If you’re hunting for the Next 100X Token, getting in early is everything. Launchpads are the fastest route to early access—whether you want to trade, create, or simply surf the next meme coin wave on Solana. Below I break down five launchpads you need to know, how they work, fees and mechanics, plus practical tips to help you spot opportunities and manage risk.

Table of Contents

- Why launchpads matter if you want the Next 100X Token

- Top 5 Launchpads to Watch (and How to Use Them)

- How to Increase Your Odds of Finding the Next 100X Token

- Risks to Keep in Mind

- FAQ

- Conclusion

Why launchpads matter if you want the Next 100X Token

Launchpads democratize early-stage token access. Instead of private presales (ICOs) that often favor insiders, modern launchpads—mainly IDO-style—let nearly anyone ape in at or near launch. That means more people can access outsized gains, but it also means more noise and risk.

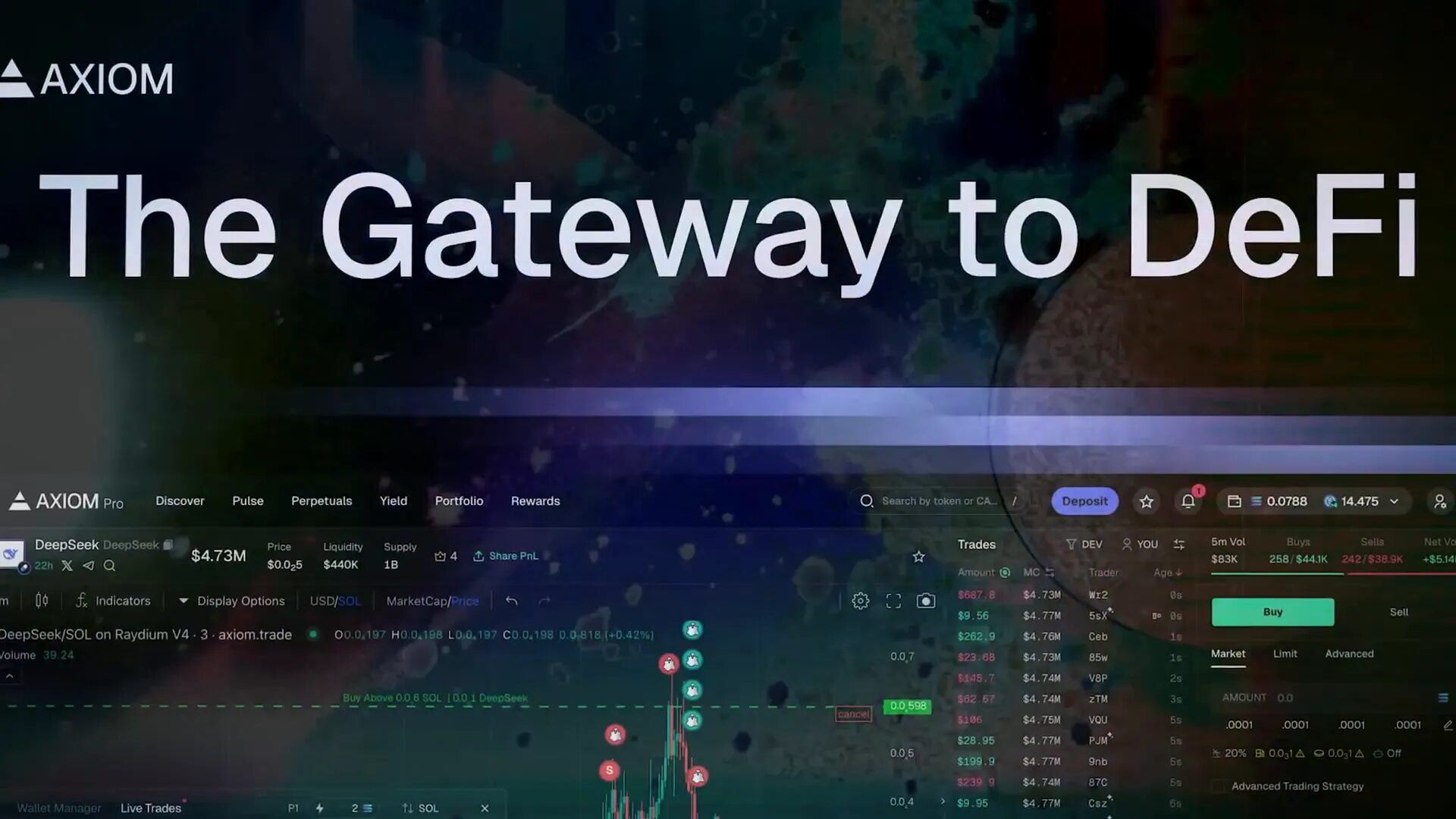

To navigate this noise you need tools that consolidate launches, track liquidity and token age, and surface momentum. Platforms like Axiom act as a centralized terminal for newly launched tokens across multiple DEXs and launchpads—handy for spotting the Next 100X Token faster.

Top 5 Launchpads to Watch (and How to Use Them)

1. Pump.fun — The original Solana meme-coin factory

Pump.fun kicked off Solana’s meme coin frenzy in Jan 2024. Built by traders fed up with rugs, Pump.fun standardized token launches with a bonding curve model and a strict, fair-launch approach: one billion tokens, no presales, no team allocations. That simple, low-friction setup let millions of tokens spawn quickly and attracted huge volume.

