If you have been watching the markets lately, you have probably seen headlines asking whether the recent rally is a blip or a turning point. Zcash Price Prediction is the question on many traders minds as privacy coins pump and push back into the spotlight. In this deep dive I am going to walk you through why privacy coins matter, how the leading projects work, which ones should be on your radar, the regulatory headwinds they face, and what Zcash Price Prediction could look like under different scenarios.

Table of Contents

- Why privacy coins exist

- How privacy coins work: cryptography and tradeoffs

- Top privacy coins to watch

- Privacy protocols and mixers

- Why privacy coins are controversial

- What privacy coins are actually used for

- Regulatory landscape and future risks

- The middle ground: compliant privacy

- Zcash Price Prediction: scenarios and drivers

- Trading opportunities and risk management

- Practical steps for users who want privacy today

- What to watch next

- What is the most important factor for a reliable Zcash Price Prediction?

- Are privacy coins illegal?

- How does Zcash differ from Monero when forming a Zcash Price Prediction?

- Can privacy coins be traced?

- Should I include privacy coins in my portfolio?

- Final thoughts

Why privacy coins exist

One of the foundational benefits of crypto is transparency. Every transaction is recorded on a public ledger and visible via blockchain explorers. This system-level transparency is powerful for audits and trustless verification, but it has a flip side. Pseudo-anonymity means transaction sizes and balances are visible while identities are not immediately public. In practice, that pseudo-anonymity often dissolves once a user interacts with a KYC exchange or a regulated payment intermediary. Wallets get linked to identities and history becomes traceable.

Privacy coins exist to solve that personal-level problem. They use advanced cryptography and network design to obscure transaction amounts, sender and receiver addresses, and other metadata. Think of them like digital cash: when you pay with a bill, nobody can scroll a public ledger and see your entire financial life. That sort of privacy can be essential for personal safety, financial confidentiality, and institutional secrecy over strategic payments and counterparties.

The need is real. Individuals in unsafe jurisdictions risk extortion, kidnapping, or harassment if their wealth is visible. Activists and whistleblowers need plausible deniability. Businesses need confidentiality for supplier payments and acquisitions. And institutions considering crypto for treasury management worry that transaction transparency could reveal strategies and harm competitiveness. These are practical use cases, not just theoretical ideals.

How privacy coins work: cryptography and tradeoffs

Privacy coins are not magic. They combine cryptography, network routing, and transaction obscuring techniques to conceal information. Some operate with privacy enabled by default, while others make it optional. Each design choice brings tradeoffs in scalability, compliance, and user experience.

Key techniques you will hear about include:

- Ring signatures which mix the sender’s signature with others to hide which input is real.

- Stealth addresses which generate one-time recipient addresses so a destination cannot be linked across transactions.

- Confidential transactions and RingCT which hide the transaction amounts so observers cannot see how much moved.

- Zero knowledge proofs like ZK-SNARKs which let validators confirm a transaction is valid without revealing its contents.

- Mixing protocols that pool funds or shuffle outputs to break links between sender and receiver.

Each tool has performance implications. Ring signatures with many mixins can be costly in size and verification time. ZK-SNARKs require complex proving systems and careful engineering. Mixing protocols can be legally sensitive because they are simple and effective ways to obscure origin and destination simultaneously. Designers pick what to use based on their threat model: is the goal maximum anonymity or pragmatic privacy that can interoperate with regulators?

Top privacy coins to watch

Not all privacy coins are created equal. Below I break down the three major projects that have dominated conversation: Monero, Zcash, and Dash. Each has a distinct philosophy, technology stack, and market niche.

Monero: the privacy standard

Monero (XMR) is the OG privacy coin and the one most people think of when privacy is discussed. Launched in 2014, Monero opted for privacy by default. You cannot turn off privacy features. That makes it a pure play on confidential value transfer.

Monero combines RingCT to hide amounts, stealth addresses to hide recipients, and ring signatures to obfuscate senders. Over the years it has added network-level protections like integration with Tor and routing projects. The project also chooses an ASIC-resistant mining algorithm called RandomX so that mining remains accessible to CPU miners. That was a deliberate choice to avoid the centralization risks that have engulfed some other proof-of-work networks.

