Imagine holding $12 in your hand and then picturing $1 million in cash. That gap looks enormous, but the path from tiny weekly contributions to a seven figure nest egg is more straightforward than most people think. The trick is a plan that combines honest spending habits, smart withdrawal rules, and the relentless power of compound interest.

Table of Contents

- The FIRE framework: retire on your terms

- The three FIRE subgroups — pick your lifestyle

- The math: withdrawal rules and the nest egg formula

- How much to invest each week to reach $1 million

- Why index funds?

- The power of compounding

- A simple, practical plan you can implement today

- Reality check: risk, inflation, and market timing

- Frequently asked questions

The FIRE framework: retire on your terms

FIRE stands for financially independent retire early. It is a practical, number-driven approach to ending the paycheck treadmill earlier than traditional retirement ages. The core idea is simple: figure out the amount of money you need to cover your annual expenses, save and invest until you reach that “nest egg,” then live on a sustainable withdrawal rate.

Why this works

Retirement is not an age. It is a financial number. Once you know the exact amount you need each year to preserve the lifestyle you want, the rest becomes arithmetic. That clarity makes saving purposeful and cuts the noise out of vague goals like “save more.”

The three FIRE subgroups — pick your lifestyle

Not everybody wants the same retirement. Pick the subgroup that matches your spending preferences because your required nest egg depends entirely on annual spending.

- Lean FIRE — Minimalist lifestyle, heavy early sacrifice. Target spending often around $25,000 per year.

- FIRE — Financial independence with a comfortable, but not extravagant, lifestyle. Middle-of-the-road spending.

- Fat FIRE — High-spend lifestyle with extra comfort and discretionary purchases. Think annual spending around $200,000.

Be honest with your current spending. That number is the single most important input when calculating how much you need to save.

The math: withdrawal rules and the nest egg formula

Two widely referenced rules govern sustainable withdrawals from an investment portfolio: the 4 percent rule and a more conservative 3 percent rule.

Sticking to a small withdrawal rate increases the probability your portfolio will last decades.

The 4 percent rule comes from research indicating that withdrawing 4 percent annually from a diversified portfolio made it unlikely to exhaust funds over a 30 year period. To improve safety against inflation and market shocks, using a 3 percent withdrawal rate gives a much higher margin of error.

Simple nest egg formula

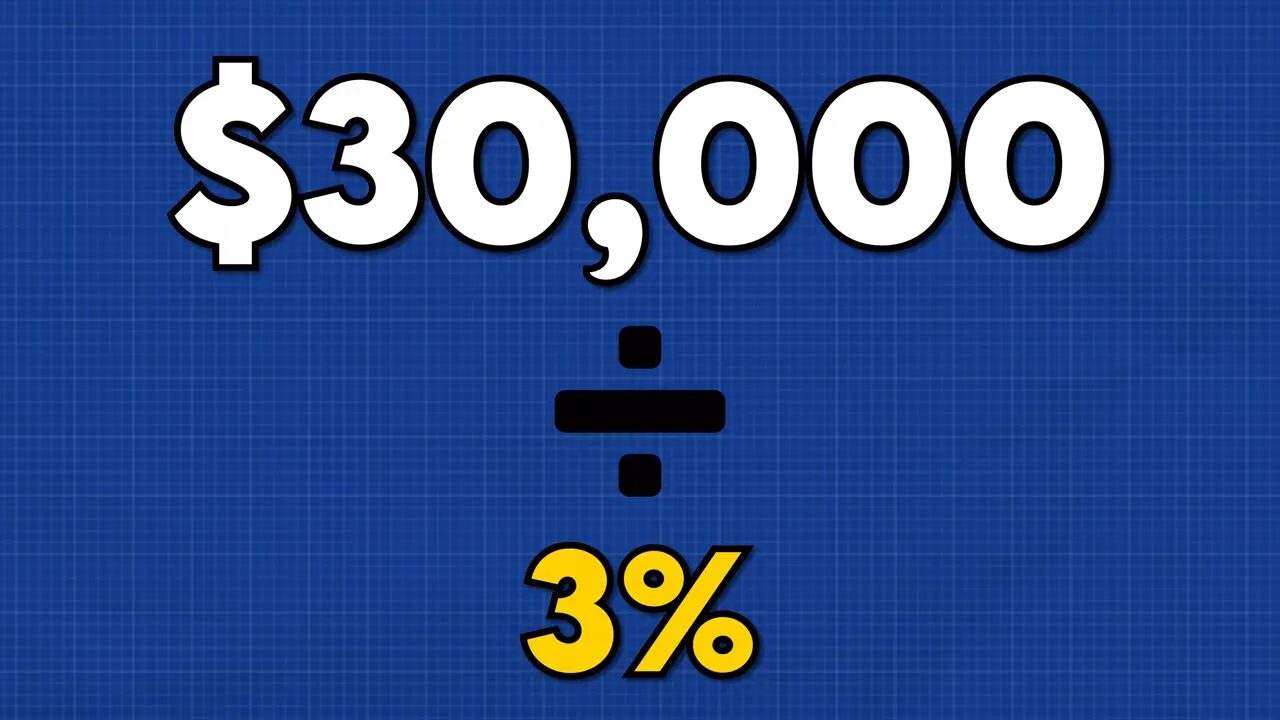

Calculate your annual expenses, then divide by the withdrawal rate you feel comfortable with:

Nest egg required = Annual spending ÷ Withdrawal rate

Example using the conservative 3 percent rule: If you spend $30,000 per year, divide $30,000 by 0.03. You get $1,000,000. That means a $1 million portfolio could theoretically fund $30,000 per year indefinitely under this rule.

