Some of the richest people on the planet are not tech founders or hedge fund managers. They are lawmakers. That fact is obvious and troubling: lawmakers can shape policy, get early access to market-moving information, and then buy or sell stocks. So I did something slightly ridiculous and borderline brilliant: I copied every trade a set of high-performing politicians made for 30 days and traded a $10,000 account to match them exactly.

Table of Contents

- Quick overview of the experiment

- Why this is interesting (and why it feels corrupt)

- How I chose which politicians to copy

- Step-by-step: how the daily routine worked

- The single biggest problem: disclosure delays

- Tools I used (and the modest ad I actually liked)

- What about crypto? Why political trades matter there, too

- Risk, ethics, and legal considerations

- How reliable is this strategy long term?

- Practical tips if you want to try a similar approach

- What I learned and what comes next

- FAQ

Quick overview of the experiment

- Objective: Test whether blindly copying U.S. politicians’ stock trades can beat the market.

- Capital: $10,000 starting balance.

- Rules: Copy every disclosed trade from a selected list of high-performing lawmakers for one month, with no analysis or second-guessing.

- Filter: Only take trades that were disclosed within one month to avoid extremely stale filings.

Why this is interesting (and why it feels corrupt)

Lawmakers write legislation and vote on policies that can create winners and losers in the market. If a senator owns shares in a company that benefits from a bill they helped craft, the optics are bad. The concern becomes: are lawmakers trading on privileged knowledge or just very good at timing the market?

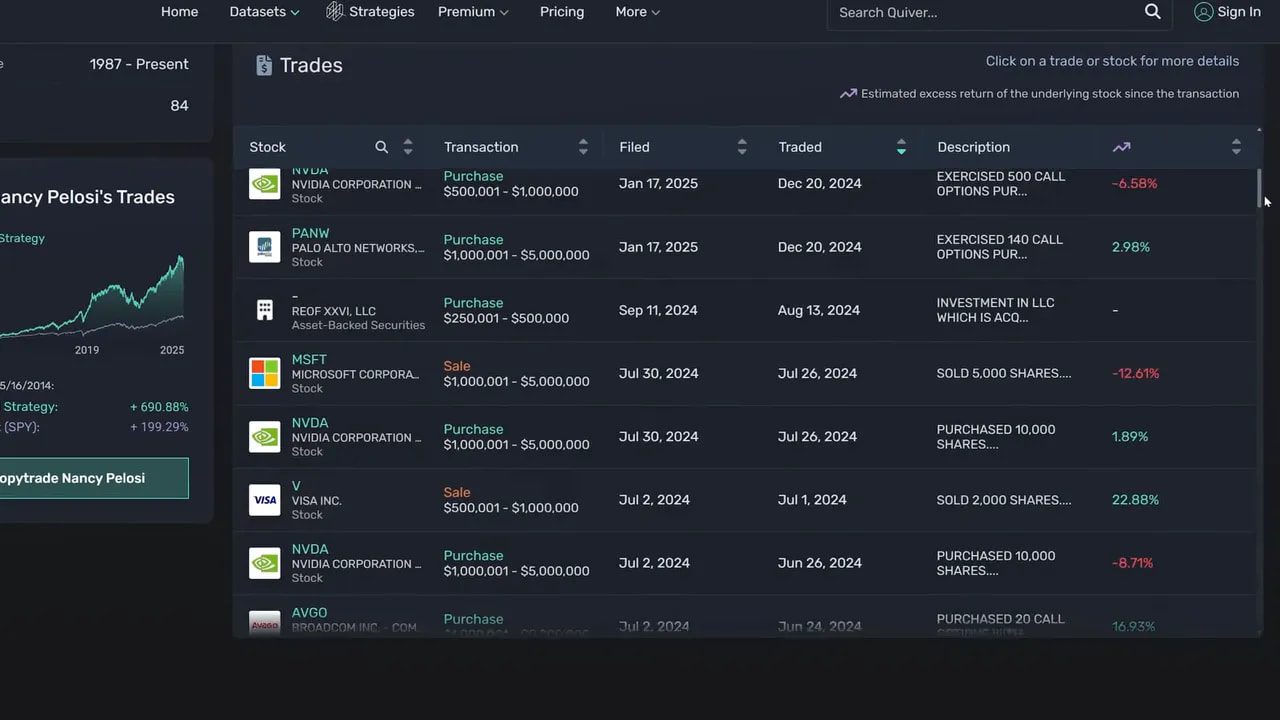

One headline example pushed this experiment over the edge: an early trade in NVIDIA that, for those who bought in at the right time, produced eye-popping returns. That sort of trade makes copying tempting — but there are caveats, and the biggest one is timing.

