Three million pages of court records, emails, flight logs and investigation notes were released to the public, and buried in that mountain of documents are repeated references to Bitcoin and other crypto projects. The reaction was immediate: panic, conspiracy and a tidal wave of speculation across social platforms. Headlines asked whether Epstein funded Bitcoin’s development, whether he knew Satoshi Nakamoto, and whether his money flowed directly into tokens and teams that helped shape crypto’s early years.

Here’s a clear, evidence-based look at what the files actually show, what they do not show, and why this matters for the future of Bitcoin and the broader crypto industry. I’ll separate the factual threads, examine the plausible connections, debunk the viral nonsense, and lay out the likely implications going forward.

Table of Contents

- Quick summary

- How these files came to light

- Where Bitcoin appears in the records

- Epstein knew about Bitcoin early — what that means

- Money, influence, and MIT’s Media Lab

- Investments in crypto companies

- Did Epstein know Satoshi? Is Epstein Satoshi?

- Separating influence from funding: what Epstein’s money could and could not change

- Were crypto assets used to fund criminal activity?

- What this means for Bitcoin’s fundamentals and reputation

- Possible regulatory and market outcomes

- How to read these findings responsibly

- Key takeaways

- Practical steps for industry participants

- Questions people keep asking

- Final thoughts

Quick summary

- Epstein had early awareness of Bitcoin and appears in emails referencing conversations with key figures and analyses sent to wealthy contacts.

- Donations tied to Epstein indirectly funded research at MIT Media Lab, which in turn supported several engineers who worked on Bitcoin Core.

- Epstein invested in crypto companies (directly or via related entities), including seed-stage allocations linked to Blockstream and a reported multi-million-dollar stake in Coinbase.

- No evidence links Bitcoin to financing Epstein’s crimes. That distinction matters for reputational and regulatory impact.

- Wild theories — such as Epstein being Satoshi — are unsupported by the files. Those claims are social-media noise, not documentary proof.

How these files came to light

The Department of Justice released a new tranche of material that spans decades of investigation. The documents include emails, court filings, interview notes, financial records and other items that investigators collected. After years of pressure and the passage of the Epstein Files Transparency Act, a significant batch — more than three million pages — was published in late January. The DOJ previously stated its holdings totaled around six million pages, but maintained that the recent release met its legal obligations.

Large-scale releases like this always produce noise: redactions, missing context, and a flood of screenshots that travel faster than careful analysis. That environment is fertile ground for misinformation. The sensible approach is to look for documented, verifiable items and to discard rumors and doctored images that circulate for likes and clicks.

Where Bitcoin appears in the records

Bitcoin shows up in a few distinct ways inside the files:

- Direct email references and forwarded analyses about the technology and its market potential.

- Evidence of Epstein’s interactions with people connected to early Bitcoin development and related research initiatives.

- Financial ties — donations and investments that connected to teams or companies working on crypto.

- Proposals Epstein circulated about building digital currencies, including ideas for a Middle East digital currency and a Sharia-compliant crypto built on Bitcoin-like infrastructure.

