In this deep dive I break down the rise of the “Top Ethereum Whales” — the public companies, newly minted treasury outfits, and institutional players that are piling ETH onto their balance sheets. I’m Guy from Coin Bureau, and in this article I’ll walk you through what Ethereum treasury companies are, how they operate, who the biggest players currently are, the exact ETH they’ve been buying, the math behind the potential future accumulation, and what all of this could mean for ETH’s price and the broader market.

Table of Contents

- Why “Top Ethereum Whales” Are Suddenly a Big Deal

- Quick Reminder: What Is an Ethereum Treasury Company?

- MNAV in Plain English (and Why It Matters)

- Who Are the Top Ethereum Whales? The Big Five Profiles

- Putting the Numbers Together: How Much ETH Have the Top Ethereum Whales Bought?

- What Does All This Mean for ETH’s Price?

- Comparing ETH Treasuries to Bitcoin Treasuries

- Where the Risk Lies: The Death Spiral Scenario and Why It Might Be Less Likely for ETH

- How Investors Might Play the “Top Ethereum Whales” Trend

- What to Watch Next

- Long-Term Implications for the Ethereum Ecosystem

- FAQs: The Top Ethereum Whales — Quick Answers

- Conclusion — Why You Should Care About the Top Ethereum Whales

Why “Top Ethereum Whales” Are Suddenly a Big Deal

For years corporate treasuries buying crypto meant Bitcoin and one name: MicroStrategy (now Strategy). Michael Saylor’s playbook — raise capital, convert part of the treasury to BTC to hedge against inflation — proved eye-catching. Fast forward to 2025 and the trend is shifting: companies are no longer focused solely on Bitcoin. The new game is building corporate ETH treasuries.

Why the shift? ETH offers something BTC generally does not: native yield opportunities. Whether through staking, participating in DeFi, restaking, or providing liquidity, ETH can generate additional ETH or yield-like returns. That makes the idea of corporate ETH treasuries attractive for companies seeking growth in both asset value and recurring income.

This movement has produced a cohort that I’ll call the Top Ethereum Whales: businesses that have publicly declared ETH accumulation strategies and are moving capital aggressively into Ethereum. They range from former miners to legacy firms that rebranded and raised hundreds of millions of dollars to buy ETH. Collectively, these entities are changing supply-demand dynamics in a meaningful way.

Quick Reminder: What Is an Ethereum Treasury Company?

An Ethereum treasury company is a firm whose primary strategic objective is to hold and grow an ETH position on its corporate balance sheet. The playbook is straightforward:

- Raise capital — usually via private placements, PIPEs, or ATM public offerings.

- Use proceeds to buy ETH (on-chain purchases reported publicly).

- Generate additional returns through staking, lending, restaking, DeFi strategies, or liquidity provision to expand the treasury.

Unlike Bitcoin treasury plays, ETH treasuries can compound their ETH holdings via yield generation. That introduces two major differences in investor incentives:

- Potentially faster growth of the underlying ETH position (staking rewards, yield strategies).

- A valuation mechanic where the company’s market price can trade at a premium to the NAV of its ETH holdings — the multiple on net asset value, or MNAV.

The MNAV concept is central to why people buy shares of a treasury company instead of just buying ETH directly. If a company is trading at a positive MNAV — i.e., its market cap is greater than the value of ETH it holds — investors effectively get leveraged or premium exposure to ETH’s upside while relying on the company to generate additional returns through staking and active treasury management.

