In this deep dive I break down the Top 5 BEST Crypto Exchanges you should consider in 2025. Choosing an exchange is one of the most important decisions you’ll make in crypto. Pick the right platform and your journey will be smooth; pick the wrong one and you could face excessive fees, weak security, poor liquidity, and unnecessary headaches.

In this guide I walk you through the Top 5 BEST Crypto Exchanges — Coinbase, Bybit, Kraken, Binance and OKX — and evaluate each on four consistent criteria: security, asset support, fees and trading experience. I’ll also share practical tips and tricks that could save you thousands when you on-ramp, trade, or off-ramp. By the end you’ll be able to choose which of the Top 5 BEST Crypto Exchanges best suits your needs.

Table of Contents

- Why this list matters: Top 5 BEST Crypto Exchanges — the big picture

- Quick but crucial disclaimers

- How to pick from the Top 5 BEST Crypto Exchanges

- Deep dive: Coinbase — the blue-chip, onshore leader

- Deep dive: Bybit — trader-focused, offshore, low fees

- Deep dive: Kraken — the OG onshore exchange with a spotless record

- Deep dive: Binance — the global heavyweight

- Deep dive: OKX — clean UI, competitive features, and surprising extras

- Side-by-side: which Top 5 BEST Crypto Exchanges fits your needs?

- Practical tips & tricks to save thousands across the Top 5 BEST Crypto Exchanges

- Onshore vs Offshore: Why it matters among the Top 5 BEST Crypto Exchanges

- FAQ — Top 5 BEST Crypto Exchanges

- Final thoughts: choosing the one right for you among the Top 5 BEST Crypto Exchanges

- Want to go deeper?

- Tell me your pick

- Appendix: Quick reference — Top 5 BEST Crypto Exchanges at a glance

Why this list matters: Top 5 BEST Crypto Exchanges — the big picture

There are hundreds of crypto exchanges, but not all are created equal. The difference between a good and a bad exchange can be the difference between a painless trade and a catastrophic loss. That’s why I built this Top 5 BEST Crypto Exchanges guide — to help you cut through the noise and pick the right platform for your goals.

Across these five exchanges you’ll see a range of approaches: US-based onshore exchanges that prioritize compliance and regulatory transparency; and offshore exchanges that prioritize rapid listings, advanced derivatives and lower fees. Both models have pros and cons, and the right choice depends on where you live, how you like to trade, and how much control you want over custody of your assets.

Core evaluation criteria

- Security: Custody model, cold storage percentage, insurance, past hacks, proof of reserves.

- Asset support: Number and variety of tokens, hot meme listings vs conservative blue chips.

- Fees: Maker/taker structure, tiers, fee discounts (exchange tokens, volume), deposit/withdrawal costs.

- Trading experience: Terminal design, advanced order types, derivatives features, mobile/web UX and customer support.

I’ll evaluate each exchange using these four lenses so you can compare apples to apples among the Top 5 BEST Crypto Exchanges.

Quick but crucial disclaimers

Before we begin: custody matters. Even on the most secure exchange, there is no substitute for self-custody. If you’re not actively trading an asset, consider withdrawing it to your own wallet — ideally a hardware wallet — so you control the private keys. Exchanges can fail or freeze withdrawals without warning; being your own custodian mitigates that risk.

Second, I have affiliate relationships with some exchanges mentioned below. Those relationships do not change my evaluation. Every exchange was judged on the four criteria above with honest, practical recommendations.

How to pick from the Top 5 BEST Crypto Exchanges

To choose among the Top 5 BEST Crypto Exchanges, ask yourself these questions first:

- Are you in a jurisdiction that restricts access (U.S., UK, Canada, EU)?

- Do you prioritize regulatory protections or fast listings and low fees?

- Are you a passive investor, an active spot trader, or a derivatives trader?

- How comfortable are you with advanced trading tools and complex order types?

- Which fiat currencies and deposit/withdrawal methods do you need?

Your answers will quickly point you towards one or more of the Top 5 BEST Crypto Exchanges. For example, if you’re in the U.S. and want strong regulatory hygiene, an onshore exchange like Coinbase or Kraken is likely best. If you’re an experienced derivatives trader chasing low fees and many listings, an offshore exchange like Bybit, Binance or OKX could be more appropriate.