Monero also uses adaptive block sizes which can expand during demand surges, theoretically supporting high throughput. Practical confirmation times can still be long by modern standards, however, with Monero developers noting cryptographic constraints on making confirmations work like instant payments.

Because privacy is baked in, Monero will always be contentious with regulators. That said, its long history and resilience have proven the technology works. For traders and privacy-conscious users, Monero remains a reference point when evaluating other designs.

Zcash: privacy you can toggle

Zcash launched in 2016 as a Bitcoin fork with a different privacy philosophy. Where Monero makes privacy mandatory, Zcash gives users the choice. That design decision profoundly affects its adoption path and regulatory exposure, and it is central to any Zcash Price Prediction conversation.

Zcash introduced shielded addresses using ZK-SNARKs. Those zero knowledge proofs let the network validate that rules are followed without revealing amounts or addresses. Users can transact between transparent addresses similar to Bitcoin, or use shielded addresses to obscure sender, receiver, and amount. The optionality can aid compliance because institutions can choose to disclose or keep private parts of their activity when required.

Because Zcash is a Bitcoin fork, it inherited a 21 million coin cap and halving events. Initially it was mineable on CPUs with the Equihash algorithm, but ASICs emerged and mining evolved accordingly. Transaction speeds and throughput have remained comparable to Bitcoin, falling into the lower tens of transactions per second.

When you hear about Zcash Price Prediction, remember this nuance: adoption, exchange support, and the share of shielded transactions all affect market behavior. If shielded usage increases and exchanges begin to integrate Z-addresses more fully, demand dynamics may change compared to a world where most ZEC remains transparent and exchange-centric.

Dash: payments with optional privacy

Dash started under the name Darkcoin and later circled back to Digital Cash to emphasize payment capabilities. Dash is a payments-focused cryptocurrency with privacy features that are optional. Its PrivateSend feature is a built-in mixing service that chains multiple hops to obscure transaction origin.

Dash also prioritizes speed with InstantSend, allowing near-instant confirmations. The governance and funding model for Dash, which allocates a portion of block rewards to a treasury, has made it a popular experiment in self-funding development and marketing. But the optionality of privacy combined with mixing means Dash sits in a gray area when regulators look for risk points.

For traders considering Zcash Price Prediction and privacy narratives, Dash offers a reminder that privacy can be combined with user-friendly payments and governance. Market moves that favor fast payment adoption can influence the price differently than purely privacy-driven narratives.

Privacy protocols and mixers

Privacy is not limited to native coins. Protocols like mixers and smart contract-based privacy layers can provide confidentiality across multiple assets. One high-profile example is Tornado Cash.