MNAV in Plain English (and Why It Matters)

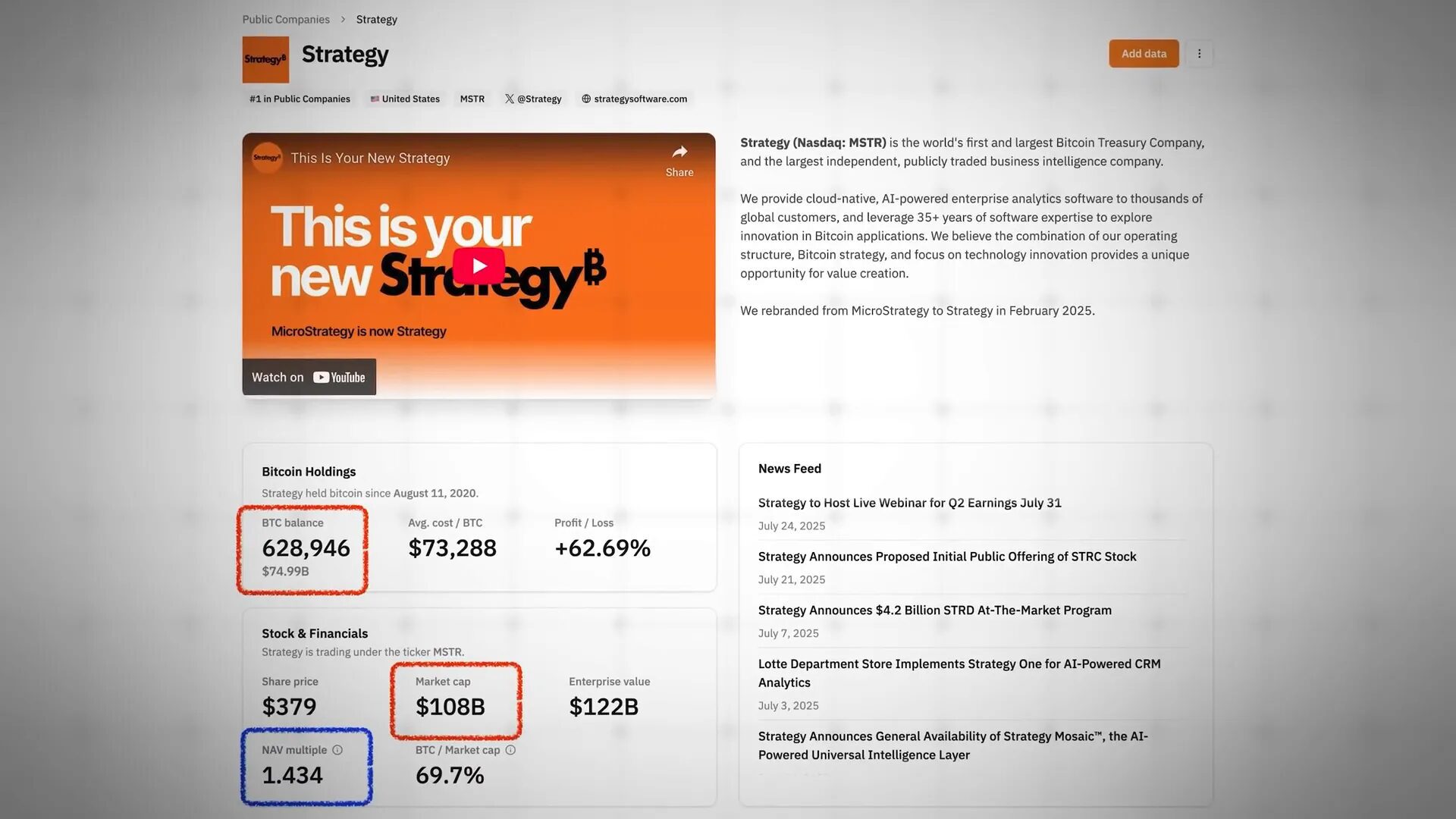

MNAV stands for Multiple on Net Asset Value. It’s simply the ratio of a company’s market cap to the market value of its crypto holdings. For example, Strategy holds nearly 630,000 BTC — worth roughly $77 billion at certain prices — yet its market cap sits around $110 billion. That’s an MNAV of about 1.4x. Investors are paying a 40% premium above the value of the BTC holdings because they expect management, optionality, or other business lines to add value.

