Table of Contents

- Introduction: Why AVNT matters right now

- What Avantis (AVNT) actually is — product overview

- The team, backers and credibility

- Why AVNT exploded: listings, volume and market attention

- How perpetuals and 500x leverage work — and why that’s dangerous

- Real World Assets (RWA) on-chain: promise and complications

- Market structure, tokenomics and AVNT market cap context

- My AVNT Price Prediction scenarios — bear, base, and bull

- How traders can approach AVNT: strategies, signals and risk management

- Key catalysts and what to watch next

- Practical checklist before you trade AVNT

- AVNT Price Prediction — a simple numerical framework

- Governance, legal structure and long-term viability

- Common mistakes traders make with tokens like AVNT

- How to integrate AVNT into a diversified crypto portfolio

- AVNT Price Prediction: What I’m personally watching and trading

- Conclusion — Where does this leave AVNT Price Prediction?

- FAQ

Introduction: Why AVNT matters right now

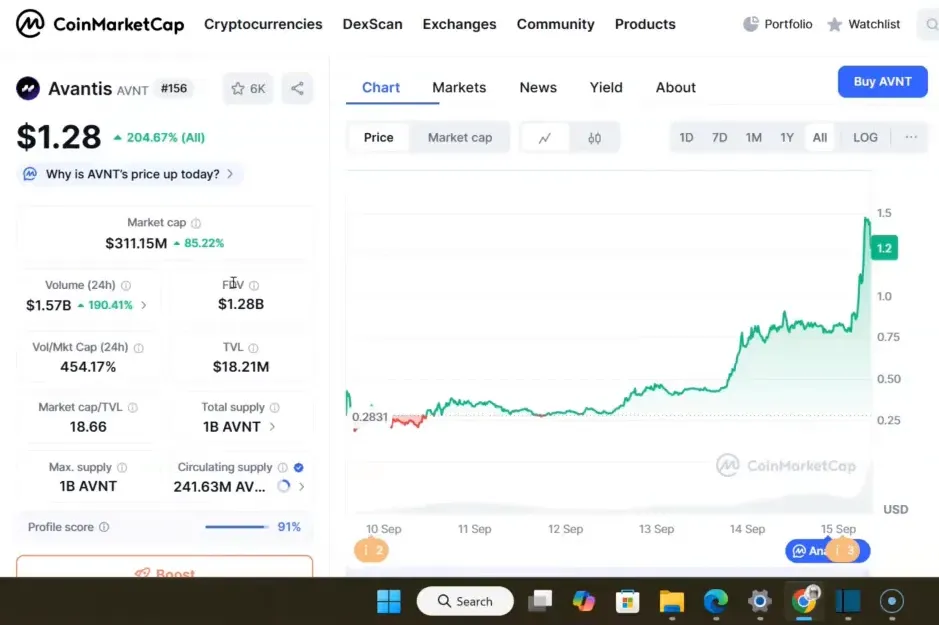

Short version: Avantis has had one hell of a week. It listed on multiple major exchanges within hours, recorded astonishing volumes — north of $1.5 billion in a 24-hour window — and immediately became a headline token in this early bull run. As someone who tracks listings and early movers closely, I believe understanding the mechanics behind Avantis and forming a disciplined AVNT Price Prediction is essential before you consider trading it.

AVNT Price Prediction starts with fundamentals: what the protocol offers, how real usage can drive demand, the token’s supply dynamics, and the macro plus exchange-driven catalysts. But it also must account for the unique risks here — chiefly the platform’s offering of zero-fee perpetuals and up to 500x leverage for traders. That combination will supercharge volume, but it can also lead to sharp, violent drawdowns during liquidations.

What Avantis (AVNT) actually is — product overview

Avantis is a decentralized exchange (DEX) specialized in perpetual contracts and real-world assets (RWA) trading. It’s built on Base and positions itself as the largest RWA perpetuals DEX in DeFi by volume. In practice that means Avantis allows users to trade crypto and tokenized versions of FX, commodities, indices and equities — often with deep leverage options.

