Table of Contents

- Why Ethena looks undervalued right now

- Quick snapshot: the numbers that matter

- How Ethena makes money and pays yield

- Token unlocks and dilution risk

- Partnerships and on-ramps

- Growth levers and what could push ENA to $1

- Risks to keep on the radar

- Use cases: trader play vs passive income

- Practical checklist before you allocate

- Valuation view — what’s fair for market cap?

- Final thoughts

- Frequently asked questions

Why Ethena looks undervalued right now

Ethena (ENA) feels undervalued. The protocol already has a huge amount of capital locked in, strong usage across multiple chains, and a built-in crypto dollar product that pays real yield. When you line up the key metrics—total value locked, user count, and on-chain supply dynamics—the market cap looks conservative compared to the utility being delivered.

The core idea is straightforward: a synthetic dollar protocol built on Ethereum combined with a globally accessible, dollar-denominated yield instrument known as the internet bond. That combination creates a compelling passive-income product for crypto-native dollars.

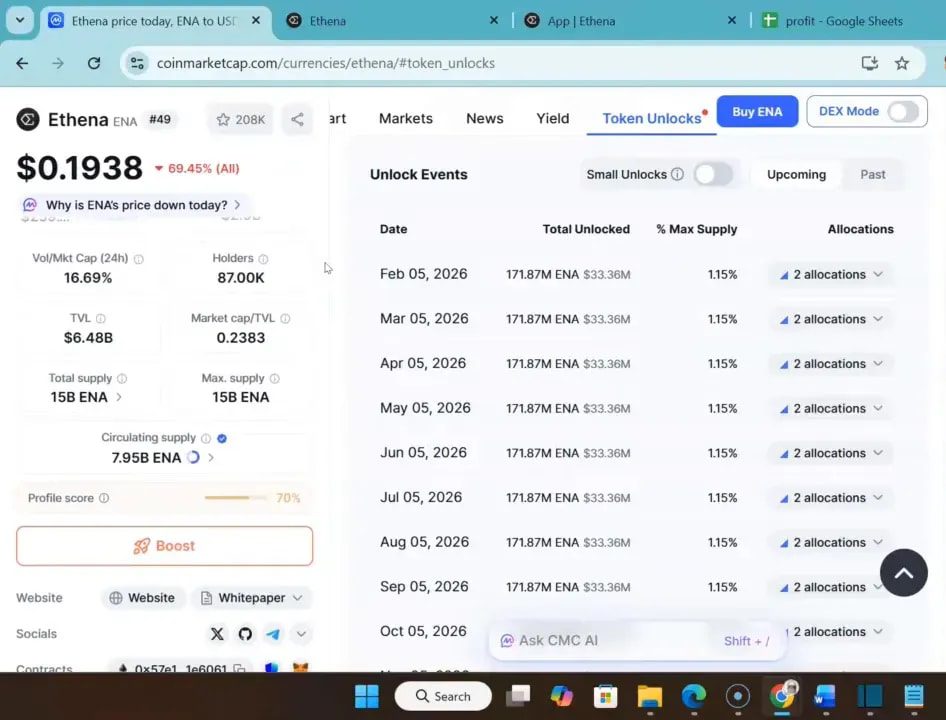

Quick snapshot: the numbers that matter

- Circulating supply: ~7.95 billion ENA tokens with frequent large unlocks.

- Holders: ~87,000 addresses — healthy decentralization for a protocol this size.

- Users: over 900,000 across 24 chains.

- Total value locked (TVL): roughly $7.3 billion.

- Market cap: about $1.54 billion — far smaller than TVL in contextual terms.

- Stable instruments: USDE supply around $6.5 billion and a USDTB supply near $866 million.

How Ethena makes money and pays yield

Ethena generates revenue primarily through funding rates on perpetual futures and reward payments tied to stablecoin holdings. That revenue funds the APY paid to participants in the protocol’s yield-bearing dollar products.

APY has fluctuated: it peaked around 19% in 2024 and sits closer to 5% now for SUSDE staking, while the internet bond concept targets an APY near 12.7% in certain conditions. Even at 5% this is far higher than typical bank rates and attractive compared with treasury yields for many retail users.

Staking and unstaking

You stake USDE to receive sUSDE. Withdrawals become available seven days after unstaking, and unstaking is currently supported only on Ethereum. Those operational nuances matter for liquidity planning.

Token unlocks and dilution risk

Regular unlocks are a legitimate concern. Typical releases are large—on the order of $33 million going to private investors, team members, and advisors. That can create sell pressure whenever a release occurs.

Offsetting factors: daily volume is strong (around $260 million), and widespread utility across many chains means unlock-driven selling doesn’t necessarily crush price if demand keeps rising and TVL continues to grow.

