Bitcoin Has Been Captured is a provocative way to describe a slow-motion shift that has unfolded over the past few years: institutions—from asset managers and hedge funds to exchanges, miners, and even governments—have accumulated an astonishing share of Bitcoin. That accumulation is bullish in many respects, but it also creates a new set of risks and trade-offs that deserve serious consideration.

The objective here is straightforward: explain what this institutional accumulation looks like, why it matters, and how it changes the dynamics of Bitcoin as both a technology and an asset. Expect numbers, practical implications, and clear-eyed analysis of the upside and downside. No fearmongering, no cheerleading—just a pragmatic view of how Bitcoin’s evolution is being shaped by the deepest pockets on Wall Street and beyond.

Table of Contents

- Outline

- Bitcoin’s original vision vs the reality of institutional adoption

- Why institutional involvement is both powerful and problematic

- Who holds Bitcoin? The institutional breakdown

- How much Bitcoin are institutions selling?

- What could trigger more institutional selling?

- Does institutional ownership threaten Bitcoin’s security?

- Concentration and price risk: how much selling could move the market?

- What this concentration does to volatility and price discovery

- Regulatory and macro implications

- Quantum computing: a genuine but manageable risk

- Custody: the operational Achilles heel

- How traders and investors should think about positioning

- Practical approaches depending on your profile

- What institutional adoption means for Bitcoin’s future

- Scenarios to watch

- How to stay tactically prepared

- Conclusion: captured or integrated?

- Will institutional ownership make Bitcoin less decentralized?

- Could institutions sell enough Bitcoin to crash the market?

- Is Bitcoin’s security at risk because institutions control so many coins?

- How should I trade or invest given institutional dominance?

- Is the quantum threat imminent?

- How can custodial risk be minimized?

- What indicators should I track to anticipate big moves?

Outline

- Bitcoin’s original vision and the rise of institutional adoption

- Who holds the coins: the institutional breakdown

- Recent institutional selling: ETFs, miners, and the mechanics

- Risks introduced by concentration: price, custody, and security

- Why institutions are still bullish and how that affects price action

- How traders and long-term holders can respond (including an introduction to crypto signals)

- Conclusion and FAQs

Bitcoin’s original vision vs the reality of institutional adoption

Bitcoin was born from a simple but radical premise: move value peer-to-peer without trusting intermediaries. The white paper described a decentralized, fixed-supply monetary network that operates independent of banks, central planners, and gatekeepers who can freeze accounts or debase money.

Fast forward to today and the contours of the story have shifted. Rather than existing separately from traditional finance, Bitcoin has been woven into it. Major banks provide Bitcoin exposure, asset managers have launched spot Bitcoin exchange-traded funds, public companies add BTC to balance sheets, and even some nations have integrated Bitcoin into public policy.

This is where the central paradox emerges: institutional adoption has helped Bitcoin become recognized as a mainstream store of value—but it has also introduced elements of centralization to an asset created explicitly to be decentralized.

Why institutional involvement is both powerful and problematic

There are several ways to look at institutional involvement. On the positive side, institutions bring:

- Capital at scale: Retail dollars alone cannot provide the liquidity and market depth that trillions of dollars in institutional portfolios can.

- Infrastructure: Custody, compliance, reporting, and operational frameworks that make Bitcoin usable for pensions, insurers, and other regulated entities.

- Legitimacy: When established financial firms publicly allocate to Bitcoin, it reduces the stigma and reassures new participants.

But there are real trade-offs:

- Custody concentration: Institutions typically do not self-custody; they rely on custodians, introducing single points of failure.

- Price sensitivity: Large concentrated holders can amplify volatility when they buy or sell in size.

- Governance and lobbying influence: Big players have outsized influence on regulation and market structures, which can steer the ecosystem toward TradFi norms rather than original Bitcoin ideals.