Key product features to know:

- Zero-fee perpetuals concept: traders only pay if they profit — this is positioned as a trader-friendly fee model that lowers friction for high-frequency or aggressive traders.

- High leverage: Avantis has promoted leverage up to 500x on certain products, which is a major draw for speculative activity.

- RWA exposure on-chain: the protocol supports leveraged trading on tokenized real-world assets, which is a high-interest vertical for institutional and retail adoption.

- Built on Base: leveraging Base’s infrastructure for speed and low fees, which helps derivatives trading performance.

The combination of zero-fee marketing, extreme leverage and RWA focus is what makes Avantis unique in DeFi right now. It’s not merely another AMM or margin DEX — it’s a marketplace geared toward derivatives and institutional-style products made accessible on-chain.

The team, backers and credibility

One reason Avantis gained trust fast: it’s backed by notable names. The founding team includes veterans from Pantera Capital, Lazard, McKinsey and other institutional firms. Founders Hareshaj Singh and Raymond Dong bring investment, hedge fund and trading experience. More broadly, many engineers and designers come from big crypto and fintech firms, including Binance and Quantopian.

Backing matters. Avantis has publicly known backers like Pantera and support from Coinbase-related channels, which explains why it got multiple exchange listings so quickly and why liquidity flowed in so aggressively during launch. That institutional pedigree is a positive when building trust — but remember, even projects with strong backers can experience brutal price action when the product enables extreme leverage.

Why AVNT exploded: listings, volume and market attention

AVNT’s parabolic move didn’t happen by accident. Two immediate drivers were:

- Exchange Listings: Within hours AVNT landed on several major exchanges and top-tier platforms. Listings create accessibility and trigger localized liquidity pools that attract both retail and institutional flows.

- Zero-fee + 500x Leverage Hype: Product features attracted short-term traders looking to scalp or make large risk-on bets with minimal fee drag. That alone can spike volumes when paired with listing news.

In the first 24 hours, trading volume eclipsed $1.5 billion — that’s the kind of number that attracts headlines, more listings, and more retail FOMO. When a coin does that in six days post-launch, it’s natural to expect further curiosity-driven inflows. But volume alone isn’t a durable moat. The big question is: will the platform maintain real usage from traders who view it as an ongoing utility, not just a speculative playground?

How perpetuals and 500x leverage work — and why that’s dangerous

We must be explicit here: leverage multiplies both gains and losses. 500x leverage is extreme. At 500x, a mere 0.2% adverse move wipes out the position. That’s one-fifth of one percent. Markets move that in seconds on news, block trades, or a single whale’s order.

How this affects AVNT and the protocol:

- Mass Liquidations: High leverage increases the chance of cascade liquidations during fast moves, which in turn generates wild price swings and can stress on-chain infrastructure or oracle feeds.

- Volume vs Real Users: Much of the reported volume may be leverage-chasing trades that don’t represent durable protocol revenue or long-term utility. The platform can look huge on volume while actual user count or net flows are modest.

- Institutional Appetite: Some institutions will like the ability to hedge or take micro-exposures, but most institutional desks avoid such extremely levered retail-style products due to regulatory and risk constraints.

As I said on camera — if you’ve never traded with leverage, don’t start here. If you are unfamiliar with leverage mechanics, 500x is not the place to learn. For traders who specialize in scalping and short-duration plays, leveraging a service like a professional-grade crypto trading signal might amplify opportunities — but it also amplifies danger. If you are going to pursue short-duration trades on highly volatile listings, consider pairing any position sizing with proven signals and strict stop regimes.

Real World Assets (RWA) on-chain: promise and complications

RWA is one of the most compelling narratives in crypto: unlocking trillions in traditional assets via tokenization could dramatically expand on-chain liquidity and use cases. Avantis is positioning itself at the intersection of perpetuals and RWA — enabling leveraged exposure to tokenized commodities, FX, indices and even equities.

