discussed here, and keep an eye on ecosystem metrics. Sui has the ingredients for a powerful bull case—but like any high-upside crypto, success depends on execution and adoption.