When it comes to cryptocurrency mining, the landscape is constantly evolving, with new mining rigs, algorithms, and coins emerging regularly. Whether you’re a seasoned miner or just starting out, knowing which mining rigs to invest in can be a game-changer for your profitability and long-term success. In this extensive guide, we dive deep into the best crypto miners to buy right now, focusing on altcoin miners as well as touching on Bitcoin miners. We’ll explore the latest trends, profitability insights, and the risks involved in mining various coins in 2025 and beyond.

Mining altcoins is not the same as mining Bitcoin, and understanding the nuances between different coins and their mining hardware is crucial for making smart investment decisions. Let’s dissect the current market, analyze popular mining hardware, and provide actionable advice to help you navigate the world of cryptocurrency mining with confidence.

Table of Contents

- Understanding the Crypto Mining Landscape: Not All Miners Are Bitcoin Miners

- Beware of Scams: The BlockDAG Example

- ASIC Miner Profitability Today: A Look at the Market

- The Most Profitable Miner in the World Right Now: Ice River AE2 for Aleo Mining

- Lessons from Past Investments: The Reality of Altcoin Mining Returns

- Emerging Dogecoin Miners: The Elphapex DG2 and Market Saturation

- Altcoin Mining Stars: Dogecoin, Scrypt, and Ethereum Classic

- Challenges with Off-Brand Miners: The Bombax Experience

- Ethereum Classic Mining: Efficiency vs. Price Dilemma

- Is Now the Right Time to Buy Dogecoin Miners?

- Nervos Network (CKB): A Hidden Gem in Altcoin Mining

- Cadena (KDA) Mining: Slow but Steady

- The Current State of Altcoin Mining: Risk vs. Reward

- Bitcoin and Dogecoin: The Cornerstones of Crypto Mining

- Final Thoughts: Strategy and Patience in Crypto Mining

- Frequently Asked Questions (FAQ)

Understanding the Crypto Mining Landscape: Not All Miners Are Bitcoin Miners

First things first: when we talk about the best crypto miners, it’s important to clarify that “crypto miners” do not necessarily mean Bitcoin miners. While Bitcoin mining rigs dominate headlines and have historically been the most profitable, there is a wide range of altcoins with their own mining algorithms and specialized hardware. These altcoins offer opportunities to diversify your mining portfolio and potentially tap into emerging markets.

Altcoin mining rigs often utilize different algorithms such as Scrypt, Ethash, or newer proof-of-work variants like the zk-SNARK algorithm used by Aleo. Each of these requires specific miners optimized for those algorithms, and profitability can vary widely based on coin price, emission rates, and network difficulty.

Bitcoin miners remain a solid foundation for many mining farms, but pairing them with altcoin miners can help spread risk and capitalize on opportunities outside the Bitcoin ecosystem.

