Table of Contents

- Introduction: Why Jio Coin matters

- What is Jio Coin (JIO)?

- How Jio Coin will be distributed and earned

- How to buy Jio Coin right now (and what you need to know)

- Trading opportunities: leverage, futures, options and platforms

- Tax and regulatory considerations mentioned

- Eight essential things to know about Jio Coin

- Risk management: how to protect capital when trading Jio Coin

- Step-by-step checklist: How to buy Jio Coin (practical timeline)

- Frequently Asked Questions (FAQ)

- Conclusion and next steps

- Final checklist: Be ready to act

Introduction: Why Jio Coin matters

Reliance’s Jio entering the token space is huge. When one of India’s largest tech and telecom ecosystems announces a token, it doesn’t just create local buzz — it affects global markets. Price action in broader crypto (Bitcoin, Solana, Ethereum) often reacts to big institutional and ecosystem moves. If you’re asking how to buy Jio Coin, you’re not alone — millions are curious about how to earn, trade, and use a token backed by Jio’s ecosystem.

The immediate reaction in markets is twofold: retail interest to acquire tokens and trader interest to take advantage of rapid price swings. That’s why it’s essential to separate how to earn Jio Coin today (via Jio’s ecosystem rewards) from how to buy Jio Coin when it’s listed on exchanges — each path has different steps, timelines, and risk profiles.

What is Jio Coin (JIO)?

Jio Coin — also referred to in the ecosystem as JIO — is a Web3 reward token introduced by Jio, built with collaboration from Polygon Labs. Polygon is a well-known blockchain scaling solution, and one of its founders is Indian, so this partnership is top of mind for many crypto enthusiasts in India.

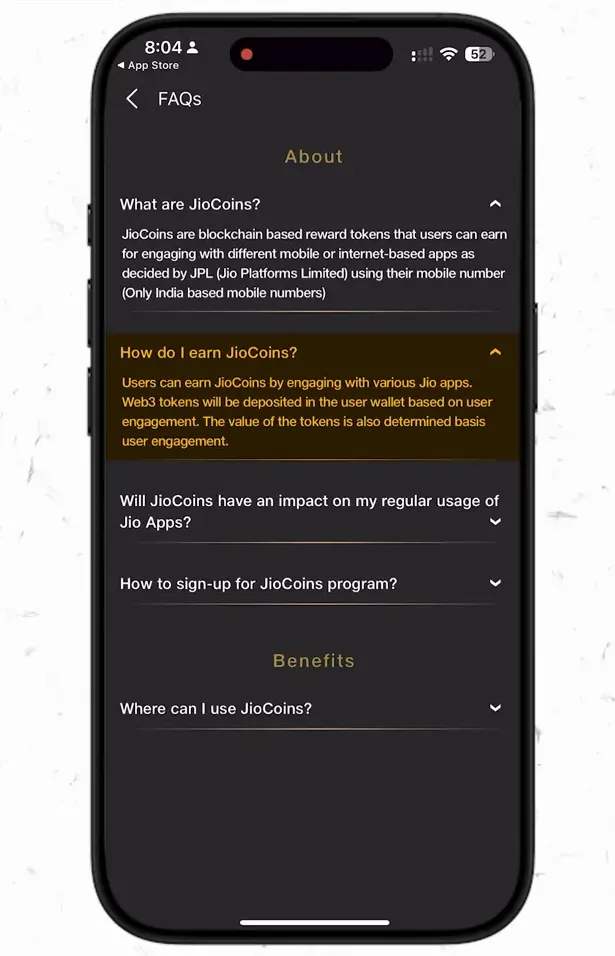

JIO is designed primarily as an engagement and utility token. It will be deposited into users’ Web3 wallets based on their engagement within the Jio ecosystem — actions such as using the new Jio browser, making purchases, recharges, or other interactions may earn you JIO tokens as rewards. Right now, the token is in beta and not transferable or listed on exchanges, but the project roadmap includes a wallet integration and future redeemability options.

Key characteristics

- Built on Polygon network (as mentioned by Jio and Polygon Labs).

- Primarily a reward/engagement token for Jio users.

- Currently distributed in beta to Web3 wallets in the Jio app environment.