But there are crucial complications:

- Valuation & Market Risk: Tokenized commodities and FX are comparatively straightforward — prices are continuous and liquid. Tokenized illiquid assets (like real estate or private equity) introduce valuation risk: what is a token actually worth in a stressed market?

- Collateral & Liquidations: If you use a tokenized house as collateral and property values crash, liquidations raise questions: who enforces ownership transfers? Are jurisdictions and legal frameworks prepared for tokenized asset seizures?

- Regulatory Complexity: Tokenized equities and debt can run into securities laws. Different jurisdictions will treat tokenized RWAs differently, creating regulatory fragmentation and compliance risk for platforms listing those assets.

In short, RWA is an enormous opportunity, but the timing and shape of the transition are uncertain. Avantis’ product-market fit depends on whether the industry can standardize legal/regulatory frameworks and create reliable, auditable oracle pricing for on-chain RWAs. That’s not immediate — it’s an ongoing multi-year process.

Market structure, tokenomics and AVNT market cap context

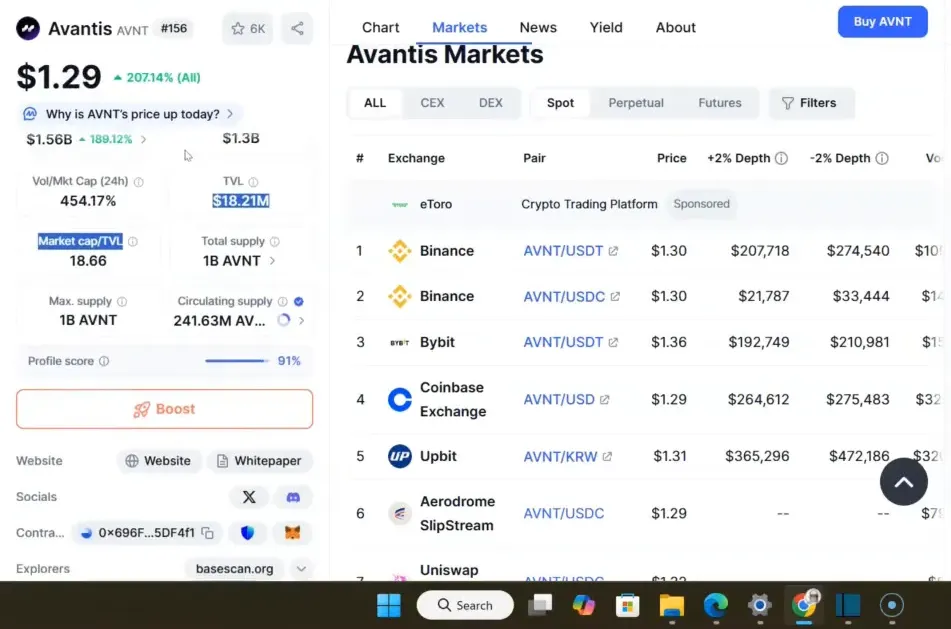

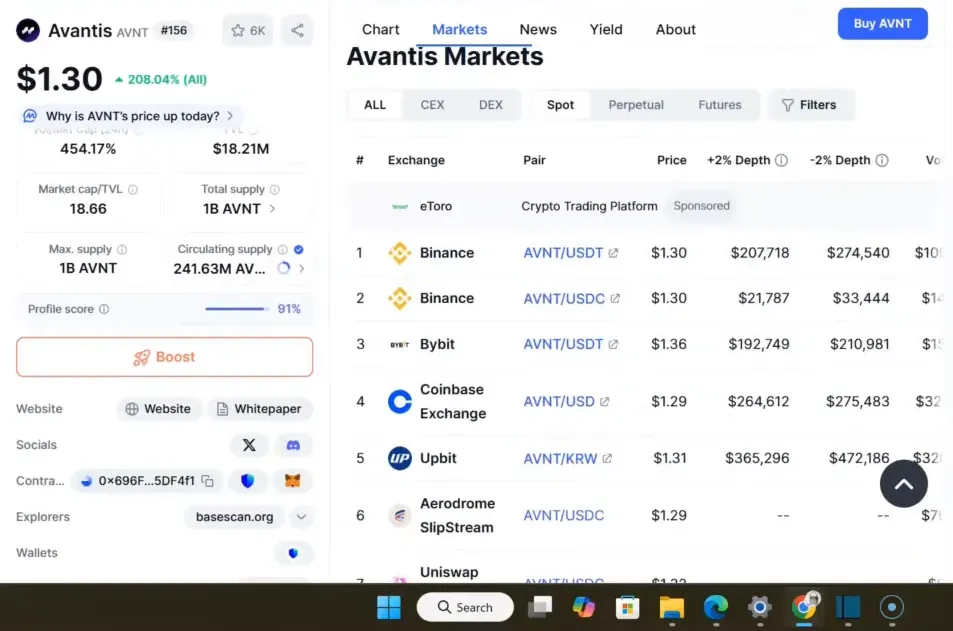

At the time of this writing AVNT sits in the top 200 by market cap, but it’s moving fast. My AVNT Price Prediction must factor in several token-specific metrics:

- Circulating supply vs total supply: Early listing and unlock schedules can lead to sudden selling pressure. Know the token release timetable.

- Liquidity on exchanges vs DEX depth: High volume with shallow liquidity can create exaggerated price action. Watch order book depth across major exchanges.

- Protocol revenue and token accrual: How much revenue does the protocol generate and how is that captured by AVNT? Some derivative DEXes burn fees or distribute revenue — understand the mechanism.

- Market sentiment and macro catalysts: Rate cuts, equities flows, and DeFi rotations all affect demand for derivatives and high-beta tokens.