Who holds Bitcoin? The institutional breakdown

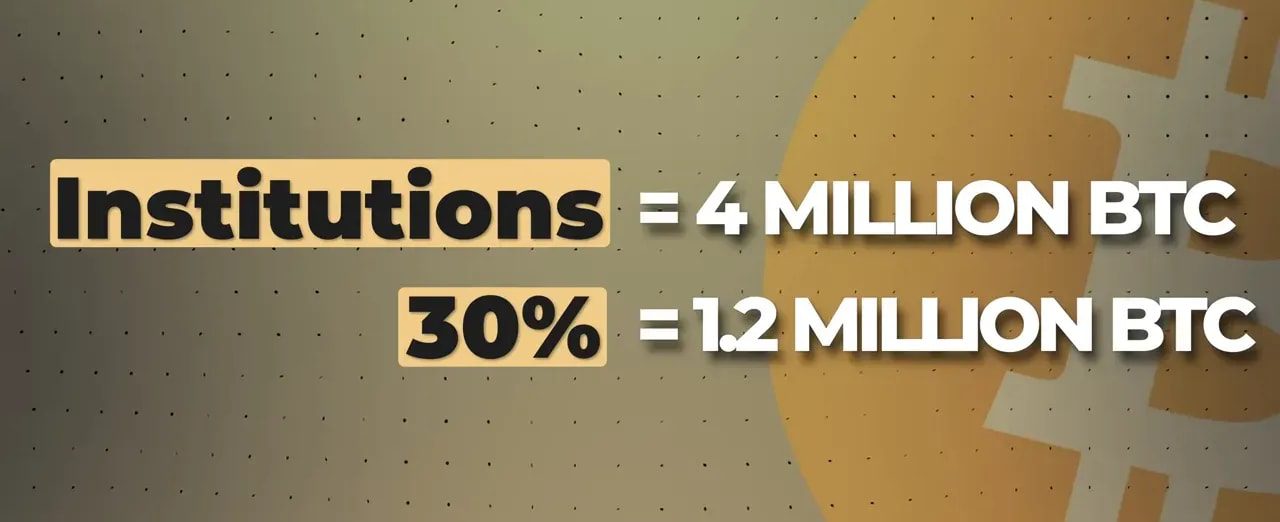

Understanding the scope of institutional ownership begins with the numbers. Collectively, institutions now control well over 4 million BTC—around one-fifth of the total supply. That’s more than most people expect and it has important ramifications.

Here’s a practical breakdown of where those institutional coins sit:

- Publicly listed companies: Over 1.1 million BTC in total. A single company accounts for roughly 62% of that: MicroStrategy (now called Strategy). They pioneered the corporate Bitcoin treasury playbook and still hold a vast amount.

- Bitcoin ETFs and exchanges: These custodial vehicles hold the largest institutional share—north of 1.6 million BTC. The dominant ETF player is BlackRock’s iShares Bitcoin Trust, which itself holds roughly 780,000 BTC. Fidelity, Grayscale, and others also hold sizable amounts.

- Governments: Nation-state entities control approximately 646,000 BTC, most of it seized from criminal operations. The US is the largest holder among states (≈328,000 BTC), followed by China (≈190,000 BTC) and the UK (≈61,000 BTC).

- Private companies and miners: Private firms hold over 288,000 BTC; Block.1 (a private firm) and Tether are among the notable holders. Mining companies also hold BTC as treasury assets.

- DeFi protocols and wrapped BTC: Around 372,000 BTC is locked to back wrapped or derivative versions of Bitcoin used across decentralized finance.

All told, these classes add up to a significant portion of the supply, and the speed of accumulation surprised many analysts. Estimates that once predicted institutional ownership crossing 20% years from now were rendered conservative when actual adoption accelerated far faster.

