In this ENSO Coin Price Prediction I break down everything you need to know about Enso Network, why it launched with huge interest, and how its technology, backers, and exchange listings could drive rapid price movement.

This ENSO Coin Price Prediction examines the project from the ground up: its founding history, who’s behind it, how the protocol is already being used in the wild, and why a freshly issued token with strong adoption could be primed for volatility and potential upside. Read on for a breakdown of the facts, a realistic look at plausible price paths over the next 48 hours and weeks, and practical trading considerations if you’re thinking about taking a position.

Table of Contents

- Outline

- Introduction: Why this ENSO Coin Price Prediction matters now

- What is Enso Network?

- Traction and real-world usage: Why adoption matters for this ENSO Coin Price Prediction

- Team, backers, and credibility

- Exchange listings, market cap, and why the initial volume matters

- Technical outlook: chart setup and short-term price possibilities

- Trading strategy and risk management for Enso

- Exchange promos and practical considerations

- Short-term scenarios: 48 hours and the coming weeks

- How I’d think about sizing and timeframe

- Key takeaways for this ENSO Coin Price Prediction

- Conclusion

- How soon could Enso reach significant price milestones after listing?

- What are the main risks to this ENSO Coin Price Prediction?

- Should I use margin or leverage to trade Enso?

- How can free crypto signals help with trading Enso?

- What should long-term investors focus on for Enso?

- Is Enso a good buy right after the initial price drop?

- Where can I track Enso’s adoption and on-chain metrics?

- How should I approach profit-taking?

- How do listings on multiple exchanges affect ENSO Coin Price Prediction?

Outline

- Introduction — quick summary and what to expect

- What is Enso Network? — mission, architecture, developer promise

- Traction & real-world usage — settlements, partners, and enterprise clients

- Team, backers and credibility — who’s behind Enso

- Exchange listings, volume and market microstructure

- Technical outlook — the early chart, volatility, and possible scenarios

- Trading and risk management — how to think about entries, exits, and sizing

- Using signals and tools — integrating tools to help inform trades

- Conclusion and practical takeaways

- FAQ

Introduction: Why this ENSO Coin Price Prediction matters now

The reason this ENSO Coin Price Prediction is timely is simple: Enso token launched recently and immediately attracted heavy trading volume, listings on nearly all major exchanges, and thousands of holders within hours. That alone is a rare combination for a new token and it creates an environment of high volatility and opportunity. When a project that has already been building real product momentum finally releases a token, the market tends to react fast — often before long-term fundamentals are properly priced in.

What is Enso Network?

Enso Network positions itself as a unified integration layer for blockchain development: a single point of access where developers can read, write, and interact with smart contracts across multiple chains from one integration. The pitch is straightforward — reduce fragmentation for developers so they can build composable applications that span Web2 and Web3 users without integrating dozens of chains individually.

From a developer and enterprise perspective, that value proposition is compelling. Web2 already has millions of apps; Web3 is still in the early innings with only a few thousand meaningful apps. A platform that meaningfully lowers the friction of multi-chain development can accelerate adoption and onboarding dramatically.

Core use cases

- Cross-chain contract interactions from a unified API

- Composability for apps that need to operate across several blockchains

- Enterprise-grade settlement and tooling

- Migration tools and incentivized launch support for other protocols

In short, Enso is not just another token — the underlying tech was being used by key projects before the token even launched, which is a big positive in the real-adoption narrative.

Traction and real-world usage: Why adoption matters for this ENSO Coin Price Prediction

Traction is the single most important on-chain factor when evaluating a newly launched token. For this ENSO Coin Price Prediction the numbers are encouraging: Enso claims it has already powered over 145 enterprise-grade products, supported 250 protocols, more than 100 apps, and over 1,900 developers building on the platform — and crucially, it says it has been used to settle more than $17 billion on-chain.

What stands out is that these relationships and transaction volumes existed while there was no public token. That indicates product-market fit at the infrastructure level. When a token finally launches for a third-party infrastructure provider, markets often price in future monetization potential quickly — hence the initial mania in volume and liquidity.