Price math: from today’s market cap, AVNT only needs to reach a modest dollar level to cross large round numbers. For instance, breaking $1 billion market cap could be achieved with a price in the low single digits depending on circulating supply. That’s why many people are optimistic and why rapid speculation can push the coin into top-100 territory quickly — but keep in mind that valuations are ephemeral in these early stages unless usage and token sinks sustain them.

My AVNT Price Prediction scenarios — bear, base, and bull

Below I outline three scenarios you can use to think about risk/reward. Each scenario includes an estimated price range and reasoning. Remember: this is an analytical framework, not guaranteed outcomes.

Bear scenario — quick retrace and consolidation

Price range: 60%–90% retrace from peak in the short term.

Why this happens:

- Initial FOMO exhausts: Listing-driven flows dry up and speculative retail profit-takes dominate.

- Liquidation events: Aggressive leverage triggers cascades of liquidations on volatile pairs, causing temporary flash crashes.

- Token unlocks: Early team/VC unlocks or vesting schedules add supply to the market.

Implications for AVNT Price Prediction: In this scenario the token corrects from its peak and consolidates while the protocol proves sustainable usage. For traders, volatility is an opportunity for short-term arbitrage and scalps, but it’s also high risk. Use strict risk controls.

Base scenario — sustained growth with pullbacks

Price range: 3–10x from listing price over 3–6 months.

Why this happens:

- Sustained volume: Traders adopt the platform for perpetuals and RWA exposure, generating real protocol revenue and on-chain activity.

- Institutional interest: VCs, hedge funds and market makers increase participation, improving liquidity and reducing spreads.

- Product maturity: Avantis expands asset lists, improves UX, addresses oracle or liquidation mechanics, and demonstrates protocol safety during a market turbulence test.

Implications for AVNT Price Prediction: This is my base case if Avantis can maintain real usage beyond the initial listing wave. AVNT benefits from network effects — the more activity, the more attention and token demand — provided the team manages risk and governance effectively.

