Table of Contents

- Overview

- Why DEMA and SuperTrend?

- Setup: Indicators and Settings

- Core Rules

- Risk Management and Profit Potential

- Practical Tips and Enhancements

- Backtest Snapshot

- How to Combine This Strategy with Broader Market Analysis

- Example Trades (What You Should Expect)

- Frequently Asked Questions

- Final Notes

Overview

A simple, rules-based approach using only two free indicators can cut through market noise and produce consistent gains. The strategy pairs a 200-period Double Exponential Moving Average (DEMA) to define trend with a SuperTrend indicator (ATR-based) for entries and exits. It works across assets and time frames, but it is especially useful in fast-moving crypto markets where momentum and timely entries matter.

Why DEMA and SuperTrend?

The DEMA is an upgraded exponential moving average designed to reduce lag and deliver faster signals than a standard EMA. That quicker reaction helps spot trend direction earlier while the SuperTrend converts volatility into a clean buy or sell signal using ATR. Together they provide a low-friction system: DEMA confirms the bias and SuperTrend times the entries and exits.

Setup: Indicators and Settings

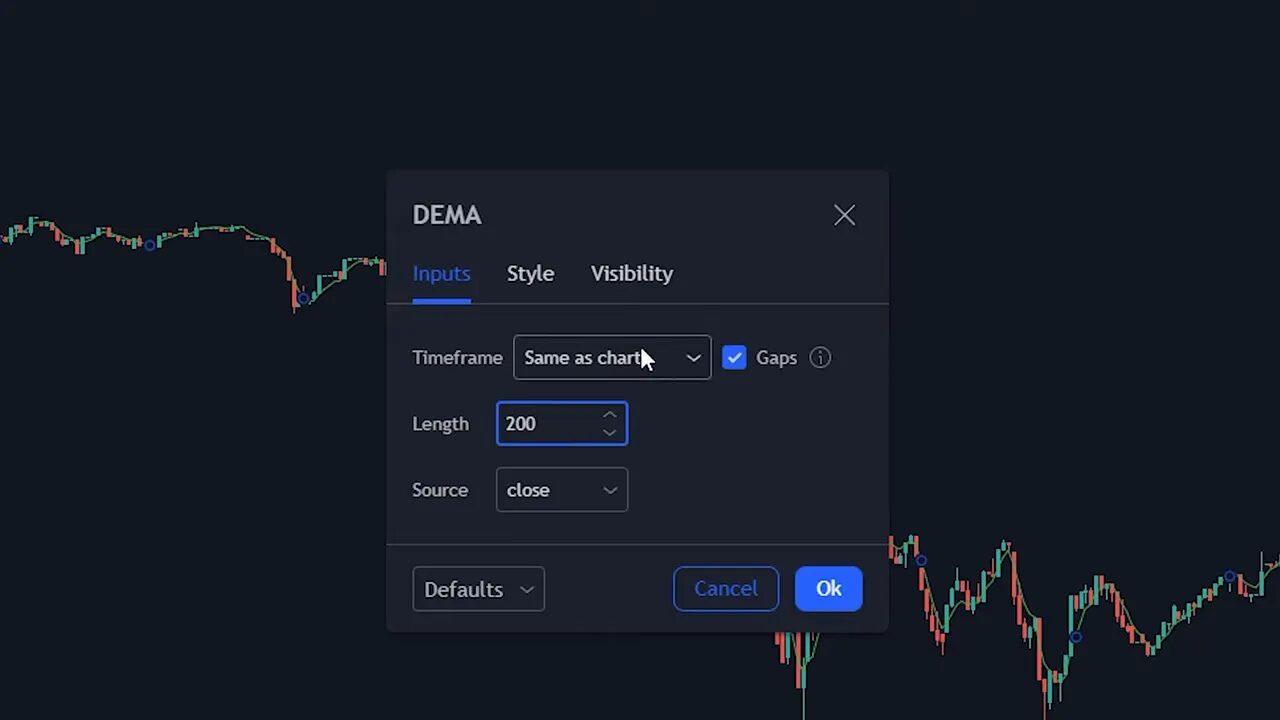

Add these two indicators on your charting platform:

- DEMA set the length to 200 and style it so it stands out (blue works well).