High-profile integrations and collaborations

- Facilitated massive transaction executions during large launches (e.g., 3.1 billion executed transactions for a high-profile chain launch)

- Worked on migration tooling in collaboration with projects like Uniswap, LayerZero, and Stargate

- Used by other prominent projects and launch campaigns such as ZK-Sync, Sonic (formerly Phantom), and others

These names matter because partnership validation from top-tier protocols reduces execution risk and signals that engineering and product quality are real, not just a marketing bluff. That supports an optimistic ENSO Coin Price Prediction in the near to medium term if growth continues.

Team, backers, and credibility

Founder pedigree and backers often determine how the market perceives a token’s probability of long-term success. Enso’s founder has a strong track record: building on Ethereum since 2016, authoring early research, and creating financial infrastructure in Europe. The founding team’s experience with regulated digital asset banking, tokenization, and custody gives the project real institutional credibility.

On the investor side, Enso is backed by well-known funds and individuals, including Polychain and Multicoin, as well as angel investors from top projects like LayerZero, Safe, OneInch, Flashbots, and others. That depth of backing is consistent with projects that can access follow-on capital and grow partnerships efficiently — another positive point for this ENSO Coin Price Prediction.

Exchange listings, market cap, and why the initial volume matters

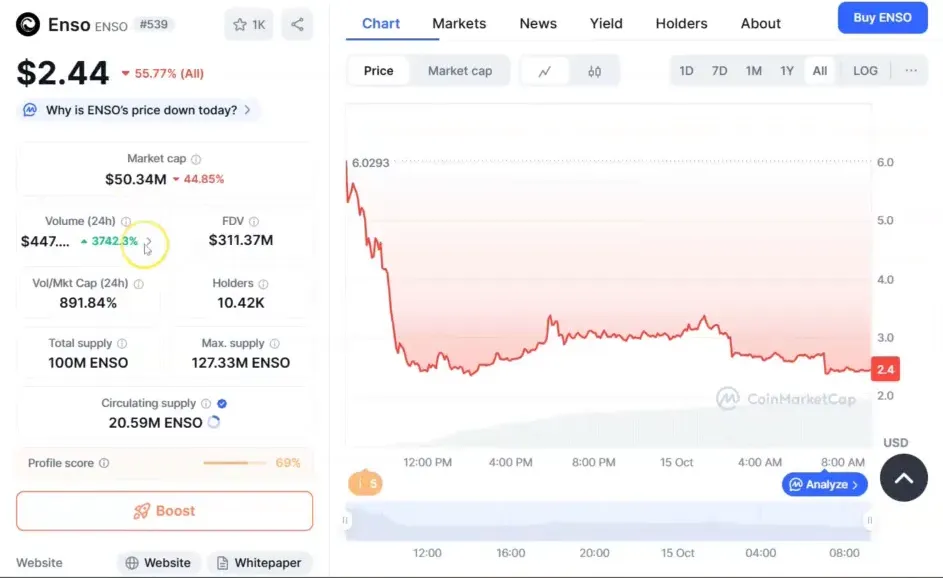

Enso’s launch has been notable because the token was listed on nearly all major exchanges immediately — Binance, Bybit, BitGet, MEXC, KuCoin — with Coinbase being the only notable absence at the time of listing. For a newly launched token, multi-exchange listings are significant because they increase discoverability and liquidity. The market responded with huge volume: in the first 24 hours the token did roughly half a billion dollars in traded volume while market cap sat around $50 million.

That combination — high volume, low-ish market cap — is the sort of environment where large percentage moves happen quickly. It’s also why early holders and short-term traders can experience big gains or losses. For this ENSO Coin Price Prediction, the launch-day behavior set the tone: a big run into the listing, followed by a 30–40% decline from initial highs as the initial liquidity and speculative momentum normalized.