Bull scenario — breakout to double digits and beyond

Price range: 10x–50x+ from early listing price over 6–12 months.

Why this happens:

- Mass adoption of RWA derivatives: If tokenized real-world markets scale faster than expected and Avantis wins significant share, transaction fees and token utility could explode.

- Zero-fee narrative becomes mainstream for traders: If Avantis proves sustainable by capturing revenue in other ways (protocol fees captured by AVNT holders or burns), trader adoption can compound rapidly.

- Macro tailwinds: An accommodative macro environment (rate cuts, liquidity flows into risk assets) results in a new wave of market participants buying high-beta crypto products.

Implications for AVNT Price Prediction: In this optimistic path, AVNT could reach double-digit prices and push into the top 50 by market cap. This requires both product execution and a favorable macro/regulatory climate.

How traders can approach AVNT: strategies, signals and risk management

Trading AVNT requires an adaptive approach because the environment is extremely volatile. Below I outline practical strategies and rules I’d follow if trading AVNT personally.

1) Position sizing and time horizon

Keep positions small relative to your portfolio. If you are purely speculative, limit exposure to small percentages (e.g., 1–3% of total capital). For swing trades, prefer mid-sized allocations (3–7%) but with stop-loss discipline. For longer-term allocation (if you truly believe in protocol adoption), allocate only what you can hold through drawdowns (10–20% max for experienced allocators).

2) Use tight risk management — stops and takers

Because of potential flash crashes, consider placing stop-limits and reduce leverage on margin positions. If you are trading on exchange order books, watch for slippage and widen stops slightly to avoid stop-hunts, but never eliminate stops entirely.

3) Scalping and short-duration trades

AVNT can be a scalper’s dream — the volatility creates many micro-trends. For scalpers, I recommend pairing your execution with a reliable crypto trading signal service that specializes in scalping signals and precise entry/exit levels. Signals that provide clear stop and take-profit levels can reduce emotional mistakes and improve execution when the market moves fast.

Note: If you plan to scalp AVNT using leverage, make sure you fully understand margin rules and funding rates on the exchange you use.

4) Longer-term investing

For investors who believe in Avantis’ product and team, treat AVNT as a high-risk allocation to a protocol that may capture a meaningful niche in derivatives and RWA. Rebalance periodically and be prepared for significant volatility. Use dollar-cost averaging to smooth entry into larger positions.

5) Arbitrage and liquidity capture

Arbitrageurs should watch for price discrepancies between centralized exchange listings and DEX liquidity pools. During listing periods these gaps can be large. But executing arb requires capital, fees, and fast execution — this is best done by experienced traders or market makers.

Key catalysts and what to watch next

Launching the AVNT Price Prediction model requires tracking catalysts. These will determine momentum and potential price expansion:

- Exchange listings and liquidity: More reputable listings increase accessibility and can push price higher. Watch order book depth across centralized exchanges and DEX pools.

- Protocol usage metrics: TVL, number of unique traders, open interest in perpetuals, and cumulative traded volume. Sustained growth here is the most important durable indicator.

- Vesting and unlock schedules: Team and investor unlocks can create selling pressure. Know the tokenomics timeline.

- Regulatory news: Coverage of RWA tokenization and derivatives regulation could materially affect adoption or restrict product offerings in certain jurisdictions.

- Macro events: Interest rate decisions and liquidity injections can legitimize another speculative leg higher in crypto markets, benefiting AVNT short-term.

For example, an expected interest rate cut can produce a market-wide surge in risk assets. If that happens and traders flood decentralized perpetual platforms, AVNT could see increased volume and price appreciation. Conversely, a hawkish surprise or regulatory clamp on derivatives could cause a rapid pullback.

Practical checklist before you trade AVNT

Here’s a short checklist I recommend you run through before taking a position:

- Confirm exchange listing status and compare order book depth.