- Not yet transferable or listed on exchanges for purchase in secondary markets (as of the current beta stage).

How Jio Coin will be distributed and earned

Jio’s approach is reward-first. Instead of launching directly on exchanges, Jio appears to be crediting JIO tokens to user wallets based on engagement. This is similar to how some other Web2-to-Web3 rollouts reward early users for participation.

Here’s how earning works in the current beta:

- Sign in to the Jio app or Jio browser and link your phone number.

- Verify via OTP and create a Web3 wallet address presented inside your Jio app.

- As you engage with Jio’s services (browser usage, purchases, recharges, grocery orders, petrol transactions), JIO tokens are expected to be deposited into the Web3 wallet based on the level of engagement.

- At launch phase, these tokens are non-transferable and non-redeemable outside Jio’s ecosystem until further updates allow conversion or external transfers.

This model is designed to encourage sustained usage of Jio apps and to bootstrap token distribution among active users. It also gives Jio a direct on-chain relationship with its customers and a way to experiment with token economics at scale.

How to buy Jio Coin right now (and what you need to know)

The honest answer is: you currently cannot buy Jio Coin on public exchanges. The token is being credited as rewards within Jio’s beta Web3 wallet and is not transferrable or listed on exchanges yet.

That said, there are two approaches depending on your goal:

1) Earning Jio Coin (the immediate route)

- Install and use Jio-supported apps (Jio browser, JioSphere) and sign in with your mobile number.

- Verify OTP and set up your Web3 wallet inside the app.

- Engage with services: browsing, purchases, recharges, and other eligible activities will likely earn you JIO tokens as they roll out reward programs.

2) Buying Jio Coin on exchanges later

When the token becomes transferable and listed on crypto exchanges, the path to buy will follow the standard process:

- Create and verify an account on a cryptocurrency exchange that lists JIO .

- Deposit INR or a base crypto (USDT, BTC, ETH) to the exchange.

- Place a buy order for JIO when listed — market or limit order depending on price action.

- Optionally transfer tokens to a private wallet if you prefer custody outside the exchange.

So, when you plan to buy jio coin, monitor official announcements about listing and transferability. Until then, accumulate JIO via the reward route and be ready with a KYC-compliant exchange account for the moment it becomes tradable.