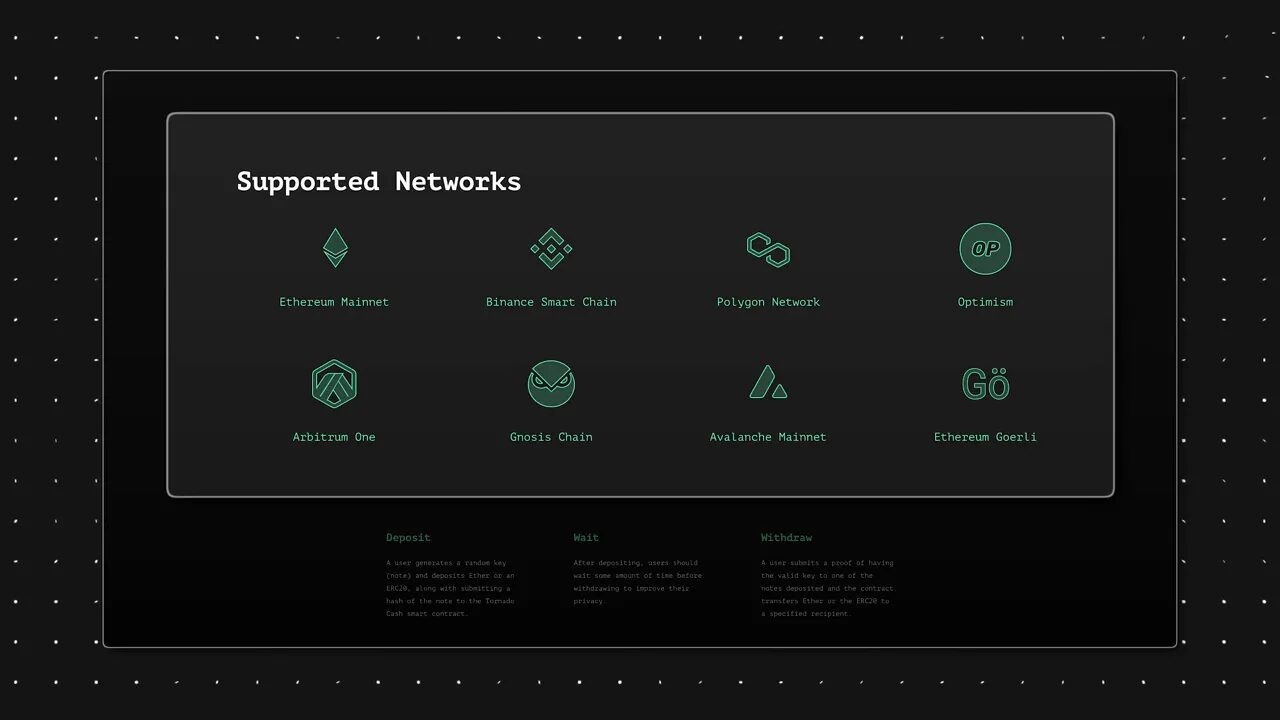

Tornado Cash is a smart contract-based mixer launched in late 2019 that allows users to deposit funds into a pool and later withdraw to a different address, using cryptographic receipts to prove ownership without linking deposit to withdrawal. It leverages zero knowledge proofs for verification and expanded to multiple EVM-compatible chains.

Tornado Cash became a flashpoint for regulators when the US Treasury sanctioned it in 2022, effectively blacklisting the protocol in that jurisdiction. The legal battle that followed included arrests and the shutdown of public infrastructure, then later an appeals court ruling clarifying limits on sanctioning immutable protocols. The incident underscores the legal gray area around noncustodial privacy tools and how quickly enforcement risk can escalate.

Why privacy coins are controversial

The features that protect dissidents and keep families safe also attract illicit use. Crimes like money laundering, darknet purchases, and sanctions evasion have leveraged privacy tools. Critics argue that the anonymity of privacy coins makes monitoring harder for law enforcement and compliance teams.

That criticism has real consequences. Major exchanges worldwide have delisted some privacy coins citing KYC and anti-money-laundering obligations. The EU has announced proposals to restrict or ban privacy coins by a given timeline, and certain national regulators have moved to curtail mixing services. Delistings reduce liquidity and market access, which feeds back into the price and utility of these assets.

But it is worth confronting an uncomfortable comparison: cash is responsible for far more illicit activity globally than privacy coins. Banning or stigmatizing privacy tools ignores legitimate uses and the rights argument around financial confidentiality. The debate is not whether privacy has costs; it is about who sets the balance and how to build privacy that can coexist with lawful oversight.

What privacy coins are actually used for

Use cases extend beyond anonymity for crime. Some of the main legitimate uses include:

- Personal safety in dangerous jurisdictions where visible wealth invites extortion.

- Business confidentiality for payments, payroll, or strategic purchases.

- Protection for activists and whistleblowers who need to move funds without revealing sources.

- Layering for on-chain privacy, where traders use privacy coins to unlink histories between transactions across assets.

One particularly interesting use is using privacy coins as a privacy layer for Bitcoin. Atomic swaps between BTC and a privacy coin like Monero can obscure transaction history when swapped back. This technique changes how we should think about privacy pathways: the native privacy coin need not be the final destination; it can function as a temporary, powerful privacy middleware.

Regulatory landscape and future risks

Privacy coins face a regulatory reality where their purpose can be construed as obstructive to law enforcement. Exchanges delist to avoid being fined or entangled in compliance actions. Governments are discussing outright bans, and sanctions regimes have targeted mixers. These pressures can reduce market liquidity, limit institutional demand, and impede mainstream adoption.