How I chose which politicians to copy

Not every lawmaker gets copied. I focused on a shortlist of politicians who historically showed high win rates and big portfolio gains. The idea was to follow the most consistently profitable traders in Congress instead of copying random filings from obscure members.

To build the list I used publicly available disclosure data and cross-checked it with aggregated performance rankings. Once I had the names, I fed them into a trade-tracking website that publishes each member’s reported transactions.

Step-by-step: how the daily routine worked

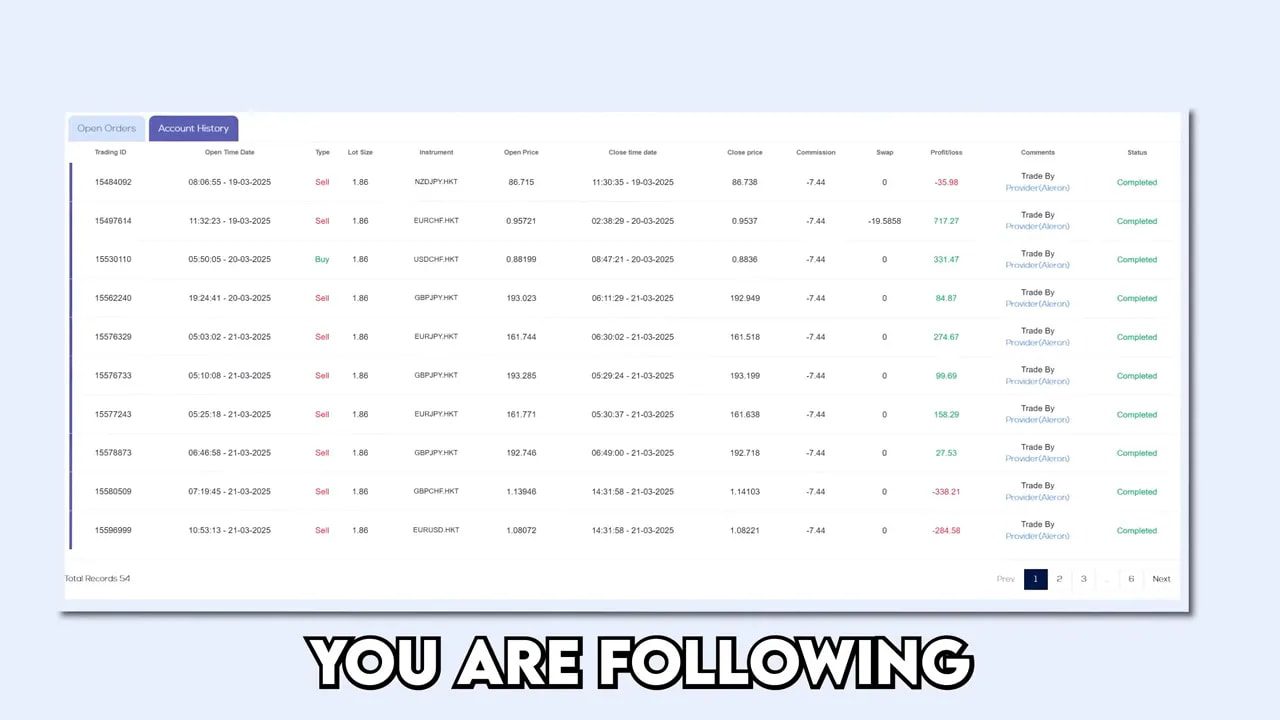

- Wake up an hour before market open and check the trade-tracking site for any new filings from the tracked politicians.

- Log every newly disclosed trade into a spreadsheet: ticker, buy or sell, reported size, and filing date.

- Take the same position size proportionally with the $10,000 account — no hedging, no additional analysis.

- Apply the one-month disclosure filter: if the filing was older than one month, skip it.

- Manage exits based on the same rules I would have used if I had initiated the trade: predefined profit targets and stop losses to keep things consistent.