1) Coinbase — the blue-chip, onshore leader

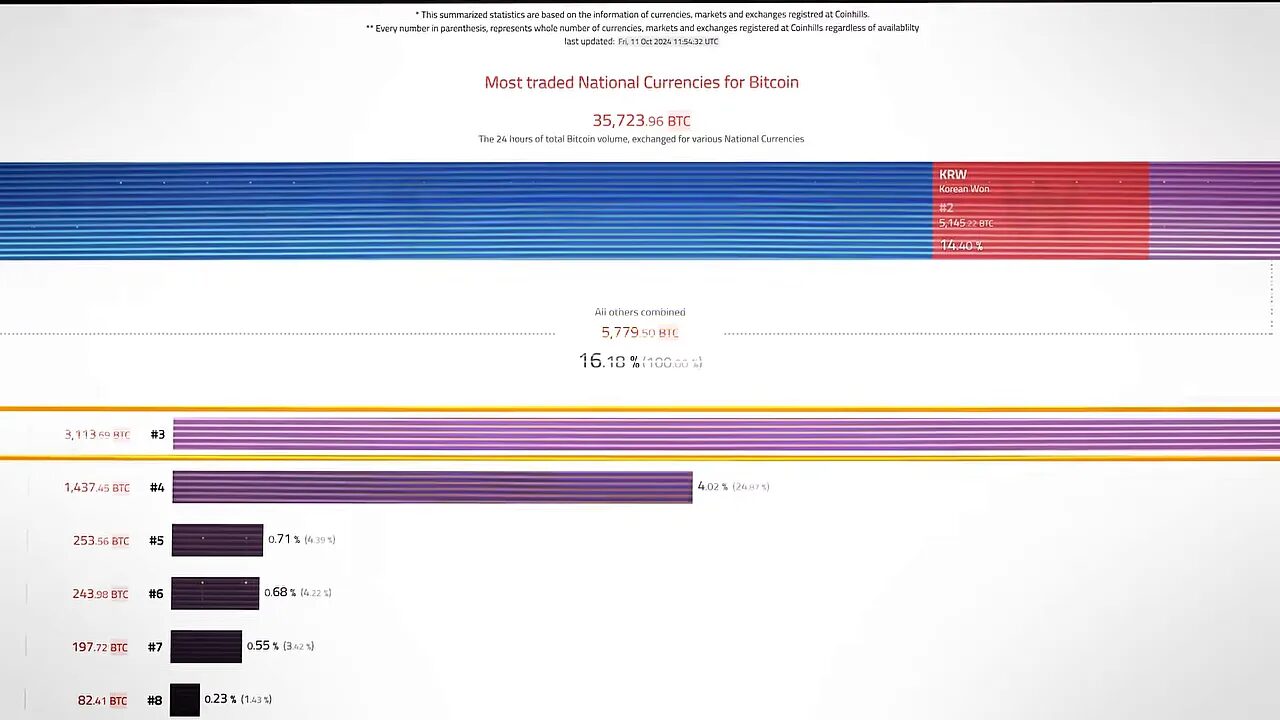

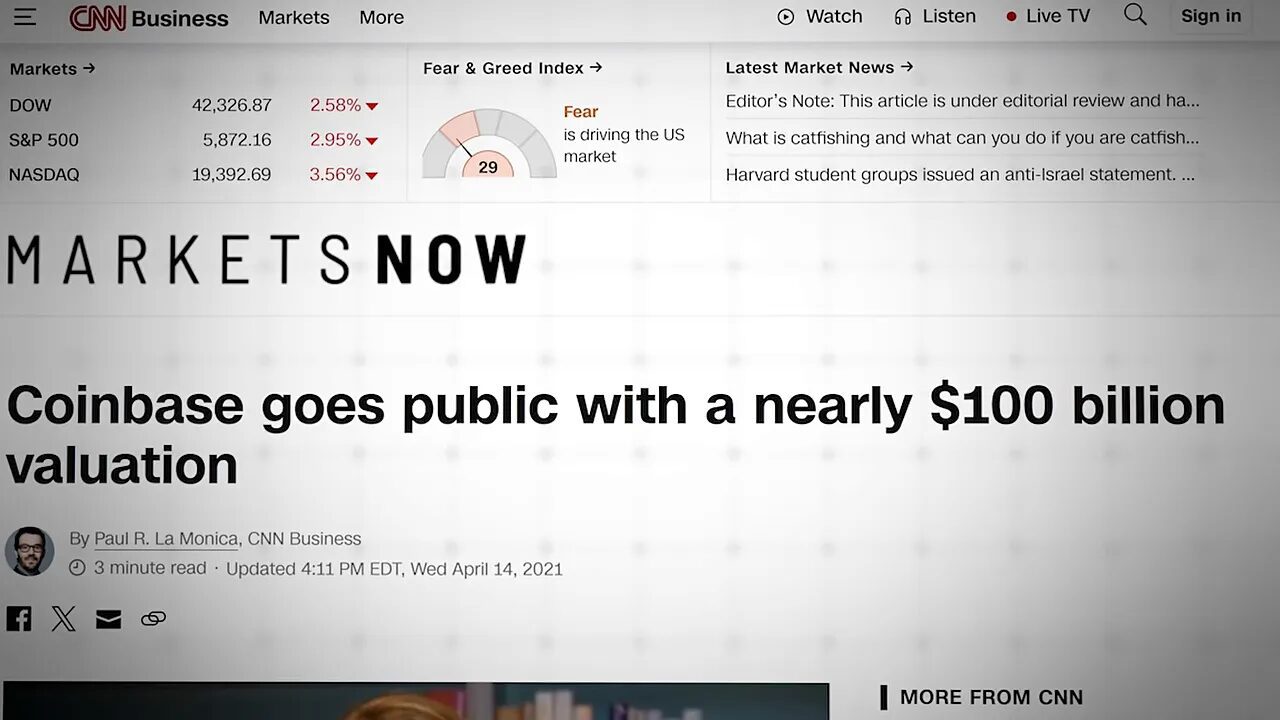

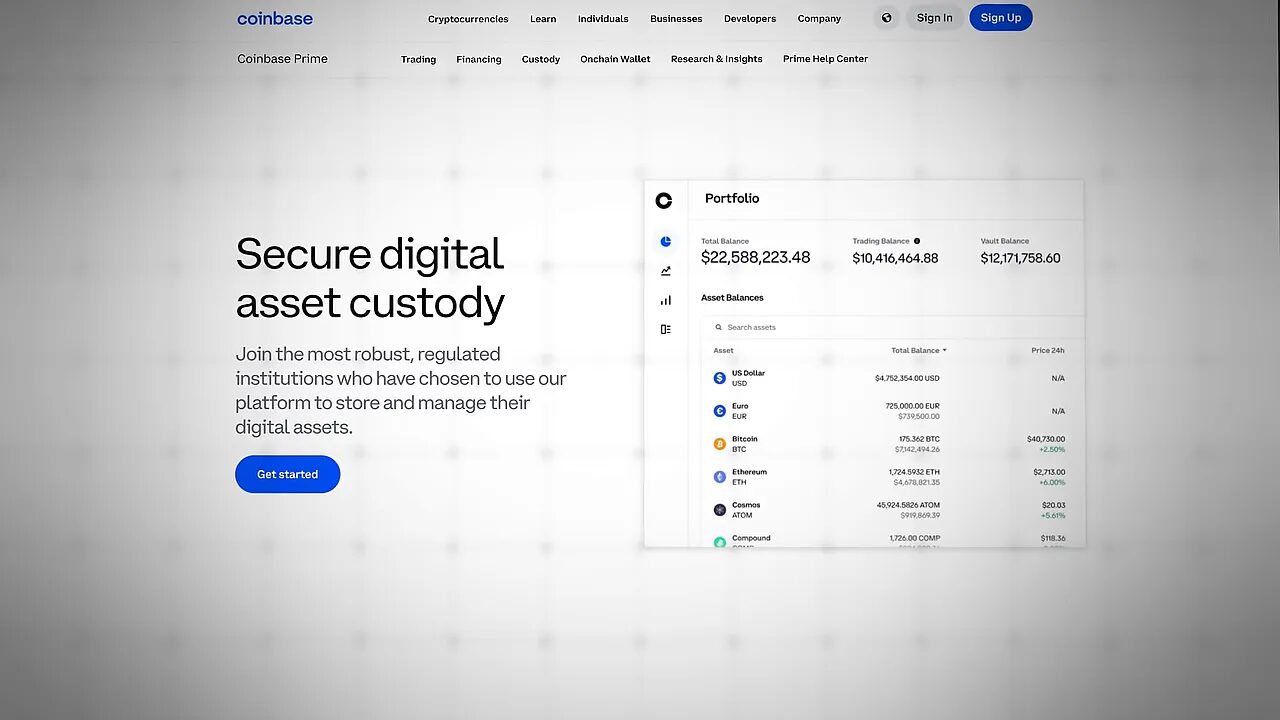

Coinbase is one of the most recognizable names in crypto and is squarely in the category of Top 5 BEST Crypto Exchanges. Founded in 2012 by Brian Armstrong, Coinbase is the largest exchange by trading volume in the United States and the only cryptocurrency exchange listed on a major stock exchange (NYSE). That public listing and a compliance-first approach have shaped Coinbase’s brand: security, onshore compliance, and mainstream accessibility.

Security

Security is a cornerstone of Coinbase’s proposition. The exchange stores approximately 98% of user funds in cold storage and insures the assets that remain online. U.S. customer cash deposits held with Coinbase are FDIC-insured up to $250,000 — though remember that FDIC insurance does not extend to crypto assets themselves.

Coinbase is a public company with audited financial statements from a Big Four auditor. That adds a level of transparency and solvency assurance you rarely see in crypto. That said, Coinbase has experienced a security incident: in March 2021 hackers accessed about 6,000 customer accounts via a vulnerability. Coinbase reimbursed affected users and implemented security improvements.

Asset support

On the surface Coinbase lists a very large index of tokens — over 17,000 names appear in its directory — but that isn’t the same as tradable listings. When you filter for tradable assets the list shrinks to a few hundred (around 263 at recent counts). This conservative listing policy is deliberate: as an onshore exchange Coinbase takes careful legal and compliance steps before listing a token, preferring to avoid regulatory exposure.

That conservative approach means Coinbase generally lists majors and established projects rather than brand-new meme coins and tiny-cap tokens. If you want the broadest range of obscure alts, Coinbase might leave you wanting.

Fiat on-ramps and off-ramps

Coinbase supports on-ramping with USD, GBP and EUR directly. Users in many countries can still use local currency on-ramps but sometimes through third-party providers that display balances in USD. Deposit methods include cards and bank transfers, and in the U.S. you can use ACH for free. In Europe, SEPA is low-cost (often cents), and U.K. faster payments are usually cheap. Credit/debit card purchases are convenient but significantly more expensive — avoid them when possible.

