Table of Contents

- Why breakouts fail and how to stop losing to them

- What exactly is a breakout?

- Common breakout patterns — and what really matters

- The single biggest mistake traders make

- Momentum candles: your confirmation signal

- Entry and stop-loss rules that tilt the odds in your favor

- Two-step take profit system — capture gains and let winners run

- Using the Chandelier Exit as your trailing exit

- Example trade walkthrough

- Applying this to crypto and multi-chain markets

- Practical checklist before taking a breakout trade

- Frequently asked questions

- Final thoughts

Why breakouts fail and how to stop losing to them

Breakouts are tempting because when they work, they often lead to fast, large moves. You draw a support line, a resistance line, wait for price to burst through, and imagine the upside. The reality is many breakouts are false. The price pokes above resistance, then reverses and leaves traders with losing positions. The difference between walking away with a win or a loss comes down to setup selection, confirmation and risk management.

What exactly is a breakout?

A breakout happens when price escapes a clear area of consolidation defined by repeated rejections at support and resistance. Think of it as the moment price bursts out of a range that has multiple touch points. The more touches that define those levels, the stronger the zone and the higher the potential reward when it actually breaks.

Common breakout patterns — and what really matters

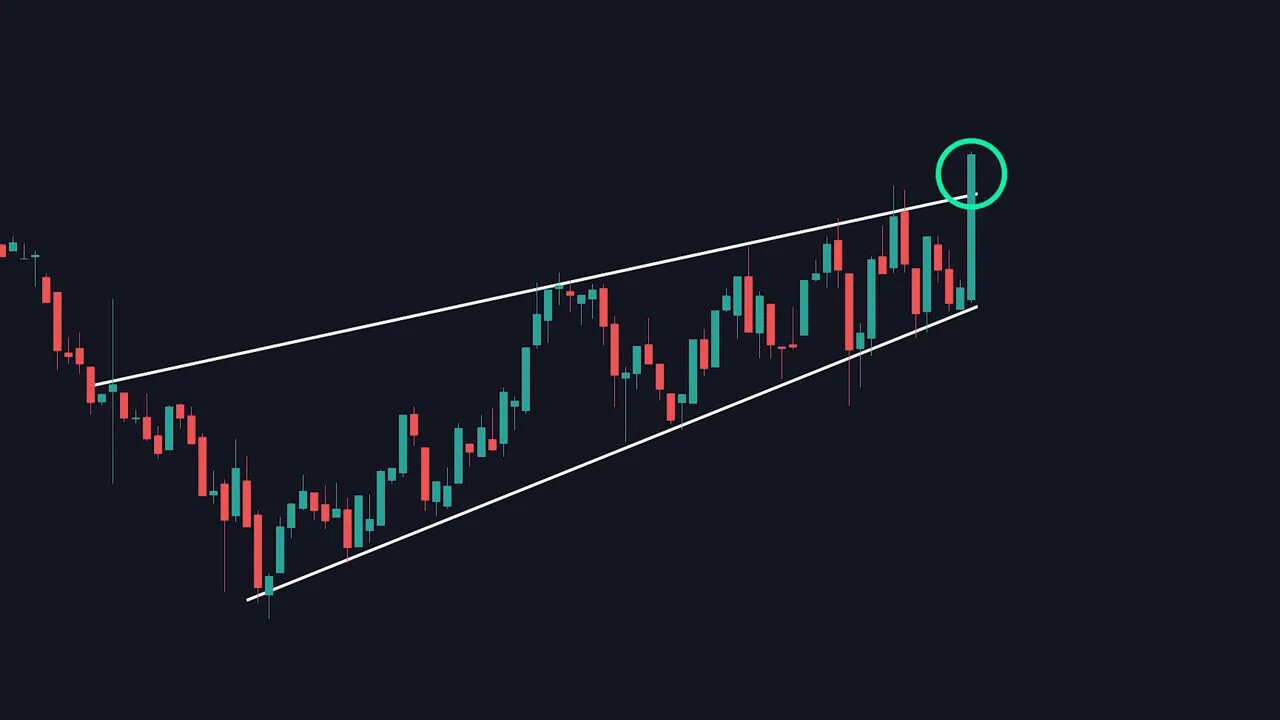

Patterns you might recognize include flags, wedges, pennants, triangles and rectangles. The precise shape rarely matches textbook drawings. What matters is the market making two clear levels of support and resistance, a period of consolidation, and then a breakout. Focus on the structure (multiple touches, shrinking range, volume behavior) rather than getting hung up on the pattern name.

The single biggest mistake traders make

Traders often enter the instant price breaches resistance or support. That instant entry gets them into many false breakouts where price quickly reverses. A better approach waits for a confirmation that momentum is actually pushing price through the level.

Momentum candles: your confirmation signal

Use momentum candles to separate real breakouts from false ones. A momentum candle is usually one of two things:

- One large candle with a substantial body closing beyond the level.

