The list of Biggest Trading Mistakes is shorter than you think. Avoid these six recurring errors and you will instantly trade more consistently. This guide breaks down what goes wrong, why it happens, and exactly what to do instead — in plain language, no fluff.

Table of Contents

- 1. Entering too late — don’t chase spikes

- 2. Using too much money — size kills discipline

- 3. Not setting a stop loss — a self-inflicted wound

- 4. Too many indicators — clean charts win

- 5. Not trading with the trend — work with the market, not against it

- 6. Not keeping a trading log — feedback is the only way to improve

- FAQ

- Final note

1. Entering too late — don’t chase spikes

Fear of missing out is the number one emotion that ruins entries. You mark a resistance level, plan to enter on the breakout, then step away. When you return the price has already rocketed above your entry and panic sets in. The natural reaction is to chase the move and buy at a worse price.

If you are late, be honest: call it a missed opportunity. Good traders either move on to the next setup or wait for a pullback that gives a cleaner risk/reward. Chasing increases your risk and turns a clear plan into gambling.

2. Using too much money — size kills discipline

Scaling up position size because you had a winning run is seductive, but dangerous. If $100 trades felt comfortable and you suddenly trade $1,000 because you want faster gains, you’ll start trading with emotion the moment the market moves against you.

Stick to sizes you can handle. Trading is about steady account growth. If a larger position causes panic when it dips, you will abandon your plan and incur unnecessary losses.

3. Not setting a stop loss — a self-inflicted wound

There is always a price that invalidates your thesis. Not placing a stop loss is leaving the front door open. Whether day trading, swing trading, or investing, decide the exact level where you no longer want exposure and set the stop.

A stop loss prevents a small mistake from becoming a catastrophic one. It limits emotional decision making and enforces discipline. Pick a stop size that fits your strategy and risk tolerance, then respect it.

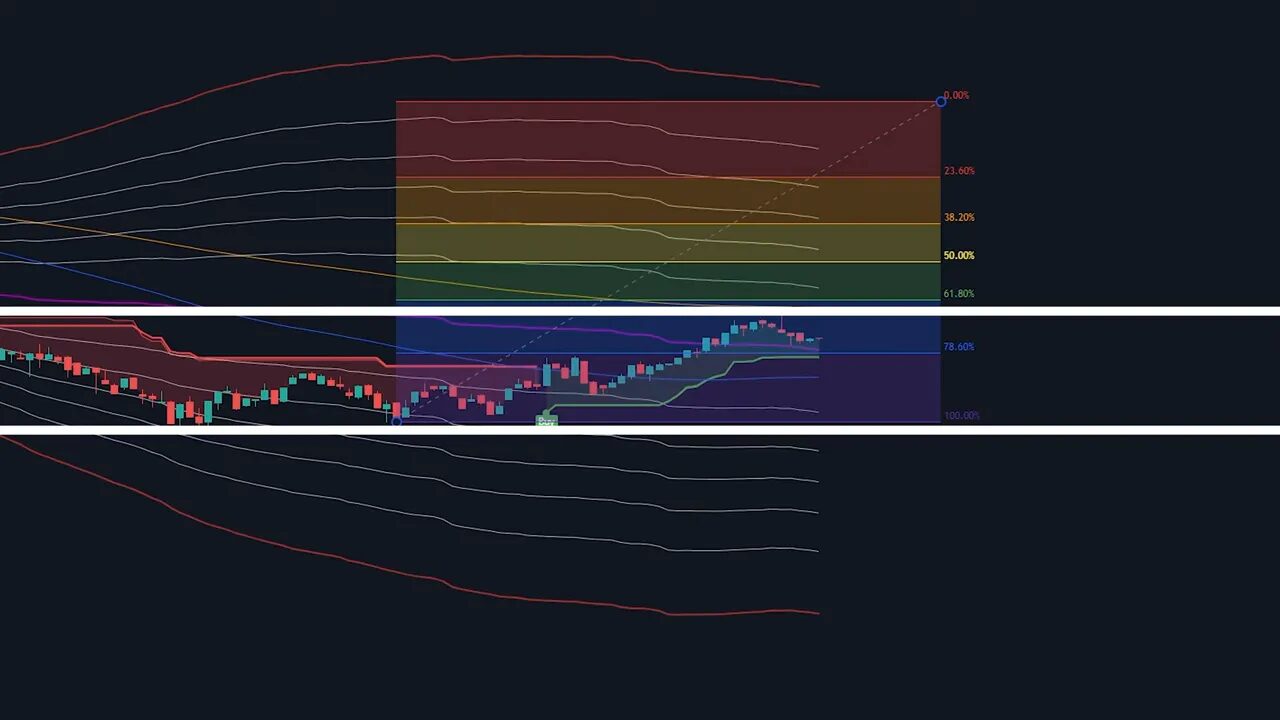

4. Too many indicators — clean charts win

Adding every indicator you see does not make your analysis smarter. Most indicators repeat similar momentum or trend information. Overcrowded charts hide signals and encourage conflicting decisions.

Use a couple of tools that complement each other and stick to one strategy per setup. Clean charts reduce confusion and help you execute with confidence.

5. Not trading with the trend — work with the market, not against it

The simplest edge is trading with the market flow. Buy when price is above a long-term moving average and consider shorts when it is below. Trying to pick the absolute bottom or top is a low-probability game.

For most traders the 200-day exponential moving average is a practical filter: price above it signals an uptrend, below it signals a downtrend. Align entries with that direction and your setups will have a higher chance of success.

For traders active in crypto markets, timely information can make all the difference. Subtle, reliable crypto signals can help you spot trend-confirming entries and avoid late, emotional entries across different blockchains. When used thoughtfully, signals complement your process — they do not replace sound risk management.

6. Not keeping a trading log — feedback is the only way to improve

Without record keeping you are missing the single best tool for improvement. Keep a trading log with screenshots, entry and exit points, and your reasoning. After the trade, note what emotions you felt and what you did right or wrong.

Reviewing your log ruthlessly turns random outcomes into lessons. Over time you stop repeating the same mistakes and build habits that compound into consistent returns.

Rules to follow every session

- Plan every trade: entry, stop, target.

- Size appropriately: risk only what you can accept losing.

- Trade with the trend: use a long-term moving average as a filter.

- Keep charts clean: fewer indicators, clearer decisions.

- Log trades: learn faster by reviewing mistakes and wins.

“If you are late, you’re late.”

That blunt sentence summarizes a lot. Trading is not about being right 100 percent of the time. It is about making high-probability decisions and protecting capital when you are wrong.

FAQ

How do I decide an appropriate stop loss level?

Base it on price structure: place stops below clear support or beyond a volatility cushion. The exact distance depends on your timeframe and risk tolerance. The key is consistency and that the stop makes the trade invalid if hit.

How large should my position be relative to my account?

Risk a fixed percentage of your account per trade, commonly 0.5 to 2 percent. This keeps emotional pressure low and preserves longevity in the game.

How often should I review my trading log?

Review weekly for short-term trends and monthly for broader performance. After a losing streak, do an immediate review to find recurring mistakes.

Can crypto signals help me avoid these mistakes?

When combined with strict risk rules and a clear strategy, crypto signals can highlight opportunities that align with market trends. Use them as a supplemental tool for market analysis and entry timing, not as a substitute for discipline.

Final note

Fix these Biggest Trading Mistakes first and everything else will get easier. Trading discipline, sensible sizing, clean charts, trend alignment, stops, and a logging habit form the foundation. Improve those areas and your edge will show up in your results.