In this post I break down the world’s first decentralized GPU rendering platform, Render, and give my RENDER Price Prediction for this bull run. I’ll cover what Render does, its tokenomics, the Render 2.0 upgrade (including the migration from Ethereum to Solana), OctaneRender integration, key features, and the price scenarios I think are realistic — plus how many RENDER tokens you would need to reach $1,000,000 under each scenario.

Table of Contents

- Quick overview: What is Render?

- How the Render network works

- Tokenomics: supply, distribution and migration

- OctaneRender: the engine behind the scenes

- Render key features and advantages

- RENDER Price Prediction: scenarios and reasoning

- Future outlook: strengths and risks

- FAQ

- Conclusion

Quick overview: What is Render?

Render is a decentralized blockchain GPU rendering network designed for heavy 3D rendering and animation workloads. Launched in 2017 and founded by Jules Urbach, the platform connects creators who need GPU power with node operators who supply GPU capacity. Render’s native token (now called Render after a 2023 rebrand) is used to pay for rendering jobs and compensate GPU providers.

Why decentralize GPU rendering?

GPU rendering is inherently parallel — GPUs perform the same operation over many data points simultaneously, which is ideal for images, video and 3D scenes. Decentralizing this workload allows artists and studios to tap into unused GPU capacity across the globe, reducing the need to buy expensive hardware while increasing scalability and cost efficiency.

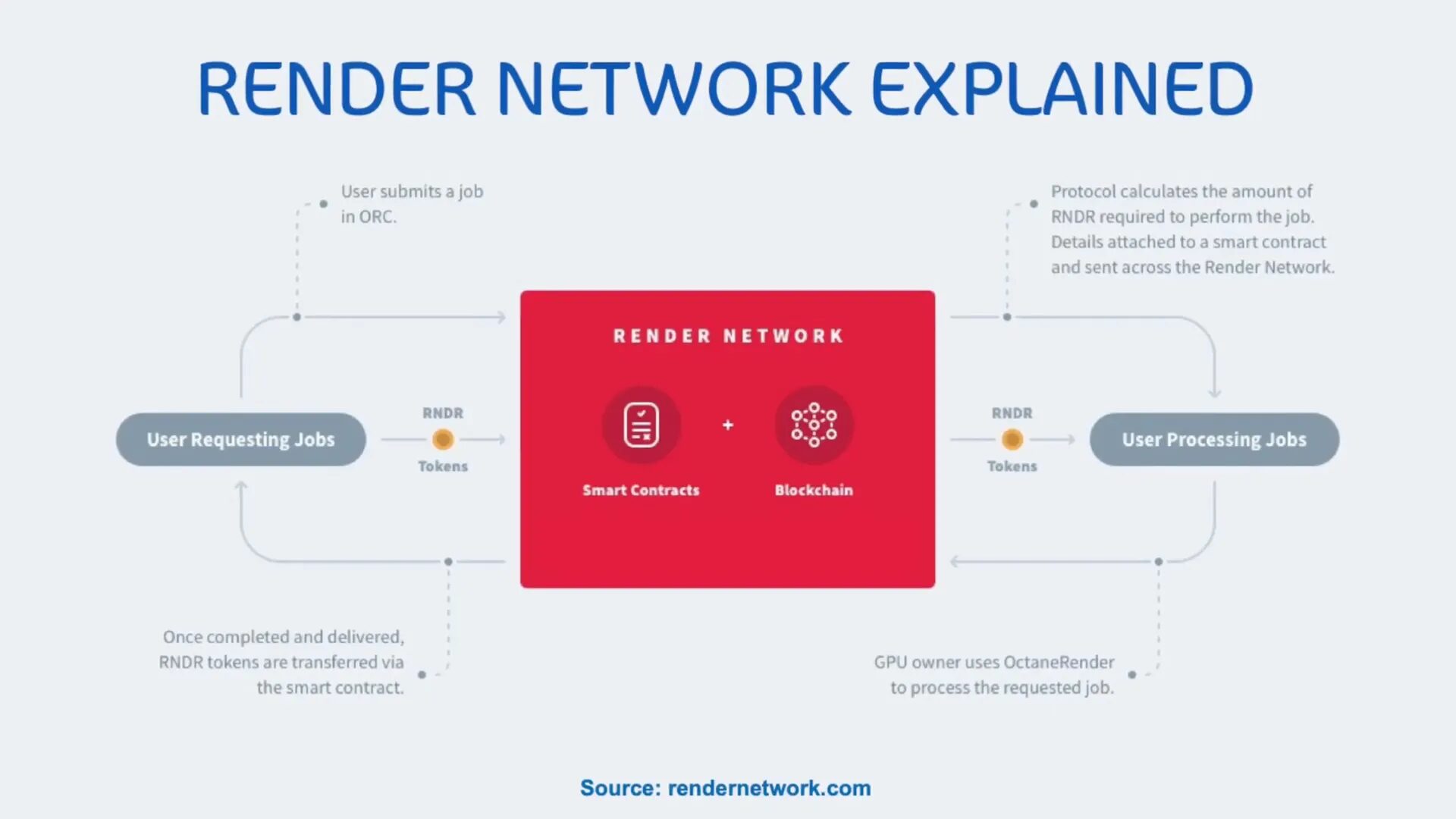

How the Render network works

The Render network is made up of three core participants:

- Creators — submit rendering jobs and pay with Render tokens.