How much to invest each week to reach $1 million

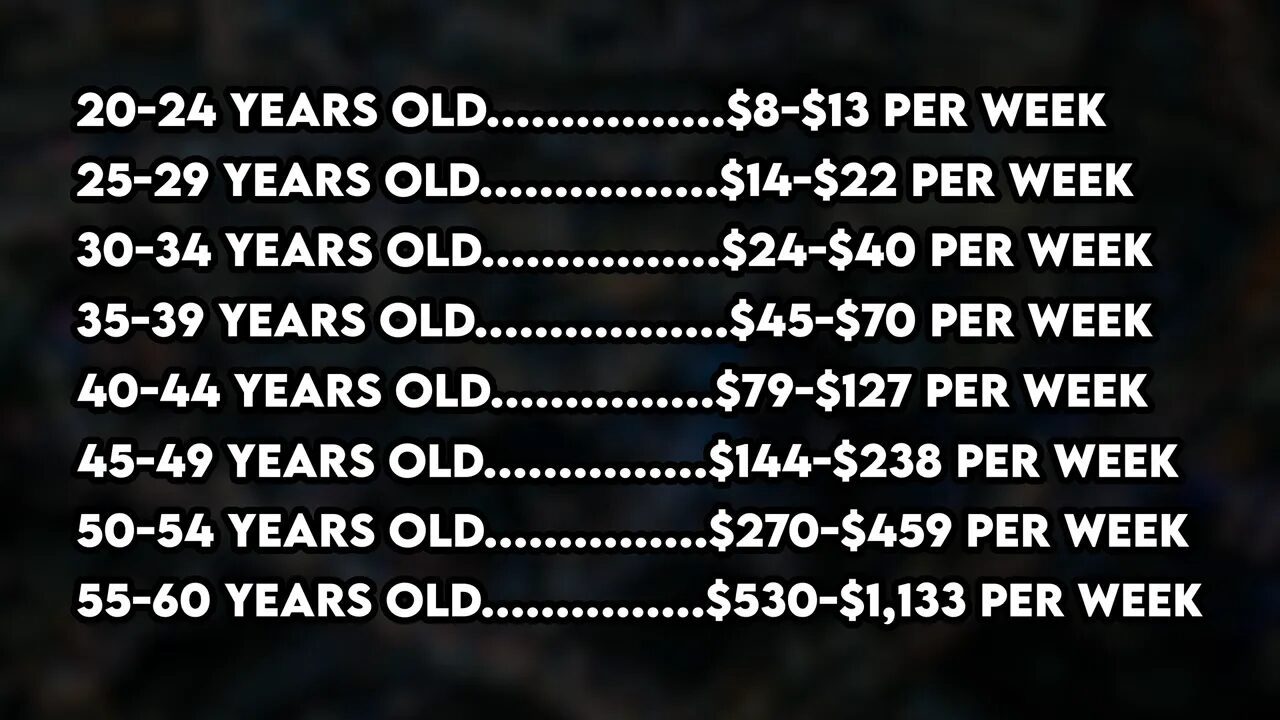

Time is your greatest ally. With regular investing and reasonable returns, even very small weekly contributions compound into big sums. The plan below assumes investing in a low-cost broad market index fund and an average long-term annual return of 12 percent.

Assumptions used here:

- Investment vehicle: low-cost index fund (for example VOO)

- Average annual return: 12 percent

- Target age to reach $1 million: 70

- Starting balance: zero

Sample weekly contributions needed (rounded):

- Age 20 (50 years to invest): about $8 per week

- Age 30 (40 years): a modest weekly contribution, larger than at 20 but still small

- Age 40 (30 years): noticeably higher weekly amounts

- Age 55 (15 years): about $530 per week

The key observation: the younger you start, the less you need to save each week. If you are older, you can still reach the goal — it just requires larger weekly contributions or higher starting capital.

Why index funds?

Index funds are a practical choice for everyday investors because they provide broad diversification, low fees, and historically consistent long-term returns. They require almost no active management or stock-picking skills, making them ideal for automated, disciplined investing.