Fees

Coinbase is known for higher fees compared to many other Top 5 BEST Crypto Exchanges. It uses a maker-taker fee model with tiers based on 30-day volume. Taker fees range from roughly 0.04% to 0.6%; maker fees range from 0% to 0.60%. For casual users the fees are often higher especially if you use instant buy/credit card options. For active traders, fee-conscious traders, or professional traders, this makes Coinbase less attractive than some offshore alternatives.

Trading experience

Coinbase’s interface is very beginner-friendly. If you prefer a minimalist experience you’ll like Coinbase. For more advanced trading you can switch to Coinbase Advanced Trade which includes TradingView charts, order book, and basic limit/market/stop orders. However, Coinbase Advanced is comparatively minimal compared to the pro terminals on other exchanges.

Who Coinbase is best for

- Newcomers who want a clean, trustworthy entry into crypto.

- Users who prioritize regulatory transparency and auditability.

- People who mostly buy-and-hold large-cap tokens rather than chasing obscure alts.

Coinbase is one of the Top 5 BEST Crypto Exchanges specifically for users who value compliance and a polished, easy experience. If you want the cheapest fees or the widest asset selection, you may prefer a different exchange from the Top 5 BEST Crypto Exchanges list.

2) Bybit — trader-focused, offshore, low fees

Bybit is another of the Top 5 BEST Crypto Exchanges and is especially popular with derivatives traders. Founded in 2018 with roots in Singapore, Bybit relocated its operations to Dubai in 2022 to take advantage of a friendlier regulatory environment. That offshore status gives Bybit the freedom to list many more tokens and to offer advanced derivatives products with competitive fees.

Security

Bybit has a strong security record: no known successful hacks or major security incidents. It uses standard best practices (2FA, cold storage, multi-signature wallets) and has implemented novel features like AI-driven fraud detection and round-the-clock emergency response systems. Bybit has also publicly doxxed wallets and offers proof-of-reserve verification via a Merkle tree so users can verify their balances.

Unlike some onshore exchanges, Bybit does not offer FDIC-type insurance for deposits. It maintains an insurance fund meant to protect leveraged positions during extreme market events, but that fund is not an insurance policy for spot balances.

Asset support

Bybit lists 500+ cryptocurrencies across spot and derivatives markets. As an offshore exchange Bybit can list tokens quickly in response to market demand — especially meme coins — which is a huge advantage for traders chasing hot launches.

Fiat and deposit methods

Bybit shows support for many fiat currencies via a fiat deposit dropdown, but actual deposit availability varies by currency and region. In some cases direct deposits are not available or are limited. Where available, some fiat options are cheap (SEPA for euros at low fees), while others (credit card providers) can be expensive. As is the case across the Top 5 BEST Crypto Exchanges, using bank transfers is usually the cheapest on-ramp.

Fees

Bybit is competitive on fees. For spot markets makers and takers often start around 0.1% with discounts for higher-volume tiers. For derivatives the base can be as low as 0.055% taker and 0.02% maker and can drop significantly at high tiers (taker 0.018%, maker 0% at some levels). Bybit’s fee schedule and tiered discounts put it among the lowest-cost options within the Top 5 BEST Crypto Exchanges.

Trading experience

Bybit’s trading terminal is powerful and designed for active traders. It offers robust charting via TradingView, multiple charts, advanced order types (TWAP, Iceberg, Chase Limit), automation via webhook signals, and a highly responsive matching engine that can process hundreds of thousands of transactions per second.

Who Bybit is best for

- Derivatives traders looking for low fees and deep liquidity.

- People who want early access to meme coins and low-cap alts.

- Traders who value fast execution and responsive markets.

Bybit is one of the Top 5 BEST Crypto Exchanges if you’re chasing trading efficiency, low costs, and a broad token catalog — but be mindful of regional restrictions (Bybit is unavailable in the U.S., UK, Canada, and the EEA, among others).

3) Kraken — the OG onshore exchange with a spotless record

Kraken is another veteran among the Top 5 BEST Crypto Exchanges. Founded in 2011 and launched in 2013 by Jesse Powell, Kraken made its name by prioritizing security and institutional-grade custody. Kraken operates in roughly 190 countries and has licensing in multiple jurisdictions. It’s a trusted, conservative onshore choice for many users.

Security

Kraken’s security record is remarkable: no reported hacks or security incidents in its history. Kraken Security Labs, a dedicated team, performs penetration testing, bug bounties, and proof-of-reserve audits. While Kraken doesn’t provide FDIC insurance on customer deposits the way Coinbase holds customer cash, Kraken’s long-term operating stability and security-first culture give a lot of reassurance.

Asset support

Kraken lists around 298 cryptocurrencies — more than Coinbase but less than offshore rivals. Kraken’s approach is conservative; they list projects only after legal, compliance and engineering checks. That said, Kraken has been gradually broadening its listings recently.

Fiat and deposits

Kraken supports a wide range of fiat deposit options: USD, CAD, AUD, EUR, GBP, CHF, and JPY among others. Bank transfers (ACH, SEPA, faster payments) are typically the cheapest on-ramps. Avoid instant buy or card purchases whenever possible because those convenience features usually carry a premium.