- SuperTrend set ATR period to 12 and ATR multiplier to 3.

Core Rules

Long entries

- Price must be above the 200 DEMA.

- Wait for the SuperTrend to flip to a buy signal. Only enter after the signal candle closes.

- Place stop loss at the SuperTrend buy signal line.

- Exit only when SuperTrend flips to a sell signal.

Short entries

- Price must be below the 200 DEMA.

- Enter on a SuperTrend sell signal once that candle closes.

- Stop loss goes at the SuperTrend sell signal line.

- Hold until SuperTrend flips back to a buy signal, then exit.

Risk Management and Profit Potential

Unlike fixed target strategies, this method uses the SuperTrend as a trailing exit. That means profit potential is effectively open ended: some trades produce very large reward-to-risk ratios because the trend can stay intact for long stretches. Stop placement is mechanical (SuperTrend line), which keeps emotion out of trade management.

Keep position sizing sensible. A longer DEMA (200) assures trades are taken in the direction of a higher-timeframe trend, lowering the frequency of false signals and protecting capital during noisy market conditions.

Practical Tips and Enhancements

The following tweaks can improve entries and reduce missed opportunities.

- When SuperTrend gives a buy while price is still below the 200 DEMA, wait for price to cross the DEMA and then enter. This captures signals that originate just before the trend confirmation.

- Use Fibonacci Bollinger Bands (FBB) as an optional safety net. Treat the outer Fibonacci Bollinger lines as absolute extremes: if price touches the outer FBB line, consider taking profits immediately even if SuperTrend is still green. Price often rebounds after touching these extremes.

Implementing FBB requires changing the indicator settings to only show the key Fibonacci bands (uncheck all but the ones) and color them for visibility. This is an optional filter that can capture outsized retracements and lock in gains during sharp swings.

For traders focused on crypto, combining this mechanical setup with a reliable crypto trading signals service can help prioritize opportunities across multiple blockchains and save time scanning volatile markets. Quality signals used alongside clear trend and timing rules can improve trade selection while preserving the strategy’s simplicity.