Epstein knew about Bitcoin early — what that means

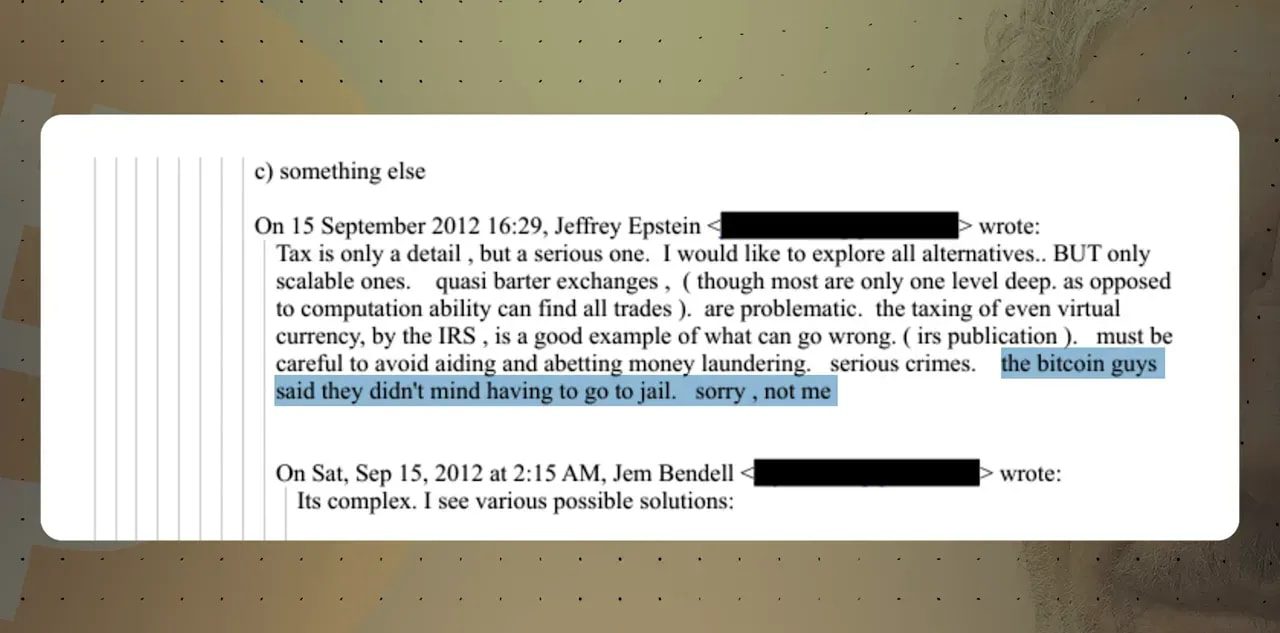

One striking detail is how early Epstein was receiving and forwarding material about Bitcoin. An email from September 2012 quotes him as saying:

The Bitcoin guys said they didn’t mind having to go to jail. Sorry, not me.

