Table of Contents

- Why this setup stands out

- What is a fair value gap?

- Step-by-step strategy

- How I manage the trade

- Quick checklist before you enter

- Why the math works

- Applying this across markets: forex, stocks, crypto

- Extra tips

- Tools that speed this up

- What exactly is a fair value gap and how do I draw it?

Why this setup stands out

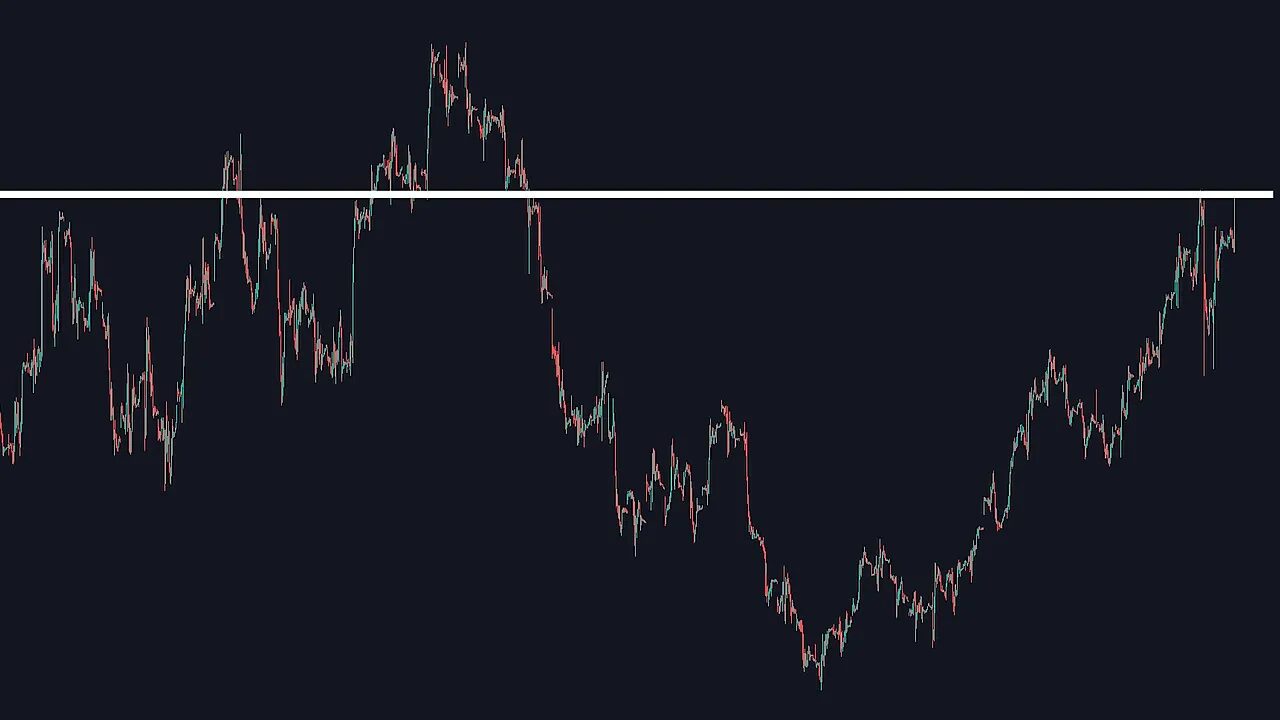

I use this fair value gap strategy all the time because it consistently delivers asymmetric risk to reward. The idea is simple: combine a key resistance level, a false breakout, a confirmation of downward momentum, then enter on a fair value gap using the GAN box 50% midline for an optimal entry. Most trades give you massive upside with minimal downside, so you only need a small win rate to be profitable.

What is a fair value gap?