Technical outlook: chart setup and short-term price possibilities

At the time of analysis, the price had dropped from its initial listing spike by around 40%, which is typical after an explosive launch. That pullback can be healthy: it removes weak hands and allows traders to form support levels. Several traders posted chart setups suggesting clear breakout potential if volume returns and market sentiment remains positive.

For this ENSO Coin Price Prediction, there are a few realistic near-term scenarios:

- Consolidation followed by continuation: The token stabilizes around a short-term support band, volume increases, and price resumes an upward trend — potentially doubling or more within weeks if momentum and broader market conditions align.

- Volatility-led spike: Due to low circulating supply and high listing demand, a few catalyst-driven spikes could send the token to multiples of its early price within days, but these moves usually come with violent retracements.

- Market pullback risk: If broader crypto markets decline, even strongly backed tokens can see momentum evaporate. In a major market sell-off, Enso’s early momentum could be arrested or reversed.

These outcomes are not mutually exclusive: short-term volatility can include both spikes and deeper retracements before a sustained trend emerges.

How to interpret the early chart

When a token lists and trades on major venues, price action is driven first by speculative demand and then by fundamental adoption. In this case, early adoption already existed on the product level — so some speculators are pricing in future on-chain monetization. The technical setup that matters for traders includes:

- Volume profile around the initial range

- Clear support zones established after the initial drop

- Resistance levels defined by all-time highs from the listing

- Order book depth across multiple exchanges to gauge liquidity

For swing traders, a sensible approach weighs support/resistance with position sizing that anticipates 30–50% intra-day moves. For longer-term investors, fundamentals and partnerships carry greater weight in this ENSO Coin Price Prediction.

Trading strategy and risk management for Enso

Given the volatility inherent in a new token launch, here are practical trading guidelines to help align risk with potential reward.

- Position sizing: Never size an initial position large enough that a 40–60% move wipes you out emotionally. Treat early-stage tokens as high-risk allocation and size accordingly.

- Staggered entries: Consider laddering into a position over several price levels rather than all at once. This reduces the risk of buying the top of the launch spike.

- Stop-loss discipline: Decide on a clear stop-loss plan based on support bands you’re comfortable with, and stick to it, especially during the first 48–72 hours when volatility is highest.

- Exchange choice: Use reliable exchanges with strong liquidity and good order execution. As mentioned earlier, some exchanges offer promotions and features that benefit traders; evaluate them for your needs.

Exchange promos and practical considerations

Several exchanges listed Enso at launch, and some platforms offer welcome packs and competitions that can be attractive for traders. These promotions can lower your cost to trade or add extra incentives if you’re active in the market, but they should not be the primary reason you trade a token.

Remember: trading contests and bonus packages are perks. The primary drivers of actual price appreciation are fundamental adoption, liquidity, network growth, and broader market conditions. In the short term though, these exchange-driven flows can increase trading activity and widen price swings — an important consideration in this ENSO Coin Price Prediction.

Short-term scenarios: 48 hours and the coming weeks

This ENSO Coin Price Prediction splits short-term scenarios into a logical set of outcomes to help you plan trades over the next two days and the weeks that follow.

Scenario A — Rapid re-acceleration (bullish)

If volume returns and there are no major market-wide sell-offs, Enso can re-accelerate. Given its low market cap and the initial listing interest, a re-test of listing highs and then new all-time highs is possible. Short-term price action could see the token double, triple, or even more as traders rotate capital into the asset.

Scenario B — Consolidation and measured climb (neutral)

The token consolidates after the initial spike. Price stabilizes into a range as market participants digest the launch and tokenomics. Over weeks, adoption milestones and continued usage may push a steady upward trend. This is the most sustainable path and often the healthiest outcome for long-term holders.

Scenario C — Pullback with reset (bearish but constructive)

A broader market decline or adverse macro events could cause a deeper pullback. If that happens, the token may correct significantly but still retain long-term potential if the fundamentals and partnerships remain intact. For traders, a deep pullback represents an opportunity to reassess entries and dollar-cost average into stronger support levels.