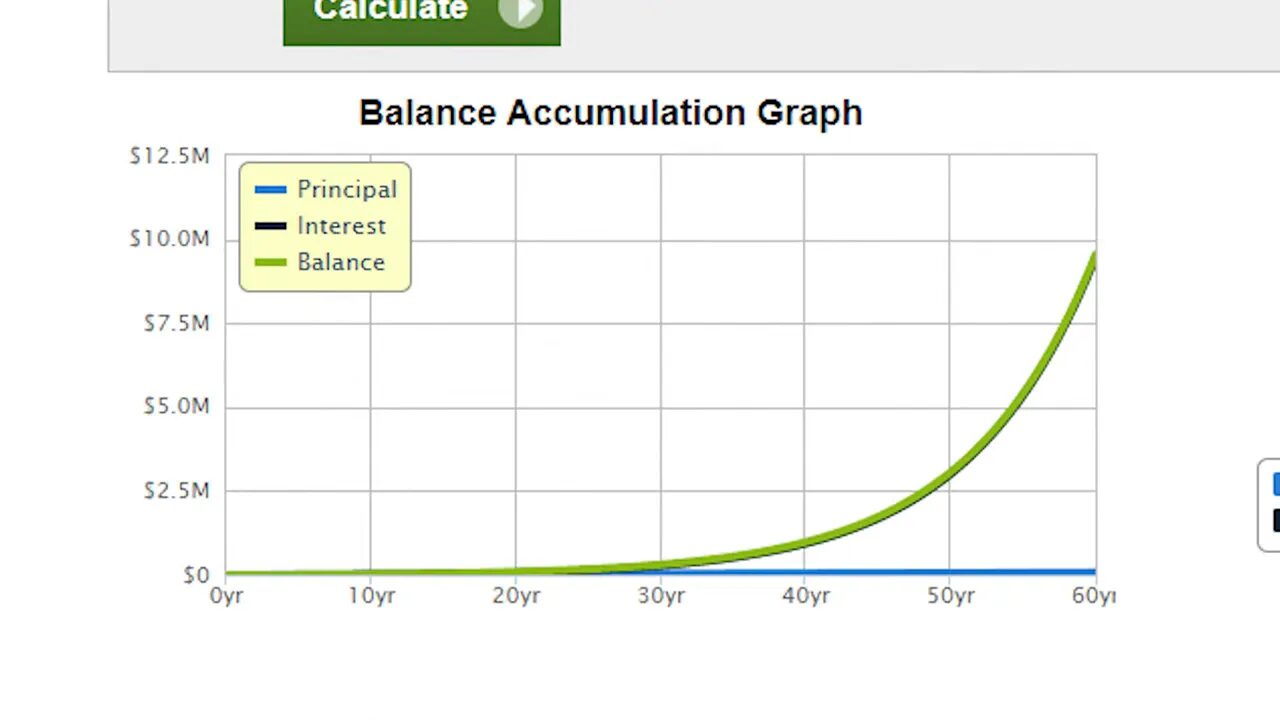

The power of compounding

Compounding is exponential. Reinvested returns generate further returns, and the growth accelerates with time. That is why small contributions over long periods become remarkably large balances.

A simple, practical plan you can implement today

- Automate contributions — Set your bank to send a fixed percentage or dollar amount to investments on payday. If the money never appears in your checking account, you will not miss it.

- Pick a low-cost index fund — Choose a broad market ETF or index fund with low fees and consistent history.

- Calculate your target nest egg — Work out your annual spending and divide by your chosen withdrawal rate (3 percent if you want extra safety).

- Adjust spending or timeline — Lowering annual spending or giving yourself more time dramatically reduces how much you need to save each week.

- Stay consistent through market cycles — Volatility is normal. Consistency and time are your allies.

Reality check: risk, inflation, and market timing

There is no guaranteed, instant path to a million dollars. Periods of high inflation, geopolitical crises, or overvalued markets can hinder short-term returns. That said, a disciplined plan that uses diversification, conservative withdrawal rates, and regular contributions substantially improves the chance of success.

Studying how experienced investors behave during turbulent times can provide useful context, but the core habit remains the same: save more than you spend, automate the process, and let compounding do the heavy lifting.

Frequently asked questions

How do I calculate how much I need to retire?

Estimate your annual spending, then divide that number by your chosen safe withdrawal rate. Using a conservative 3 percent withdrawal rate increases the margin of safety. For example, $30,000 per year ÷ 0.03 = $1,000,000.

What is the difference between the 4 percent and 3 percent rules?

The 4 percent rule is a historical guideline suggesting a portfolio withdrawal of 4 percent per year was unlikely to deplete funds over 30 years. The 3 percent rule is more conservative and better protects against inflation, market crashes, and longer retirement horizons.

Is a 12 percent annual return realistic?

Historical stock market returns have varied. A 12 percent long-term return is optimistic but has been used in scenarios to illustrate compounding. Using lower return assumptions is prudent for conservative planning.

What if I start late?

Starting late means larger weekly or monthly contributions, or adjusting retirement expectations. Even at older ages, disciplined saving and investing can still produce meaningful results; the math simply requires higher savings rates or additional time.

How do I automate savings?

Set up automatic transfers from your checking account to an investment account each payday, or use payroll deductions if available. Automating removes decision fatigue and makes investing consistent.