Fees

Kraken uses a tiered maker-taker model. On Kraken Pro makers start around 0.16% and takers around 0.26%, dropping with higher volume tiers. Kraken Pro supports a broader set of order types and is the place to be for fee-conscious traders. The standard Kraken interface offers instant buy features which carry higher fees (e.g., 1.5% for most cryptos when using USD instant buy), so be mindful of which interface you use.

Trading experience

Kraken sits between Coinbase and exchanges like Bybit or Binance in terms of the trader experience. The standard Kraken interface is simple and beginner-friendly. Kraken Pro is a powerful pro terminal with multiple order types (nine total, including iceberg and nuanced trailing stop options), price alerts, and customizable widgets for metrics like open interest and liquidation volume.

Who Kraken is best for

- Users who want an onshore exchange with strong security and professional support.

- Beginners who want quality customer service and a dependable platform.

- Traders who want solid pro tools without sacrificing safety and compliance.

Kraken is one of the Top 5 BEST Crypto Exchanges for users that want a trusted, stable on-ramp and a pro terminal that is more advanced than entry-level platforms.

4) Binance — the global heavyweight

Binance is the largest crypto exchange in the world by volume and users, and it’s consistently one of the Top 5 BEST Crypto Exchanges. Launched by Changpeng Zhao (CZ) and Yi He in 2017, Binance grew rapidly by offering enormous asset support, low fees, and deep liquidity.

Security

As the largest exchange, Binance is the biggest target. In 2019 a compromised API enabled a $40 million loss. Binance had already established SAFU (Secure Asset Fund for Users) in 2018, and that fund reimbursed impacted users. Since then Binance has invested heavily in security, cold storage, multi-signature and threshold schemes, and real-time monitoring. Binance publishes proof-of-reserves using a ZK-SNARK-based protocol and Merkle trees so users can verify backing.

Asset support

Binance lists hundreds of assets — roughly 386 at the time of review — across spot, margin, and derivatives. That’s significantly more than Coinbase or Kraken, though still a little fewer than some offshore competitors like Bybit in terms of total token count. Binance tends to list a wide range of tokens but also periodically delists tokens that fail to meet standards for liquidity, compliance or adoption.

Fiat and deposits

Binance supports many fiat currencies through its buy-and-sell feature, which uses third-party providers and can be expensive. Direct fiat deposits to Binance are more limited by region and currency; if you want cheap USD/GBP/EUR on-ramps, you may find an onshore exchange like Kraken to be a better funnel — buy stablecoins there and transfer them to Binance if you want Binance liquidity and features.

Fees

Binance is known for low fees thanks to scale. Spot base rates start at 0.1% for both maker and taker, and can drop dramatically for high-volume traders (makers down to 0.011%, takers to 0.023% for top tiers). Binance also offers fee discounts if you hold BNB (the exchange token) and has tiered structures for futures and derivatives (with maker fees as low as 0%). That makes Binance one of the cheapest choices among the Top 5 BEST Crypto Exchanges.

Trading experience

Binance’s terminal is feature-rich and powerful. Liquidity is typically the deepest, spreads are tight, and execution is fast. The breadth of features is massive: staking, savings, margin, futures, P2P, NFTs, and more. That abundance can be overwhelming for newcomers; Binance is a better fit for people who know what they want and can navigate a busy, feature-packed UI.

Who Binance is best for

- Experienced traders who want the largest liquidity pools and lowest fees.

- Traders who want a broad ecosystem of products and tokens.

- Users willing to learn a more complex interface for better pricing and execution.

Binance is a heavyweight among the Top 5 BEST Crypto Exchanges — very powerful, very low-cost, and excellent for people who need scale and depth.

6) OKX — clean UI, competitive features, and surprising extras

OKX is another major offshore exchange in the Top 5 BEST Crypto Exchanges club. Founded in 2017 (originally as OKEx), OKX rebranded and broadened its scope beyond exchange services to include DeFi, NFTs, gaming and more. OKX combines a polished trading interface with many advanced features that traders appreciate.

Security

OKX has not suffered a known hack and uses robust security practices: 95% cold storage, multi-signature wallets, private keys stored in RAM with backups in secure vaults, and a risk shield fund funded by trading fees. As with other offshore exchanges, OKX’s risk shield protects derivatives market participants during extreme events, but it is not the same as deposit insurance.

Asset support

OKX lists around 296 tokens — not the largest number among offshore exchanges but still substantial. OKX appears to balance quality and responsiveness, and in recent months it has listed many popular meme coins alongside established projects.

Fiat and deposits

OKX supports many fiat currencies for buying crypto via third-party providers. For direct deposits, available fiat currencies vary by region. Where possible, bank transfers or SEPA are the cost-effective options; credit card purchases are more expensive but convenient.

Fees

OKX’s fees are competitive. OKX has its exchange token OKB that confers fee discounts, and tiered levels are determined by OKB holdings (for regular tiers) and by volume/balances at VIP levels. Derivatives maker fees can start at 0.02% maker and 0.05% taker, and at the top VIP levels makers can be paid (negative maker fees). Spot makers can start at 0.08% and takers at 0.1% — marginally cheaper than some other offshore options.