Beware of Scams: The BlockDAG Example

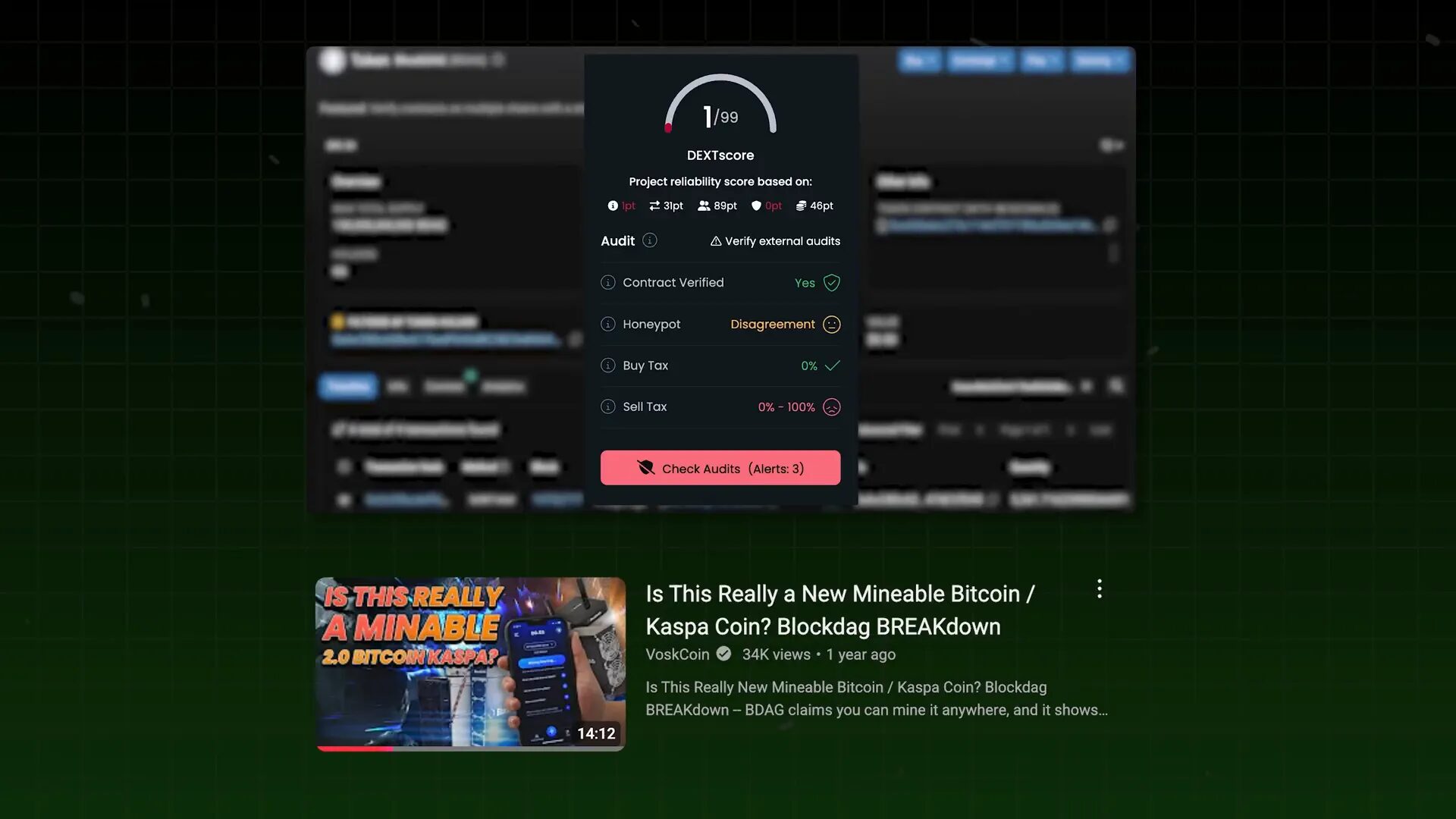

Before diving into the best miners to buy, a quick word of caution. The crypto space is rife with scams and misleading projects, and BlockDAG serves as a prime example. This project claimed to launch custom ASIC miners in partnership with Ivy Link, a reputable ASIC manufacturer. However, after thorough investigation, it became clear that BlockDAG was promoting fake miners that never existed.

Despite promises of revealing their contract address with the mainnet launch, the address they provided was flagged as a honeypot contract with a smart contract auditing score of just 1 out of 100. Interacting with it could result in losing your funds entirely.

Attempts to confirm the relationship between BlockDAG and Ivy Link were met with silence, and multiple representatives from Ivy Link denied any confirmed partnership. This experience highlights the importance of due diligence and skepticism when evaluating new mining hardware and projects.

“Given the fact that BlockDAG has promoted fake miners that never existed previously, I can only assume that these two are fake.” – Bosco

ASIC Miner Profitability Today: A Look at the Market

The market for ASIC miners is diverse and dynamic. To evaluate the best crypto miners right now, it’s essential to look at profitability rankings from reliable sources like MiningNow or ASIC Miner Value, which track daily returns based on hash rate, power consumption, and coin price.

