The secret order block strategy turns the common problem of multiple order blocks into a clear decision. When a chart makes higher highs and higher lows, it creates several potential zones to buy from. Instead of guessing which zone will hold, this approach uses two simple concepts — inducement and imbalance — to identify the true institutional zone with the highest probability of success. Apply this method and your order block accuracy improves immediately.

Table of Contents

- Why multiple order blocks confuse traders

- The inducement concept explained

- How to use the secret order block strategy step by step

- Example trade breakdown

- Practical tips and traps to avoid

- Key takeaways

- FAQ

Why multiple order blocks confuse traders

Seeing several order blocks on a chart is normal. The hard part is choosing which one to trade. The instinctive rules most traders use often fail: some assume the lowest zone must be strongest, others pick the most recent zone that looks clean. Both choices can lead to weak trades because they ignore where liquidity and untested price areas live.

The inducement concept explained

The heart of this method is the inducement concept. An inducement zone looks like a great entry to retail traders but is actually a trap. It attracts entries and stop placements, then gets taken out so price can reach a deeper, stronger zone where institutions have real orders and the move formed.

What makes a zone an inducement

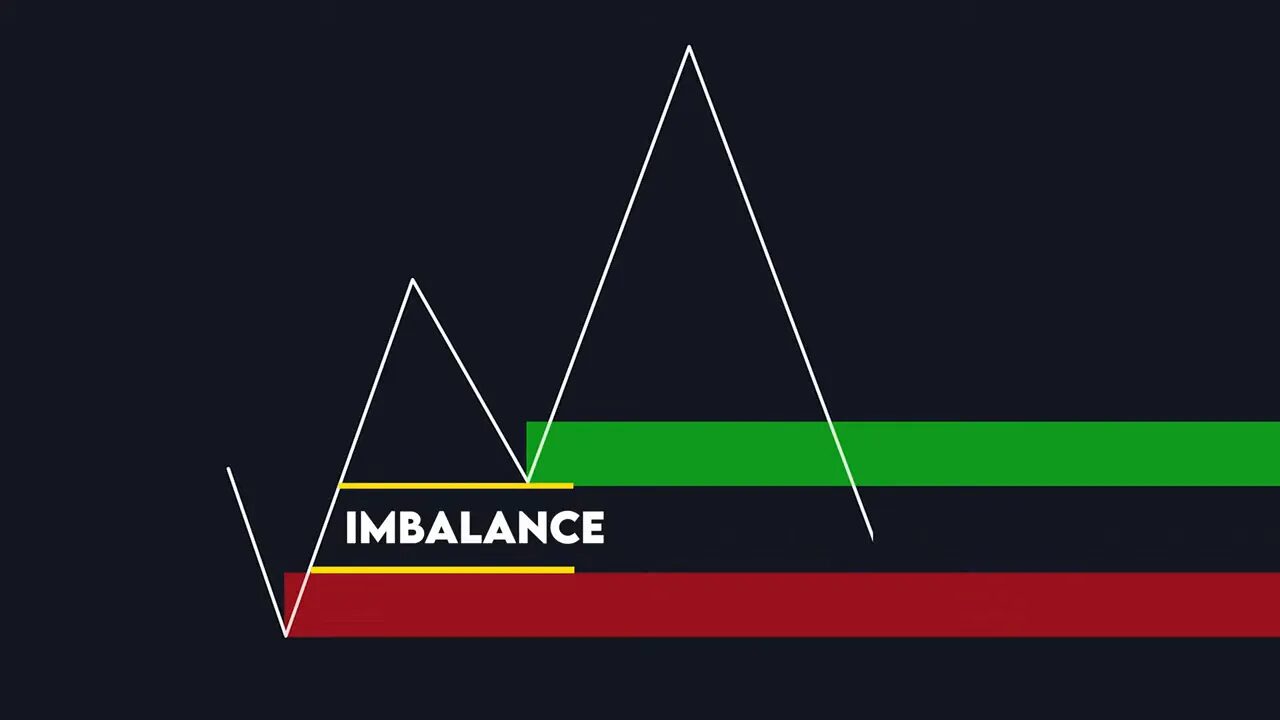

An inducement zone has two main characteristics: it sits above an untested imbalance and it contains concentrated liquidity from stops and limit orders. When price returns to it, those stop losses and breakout orders create the fuel for a sweep. Once swept, price often continues to the true demand or supply zone below.