With ETH treasuries, this dynamic can be amplified. Because ETH can be staked and otherwise deployed, a company that’s good at deploying ETH into yield strategies can justify a higher MNAV. Higher MNAV attracts more capital, which allows the firm to buy more ETH, which (if ETH price and staking returns cooperate) further increases MNAV — a positive feedback loop.

Who Are the Top Ethereum Whales? The Big Five Profiles

Below I profile the five largest public or semi-public ETH treasury companies as of the most recent reporting: BitMine (Bitmine Immersion Tech), Sharplink Gaming, The Ether Machine, Bit Digital, and ETHzilla. For each, I cover their history, how they fund ETH accumulation, their purchases and current holdings (as recorded), and their stated ambitions.

1) BitMine (Bitmine Immersion Tech) — The Fastest-Ramping ETH Treasury

History and pivot: BitMine, incorporated in 2019 as a publicly traded Bitcoin miner, made a dramatic pivot on June 30, 2025. The company raised $250 million via private placement to create an ETH treasury while still operating Bitcoin mining assets. The pivot was bold and headline-grabbing.

Why the change? BitMine’s chairman, Tom Lee, framed this as a bet on stablecoin-driven payment volume and on Ethereum’s central role in stablecoin settlement. He also made a more controversial suggestion: large ETH treasuries could create a “Wall Street put” similar to the idea that Strategy became a sort of sovereign-significant holder of Bitcoin. In short: if an entity accumulates a large percentage of supply, there’s a perception of strategic importance that can attract buyers at scale — though the political and practical implications of that argument are debatable.

How BitMine funds accumulation: The company intends to use a mix of reinvested cash flows, staking yield, and opportunistic market buys (buying dips), plus proceeds from corporate actions. After the initial private raise they executed a flurry of purchases:

- July 13: ~$500M to acquire ~163,000 ETH.

- July 20: ~137,000 ETH.

- July 27: ~266,000 ETH.

- August 3: ~58,000 ETH.

- August 10: ~208,000 ETH.

- August 12: ~317,000 ETH.

Aggregate holdings and ambition: At time of recording, BitMine held approximately 1.2 million ETH (~1% of total ETH supply), worth around $5.2 billion. The company publicly announced an ambition to accumulate up to $25 billion in ETH for its treasury — an incredibly bold target that, if executed, would materially change market demand dynamics.

2) Sharplink Gaming — The One with Joe Lubin on the Board

History and pivot: Sharplink is a surprising entrant. Founded in 1995 as a sports betting and online casino marketing company, Sharplink announced on March 27, 2025 that it would raise $425 million via private placement to pivot to an ETH treasury. What made Sharplink the center of attention was its board chairman: Joseph Lubin, one of Ethereum’s co-founders and founder of ConsenSys.

Why it matters: Lubin’s involvement lends institutional credibility and deep protocol expertise. He has publicly stated that ETH treasury companies are vital to the ecosystem and has signaled Sharplink’s intention to accumulate ETH rapidly — even calling it Ethereum’s equivalent of Strategy.

How Sharplink funds accumulation: Sharplink has been using a blend of private placements (PIPEs) and at-the-market (ATM) stock sales. After its first announcement, sBet stock skyrocketed >3000% in one week — then later crashed when the company filed to sell $1 billion in stock, a move that spooked some investors and erased much of that speculative rally. Since then, the firm has resumed systematic ETH buys and staking.

- June 13: ~$463M purchase (largest initial public holding at the time).

- June 24: ~$30M purchase via ATM sales, staking all ETH accumulated up to that point.

- June 28–July 4: ~7,600 ETH accumulated in a buying spree.

- July 11: The Ethereum Foundation sold 10,000 ETH to Sharplink at a discount — a noteworthy off-market transfer that underscored institutional-level relationships.

Aggregate holdings and ambition: Sharplink holds just under 600,000 ETH (~2.78B USD value at time of recording). The company initially sought $1B via stock issuance and later moved to expand that to $6B — a huge signal that Sharplink wants to be a dominant ETH holder in the public markets.