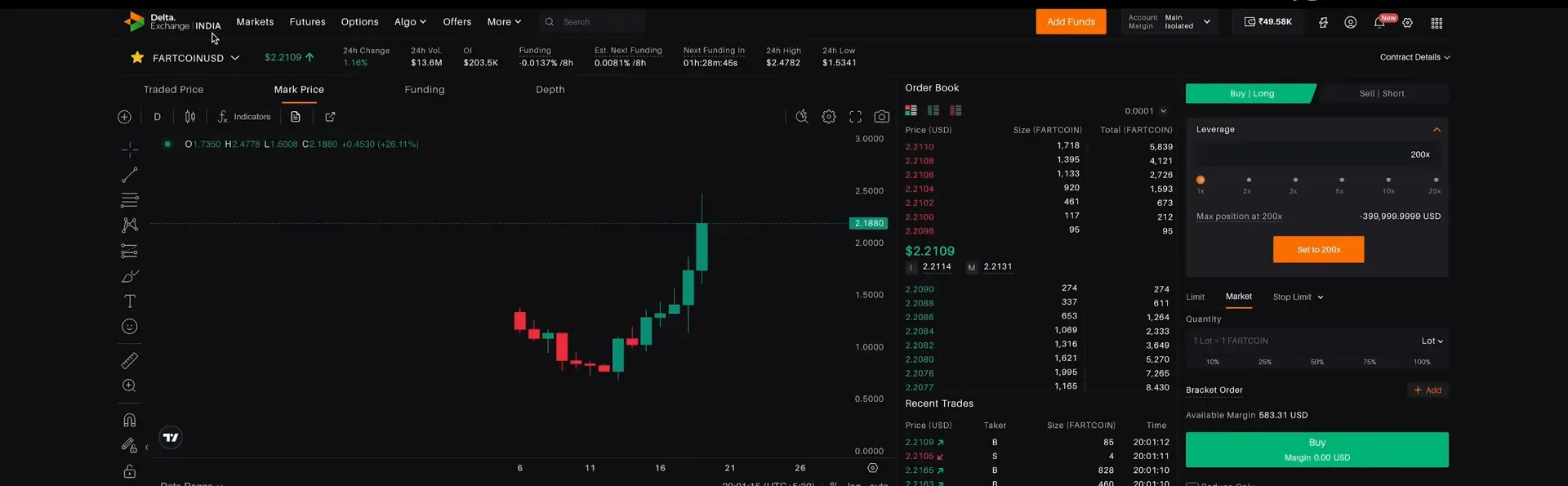

Trading opportunities: leverage, futures, options and platforms

One of the major themes discussed is trading opportunity. The speaker emphasized how traders can make outsized returns using leverage — and why that’s both opportunity and risk. Here are the main points and practical takeaways.

Understanding leverage with a real example

Example from the discussion:

- You put in a small amount of capital (say $1,000) but trade with heavy leverage so your notional exposure becomes $200,000.

- If the underlying asset (e.g., Bitcoin or a token) moves 20% in your favor, a 20% move on $200,000 equals $40,000 profit — from a $1,000 initial investment.

This shows why traders are excited: leverage multiplies returns. But remember — it also multiplies losses. If the token moves 20% against you, your capital can be wiped out quickly.

Futures, options and where to trade

The recommendation in the discussion was to use specialized derivatives platforms like Delta Exchange (Delta Exchange India) for futures/options trading. Delta Exchange supports crypto derivatives, including futures and options, and offers different leverage levels. According to the talk, many traders prefer such platforms because they can access high leverage and frequent expiries.

Important notes from the discussion:

- Some tokens provide very high leverage (example mentioned: 20x for a specific token), though leverage availability varies by token and platform.

- Delta Exchange and similar platforms may offer daily expiries for certain contracts, which is attractive for active traders who want defined timeframes.

- Using leverage requires strict risk management: use stop losses, limit leverage sizes, and only risk what you can afford to lose.

Tax and regulatory considerations mentioned

The video highlighted a key trading-related point: tax treatment can differ between trading and investing. According to the speaker:

- If you trade cryptocurrencies actively (rather than invest long-term), different tax rules may apply compared to owning crypto as an asset. The speaker claimed that on certain platforms traders don’t pay a flat 30% tax and that trading transactions may fall under taxable income rules as per one’s slab.

- Also, the speaker mentioned that TDS might not be applicable on these trading transactions, which he presented as a trading benefit.

Important caution: tax laws frequently change and are jurisdiction-specific. Always consult a qualified tax advisor before making decisions based on tax assumptions. Use official sources and recent guidance when planning taxes related to crypto.