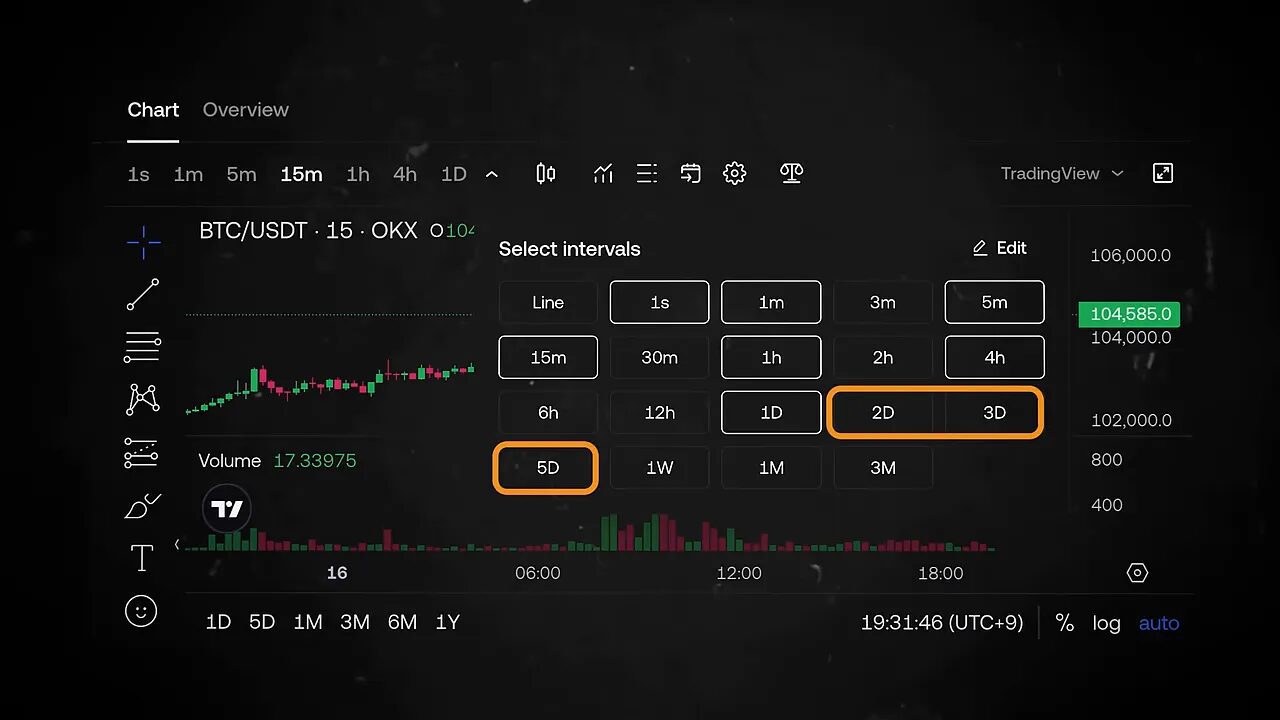

Trading experience

OKX’s terminal strikes a nice balance between clarity and power. It’s cleaner than Binance in many ways and includes unique features like 2/3/5-day timeframes (normally available only via paid TradingView plans), time-anchoring of charts, robust multi-chart layouts, and advanced order types. The UI is intuitive yet capable, making OKX a favorite among active traders who want serious tools without clutter.

Who OKX is best for

- Active traders who want a clean, powerful terminal with smart features.

- Users who want competitive fees plus discounts via an exchange token (OKB).

- People who can access OKX geographically (it’s restricted in some onshore markets).

OKX comfortably sits among the Top 5 BEST Crypto Exchanges as a balanced, trader-focused platform with thoughtful UI and features.

Side-by-side: which Top 5 BEST Crypto Exchanges fits your needs?

To summarize how the Top 5 BEST Crypto Exchanges compare:

- Coinbase: Onshore, best for beginners, strong regulatory posture, higher fees, limited token listings relative to offshore exchanges.

- Bybit: Offshore, best for derivatives traders, low fees, lots of listings and responsive customer support, not available everywhere.

- Kraken: Onshore veteran, spotless security history, excellent customer service, competitive fees on Kraken Pro.

- Binance: Global leader, deepest liquidity, lowest fees, lots of features; complex UI and partial geographic restrictions.

- OKX: Clean interface, unique charting features, competitive fees and VIP discounts via OKB, good balance of design and power.

Quick recommendations

- If you live in the U.S. and want safety and regulation: Coinbase or Kraken.

- If you’re a derivatives trader chasing low fees: Bybit, Binance or OKX.

- If you want the widest ecosystem and the deepest liquidity: Binance.

- If you want excellent customer support and long-term stability: Kraken.

- If you want an easy-to-use interface with good trading tools: OKX or Bybit (depending on jurisdiction).

Practical tips & tricks to save thousands across the Top 5 BEST Crypto Exchanges

Now for the part that can actually save you money. Some of these are simple behavioral changes; others are strategic moves that active traders use every day.

Avoid buying with a credit card

Credit card purchases are convenient but expensive. Card purchases through third-party providers can add 2–5% or more in fees — sometimes much higher — which quickly erodes returns, especially for smaller buys. Instead:

- Use ACH in the U.S. (often free).