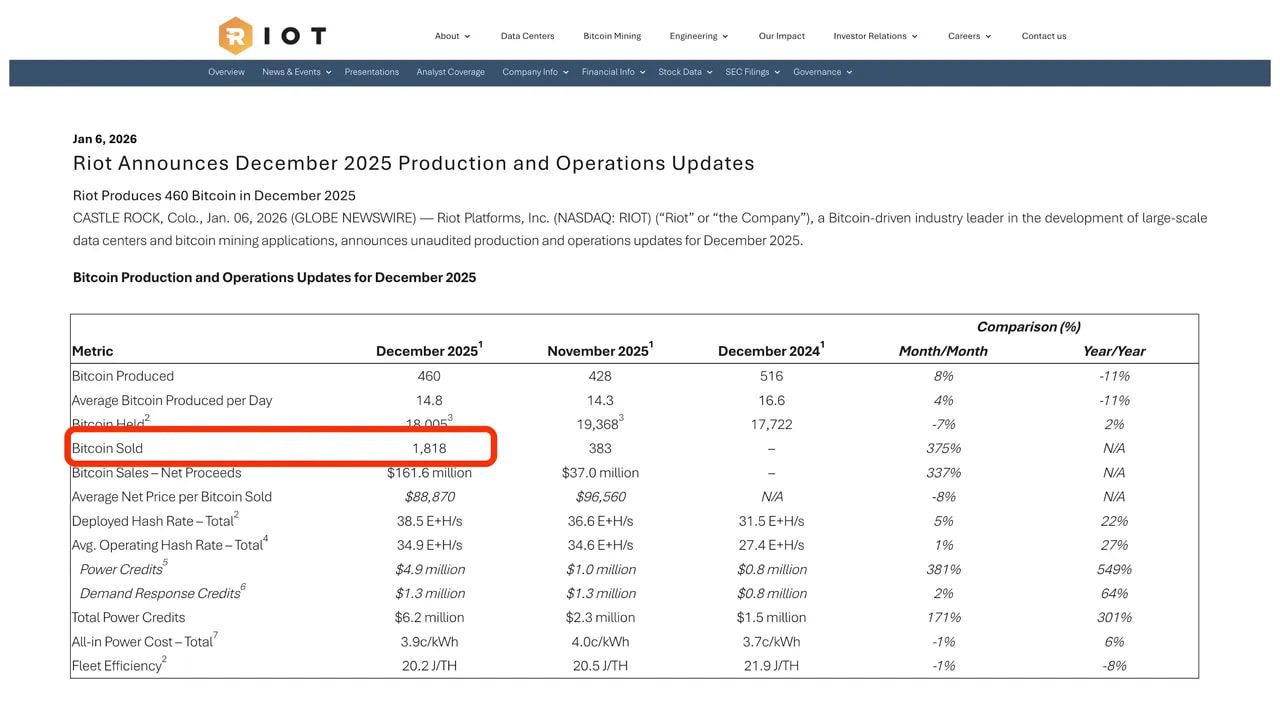

How much Bitcoin are institutions selling?

Accumulation is only one side of the ledger—selling matters too. Over the past months some institutional selling has occurred, and the largest selling pressure has come through spot Bitcoin ETFs.

Because ETFs provide an easy on-ramp and off-ramp for large pools of capital, they’ve become major drivers of short-term price action. When inflows are strong, Bitcoin rallies. When outflows spike, the price finds itself under pressure.

![Glassnode chart titled 'BTC: US Spot ETF Net Flows [BTC]' showing green inflows, red outflows and a black BTC price line](https://bullcryptosignals.com/blog/wp-content/uploads/2026/02/btc-us-spot-etf-net-flows-glassnode-02.jpg)

Recent months illustrate this dynamic:

- Following a large liquidation event in October that removed nearly $20 billion from the crypto market, spot Bitcoin ETFs experienced strong outflows as investors de-risked.

- November showed outflows of more than $3.4 billion from spot ETFs—one of the largest months for ETF outflows on record.

- December and January saw continued ETF selling, with hundreds of millions to billions in BTC liquidated across those months.