3) The Ether Machine — A New Contender Built from Two Firms

Formation and leadership: The Ether Machine emerged in mid-July via the proposed merger of The Ether Reserve and Dynamics Corporation. Once finalized, the plan is to trade publicly under the ticker ETHM (replacing Dynamics’ ticker DYNX) by Q4. Co-founders Andrew Keyes and David Merrin both have ConsenSys pedigrees, linking this entity into the same talent network as Sharplink.

Strategy and funding: The Ether Machine aims to raise $1.6 billion to buy ETH by Q4. Its model emphasizes not only staking but restaking and DeFi participation — a mix designed to maximize ETH yield and on-chain exposure.

Purchases to date:

- Late July: ~320,000 ETH (largest single purchase).

- July 30: $57M to buy ~15,000 ETH (a splashy purchase to celebrate Ethereum’s 10th birthday).

- August 4: ~10,000 ETH for $40M.

Holdings and runway: The Ether Machine holds roughly 345,000 ETH (~$1.6B value) and, notably, reported about $400M of its $1.6B raise still on the sidelines — enough to purchase tens of thousands more ETH at prevailing prices. Their stated intention is to be among the largest on-chain ETH holders, which makes them a key player among the Top Ethereum Whales.

4) Bit Digital — From Mining to ETH Treasury

Origins and pivot: Bit Digital began life as Golden Bull Limited (a car rental business) and shifted to Bitcoin mining in 2020. It even mined ETH back when Ethereum used proof-of-work. Over the last 18 months Bit Digital explored GPU cloud services for AI and began staking ETH. In June this year the company publicly exited Bitcoin mining to focus on being an Ethereum staking and treasury company.

How they’re funding ETH buys: Bit Digital is repurposing existing assets — selling mining operations, listing its HPC subsidiary White Fiber, and issuing shares to raise capital. In late June it announced a $150M share sale to reposition into ETH staking and treasury management.

Notable purchases and holdings:

- Early July: Spent $172M to acquire 100,000 ETH (briefly making Bit Digital the second largest publicly traded ETH holder after Coinbase).

- Mid-July: Added another 20,000 ETH.

Total holdings: Over 120,000 ETH (~$566M at time of recording). Bit Digital has been less specific about long-term targets but described the intention to “aggressively add more” and to become a preeminent ETH holding company.

5) ETHzilla — The Rebranded Biotech That Went Full ETH

Transformation: Formerly One Eighty Life Sciences (founded 2007), the firm rebranded to ETHzilla in July after securing $425M in private funding to build an ETH treasury. The raise included over 60 institutions and crypto-native investors such as Polychain Capital and Electric Capital (which serves as external asset manager).

Funding and plan: In addition to the $425M private raise, ETHzilla plans to issue ~$150M in debt to further back its ETH purchases. The company intends to aggressively grow its ETH via staking, lending, and liquidity provision — aiming for yields that exceed standard ETH staking.

Interesting governance and social proof: A DeFi council (involving members from Etherealize and other DeFi players) will advise on treasury deployment. Then came a dramatic development: tech billionaire Peter Thiel disclosed a 7.5% stake in the company, which sent stock parabolic in the short term.

Purchases: ETHzilla made one major purchase at time of recording — $313M to acquire ~82,000 ETH. That left around $112M remaining from the initial raise, plus the planned $150M debt facility to deploy.

Putting the Numbers Together: How Much ETH Have the Top Ethereum Whales Bought?

Let’s do the math. Collectively, the five largest ETH treasury companies profiled above have accumulated approximately 2.3 million ETH. That’s just under 2% of Ethereum’s total supply and was worth more than $10.2 billion at the recording prices.

But it’s broader than just the top five. According to public trackers focused on corporate ETH treasuries, all known ETH treasury companies jointly hold over 3.5 million ETH — roughly 3% of the circulating supply — with an aggregate market value of approximately $16.8 billion (at the time of recording).