The single biggest problem: disclosure delays

Lawmakers are required to disclose trades, but not instantly. In many cases filings can be submitted up to 45 days after the trade. That delay can turn a great idea into a trap: you might be buying after the price already ran and the catalyst has passed — basic falling-knife territory.

To reduce this timing risk I used the one-month filter. It doesn’t solve the problem entirely, but it helps avoid the worst-case of copying months-old positions that have already moved significantly.

Tools I used (and the modest ad I actually liked)

There are trade-tracking sites that livestream congressional disclosures. I used one to surface filings in near real-time. Separately, there are copy-trading platforms that let you mirror other traders automatically. If you’re exploring alternative strategies—especially for fast-moving markets—copy trading platforms can speed execution.

What about crypto? Why political trades matter there, too

Regulation and policy influence crypto prices dramatically. A single speech, committee hearing, or proposed rule can push tokens and blockchain stocks up or down. That makes following lawmakers relevant beyond equities.

If you’re tracking policy-driven crypto moves, a reliable source of trade signals can make a difference. Disclosures for crypto are different in many jurisdictions, and price moves can be violent. Using curated crypto trading signals alongside policy-monitoring helps filter noise and identify actionable setups across chains without spending hours hunting filings.

Risk, ethics, and legal considerations

Copying politicians raises questions beyond profitability. Insider trading laws apply when someone trades on nonpublic material information. Public disclosures make the trades transparent after the fact, but that transparency does not erase potential ethical concerns.

Practical risks to consider:

- Timing risk: Disclosure delays can leave you chasing performance.

- Concentration risk: Politicians often hold large positions in a few names.

- Regulatory risk: A quick policy reversal or negative press can blow up a position.

How reliable is this strategy long term?

Short answer: it’s inconsistent. Some lawmakers have good track records, but success is uneven and often driven by a few big wins. Replicating a politician’s performance requires precise timing, position sizing discipline, and sometimes sheer luck.

This is not a replacement for sound risk management. If you try to replicate any disclosed trades, do it with rules, caps, and an awareness that past performance—even by elected officials—is not a guarantee of future returns.

Practical tips if you want to try a similar approach

- Track a small list of lawmakers with proven performance data.

- Use a filing-age filter to avoid stale disclosures.

- Predefine position sizes relative to your account to avoid overexposure.

- Automate alerts where possible so you get filings quickly.

- Combine this with broader market signals: technicals, macro context, and sector momentum.

For traders who want to monitor crypto policy moves, pairing a policy-watchlist with targeted crypto trading signals can help you react faster to chain-specific catalysts while keeping emotional trading in check.

What I learned and what comes next

Copying politicians is entertaining and occasionally profitable, but it is not a silver bullet. Timing and disclosure lag are fatal flaws. Still, following the most successful political traders can surface interesting ideas and potential trade candidates.

This approach works best as a component of a broader strategy: use disclosures to generate ideas, cross-check with technical and macro analysis, and manage risk tightly. For crypto, where policy can move markets overnight, supplementing manual tracking with curated crypto trading signals will save time and surface higher-probability trades.

FAQ

Is copying politicians’ trades legal?

Yes, copying disclosed trades is legal. Politicians must report trades publicly. However, trading on nonpublic, material information is illegal. Public filings themselves are legal to use, but ethical and regulatory questions remain.

Where can I find the filings?

Many websites aggregate congressional disclosure forms and present them in real time. Look for platforms that show the transaction date, filing date, company, and reported dollar amount to evaluate recency and size.

Do disclosure delays make this strategy useless?

Not necessarily useless, but delays are a significant disadvantage. A disclosure lag can turn a great trade into a late entry. Filters that exclude older filings help, but they can’t eliminate the timing problem entirely.

How much money do I need to start copying?

You can start small, but position sizing matters. Use a fixed percentage of your account per trade and diversify across filings. The experiment used $10,000, but any size works as long as risk rules are respected.

Can this approach work for crypto?

Yes, especially because policy and regulation heavily influence crypto prices. However, crypto markets are faster and more volatile. Pairing policy tracking with reliable crypto trading signals can provide faster, more actionable entries while keeping you aligned with chain-specific catalysts.

Are politicians consistently better traders than the market?

No. Some have strong records, but performance varies. A few big winners can skew a politician’s track record. Use disclosures as idea generators, not as a guaranteed blueprint for outperformance.