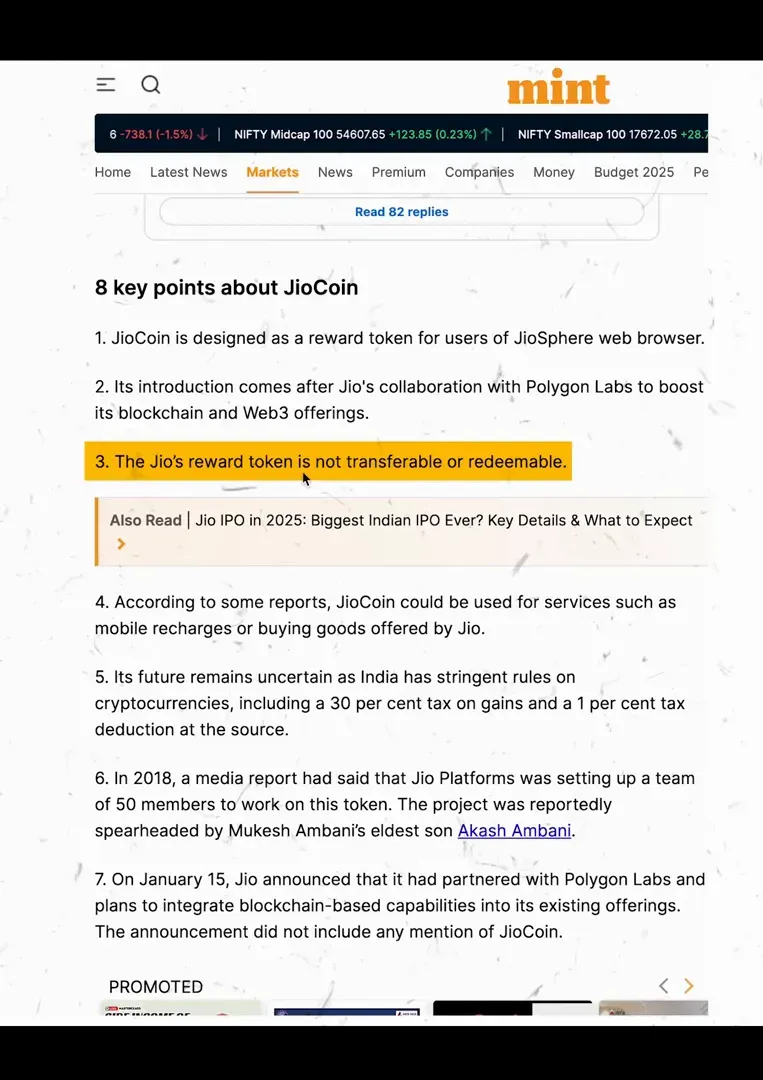

Eight essential things to know about Jio Coin

Here are the eight clear and practical points distilled from the discussion — treat these as a checklist before you consider how to buy Jio Coin or trade it:

- Partnership with Polygon Labs: Jio has collaborated with Polygon Labs to build JIO. This gives the token technical credibility since Polygon is an established scaling solution in the crypto world.

- Beta distribution via Jio apps: JIO is currently in beta and credited to Web3 wallets inside Jio’s ecosystem based on user engagement.

- Non-transferable in beta: At present, credited JIO tokens cannot be transferred to external wallets or exchanges. They’re internal reward tokens until future updates enable transfers.

- Not listed on exchanges yet: You cannot buy JIO on public exchanges now. Wait for official listing announcements to learn where to buy Jio Coin when that happens.

- Use-cases in the ecosystem: Jio plans to let you use JIO for services like grocery purchases, mobile recharges, petrol payments, and other Jio transactions.

- Wallet integration coming: Jio will update the Web3 wallet inside its apps to show detailed info and redemption options as the token evolves.

- Trading vs investing: The speaker emphasized trading opportunities (futures/options/algo), noting higher upside potential for traders but also higher risk.

- Team and roadmap: Reports mentioned that Jio formed a dedicated team (50 people reported) to work on the token project, indicating a serious long-term commitment from Reliance.

Risk management: how to protect capital when trading Jio Coin

Trading tokens at launch can mean volatility and big returns — but also swift losses. Here are practical, battle-tested rules to manage risk if you plan to trade JIO once it’s tradable:

- Define your risk per trade: Never risk more than a small percentage of your trading capital on a single trade (1–3% is common among experienced traders).

- Use stop losses: Always place a stop loss. Leverage amplifies both profit and loss.

- Avoid maximal leverage: Don’t default to the highest leverage offered. Start with lower leverage (e.g., 5x–10x) until you understand the token’s behavior.

- Position sizing: Position size = (Account risk amount) / (Stoploss distance). This ensures consistent capital protection.

- Monitor liquidity: New listings may have low liquidity and high spreads. Avoid entering huge positions immaturity.

- Have an exit plan: Predefine profit targets and re-evaluate your trade if conditions change.

- Keep crypto allocation prudent: Don’t over-allocate your portfolio to a single token or high-risk assets.

Step-by-step checklist: How to buy Jio Coin (practical timeline)

If you’re planning how to buy jio coin — or at least be ready the moment it becomes tradable — follow this timeline:

Phase 1 — Earn and prepare (now)

- Install the Jio browser or JioSphere app and sign in with your mobile number. Verify via OTP and check the Web3 wallet section.

- Engage with Jio services (browser, recharges, shopping) to accumulate JIO rewards as they roll out.

- Document your wallet address and keep records of credited JIO tokens for future tracking and tax reporting.

Phase 2 — Account setup (before listing)

- Create and verify accounts on one or more reputable exchanges that may list JIO. Complete KYC in advance to avoid delays.

- Secure funds (INR, USDT) on exchanges so you can act immediately when JIO lists.