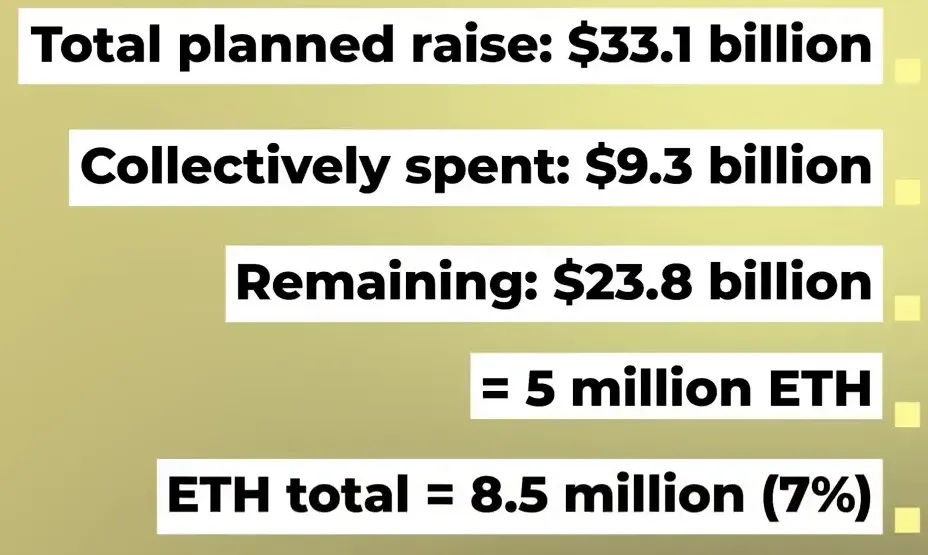

What’s particularly interesting is the stated capital these companies intend to raise going forward. Using public filings and company statements, the top five plan to raise about $33.1 billion in aggregate and have already spent $9.3 billion. That leaves around $23.8 billion potentially available to buy ETH. At the prevailing prices referenced in the reporting, that could purchase roughly 5 million more ETH.

If those funds were fully deployed, the total ETH in corporate treasuries could reach about 8.5 million ETH — representing roughly 7% of the total supply. That’s a substantial portion concentrated in corporate hands and it would materially change on-chain supply dynamics.

What Does All This Mean for ETH’s Price?

There are two primary forces at work here:

- Demand shock: Corporates converting cash into ETH reduces available market float, which, all else equal, pushes the price higher.

- Yield synergy: Companies can earn rewards on top of price appreciation via staking and DeFi — compounding returns and potentially justifying higher MNAVs.

Taken together, these dynamics create an environment where corporate ETH accumulation can significantly amplify bullish momentum. The evidence is already visible: large announced buys (particularly by BitMine and Sharplink) correlated with substantial price rallies that drove ETH toward multi-year highs.

However, it’s not all one-way upside. There are important risks that could create material sell pressure or derisking events:

- MNAV turns negative. If a treasury company’s stock drops below the net asset value of its ETH holdings (i.e., market cap < NAV), it may be forced into corporate actions to preserve liquidity. That can include share issuance, cuts to spending, or even liquidation of ETH holdings — the latter would be a headwind for ETH price.

- Operational mismanagement. Companies that mismanage staking or DeFi positions can lose capital and reputational trust, eroding investor appetite and possibly causing fire sales.

- Regulatory risk. Public companies attract regulatory scrutiny; rules around staking, custody, SEC classification of tokens, and lending could influence how attractive ETH treasuries remain.

- Concentration risk. If too much ETH accumulates within a small group of corporate entities, market liquidity becomes fragile. Large offload decisions could move the market sharply.

So does this activity guarantee a new all-time high for ETH? Not guaranteed. But it is a powerful, credible demand-side narrative that has already accelerated ETH price functionally. If even a portion of planned capital is deployed without a wave of forced liquidations, the net effect will be bullish. The presence of yield-generation opportunities unique to ETH gives treasury companies a better chance of sustaining MNAV premiums compared to BTC-only peers.