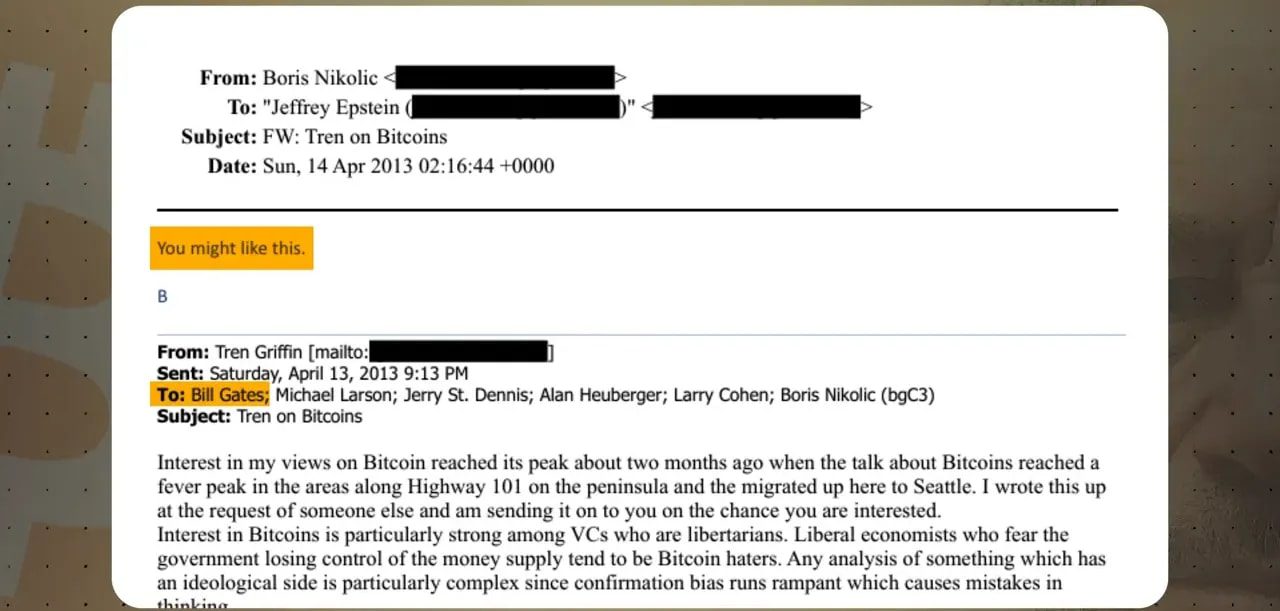

That line is simultaneously revealing and unremarkable: it shows awareness and some skepticism, but it does not prove operational involvement. Other documents show Epstein being forwarded an analysis of Bitcoin in 2013 that was originally shared among wealthy tech figures. The memo described Bitcoin as speculative but also captured investor excitement about its potential to upend legacy finance.

Perhaps more eyebrow-raising: Epstein contacted Gavin Andresen in June 2011 — two days before Andresen visited CIA headquarters to discuss Bitcoin. Andresen had been chosen by Satoshi Nakamoto as one of the early public maintainers of Bitcoin. That sequence of events is interesting because it places Epstein in communication with people at the center of Bitcoin’s earliest phase.

Does that mean intelligence agencies or shadowy funders were steering Bitcoin? Not necessarily. Early interest from the intelligence community and government researchers fits the pattern of disruptive technology attracting attention. The mere existence of contact does not imply control, and the records contain no direct evidence that Epstein or any intelligence agency dictated Bitcoin’s technical design.

Money, influence, and MIT’s Media Lab

Where the links get more concrete is funding. In 2015, Joy Ito, then director of the MIT Media Lab, emailed Epstein about MIT’s Digital Currency Initiative (DCI). The DCI became a major funding source for several Bitcoin Core developers at a time when the Bitcoin Foundation was struggling financially.

According to the records, MIT claimed Epstein had donated roughly $850,000 to the institute, with $525,000 earmarked for the Media Lab. Investigative reporting later suggested the real amount tied to Epstein and his associates may have been considerably larger, perhaps as high as $7.5 million. Whatever the precise figure, the key point is this:

Some funds connected to Epstein flowed into the DCI, which helped pay the salaries of core Bitcoin developers for a period.

It is important to be precise about causality. Financial support for people who worked on Bitcoin does not equal control of the protocol. Bitcoin’s governance is decentralized and open-source contributions are public. Funding developers does not translate into unilateral power over the protocol, especially for something as distributed and community-driven as Bitcoin.

Still, the optics matter. Funding linked to a criminal figure sitting in a project’s funding history is reputationally unfortunate. It was unsurprising that this revelation provoked outrage and calls for more transparency at institutions that accepted such donations.

Investments in crypto companies

Beyond donations, multiple records show Epstein-related entities participating in early-stage investments across the crypto landscape.