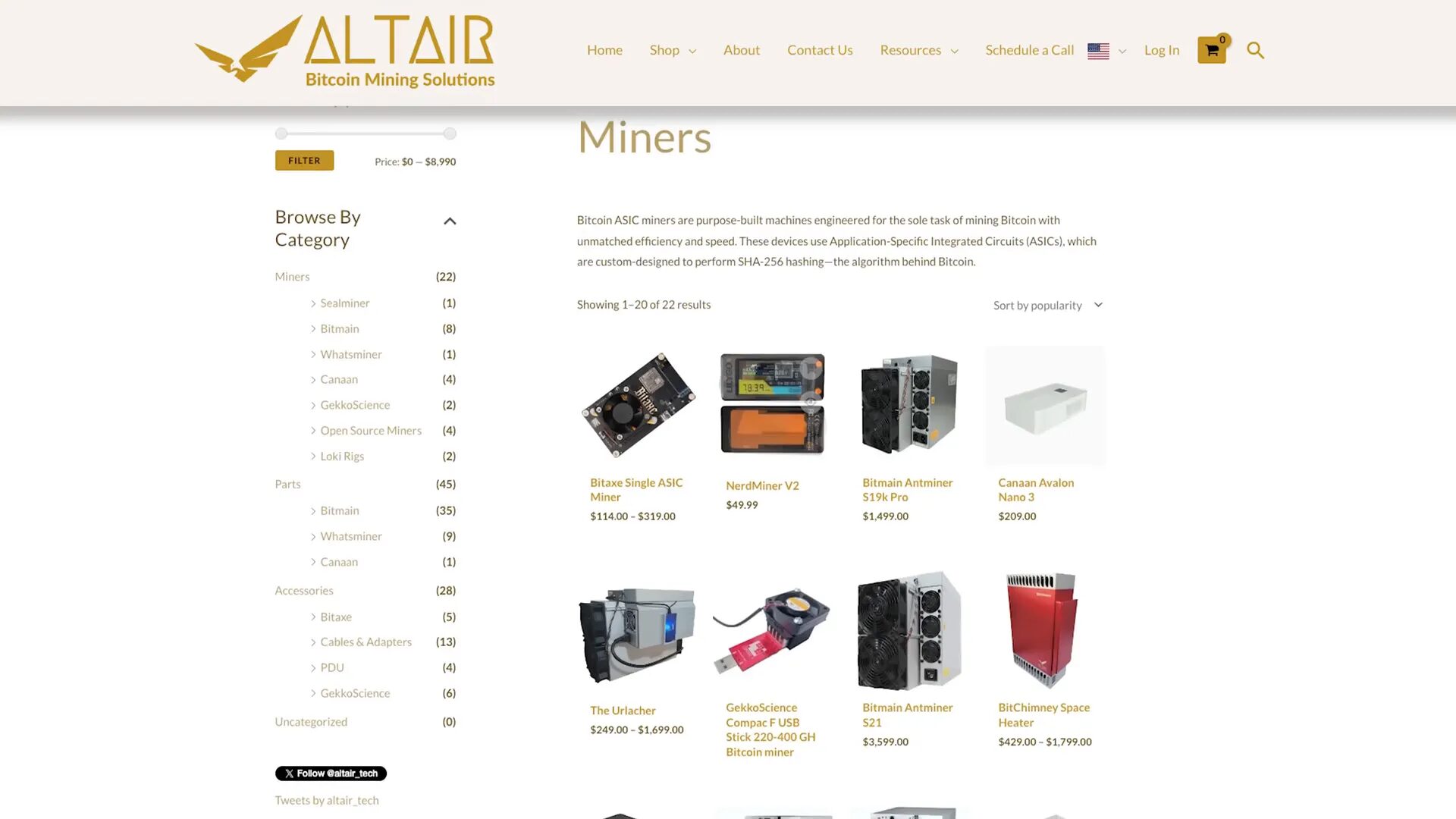

While Bitcoin miners often dominate profitability charts, altcoin miners show promising opportunities when chosen carefully. For those solely interested in Bitcoin mining hardware, companies like Altair in the USA offer a range of miners, mining parts, and essential accessories like power cables and PDUs, which are often hard to find elsewhere.

Altair’s mining PDUs (Power Distribution Units) are highly recommended for anyone serious about building or upgrading a mining farm. Using trusted suppliers and quality equipment can save you headaches and downtime.

The Most Profitable Miner in the World Right Now: Ice River AE2 for Aleo Mining

On paper, the Ice River AE2 miner is currently the most profitable miner globally, mining the Aleo cryptocurrency. Aleo is unique as it uses the zk-SNARK mining algorithm, which is not widely adopted by other coins, giving it a special place in the mining ecosystem.

However, there’s some confusion and lack of transparency around the Ice River AE2 model. Despite its high profitability ranking, the Ice River official website and social media channels do not list the AE2 miner. Attempts to confirm its specs and availability via Telegram and Twitter have been unsuccessful, raising questions about its legitimacy or availability.