Partnerships and on-ramps

Partnerships strengthen credibility. Anchorage Digital has been involved with USDTB, a yield-bearing digital dollar tied to institutional-grade assets, and there are mentions of BlackRock-related backing in some yield structures. Those integrations help when bringing dollar-denominated crypto products into regulated markets.

Growth levers and what could push ENA to $1

Several realistic growth paths could push ENA materially higher:

- TVL expansion: If TVL keeps rising, the protocol’s revenue and the attractiveness of its yield products rise in tandem.

- Wider user acquisition: Traditional marketing and large exchange listings helped other projects scale quickly in prior cycles. Ethena needs to convert mainstream savers who are currently in low-yield bank accounts.

- Institutional partnerships: Continued collaboration with entities like Anchorage and large asset managers provides on-ramps and regulatory comfort for U.S. users.

- Product adoption: The internet bond and synthetic-dollar flows must become a meaningful part of how people hold dollar-like value on-chain.

If those levers are pulled effectively, a move back to $1 is plausible. The market cap required for that is well within reach if TVL and user adoption climb further.

Risks to keep on the radar

- Funding rate dependence: A large share of revenue comes from funding rates on perpetuals. In a market with sustained periods of low funding rates, the APY could compress quickly.

- Unlock-driven selling: Repeated, large vesting events create periodic downward pressure on price.

- Regulatory scrutiny: Dollar-denominated products attract regulatory attention, which can be either constructive or disruptive depending on outcomes.

Use cases: trader play vs passive income

Ethena offers two clear use cases:

- Passive income — stake USDE for sUSDE and earn yield that beats traditional savings.

- Speculative trade — allocate smaller position sizes to capture a potential rerating if adoption and TVL accelerate.

For traders and allocators looking to act on short- and medium-term opportunities across multiple chains, a reliable edge helps. Crypto trading signals can be a natural complement here—signals that highlight high-probability setups, cross-chain flow changes, and key unlock events can help you time entries and manage risk without constant screen time.

Practical checklist before you allocate

- Confirm where you will hold and unstake (Ethereum-only unstaking mechanics apply).

- Check upcoming unlock schedules and adjust position sizing to account for potential pressure.

- Decide whether you’re here for yield, price appreciation, or both—and size positions accordingly.

- Monitor funding rate trends on perpetuals since these impact APY directly.

Valuation view — what’s fair for market cap?

The current market cap is about $1.54 billion while TVL sits around $7.3 billion. That TVL-to-market-cap ratio suggests room for appreciation if utility continues to grow. A return to $1 per ENA would not be outlandish given continued adoption, increased TVL, and improved mainstream distribution. Still, timing and execution matter.

If the team aggressively pursues traditional user acquisition—advertising, partnerships, and exchange-first growth—the rerating could be faster. Without that, growth may be steadier and more tied to crypto-native adoption curves.

Final thoughts

Ethena combines a synthetic dollar, a yield-bearing internet bond, and multi-chain reach in a compact package. The numbers are strong: high TVL, large stable supply on-chain, and significant user footprint. Risks remain—especially unlock schedules and funding-rate dependence—but the upside case is very real and could push ENA back toward the dollar mark if momentum continues.

Not financial advice. Do your own research and size positions to your risk tolerance.

Frequently asked questions

What exactly is Ethena’s internet bond?

The internet bond is Ethena’s dollar-denominated savings instrument. It’s a globally accessible product designed to deliver yield on crypto-native dollars by pooling capital and using revenue sources such as funding rates from perpetual futures and yield from stable assets.

How does Ethena pay 10%+ APY?

APY is funded mainly through funding rates on perpetual futures and reward payments on stablecoin holdings. When funding rates are healthy and perpetual activity is high, Ethena can sustain higher yields. If funding disappears, yield compresses, so this depends on a continual flow of perpetual market activity.

Is unlock dilution a dealbreaker?

Not necessarily, but it matters. Large periodic unlocks create sell pressure. The key questions are whether demand and TVL keep growing and whether daily volume can absorb vesting sales without dramatic price impact.

Can Ethena reach $1?

Yes, it can. If TVL and user adoption rise, and the protocol executes on marketing and partnerships, a move back to $1 is plausible. Execution and market conditions will determine timing and size of the move.

How should I position for both yield and upside?

Consider splitting allocations: a portion for staking USDE to earn yield, and a smaller speculative allocation to ENA itself for price appreciation. Keep an eye on unlock schedules and funding-rate trends. For faster decision-making, curated crypto trading signals can help identify optimal entry and exit windows while you manage yield positions.