Yet the legal landscape is not uniform. Court rulings and public debate are forcing regulators to reckon with fundamental rights to privacy. The United Nations recognizes privacy as a human right. Balancing that right with the need to prevent crime is the central policy problem. Technology like zero knowledge proofs offers a possible route to reconcile the two by enabling verifiable compliance without wholesale exposure of transactional data.

The middle ground: compliant privacy

A likely long-term outcome is not the total elimination of privacy tech but the normalization of privacy that is compatible with compliance. Instead of privacy by default that fully blocks oversight, privacy by design can embed selective disclosure and cryptographic proof mechanisms. That is where technologies like ZK-SNARKs and other zero knowledge systems come into play.

Compliant privacy means a user could prove that funds are not illicit, that a counterparty meets KYC requirements, or that transactions meet AML thresholds, all without revealing the full history. That compromises between the need for law enforcement access and the right to financial privacy. For investors, protocols and coins that can integrate compliant privacy measures while retaining strong confidentiality may attract institutional interest and therefore influence price action.

Zcash Price Prediction: scenarios and drivers

Now we get to the crux. If you are searching for a Zcash Price Prediction you need to consider technology, adoption, liquidity, and regulation. Zcash is unique because of its optional shielded transactions and the underlying zero knowledge proof technology. That optionality shapes both upside and downside scenarios.

Here are the major drivers to watch for any Zcash Price Prediction:

- Shielded adoption – If more users and exchanges adopt shielded Z-addresses and privacy-first wallets make the UX seamless, demand for ZEC could rise. Increased utility as a privacy-preserving asset means more on-chain activity and deeper liquidity.

- Regulatory clarity – Positive legal frameworks that recognize compliant privacy will favor Zcash because its optional privacy lets it adapt. Conversely, harsh bans or delistings would directly reduce exchange liquidity and price.

- Interoperability and tooling – Integration with atomic swaps, cross-chain bridges, and layer 2 privacy tooling can expand Zcash utility. The easier it is to move value privately across ecosystems, the more useful ZEC becomes beyond speculative trading.

- Market-wide crypto cycles – Zcash does not trade in isolation. Bull markets lift many assets, but privacy narratives can amplify moves as speculation and narrative-driven flows pile in.

- Mining economics – With ASICs in the mix, mining centralization, block rewards, and tail emission mechanics influence supply-side dynamics that affect price predictions.

Putting that together, a plain language Zcash Price Prediction looks like this:

- In a bullish regulatory scenario where compliant privacy standards emerge and shielded adoption increases, Zcash could see meaningful appreciation relative to current levels as institutional and privacy-conscious users buy in for utility, pushing Zcash Price Prediction higher.

- In a hostile regulatory scenario with delistings or bans, liquidity could dry up and Zcash Price Prediction would skew lower as trading venues remove the asset and demand collapses.

- Under neutral conditions—if nothing dramatic changes—Zcash Price Prediction will largely track broader crypto market cycles with periodic spikes if privacy narratives or technical upgrades make headlines.

This is not financial advice, but the takeaway is that Zcash Price Prediction is highly conditional. The coin’s optional privacy architecture is both a strength and a vulnerability: it can attract mainstream players if the ecosystem embraces shielded features responsibly, but it remains sensitive to policy risk.

Trading opportunities and risk management

Trading privacy coins requires a careful approach. Liquidity can evaporate during regulatory shocks, spreads can widen on delisted venues, and wallets with shielded features may lack institutional custody options. Traders should therefore balance potential upside with execution risk and legal exposure depending on their jurisdiction.

If you trade Zcash or other privacy coins, consider these practical tips:

- Diversify across privacy coin designs rather than betting everything on one approach.

- Monitor exchange listings and delisting risks closely; price moves often precede official announcements.

- Understand the on-chain privacy posture of the coin. For Zcash, track shielded pool usage metrics because this can be a proxy for utility and adoption.

- Plan exit strategies for liquidity shocks. Keep some allocations in easy-to-move assets in case exchanges restrict withdrawals or delistings create congestion.