Interestingly, Aleo mining emissions are visible on some pools like F2Pool, which reports $74,000 worth of Aleo coins mined in the last 24 hours—a significant figure for a cryptocurrency with a market cap under $100 million. Aleo ranks as the seventh most profitable mineable coin according to F2Pool statistics.

Lessons from Past Investments: The Reality of Altcoin Mining Returns

Many miners, including myself, have made investments in altcoin miners that did not pan out as expected. For example, the Bitmain A01 miner cost around $30,000 and took nearly $7 per day in electricity to run, resulting in disappointing returns despite mining several thousand dollars worth of coins over a year.

Similarly, miners for coins like Casper and Dragon Ball have largely been unprofitable. Casper miners consume more power than the value they generate, while models like the A40 and A11 failed to deliver worthwhile returns. The Radiant miner was another total bust.

These experiences underscore the importance of careful evaluation and avoiding hype-driven purchases when it comes to altcoin mining rigs.

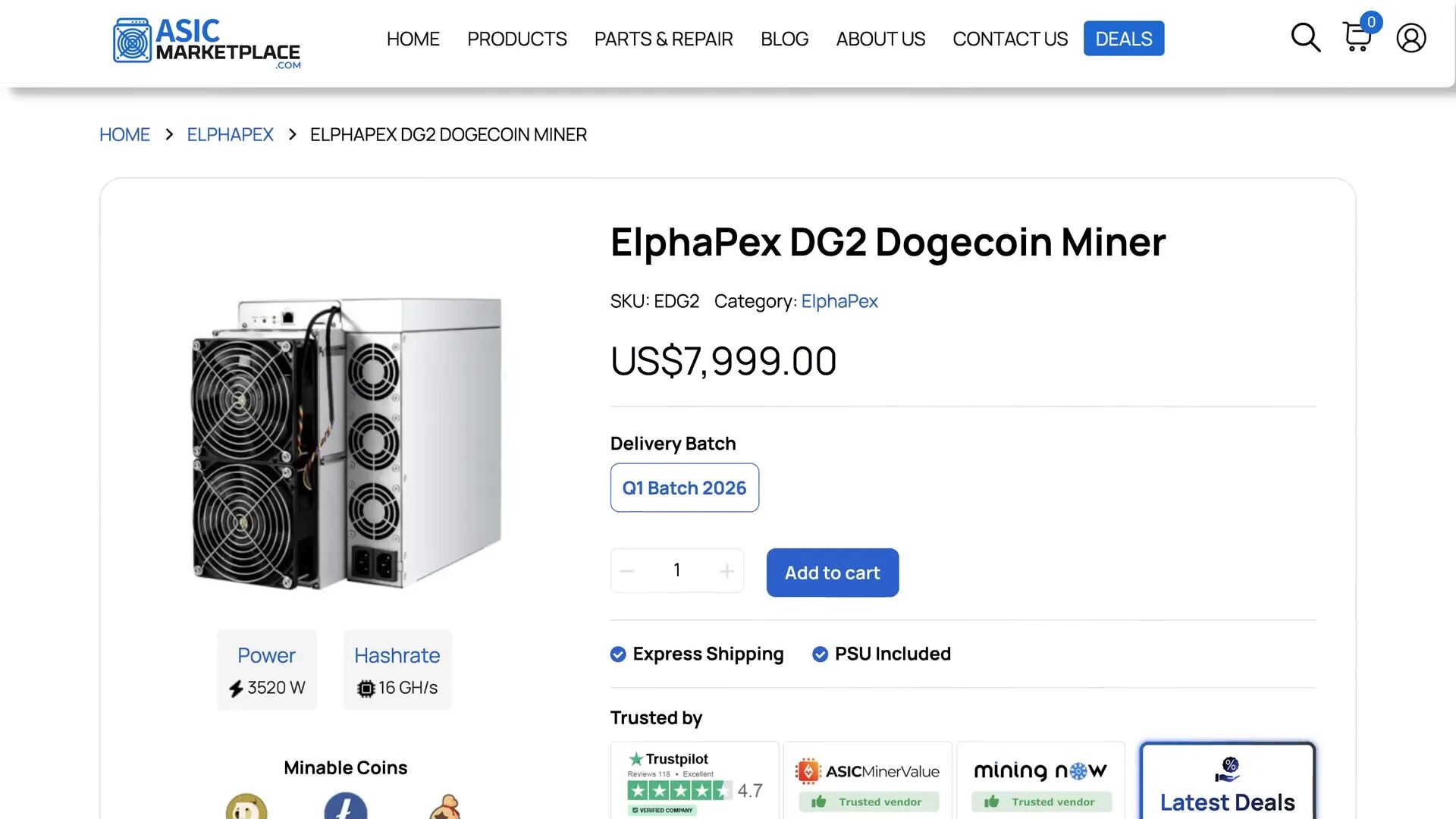

Emerging Dogecoin Miners: The Elphapex DG2 and Market Saturation

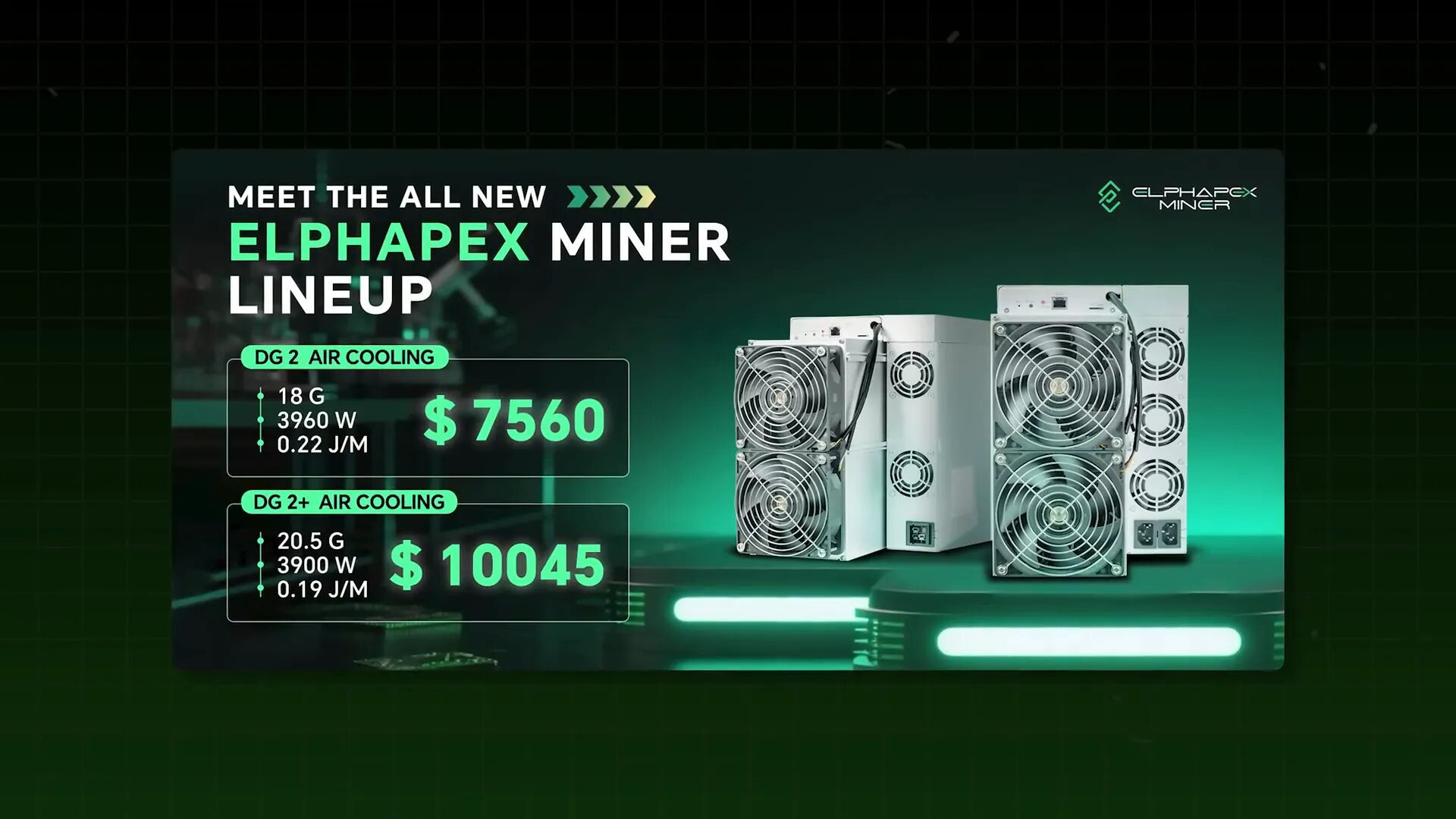

Dogecoin mining remains one of the brighter spots in altcoin mining. Elphapex has recently announced the DG2 and DG2 Plus miners, which offer hash rates, profitability, and efficiency comparable to the popular Antminer L9.