Comparing ETH Treasuries to Bitcoin Treasuries

It’s instructive to contrast this new wave of ETH treasuries with the earlier wave of BTC treasury companies dominated by Strategy and other miners. The key differences:

- Yield: ETH staking and DeFi allow companies to generate returns in kind (more ETH or yield income). BTC offers no native yield; miners generate issuance rewards but not passive, risk-free yields for treasury holding.

- Operational complexity: Managing staking nodes, restaking, and DeFi strategies requires different operational skillsets and risk management than simply hodling BTC. There’s more upside potential, and also more room for implementation mistakes.

- Regulatory intersection: ETH’s classification and staking mechanics attract regulatory attention (e.g., custody and securities arguments), which may influence institutional participation differently than BTC.

Put simply, ETH treasuries can compound their position; that makes the model potentially more lucrative than BTC treasuries, but also operationally riskier and more dependent on good governance.

Where the Risk Lies: The Death Spiral Scenario and Why It Might Be Less Likely for ETH

The “death spiral” for treasury companies happens when the company’s stock drops below NAV, leading to forced liquidity raises or asset sales, which further depresses the stock and assets — a vicious cycle. Several BTC treasury companies faced such a dynamic. Could the same happen to ETH treasuries?

It’s possible. If ETH’s price collapses or staking/DeFi yield strategies generate losses, investors could flee. However, there are reasons to believe ETH treasuries might be more resilient:

- Yield cushions: Staking rewards and DeFi income can generate cash flow or additional ETH, helping MNAV recover even if price action is unfavorable.

- Diversified funding options: Many of these firms have access to private placement capital, debt facilities, and ATM share programs that allow more gradual capital raising rather than immediate, dilutive issuance.

- Institutional backing: Several ETH treasuries boast institutional investors and marquee names (e.g., Peter Thiel backing ETHzilla), which can stabilize investor confidence relative to pure retail enthusiasm.

That said, complacency is dangerous. Good governance, transparent reporting, thoughtful staking and risk management, and conservative leverage are essential to avoid cascading failures. The outcome will depend on execution.

How Investors Might Play the “Top Ethereum Whales” Trend

If you’re an investor looking to position for this structural demand, here are the core approaches people are taking (note: this is educational and not investment advice):

- Direct ETH exposure: Buy ETH on exchanges or custody yourself to participate in price upside without counterparty risk from corporate management choices.

- Buy treasury company stock: For those seeking leverage or a potential MNAV premium, buying the shares of listed ETH treasury companies offers a proxy — but with corporate and operational risks.

- ETFs and managed products: Keep an eye out for institutional products that aim to wrap ETH exposure with stewardship and custody solutions.

- Yield strategies: For qualified investors, direct staking, liquid staking tokens (LSTs), or DeFi exposure are ways to earn yield on ETH and potentially participate in the ecosystem’s income generation.

Deciding which route depends on your risk appetite, regulatory constraints, and preference for direct vs indirect exposure. Corporate treasuries are an interesting new instrument, but they are not a substitute for doing the basics: understanding custody, slashing risk for staking, and diversification.

What to Watch Next

If you’re tracking the Top Ethereum Whales, these are the indicators that will matter most over the next months:

- Announced raises and capital deployment timelines — if the $33.1B planned raise starts flowing into purchases, demand will accelerate.

- Quarterly and monthly filings reporting ETH holdings — these will show how quickly each company is deploying capital.

- Staking and DeFi returns — yield performance will influence MNAV and investor sentiment.

- Regulatory updates — especially around staking and token classification in major jurisdictions.

- On-chain supply concentration metrics — rising corporate holdings as a percentage of total supply can change liquidity dynamics.

Long-Term Implications for the Ethereum Ecosystem

Beyond price action, corporate ETH treasuries may have broader implications for the Ethereum ecosystem:

- Network security and decentralization dynamics: Large corporate staking operations could centralize validator power if concentrated, which raises governance questions.