Key mechanics:

- Bonding curve pricing that adjusts buy/sell prices with demand.

- Built-in burn mechanisms to manage supply.

- Once a token grows, it migrates to Pump Swap (native DEX).

Fees: creating tokens is free; 1% fee while on the bonding curve, then 0.3% after migration (with 0.05% to the creator).

Stats: >12 million tokens launched and hundreds of millions in revenue—Pump.fun even out-earned the Ethereum chain in daily revenue at one point.

2. Let’s Bonk — Raydium-backed and transparent

Let’s Bonk launched in April and integrates tightly with Raydium and Jupiter routing, giving instant DEX liquidity. Its bonding-curve model locks 75% of supply into the curve and reserves 25% for airdrops, grants, or rewards.

What stands out is transparency: Let’s Bonk publishes detailed revenue allocation—half of fees buy and burn BONK, others fund staking derivatives, infrastructure, growth, and rewards. That economic clarity helped it overtake Pump.fun by daily revenue in mid-2025.

Fees: 1% swap fee + small Raydium post-migration volume fee (0.1–0.2%).

3. Believe.app — launch via social (X) engagement

Believe lets creators launch tokens by tweeting and tagging @launchercoin—its backend checks engagement thresholds, then mints the token on Solana and places it on a bonding curve. Graduations happen around a $1M market cap and integration is done through Meteora.

Believe skews toward web2 creators aiming for real utility, not pure speculation. Every trade carries a 2% fee split 70/30 favoring creators.

Tip: Believe-token trades lack pro charts in-app—use platforms like Axiom to access advanced trading tools if you want to hunt the Next 100X Token effectively.

4. Moonshot — mobile-first meme coin simplicity

Moonshot is a phone-friendly app that removes wallet complexity: buy and sell directly via Apple/Google Pay or deposited funds. It’s designed for beginners and meme coin traders who want zero friction. Moonshot Create lets iOS users launch a token in seconds using Apple Pay.

Originally there were small launch fees (0.5% → 0.3%), but launches became free shortly after with creators eligible for 50% of trading fees.

Note: simplicity sacrifices advanced charts—pro traders should route Moonshot tokens through Axiom or another terminal for technical indicators.

5. Raydium LaunchLab — advanced controls and integrations

Raydium’s LaunchLab offers both a “just send it” basic flow and an advanced creator mode. Advanced options let creators tweak supply presets, bonding-curve parameters, migration thresholds, and token vesting/locking.

Creators can opt into LP fee share and integrate with Raydium’s burn & earn system to lock/burn LP tokens and earn fee-key NFTs—useful for long-term pool stability.

Fees: 1% transaction fee (50% community pool, 25% buys back RAY token, remainder for ops).

How to Increase Your Odds of Finding the Next 100X Token

Finding the Next 100X Token requires a mix of speed, analysis, and risk management:

- Monitor multiple launchpads via aggregators like Axiom to catch momentum early.

- Check token age, initial liquidity, and bonding-curve behavior.

- Follow engagement signals (social traction) and on-chain metrics (wallet accumulation, volume).

- Set stop-losses and position size carefully—these markets are volatile.

If you want curated alerts focused on Solana meme coin launches, consider using a dedicated service like Meme Coin Signals. It provides timely signals and context tailored to meme coin cycles, helping you track potential runners without information overload.

Risks to Keep in Mind

- Rugs and malicious projects still exist—prefer platforms with fair-launch rules and transparent revenue mechanics.

- High volatility: even tokens that pump can dump hard.

- Liquidity migration thresholds: tokens that never migrate may remain illiquid.

- Regulatory and market risks—never risk more than you can afford to lose.

FAQ

How do bonding curves work?

Bonding curves automatically set token price based on the amount of tokens sold into the curve. Buy pressure pushes price up, sell pressure pulls it down—this provides continuous liquidity without traditional order books.

Which launchpad is best for the Next 100X Token?

There’s no single “best.” Pump.fun and Let’s Bonk excel at meme-coin volume; Believe targets creator-driven utility tokens; Moonshot is easiest for mobile users; LaunchLab offers control for serious creators. Use aggregators to cover all bases.

Can I create my own token? How much does it cost?

Yes. Most of these platforms let you launch tokens cheaply or free. Expect small trading fees, but token creation itself is often minimal cost—platforms monetize via swap fees and revenue shares.

Is there a safer way to use launchpads?

Yes—diversify small positions, vet creators and social traction, prefer platforms with fair-launch and anti-rug measures, and use analytics tools to monitor early wallet distribution and liquidity behavior.

Conclusion

Launchpads are the frontline if you’re looking to discover the Next 100X Token. Each platform brings its own trade-offs: speed vs. control, simplicity vs. analytics, and social-first vs. pure on-chain mechanics. Combine a few launchpads with an aggregator, use disciplined risk management, and consider services like Meme Coin Signals if you want curated Solana meme coin alerts. Above all—move fast, but trade safe.

Which launchpad are you watching right now? Drop your picks and experiences in the comments below.