- Node operators / GPU owners — accept jobs, run OctaneRender to process work, and receive Render tokens on job completion.

- OctaneRender — the GPU render engine that actually produces the final images and integrates with the Render protocol.

Workflow in short: a user submits a job → protocol estimates Render tokens required → job details are attached to a smart contract → a GPU owner processes the job using OctaneRender → tokens are transferred to the GPU owner upon completion. This smart-contract-driven flow ensures payments and job integrity are automated.

Tokenomics: supply, distribution and migration

Key token stats:

- Max supply: ~644 million Render tokens

- Circulating supply: ~532 million tokens (current at the time of analysis)

- Initial allocation: 65% to Render user development (held in escrow to manage supply/demand), 25% to public token sale, 10% to Render reserve.

In November 2023 the project completed Render 2.0: a community-approved migration from Ethereum to Solana, with the token renamed from RNDR to Render. The move prioritized Solana’s high throughput and low transaction fees to better support the network’s growth. Holders of the legacy RNDR tokens were given an upgrade path through the Render upgrade portal, and exchanges updated their listings accordingly.

OctaneRender: the engine behind the scenes

OctaneRender is the GPU render engine developed by OTOY (founded and led by Jules Urbach). It’s an unbiased, real-time capable renderer used widely in film and gaming for photorealistic outputs. OctaneRender integrates with many content creation tools and allows creators to edit scenes in near real time — a major advantage for iterative production pipelines.

“We are building the next level metaverse rendering company, which will compete with the big Hollywood studios.”

Render key features and advantages

- Physically based rendering: realistic lighting and material behavior that mirror real-world physics.

- Advanced lighting: global illumination and multiple light types for depth and realism.

- High-quality texturing: realistic materials and textures for photoreal output.

- Decentralized, scalable rendering: distributed nodes make scaling easier and often cheaper than centralized providers.

- Energy efficiency: unused GPU time is monetized instead of wasted, improving overall energy utilization.

RENDER Price Prediction: scenarios and reasoning

Before diving into the forecasts, note Render’s previous all-time high of $13.60 (March 2024). Using market cap comparisons with peers and realistic growth assumptions, here are three scenarios (not financial advice, just my view):

- Conservative: Market cap reaches ~$10 billion → RENDER price ≈ $20.

- Mid-range: Market cap reaches ~$15 billion → RENDER price ≈ $30.