Outside ETFs, miners and public companies sometimes trim positions—for instance, Riot Platforms sold over 1,800 BTC in a recent month. These sales are typically operational (payroll, CapEx) or risk-management driven rather than ideological abandonment.

What could trigger more institutional selling?

Several catalysts could prompt institutions to reduce their BTC exposure quickly:

- Regulatory shocks: Institutions value regulatory clarity. Sudden hostile legislation, enforcement actions, or reversals in favorable frameworks could push them to de-risk fast.

- Macro shocks: Recessions, liquidity crises, or extreme geopolitical events can force even long-term holders to sell to meet cash needs or margin calls.

- Technological threat—quantum computing: The possibility that quantum computers could break cryptographic protections is a serious concern. If perceived as imminent, institutions—being forward-looking—could sell en masse before protocols are upgraded.

Institutions typically don’t “hodl through uncertainty” the way many retail holders do. They manage risk, and if the environment becomes too hostile or the threat landscape shifts suddenly, holdings can be reduced quickly—which could create outsized price moves given their scale.

Does institutional ownership threaten Bitcoin’s security?

Short answer: not directly to the protocol. Bitcoin’s security rests on proof-of-work: decentralized miners securing the network through computational power. Owning coins, even in massive quantities, does not allow holders to rewrite blocks or censor transactions. To disrupt the protocol, an entity would need to control the majority of hash power.

That said, there are indirect security concerns worth highlighting:

- Hash power concentration: If institutional investment flows into mining—buying miners or owning mining pools—it could concentrate hash power. A 51 percent attack requires enormous resources, but persistent concentration raises theoretical risks and centralization pressures.

- Custodial single points of failure: Institutions rely on custodians. If a top custodian is hacked, becomes insolvent, or mismanages keys, the impact could be catastrophic for markets and client balances.

History shows custodians can fail: Prime Trust was placed into receivership when it allegedly lacked sufficient assets in 2023. BitGo, another large custodian, had a wallet vulnerability discovered in 2023 (patched quickly). These incidents underscore that institutional-grade services are not immune to operational risk.

Concentration and price risk: how much selling could move the market?

Price risk is the most tangible threat from institutional concentration. Institutions collectively hold roughly 4 million BTC. If a shock forced them to sell a significant portion—say 30%—that would inject roughly 1.2 million BTC onto the market.

To put that in perspective, 1.2 million BTC is more than the combined holdings of the major Bitcoin treasury companies. Flooding the market with that volume would cause severe price dislocation and liquidity stress.

Even smaller sales by ETFs have shown they can move prices dramatically. The lesson is simple: large, concentrated holders create market fragility even if the protocol remains secure. Market infrastructure and liquidity depth are not yet infinite; they can be overwhelmed by concentrated flows.

What this concentration does to volatility and price discovery

There are two competing effects in play.

On one hand, institutional accumulation removes coins from the liquid supply. Fewer coins available to trade can magnify price moves when flows occur. That means a market dominated by large holders can be more volatile, not less; a single large sell order can push the price more violently because there’s less depth outside of those long-term holdings.

On the other hand, institutions provide consistent demand and a structural bid. If institutions keep buying and holding, they create a price floor and bring long-term capital that could dampen volatility over years. Furthermore, institutional buys can attract further participants who view institutional allocation as a signal of permanence.

Which effect dominates is a function of time horizon, market conditions, and the behavior of institutional investors. In turbulent markets, withdrawal and de-risking behaviors are likely to dominate. In stable, bullish markets, accumulation and financing behavior will strengthen the bid.

Regulatory and macro implications

Regulatory clarity has been the single biggest factor encouraging institutions to allocate to Bitcoin. Product approvals, custodial frameworks, and KYC/AML processes allow pension funds, insurers, and endowments to participate without running afoul of compliance obligations.

But if regulatory progress stalls or reverses—through hostile legislation, adverse court rulings, or unpredictable enforcement—institutions will react faster than retail. Abrupt policy changes can cascade into large institutional outflows, which is why the regulatory environment remains the most important risk to watch.