- Use SEPA in Europe (low fixed cents), or domestic transfers like UK Faster Payments.

- Deposit fiat to an onshore exchange and transfer stablecoins to an offshore exchange if needed.

Use maker orders where possible

Maker orders (limit orders that add liquidity) usually attract lower fees than taker orders (market orders that take liquidity). If you can patiently place limit orders, you will pay less — sometimes dramatically less — over the long run. This is especially valuable on exchanges with significant maker/taker spreads in their fee schedule.

Leverage fee discounts

Many exchanges offer discount routes: holding exchange tokens (BNB, OKB), reaching higher 30-day volume tiers, or using referral/offers. If you plan to be an active trader, even modest discounts compound over hundreds or thousands of trades. Check the fee schedules of the Top 5 BEST Crypto Exchanges and plan how to accumulate legitimate discounts.

Think in stablecoins for cross-exchange moves

If deposit options are limited on the exchange you want to use (for example, Binance or Bybit in some regions), buy USD-pegged stablecoins (USDC, USDT, BUSD where applicable) on an onshore exchange using bank transfer and send them to your chosen offshore exchange. This often saves on deposit fees and is faster than repeated fiat transfers.

Use proof-of-reserve and wallet doxxing features for peace of mind

Several exchanges — Binance, Bybit, OKX — provide proof-of-reserve tools or publicly list wallets. Use these features periodically to verify that your exchange is solvent. It’s not a guarantee, but it gives transparency that many exchanges historically did not offer.

Be cautious with leverage and derivatives

Derivatives amplify both gains and losses. While exchanges like Bybit, Binance and OKX make leverage accessible, maintain strict risk management: size positions relative to account equity, set stop losses, and be mindful of funding rates and liquidation mechanics. Insurance/risk funds on exchanges are not deposit insurance; they are designed to smooth out liquidation dynamics, not to protect spot balances.

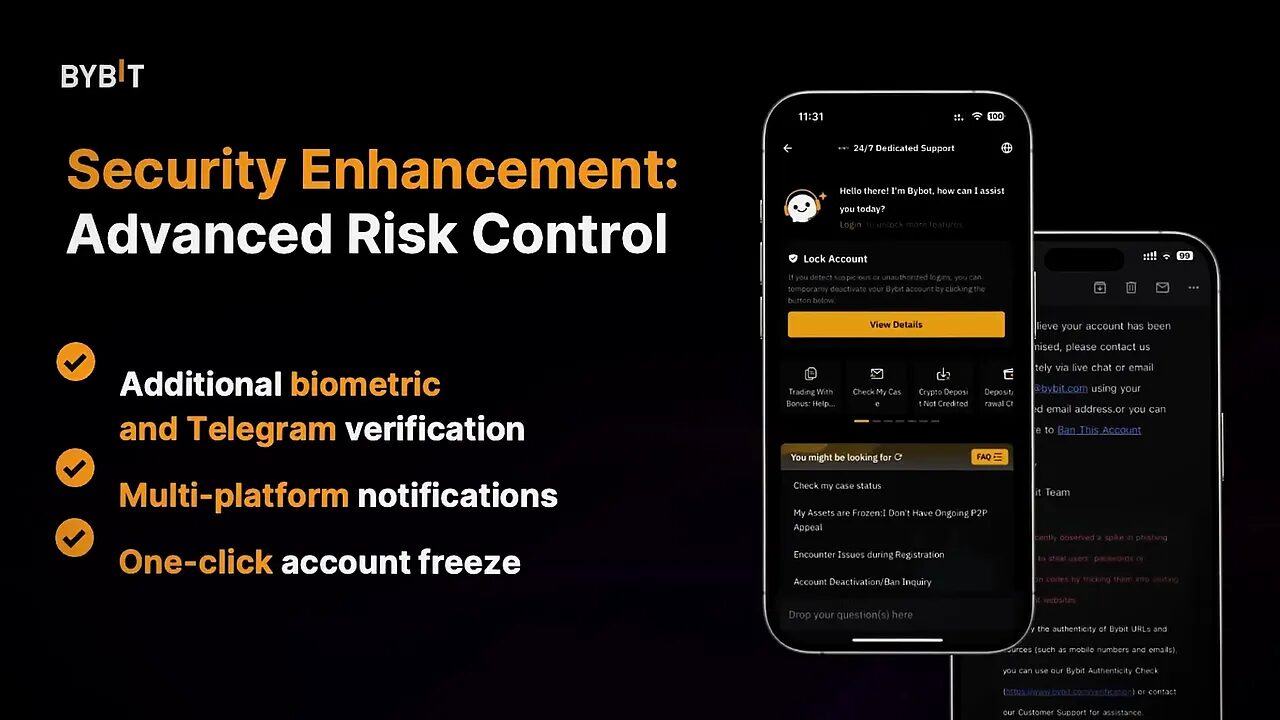

Enable account protection features

Always enable two-factor authentication. Use strong passwords, unique emails for accounts, and enable withdrawal whitelisting where available. Some exchanges like Bybit have one-click account freeze — use such features if you suspect compromise. Consider separate accounts for trading and custody: keep only active trading balances on exchanges and self-custody the rest.