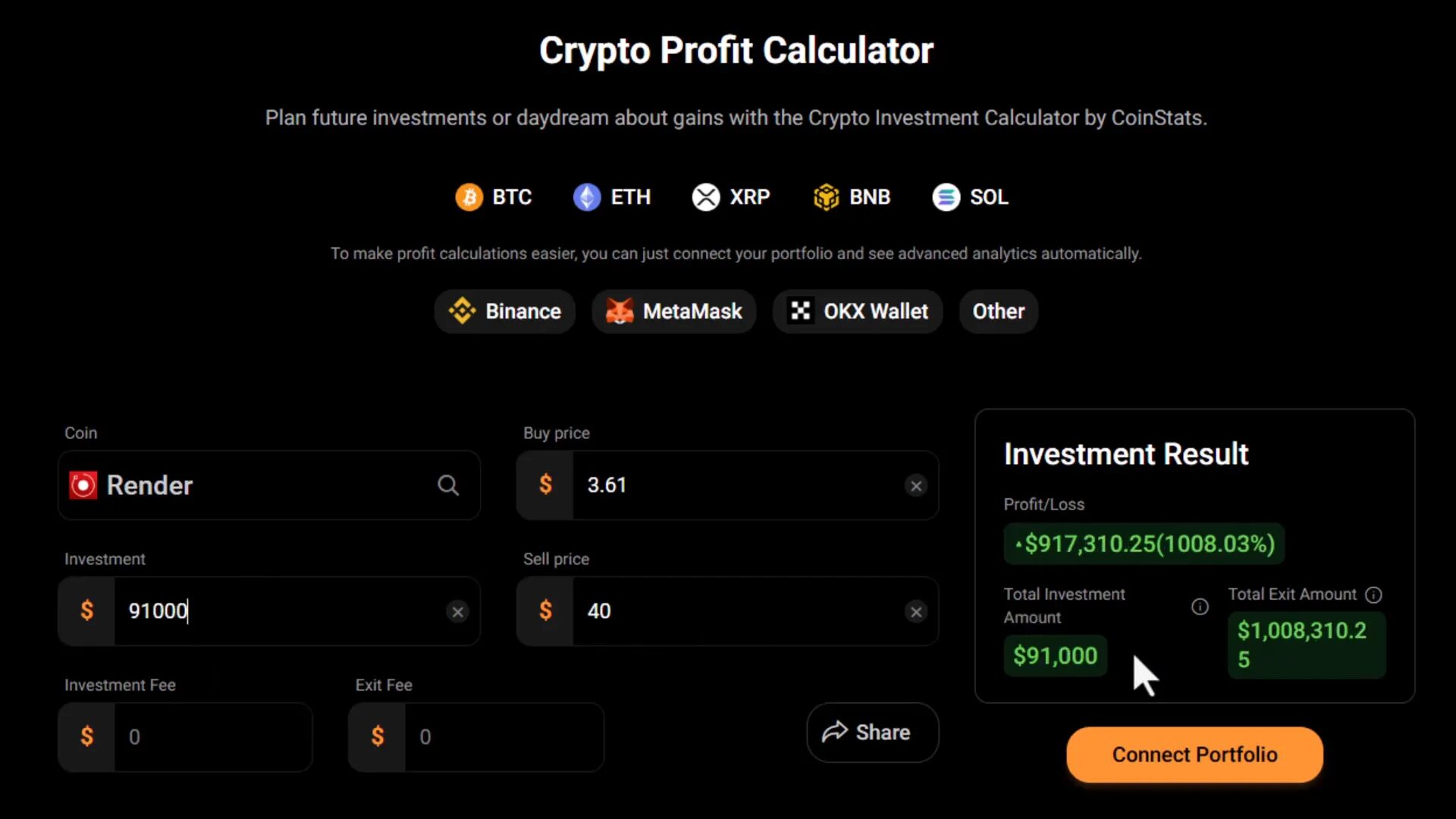

- Aggressive: Market cap reaches ~$20 billion → RENDER price ≈ $40.

Why these targets? The upgrade to Solana improves throughput and reduces fees, which helps adoption. Render’s first-mover advantage in decentralized GPU rendering is strong, but long-term success depends on convincing studios, game developers and AI rendering workflows to choose Render over centralized alternatives.

How many RENDER tokens to be a millionaire in this bull run?

Using current prices and the target sale prices above, here are the breakpoints to reach $1,000,000:

- Sell at $20: You would need ~50,000 RENDER tokens. At today’s price that equates to roughly $181,000 invested.

- Sell at $30: You would need ~33,000 RENDER tokens. Today’s cost would be about $121,000 invested.

- Sell at $40: You would need ~25,000 RENDER tokens. Today’s cost would be about $91,000 invested.

These estimates hinge on price movement and market liquidity. They assume the market cap grows as outlined and that you can buy and later sell significant amounts without materially moving the price — real-world slippage and taxes will affect outcomes.

Future outlook: strengths and risks

Strengths:

- First-mover advantage in decentralized GPU rendering.

- Direct integration with OctaneRender and OTOY’s ecosystem.

- Solana migration provides faster, cheaper transactions for the protocol.

Risks:

- Competition from centralized cloud GPU providers and potential new decentralized entrants.

- Need to scale adoption among studios, game developers, VFX houses and AI companies.

- Token utility depends on ongoing demand for on-chain rendering and the network’s ability to deliver reliable, high-quality service.

FAQ

What is the Render token used for?

Render tokens pay for rendering jobs on the network and compensate GPU node operators for completed work.

Why did Render migrate from Ethereum to Solana?

The community voted to migrate to Solana to take advantage of faster transaction speeds and much lower fees, which better support high-volume, small-value transactions that the network needs.

Is OctaneRender required to use the Render network?

OctaneRender is the primary GPU render engine used by the network to process jobs, and it’s tightly integrated into the Render workflow.

Are the price predictions guaranteed?

No. These are scenarios based on market cap targets and current supply. Cryptocurrency investing is high risk — prices can be volatile and outcomes are uncertain.

Conclusion

Render presents a compelling proposition as the first decentralized GPU rendering platform with OctaneRender integration and a strategic move to Solana. My RENDER Price Prediction scenarios ($20, $30, $40) are rooted in achievable market-cap milestones, but adoption is the deciding factor: Render must convince creators and enterprises to route rendering workloads to the network. If it does, the upside could be substantial — but as always, do your own research and consider risk before investing.