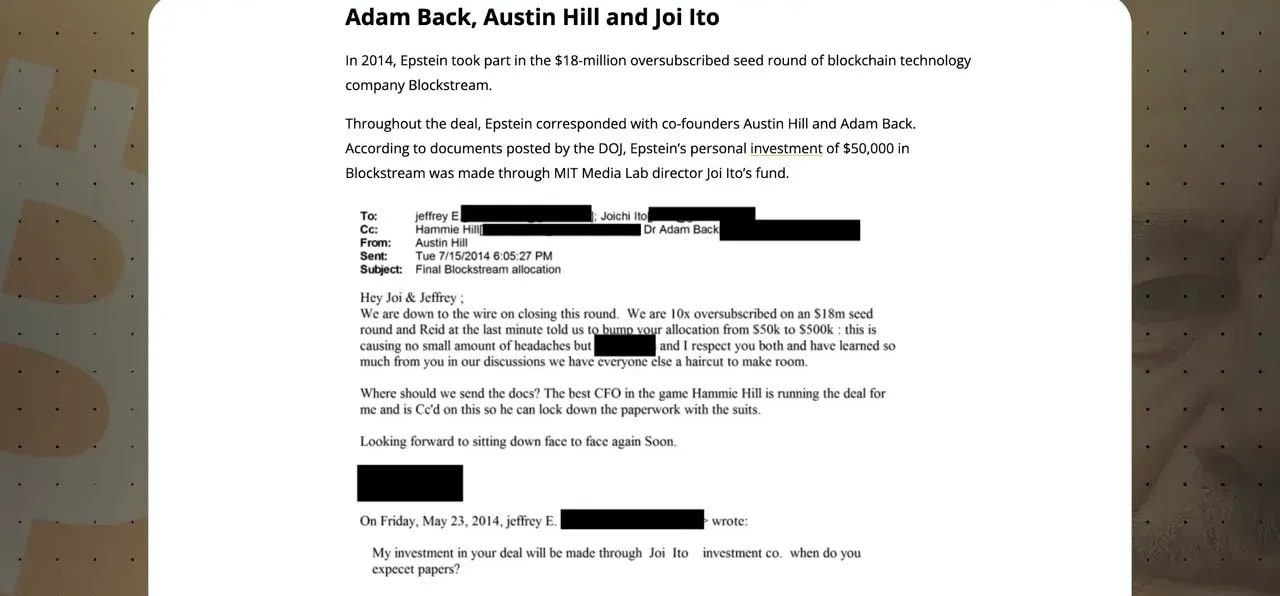

Blockstream

Blockstream, founded to build Bitcoin infrastructure, raised an oversubscribed seed round in 2014. Documents indicate Epstein made an initial personal investment — reportedly $50,000 routed through a fund tied to Joy Ito — which was eventually increased to $500,000. The fund itself held a minority stake in the round and, according to Blockstream’s CEO, divested its shares later due to potential conflicts of interest.

Blockstream has publicly stated it has no ongoing direct or indirect financial connection to Epstein or his estate. The record shows a short-lived financial link that the company and associated parties subsequently disentangled from.

Coinbase

Another headline-making connection is an Epstein-related entity that invested roughly $3 million in Coinbase in 2014. At that time, Coinbase was a much smaller company, valued at about $400 million. Epstein is reported to have sold half of his stake in 2018 for approximately $15 million — a tidy return.

These investments were presented to Epstein by figures active in the crypto venture world. That historical detail explains how Epstein came to be exposed to early-stage crypto deals: he wasn’t an industry insider by default, but he was a prolific investor who backed opportunities brought to him.