Onshore vs Offshore: Why it matters among the Top 5 BEST Crypto Exchanges

A major theme when comparing the Top 5 BEST Crypto Exchanges is whether they are onshore (e.g., Coinbase, Kraken) or offshore (e.g., Bybit, Binance, OKX). Each approach has trade-offs.

Onshore exchanges

- Pros: Stronger alignment with local regulations, audited financials, sometimes deposit protections, clearer legal recourse.

- Cons: Conservative listing policies, may list fewer tokens, higher fees in some cases due to compliance costs.

Offshore exchanges

- Pros: Broader token listings, faster new token launches, typically lower fees, advanced derivatives features.

- Cons: Varying regulatory clarity, deposit insurance is often absent, access restricted in certain jurisdictions.

Your residency and your priorities should guide your choice. If you live in the U.S., many offshore exchanges are simply unavailable. If you value rapid token access and low fees, an offshore exchange might be ideal provided you manage custody prudently.

FAQ — Top 5 BEST Crypto Exchanges

Q: Which of the Top 5 BEST Crypto Exchanges is the safest?

A: “Safe” is a combination of operational security, regulatory transparency, and custody practices. Kraken and Coinbase have exceptionally strong security reputations and onshore oversight. Binance, Bybit and OKX also have strong security protocols but differ in regulatory posture. Regardless of exchange, always practice self-custody for long-term holdings.

Q: Which of the Top 5 BEST Crypto Exchanges has the lowest fees?

A: Binance, Bybit, and OKX typically offer the lowest trading fees, particularly for high-volume traders. Fee discounts via exchange tokens (BNB, OKB) and tiered volume structures further reduce costs.

Q: Which exchange lists the most tokens among the Top 5 BEST Crypto Exchanges?

A: Bybit currently lists the most tokens among the five, followed by Binance and OKX. Coinbase and Kraken list fewer tokens, focusing on majors and regulated projects.

Q: I’m a beginner. Which of the Top 5 BEST Crypto Exchanges should I pick?

A: Coinbase and Kraken are excellent for beginners. Coinbase is extremely user-friendly and has wide brand recognition; Kraken offers strong customer support and a secure, stable platform. Start there, learn the ropes, then consider a second account on an offshore exchange if you need lower fees or more token variety.

Q: Should I keep all my crypto on an exchange?

A: No. Exchange custody is convenient for trading, but you should self-custody any assets you’re not actively using. Consider a hardware wallet for long-term holdings and only keep short-term trading balances on exchanges.

Q: How can I avoid paying high deposit fees?

A: Use bank transfers (ACH, SEPA, Faster Payments) when available. Avoid credit cards. If a desired offshore exchange doesn’t accept your currency cheaply, deposit fiat to an onshore exchange then transfer stablecoins to your target exchange.

Q: What is proof-of-reserve and how useful is it?

A: Proof-of-reserve allows users to verify that an exchange holds assets that collectively back customer balances, often via Merkle trees or zero-knowledge proofs. It’s a transparency tool; it doesn’t guarantee future solvency or protect against operational fraud, but it is a helpful metric to check periodically.

Final thoughts: choosing the one right for you among the Top 5 BEST Crypto Exchanges

The Top 5 BEST Crypto Exchanges each serve different user needs. Coinbase and Kraken excel with regulatory clarity and security. Bybit, Binance and OKX win on token selection, low fees, and advanced trading features. The best exchange for you depends on your jurisdiction, trading style, fee sensitivity, and comfort with custody.

My closing advice: 1) Decide your primary goal (savings, spot trading, derivatives), 2) choose the exchange that fits that goal while respecting your jurisdiction, and 3) adopt a custody plan — keep only what you need on exchanges and self-custody the rest. Do these three and you’ll avoid many common pitfalls.

Want to go deeper?

If you’d like a practical next step: open one account on an onshore exchange like Coinbase or Kraken for fiat on-ramps and custodial safety, and a second account on an offshore exchange like Bybit, Binance or OKX for lower fees and a wider token selection. Use bank transfers for on-ramps, place limit maker orders to lower fees, and move long-term holdings to hardware wallets.

Whichever of the Top 5 BEST Crypto Exchanges you choose, make smart security choices, watch fees closely, and treat exchange balances as working capital — not savings.

Tell me your pick

Which exchange from the Top 5 BEST Crypto Exchanges are you leaning toward and why? Share your choice and experience — your insights help other readers pick the right platform for their own crypto journey.

Appendix: Quick reference — Top 5 BEST Crypto Exchanges at a glance

- Coinbase — Best for beginners and onshore regulatory clarity; higher fees; excellent security and audited financials.

- Bybit — Best for derivatives, lots of tokens, low fees, rapid listings; offshore with strong security but no FDIC insurance.

- Kraken — Best for long-term trust and customer support; spotless security record; competitive pro fees.

- Binance — Best for deepest liquidity and lowest fees; feature-rich but complex UI; regional access limitations.

- OKX — Best for clean interface with advanced tools; competitive fees and unique charting features; solid security history.

Use this appendix to match features to what you value most. Then open accounts, compare trading experiences, and consolidate where you feel most comfortable.