How I’d think about sizing and timeframe

For speculative capital, limit exposure to a small percentage of overall portfolio — enough to capture upside but small enough to absorb a large downside. For swing traders, aim for shorter timeframes and tighter risk controls. For longer-term investors drawn to the infrastructure narrative, staggered buys over weeks and months as usage milestones arrive is reasonable.

Key takeaways for this ENSO Coin Price Prediction

- Enso has real-world traction: enterprise usage, settlements, and developer adoption existed before the token launch. That’s a major, positive differentiator in the field of new tokens.

- Immediate exchange listings and high first-day volume demonstrate market interest, but also amplify short-term volatility.

- Backers and founder pedigree lend credibility, making a bullish medium-term narrative plausible if market conditions are supportive.

- Short-term price paths include fast spikes, consolidation, or pullbacks; risk management is essential.

- Tools like free crypto signals can help identify high-confidence trade opportunities and alert you to cross-exchange volume anomalies during early volatility.

Conclusion

This ENSO Coin Price Prediction acknowledges both the risk and the potential reward. Enso’s combination of pre-token product traction, blue-chip backers, and multi-exchange listings created the conditions for rapid price action on launch. That said, the token’s early price is likely to remain volatile — presenting opportunities for active traders and questions for long-term investors.

My advice: if you believe in the infrastructure thesis and want exposure, use tactical sizing, staggered entries, and strict risk controls. Consider augmenting your approach with reliable signal services — free crypto signals can be a useful complement to your own analysis when navigating the fast-moving environment that accompanies new token launches.

How soon could Enso reach significant price milestones after listing?

The timeline is unpredictable. Rapid moves within days are possible due to low market cap and high volume, but sustainable milestones depend on continued adoption, integrations, and broader market trends. In a bullish market, quick multi-fold increases are plausible, while in a correction they may be delayed.

What are the main risks to this ENSO Coin Price Prediction?

Primary risks include broader crypto market sell-offs, liquidity drying up, token unlock schedules, or failing to convert product usage into meaningful token economics. Regulatory shocks or technical issues with the platform can also reduce price potential.

Should I use margin or leverage to trade Enso?

Given the high volatility around new listings, using leverage increases risk dramatically. If you are inexperienced or unable to manage rapid price moves, avoid leverage. If you use leveraged products, size positions conservatively and employ strict stops.

How can free crypto signals help with trading Enso?

Free crypto signals can alert you to momentum shifts, spikes in cross-exchange volume, and potential breakout patterns. They are most valuable when used alongside your own research and strict risk management, particularly during the chaotic early days of a token’s listing.

What should long-term investors focus on for Enso?

Long-term investors should prioritize adoption metrics, developer growth, enterprise partnerships, settled transaction volumes, tokenomics (supply and unlock schedules), and how the platform monetizes its services. Price volatility is to be expected; fundamentals will determine long-term outcomes.

Is Enso a good buy right after the initial price drop?

Whether it’s a good buy depends on your timeframe and risk tolerance. The initial drop removes speculative froth; it can be a good entry for those who believe in the project long-term, but traders should still use staggered entries and strong risk controls due to continued volatility.

Where can I track Enso’s adoption and on-chain metrics?

Track official project dashboards, on-chain explorers, and protocol reports to monitor settled transactions, developer activity, and enterprise integrations. Community posts and official announcements from partners also provide context for adoption milestones.

How should I approach profit-taking?

Have a plan before entering. Consider partial take-profits at defined resistance levels, and reinvest a portion if price retests support. For longer-term holders, monitor adoption milestones and sell incrementally if price spikes rapidly to lock in gains.

How do listings on multiple exchanges affect ENSO Coin Price Prediction?

Multi-exchange listings increase liquidity and accessibility, often causing higher initial volume and volatility. They can accelerate price discovery and make it easier for institutional flows to participate, which can support a stronger rally if fundamental adoption continues.