However, the market for Doge miners is becoming saturated, leading to lower profitability across the board. For example, the DG2 miner is priced at about twice the cost of a BitDeer Steel Miner A2, yet both yield roughly the same daily mining profitability. The BitDeer miner can mine Bitcoin, which has a much higher market cap and coin emission than Dogecoin.

Given this, it might make more sense to invest in a next-generation Bitcoin miner like the Antminer S23, which offers similar profitability but with less risk.

Altcoin Mining Stars: Dogecoin, Scrypt, and Ethereum Classic

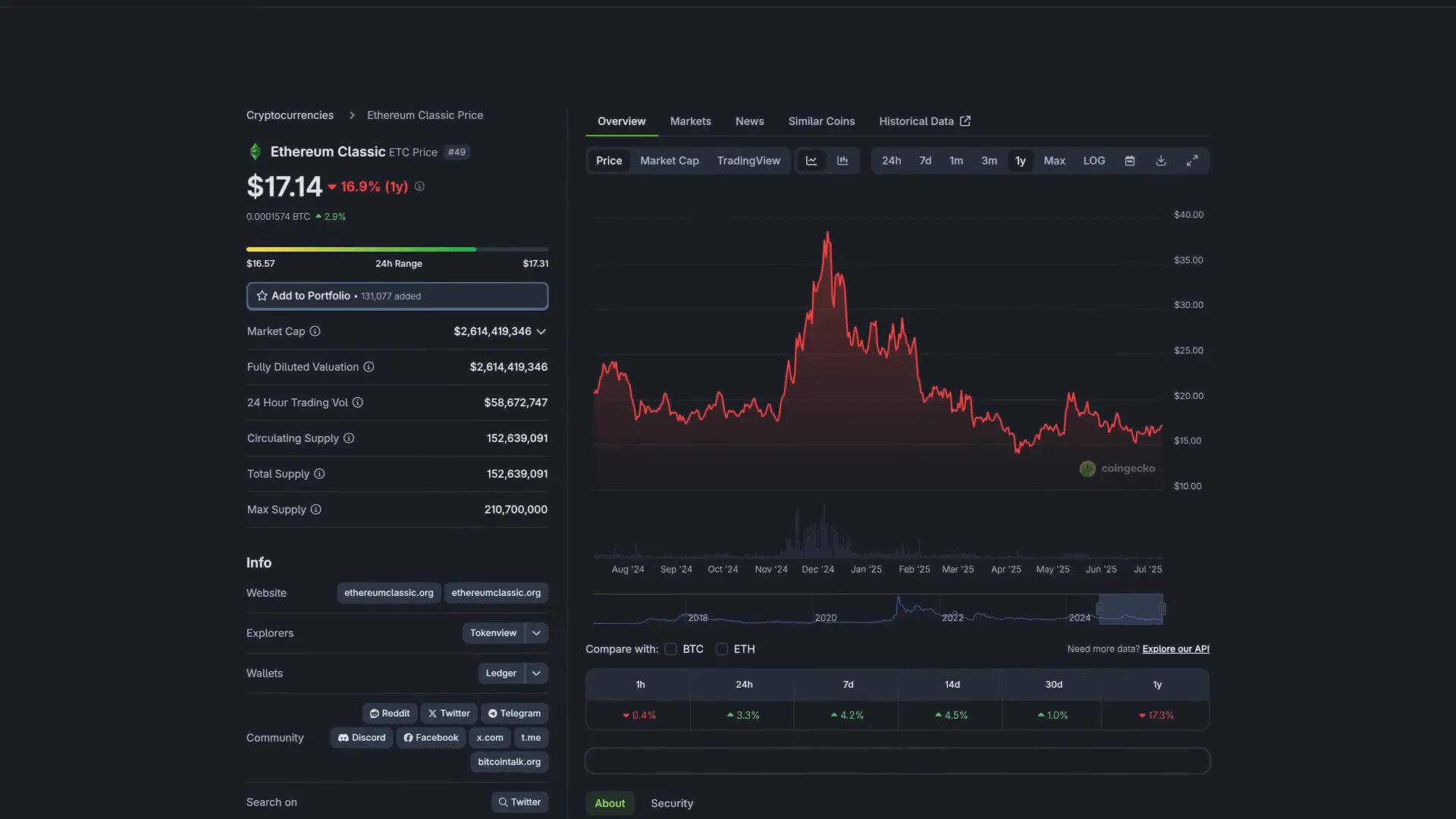

Despite the challenges in altcoin mining, two coins stand out as relatively stable and profitable options: Dogecoin (using the Scrypt algorithm) and Ethereum Classic (ETC).