For traders looking for an extra edge, our cryptocurrency trading signals service can help surface momentum shifts and entry or exit points across privacy coins and other assets. Signals are not a replacement for due diligence, but they can aid timing decisions and risk management when markets move fast. We place these signals within a framework that considers liquidity, regulatory news, and technical trends so you can make better-informed trades.

Practical steps for users who want privacy today

If privacy matters to you, there are practical steps you can take while the policy environment evolves:

- Use privacy wallets and follow best practices. Hardware wallets, address re-use avoidance, and using privacy features where available reduce traceability.

- Separate identities across wallets. Avoid mixing personal KYC addresses with privacy-focused holdings.

- Leverage compliant privacy where available. For example, a shielded Zcash transaction can provide strong privacy while enabling selective disclosure if the need arises.

- Keep abreast of local laws. What is permitted in one country may be restricted in another, and enforcement priorities can change quickly.

What to watch next

For anyone tracking Zcash Price Prediction and the broader privacy coin space, these are the near-term indicators that will matter most:

- Exchange policies on shielded addresses and whether major exchanges add or remove Z-address support.

- Regulatory announcements from the EU, US, and major financial jurisdictions that would affect trading access.

- Usage metrics: shielded pool volumes, mix and swap flow, and cross-chain privacy protocol adoption.

- Technical upgrades or partnerships that make shielded usage easier for institutions.

- Macro crypto cycles and liquidity conditions across the market.

Keeping a close eye on these signals will inform any Zcash Price Prediction you build and help you adapt positions as the narrative evolves.

What is the most important factor for a reliable Zcash Price Prediction?

The adoption of shielded transactions and regulatory clarity are the two most important factors. Increased shielded usage signals real privacy-driven utility while friendly regulatory frameworks encourage institutional participation. Together they can shift demand dynamics and influence Zcash Price Prediction substantially.

Are privacy coins illegal?

No. Privacy coins themselves are not inherently illegal. They are tools that can be used for both lawful and unlawful purposes. Legality depends on jurisdiction and how the coin is used. Some countries have restrictions, and exchanges may delist privacy coins for compliance reasons, but ownership and use are not universally criminalized.

How does Zcash differ from Monero when forming a Zcash Price Prediction?

Zcash offers optional privacy with shielded and transparent addresses, while Monero has privacy by default. This leads to different adoption profiles. Zcash can appeal to institutions that want configurable privacy, which affects liquidity, exchange support, and ultimately any Zcash Price Prediction. Monero’s mandatory privacy is more robust for anonymity but faces steeper regulatory resistance.

Can privacy coins be traced?

Tracing is more difficult but not always impossible. Techniques can sometimes deanonymize transactions or reveal patterns, especially when privacy features are misused or when users interact with KYC services. Advances in analytics and law enforcement techniques continue to challenge privacy tools, which is why robust privacy design and proper usage matter.

Should I include privacy coins in my portfolio?

That depends on risk tolerance, jurisdictional exposure, and investment thesis. Privacy coins can offer diversification and unique utility, but they come with legal and liquidity risks. Allocating a conservative portion, staying informed on regulation, and using proper risk management are prudent steps.

Final thoughts

Privacy coins are not a relic. They have been dismissed many times but they keep returning because they solve a real problem. Whether you believe privacy is an absolute right or a negotiable tradeoff with law enforcement, the technology matters. For anyone making a Zcash Price Prediction, the interplay between technology adoption, liquidity, and regulatory clarity will determine the outcome.

Compliant privacy innovations, better tooling for shielded transactions, and sensible regulation that recognizes individual rights are the most constructive outcome for both users and markets. Traders who want to navigate this space should stay flexible, use signals and analytics to time entries, and risk manage with the awareness that policy shocks can create sudden liquidity shifts.

If privacy matters to you, treat it as both a human right and a technical challenge. Keep an eye on shielded metrics, regulatory updates, and technological integrations. Those data points will be the best inputs into any robust Zcash Price Prediction you produce. Trade carefully, protect your identity where necessary, and remember that privacy is as much about freedom as it is about technology.