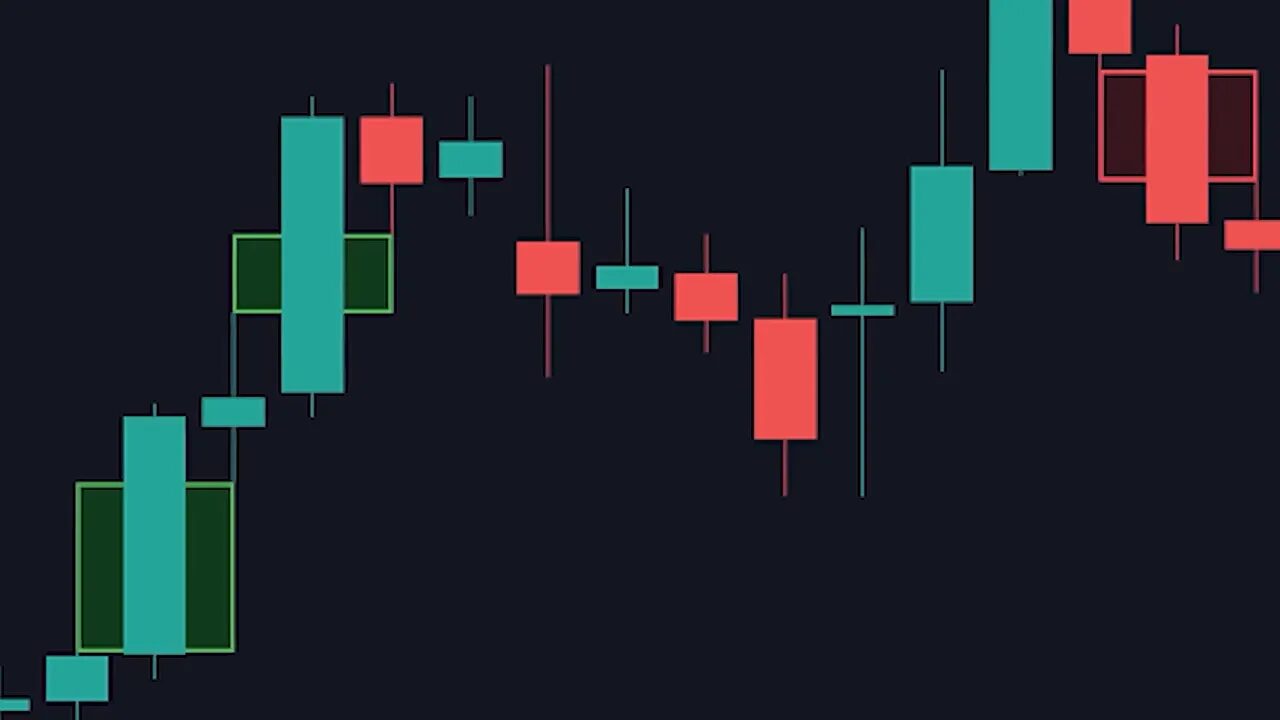

A fair value gap appears when price explodes in one direction so quickly that the other side (buyers or sellers) never had time to fully react. That creates an imbalance on the chart — price naturally wants to come back and test that gap. You can mark it by taking the wick before the big move and the wick after it; the area between those wicks is the fair value gap.

Step-by-step strategy

1. Identify a key resistance (or support for longs)

Use a recent swing high or go up to a higher timeframe (for example the one hour) and mark a strong resistance level. This is the structural area where the move either fails or breaks.

2. Wait for a fakeout

A fakeout is when price briefly breaks the resistance and then reverses back below it. The reason this matters is behavioral: traders enter longs on that breakout and place stop losses just below the break. When the breakout fails and price returns, those stops fuel the downward momentum you want for a short.

3. Confirm the start of a downtrend

Look for two lower lows after the fakeout. Two lower lows are a simple, high-probability signal that the market is beginning a downward move. When this aligns with a recent false breakout, the bearish bias is strong.

4. Find the bearish fair value gap on the pullback

On the swing back up after the second low, identify any bearish fair value gaps. If multiple gaps appear, use the highest (closest to price) fair value gap as your target — it typically offers the best risk to reward.

5. Use the GAN box to set your entry at the 50% mark

Place TradingView’s GAN box on the ends of the fair value gap, then set the display so it draws a line exactly in the middle. Price commonly revisits that 50% midline and rejects. When it does, that’s your entry trigger.

6. Stop loss and take profit rules

Set your stop loss at the recent swing high for a tighter, higher R:R entry, or above the original resistance if you want extra buffer. The primary take profit should be the low where the original move started. For higher win rate, scale out at key hesitation zones observed during the prior move up.

How I manage the trade

I like to scale out to guarantee profits along the way. A common approach: sell 25% at the first hesitation level, another 25% at the next, and let the remainder run to the final target. This locks in gains while allowing the strong momentum to capture the rest.

Quick checklist before you enter

- Key resistance identified on a higher timeframe.

- False breakout confirmed (price breaks, then reverses).

- Two lower lows formed after the fakeout.

- Bearish fair value gap present on the pullback.

- Entry at GAN box 50% midline of the fair value gap.

- Stop loss at recent swing high (or above resistance).

- Take profits scaled at hesitation levels and final swing low.

Why the math works

This setup frequently produces large potential rewards with small stop distances, giving a favorable risk to reward. If your average trade risks 1 unit to make 4 or more units, you only need a win rate of around 25 percent to be profitable. Combine that with partial exits to lock gains and you get a very resilient approach.

Applying this across markets: forex, stocks, crypto

The structure behind fair value gaps and fakeouts is market neutral. Whether you trade EUR/USD, individual stocks, or cryptocurrencies, the same mechanics apply. Crypto markets often have sharper moves and deeper imbalances, so fair value gaps can be especially pronounced there. If you trade crypto, consider pairing this setup with timely market alerts — free crypto signals can help you spot large imbalance moves across different blockchains and save time scanning multiple pairs.

Extra tips

- Prefer the highest bearish fair value gap for a short entry when multiple gaps appear.

- Use higher timeframes to validate major support and resistance.

- Check for confluence: volume spikes, cluster stops, or macro news that support directional bias.

- Practice the entry technique on a demo account first to get comfortable with the GAN box midline timing.

Tools that speed this up

TradingView’s GAN box is essential for precisely marking the midline. There are also indicators that automatically highlight fair value gaps and color-code them bullish or bearish, which can save time when scanning multiple markets.

What exactly is a fair value gap and how do I draw it?

Draw a fair value gap between the wick before a strong one-directional candle and the wick after that move. That empty area represents market imbalance where the counter side did not fully respond. Price often returns to test that zone.

Where should I place my stop loss?

Place your stop loss at the recent swing high for a tighter R:R, or above the original resistance level for more room. Tighter stops give better risk to reward but increase the chance of being stopped out.

Does this work on crypto markets?

Yes. Crypto tends to have stronger spikes and deeper imbalances, so fair value gaps can be very effective. Combining this structure with timely alerts, such as free crypto signals, can improve your entry timing across multiple coins.

How many trades do I need to be profitable?

If your average win is 4x your loss, you only need roughly 1 out of 4 trades to win to be profitable. Risk management and partial exits further reduce breakeven thresholds.

What if price never returns to the fair value gap midline?

Missed trades are part of the game. Wait for the next valid setup. It is better to skip the trade than to force an entry with poor R:R. Patience preserves capital and keeps your edge intact.