Altcoin and privacy-project connections

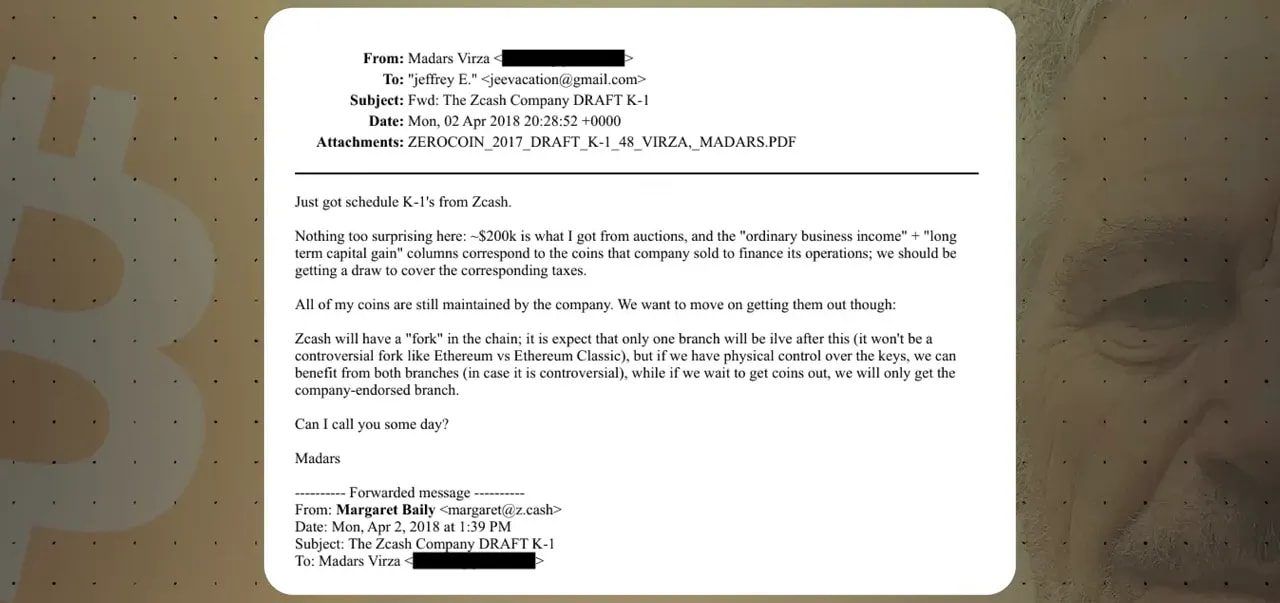

Other documents point to interactions with projects such as Zcash, Ripple and Stellar. For instance:

- In 2018, an email to Epstein from Madars Virza (a researcher associated with the MIT Media Lab) mentioned an imminent fork of Zcash and discussed the implications for coin allocations.

- In mid-2014, a Blockstream co-founder told Epstein that investments in Ripple and Stellar were harmful to Blockstream’s mission, and urged that allocations be reduced or moved.

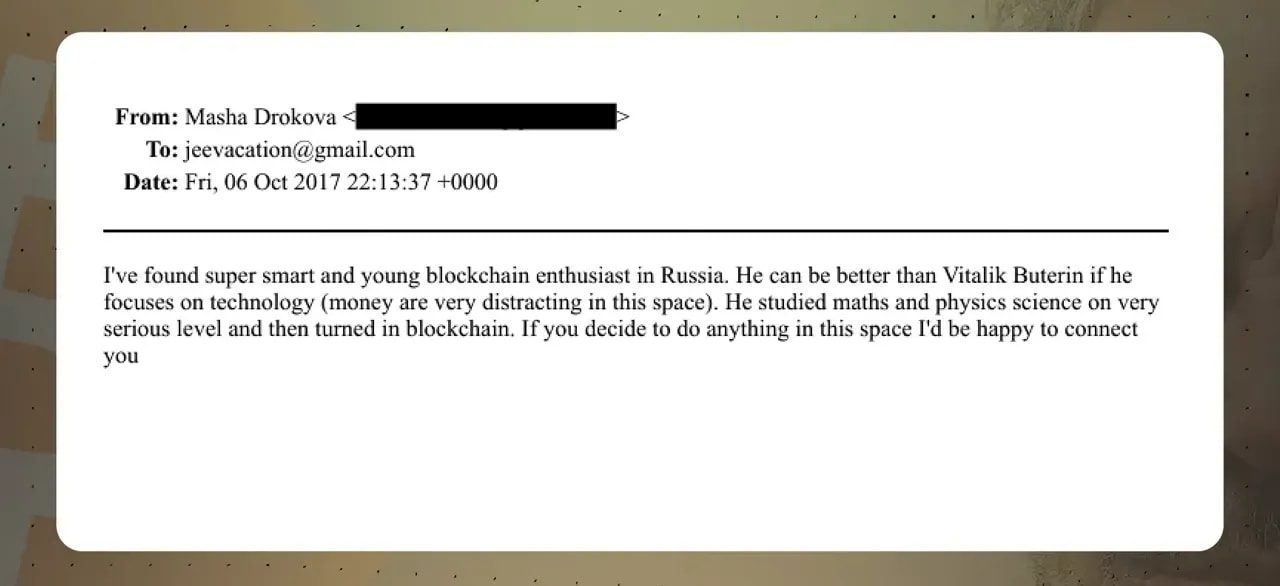

Ethereum appears scarcely in the records. A curious note shows an investor offering to introduce Epstein to a promising young Russian blockchain developer who could, in their words, “become better than Vitalik Buterin.” There is no evidence Vitalik was contacted or compromised.

Did Epstein know Satoshi? Is Epstein Satoshi?

Two viral narratives gained traction after the release: that Epstein spoke directly to Satoshi Nakamoto or that Epstein himself was Satoshi. Both claims are sensational, and both lack reliable documentary support.