Quantum computing: a genuine but manageable risk

The potential for quantum computers to threaten cryptographic primitives is a real issue. If sufficiently advanced quantum machines can break the elliptic-curve signatures that protect Bitcoin wallets, it could potentially expose private keys and allow theft at scale.

Developers and researchers are actively working on quantum-resistant cryptography and migration strategies. The ecosystem needs a coordinated path to upgrade addresses and move funds to quantum-safe schemes. If that work progresses proactively, the risk is manageable. If it is ignored until the last minute, panic selling by risk-averse institutions could follow.

Custody: the operational Achilles heel

Custody is the operational backbone of institutional bitcoin adoption. Institutions prefer to outsource key custody to specialist providers for scalability and compliance. That introduces an operational centralization point that can fail in several ways:

- Hacks: Even sophisticated custodians can be breached; attackers are incentivized to go after large pools of funds.

- Internal fraud or mismanagement: Custodians can misplace or misaccount for assets, intentionally or not.

- Insolvency: A custodian going bankrupt can have cascading effects on clients who cannot access their funds.

These are not hypotheticals. Prime Trust and other mid-tier custodians have had run-ins with solvency and operational issues. That’s why institutional custody often involves layers of insurance, multi-party computation, and audited processes—but even those measures have limits.

How traders and investors should think about positioning

For long-term holders, the core message is unchanged: Bitcoin is an emergent, scarce monetary asset that continues to attract capital. Institutional involvement increases the probability that Bitcoin will be recognized as a legitimate asset class by mainstream allocators. That is bullish for the long-term price trajectory.

For active traders, the environment has shifted. Institutional flows—especially ETF inflows and outflows—can dominate market moves. Understanding where liquidity sits and monitoring institutional flows becomes essential. Events like large ETF redemptions or miner sales can create short-term trading opportunities but also risk sudden losses if liquidity evaporates.

If you trade or speculate, a tool that tracks and signals institutional flow events, ETF inflows/outflows, and on-chain accumulation can be invaluable. A crypto signals service that provides timely alerts on these dynamics can help you navigate volatile windows and spot accumulation opportunities when institutions are buying the dips. These signals are best used as part of a disciplined risk-management framework, combining position sizing, stop losses, and awareness of macro/regulatory catalysts.

Practical approaches depending on your profile

- Long-term HODLers: Continue dollar-cost averaging, consider using secure custody solutions, and treat volatility as an opportunity to add rather than panic.

- Active traders: Monitor ETF flow reports, on-chain accumulation, and miner movement. Use a signals service for early notification of institutional flow changes and pair that with disciplined trade management.

- Institutional or accredited investors: Focus on custody audits, counterparty risk, and regulatory compliance. Stress-test your allocation scenarios against regulatory shocks and macro liquidity events.

What institutional adoption means for Bitcoin’s future

Institutional involvement is unlikely to “break” Bitcoin. The protocol itself is resilient: owning coins doesn’t grant protocol control. However, the ecosystem is changing in meaningful ways:

- Market structure: Bitcoin is increasingly traded and held through TradFi rails, making price action more sensitive to institutional flows and brokerage-level dynamics.

- Perception: Institutional adoption improves the narrative of Bitcoin as a legitimate store of value, attracting further capital.

- Risk profile: Concentration and custody risks raise the stakes for market stability and operational resilience.

These changes are not inherently negative. Many bring maturity and stability over the long run. But they do change the character of Bitcoin from a purely peer-to-peer, self-sovereign money experiment into an asset class that must coexist with legacy finance.

Scenarios to watch

Here are a few plausible scenarios and their likely outcomes:

- Regulatory clarity continues: Institutions increase allocations; Bitcoin becomes a larger portion of global portfolios; volatility gradually lowers as liquidity depth improves.

- Temporary regulatory shock: Rapid outflows trigger sharp price drops, but long-term accumulation resumes once clarity returns; opportunity for deep-value buying.