- Check the team/vesting schedule and any imminent unlocks.

- Review protocol revenue capture mechanics (does AVNT accrue fees?).

- Decide on a time horizon — scalp, swing, or long-term.

- Set strict position sizing rules and pre-plan exit levels.

- Consider subscribing to a crypto trading signal service if you need precise scalping/trading guidance during volatile listing windows.

Integrating services like a reliable crypto trading signal offering can be extremely helpful during the first few days of a listing. Signals that focus on short-duration setups and show historical performance can make execution cleaner and help prevent costly emotional mistakes when volatility spikes.

AVNT Price Prediction — a simple numerical framework

To turn the scenarios into numbers, let’s use simple multipliers from an early listing baseline:

- Bear case: 0.2x–0.6x of current price (deep correction and consolidation)

- Base case: 3x–10x over 3–6 months if Avantis keeps strong product usage and avoids major liquidations or technical issues

- Bull case: 10x–50x+ over 6–12 months in a best-case adoption and macro tailwinds scenario

These ranges are wide because early-stage token prices are highly sensitive to narrative, liquidity, and macro conditions. The important thing is not the exact number but the process: monitor usage metrics, liquidity, and unlock schedules and adjust your AVNT Price Prediction as new data arrives.

Governance, legal structure and long-term viability

Avantis is governed by an Avantis Foundation based out of the Cayman Islands. This is a common structure in crypto, designed for administrative flexibility and favorable regulatory treatment in certain jurisdictions. Governance structure matters because it determines how protocol updates, fee changes, or emergency interventions happen.

Key governance questions to monitor:

- How are fee changes proposed and approved?

- Is there an emergency multisig or safety mechanism for oracle failures or liquidation issues?

- What is the process for listing additional RWAs and ensuring legal compliance on new assets?

A robust governance structure combined with transparency about risk controls (oracles, liquidation mechanisms, insurance pools) will materially increase the protocol’s long-term viability and positively influence AVNT Price Prediction over the medium term.

Common mistakes traders make with tokens like AVNT

Because Avantis combines explosive features — zero-fee narrative, 500x leverage, RWA derivatives — it attracts certain predictable mistakes:

- Overleveraging: Trying to catch a moonshot with 100x+ leverage is a fast path to account wipe-out.

- Chasing price: Buying at instant ATHs driven by headlines without checking liquidity or protocol metrics.

- Ignoring unlock schedules: Massive future sell pressure can arrive from token unlocks — always review tokenomics.

- No exit plan: Entering without pre-defined stop-loss or profit-taking rules during a parabolic move.

Avoid these pitfalls. Plan trades, size positions, and use signals where appropriate if you are not a full-time scalper or market maker operating automated strategies.

How to integrate AVNT into a diversified crypto portfolio

For most investors, AVNT should be a satellite position — meaning a small, high-risk allocation complementing core crypto holdings like BTC and ETH. The percentage depends on risk tolerance, but for typical investors I’d recommend under 5% allocation to extremely volatile early-stage tokens. For more aggressive traders, this might expand to 5–10% with tight risk controls.

Rebalancing rules:

- Review allocations weekly during high volatility periods.

- Trim winners to maintain target risk levels — selling into exuberance avoids holding overvalued assets into corrections.

- Use dollar-cost averaging if buying for the long term to avoid timing risk.

AVNT Price Prediction: What I’m personally watching and trading

Here’s what I’m watching and how I’m approaching the asset personally:

- Daily protocol metrics: TVL, open interest, unique traders, and cumulative revenue trends.

- Exchange depth: How price performs across centralized order books vs DEX pools.

- Stress tests: Watching for any oracle or liquidation issues during high leverage events.

- Macro catalysts: Interest rate decisions and risk-on flows.