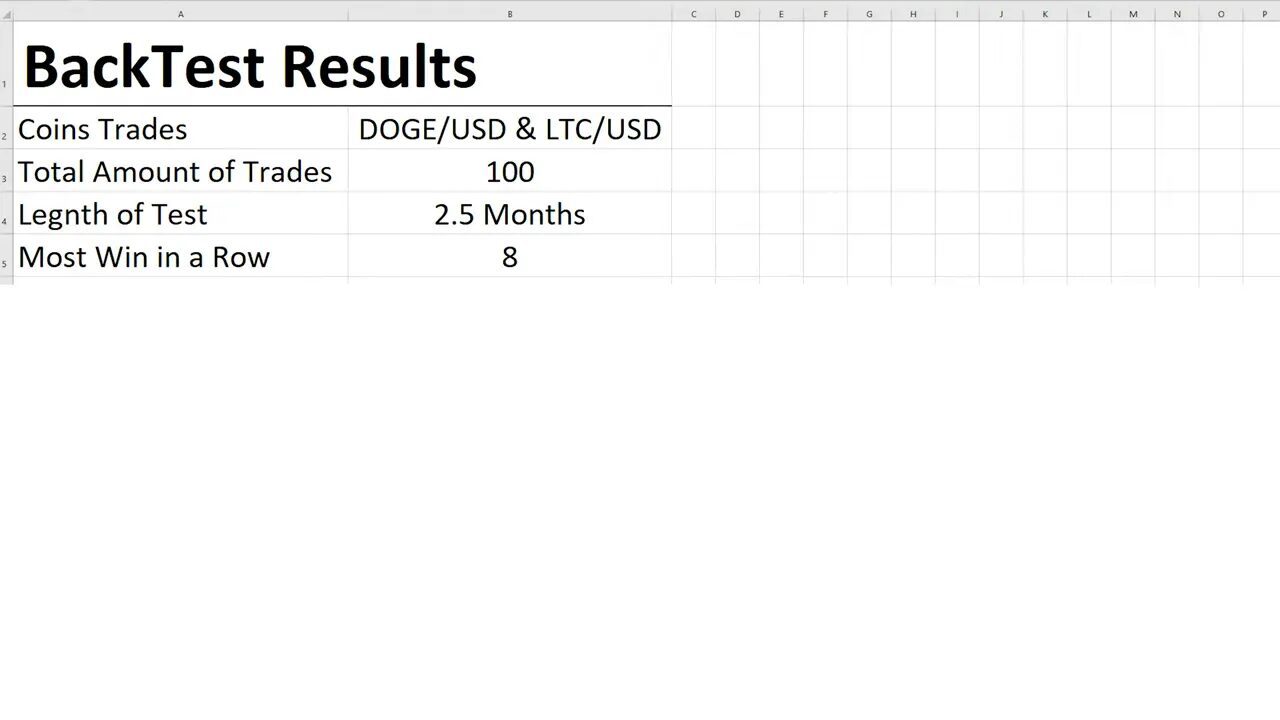

Backtest Snapshot

A focused 100-trade backtest conducted over roughly 2.5 months on two crypto pairs produced notable results:

- Trades: 100 (DOGE and LTC)

- Win rate: 60% (60 wins / 40 losses)

- Max win streak: 8

- Max loss streak: 3

- Total gain: 130.14%

Those stats highlight how a mechanical, trend-following approach can compound returns when the rules are simple and consistently applied. Backtesting across multiple assets and longer time frames is recommended before live deployment.

How to Combine This Strategy with Broader Market Analysis

Use higher-timeframe DEMA checks for macro bias and scan multiple assets with SuperTrend alerts to capture the best opportunities. Adding a curated feed, such as a vetted crypto trading signals service, can speed up opportunity discovery—especially across fast-moving tokens where manual scanning is time consuming.

Example Trades (What You Should Expect)

Expect clean trends with occasional whipsaws. The use of a 200 DEMA reduces the frequency of choppy trades while SuperTrend keeps exits disciplined. Typical pattern: price crosses DEMA, SuperTrend confirms, you enter, and the trade runs until the trend weakens and the SuperTrend flips.

Frequently Asked Questions

What time frames work best with this DEMA + SuperTrend system?

The strategy is flexible. It performs well on intraday charts such as 15 minutes and also on daily charts for swing trading. The 200 DEMA provides the trend bias across time frames—shorter frames give more signals but increase noise.

How should I size positions and place stops?

Position size should be based on risk per trade, commonly 0.5–2% of account capital. Stop loss is the SuperTrend signal line for each entry. Calculate size so that the dollar risk matches your predefined tolerance.

Can this strategy be used on altcoins and smaller cap tokens?

Yes, but smaller cap tokens can be more volatile and may produce whipsaws. Use higher time frames or supplement with additional filters like FBB or a reliable crypto trading signals feed to prioritize higher-probability setups.

Should I use a fixed profit target or let SuperTrend decide the exit?

The strength of this approach is letting SuperTrend define the exit, allowing large trends to compound gains. A fixed target can be used alongside for partial profit-taking, but the primary exit should remain SuperTrend-based.

Is the Double EMA always better than a standard EMA?

DEMA offers less lag and faster signals, which helped this specific system in backtests. However, less lag can increase sensitivity to noise. It is worthwhile to test both DEMA and EMA on the assets and time frames you trade to find what fits your risk tolerance.

How can I test this strategy before trading real capital?

Backtest across historical data for the asset and time frame you plan to trade. Paper trade or use a small live allocation while monitoring results. Track win rate, drawdowns, and risk-adjusted returns to validate performance.

Final Notes

The appeal of this setup is its clarity: trend defined by a 200 DEMA, signals and exits handled by a tuned SuperTrend, and optional filters like Fibonacci Bollinger Bands to capture extremes. Its simplicity makes it repeatable and scalable.

For traders who want to focus on high-probability crypto opportunities without endless scanning, integrating disciplined rules with curated crypto trading signals can be a practical way to find setups across multiple blockchains while keeping execution mechanical.

Consistent application of simple rules often outperforms complex systems that are hard to follow.