A fraudulent email montage circulated on social platforms claiming Epstein wrote to Ghislaine Maxwell in 2008 saying, “the Satoshi pseudonym is working perfectly. Our little digital goldmine is ready for the world. Funding secured.” The fake message looks convincing at first glance, but it contains formatting errors, and no such email exists in the DOJ’s searchable release.

Epstein’s own emails do include a 2016 pitch to Saudi contacts where he proposed creating a Middle East digital currency — possibly a stablecoin — and a Sharia-compliant crypto built on Bitcoin’s infrastructure. In those messages, he claimed to have “spoken to some of the founders of Bitcoin.” That phrasing is interesting because it suggests he believed Bitcoin had more than one founder, but it does not establish contact with Satoshi, nor does it provide any verifiable link to Satoshi’s real identity.

The reality is that the identity of Satoshi remains unresolved for sound reasons: plausible candidates have been proposed and examined (Hal Finney, Nick Szabo, Adam Back, Len Sassaman and others), but each theory has strengths and counter-evidence. The Bitcoin white paper’s use of “we” and the technical breadth of the design have fueled speculation that more than one person could be involved, but that remains speculative. Nothing in the Epstein files proves a direct connection to Satoshi, and the claim that Epstein is Satoshi is unsupported.

Separating influence from funding: what Epstein’s money could and could not change

Money can buy attention and influence access, but it cannot rewrite an immutable ledger or unilaterally change an open-source protocol’s code without community consent.

Funding that pays developer salaries can shape the pace or focus of work, but Bitcoin operates through decentralized contributions, public discourse, and broadly distributed economic incentives. Major changes require consensus across miners, node operators, exchanges and the community at large. The files show financial links to people and projects, but they do not show evidence that Epstein controlled code merges, dictated Bitcoin’s roadmap, or altered consensus rules.

To be blunt: funding relationships are worth investigating for conflict-of-interest and ethics reasons, but they are not the same as technological capture.

Were crypto assets used to fund criminal activity?

This is a crucial question. One fear is that cryptocurrency was used to finance Epstein’s crimes — a narrative that would carry severe reputational and legal consequences for the industry. The files, however, do not provide evidence that crypto funded Epstein’s criminal activity.

That alone changes the story’s tenor. Years ago Bitcoin was tied in the public imagination to illicit markets and money laundering. Today, despite those early associations, the evidence here does not support the claim that crypto played a central role in Epstein’s wrongdoing.

What this means for Bitcoin’s fundamentals and reputation

Short-term, the headlines and viral content will harm Bitcoin and crypto’s image in the court of public opinion. The industry already struggles with perceptions tied to scams, hacks and shady actors. Having Epstein’s name in the documentation of early funding and investment is a reputational blow.

Longer-term, however, the technical fundamentals of Bitcoin are unchanged. The protocol’s security, decentralization and open-source nature are not invalidated by historical donations or early-stage investments. Institutional investors tend to be forward looking. If regulators and institutional capital do their due diligence, they will weigh documented risks and governance structures rather than sensational headlines alone.

There is also an important silver lining: no evidence in the released files shows crypto assets were used to finance Epstein’s crimes. That fact reduces the likelihood of immediate, dramatic regulatory blowback specifically targeted at crypto on the basis of these documents.

Possible regulatory and market outcomes

Expect a few outcomes to play out over the next months and years:

- Reputational fallout for institutions that accepted donations tied to Epstein. Universities and labs will likely face reviews of their funding structures and disclosure practices.

- Increased diligence from VC and corporate backers when onboarding investors and donations to avoid reputational risk.

- Targeted media scrutiny on named individuals and companies that were documented as having financial links. That scrutiny can pressure companies to disclose more about investor provenance.

- Limited immediate systemic shock for Bitcoin and major crypto projects. Because there is no evidence of protocol compromise or direct use of crypto for financing crimes, widespread market panic tied solely to these revelations is unlikely to be sustained.

How to read these findings responsibly

When parsing large document dumps, follow these rules:

- Favor primary sources. Look for the actual emails or filings, not screenshots on social media.

- Ask whether a financial link equals control. Funding an initiative does not mean legal or operational control of a decentralized system.