Imbalance: the fingerprint of unfinished business

An imbalance is simply a price area that has not been retested. Price has jumped away from it, leaving orders unfilled. Markets often revisit these areas to clear the imbalance. If an order block sits above such an imbalance, expect price to probe lower before the real buying or selling interest kicks in.

How to use the secret order block strategy step by step

- Mark all order blocks you can reasonably identify during the trend. Note which ones price started moves from — institutional origin is important.

- Locate imbalances below those blocks. Any untested gap or quick sweep suggests liquidity and future retests.

- Label inducement zones — blocks sitting above clear imbalances are suspect. Remove them from your primary candidate list.

- Seek the true zone — the order block that price actually used to break significant highs or lows and that stands above no untested imbalance.

- Drop to a lower timeframe for precision once price revisits the true zone. Look for structure change, confirmations like a break of short-term structure, and a clean imbalance that aligns with your higher timeframe stop placement.

- Risk setup — set stop loss below the zone low and target the previous swing high or an appropriate risk-reward level.

Example trade breakdown

Imagine an uptrend with three demand zones. The top zone shows an imbalance underneath, so it is an inducement and removed. The lowest zone looks tempting because it is the deepest, but a closer look shows it barely helped price break a previous high. That means the middle zone actually supplied the force that created the legitimate breakout. The middle zone is the true order block.

After price sweeps the inducement zone and heads into the true zone, drop to a 15 minute timeframe for a structural shift confirmation. Wait for price to break short-term structure, then fill into the imbalance on the lower timeframe and enter. Place your stop below the confirmed low on the higher timeframe and take profit at the previous high. This disciplined process is the essence of the secret order block strategy.

Practical tips and traps to avoid

- Do not assume lower equals stronger — the deepest order block is not automatically the safest trade.

- Watch for weak highs — if a high barely prints above the previous one, the impulse likely came from a different block.

- Confirm on a lower timeframe to reduce false entries and to time better stops and targets.

- Manage size since even the strongest order block can fail; keep position sizing consistent with your risk rules.

Key takeaways

The secret order block strategy simplifies trade selection by removing inducement zones and focusing on the order block that actually moved price. By combining liquidity awareness, imbalance identification, and lower timeframe confirmations, you lift your edge and avoid common traps that create many retail losses.

FAQ

How often should I expect the chosen order block to hold?

No strategy wins every time. The secret order block strategy improves probability by eliminating traps. Expect better win rates than random selection, but still plan for occasional losses and trade with proper risk management.

How do I identify an imbalance on the chart?

Look for sharp, one-directional moves that left little to no retest of price levels. These gaps or single candles that skipped price create imbalances. Mark them and watch how price often returns to those areas to gather liquidity.

Can this be used in any market or timeframe?

Yes. The principles of inducement and imbalance apply to forex, crypto, stocks, and futures. Use higher timeframe context for zone strength and lower timeframes for entry precision. The method scales across timeframes.

What is the best way to confirm a true zone on a lower timeframe?

Wait for a break of short-term structure and a pullback into a small imbalance or order block on the lower timeframe. Entry should align with the higher timeframe zone and show signs of institutional buying or selling like quick rejections and momentum continuation.

Is the secret order block strategy a complete trading system?

It is a powerful selection filter and entry framework but should be combined with money management, a defined edge, and a plan for exits. Treat it as a core method for picking quality zones, then layer in risk controls and trade psychology.