- Familiarize yourself with derivatives platforms if you plan to trade futures/options — open an account and complete necessary verification on platforms like Delta Exchange.

Phase 3 — At listing (buying)

- Monitor official Jio announcements about transferability and exchange listings.

- Place buy orders (limit orders preferred initially to avoid front-running and high slippage).

- Consider using smaller increments to scale into a position rather than a single large buy.

Phase 4 — Post-purchase

- Move tokens to your private wallet if you prefer custody (once transfers are enabled).

- Document purchases for tax reporting and maintain transaction records.

- Re-evaluate your investment thesis periodically (utility adoption, tokenomics, partnerships).

Frequently Asked Questions (FAQ)

Q: How to buy jio coin right now?

A: At present you cannot buy Jio Coin on public exchanges. The immediate way to acquire JIO is to earn it within the Jio ecosystem by signing into Jio apps and participating in engaged activities. When JIO becomes transferable and listed, you will be able to buy it on exchanges — this article’s step-by-step checklist explains how to prepare.

Q: Will JIO tokens affect my regular Jio app usage?

A: No. The Jio team has said JIO will not change the user experience of existing Jio apps. You will continue using apps as before, and tokens will be calculated and credited based on your engagement level.

Q: Can I transfer or trade JIO today?

A: Not in the current beta phase. JIO credited in the Web3 wallet is non-transferable until Jio enables transferability and/or exchange listings.

Q: Where will JIO be usable?

A: Jio intends JIO to be redeemable for ecosystem services like grocery purchases, mobile recharges, and petrol at participating outlets. Full redemption details and bank linking procedures are expected as the project evolves.

Q: Is trading JIO better than investing?

A: That depends on your skillset and risk tolerance. The speaker highlighted trading opportunities (derivatives, leverage, daily expiries) as attractive for active traders. Investors with longer horizons should evaluate tokenomics, utility adoption, and team credibility. Both approaches carry risk.

Q: Which platforms should I watch for listings?

A: Watch major centralized exchanges and derivatives platforms. Also monitor Delta Exchange if you’re interested in futures or options. Complete KYC on reputable exchanges ahead of time so you can act when JIO lists.

Q: What about tax implications?

A: Tax treatment varies by jurisdiction and whether you trade or hold. The video mentioned possible differences between trading and investing tax treatment, but always consult a licensed tax professional for accurate guidance and record-keeping.

Q: Should I use leverage to trade JIO ?

A: Use leverage only if you thoroughly understand its risks. Start small, use stop losses, and never risk more than you can afford to lose. Leverage multiplies gains and losses equally.

Conclusion and next steps

To recap: If your question is how to buy jio coin today, the practical action is to earn JIO inside Jio’s beta Web3 wallet by engaging with Jio apps. If your question is how to buy jio coin once it’s tradable — prepare now: open and KYC exchanges, fund accounts, learn derivatives platforms, and set clear risk rules for leverage. Jio’s partnership with Polygon Labs and its intent to integrate JIO into everyday services (recharge, grocery, petrol) make it an important development in India’s crypto adoption story.

This is a high-opportunity, high-risk environment. Whether you plan to hold as an investor or trade as a speculator, be cautious, educate yourself, and always protect your principal with sound risk management strategies. If you want a deeper practical series on crypto trading mechanics (futures, options, expiries, and algo trading), the presenter mentioned plans for a free educational series — keep an eye out and demand it if you want it.

Finally, be patient. The token is in beta; transferability and exchange listings will come with official announcements. Prepare now so that when the time arrives, you’ll know exactly how to buy jio coin, how to trade it safely, and how to use it within the Jio ecosystem.

Final checklist: Be ready to act

- Sign into Jio apps and set up the Web3 wallet (earn JIO now).

- Complete KYC on major exchanges and derivatives platforms.

- Fund exchange accounts so you can buy immediately on listing.

- Decide your primary strategy: earn & hold, or trade with strict risk rules.

- Monitor official Jio announcements for transferability and listing details.

Preparing ahead will let you pivot between earning, buying, or trading seamlessly. If your plan is to learn more about trading crypto derivatives before JIO lists, start with small positions and paper-trading strategies to build skill and confidence. Good luck — and remember, disciplined risk management is your best friend when markets move fast.