- Liquidity ecosystems: Greater institutional holdings could increase liquidity in certain venues but reduce available sell-side depth in the open market.

- Institutionalization of DeFi: As corporate treasuries seek yield, demand for institutional-grade DeFi tools, custody providers, and liquid staking products is likely to rise.

- Funding for public goods: Companies working with foundations or donating stake to public good initiatives could become a new funding channel for protocol development.

The net effect is complex: corporate adoption accelerates capital inflows and product innovation, but it raises governance and centralization tradeoffs that the community will need to address.

FAQs: The Top Ethereum Whales — Quick Answers

Q: Who are the Top Ethereum Whales right now?

A: The most prominent public ETH treasury companies include BitMine (Bitmine Immersion Tech), Sharplink Gaming, The Ether Machine, Bit Digital, and ETHzilla. Collectively they represent the largest institutional and corporate ETH holders outside of exchanges and major foundations.

Q: How much ETH have these companies bought so far?

A: The top five discussed here have accumulated about 2.3 million ETH in aggregate. Across all known ETH treasury entities, trackers report roughly 3.5 million ETH held by treasury-style companies.

Q: Are ETH treasury companies safer or riskier than BTC treasury companies?

A: It’s nuanced. ETH treasuries offer yield-generation that can act as a buffer and growth engine, potentially making MNAVs more sustainable. However, they introduce extra operational and counterparty risks from staking, liquidity provisioning, and DeFi. BTC treasuries are simpler from an operational standpoint but lack native yield.

Q: Could these companies force ETH to new all-time highs?

A: They could be a major catalyst because they represent large, predictable demand. If a significant portion of planned capital is deployed without severe market shocks, the price pressure could push ETH toward new highs. However, market dynamics, macro conditions, and potential forced liquidations are important risk factors.

Q: What is MNAV and why should I care?

A: MNAV — Multiple on Net Asset Value — measures how much investors are willing to pay for a company relative to the value of its crypto holdings. A high MNAV indicates investors expect the company to deliver additional value (via earnings, yield, growth) above the raw asset value. For ETH treasuries, MNAV can be amplified due to yield potential, making the corporate stock attractive if well-managed.

Q: What are the main risks of investing in treasury company stocks?

A: Primary risks include: MNAV compression leading to forced asset sales, operational errors in staking/DeFi causing losses, regulatory action, dilution from share issuance, and concentration risk leading to fragile market liquidity.

Q: How can I track corporate ETH holdings?

A: There are trackers and dashboards run by independent researchers that collect on-chain and disclosure data for ETH treasury companies. Watching SEC filings for public companies and monitoring on-chain addresses associated with corporate wallets are common methods.

Conclusion — Why You Should Care About the Top Ethereum Whales

We’re witnessing a structural shift: corporations once comfortable simply holding cash or BTC are now seeing Ethereum as a strategic asset class. The Top Ethereum Whales are central to this story. They’re large, they’re publicly visible, and they’re actively building treasuries that not only hold ETH but also generate additional ETH and yield via staking and DeFi participation.

The potential implications are big. On the bullish side, rising corporate demand for ETH — coupled with its yield-generation mechanics — creates a powerful support driver for price. On the risk side, mismanagement, MNAV collapses, or coordinated liquidations could produce severe market stress.

Ultimately, the outcome depends on execution. Companies that execute responsibly, manage risk carefully, and deploy capital transparently could validate the ETH treasury model and contribute to ETH’s growth cycle. Those that fail to do so could create sharp downturns and reputational damage.

Either way, the rise of the Top Ethereum Whales is one of the most consequential narratives in crypto markets right now. Watching how the next $20–30 billion of planned capital is deployed will tell us a lot about where ETH is headed next.

Thanks for reading — if you want to stay on top of developments from the Top Ethereum Whales, keep an eye on public filings, on-chain treasury addresses, and reports from institutional trackers that consolidate corporate ETH holdings. The pace of change is fast, and the next big move could arrive sooner than you expect.