- Quantum breakthrough without mitigation: Panic and mass liquidation could cause a massive market downturn unless a coordinated upgrade is executed quickly.

- Major custodian failure: Short-term contagion and liquidity crunch; long-term confidence restoration depends on improved custody standards and insurance.

How to stay tactically prepared

Actionable steps investors can take:

- Follow institutional flow metrics. ETF inflows/outflows are leading indicators for short-term price pressure.

- Use robust custody solutions—prefer multi-sig, institutional-grade custodians with clear audit trails and insurance.

- Maintain a contingency plan for large sell-offs, including buying opportunities and exit protocols.

- Monitor regulatory headlines closely. Policy shifts are the fastest way to change institutional sentiment.

For active traders and portfolio managers, pairing market awareness with a reliable crypto signals service can improve reaction time. Signals that highlight big ETF redemptions, miner wallet movement, or on-chain whale shifts help you make more informed, timely decisions rather than reacting after moves have already happened.

Conclusion: captured or integrated?

Saying Bitcoin Has Been Captured is a useful provocation. It forces us to confront that a substantial share of Bitcoin now sits in institutions rather than individual self-custody. That shift brings both strength and vulnerability. Institutions provide credibility, capital, and infrastructure, helping Bitcoin mature into a recognized asset class. But they also introduce concentration risks that can amplify price moves, create single points of failure via custody, and change the social dynamics around control and governance.

The path forward depends on how the ecosystem responds. Addressing quantum risk, hardening custody, widening liquidity, and preserving the cultural value of self-sovereignty can help reconcile Bitcoin’s original ideals with the realities of institutional adoption.

Ultimately, institutions are unlikely to break Bitcoin overnight. They will, however, shape its market behavior for the foreseeable future. Understanding that new landscape—and using the right tools and signals to navigate it—will be essential for anyone with exposure to this evolving asset class.

Will institutional ownership make Bitcoin less decentralized?

Institutional ownership shifts economic control but does not directly change the technical decentralization of the Bitcoin protocol. Ownership concentration increases market centralization and custody dependence, which can influence price and systemic risk. Technical control of the network remains dependent on hash power distribution and miners rather than coin ownership.

Could institutions sell enough Bitcoin to crash the market?

Yes—large coordinated selling by institutions could cause severe price declines because they hold a significant portion of the supply. Historical ETF outflows show large holders can move markets. That said, coordinated mass selling would likely be driven by severe external shocks (regulatory, macro, technological) rather than sudden changes in belief alone.

Is Bitcoin’s security at risk because institutions control so many coins?

Not directly. Bitcoin’s security is rooted in proof-of-work and mining decentralization. Coin ownership does not grant control over block production. The more realistic concerns are custodial risk and hash power concentration if institutions start buying mining operations en masse.

How should I trade or invest given institutional dominance?

Align your approach with your time horizon. Long-term investors can continue dollar-cost averaging and strengthen custody practices. Traders should watch ETF flows, miner movements, and on-chain accumulation. Using a crypto signals service that flags institutional flows and on-chain whale activity can provide early warnings for trading decisions.

Is the quantum threat imminent?

Quantum computing poses a potential future risk. Experts disagree on timing—some see it years away, others sooner. The industry must prioritize quantum-resistant upgrades and migration paths. A proactive, coordinated approach would mitigate the threat and preserve institutional confidence.

How can custodial risk be minimized?

Custodial risk can be reduced through multi-party computation, multi-signature setups, regular audits, strong insurance policies, and diversifying custody providers. Institutions typically layer these protections, but even so, systemic risk remains if a prominent custodian fails.

What indicators should I track to anticipate big moves?

Key indicators include spot ETF inflows/outflows, large wallet transfers (especially from custodians or miners), exchange reserve changes, and on-chain accumulation by known institutional addresses. Macro indicators like liquidity conditions and regulatory news also matter. Combining these signals provides the best chance of staying ahead of major moves.