- Beware of doctored images and anecdotes shared for virality. Cross-check with the DOJ’s searchable release before spreading claims.

- Keep the distinction between reputational harm and technical compromise front of mind. One can afflict a project without breaking it.

Key takeaways

- Epstein’s name appears in crypto-related records, sometimes as a donor or investor and sometimes as a recipient of pitches or analyses.

- Some funds linked to Epstein flowed into research that supported Bitcoin developers, specifically via MIT’s DCI; that funding was a matter of record and is unfortunate given Epstein’s crimes, but it does not mean control of Bitcoin.

- There is no credible evidence that Epstein was Satoshi, nor that he directly shaped Bitcoin’s protocol or its core governance.

- No documentation released so far shows crypto assets financing Epstein’s crimes. That mitigates immediate legal risks to the industry from these specific files.

- Reputational consequences remain real and should prompt better transparency from institutions and clearer investor disclosure practices across the ecosystem.

Practical steps for industry participants

For founders, VCs, researchers and institutions:

- Review historical donations and investor onboarding procedures. Know your investor, and be transparent about provenance.

- Strengthen conflict-of-interest policies where research funding intersects with industry development.

- Publicly clarify any historical funding ties and what governance controls were in place to avoid influence on core development work.

- Distance critical infrastructure from any single investor, and document decision-making processes on protocol changes.

Questions people keep asking

Did Jeffrey Epstein create Bitcoin or is he Satoshi Nakamoto?

No. The released documents do not provide credible evidence that Epstein created Bitcoin or was Satoshi. Viral posts claiming otherwise have been debunked; a particularly damaging piece of “evidence” is a fake email that does not appear in the official records and contains formatting errors. Epstein did claim in a 2016 message to have “spoken to some of the founders of Bitcoin,” but that is not the same as proving identity or authorship.

Did Epstein fund Bitcoin’s development?

Indirectly, yes. Some funds linked to Epstein were donated to MIT and the Media Lab, and some of that money flowed into the Digital Currency Initiative, which supported a handful of Bitcoin Core contributors. That funding helped pay developers’ salaries for a time, but there is no evidence Epstein controlled the project or dictated technical decisions.

Were cryptocurrencies used to finance Epstein’s crimes?

No evidence currently released shows that crypto assets financed Epstein’s crimes. The documents do not paint crypto as the vehicle for his criminal activity, which is an important distinction relative to earlier historical associations between Bitcoin and illicit markets.

Which crypto companies had links to Epstein?

Documents indicate ties — direct or indirect — to several entities, including Blockstream and Coinbase (seed-stage investments), and communications related to projects like Zcash, Ripple and Stellar. The nature of these links varies: some are donations, some are investments, and some are simply forwarded emails or pitches.

Does this change Bitcoin’s security or decentralization?

No. Bitcoin’s technical security and decentralization rely on consensus rules, network distribution and cryptographic primitives. Funding or investment events do not bypass that architecture. While reputational damage matters, the protocol itself remains intact unless concrete technical compromises are shown.

Could more damaging files still be released?

Possibly. The DOJ has said the recently released batch was its final one, but earlier statements about document totals and redactions were contentious. Additional disclosures — whether from courts, investigative journalists or future releases — could reveal more context. Readers should treat new claims cautiously and verify against primary sources.

Final thoughts

Finding Epstein’s name in a pile of historical documents is disturbing and will rightly generate outrage. It is also a reminder that disruptive technologies often attract a diverse array of backers — some with shady motives. The proper response is not to panic, but to demand transparency and better governance where public-interest research intersects with private funding.

Technically and economically, Bitcoin’s core properties stand on their own. Reputation and perception are different matters; they will be tested and must be defended through clearer disclosures and institutional reforms. For investors and participants, the sensible path is to maintain critical skepticism, demand primary evidence for any sensational claim, and prioritize projects and institutions that demonstrate strong ethics and transparency.

What happened with these files should spark careful inquiry — not conspiracy. The industry’s best response is to learn, reform funding practices, and move forward with stronger guardrails so the next generation of innovation faces fewer risks from bad actors in the past.