- Three consecutive medium candles moving in the breakout direction.

If the candle only pokes its wick above resistance and the body closes mostly below, that is not momentum. Wait for the majority of the candle body to be beyond the level, or for the 3-candle confirmation.

In the example above the first candle only touched the resistance with its tip — ignore it. In the stronger example a sequence of green candles closes progressively outside the level and that is where the edge appears.

Entry and stop-loss rules that tilt the odds in your favor

Entry: take the trade at the close of the momentum candle (or on confirmation of the 3rd candle). Stop loss: place it just below the broken resistance (now acting as support).

Why this works: if price pulls back and respects the old resistance as support, it will not reach your stop and you remain profitable. If the breakout keeps accelerating, you are already positioned to capture the move.

Two-step take profit system — capture gains and let winners run

Breakouts often offer large upside, so avoid exiting the entire position at the first target. Use a two-step approach:

- Set an initial take profit at a 1.5 risk-reward ratio. When price hits this level, sell half of the position to lock in profit.

- Move your stop loss to the initial take profit level and let the remaining half run. Use a trailing exit indicator to capture extended moves.

This method guarantees part of your profit while keeping exposure to further upside without risking the initial gain.

Using the Chandelier Exit as your trailing exit

The Chandelier Exit is a simple tool for trailing stops. On charting platforms search for “chandelier stop” and set the ATR multiplier to 2. It will give you a dynamic level that trails price and flips color when the trend weakens. Once your Chandelier changes color, exit the remaining position.

The sequence: sell half at the 1.5 target, move your stop to that target, enable the Chandelier with ATR multiplier 2, and exit when the Chandelier signals a change. That one extra step often captures a large chunk of profit that a single-take-profit approach misses.

Example trade walkthrough

1. Identify a consolidation with multiple touches forming support and resistance.

2. Wait for a momentum candle (big body) or three consecutive confirming candles that close outside resistance.

3. Enter at the close of the momentum candle. Place stop loss just below the broken level.

4. Set initial take profit at 1.5 R, sell half when hit, move stop to that secured level, and let the rest run until the Chandelier exit flips.

Applying this to crypto and multi-chain markets

Crypto markets are notorious for fast breakouts and false breakouts during news-driven cycles and low liquidity periods. The momentum candle and two-step take profit framework translates well to crypto, but be mindful of exchange spreads, slippage and differing session activity across chains. If you trade across multiple crypto pairs, consider pairing this method with a reliable signal feed to spot high-probability breakouts across exchanges and blockchains.

A crypto spot trading signals service can help surface setups that match your breakout criteria, saving time and reducing emotional trading when markets move quickly. Use signals as an additional filter, then apply momentum confirmation and the two-step exit to execute with discipline.

Practical checklist before taking a breakout trade

- Is the level defined by multiple touches? The more touches the better.

- Does the breakout include a momentum candle or three confirming candles?

- Is volume or volatility supporting the move? Low-volume pokes are suspect.

- Is your stop loss placed below the broken level and sized to a tolerable risk?

- Have you set a 1.5 initial target and planned your Chandelier trail for the remainder?

- For crypto, account for spreads, slippage and potential exchange-specific quirks.

Frequently asked questions

How do I define a momentum candle?

A momentum candle is either a single large-bodied candle that closes beyond the level or a run of three medium candles all closing in the breakout direction. Wicks that merely touch the level do not count.

When should I enter after a breakout?

Enter at the close of the momentum candle or immediately after the third confirming candle. Avoid chasing initial wick pokes that do not close convincingly beyond the level.

Where should I place my stop loss?

Place the stop loss just below the broken resistance, which becomes new support. This placement protects against normal pullbacks while keeping risk controlled.

Why use a two-step take profit?

Selling half at a 1.5 target locks in profit and reduces emotional pressure. Letting the rest run with a trailing exit captures larger trends and prevents leaving money on the table.

How do I set up the Chandelier Exit?

On most charting platforms search for “chandelier stop” and set the ATR multiplier to 2. Use its color change or flip as your signal to exit the remaining position.

Do these rules work for all markets?

The framework is market neutral and can be applied to stocks, forex and crypto. Adjust for market-specific factors like liquidity, session times and volatility.

Can I combine signals with this strategy?

Yes. Combining a curated signal service with momentum confirmation can reduce screen time and surface better setups. For traders focused on crypto, a trustworthy crypto spot trading signals feed can highlight breakouts across multiple pairs and chains while you apply the entry and exit rules explained here.

Final thoughts

False breakouts are less about bad luck and more about missing confirmation and poor risk rules. By waiting for momentum candles, using a disciplined stop placement, and adopting a two-step take profit with a Chandelier trail, you stack the odds in your favor. The plan locks in partial profit early and lets the rest ride with a smart trail that exits when the trend weakens.

Use the checklist, apply the confirmations consistently, and consider a reliable crypto spot trading signals service if you trade fast-moving crypto markets. Discipline and process beat impulse; the rest is just execution.