Table of Contents

- Quick summary

- What happened: the unlock and the price response

- Why the price held — three reasons

- Technology and long-term thesis

- Usage metrics that matter now

- Near-term and mid-term price perspective

- How to approach Sui as an investor

- Opportunity vs risk

- Final thoughts

- FAQ

Quick summary

This SUI Crypto Review explains why Sui’s recent price action looks durable, what fundamentals are backing it, and how to think about the upside and risk. Key points: a $65 million token unlock was absorbed without a crash, on-chain activity is rising, trading liquidity is healthy, and Sui’s tech claims massive throughput potential. Those factors together make a compelling case for further upside.

What happened: the unlock and the price response

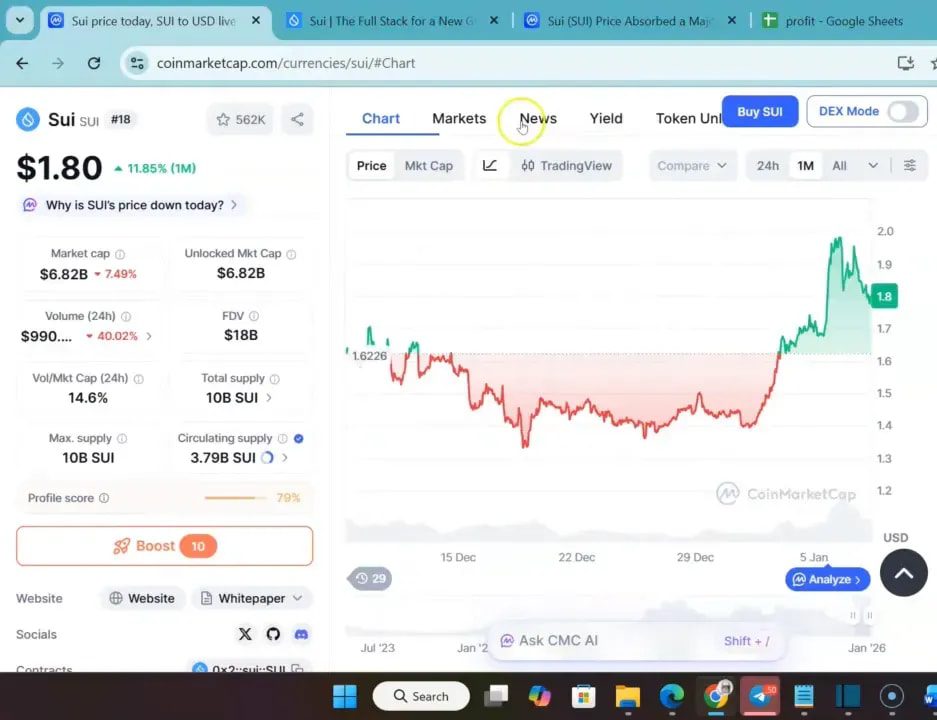

Over the past several days Sui rose from about $1.40 to $2.00 then pulled back slightly — notable because a $65 million token unlock hit the market during that run and the price did not capitulate. Instead the token reclaimed the $1.80 zone and moved higher, a clear sign buyers met the selling pressure.

Why the price held — three reasons

- Buyers absorbed the unlock: Unlocks typically bring selling. In this case the market absorbed the new supply and price continued upward, which suggests real demand rather than a one-off pump.

- Rising on-chain activity: Activity is up roughly 30% since late November, indicating growing usage rather than speculative noise. That usage matters for long-term token value.

- Healthy liquidity and volume: Trading volume around $1.7 billion on a $7.3 billion market cap means the market can move size without falling apart, which reduces flash crash risk on big trades.

ETF filings and institutional interest add another layer of context. They do not guarantee price moves but they keep Sui in the same institutional conversation as other assets, which helps sentiment and liquidity.

Technology and long-term thesis

Sui is a layer one blockchain built by lead architects who previously worked on Meta’s blockchain research. Its standout claim is a test throughput of 297,000 transactions per second. That number is not needed by crypto today, but it becomes relevant if major payment rails or central banks move significant volumes on-chain.

If Visa, Mastercard, banks, or CBDCs start routing high-frequency payments on public chains, throughput will matter. In that scenario Sui’s architecture gives it a legitimate product-market fit as a payments or high-volume settlement layer.

Usage metrics that matter now

- Daily transactions are steady in the low millions (roughly 10–12 million per day).

- Gas fees are negligible — around 0.001–0.002 SUI — which makes it practical for small-value transactions and DeFi activity.

- New projects and DeFi launches are appearing regularly on Sui, and many Sui-based tokens have rallied alongside the native token.

When a layer one shows sustained real usage, price appreciation often follows. PancakeSwap is an example of unusual divergence where usage rose without price moves, but layer ones tend to benefit more directly from network adoption — Binance Coin is an example that hit new highs driven by rising usage.

Near-term and mid-term price perspective

Near term the chart suggests Sui could test $2.20 and potentially $2.50 if momentum continues. Its all-time high sits at around $5.35, and the bull-case thesis many analysts voice is that Sui could revisit or exceed those levels if adoption accelerates.

Some investors view Sui as an early-stage opportunity similar to getting into Solana in 2019. That comparison is about timing — if Sui becomes the high-throughput layer many expect, $10 is a plausible mid-term target under a robust bull market and continued adoption.

How to approach Sui as an investor

- Define time horizon: Short-term traders may scalp momentum; long-term holders should focus on network growth and partnerships.

- Use risk management: Consider position sizing and stop-loss levels. Unlocks and volatility can flip sentiment quickly.

- Consider dollar-cost averaging if you believe in the long-term thesis but want to reduce timing risk.

For traders who prefer signal-driven entry and exit points, free crypto signals can be useful to identify momentum shifts, absorption events like the $65 million unlock, and sensible take-profit levels. Integrating quality signals into your plan helps you act decisively without emotional overtrading.

Opportunity vs risk

- Opportunity: If large-scale payments or enterprise adoption head on-chain, Sui’s throughput and low fees place it in a strong position.

- Risk: Macro shocks, lost developer mindshare, or an extended bear period could keep price suppressed despite good fundamentals.

One practical approach is to combine conviction (size a core long-term position) with tactical entries (use DCA or signal-based top-ups). Again, free crypto signals are a low-friction way to spot those tactical moments without chasing every headline.

Final thoughts

Sui checks a lot of boxes: an experienced team, standout technical claims, rising on-chain activity, and the ability to absorb a significant token unlock without a crash. That mix creates a credible path for further upside from current levels. Whether Sui reaches $10 depends on adoption, macro conditions, and how institutions interact with on-chain payment rails. For investors aligned with that thesis, disciplined entries and active risk management are the right playbook.

FAQ

Is Sui a good buy right now?

Sui looks attractive for investors who believe in high-throughput layer ones and long-term blockchain payments adoption. Short-term traders should watch liquidity and momentum. Dollar-cost averaging plus signal-guided entries is a balanced approach.

How did the $65 million unlock not crash the price?

Buyers absorbed the new supply. Rising on-chain activity and healthy trading volume meant the market could handle the sell pressure, so price did not capitulate.

What real use cases support Sui?

Low-fee microtransactions, DeFi primitives, high-frequency payment rails, and potential enterprise or CBDC settlement are the primary use cases that justify Sui’s architecture.

Could Sui reach $10 this year?

It is possible in a strong bull market with sustained adoption and institutional flows. However, that outcome depends on broader market conditions and execution by the Sui ecosystem.