From a trading viewpoint, I’m using a mix of scalps and small swing trades while keeping a modest core allocation for medium-term upside. When I scalp during early listing volatility I often rely on professional-grade crypto trading signal alerts to refine entry and exit timing — especially on trades where leverage is employed. These signals can help mitigate the human errors that happen in high-speed markets.

Conclusion — Where does this leave AVNT Price Prediction?

Avantis is one of the most exciting and volatile new plays in DeFi today. The AVNT Price Prediction depends on two core dimensions: whether volume converts into sustained usage and whether the product can manage the systemic risks created by extreme leverage and RWA complexity.

Short-term: expect wild price swings, potential sharp retracements and intense media focus. Mid-term (3–6 months): if Avantis demonstrates stable revenue capture and increases active users, AVNT could be a multi-bagger from early listing levels. Long-term: adoption of tokenized RWAs across DeFi would be a multi-year tailwind, and protocols that win today could become foundational pieces of on-chain finance.

Trading practicalities: for those active in the market, combine strict risk management with the right tools. If you scalp AVNT or trade intraday during listing windows, pairing your execution with a reliable crypto trading signal service focused on scalps and short-duration trades can materially improve outcomes — it keeps setups disciplined and reduces emotional errors under stress.

My AVNT Price Prediction remains cautiously optimistic: big upside exists, but so too does existential risk from liquidations and regulatory issues. Trade small, plan exits, and watch the fundamentals closely.

FAQ

Q: What is the most realistic AVNT Price Prediction for the next 3 months?

A: The most realistic near-term scenario is continued volatility with potential for a multi-fold move if volume sustains. In practice, expect a base scenario of 3x–10x if protocol usage grows and the macro environment remains risk-on. Below that, the bear case is a significant retracement if the listing frenzy cools or if leverage-driven liquidations trigger broad sell pressure.

Q: Is AVNT a buy now?

A: That depends on your time horizon and risk tolerance. For traders comfortable with extreme volatility, AVNT offers scalp and swing opportunities. For investors, consider a small, carefully sized position if you believe in Avantis’ long-term product-market fit. Always check tokenomics, unlock schedules, and exchange liquidity before buying.

Q: How dangerous is 500x leverage on Avantis?

A: Extremely dangerous. 500x means a 0.2% adverse move can liquidate the position. It is suitable only for experienced margin traders who understand how to manage risk and funding. Retail traders should avoid such leverage unless they have the knowledge, discipline, and stop mechanisms in place.

Q: How should I size my AVNT position?

A: Use position sizing rules: speculative positions 1–3% of portfolio, swing trades 3–7%, and long-term core bets no more than 10–20% for experienced allocators who understand the risk. Your personal size depends on risk appetite and ability to withstand drawdowns.

Q: Can Avantis become a top-100 token?

A: Yes — if it keeps high volumes and converts them into recurring protocol revenue with continued product adoption. Listings, institutional ties and the derivatives market growth can propel AVNT into the top 100, but it requires sustained adoption beyond initial FOMO.

Q: Should I use a crypto trading signal service for AVNT?

A: For short-duration trades, scalps, and volatile listing windows, using a reputable crypto trading signal service can help with timing, entries and exits. Signals aren’t a substitute for risk management, but they can be an effective tool for traders who need structure during fast-moving markets. For high accuracy crypto signals, you can see our packages.

Q: What are the red flags to watch for?

A: Red flags include sudden large token unlocks, oracle failures, repeated liquidation cascades, sudden regulatory notices on derivatives or tokenized RWAs, and falling active users despite high volume. Those are signs the token’s price may not be supported.

If you want to follow my other picks and the coins I personally hold, check the resources I run where I share positions and reasoning with members. And if you trade AVNT aggressively during the launch phase, consider using a structured approach with strong signals for scalps — it can be the difference between disciplined execution and emotional losses.

Good luck, trade carefully, and remember: the upside can be incredible, but the risks are real. AVNT Price Prediction depends on product adoption, risk controls, and macro flows. Stay informed and stay disciplined.