Ethereum Classic has shown remarkable stability despite being considered by some as a “zombie chain.” Its price has fluctuated between $15 and $37 over the past couple of years, and it maintains a decent market cap. Previously, ETC miners could merge mine ZIL simultaneously, but ZIL is no longer mineable, which has somewhat impacted returns.

Dogecoin’s established presence and growing ecosystem make it a viable altcoin mining target, especially with newer, efficient miners entering the market.

Challenges with Off-Brand Miners: The Bombax Experience

Off-brand miners, such as those from Bombax, can be tempting due to lower prices, but they come with their own set of challenges. I have three Bombax miners—the EZ 100 and EZ 100 Pro—running on my farm. While they have operated consistently, one of them recently broke down, and reaching out to Bombax for support has been frustratingly unproductive.

Often, issues with off-brand miners boil down to power supply problems or poor support infrastructure, which can result in costly downtime and repairs. Furthermore, these miners are typically produced in limited quantities and are often overpriced relative to their performance.

Ethereum Classic Mining: Efficiency vs. Price Dilemma

Ethereum Classic mining hardware presents a tough choice. On one hand, Jazzminer offers high-efficiency, high-density miners like the X44P, but their prices and returns don’t justify the investment for many miners. Bitmain’s recent E11 miner has worse efficiency compared to Jazzminer’s offerings.

For miners who don’t already own ETC hardware, current options are either too inefficient for the price or too expensive given the expected returns. This situation makes it hard to recommend buying new ETC mining gear at the moment.

Is Now the Right Time to Buy Dogecoin Miners?

Dogecoin mining hardware prices remain relatively high, with models like the DG2 and Antminer L9 both hovering around $8,000. The mining market for Doge is somewhat overvalued due to recent price pumps, and profitability has normalized since.

Given the comparable profitability between Dogecoin miners and newer Bitcoin miners like the S23, which offer less risk, the current market may not be the best time to buy Dogecoin-specific miners.

With Dogecoin’s price volatility and the risk of halving events, a conservative approach might be to invest in proven Bitcoin mining equipment rather than doubling down on Doge miners.

Nervos Network (CKB): A Hidden Gem in Altcoin Mining

Nervos Network’s CKB token is a lesser-known altcoin with a dedicated mining community and promising fundamentals. Mining emissions stand at about $21,000 per day, with a market cap around $162 million. Despite a 65% price drop over the past year and a 92% decline from its all-time high, I’ve maintained a mine-and-hold strategy, continuing to accumulate CKB tokens mined.

Nervos recently completed a hard fork called Meepo, which brings enhanced performance, scalability, and future-proof blockchain primitives to the platform. Additionally, Nervos launched a multi-EVM (Ethereum Virtual Machine) capable platform, increasing its utility and developer appeal.

With 15 CKB miners running on my farm, it ranks as my third-largest mining initiative after Bitcoin and Dogecoin. The M.Miner K7 ASIC is currently the best miner for the Nervos algorithm, Supreme Eagle Song.

While I expect a more efficient miner to eventually replace the K7, none has been released yet, so I continue to run these machines and hold the coins mined, hoping for a future market rebound.

Cadena (KDA) Mining: Slow but Steady

Cadena is another altcoin with mining potential, although its market cap has also pulled back significantly. The KA3 miner, released around the same time as the K7, earns about $1 per day per unit. I have three KA3 miners on my farm, and while their profitability is modest, they run at a profit and contribute to a diversified mining portfolio.

Both Cadena and Nervos could see substantial gains if their market caps increase dramatically—potentially by 10x—which would push mining emissions and profitability to much higher levels. For now, they remain niche plays suited for miners willing to hold and wait for better market conditions.

The Current State of Altcoin Mining: Risk vs. Reward

Mining altcoins in 2025 is arguably one of the riskiest endeavors in the crypto space. Profitability is at historic lows, and many coins have seen significant price declines. For example, Casper is down 54% over the last year and continues to rapidly reduce its emission rate, leading to oversaturation and declining mining returns.

Other coins like Kaspa are experiencing falling hash rates, while coins like Handshake and SCP are essentially dead or no longer profitable to mine. Monero mining with the XMRig 6 series is no longer competitive compared to building a CPU rig.

In this environment, the only altcoins showing real staying power and mining viability are Dogecoin and Ethereum Classic. Dogecoin, in particular, has solidified its position as a major player with a strong market cap and active mining community.

Bitcoin and Dogecoin: The Cornerstones of Crypto Mining

Given the challenges with altcoin mining, Bitcoin and Dogecoin miners remain the most reliable investments. Bitcoin miners, especially the latest generation like the Antminer S23, offer consistent returns and relatively lower risk.

Dogecoin mining benefits from its Scrypt algorithm and merge mining relationship with Litecoin, which helps maintain network security and profitability. It’s likely we will soon see Dogecoin mining farms, ETFs, and other financial products emerge, further legitimizing Dogecoin mining as a mainstream investment.

For miners deciding what to buy, the best crypto miners right now are the newest Dogecoin miners (such as the DG2 and Antminer L9) and Bitcoin miners (like the S23). These rigs balance efficiency, profitability, and risk more effectively than many altcoin miners.

Final Thoughts: Strategy and Patience in Crypto Mining

Mining profitability is cyclical and heavily influenced by coin prices, emission rates, and hardware efficiency. While the current market is tough for altcoin miners, a parabolic altcoin bull run could quickly change the landscape, making many of today’s miners highly profitable.

Until then, focusing on well-established coins like Bitcoin and Dogecoin, running efficient rigs, and adopting a mine-and-hold strategy can help minimize risk and position miners for future gains.

Remember, mining is a long-term game that requires careful research, a solid understanding of hardware capabilities, and patience. Avoid hype and scams, and always calculate your break-even points considering electricity costs and market volatility.

Good luck out there, and happy mining!

Frequently Asked Questions (FAQ)

What are the best crypto miners to buy right now?

The best crypto miners currently are the latest generation Dogecoin miners like the Elphapex DG2 and Antminer L9, as well as Bitcoin miners such as the Antminer S23. These miners offer the best balance of efficiency, profitability, and lower risk compared to many altcoin miners.

Is it worth mining altcoins like Aleo or Casper?

Mining altcoins like Aleo or Casper can be risky due to uncertain hardware availability, rapid emission reductions, and price volatility. Aleo mining hardware availability is unclear, and Casper mining has seen declining profitability. It’s generally advisable to be cautious and do thorough research before investing in altcoin miners.

How do I avoid scams in crypto mining?

Always verify the legitimacy of mining hardware and projects through multiple sources. Avoid miners or projects with little transparency, unverifiable claims, or poor communication. For example, the BlockDAG project was exposed as a scam due to fake hardware claims and honeypot contracts.

Can I mine Bitcoin and altcoins simultaneously?

Yes, many mining farms diversify their rigs to mine Bitcoin and various altcoins simultaneously. This helps spread risk and can increase overall profitability. Merge mining (mining two coins simultaneously) is also possible for some coins like Dogecoin and Litecoin.

What factors affect mining profitability?

Mining profitability depends on hardware efficiency (hash rate vs. power consumption), electricity costs, coin price, network difficulty, and emission rates. Regularly monitoring these factors and mining profitability calculators can help you make informed decisions which use to work like crypto profit and loss calculators in trading.

Should I buy off-brand miners to save money?

Off-brand miners may be cheaper but often come with risks like poor build quality, lack of support, and higher failure rates. It’s generally safer to invest in reputable brands with proven track records, especially for large mining operations.

What is the best strategy for mining in a bear market?

In a bear market, adopting a mine-and-hold strategy can be effective. Focus on efficient hardware that minimizes losses and accumulate coins to sell when the market recovers. Avoid chasing hype or buying overpriced miners with poor returns.

Where can I buy reliable mining hardware and accessories?

Trusted suppliers like Altair (for Bitcoin miners and accessories), ASIC Marketplace, and official manufacturer websites are good places to buy mining hardware. They also offer essential accessories like power cables and PDUs that are often hard to source elsewhere.